平狄克微观经济学答案

- 格式:doc

- 大小:50.33 KB

- 文档页数:24

CHAPTER 18EXTERNALITIES AND PUBLIC GOODSThis chapter extends the discussion of market failure begun in Chapter 17. To avoid over-emphasis on definitions, stress the main theme of the chapter: the characteristics of some goods lead to situations where price is not equal to marginal cost. Rely on the discussion of market power (Chapter 10) as an example of market failure. Also, point out with each case that government intervention might not be required if property rights can be defined and transaction costs are small (Section 18.3). The first four sections present positive and negative externalities and solutions to market failure. The last two sections discuss public goods and public choice.The consumption of many goods involves the creation of externalities. Stress the divergence between social and private costs. Exercise (5) presents the classic beekeeper/apple-orchard problem, originally popularized in Meade, “External Economies and Diseconomies in a Competitive Situation,” Economic Journal (March 1952). Empirical research on this example has shown that beekeepers and orchard owners have solved many of their problems: see Cheung, “The Fable of the Bees: An Economic Investigation,” Journal of Law and Economics (April 1973).Solutions to the problems of externalities are presented in Sections 18.2 and 18.3. Section 18.2, in particular, discusses emission standards, fees, and transferable permits. Example 18.1 and Exercise (3) are simple applications of these concepts.One of the main themes of the law and economics literature since 1969 is the application of Coase’s insight on the assignment of property rights. The original article is clear and can be understood by students. Stress the problems posed by transactions costs. For a lively debate, ask students whether non-smokers should be granted the right to smokeless air in public places (see Exercise (4)). For an extended discussion of the Coase Theorem at the undergraduate level, see Polinsky, Chapters 3-6, An Introduction to Law & Economics (Little, Brown & Co., 1983).The section on common property resources emphasizes the distinction between private and social marginal costs. Example 18.5 calculates the social cost of unlimited access to common property, and the information provided is used in Exercise (7). Exercise (8) provides an extended example of managing common property.The last two sections focus on public goods and private choice. Point out the similarities and differences between public goods and other activities with externalities. Since students confuse nonrival and nonexclusive goods, create a table similar to the following and give examples to fill in the cells:The next stumbling block for students is achieving an understanding of why we add individual demand curves vertically rather than horizontally. Exercise (6) compares vertical and horizontal summation of individual demand.The presentation of public choice is a limited introduction to the subject, but you can easily expand on this material. A logical extension of this chapter is an introduction to cost-benefit analysis. For applications of this analysis, see Part III, “Empirical Analysis of Policies and Programs,” in Haveman and Margolis (eds.), Public Expenditure and Policy Analysis (Houghton Mifflin, 1983).1. Which of the following describes an externality and which does not? Explain the difference.a. A policy of restricted coffee exports in Brazil causes the U.S. price of coffee to rise,which in turn also causes the price of tea to increase.Externalities cause market inefficiencies by preventing prices from conveying accurateinformation. A policy of restricting coffee exports in Brazil causes the U.S. price ofcoffee to rise, because supply is reduced. As the price of coffee rises, consumers switchto tea, thereby increasing the demand for tea, and hence, increasing the price of tea.These are market effects, not externalities.b. An advertising blimp distracts a motorist who then hits a telephone pole.An advertising blimp is producing information by announcing the availability of somegood or service. However, its method of supplying this information can be distractingfor some consumers, especially those consumers who happen to be driving neartelephone poles. The blimp is creating a negative externality that influences thedrivers’ safety. Since the price charged by the advertising firm does not incorporate theexternality of distracting drivers, too much of this type of advertising is produced fromthe point of view of society as a whole.2. Compare and contrast the following three mechanisms for treating pollution externalities when the costs and benefits of abatement are uncertain: (a) an emissions fee, (b) an emissions standard, and (c) a system of transferable emissions permits.Since pollution is not reflected in the marginal cost of production, its emission createsan externality. Three policy tools can be used to reduce pollution: an emissions fee, anemissions standard, and a system of transferable permits. The choice between a feeand a standard will depend on the marginal cost and marginal benefit of reducingpollution. If small changes in abatement yield large benefits while adding little to cost,the cost of not reducing emissions is high. Thus, standards should be used. However, ifsmall changes in abatement yield little benefit while adding greatly to cost, the cost ofreducing emissions is high. Thus, fees should be used.A system of transferable emissions permits combines the features of fees and standardsto reduce pollution. Under this system, a standard is set and fees are used to transferpermits to the firm that values them the most (i.e., a firm with high abatement costs).However, the total number of permits can be incorrectly chosen. Too few permits willcreate excess demand, increasing price and inefficiently diverting resources to ownersof the permits. Typically, pollution control agencies implement one of threemechanisms, measure the results, reassess the success of their choice, then reset newlevels of fees or standards or select a new policy tool.3. When do externalities require government intervention, and when is such intervention unlikely to be necessary?Economic efficiency can be achieved without government intervention when theexternality affects a small number of people and when property rights are wellspecified. When the number of parties is small, the cost of negotiating an agreementamong the parties is small. Further, the amount of required information (i.e., the costsof and benefits to each party) is small. When property rights are not well specified,uncertainty regarding costs and benefits increases and efficient choices might not bemade. The costs of coming to an agreement, including the cost of delaying such anagreement, could be greater than the cost of government intervention, including theexpected cost of choosing the wrong policy instrument.4. An emissions fee is paid to the government, whereas an injurer who is sued and is held liable pays damages directly to the party harmed by an externality. What differences in the behavior of victims might you expect to arise under these two arrangements?When the price of an activity that generates an externality reflects social costs, anefficient level of the activity is maintained. The producer of the externality reduces (fornegative externalities) or increases (for positive externalities) activity away from(towards) efficient levels. If those who suffer from the externality are not compensated,they find that their marginal cost is higher (for negative externalities) or lower (forpositive externalities), in contrast to the situation in which they would be compensated.5. Why does free access to a common property resource generate an inefficient outcome?Free access to a resource means that the marginal cost to the user is less than the socialcost. The use of a common property resource by a person or firm excludes others fromusing it. For example, the use of water by one consumer restricts its use by another.Because private marginal cost is below social marginal cost, too much of the resource isconsumed by the individual user, creating an inefficient outcome.6. Public goods are both nonrival and nonexclusive. Explain each of these terms and state clearly how they differ from each other.A good is nonrival if, for any level of production, the marginal cost of providing the goodto an additional consumer is zero (although the production cost of an additional unitcould be greater than zero). A good is nonexclusive if it is impossible or very expensiveto exclude individuals from consuming it. Public goods are nonrival and nonexclusive.Commodities can be (1) exclusive and rival, (2) exclusive and nonrival, (3) nonexclusiveand rival, or (4) nonexclusive and nonrival. Most of the commodities discussed in thetext to this point have been of the first type. In this chapter, we focus on commodities ofthe last type.Nonrival refers to the production of a good or service for one more customer. It usuallyinvolves a production process with high fixed costs, such as the cost of building ahighway or lighthouse. (Remember that fixed cost depends on the period underconsideration: the cost of lighting the lamp at the lighthouse can vary over time, butdoes not vary with the number of consumers.) Nonexclusive refers to exchange, wherethe cost of charging consumers is prohibitive. Incurring the cost of identifyingconsumers and collecting from them would result in losses. Some economists focus onthe nonexclusion property of public goods because it is this characteristic that poses themost significant problems for efficient provision.7. Public television is funded in part by private donations, even though anyone with a television set can watch for free. Can you explain this phenomenon in light of the free rider problem?The free-rider problem refers to the difficulty of excluding persons from consuming anonexclusive commodity. Non-paying consumers can “free-ride” on commoditiesprovided by paying customers. Public television is funded in part by contributions.Some viewers contribute, but most watch without paying, hoping that someone else willpay so they will not. To combat this problem these stations (1) ask consumers to assesstheir true willingness to pay, then (2) ask consumers to contribute up to this amount,and (3) attempt to make everyone else feel guilty for free-riding.8. Explain why the median voter outcome need not be efficient when majority rule voting determines the level of public spending.The median voter is the citizen with the middle preference: half the voting population ismore strongly in favor of the issue and half is more strongly opposed to the issue.Under majority-rule voting, where each citizen’s vote is weighted equally, the preferredspending level on public-goods provision of the median voter will win an electionagainst any other alternative.However, majority rule is not necessarily efficient, because it weights each citizen’spreferences equally. For an efficient outcome, we would need a system that measuresand aggregates the willingness to pay of those citizens consuming the public good.Majority rule is not this system. However, as we have seen in previous chapters,majority rule is equitable in the sense that all citizens are treated equally. Thus, weagain find a trade-off between equity and efficiency.1. A number of firms located in the western portion of a town after single-family residences took up the eastern portion. Each firm produces the same product and, in the process, emits noxious fumes that adversely affect the residents of the community.a. Why is there an externality created by the firms?Noxious fumes created by firms enter the utility function of residents. We can assumethat the fumes decrease the utility of the residents (i.e., they are a negative externality)and lower property values.b. Do you think that private bargaining can resolve the problem with the externality?Explain.If the residents anticipated the location of the firms, housing prices should reflect thedisutility of the fumes; the externality would have been internalized by the housingmarket in housing prices. If the noxious fumes were not anticipated, privatebargaining could resolve the problem of the externality only if there are a relativelysmall number of parties (both firms and families) and property rights are well specified.Private bargaining would rely on each family’s willingness to pay for air quality, buttruthful revelation might not be possible. All this will be complicated by theadaptability of the production technology known to the firms and the employmentrelations between the firms and families. It is unlikely that private bargaining willresolve the problem.c. How might the community determine the efficient level of air quality?The community could determine the economically efficient level of air quality byaggregating the families’ willingne ss to pay and equating it with the marginal cost ofpollution reduction. Both steps involve the acquisition of truthful information.2. A computer programmer lobbies against copyrighting software. He argues that everyone should benefit from innovative programs written for personal computers and that exposure to a wide variety of computer programs will inspire young programmers to create even more innovative programs. Considering the marginal social benefits possibly gained by his proposal, do you agree with the programmer’s position?Computer software as information is a classic example of a public good. Since it can becostlessly copied, the marginal cost of providing software to an additional user is nearzero. Therefore, software is nonrival. (The fixed costs of creating software are high, butthe variable costs are low.) Furthermore, it is expensive to exclude consumers fromcopying and using software