Prentice hall's federal taxation test bank chapter 15

- 格式:doc

- 大小:108.00 KB

- 文档页数:28

W-8BEN-美国预提税及申报受益所有⼈之外国⼈⾝份证明(个W-8BEN-美国预提税及申报受益所有⼈之外国⼈⾝份证明(个⼈)每位户⼝持有⼈必须填写⼀份表格。

W-8BEN表格必须准确填写,不得涂改。

如果填写有误,请⽤新表格重新填写。

请勿使⽤涂改液或其他涂改⼯具。

所有W-8BEN表格均必须以英⽂填写。

甲.请详阅本节和相关指引,确保使⽤正确的W-8BEN表格。

⼄.第⼀部分(受益所有⼈⾝份)1.请填写您的姓名2.请填写您的国籍3.于第⼀⾏填写完整的街道地址,于第⼆⾏填写城市或城镇、州或省,包括邮政编码。

所填地址应与⾹港⼀卡通所留住宅地址相同。

请勿使⽤:邮政信箱或代收地址、第三⽅姓名、⾦融机构或美国地址。

4.如果您的邮寄地址与永久居住地址不同,才需填写邮寄地址。

注意:如果填写美国邮寄地址,必须书⾯说明使⽤美国邮寄地址的原因。

如果填写的国家与永久居住地所在国家不同,也必须书⾯说明原因。

5.如果您是美国纳税⼈,请填写您的美国纳税⼈识别号码(TIN)。

该号码为您的社会保障号码(SSN)或个⼈纳税⼈识别号码(ITIN)。

有效的纳税⼈识别号码应由9个数字组成。

纳税⼈识别号码不会:(1)含有数字以外的内容,(2)少于或超过9个数字,(3)含有9个相同的数字,或(4)含有9个顺序排列的数字(⽆论升序还是降序)。

6.请填写您在美国以外的税务识别号码。

如果没有外国税务识别号码,请转⾄第8栏。

7.请勿填写户⼝号码,否则表格将仅限于所列户⼝使⽤,您可能须为其他户⼝另外填写表格。

8.请填写您的出⽣⽇期(需按⽉⽉-⽇⽇-年年年年格式填写)丙.第⼆部分(申请税务协定利益)9.仅当您是协定国居民(与美国有签订所得税协定的国家的居民)并有权申请税务协定利益,即您收到源⾃美国的固定或可确定年度或定期(FDAP)收⼊(如股息)时,才需填写本节内容。

如果对您是否有资格申请税务协定利益存有疑问,我们建议您寻求独⽴税务意见。

10.与第9栏说明相同。

2019美国留学生报税指南(一)一、美国个人报税时间每年个人报税截至日期为4月15日,如果遇到周末,顺延到下一个工作日。

如果无法在4月15日前提交税表,可以申请延期,报税截至日期顺延到10月15日。

申请延期一定要在4月15日之前分别递交联邦和州两份延期表,不然会有罚款。

申请延期时应把预计的当年欠税款提前缴交,可适当多交一些,最后报税时会多退少补,不然即使你做了延期仍会有罚款。

报税开始时间,由于公司寄出W2和1099表格的截至日期为每年的1月31日,大部分人会在2月左右收到W2和1099,也就意味着你可以开始报税了。

二、我需不需要报税?应税收入包括哪些?无论是美国居民还是外国人,只要在美国取得收入就需要报税。

美国税务居民用1040税表报税,非居民(Nonresident Alien)用1040NR税表报税。

应税收入包括W2、1042S上的劳动所得、银行利息、股票分红、资本利得、K1公司经营利得、房屋租金、1099-Misc自雇收入等。

这里要特别提醒一下广大留学生,由于受移民法的限制,留学生只能从事和自己学习领域相关的工作,不能随心所欲的自雇。

如果顺手在Amazon上卖点东西、放学顺路开Uber、在Airbnb上出租房子、未申请工作许可就兼职等,都会收到1099-Misc,从而违反移民法,置自己于不利处境。

我们收到过太多惊慌失措、悔不当初的留学生来信。

如果持有F、J、M、Q等非移民签证,并且没有收入,则无需填写税表,只要每年寄出一份8843表格即可。

2018年之前美国非居民税表上有4050美元的个人免税额(Personal Exemption),即如果你的W2、1042S上的收入低于4050美元,可以不报税。

但是2018年开始个人免税额已被取消。

这意味着非居民哪怕只有1美元的收入都需填报税表。

三、不报税有什么危害?报税又有什么好处?在美国税表是一个人的财务证明,非常重要,当你申请绿卡、公民入籍、贷款买房买车、上大学申请奖学金、申请退休金、办医疗保险卡、申请社会福利、申请国内亲属移民美国等等时候,都需要查验税表。

