国际经济学英文版第9版_ppt- (8)[30页]

- 格式:ppt

- 大小:1009.00 KB

- 文档页数:30

*CHAPTER 8 (Core Chapter)TRADE RESTRICTIONS: TARIFFSOUTLINE8.1 Introduction8.2 Partial Equilibrium Analysis of a TariffCase Study 8-1: Average Tariff on Non-Agricultural Products in Major Developed CountriesCase Study 8-2: Average Tariff on Non-Agricultural Products in Some MajorDeveloping Countries8.2a Partial Equilibrium Effects of a Tariff8.2b Effects of a Tariff on Producer and Consumer Surplus8.2c Costs and Benefits of a TariffCase Study 8-3: The Welfare Effects of Liberalizing Trade in Some U.S. Products Case Study 8-4: The Welfare Effects of Liberalizing Trade in Some EU Products 8.3 The Theory of Tariff Structure8.3a The Rate of Effective Protection8.3b Generalization and Evaluation of the Theory of Effective ProtectionCase Study 8-5: Rising Tariff Rates with Degree of Domestic ProcessingCase Study 8-6: Structure of Tariffs on Industrial Products in U.S., EU, Japan, and Canada8.4 General Equilibrium Analysis of a Tariff in a Small Country8.4a General Equilibrium Effects of a Tariff in a Small Country8.4b Illustration of the Effects of a Tariff in a Small Country8.4c The Stolper-Samuelson Theorem8.5 General Equilibrium Analysis of a Tariff in a Large Country8.5a General Equilibrium Effects of a Tariff in a Large Country8.5b Illustration of the Effects of a Tariff in a Large Country8.6 The Optimum Tariff8.6a The Meaning of the Concept and Retaliation8.6b Illustration of the Optimum Tariff and RetaliationAppendix: A8.1 Partial Equilibrium Effects of a Tariff in a Large NationA8.2 Derivation of the Formula for the Rate of Effective ProtectionA8.3 The Stolper-Samuelson Theorem GraphicallyA8.4 Exception to the Stolper-Samuelson Theorem - The MetzlerParadoxA8.5 Short-run Effect of a Tariff on Factors' IncomeA8.6 Measurement of the Optimum TariffKey TermsTrade or commercial policies Consumer surplusImport tariff Rent or producer surplusExport tariff Protection cost or deadweight loss of a tariff Ad valorem tariff Nominal tariffSpecific tariff Rate of effective protectionCompound tariff Domestic value addedConsumption effect of a tariff Prohibitive tariffProduction effect of a tariff Stolper-Samuelson theoremTrade effect of a tariff Metzler paradoxRevenue effect of a tariff Optimum tariffLecture Guide1.I would cover sections 1 and 2 and assign problems 1-2 in the first lecture. Themost difficult part of section 2 is the meaning and measurement of consumer and producer surplus. Since a clear understanding of the meaning and measurementof consumer and producer surplus is crucial in evaluating the effect of tariffs, Iwould explain t hese concepts very carefully.2.I would then cover section 3 and assign problems 3-6 in the second lecture. Thetheory of tariff structure is also very difficult and important, and so I would alsoexplain this concept very carefully. I found that the best way to explain it is byusing the simple example used in the text of the suit with and without importedinputs.3.The rest of the chapter can be skipped without loss of continuity by thoseInstructors who do not wish to cover the general equilibrium effects of tariffs. 4.For those Instructors who wish to cover the rest of the chapter, I would take upanother two lectures to do so. I would also assign and grade problems 8-14 tomake sure that students understand the material.5.In covering section 8.4, I would pay special attention to the explanation of Figure8-5 and to the Stolper-Samuelson theorem.6.In covering Section 8.6, please note that the optimum tariff can only be discussedintuitively without trade indifference curves (examined in Appendix A8.6). Answer to Problems1.a) Consumption is 70Y, production is 10Y and imports are 60Y (see Figure 1 onthe next page).b) Consumption is 60Y, production is 20Y and imports are 40Y (see Figure 1).c) The consumption effect is -10Y, the production effect is +10Y, the trade effectis -20Y and the revenue effect is $40 (see Figure 1).2. a) The consumer surplus is $245 without and $l80 with the tariff (see Figure 1).b)Of the increase in the revenue of producers with the tariff (as compared withtheir revenues under free trade), $l5 represents the increase in production costsand another $15 represents the increase in rent or producer surplus (see Figure1).c) The dollar value or the protection cost of the tariff is $l0 (see Figure 1).3. This will increase the rate of effective protection in the nation.4. a) g = 0.4 - (0.5)(0.4) = 0.4 - 0.2 = 0.2 = 40%1.0 - 0.5 0.5 0.55. a) g=60%b) g=80%c) g=0d) g=20%6. a) g=70%b) See the first paragraph of section 8.3b.7. See Figure 2.8.When Nation 1 (assumed to be a small nation) imposes an import tariff oncommodity Y, the real income of labor falls and that of capital rises.9.Py/Px rises for domestic producers and consumers. As production of Y (the K-intensive commodity) rises and that of X falls, the demand and income of K rises and that of L falls. Therefore, r rises and w falls.10.If Nation 1 were instead a large nation, then Nation 1's terms of trade rise and thereal income of L may also rise.India is more likely to restrict imports of K-intensive commodities in which India has a comparative disadvantage and this is likely to