because copy protection schemes are available only at highcost or high inconvenience to users. Therefore, software is also nonexclusive. As bothnonrival and nonexclusive, computer software suffers the problems of public goodsprovision: the presence of free-riders makes it difficult or impossible for markets toprovide the efficient level of software. Rather than regulating this market directly, thelegal system guarantees property rights to the creators of software. If copyrightprotection were not enforced, it is likely that the software market would collapse.Therefore, we do not agree with the computer programmer.3. Four firms located at different points on a river dump various quantities of effluent into it. The effluent adversely affects the quality of swimming for homeowners who live downstream. These people can build swimming pools to avoid swimming in the river, and firms can purchase filters that eliminate harmful chemicals in the material that is dumped in the river. As a policy advisor for a regional planning organization, how would you compare and contrast the following options for dealing with the harmful effect of the effluent:a. An equal-rate effluent fee on firms located on the river.First, one needs to know the value to homeowners of swimming in the river. Thisinformation can be difficult to obtain, because homeowners will have an incentive tooverstate this value. As an upper boundary, if there are no considerations other thanswimming, one could use the cost of building swimming pools, either a pool for eachhomeowner or a public pool for all homeowners. Next, one needs to know the marginalcost of abatement. If the abatement technology is well understood, this informationshould be readily obtainable. If the abatement technology is not understood, anestimate based on the firms’ knowledge must be used.The choice of a policy tool will depend on the marginal benefits and costs of abatement.If firms are charged an equal-rate effluent fee, the firms will reduce effluents to thepoint where the marginal cost of abatement is equal to the fee. If this reduction is nothigh enough to permit swimming, the fee could be increased. Alternatively, revenuefrom the fees could be to provide swimming facilities, reducing the need for effluentreduction.b. An equal standard per firm on the level of effluent each firm can dump.Standards will be efficient only if the policy maker has complete information regardingthe marginal costs and benefits of abatement. Moreover, the standard will notencourage firms to reduce effluents further when new filtering technologies becomeavailable.c. A transferable effluent permit system, in which the aggregate level of effluent isfixed and all firms receive identical permits.A transferable effluent permit system requires the policy maker to determine theefficient effluent standard. Once the permits are distributed and a market develops,firms with a higher cost of abatement will purchase permits from firms with lowerabatement costs. However, unless permits are sold initially, rather than merelydistributed, no revenue will be generated for the regional organization.4. Recent social trends point to growing intolerance of smoking in public areas. Many people point out the negative effects of “second hand” smoke. If you are a smoker and you wish to continue smoking despite tougher anti smoking laws, describe the effect of the following legislative proposals on your behavior. As a result of these programs, do you, the individual smoker, benefit? Does society benefit as a whole?Since smoking in public areas is similar to polluting the air, the programs proposedhere are similar to those examined for air pollution. A bill to lower tar and nicotinelevels is similar to an emissions standard, and a tax on cigarettes is similar to anemissions fee. Requiring a smoking permit is similar to a system of emissions permits,assuming that the permits would not be transferable. The individual smoker in all ofthese programs is being forced to internalize the externality of “second-hand” smokeand will be worse off. Society will be better off if the benefits of a particular proposaloutweigh the cost of implementing that proposal. Unfortunately, the benefits ofreducing second-hand smoke are uncertain, and assessing those benefits is costly.a. A bill is proposed that would lower tar and nicotine levels in all cigarettes.The smoker will most likely try to maintain a constant level of consumption of nicotine,and will increase his or her consumption of cigarettes. Society may not benefit fromthis plan if the total amount of tar and nicotine released into the air is the same.b. A tax is levied on each pack of cigarettes sold.Smokers might turn to cigars, pipes, or might start rolling their own cigarettes. Theextent of the effect of a tax on cigarette consumption depends on the elasticity ofdemand for cigarettes. Again, it is questionable whether society will benefit.c. Smokers would be required to carry smoking permits at all times. These permitswould be sold by the government.Smoking permits would effectively transfer property rights to clean air from smokers tonon-smokers. The main obstacle to society benefiting from such a proposal would bethe high cost of enforcing a smoking permits system.5. A beekeeper lives adjacent to an apple orchard. The orchard owner benefits from thebees because each hive pollinates about one acre of apple trees. The orchard owner pays nothing for this service, however, because the bees come to the orchard without his having to do anything. There are not enough bees to pollinate the entire orchard, and the orchard owner must complete the pollination by artificial means, at a cost of $10 per acre of trees.Beekeeping has a marginal cost of MC = 10 + 2Q, where Q is the number of beehives.Each hive yields $20 worth of honey.a. How many beehives will the beekeeper maintain?The beekeeper maintains the number of hives that maximizes profits, when marginalrevenue is equal to marginal cost. With a constant marginal revenue of $20 (there is noinformation that would lead us to believe that the beekeeper has any market power)and a marginal cost of 10 + 2Q:20 = 10 + 2Q, or Q = 5.b. Is this the economically efficient number of hives?If there are too few bees to pollinate the orchard, the farmer must pay $10 per acre forartificial pollination. Thus, the farmer would be willing to pay up to $10 to thebeekeeper to maintain each additional hive. So, the marginal social benefit, MSB, ofeach additional hive is $30, which is greater than the marginal private benefit of $20.Assuming that the private marginal cost is equal to the social marginal cost, we setMSB = MC to determine the efficient number of hives:30 = 10 + 2Q, or Q = 10.Therefore, the beekeeper’s private choice of Q = 5 is not the socially efficient number ofhives.c. What changes would lead to the more efficient operation?The most radical change that would lead to more efficient operations would be themerger of the farmer’s business with the beekeeper’s business. This merger wouldinternalize the positive externality of bee pollination. Short of a merger, the farmerand beekeeper should enter into a contract for pollination services.7. Reconsider the common resource problem as given by Example 18.5. Suppose that crawfish popularity continues to increase, and that the demand curve shifts from C = 0.401 - 0.0064F to C = 0.50 - 0.0064F. How does this shift in demand affect the actual crawfish catch, the efficient catch, and the social cost of common access? (Hint: Use the marginal social cost and private cost curves given in the example.)The relevant information is now the following:Demand: C = 0.50 - 0.0064FMSC: C = -5.645 + 0.6509F.With an increase in demand, the demand curve for crawfish shifts upward, intersectingthe price axis at $0.50. The private cost curve has a positive slope, so additional effortmust be made to increase the catch. Since the social cost curve has a positive slope, thesocially efficient catch also increases. We may determine the socially efficient catch bysolving the following two equations simultaneously:0.50 - 0.0064F = -5.645 + 0.6509F, or F* = 9.35.To determine the price that consumers are willing to pay for this quantity, substituteF* into the equation for marginal social cost and solve for C:C = -5.645 + (0.6509)(9.35), or C = $0.44.Next, find the actual level of production by solving these equations simultaneously:Demand: C = 0.50 - 0.0064FMPC: C = -0.357 + 0.0573F0.50 - 0.0064F = -0.357 + 0.0573F, or F** = 13.45.To determine the price that consumers are willing to pay for this quantity, substituteF** into the equation for marginal private cost and solve for C:C = -0.357 + (0.0573)(13.45), or C = $0.41.Notice that the marginal social cost of producing 13.45 units isMSC = -5.645 +(0.6509)(13.45) = $3.11.With the increase in demand, the social cost is the area of a triangle with a base of 4.1million pounds (13.45 - 9.35) and a height of $2.70 ($3.11 - 0.41), or $5,535,000 morethan the social cost of the original demand.8. The Georges Bank, a highly productive fishing area off New England, can be divided into two zones in terms of fish population. Zone 1 has the higher population per square mile but is subject to severe diminishing returns to fishing effort. The daily fish catch (in tons) in Zone 1 isF 1 = 200(X1) - 2(X1) 2where X1is the number of boats fishing there. Zone 2 has fewer fish per mile but is larger, and diminishing returns are less of a problem. Its daily fish catch isF 2 = 100(X2) - (X2) 2where X2is the number of boats fishing in Zone 2. The marginal fish catch MFC in each zone can be represented asMFC1 = 200 - 4(X1) MFC2= 100 - 2(X2).There are 100 boats now licensed by the U.S. government to fish in these two zones. The fish are sold at $100 per ton. The total cost (capital and operating) per boat is constant at $1,000 per day. Answer the following questions about this situation.a. If the boats are allowed to fish where they want, with no government restriction,how many will fish in each zone? What will be the gross value of the catch?Without restrictions, the boats will divide themselves so that the average catch (AF 1and AF 2) for each boat is equal in each zone. (If the average catch in one zone is greaterthan in the other, boats will leave the zone with the lower catch for the zone with thehigher catch.) We solve the following set of equations:AF 1 = AF 2 and X 1 + X 2 = 100 where 11121120022002AF X X X X =-=- and 222222100100AF X X X X =-=-. Therefore, AF 1 = AF 2 implies200 - 2X 1 = 100 - X 2,200 - 2(100 - X 2) = 100 - X 2, or X 21003= and 320031001001=⎪⎭⎫ ⎝⎛-=X . Find the gross catch by substituting the value of X 1 and X 2 into the catch equations:()(),,,,F 444488983331332002320020021=-=⎪⎭⎫ ⎝⎛-⎪⎭⎫ ⎝⎛= and ().,,,F 2222111133333100310010022=-=⎪⎭⎫ ⎝⎛-⎪⎭⎫ ⎝⎛= The total catch is F 1 + F 2 = 6,666. At the price of $100 per ton, the value of the catch is$666,600. The average catch for each of the 100 boats in the fishing fleet is 66.66 tons.To determine the profit per boat, subtract total cost from total revenue:π = (100)(66.66) - 1,000, or π = $5,666.Total profit for the fleet is $566,000.b. If the U.S. government can restrict the boats, how many should be allocated to eachzone? What will the gross value of the catch be? Assume the total number of boats remains at 100.Assume that the government wishes to maximize the net social value of the fish catch,i.e., the difference between the total social benefit and the total social cost. Thegovernment equates the marginal fish catch in both zones, subject to the restrictionthat the number of boats equals 100:MFC 1 = MFC 2 and X 1 + X 2 = 100,MFC 1 = 200 - 4X 1 and MFC 2 = 100 - 2X 2.Setting MFC 1 = MFC 2 implies:200 - 4X 1 = 100 - 2X 2, or 200 - 4(100 - X 2) = 100 - 2X 2, or X 2 = 50 andX 1 = 100 - 50 = 50.Find the gross catch by substituting X 1 and X 2 into the catch equations:F 1 = (200)(50) - (2)(502) = 10,000 - 5,000 = 5,000 andChapter 18: Externalities and Public Goods242 F 2 = (100)(50) - 502 = 5,000 - 2,500 = 2,500.The total catch is equal to F 1 + F 2 = 7,500. At the market price of $100 per ton, thevalue of the catch is $750,000. Total profit is $650,000. Notice that the profits are notevenly divided between boats in the two zones. The average catch in Zone A is 100 tonsper boat, while the average catch in Zone B is 50 tons per boat. Therefore, fishing inZone A yields a higher profit for the individual owner of the boat.c. If additional fishermen want to buy boats and join the fishing fleet, should agovernment wishing to maximize the net value of the fish catch grant them licenses to do so? Why or why not?To answer this question, first determine the profit-maximizing number of boats in eachzone. Profits in Zone A areππA A X X X X X =--=-1002002100019000200112112b g e j,,, or . To determine the change in profit with a change in X 1 take the first derivative of theprofit function with respect to X 1:d dX X A π1119000400=-,. To determine the profit-maximizing level of output, setd dX A π1equal to zero and solve for X 1:19,000 - 400X 1 = 0, or X 1 = 47.5.Substituting X 1 into the profit equation for Zone A gives: ()()()()()()()()250,451$5.47000,15.4725.472001002=--=A π.For Zone B follow a similar procedure. Profits in Zone B areππB B X X X X X =--=-100100100090002002222222b g e j,,, or . Taking the derivative of the profit function with respect to X 2 givesd X B π229000200=-,. Setting d B π2equal to zero to find the profit-maximizing level of output gives 9,000 - 200X 2 = 0, or X 2 = 45.Substituting X 2 into the profit equation for Zone B gives:πB = (100)((100)(45) - 452) - (1,000)(45) = $202,500.Total profit from both zones is $653,750, with 47.5 boats in Zone A and 45 boats in ZoneB. Because each additional boat above 92.5 decreases total profit, the governmentshould not grant any more licenses.。