Prentice Hall's Federal Taxation 2013 Individuals, 26e (Pope)Chapter I1 An Introduction to Taxation1) The tax law encompasses administrative and judicial interpretations, such as Treasury regulations, revenue rulings, revenue procedures, and court decisions, as well as statutes.Answer: TRUEPage Ref.: I:1-24Objective: 62) Generally, tax legislation is introduced first in the Senate and referred to the Senate Finance Committee. Answer: FALSEExplanation: A tax bill is introduced in the House and referred to the Ways and Means Committee.Page Ref.: I:1-24Objective: 73) The Internal Revenue Service is the branch of the Treasury Department responsible for administering the federal tax law.Answer: TRUEPage Ref.: I:1-26Objective: 84) Generally, the statute of limitations is three years from the later of the date the tax return is filed or the due date.Answer: TRUEPage Ref.: I:1-28Objective: 85) Arthur pays tax of $5,000 on taxable income of $50,000 while taxpayer Barbara pays tax of $12,000 on $120,000. The tax is aA) progressive tax.B) proportional tax.C) regressive tax.D) None of the above.Answer: BExplanation: B) The tax rate is proportional because the 10% tax rate applies to both taxpayers regardless of their income level.Page Ref.: I:1-4; Example I:1-3Objective: 26) Which of the following taxes is progressive?A) sales taxB) excise taxC) property taxD) income taxAnswer: DExplanation: D) The income tax rates increase as a taxpayer's taxable income rises.Page Ref.: I:1-47) Which of the following taxes is proportional?A) gift taxB) income taxC) sales taxD) Federal Insurance Contributions Act (FICA)Answer: CExplanation: C) A sales tax is assessed at a fixed rate of the purchase amount, based on state and local law.Page Ref.: I:1-4 and I:1-11; Topic Review I:1-1Objective: 28) Which of the following taxes is regressive?A) Federal Insurance Contributions Act (FICA)B) excise taxC) property taxD) gift taxAnswer: AExplanation: A) For upper income wage earners, the Social Security tax ceases at a maximum wage base. For 2012, wages over $110,100 are not subject to the Social Security tax.Page Ref.: I:1-4 and I:1-11; Topic Review I:1-1Objective: 29) Sarah contributes $25,000 to a church. Sarah's marginal tax rate is 35% while her average tax rate is 25%. After considering her tax savings, Sarah's contribution costsA) $6,250.B) $8,750.C) $16,250.D) $18,750.Answer: CExplanation: C) [$25,000 × (100% - 35%)] = $16,250Page Ref.: I:1-5; Example I:1-4Objective: 210) Helen, who is single, is considering purchasing a residence that will provide a $28,000 tax deduction for property taxes and mortgage interest. If her marginal tax rate is 25% and her effective tax rate is 20%, what is the amount of Helen's tax savings from purchasing the residence?A) $5,600B) $7,000C) $21,000D) $22,400Answer: BExplanation: B) $28,000 × .25 marginal rate = $7,000 tax savings.Page Ref.: I:1-5; Example I:1-4Objective: 211) Charlotte pays $16,000 in tax deductible property taxes. Charlotte's marginal tax rate is 28%, effective tax rate is 22% and average rate is 25%. Charlotte's tax savings from paying the property tax isB) $4,000.C) $4,480.D) $11,520.Answer: CExplanation: C) $16,000 × 0.28 = $4,480Page Ref.: I:1-5; Example I:1-4Objective: 212) Anne, who is single, has taxable income for the current year of $38,000 while total economic income is $43,000 resulting in a total tax of $5,625. Anne's average tax rate and effective tax rate are, respectively,A) 14.80% and 13.08%.B) 13.08% and 14.80%.C) 11.58% and 13.08%.D) 14.80% and 13.65%.Answer: AExplanation: A) $5,625 ÷ $38,000 = 0.1480$5,625 ÷ $43,000 = 0.1308Page Ref.: I:1-6; Example I:1-5Objective: 213) The unified transfer tax systemA) imposes a single tax upon transfers of property during an individual's lifetime only.B) imposes a single tax upon transfers of property during an individual's life and at death.C) imposes a single tax upon transfers of property only at an individual's death.D) none of above.Answer: BExplanation: B) The gift (transfers during life) tax and estate (transfers after death) tax systems are unified.Page Ref.: I:1-7Objective: 314) When property is transferred, the gift tax is based onA) replacement cost of the transferred property.B) fair market value on the date of transfer.C) the transferor's original cost of the transferred property.D) the transferor's depreciated cost of the transferred property.Answer: BExplanation: B) The gift tax is based on the property's fair market value on the date of transfer.Page Ref.: I:1-8Objective: 315) Paul makes the following property transfers in the current year:• $22,000 cash to his wife• $34,000 cash to a qu alified charity• $220,000 house to his son• $3,000 computer to an unrelated friendThe total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to theunified transfer tax isA) $207,000.B) $223,000.C) $245,000.D) $279,000.Answer: AExplanation: A) $220,000 - $13,000 = $207,000. The gift to the unrelated friend is below the $13,000 annual gift tax exclusion. The gifts to his wife and to the charity are not subject to gift tax.Page Ref.: I:1-8; Example I:1-6Objective: 316) Charlie makes the following gifts in the current year: $40,000 to his spouse, $30,000 to his church, $18,000 to his nephew, and $25,000 to a friend. Assuming Charlie does not elect gift splitting with his wife, his taxable gifts in the current year will beA) $13,000.B) $17,000.C) $25,000.D) $40,000.Answer: BExplanation: B) ($18,000 - $13,000) + (25,000 - $13,000) = $17,000. The gift to his spouse and the charitable gift are not subject to gift taxes.Page Ref.: I:1-8; Example I:1-6Objective: 317) Shaquille buys new cars for five of his friends. Each car cost $70,000. What is the amount of Shaquille's taxable gifts?A) $0B) $285,000C) $337,000D) $350,000Answer: BExplanation: B) (5 × $70,000) - (5 × $13,000) = 285,000Page Ref.: I:1-8; Example I:1-6Objective: 318) In 2012, an estate is not taxable unless the sum of the taxable estate and taxable gifts made after 1976 exceedsA) $1,500,000.B) $2,000,000.C) $3,500,000.D) $5,000,000.Answer: DExplanation: D) The unified credit equivalent for estate and gift taxes is $ 5,000,000 for 2011.Page Ref.: I:1-9; Example I:1-7Objective: 319) Eric dies in the current year and has a gross estate valued at $6,500,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Eric's debts which amount to $250,000. Ericbequeaths $600,000 to his wife. Eric made no taxable transfers during his life. Eric's taxable estate will beA) $550,000.B) $5,550,000.C) $6,150,000D) $6,500,000.Answer: BExplanation: B) ($6,500,000 - $100,000 - $250,000 - $600,000) = $5,550,000Page Ref.: I:1-10; Example I:1-8Objective: 320) Thomas dies in the current year and has a gross estate valued at $3,000,000. During his lifetime (but after 1976) Thomas had made taxable gifts of $400,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Thomas' debts which amount to $300,000. Thomas bequeaths $500,000 to his wife. What is the amount of Thomas' tax base, the amount on which the estate tax is computed?A) $2,100,000B) $2,500,000C) $2,600,000D) $3,400,000Answer: BExplanation: B) ($3,000,000 - $100,000 - $300,000 - $500,000 = $2,100,000 taxable estate + $400,000 gifts = $2,500,000 tax base)Page Ref.: I:1-10; Example I:1-8Objective: 321) Which of the following statements is incorrect?A) Property taxes are levied on real estate.B) Excise taxes are assessed on items such as gasoline and telephone use.C) Gift taxes are levied on the recipient of a gift.D) The estate tax is based on the fair market value of property at death or the alternate valuation date. Answer: CExplanation: C) Gift taxes are levied on the donor of a gift, not the recipient.Page Ref.: I:1-8 through I:1-10Objective: 322) Denzel earns $120,000 in 2012 through his job as a sales manager. What is his FICA tax?A) $6,364B) $8,566C) $6,780D) $9,180Answer: AExplanation: A) (110,100 × .042) + (120,000 × .0145) = $6,364Page Ref.: I:1-11Objective: 323) Martha is self-employed in 2012. Her business profits are $140,000. What is her self-employment tax?A) $17,700B) $15,510C) $21,420D) None of the above.Answer: BExplanation: B) (110,100 × .104) + (140,000 × .029) = $15,510Page Ref.: I:1-11Objective: 324) Which of the following is not one of Adam Smith's canons of taxation?A) equityB) convenienceC) certaintyD) paid by all citizensAnswer: DExplanation: D) Smith's canons of taxation are equity, certainty, convenience and economy.Page Ref.: I:1-11Objective: 425) Horizontal equity means thatA) taxpayers with the same amount of income pay the same amount of tax.B) taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.C) all taxpayers should pay the same tax.D) none of the above.Answer: AExplanation: A) Horizontal equity means that taxpayers with the same amount of income pay the same amount of tax.Page Ref.: I:1-12Objective: 426) Vertical equity means thatA) taxpayers with the same amount of income pay the same amount of tax.B) taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.C) all taxpayers should pay the same tax.D) none of the above.Answer: BExplanation: B) Vertical equity means that taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.Page Ref.: I:1-12Objective: 427) Which of the following is not an objective of the federal income tax law?A) Stimulate private investment.B) Reduce employment.C) Encourage research and development activities.D) Prevent taxpayers from paying a higher percentage of their income in personal income taxes due to inflation.Answer: BExplanation: B) Reduction of unemployment is an objective.Page Ref.: I:1-14 and I:1-15Objective: 428) Which of the following is not a social objective of the tax law?A) prohibition of a deduction for illegal bribes, fines and penaltiesB) a deduction for charitable contributionsC) an exclusion for interest earned by large businessesD) creation of tax-favored pension plansAnswer: CExplanation: C) There is no exclusion for interest income earned by large businesses.Page Ref.: I:1-15Objective: 429) Which of the following is not a taxpaying entity?A) CorporationB) PartnershipC) IndividualD) All of the above are taxpayers.Answer: BExplanation: B) A partnership is a flow-through entity.Page Ref.: I:1-17 through 23Objective: 530) All of the following are classified as flow-through entities for tax purposes exceptA) partnerships.B) C corporations.C) S corporations.D) limited liability companies.Answer: BExplanation: B) A C corporation is a taxpaying entity.Page Ref.: I:1-17Objective: 531) Rocky and Charlie form RC Partnership as equal partners. Rocky contributes $100,000 into RC while Charlie contributes real estate with a fair market value of $100,000. During the current year, RC earned net income of $600,000. The partnership distributes $200,000 to each partner. The amount that Rocky should report on his individual tax return isA) $0.B) $100,000.C) $200,000.D) $300,000.Answer: DExplanation: D) Rocky must report 50% × $600,000 or $300,000, his share of partnership net income. The distribution of $200,000 is not taxable but rather nontaxable return of capital reducing Rocky's basis ($100,000 original investment + $300,000 share of income) by $200,000 to $200,000.Page Ref.: I:1-21; Example I:1-18Objective: 532) AB Partnership earns $500,000 in the current year. Partners A and B are equal partners who do not receive any distributions during the year. How much income does partner A report from the partnership?A) $0B) $250,000C) $500,000D) None of the above.Answer: BExplanation: B) $500,000 × .5 = $250,000Page Ref.: I:1-21; Example I:1-18Objective: 533) In an S corporation, shareholdersA) are taxed on their proportionate share of earnings.B) are taxed only on dividends.C) may allocate income among themselves in order to consider special contributions.D) are only taxed on salaries.Answer: AExplanation: A) Similar to partners in a partnership, S corporation shareholders are taxed on their proportionate share of the income earned by the corporation, regardless of distribution payments.Page Ref.: I:1-22Objective: 534) All of the following statements are true exceptA) the net income earned by a sole proprietorship is reported on the owner's individual income tax return.B) the net income of an S corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the S corporation to individual shareholders are also taxed.C) the net income of C corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the C corporation to individual shareholders is also taxed.D) LLCs are generally taxed as partnerships.Answer: BExplanation: B) An S Corporation is a flow-through entity, not a taxable entity. The items of income/loss are allocated to each shareholder who pays tax on the items on his or her individual income tax return. Page Ref.: I:1-17 through 23Objective: 535) Which of the following is not an advantage of a limited liability company (LLC)?A) limited liability for all members of a LLCB) ability to choose between taxation as a partnership or corporationC) double taxationD) All of the above are advantages of an LLC.Answer: CExplanation: C) A business operated as an LLC is a flow-through entity so it is not subject to double taxation.Page Ref.: I:1-22 and I:1-23Objective: 536) What is an important aspect of a limited liability partnership?A) It is the same as a limited partnership where the general partner has unlimited liability.B) A partner has unlimited liability arising from his or her own acts of negligence or misconduct or similar acts of any person under