increase the return to capitaland reduce the return to labor according to the Stolper-Samuelson theorem.12. See Figure 3 on the previous page.13. See Figure 4.14. a) The volume of trade may shrink to zero (the origin of offer curves).App. 1. The more elastic S H and S F are, the lower is the free trade priceof the commodity and the lower is the increase in the domesticprice of the commodity as a result of the tariff.App. 2a. The supply curve of the nation for the commodity shifts upand to the left (as with the imposition of any tax); this does not affectthe consumption of the commodity with free trade, but it reducesdomestic production and increases imports of the commodity; italso increases the revenue effect and reduces producers' surplus.b)The imposition of a tariff on imported inputs going into the domestic productionof the commodity will have no effect on the size of the protection cost ordeadweight loss.App. 3. See Figure 5 (on the next page).App. 4. See Figure 6.App. 5. Real w will fall in terms of Y and rise in terms of X. On theother hand, r eal r will rise in terms of Y and fall in terms of X. Thiscan be seen by drawing a figure similar to Figure 8-10, but with theVMPLy curve shifting upward.App. 6a. See Figure 7.c) After Nation 1 has imposed an optimum tariff and Nation 2 has retaliatedwith an optimum tariff of its own, the approximate terms of trade for Nation1 is 0.8, while the approximate terms of trade of Nation2 is 1.25.d) Nation 1's welfare declines from the reduction in the volume and in the termsof trade. Although nation 2's terms of trade are higher than under free trade,the volume of trade has shrunk so much that nation 2's welfare is also likelyto be lower than under free trade.Multiple-choice Questions1. Which of the following statements is incorrect?a. An ad valorem tariff is expressed as a percentage of the value of the traded commodityb. a specific tariff is expressed as a fixed sum of the value of the traded commodity.c. export tariffs are prohibited by the U.S. Constitution*d. The U.S. uses exclusively the specific tariff2. A small nation is one:a. which does not affect world price by its tradingb. which faces an infinitely elastic world supply curve for its import commodityc. whose consumers will pay a price that exceeds the world price by the amount of the tariff*d. all of the above3. If a small nation increases the tariff on its import commodity, its:a. consumption of the commodity increasesb. production of the commodity decreasesc. imports of the commodity increase*d. none of the above4.The increase in producer surplus when a small nation imposes a tariff is measured bythe area:*a. to the left of the supply curve between the commodity price with and without the tariffb. under the supply curve between the quantity produced with and without the tariffc. under the demand curve between the commodity price with and without the tariffd. none of the above.5. If a small nation increases the tariff on its import commodity:*a. the rent of domestic producers of the commodity increasesb. the protection cost of the tariff decreasesc. the deadweight loss decreasesd. all of the above6.Which of the following statements is incorrect with respect to the rate of effectiveprotection?a. for given values of ai and ti, g is larger the greater is tb. for a given value of t and ti, g is larger the greater is a ic. g exceeds, is equal to or is smaller than t, as t i is smaller than, is equal to or is larger than t*d. when a i t i exceeds t, the rate of effective protection is positive7. With a i=50%, t i=0, and t=20%, g is:*a. 40%b. 20%c. 80%d. 08. The imposition of an import tariff by a small nation:*a. increases the relative price of the import commodity for domestic producers and consumersb. reduces the relative price of the import commodity for domestic producers and consumersc. increases the relative price of the import commodity for the nation as a wholed. any of the above is possible9. The imposition of an import tariff by a small nation:a. increases the nation's welfare*b. reduces the nation's welfarec. leaves the nation's welfare unchangedd. any of the above is possible10. According to the Stolper-Samuelson theorem, the imposition of a tariff by a nation:a. increases the real return of the nation's abundant factor*b. increases the real return of the nation's scarce factorc. reduces the real return of the nation's scarce factord. any of the above is possible11. The imposition of an import tariff by a nation results in:a. an increase in relative price of the nation's import commodityb. an increase in the nation's production of its importable commodityc. reduces the real return of the nation's abundant factor*d. all of the above12. The imposition of an import tariff by a nation can be represented by a rotation of the: *a. nation's offer curve away from the axis measuring the commodity of its comparative advantageb. the nation's offer curve toward the axis measuring the commodity of its comparative advantagec. the other nation's offer curve toward the axis measuring the commodity of its comparative advantaged. the other nation's offer curve away from the axis measuring the commodity of its comparative advantage13. The imposition of an import tariff by a large nation:a. increases the nation's terms of tradeb. reduces the volume of tradec. may increase or reduce the nation's welfare*d. all of the above14. The imposition of an optimum tariff by a large nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. all of the above15. The optimum tariff for a small nation is:a. 100%b. 50%*c. 0d. depends on elasticities。