平狄克第八版课后答案【篇一:平狄克微观经济学课后习题答案-第7-8 章】> 1. 显性成本2. 她自己做其他事时会得到的最高收入3. 多用资本,少用工人4. 完全竞争价格给定, 即斜率不变5. 不意味6. 意味着递增7. avcac mc 递增mc=avc 最低点mc=ac 最低点1.1 形9 . 长期扩展线为把等产量线簇上斜率相同点连起来,此时它改变了斜率10 .规模经济基础是内在经济,针对一种产品范围经济基础是同时生产高度相关的产品.练习题1.avc=1000 ac=1000+1000/q非常大,最后为10002. 不对,除非工人只可以在这里找到工作3. 见书后4. 见书后5. 见书后6. 每个均衡点斜率更小7. 不同意,应按不同时段定价,如不可,则同意8. 见书后9.tc=120000+3000(q/40)+2000ac=75+122000/qmc=75ac 随q 减小2 个劳动组,1600 元1/4, 更大的生产能力11.190 万元53 元53 元19 元第七章附录练习题1 、我们考查规模报酬时可由f( ak,al)与af( k,l)之间的关系判断当f( ak,al) af( k,l),表明是规模报酬递增;当f( ak,al) =af( k,l),表明是规模报酬不变;当f( ak,al) af( k,l),表明是规模报酬递减;( a)规模报酬递增;( b)规模报酬不变;( c)规模报酬递增。