his or her direct supervision, but does not have unlimited liability in other matters.C) All partners have limited liability regarding all partnership activities.D) All partners have unlimited liability.Answer: BExplanation: B) A partner in an LLP remains responsible for his or her own actions, or those under his supervision, but is not liable for the actions of other partners.Page Ref.: I:1-23Objective: 537) The term "tax law" includesA) Internal Revenue Code.B) Treasury Regulations.C) judicial decisions.D) all of the above.Answer: DExplanation: D) The Code is a legislative source; the Regulations are an administrative source, and judicial decisions are judicial sources of tax law.Page Ref.: I:1-24Objective: 638) Which of the following serves as the highest authority for tax research, planning, and compliance activities?A) Internal Revenue CodeB) Income Tax RegulationsC) Revenue RulingsD) Revenue ProceduresAnswer: AExplanation: A)The Internal Revenue Code is the law passed by Congress. The other documents provide guidance in applying the law.Page Ref.: I:1-24Objective: 639) All of the following are executive (administrative) sources of tax law exceptA) Internal Revenue Code.B) Income Tax Regulations.C) Revenue Rulings.D) Revenue Procedures.Answer: AExplanation: A) The Internal Revenue Code is a legislative source.Page Ref.: I:1-24 and Topic Review I:1-3Objective: 640) Which of the following steps, related to a tax bill, occurs first?A) signature or veto by the President of the United StatesB) consideration by the SenateC) consideration by the House Ways and Means CommitteeD) consideration by the Joint Conference CommitteeAnswer: CExplanation: C) Most tax legislation originates in the House of Representatives and is then referred to the House Ways and Means Committee.Page Ref.: I:1-24Objective: 741) A tax bill introduced in the House of Representatives is thenA) referred to the House Ways and Means Committee for hearings and approval.B) referred to the full House for hearings.C) forwarded to the Senate Finance Committee for consideration.D) voted upon by the full House.Answer: AExplanation: A) Most tax legislation originates in the House of Representatives and is then referred to the House Ways and Means Committee.Page Ref.: I:1-24Objective: 742) When new tax legislation is being considered by Congress,A) the tax bill will usually originate in the Senate.B) different versions of the House and Senate bills are reconciled by the Speaker of the House and the President of the Senate.C) different versions of the House and Senate bills are reconciled by a Joint Conference Committee.D) after the President of the U.S. approves a tax bill, the Joint Conference Committee must then vote on passage of the bill.Answer: CExplanation: C) The Joint Conference Committee reconciles the House and Senate bills.Page Ref.: I:1-25Objective: 743) The Senate equivalent of the House Ways and Means Committee is the SenateA) Joint Committee on Taxation.B) Ways and Means Committee.C) Finance Committee.D) Joint Conference Committee.Answer: CExplanation: C) The Senate Finance Committee considers tax legislation.Page Ref.: I:1-25Objective: 744) When returns are processed, they are scored to determine their potential for yielding additional tax revenues. This program is calledA) Taxpayer Compliance Measurement Program.B) Discriminant Function System.C) Standard Audit Program.D) Field Audit Program.Answer: BPage Ref.: I:1-27Objective: 845) Which of the following individuals is most likely to be audited?A) Lola has AGI of $35,000 from wages and uses the standard deduction.B) Marvella has a $145,000 net loss from her unincorporated business (a horse farm). She also received $350,000 salary as a CEO of a corporation.C) Melvin is retired and receives Social Security benefits.D) Jerry is a school teacher with two children earning $45,000 a year. He also receives $200 in interest income on a bank account.Answer: BExplanation: B) Of those listed, the taxpayer with investments or trade or business expenses that produce significant losses, Marvella, is more likely to be audited.Page Ref.: I:1-27Objective: 846) Alan files his 2011 tax return on April 1, 2012. His return contains no misstatements or omissions of income. The statute of limitations for changes to the return expiresA) April 1, 2014.B) April 15, 2015.C) April 15, 2016.D) The statute of limitations never expires.Answer: BExplanation: B) The three-year statute applies.Page Ref.: I:1-28Objective: 847) Peyton has adjusted gross income of $20,000,000 on his 2011 tax return, filed April 15, 2012. He accidentally failed to include $200,000 that he received for a television advertisement. How long does the IRS have to audit Peyton's federal tax return?A) until April 15, 2014B) until April 15, 2015C) until April 15, 2018D) The IRS can audit Peyton's return at any future date.Answer: BExplanation: B) The omission does not meet the 25% of reported income level, so the three-year statute still applies. Since the omission was accidental, the rules for fraud do not apply.Page Ref.: I:1-28Objective: 848) Latashia reports $100,000 of taxable income on her 2011 tax return, filed April 15, 2012. She omits $30,000 of income, but the error was not fraudulent. When does the statute of limitations for examining her tax return expire?A) April 15, 2015B) April 15, 2016C) April 15, 2018D) It never expires.Answer: CExplanation: C) The six-year statute applies since over 25% of income was omitted.Page Ref.: I:1-28Objective: 849) The IRS must pay interest onA) all tax refunds.B) tax refunds paid later than 30 days after the due date.C) tax refunds paid later than 45 days after the due date.D) The IRS never pays interest on tax refunds.Answer: CPage Ref.: I:1-28; Example I:1-27Objective: 850) Kate files her tax return 36 days after the due date. When she files the return, she sends a check for $2,000 which is the balance of the tax owed by her. Kate's penalty for failure to file a return will beA) 0.5% per month (or factor thereof) up to a maximum of 25%.B) 5% per month (or factor thereof) up to a maximum of 25%.C) 20% per month (or factor thereof).D) none of the above.Answer: BExplanation: B) The penalty for failure to file is 5% per month up to 25%.Page Ref.: I:1-28Objective: 851) What are the correct monthly rates for calculating failure to file and failure to pay penalties?Answer: CExplanation: C) The penalty for failure to file is 5% per month up to 25%. The failure to pay penalty is.0.5% per month up to 25%.Page Ref.: I:1-28 and I:1-29Objective: 852) Which is not a component of tax practice?A) providing clients tax refund advance loansB) tax researchC) tax planning and consultingD) complianceAnswer: APage Ref.: I:1-29Objective: 9。