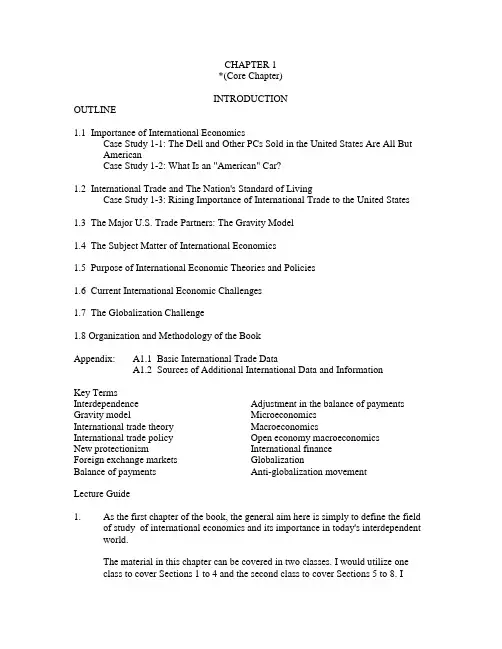

CHAPTER 1*(Core Chapter)INTRODUCTIONOUTLINE1.1 Importance of International EconomicsCase Study 1-1: The Dell and Other PCs Sold in the United States Are All ButAmericanCase Study 1-2: What Is an "American" Car?1.2 International Trade and The Nation's Standard of LivingCase Study 1-3: Rising Importance of International Trade to the United States 1.3 The Major U.S. Trade Partners: The Gravity Model1.4 The Subject Matter of International Economics1.5 Purpose of International Economic Theories and Policies1.6 Current International Economic Challenges1.7 The Globalization Challenge1.8 Organization and Methodology of the BookAppendix: A1.1 Basic International Trade DataA1.2 Sources of Additional International Data and InformationKey TermsInterdependence Adjustment in the balance of payments Gravity model MicroeconomicsInternational trade theory MacroeconomicsInternational trade policy Open economy macroeconomicsNew protectionism International financeForeign exchange markets GlobalizationBalance of payments Anti-globalization movementLecture Guide1. As the first chapter of the book, the general aim here is simply to define the fieldof study of international economics and its importance in today's interdependent world.The material in this chapter can be covered in two classes. I would utilize oneclass to cover Sections 1 to 4 and the second class to cover Sections 5 to 8. Iwould spend most of the second class on Section 6 on the major currentinternational economic challenges facing the United States and the world todayand to show how international economics can suggest ways to solve them. Thisshould greatly enhance students' motivation.Answer to Problems1. a) International economic problems reported in our daily newspapers are likely toinclude:•trade controversies between the United States, Europe, Japan, and China;•great volatility of exchange rates;•Increasing international competition from China and fear of job losses in the United States and other advanced countries.•structural unemployment and slow growth in Europe, and stagnation in Japan;•financial crises in emerging market economies;•restructuring problems of transition economies;•deep poverty in many developing nations in the world.b) Can result in trade restrictions or even a trade war, which reduce the volumeand the gains from trade;•discourage foreign trade and investments, and thus reduce the benefits from trade;•Can result in trade restrictions or even a trade war, which reduce the volume and the gains from trade;•reduces European and Japanese imports and the volume and the benefits from trade;•financial crises in emerging market economies could spread to the United States;•can lead to political instability, which will adversely affect the United States;•can lead to political instability in these countries - which also adversely affect the United States.c) Can result in your paying higher prices for imported products;•lead to great fluctuations in the price of imported products and cost of foreign travel;•Can lead higher prices for imported products and increases the chances that you will have to change jobs;•can lead you to support demands for trade protection in the United States;•can reduce the value of your investments (such as a stocks) in the United States;•can lead to your paying higher taxes for the United States to respond to these threats;•can result in your paying higher taxes to help these nations.2. a) Five industrial nations not mentioned are: Italy, France, Canada, Austria, andIreland.b) See Table 1A.c) Smaller nations, such as Ireland and Austria, are more interdependent than thelarger ones. Note that interdependence was measured by the percentage of thevalue of imports and exports (line 98c and 90c, respectively in IFS) to GDP (line99b).Table 1AEconomic Interdependence asMeasured by Imports and Exports*Source: International Financial Statistics(Washington, D.C., IMF, March 2006).3. a) Five developing nations not mentioned in the text are: Brazil, Pakistan,Colombia, Nepal, and Tunisia.b) See Table 1B.c) In general, the smaller the nation, the greater is its economic interdependence.Note that interdependence was measured by the percentage of the value ofimports and exports (line 98c and 90c, respectively in IFS) to GDP (line 99b).Table 1BEconomic Interdependence asMeasured by Imports and Exports*Source: International Financial Statistics(Washington, D.C., IMF, March 2006).4. Trade between the United States and Brazil is much larger than trade between theUnited States and Argentina. Since Brazil is larger and closer than Argentina, this trade does follow the predictions of the gravity model.5. a) Mankiw’s Economics (4th., 2007) includes the following microeconomicstopics:•The market forces of demand and supply;•elasticity