2 、根据已知条件,资本价格r=30 ,设劳动价格为w,则成本函数c=30k+ wl联立(1) ,(2),(3)可得k=(w/3) 1/2 ,l=(300/w) 1/2 ,此时成本最小,代入成本函数c=30k+ wl ,得c=2 ( 300w ) 1/2联立(1) ,(2),(3)可得k/l=3/4 ,此时成本最小,即生产既定产出的成本最小化的资本和劳动的组合为资本/劳动=3/4。

4、( a)已知q=10k0.8(l-40)0.2 ,得mpl=2(k/ (l-40))0.8 , mpk=8( (l-40) / k)0.2 ,在最小成本点有:mpl/ mpk=w/r即2(k/ (l-40))0.8/8( (l-40) / k)0.2=w/r ,k/( l-40) =4 w/r ,l-40=kr/4w ,0.80.20.2q=10k(l-40)=10 k ( r/4w),最小需求为:k=q/10(r/4w)0.2 ,l=40+ q (r/4w)0.8/10总成本函数为:tc=10q+kr+lw=10q+q/10((4w)0.2r0.8+(r/4)0.8w0.2)+40w( b)当r=64 ,w=32 时tc=10q+ (2*20.2+0.50.8)32 q/10+1280tc=1280+10q+91.84 q/10=1280+19.184q该技术呈现规模递减。

第十章 复习题1.该垄断者减少产量,直到边际成本等于边际收益。

2.P MC P E D-=-1该等式表明,当弹性上升(需求变得更加有弹性),弹性相反数的下降和度量市场力的下降,因而当弹性上升(下降),厂商有更少(多)能力使价格高于边际成本。

3.垄断者的产出决定由需求曲线和边际成本决定。

因而需求的变动不仅像竞争的供给曲线那样给出一系列价格和产量,而且需求的变动可以导致价格改变但产量并不变,也可以导致产量改变而价格不变。

他们不存在价格和产量之间的一一对应关系,因自垄断市场没有供给曲线。

4.垄断力量的程度或一个厂商左右市场的力量取决于面对的需求曲线的弹性。

因此如果厂商的需求曲线的弹性小于无穷,厂商就有一些垄断势力。

5.来源于3个方面:(1)市场需求弹性,如,欧佩克利用石油在短期是无弹性而控制油价(2)厂商的数目,如,某3个厂商控制某一产品的市场份额,他们就有了垄断势力(3)厂商间的相互作用,如,几个主要的厂商相互串通,那么他们就能产生垄断势力。

6.同上7.垄断势力的结果是较高的价格和较低的产量,容易使消费者的利益受损,消费者剩余就会减少。

同时厂商可能用一些非生产的方式来保持他的垄断地位,从而使社会成本更大。

8. 藉由在垄断者的取利润最大值的价格下面限制价格,政府能改变厂商的边际收益曲线的形状。

当价格极高被征税的时候,边际收益为比以极高价格量低的量和极高价格相等。

如果政府取输出最大值,它应该将一个价格对手设定为边际成本。

价格在这一个水平下面引诱公司减少制造, 假定边际成本曲线正在以上难以下咽的食物。

调整者的问题要决定垄断的边际成本曲线的形状。

9. 边际的支出是在总支出方面的改变如被购买的量的变化。

对于为购买由于许多厂商竞争的一个厂商,边际的支出和平均支出相等。

所有的厂商应该购买以便最后一个单位的边际价值和在那一个单位上的边际支出相等。

这对两者的竞争买主和垄断者是真实的。

10. 买方垄断势力是购买者影响一种货物价格的能力。

第一章复习题1.市场是通过相互作用决定一种或一系列产品价格的买卖双方的集合,因此可以把市场看作决定价格的场所。

行业是出售相同的或紧密相关的产品的厂商的集合,一个市场可以包括许多行业。

2.评价一个理论有两个步骤:首先,需要检验这个理论假设的合理性;第二,把该理论的预测和事实相比较以此来验证它。

如果一个理论无法被检验的话,它将不会被接受。

因此,它对我们理解现实情况没有任何帮助。

3.实证分析解释“是什么”的问题,而规范分析解释的是“应该是什么”的问题。

对供给的限制将改变市场的均衡。

A中包括两种分析,批评这是一种“失败的政策”——是规范分析,批评其破坏了市场的竞争性——是实证分析。

B向我们说明在燃油的配给制下总社会福利的被损坏——是实证分析。

4.由于两个市场在空间上是分离的,商品在两地间的运输是套利实现的条件。

如果运输成本为零,则可以在Oklahoma购买汽油,到New Jersey出售,赚取差价;如果这个差价无法弥补运输成本则不存在套利机会。

5.商品和服务的数量与价格由供求关系决定。

鸡蛋的实际价格从1970年至1985年的下降,一方面是由于人们健康意识的提高而导致鸡蛋需求的减少,同时也因为生产成本的降低。

在这两种因素下,鸡蛋的价格下降了。

大学教育的实际价格的升高,是由于越来越多的人倾向于获得大学教育而导致需求提高,同时教育的成本也在升高。

在这两方面因素作用下,大学教育费用提高了。

6.日圆相对美圆来说,价值升高,升值前相比,兑换同样数量的日圆需要付出更多的美圆。

由汇率的变化引起购买力的变化,在日本市场出售的美国汽车,由于美圆贬值日圆升值,持有日圆的消费者将较以前支付较底的价格;而在美国市场出售的日本汽车,由于日圆升值美圆贬值,持有美圆的消费者将面对较以前提高的价格。