全日制税务硕士专业学位研究生培养方案为了适应我国现代税务事业发展对税务专门人才的迫切需要,完善税务人才培养体系,有效提高全日制税务硕士专业学位研究生的培养质量,根据国务院学位委员会、教育部、人力资源与社会保障部有关文件精神,以及全国税务专业学位研究生教育指导委员会《关于税务硕士专业学位研究生培养方案制定的指导性意见》,特制定本方案。

一、培养目标面向税务、司法等国家机关、企业、中介机构等相关职业,培养具有从事税务相关职业所需的专业知识与技能的高层次、应用型专门人才。

基本要求为:1.掌握科学社会主义基本理论,具有良好的政治素质和职业操守。

2.系统掌握现代税收理论、实务与技能,能综合运用税收和会计、法律等相关专业知识,具有良好的战略意识和风险意识,具有较强的税收规划能力和解决税收实际问题的能力。

3.熟练地掌握和运用至少一门外语。

4.具有良好的身体素质和心理素质,具备团队协作精神。

二、招生对象具有国民教育序列大学本科学历(或本科同等学力)人员。

三、学习方式及年限采用全日制学习方式,学习年限一般为2年。

四、培养方式1.以课程教学为主,并重视和加强实践教学。

2.注重理论联系实际,鼓励案例教学,培养学生分析问题和解决实际问题的能力。

加强教学部门与实践部门的联系和交流,聘请相关部门的专家参与教学工作。

3.采取考试与考查相结合的评定方式,必修课以考试为主,选修课以考查为主,包括案例分析、专题报告等。

4.成立导师组,采取集体培养与个人负责相结合的指导方式。

导师组应以具有指导硕士研究生资格的教师为主,并适当吸收实务部门具有高级专业技术职务或具有注册会计师、注册税务师等专业资格的相关人员参加。

五、课程设置及学分分配实行学分制,总学分不少于70学分,其中:课内40学分、实践环节15学分、学位论文15学分。

1.必修课(1)外语(6学分);(2)科学社会主义理论与实践(2学分);(3)中国财政经济问题(2学分);(4)现代经济学(含宏、微观经济学)(3学分)(5)税收理论与政策(3学分)(6)中国商品税制专题(2学分)(7)中国所得税制专题(2学分)(8)中国财产税制专题(2学分)(9)国际税收专题(2学分)(10)税收管理与税务稽查专题(3学分)(11)税收筹划专题(2学分)(12)财务会计理论和实务(3学分)2.专业选修课(由学生在下列选修课程或全校为硕士研究生开设的其他公选课程中选修不少于8学分)(1)高级税务会计(2学分)(2)纳税评估实务(2学分)(3)税务代理实务(2学分)(4)税务争议专题(2学分)(5)税收信息化(2学分)(6)公文写作(2学分)(7)企业税务风险管理(2学分)(8)财务报表分析(2学分)(9)经济法专题(2学分)(10)战略管理(2学分)(11)公共管理(2学分)(12)数量分析方法(3学分)六、专业实践税务硕士研究生参与教学实践时间不少于6个月,其中在财政、税务部门、注册税务师事务所、会计师事务所、律师事务所等相关涉税部门实习不少于3个月。

美国纳税体系详解美国纳税体系详解从税收税种上来讲,美国有:个人所得税,企业所得税,社会保险税Social security),医疗保险税e die are tax),消费税,赠与税遗产税等等。