and its application;•the theory of consumer choice;•consumers, producers, and the efficiency of markets;•the costs of production;•firms in competitive markets;•monopoly;•oligopoly;•monopolistic competition;•markets for the factors of production;•the demand for resources;b) Just as the microeconomics parts of your principles text deal with individualconsumers and firms, and with the price of individual commodities and factors of production, so do Parts One and Two of this text deal with production andconsumption of individual nations with nations with and without trade, and withthe relative price of individual commodities and factors of production.c) Mankiw’s Economi cs (4th., 2007) includes the following microeconomics topics:measuring a nation’s income and the cost of living;•production and growth;•savings investment and the financial system;•unemployment and its natural rate;•the monetary system, growth and inflation;•money growth and inflation;•open-economy macroeconomics: basic concepts;• a macroeconomic theory of the open economy;•aggregate demand and aggregate supply;•the influence of monetary and fiscal policy on aggregate demand;•the short-run trade off between inflation and unemployment•five debates over macroeconomic policy.d) Just as the macroeconomics parts of your principles text deal with the aggregatelevel of savings, consumption, investment, and national income, the general price level, and monetary and fiscal policies, so do Parts Three and Four of this textdeal with the aggregate amount of imports, exports, the total international flow of resources, and the policies to affect these broad aggregates.6. a) Consumer demand theory predicts than when the price of a commodity rises(cet. par.), the quantity demanded of the commodity declines.When the price of imports rises to domestic consumers, the quantity demanded of exports can be expected to decline (if everything else remains constant).7. a) A government can reduce a budget deficit by reducing governmentexpenditures and/or increasing taxes.b) A nation can reduce or eliminate a balance of payments deficit by taxingimports and/or subsidizing exports, by borrowing more abroad or lending less toother nations, as well as by reducing the level of its national income.8. a) Nations usually impose restrictions on the free international flow of goods,services, and factors. Differences in language, customs, and laws also hamperthese international flows. In addition, international flows may involve receipts and payments in different currencies, which may change in value in relation to oneanother through time. This is to be contrasted with the interregional flow ofgoods, services, and factors, which face no such restrictions as tariffs and areconducted in terms of the same currency, usually in the same language, and under basically the same set of customs and laws.b) Both international and interregional economic relations involve the overcomingof space or distance. Indeed, they both arise from the problems created bydistance. This distinguishes them from the rest of economics, which abstractsfrom space and treats the economy as a single point in space, in which production, exchange, and consumption take place.9. We can deduce that nations benefit from voluntarily engaging in internationaltrade because if they did not gain or if they lost they could avoid those losses bysimply refusing to trade. Disagreement usually arises regarding the relativedistribution of the gains from specialization in production and trade, but this does not mean that each nation does not gain from trade.10. International trade results in lower prices for consumers but harms domesticproducers of products, which compete with imports. Often those domesticproducers that stand to lose a great deal from imports band together to pressurethe government to restrict imports. Since consumers are many and unorganizedand each individually stands to lose only very little from the import restrictions,governments often give in to the demands of producers and impose some importrestrictions. These topics are discussed in detail in Chapter 9.11. A nation can subsidize exports of the commodity to other nations until it drivesthe competing nation's industry out of business, after which it can raise its priceand benefit from its newly acquired monopoly power.Some economists and politicians in the United States have accused Japan of doing just that (i.e., of engaging in strategic trade and industrial policy at the expense of U.S. industries), but this is a very complex and controversial aspect of tradepolicy and will be examined in detail in Chapter 9.12. a) When the value of the U.S. dollar falls in relation to the currencies of othernations, imports become more expensive for Americans and so they wouldpurchase a smaller quantity of imports.b) When the value of the U.S. dollar falls in relation to the currencies of othernations, U.S. exports become chapter for foreigners and so they would purchase a greater quantity of U.S. exports.Multiple-Choice Questions1. Which of the following products are not produced at all in the United States?