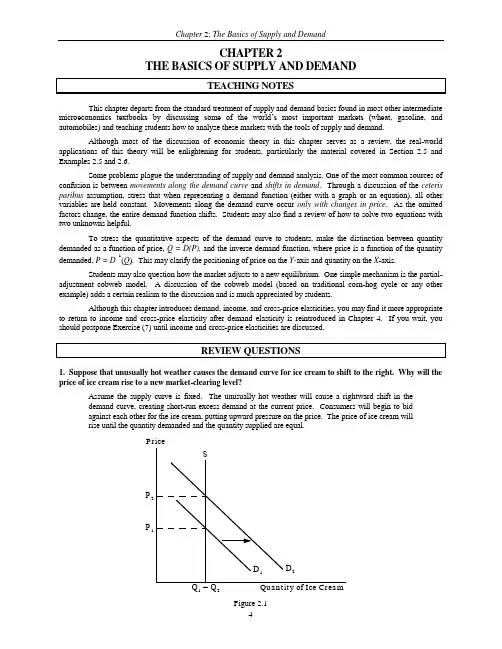

第二章复习题1.假设供给曲线固定,炎热天气通常会引起需求曲线右移,在当前价格上造成短期需求过剩。

消费者为获得冰激凌,愿意为每一单位冰激凌出价更高。

CHAPTER 2THE BASICS OF SUPPLY AND DEMANDThis chapter departs from the standard treatment of supply and demand basics found in most other intermediate microeconomics textbooks by discussing some of the world’s most important markets (wheat, gasoline, and automobiles) and teaching students how to analyze these markets with the tools of supply and demand.Although most of the discussion of economic theory in this chapter serves as a review, the real-world applications of this theory will be enlightening for students, particularly the material covered in Section 2.5 and Examples 2.5 and 2.6.Some problems plague the understanding of supply and demand analysis. One of the most common sources of confusion is between movements along the demand curve and shifts in demand. Through a discussion of the ceteris paribus assumption, stress that when representing a demand function (either with a graph or an equation), all other variables are held constant. Movements along the demand curve occur only with changes in price. As the omitted factors change, the entire demand function shifts. Students may also find a review of how to solve two equations with two unknowns helpful.To stress the quantitative aspects of the demand curve to students, make the distinction between quantity demanded as a function of price, Q = D(P), and the inverse demand function, where price is a function of the quantity demanded, P = D-1(Q). This may clarify the positioning of price on the Y-axis and quantity on the X-axis.Students may also question how the market adjusts to a new equilibrium. One simple mechanism is the partial-adjustment cobweb model. A discussion of the cobweb model (based on traditional corn-hog cycle or any other example) adds a certain realism to the discussion and is much appreciated by students.Although this chapter introduces demand, income, and cross-price elasticities, you may find it more appropriate to return to income and cross-price elasticity after demand elasticity is reintroduced in Chapter 4. If you wait, you should postpone Exercise (7) until income and cross-price elasticities are discussed.1. Suppose that unusually hot weather causes the demand curve for ice cream to shift to the right. Why will the price of ice cream rise to a new market-clearing level?Assume the supply curve is fixed. The unusually hot weather will cause a rightwardshift in the demand curve, creating short-run excess demand at the current price.Consumers will begin to bid against each other for the ice cream, putting upwardpressure on the price. The price of ice cream will rise until the quantity demanded andthe quantity supplied are equal.4. Why do long-run elasticities of demand differ from short-run elasticities? Consider two goods: paper towels and televisions. Which is a durable good? Would you expect the price elasticity of demand for paper towels to be larger in the short-run or in the long-run? Why? What about the price elasticity of demand for televisions?Long-run and short-run elasticities differ based on how rapidly consumers respond toprice changes and how many substitutes are available. If the price of paper towels, anon-durable good, were to increase, consumers might react only minimally in the shortrun. In the long run, however, demand for paper towels would be more elastic as newsubstitutes entered the market (such as sponges or kitchen towels). In contrast, thequantity demanded of durable goods, such as televisions, might change dramatically inthe short run following a price change. For example, the initial influence of a priceincrease for televisions would cause consumers to delay purchases because durablegoods are built to last longer. Eventually consumers must replace their televisions asthey wear out or become obsolete; therefore, we expect the demand for durables to bemore elastic in the long run.5. Explain why, for many goods, the long-run price elasticity of supply is larger than the short-run elasticity.The elasticity of supply is the percentage change in the quantity supplied divided by thepercentage change in price. An increase in price induces an increase in the quantitysupplied by firms. Some firms in some markets may respond quickly and cheaply toprice changes. However, other firms may be constrained by their production capacity inthe short run. The firms with short-run capacity constraints will have a short-runsupply elasticity that is less elastic. However, in the long run all firms can increasetheir scale of production and thus have a larger long-run price elasticity.6. Suppose the government regulates the prices of beef and chicken and sets them below their market-clearing levels. Explain why shortages of these goods will develop and what factors will determine the sizes of the shortages. What will happen to the price of pork? Explain briefly.If the price of a commodity is set below its market-clearing level, the quantity that firmsare willing to supply is less than the quantity that consumers wish to purchase. Theextent of the excess demand implied by this response will depend on the relativeelasticities of demand and supply. For instance, if both supply and demand are elastic,the shortage is larger than if both are inelastic. Factors such as the willingness ofconsumers to eat less meat and the ability of farmers to change the size of their herdsand produce less determine these elasticities and influence the size of excess demand.Rationing will result in situations of excess demand when some consumers are unableto purchase the quantities desired. Customers whose demands are not met willattempt to purchase substitutes, thus increasing the demand for substitutes and raisingtheir prices. If the prices of beef and chicken are set below market-clearing levels, theprice of pork will rise.7. In a discussion of tuition rates, a university official argues that the demand for admission is completely price inelastic. As evidence she notes that while the university has doubled its tuition (in real terms) over the past 15 years, neither the number nor quality of students applying has decreased. Would you accept this argument? Explain briefly. (Hint: The official makes an assertion about the demand for admission, but does she actually observe a demand curve? What else could be going on?)If demand is fixed, the individual firm (a university) may determine the shape of thedemand curve it faces by raising the price and observing the change in quantity sold.The university official is not observing the entire demand curve, but rather only theequilibrium price and quantity over the last 15 years. If demand is shifting upward, assupply shifts upward, demand could have any elasticity. (See Figure 2.7, for example.)Demand could be shifting upward because the value of a college education hasincreased and students are willing to pay a high price for each opening. More marketc. A drought shrinks the apple crop to one-third its normal size.The supply curve would shift in, causing the equilibrium price to rise and theequilibrium quantity to fall.d. Thousands of college students abandon the academic life to become apple pickers.The increased supply of apple pickers will lead to a decrease in the cost of bringingapples to market. The decreased cost of bringing apples to market results in anoutward shift of the supply curve of apples and causes the equilibrium price to fall andthe equilibrium quantity to increase.e. Thousands of college students abandon the academic life to become apple growers.This would result in an outward shift of the supply curve for apples, causing theequilibrium price to fall and the equilibrium quantity to increase.1. Consider a competitive market for which the quantities demanded and supplied (per year) at various prices are given as follows:Price($)Demand (millions) Supply (millions) 6022 14 8020 16 10018 18 12016 20 a. Calculate the price elasticity of demand when the price is $80. When the price is$100.We know that the price elasticity of demand may be calculated using equation 2.1 fromthe text:E Q Q P PP Q Q PD D D D D ==∆∆∆∆. With each price increase of $20, the quantity demanded decreases by 2. Therefore,∆∆Q P DF HG I K J =-=-22001.. At P = 80, quantity demanded equals 20 andE D =F HG I KJ -=-802001040...b g Similarly, at P = 100, quantity demanded equals 18 andE D =F HG I K J -=-1001801056...b g b. Calculate the price elasticity of supply when the price is $80. When the price is $100.The elasticity of supply is given by:E Q Q P P Q Q PS S S S S ==∆∆∆∆. With each price increase of $20, quantity supplied increases by 2. Therefore,∆∆Q SF HG I K J ==22001.. At P = 80, quantity supplied equals 16 andE S =F HG I KJ =80160105..bg .Similarly, at P = 100, quantity supplied equals 18 andE S=FH GIK J= 1001801056...bgc. What are the equilibrium price and quantity?The equilibrium price and quantity are found where the quantity supplied equals thequantity demanded at the same price. As we see from the table, the equilibrium priceis $100 and the equilibrium quantity is 18 million.d. Suppose the government sets a price ceiling of $80. Will there be a shortage, and, ifso, how large will it be?With a price ceiling of $80, consumers would like to buy 20 million, but producers willsupply only 16 million. This will result in a shortage of 4 million.2. Refer to Example 2.3 on the market for wheat. Suppose that in 1985 the Soviet Union hadbought an additional 200 million bushels of U.S. wheat. What would the free market price of wheat have been and what quantity would have been produced and sold by U.S. farmers?The following equations describe the market for wheat in 1985:QS= 1,800 + 240PandQD= 2,580 - 194P.If the Soviet Union had purchased an additional 200 million bushels of wheat, the newdemand curve 'Q D, would be equal to Q ED + 200, or'Q D= (2,580 - 194P) + 200 = 2,780 - 194PEquating supply and the new demand, we may determine the new equilibrium price,1,800 + 240P = 2,780 - 194P, or434P = 980, or P* = $2.26 per bushel.To find the equilibrium quantity, substitute the price into either the supply or demandequation, e.g.,QS= 1,800 + (240)(2.26) = 2,342andQD= 2,780 - (194)(2.26) = 2,342.3. The rent control agency of New York City has found that aggregate demand is QD= 100 - 5P measured in tens of thousands of apartments, and price, the average monthly rental rate, P, with quantity