那么这里我强调一点,就是美国的个人所得税在美国税收来源中占有举足轻重的比例。

而我们国家的税收主要来源是流转税,个人所得税所占比例很小。

从征收体制上讲,美国分为联邦税(FedemlTax),州税(State Tax)以及城市税(City Tax)。

所以一般您如果生活工作在美国,那么您就需要每年进行美国联邦税以及州税的申报,部分城市还需要申报城市税。

当然美国并不是所有的州都需要缴纳州税。

我列举一下不需要缴纳美国州税的地区:阿拉斯加州(A laska),内华达州(N evada),德克萨斯州(Texas),佛罗里达州(Florida 仅就无形资产所得征税),华盛顿州(W ashington ,此为W ashington S tate, notW ashington D .C .),怀俄明州(W yom ing),南达科他州(S outh D akota), 田纳西州(Tennessee仅利息红利征税),新罕布什尔州New Ham pshire収利息红利征税)。

那么为什么,这些州没有州税呢?其实税收的本质是为了维持国家的财政收入以及调节人民贫富差距。

这些州在美国相对来说,属于经济落后地区,所以免征州税也是政府刺激当地经济的一种手段。

举个例子,加州和纽约州的州税都高。

因为这些地区人太富有。

再来介绍一下美国和税务相关的两个重要部门。

一就是美国财政部(United States Treasury),您要是给美国寄支票缴税,上面的收款人肯定是美国财政部,而不是税务局。

另外一个就是大名鼎鼎的美国税务局(3RS-Jhteiiidl Revenue Service ),隶属于财政部。

1862年,林肯总统及当时的国会为支付战争费用,创立了美国税务局。

加拿大遗产相关税务知多少加拿大没有遗产税,也没有死亡(Death)税、继承税(Inheritance)等,而以资本利得(Capital Gain)。

加拿大与遗产处理有关的税费主要有两项,一项是死者最后一次缴纳收入所得税;一项是遗嘱验证税。

所谓人生的“最后一次纳税”,就是指人生中最不可能避免的“死亡和税收”同时发生的事情了。

当事人去世当年也要进行纳税的,会计师会对其名下的所有资产进行核对,然后按当年收入进行税务申报。

如果积累了一定财富而又在生前又没有进行合理转移和规划的话,这最后一次纳税所付出的财产会相当多。

遗嘱验证税(Probate Fee, Probate Taxes)是指立有遗嘱的人一旦去世,其遗嘱(Will)拥有法律效力处理其遗产(Estate)。

虽然遗嘱执行人(Executor)法律上有权根据遗嘱处理遗产,但当转移资产如投资、房产时,通常需要对遗嘱由法庭进行验证(Court Verification)。

而验证是要收取费用的。

因此,尽管加拿大没有明确的遗产税,但有与处理遗产有关的税收和费用及财产持有人过世后的最后一次收入申报。

并不是所有财产都需要包含在遗嘱内。

不少项目,如生前已经捐赠出去的资产、联名帐号(Joint Tenants with Rights of Survivorship)内的资产、已适当注明受益人的注册计划(如RRSP、RRIF)和人寿保险、信托里面的财产,大多数情况下可能不需要遗嘱,或者另立单独的无须验证的遗嘱。

注意,加拿大各省的遗嘱验证税率不同。

合理的计划可以降低遗嘱验证税。

如生前捐赠、联名帐号、在注册计划(如RRSP、RRIF)和人寿保险中指定适当收益人、建立信托、立两个或以上的不同遗嘱等。

要对身后的财产进行合理分配和转移,首先要进行规划设计,而且最好寻求专业帮助。

做资产与遗嘱规划时界定财产地很重要。

作为中国新移民来说,会面临两个地点,一个是中国,一个是加拿大。

这两地的处理是完全不一样的,如果在中国就要遵守国内的法律体系,从各种报道和政策的走向来看,中国未来对遗产税进行征收是极有可能的。

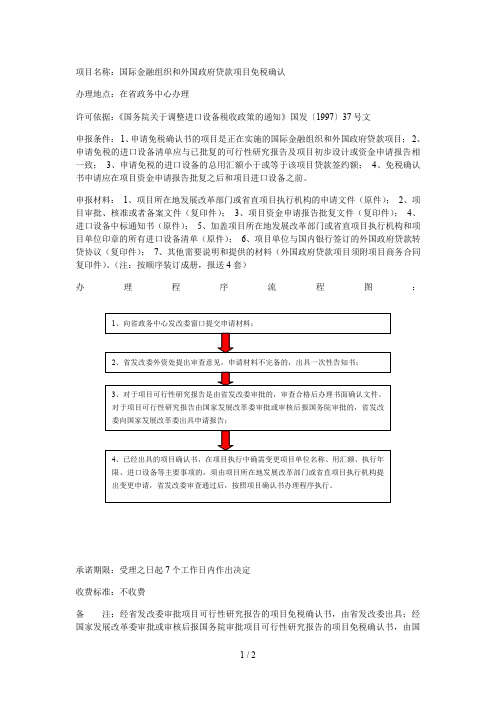

项目名称:国际金融组织和外国政府贷款项目免税确认

办理地点:在省政务中心办理

许可依据:《国务院关于调整进口设备税收政策的通知》国发〔1997〕37号文

申报条件:1、申请免税确认书的项目是正在实施的国际金融组织和外国政府贷款项目;2、申请免税的进口设备清单应与已批复的可行性研究报告及项目初步设计或资金申请报告相一致;3、申请免税的进口设备的总用汇额小于或等于该项目贷款签约额;4、免税确认书申请应在项目资金申请报告批复之后和项目进口设备之前。