*a. Coffee, tea, cocoab. steel, copper, aluminumc. petroleum, coal, natural gasd. typewriters, computers, airplanes2. International trade is most important to the standard of living of:a. the United States*b. Switzerlandc. Germanyd. England3. Over time, the economic interdependence of nations has:*a. grownb. diminishedc. remained unchangedd. cannot say4. A rough measure of the degree of economic interdependence of a nation is given by:a. the size of the nations' populationb. the percentage of its population to its GDP*c. the percentage of a nation's imports and exports to its GDPd. all of the above5. Economic interdependence is greater for:*a. small nationsb. large nationsc. developed nationsd. developing nations6. The gravity model of international trade predicts that trade between two nations is largera. the larger the two nationsb. the closer the nationsc. the more open are the two nations*d. all of the above7. International economics deals with:a. the flow of goods, services, and payments among nationsb. policies directed at regulating the flow of goods, services, and paymentsc. the effects of policies on the welfare of the nation*d. all of the above8. International trade theory refers to:*a. the microeconomic aspects of international tradeb. the macroeconomic aspects of international tradec. open economy macroeconomics or international financed. all of the above9. Which of the following is not the subject matter of international finance?a. foreign exchange marketsb. the balance of payments*c. the basis and the gains from traded. policies to adjust balance of payments disequilibria10. Economic theory:a. seeks to explain economic eventsb. seeks to predict economic eventsc. abstracts from the many detail that surrounds an economic event*d. all of the above11. Which of the following is not an assumption generally made in the study of international economics?a. two nationsb. two commodities*c. perfect international mobility of factorsd. two factors of production12. In the study of international economics:a. international trade policies are examined before the bases for tradeb. adjustment policies are discussed before the balance of paymentsc. the case of many nations is discussed before the two-nations case*d. none of the above13. International trade is similar to interregional trade in that both must overcome: *a. distance and spaceb. trade restrictionsc. differences in currenciesd. differences in monetary systems14. The opening or expansion of international trade usually affects all members of society:a. positivelyb. negatively*c. most positively but some negativelyd. most negatively but some positively15. An increase in the dollar price of a foreign currency usually:a. benefit U.S. importers*b. benefits U.S. exportersc. benefit both U.S. importers and U.S. exportersd. harms both U.S. importers and U.S. exporters16. Which of the following statements with regard to international economics is true?a. It is a relatively new field*b. it is a relatively old fieldc. most of its contributors were not economistsd. none of the above。

Chapter 1Introduction⏹Chapter OrganizationWhat Is International Economics About?The Gains from TradeThe Pattern of TradeHow Much Trade?Balance of PaymentsExchange Rate DeterminationInternational Policy CoordinationThe International Capital MarketInternational Economics: Trade and Money⏹Chapter OverviewThe intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, andthe lead reports on television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad.The study of the theory of international economics generates an understanding of many key events that shape our domestic and international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexican crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. The financial crisis that began in East Asia in 1997 and spread to many countries around the globe and the Economic and Monetary Union in Europe highlighted the way in which various national economies are linked and how important it is for us to understand these connections. These global linkages have been highlighted yet again with the rapid spread of the financial crisis in the United States to the rest of the world. At the same time, protests at global economic meetings and a rising wave of protectionist rhetoric have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur.© 2012 Pearson Education, Inc. Publishing as Addison-Wesley2 Krugman/Obstfeld/Melitz • International Economics: Theory & Policy, Ninth Edition©2012 Pearson Education, Inc. Publishing as Addison Wesley Chapter 1 of the text presents data demonstrating the growth in trade and the increasing importance of international economics. This chapter also highlights and briefly discusses seven themes which arisethroughout the book. These themes are (1) the gains from trade; (2) the pattern of trade; (3) protectionism; (4) the balance of payments; (5) exchange rate determination; (6) international policy coordination; and (7) the international capital market. Students will recognize that many of the central policy debates occurring today come under the rubric of one of these themes. Indeed, it is often a fruitful heuristic to use current events to illustrate the force of the key themes and arguments which are presented throughout the text.。