measured in hundreds of dollars. The agency also noted that the increase in Q at lower P results from more three-person families coming into the city from Long Island and demanding apartments. The city’s board of realtors acknowledges that this is agood demand estimate and has shown that supply is QS= 50 + 5P.a. If both the agency and the board are right about demand and supply, what is the freemarket price? What is the change in city population if the agency sets a maximum average monthly rental of $100, and all those who cannot find an apartment leave the city?To find the free market price for apartments, set supply equal to demand:100 - 5P = 50 + 5P, or P = $500.Substituting the equilibrium price into either the demand or supply equation todetermine the equilibrium quantity:QD= 100 - (5)(5) = 75andQ S = 50 + (5)(5) = 75.We find that at the rental rate of $500, 750,000 apartments are rented.If the rent control agency sets the rental rate at $100, the quantity supplied would thenbe 550,000 (Q S = 50 + (5)(100) = 550), a decrease of 200,000 apartments from the freemarket equilibrium. (Assuming three people per family per apartment, this wouldimply a loss of 600,000 people.) At the $100 rental rate, the demand for apartments is950,000 units, and the resultant shortage is 400,000 units.b. Suppose the agency bows to the wishes of the board and sets a rental of $900 permonth on all apartments to allow landlords a “fair” rate of return. If 50 percent of any long-run increases in apartment offerings comes from new construction, how many apartments are constructed?At a rental rate of $900, the supply of apartments would be 50 + 5(9) = 95, or 950,000units, which is an increase of 200,000 units over the free market equilibrium.Therefore, (0.5)(200,000) = 100,000 units would be constructed. Note, however, thatsince demand is only 550,000 units, 400,000 units would go unrented.4. Much of the demand for U.S. agricultural output has come from other countries. From Example 2.3, total demand is Q = 3,550 - 266P . In addition, we are told that domestic demand is Q d = 1,000 - 46P . Domestic supply is Q S = 1,800 + 240P . Suppose the export demand for wheat falls by 40 percent.a. U.S. farmers are concerned about this drop in export demand. What happens to thefree market price of wheat in the United States? Do the farmers have much reason to worry?Given total demand, Q = 3,550 - 266P , and domestic demand, Q d = 1,000 - 46P , we maysubtract and determine export demand, Q e = 2,550 - 220P .The initial market equilibrium price is found by setting total demand equal to supply:3,550 - 266P - 1,800 + 240P , orP = $3.46.There are two different ways to handle the 40 percent drop in demand. One way is toassume that the demand curve shifts down so that at all prices demand decreases by 40percent. The second way is to rotate the demand curve in a clockwise manner aroundthe vertical intercept (i.e. in the current case the demand curve would becomeQ = 3,550 - 159.6P ). We apply the former approach in the solution to exercises here.Regardless of the two approaches, the effect on prices and quantity will be qualitativelythe same, but will differ quantitatively.Therefore, if export demand decreases by 40 percent, total demand becomesQ D = Q d + 0.6Q e = 1,000 - 46P + (0.6)(2,550 - 220P ) = 2,530 - 178P .Equating total supply and total demand,1,800 + 240P = 2,530 - 178P , orP = $1.75,which is a significant drop from the market-clearing price of $3.46 per bushel. At thisprice, the market-clearing quantity is 2,219 million bushels. Total revenue hasdecreased from $9.1 billion to $3.9 billion. Most farmers would worry.b. Now suppose the U.S. government wants to buy enough wheat each year to raise theprice to $3.00 per bushel. Without export demand, how much wheat would the government have to buy each year? How much would this cost the government?With a price of $3, the market is not in equilibrium. Demand = 1000 - 46(3) = 862.Supply = 1800 + 240(3) = 2,520, and excess supply is therefore 2,520 - 862 = 1,658. Thegovernment must purchase this amount to support a price of $3, and will spend $3(1.66million) = $5.0 billion per year.5. In Example 2.6 we examined the effect of a 20 percent decline in copper demand on the price of copper, using the linear supply and demand curves developed in Section 2.5. Suppose the long-run price elasticity of copper demand were -0.4 instead of -0.8.a. Assuming, as before, that the equilibrium price and quantity are P* = 75 cents perpound and Q* = 7.5 million metric tons per year, derive the linear demand curve consistent with the smaller elasticity.Following the method outlined in Section 2.5, we solve for a and b in the demandequation Q D = a - bP . First, we know that for a linear demand function E b P D =-F H G I KJ *. Here E D = -0.4 (the long-run price elasticity), P* = 0.75 (the equilibrium price), and Q* =7.5 (the equilibrium quantity). Solving for b , -=-F H I K0407575...b , or b = 4. To find the intercept, we substitute for b , Q D (= Q *), and P (= P *) in the demandequation:7.5 = a - (4)(0.75), or a = 10.5.The linear demand equation consistent with a long-run price elasticity of -0.4 isthereforeQ D = 10.5 - 4P .b. Using this demand curve, recalculate the effect of a 20 percent decline in copperdemand on the price of copper.The new demand is 20 percent below the original (using our convention that the wholedemand curve is shifted down by 20 percent):'Q D =-=-0810548432....a f a fP P . Equating this to supply,8.4 - 3.2P = -4.5 + 16P , orP = 0.672.With the 20 percent decline in the demand, the price of copper falls to 67.2 cents perpound.6. Example 2.7 analyzes the world oil market. Using the data given in that example,a. Show that the short-run demand and competitive supply curves are indeed given byD = 24.08 - 0.06PS C = 11.74 + 0.07P .First, considering non-OPEC supply:S c = Q * = 13.With E S = 0.10 and P * = $18, E S = d (P */Q *) implies d = 0.07.Substituting for d , S c , and P in the supply equation, c = 11.74 and S c = 11.74 + 0.07P .Similarly, since Q D = 23, E D = -b (P */Q *) = -0.05, and b = 0.06. Substituting for b , Q D = 23, and P = 18 in the demand equation gives 23 = a - 0.06(18), so that a = 24.08.Hence Q D = 24.08 - 0.06P .b. Show that the long-run demand and competitive supply curves are indeed given byD = 32.18 - 0.51PS C = 7.78 + 0.29P .As above, E S = 0.4 and E D = -0.4: E S = d (P */Q *) and E D = -b(P*/Q*), implying 0.4 = d (18/13)and -0.4 = -b (18/23). So d = 0.29 and b = 0.51.Next solve for c and a :S c = c + dP and Q D = a - bP , implying 13 = c + (0.29)(18) and 23 = a - (0.51)(18).So c = 7.78 and a = 32.18.c. Use this model to calculate what would happen to the price of oil in the short-runand the long-run if OPEC were to cut its production by 6 billion barrels per year.With OPEC’s supply reduced from 10 bb/yr to 4 bb/yr, add this lower supply of 4 bb/yr to the short-run and long-run supply equations:S c ' = 4 + S c = 11.74 + 4 + 0.07P = 15.74 + 0.07P and S " = 4 + S c = 11.78 + 0.29P .These are equated with short-run and long-run demand, so that:15.74 + 0.07P = 24.08 - 0.06P ,implying that P = $64.15 in the short run; and11.78 + 0.29P = 32.18 - 0.51P ,implying that P = $24.29 in the long run.7.Refer to Example 2.8, which analyzes the effects of price controls on natural gas. a. Using the data in the example, show that the following supply and demand curvesdid indeed describe the market in 1975:Supply: Q = 14 + 2P G + 0.25P ODemand: Q = -5P G + 3.75P Owhere P G and P O are the prices of natural gas and oil, respectively. Also, verify that if the price of oil is $8.00, these curves imply a free market price of $2.00 for natural gas.To solve this problem, we apply the analysis of Section 2.5 to the definition of cross-price elasticity of demand given in Section 2.3. For example, the cross-price-elasticity of demand for natural gas with respect to the price of oil is:E Q P P Q GO G O G G=F HG I K J FH GI KJ ∆∆. ∆∆Q P G O F H G IK J is the change in the quantity of natural gas demanded, because of a small change in the price of oil. For linear demand equations,∆∆Q P G O F H G I K J is constant. If we represent demand as:Q G = a - bP G + eP O(notice that income is held constant), then∆∆Q P G OF HG I K J = e . Substituting this into the cross-price elasticity, E e P Q PO O G=F H G I K J **, where P O * and Q G * are the equilibrium price and quantity. We know that P O * = $8 and Q G* = 20 trillion cubic feet (Tcf). Solving for e , 15820.=F H G I KJ e , or e = 3.75. Similarly, if the general form of the supply equation is represented as:Q G = c + dP G + gP O , the cross-price elasticity of supply is g P Q OG**F H G I K J , which we know to be 0.1. Solving for g , ⎪⎭⎫ ⎝⎛=2081.0g , or g = 0.25. The values for d and b may be found with equations 2.5a and 2.5b in Section 2.5. Weknow that E S = 0.2, P* = 2, and Q* = 20. Therefore,⎪⎭⎫ ⎝⎛=2022.0d , or d = 2.Also, E D = -0.5, so⎪⎭⎫ ⎝⎛=-2025.0b , or b = -5. By substituting these values for d, g, b , and e into our linear supply and demandequations, we may solve for c and a :20 = c + (2)(2) + (0.25)(8), or c = 14,and20 = a - (5)(2) + (3.75)(8), or a = 0.If the price of oil is $8.00, these curves imply a free market price of $2.00 for naturalgas. Substitute the price of oil in the supply and demand curves to verify theseequations. Then set the curves equal to each other and solve for the price of gas.14 + 2P G + (0.25)(8) = -5P G + (3.75)(8), 7P G = 14, orP G = $2.00.b. Suppose the regulated price of gas in 1975 had been $1.50 per million cubic feet,instead of $1.00. How much excess demand would there have been?With a regulated price of $1.50 for natural gas and a price of oil equal to $8.00 perbarrel,Demand: Q D = (-5)(1.50) + (3.75)(8) = 22.5, andSupply: Q S = 14 + (2)(1.5) + (0.25)(8) = 19.With a supply of 19 Tcf and a demand of 22.5 Tcf, there would be an excess demand of3.5 Tcf.c. Suppose that the market for natural gas had not been regulated. If the price of oilhad increased from $8 to $16, what would have happened to the free market price of natural gas?If the price of natural gas had not been regulated and the price of oil had increasedfrom $8 to $16, thenDemand: Q D = -5P G + (3.75)(16) = 60 - 5P G , andSupply: Q S = 14 + 2P G + (0.25)(16) = 18 + 2P G .Equating supply and demand and solving for the equilibrium price,18 + 2P G = 60 - 5P G , or P G = $6.The price of natural gas would have tripled from $2 to $6.。