申报材料:1、项目所在地发展改革部门或省直项目执行机构的申请文件(原件);2、项目审批、核准或者备案文件(复印件);3、项目资金申请报告批复文件(复印件);4、进口设备中标通知书(原件);5、加盖项目所在地发展改革部门或省直项目执行机构和项目单位印章的所有进口设备清单(原件);6、项目单位与国内银行签订的外国政府贷款转贷协议(复印件);7、其他需要说明和提供的材料(外国政府贷款项目须附项目商务合同复印件)。

(注:按顺序装订成册,报送4套)

办理程序流程图:

承诺期限:受理之日起7个工作日内作出决定

收费标准:不收费

备注:经省发改委审批项目可行性研究报告的项目免税确认书,由省发改委出具;经国家发展改革委审批或审核后报国务院审批项目可行性研究报告的项目免税确认书,由国

家发展改革委出具。

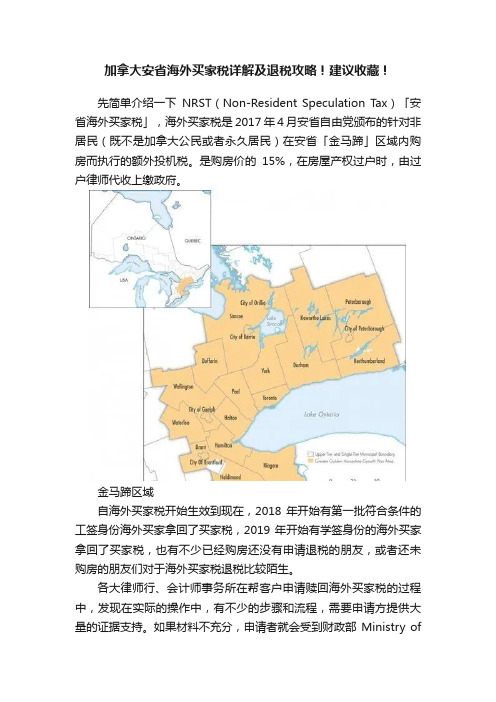

加拿大安省海外买家税详解及退税攻略!建议收藏!先简单介绍一下NRST(Non-Resident Speculation Tax)「安省海外买家税」,海外买家税是2017年4月安省自由党颁布的针对非居民(既不是加拿大公民或者永久居民)在安省「金马蹄」区域内购房而执行的额外投机税。

是购房价的15%,在房屋产权过户时,由过户律师代收上缴政府。

金马蹄区域自海外买家税开始生效到现在,2018年开始有第一批符合条件的工签身份海外买家拿回了买家税,2019年开始有学签身份的海外买家拿回了买家税,也有不少已经购房还没有申请退税的朋友,或者还未购房的朋友们对于海外买家税退税比较陌生。

各大律师行、会计师事务所在帮客户申请赎回海外买家税的过程中,发现在实际的操作中,有不少的步骤和流程,需要申请方提供大量的证据支持。

如果材料不充分,申请者就会受到财政部Ministry ofFinance的质疑,申请有可能被直接驳回(Statement of Disallowance)。

关于申请退海外买家税,大家一定要严谨、积极地对待这件事,在购房前详细了解自己是否符合退税要求,从购房开始就积极准备好退税材料!哪些情况下可以退回已经缴纳的海外买家税?1.新移民:成为加拿大永久居民的外国公民,在购买房产的四年内由外国公民转变身份为加拿大加拿大永久居民或加拿大公民。

自交房日起,购房者在4年内成为加拿大落地移民,则可以申请赎回海外买家税。

、注意:财政部必须在购房者成为落地移民的90天内收到赎回的申请,所以,也就是说,新移民从交房开始,最多可以有4年零90天的时间。

2.国际学生:购房后在政府认可的大学或学院以全日制学生身份连续学习两年及以上的国际学生。

全日制意味着注册至少所有课程的60%或40%(如果个人有残疾)。

就读的学校可以是大学University或者大专College,但学校必须是安省70/17号法案下注册的学府(这一点建议购房买家向校方求证)。

1. 额外报酬(Additional Compensation):客户会提供的额外报酬,注意披露。

2. 旁观者效应(Bystander Effect):情景影响的一种,当周围有旁人时,人的行为会受到影响。

3. 考生保证书(Candidate Pledge):考试时考生签署的保证遵守考试纪律的承诺书。

4. 警告信(Cautionary Letter):警告信是非公开的,一般适用于相对不太严重的违反行为。

5. 民事非暴力反抗(Civil Disobedience):民众举行的抗议活动,属于个人行为。

6. 客户指定经纪费(Client Directed Brokerage):客户指定经纪费如何使用的一种费用。

7. 共同投资(Co-Investment):与客户共同进行投资,目的是共担风险。

8. 合规部门(Compliance Department):保持公司治理、风险控制及遵守法律法规的部门。

9. 机密(Confidentiality):遵守保密性,不可随意的泄露客户的信息。

10. 对价(Consideration):一方为换取另一方做某事的承诺而向另一方支付的金钱代价或得到该种承诺的代价。

11. 信用评级机构(Credit-rating Agencies):对证券发行人和证券信用进行等级评定的组织,给出的债券评级会影响债券发行人的融资成本。

12. 下行风险(Downside Risk):是指未来股价走势有可能低于分析师或投资者预期的目标价位的风险。

13. 尽职调查(Due Diligence):投资人在与目标企业达成初步合作意向后,投资人对目标企业一切与本次投资有关的事项进行现场调查、资料分析的活动。

14. 公平交易(Fair Dealing):在提供投资分析,做投资建议,采取投资决策等活动时,公平公正对待所有的客户。

15. 信托(Fiduciary):委托人基于对受托人的信任,将其财产权委托给受托人,由受托人按委托人的意愿以自己的名义,为受益人的利益或特定目的,进行管理和处分的行为。