第一章复习题1.市场是通过相互作用决定一种或一系列产品价格的买卖双方的集合,因此可以把市场看作决定价格的场所。

行业是出售相同的或紧密相关的产品的厂商的集合,一个市场可以包括许多行业。

2.评价一个理论有两个步骤:首先,需要检验这个理论假设的合理性;第二,把该理论的预测和事实相比较以此来验证它。

如果一个理论无法被检验的话,它将不会被接受。

因此,它对我们理解现实情况没有任何帮助。

3.实证分析解释“是什么”的问题,而规范分析解释的是“应该是什么”的问题。

对供给的限制将改变市场的均衡。

A中包括两种分析,批评这是一种“失败的政策”——是规范分析,批评其破坏了市场的竞争性——是实证分析。

B向我们说明在燃油的配给制下总社会福利的被损坏——是实证分析。

4.由于两个市场在空间上是分离的,商品在两地间的运输是套利实现的条件。

如果运输成本为零,则可以在Oklahoma购买汽油,到New Jersey出售,赚取差价;如果这个差价无法弥补运输成本则不存在套利机会。

5.商品和服务的数量与价格由供求关系决定。

鸡蛋的实际价格从1970年至1985年的下降,一方面是由于人们健康意识的提高而导致鸡蛋需求的减少,同时也因为生产成本的降低。

在这两种因素下,鸡蛋的价格下降了。

大学教育的实际价格的升高,是由于越来越多的人倾向于获得大学教育而导致需求提高,同时教育的成本也在升高。

在这两方面因素作用下,大学教育费用提高了。

6.日圆相对美圆来说,价值升高,升值前相比,兑换同样数量的日圆需要付出更多的美圆。

由汇率的变化引起购买力的变化,在日本市场出售的美国汽车,由于美圆贬值日圆升值,持有日圆的消费者将较以前支付较底的价格;而在美国市场出售的日本汽车,由于日圆升值美圆贬值,持有美圆的消费者将面对较以前提高的价格。

第二章复习题1.假设供给曲线固定,炎热天气通常会引起需求曲线右移,在当前价格上造成短期需求过剩。

消费者为获得冰激凌,愿意为每一单位冰激凌出价更高。

第2章供给和需求的基本原理一、单项选择题1.若需求曲线为直角双曲线,则商品价格的上升将引起消费者在该商品上的总花费()。

A.增加B.下降C.不变D.以上均有可能【答案】C【解析】因为直角双曲线上点弹性处处相等且等于1,即处处为单位弹性。

单位弹性的商品降价或提高价格对厂商的销售收入都没有影响,因此消费者在该商品上的总花费不变。

2.下列说法中正确的是()。

A.收入弹性取决于商品本身的属性B.不同商品在一定收入范围内具有相同的收入弹性C.同一商品在不同的收入范围内具有相同的收入弹性D.同一商品在不同的收入范围内具有不同的收入弹性【答案】D【解析】收入弹性取决于商品本身的属性和消费者的收入水平。

例如,对同一个消费者而言,任一收入水平下,都会有必需品和奢侈品,其收入弹性自然不同;同时,对同一个消费者而言,收入水平极低时,水果是奢侈品,收入弹性,但收入水平提高后,也许就成了必需品了,收入弹性。

因此,商品不同、收入水平不同,都会有不同的收入弹性。

3.需求价格弹性等于( )。

A .需求曲线上两点间价格的变动量除以需求的变动量B .需求曲线上需求的变动量除以价格的变动量C .需求曲线上价格的变动比除以需求的变动比D .需求曲线上需求的变动比除以价格的变动比【答案】D【解析】需求价格弹性表示商品需求量对自身价格变动的反应程度,即:。

4.商品是正常品,则当其价格下降时( )。

A .商品的需求量会下降B .商品的需求会下降C .商品的需求量会上升D .商品的需求会上升【答案】C【解析】需求变动是指价格之外的变量变化对消费者决策的影响,它与整个需求曲线的移动是对应的;需求量的变动则是价格变化对消费者均衡购买量的影响,它对应于一条需求曲线上点的移动。

因此当商品价格下降时,其需求量会上升。

1I E >1I E <//P Q Q E P P∆=∆x x x x x x5.如果某商品的价格下降5%后,消费者对此商品的货币支出增加了2%,则需求曲线在这一区域内的需求弹性为( )。

平狄克微观经济学课后习题答案(中文)第九版第一章经济学的研究对象和方法习题1-1答案:经济学的研究对象是人类的经济活动,包括生产、交换、分配和消费等方面。

经济学的研究方法主要包括观察、实证分析和理论分析等。

习题1-2答案:观察是经济学研究的基础,通过观察可以获得经济现象的真实情况。

实证分析是基于观察数据进行的定量分析,通过统计分析等方法来验证经济理论的有效性。

理论分析是通过构建模型和假设来研究和解释经济现象的原因和机制。

习题1-3答案:经济学的分类有宏观经济学和微观经济学两个主要方向。

宏观经济学研究整个经济体系的总体运行规律,涉及国民经济的总量问题;微观经济学研究个体经济单位(如个人、家庭、企业)的经济行为和决策,涉及资源配置和效率问题。

习题1-4答案:正式的经济学的定义是一个关于个体与群体选择的社会科学。

它研究人们如何利用有限的资源,以满足无限的欲望。

经济学通过分析经济行为的原理和规律,帮助人们做出更好的经济决策,实现资源的高效配置和社会福利的最大化。

第二章需求、供给与市场均衡习题2-1答案:需求是指个人或市场上愿意购买某种商品或服务的能力和意愿。

供给是指个人或企业愿意出售某种商品或服务的能力和意愿。

习题2-2答案:需求曲线是描述消费者对某种商品或服务需求量与价格之间关系的曲线。

供给曲线是描述生产者或企业对某种商品或服务供给量与价格之间关系的曲线。

习题2-3答案:当市场需求量大于市场供给量时,市场处于短缺状态,价格将上涨;当市场供给量大于市场需求量时,市场处于过剩状态,价格将下降。

只有当市场需求量等于市场供给量时,市场达到均衡状态,价格稳定。

习题2-4答案:市场需求量变化的因素包括消费者收入、商品价格、相关商品价格和个人偏好等。

市场供给量变化的因素包括生产成本、生产技术、生产要素价格和政府政策等。

第三章边际分析及其应用习题3-1答案:边际分析是指在某一决策过程中,考察增加或减少一单元该决策的收益或成本的变化量。

目 录第1篇 导论:市场和价格第1章 绪 论第2章 供给和需求的基本原理第2篇 生产者、消费者与竞争性市场第3章 消费者行为第4章 个人需求和市场需求第5章 不确定性与消费者行为第6章 生 产第7章 生产成本第8章 利润最大化与竞争性供给第9章 竞争性市场分析第3篇 市场结构与竞争策略第10章 市场势力:垄断和买方垄断第11章 有市场势力的定价第12章 垄断竞争和寡头垄断第13章 博弈论与竞争策略第14章 投入要素市场第15章 投资、时间与资本市场第4篇 信息、市场失灵与政府的角色第16章 一般均衡与经济效率第17章 信息不对称的市场第18章 外部性和公共物品附 录 指定平狄克《微观经济学》教材为考研参考书目的院校列表第1篇 导论:市场和价格第1章 绪 论一、单项选择题1.经济学可以被定义为( )。

A .政府对市场制度的干预B .企业赚取利润的活动C .研究稀缺资源如何有效配置的问题D .个人的生财之道2.经济物品是指( )。

A .有用的东西B .稀缺的物品C .要用钱购买的物品D .有用且稀缺的物品C【答案】经济学是研究人们和社会如何做出选择,来使用可以有其他用途的稀缺的经济资源在现在或是将来生产各种物品,并把物品分配给社会的各个成员或集团以供消费之用的一门社会科学。

【解析】D【答案】现实世界中绝大多数的物品都是不能自由取得的,因为资【解析】3.一个经济体必须作出的基本选择是( )。

A .生产什么B .生产多少,何时生产C .为谁生产D .以上都是4.宏观经济学与微观经济学的关系是( )。

A .相互独立的B .两者建立在共同的理论基础上C .两者既有联系又有矛盾D .毫无联系源是稀缺的,要获得这些有限的物品就必须付出代价,这种物品就被称为“经济物品”。

D【答案】经济学所要解决的问题包括:①生产什么;②如何生产;③为谁生产;④何时生产。

【解析】C【答案】宏观经济学所研究的总量经济特征正是由经济体系中无数微观主体(家庭和厂商)的经济行为所决定的,因而微观经济主体的决策行为就构成了宏观经济分析的基础,宏观经济学需要构建自己的微观基础。

第八章利润最大化和竞争性供给教学笔记这一章确定了追求利润最大化的厂商的行为动机,揭示了这些厂商在竞争性市场的相互影响和作用。

这一章的每一节都很重要,它们构建了对竞争性市场供给一方的彻底完全的认识。

在学习这本教科书的第三部分之前,建立这样一个基础是非常必要的。

虽然这一章的材料都写得很清楚易懂,但是学生可能还是会对有些概念、思想感到很难理解,比如说那些有关厂商应该怎样选择最佳生产数量的思想、有关厂商怎样应用我们前面学习过的成本曲线的思想,等等。

这里有一个讲课的建议:花些时间研究与这一章的最后部分的习题中用到的表格相类似的表格。

研究一些与此类表格有关的例题对于学生理解不同类型的成本,以及相应的厂商的最佳产量是有帮助的。

8.1节确定了完全竞争市场的三个基本假设,8.2节对“厂商以利润最大化为经营目标”这一假设进行了讨论。

8.3节和8.5节对厂商的供给曲线进行了推导,8.1节和8.2节为8.3节、8.5节中供给曲线的推导打下了基础。

8.3节推导出一个一般性的结论:只要边际收入等于边际成本,厂商就应当生产。

这一节接下来确定了完全竞争(一个特殊的案例)的条件之一:价格等于边际收入,这个结论是8.1节中“接受价格”这个假设的直接的逻辑结果。

如果你的学生掌握微积分,那么通过对利润函数关于产量q求微分,可以导出边际成本与边际收入相等。

如果你的学生还没有掌握微积分,那么可以通过对数据表格的多加研究来理解当边际收入和边际成本相等时厂商能达到利润最大化目标这个结论。

这里有一点需要强调:完全竞争市场上,每个厂商只能通过产量的变化而不能通过价格的变化来取得最大利润。

为了正确理解完全竞争市场,我们在提出有关完全竞争市场的假设之前,也要对卖方垄断、寡头卖方垄断和垄断性竞争有一定的了解。

将讨论限定一个专门的范围,这个范围包括确定一个行业里有多少厂商、这个行业是否有进入壁垒、各个厂商的产品是否存在差异,以及行业里每个厂商对其他厂商对于其价格、数量方面的决策的反应做出的假设。