美国留学生退税申请注意事项美国留学生退税相关问题一直是大家最为关注的话题,对于计划申请美国研究生的人来说,可以先来了解一下美国留学生退税的相关问题,以免日后办理时遇到问题不好解决,下面就来看看美国留学生退税都需要注意哪些问题。

首先需要了解一些关于美国留学生退税的知识:1.联邦税:外国留学生要填的税表是1040NR或1040NR-EZ. 如果你的收入只有奖学金和银行利息, 那么你就填1040NR-EZ,否则要填1040NR. 两者的区别在于1040NR允许你申报其他的收入或损失,步骤也繁琐些. 另外,只有征税收入在$50,000以下的人才可以填1040NR-EZ. 如果拿的是fellowship则要填1042-s,那个简单多了,这里直接跳过。

关于实质性存在测试(Substantial Presence Test, Form 8843)这是用来确定你是否应该在美国交税的一个依据, 但其实这对中国留学生并没有什么用处,因为即使我们全年都在美国, 仍然只能作为Non-Resident Alien报税, 所以理论上这个表不需要填.当然其实8843本身不算特别麻烦的表格,一般还是填好并随1040NR或1040NR-ez寄出。

2.关于非居民外国人税收减免 (Form 8233):中美政府签订了关于中国公民在美国期间的收入的税收协定: UNITED STATES-THE PEOPLE'S REPUBLIC OFCHINA INCOME TAX CONVENTION. Article 20 是专门针对学生学者的. 根据这个协定,中国留学生在美国期间的收入中每年有$5000不用交税.这个表可以填一下, 同1040表一起递交. 有效期是从入学起五年,但事实上是只要你还是学生, 一直可以利用这个减免1040NR-EZ的J项及1040NR的M项就是这个, 所以也可以不填.这两项都填成"$5000, UNITEDSTATES-THE PEOPLE'S REPUBLIC OF CHINA INCOMETAX CONVENTION, article 20"8233 的主要好处是可以在较早提交,这样相当于提前拿到退税,毕竟退税实际上没啥利息的。

美国博士后报税和退税入门指南根据美国的法律,不论是居民外籍人士(Resident Alien),还是非居民外籍人士(Nonresident Alien)都需要在美国报税。

根据中美政府协议,中国博士后初到美国的前三年免税,根据各学校的人事要求不同,可以在入职时办理免税申请,也可在每年年初报税时申请前一年的退税。

因为美国报税情况记录入个人征信,所以一些学校会鼓励博士后报税。

美国的纳税体系是建立在个人申报的基础上。

纳税人自己负责汇总资料,填写和提交报税表。

据纳税人类型及收入差异,需填报的报税表也不尽相同。

我们在此为您简单介绍美国博士后报税的细节及注意事项。

一、概述在美国联邦国税局(IRS)的要求下,雇主需要在每年的1月底之前向正式雇员(Employee)寄出他们在上一年度的工资情况表以帮助雇员完成上一年度的纳税申报。

这里的工资情况表就是W-2表格。

除了雇主,其他收入来源也会向纳税人邮寄报税表格,包括银行、股票经济、失业局等。

美国工资表W-2W-2表格总共有6页,分别是Copy A,B,C,D,1,2。

其中CopyA,D由雇主保留,Copy B,C,1,2将送给雇员填写。

表格的主要身份信息包括:雇员的社会安全号码(Social Security number,SSN),雇主税务号(Employer Identification Number,EIN),雇员姓名、地址等信息。

由表格可看出,在雇员的工资及福利总额的基础上,雇主代为缴纳了联邦收入税(Federal income tax withheld)、社会保障税(Social security tax withheld)、医疗保险税(Medicare tax withheld)、州税(State income tax)、地税(Local income tax)等。

在美国,工资单上的联邦税、州税、个人所得税等是预扣的,真正的扣税数值需要等到报税的时候才知道。

中国银行机构税收居民身份声明英文China Banking Institution Tax Resident Identity DeclarationIn accordance with the tax laws and regulations of the People's Republic of China, individuals who qualify as tax residents are required to make a declaration to their banking institutions. This declaration confirms their tax residency status and helps the institutions comply with their obligations under the law.As a customer of China Bank, it is important for you to understand the concept of tax residency and the implications it has on your banking transactions. In this document, we will provide you with information on how to determine your tax residency status and how to make a tax resident identity declaration to China Bank.What is Tax Residency?Tax residency refers to the jurisdiction in which an individual is liable to pay taxes on their worldwide income. In China, an individual is considered a tax resident if they meet any of the following criteria:1. They have a registered permanent residence in China.2. They reside in China for a period exceeding 183 days in a calendar year.3. They are domiciled in China.If you fall under any of these criteria, then you are considered a tax resident of China and are required to comply with the tax laws and regulations of the country.Why is Tax Residency Declaration Important?Making a tax resident identity declaration to China Bank is important for two main reasons:1. Compliance with Tax Laws: By declaring your tax residency status, you ensure that China Bank has accurate information about your tax obligations. This helps the bank comply with its reporting requirements to the tax authorities.2. Tax Treaties and Agreements: China has tax treaties and agreements with various countries to avoid double taxation. By declaring your tax residency status, you may be eligible for certain tax benefits and exemptions under these agreements.How to Make a Tax Resident Identity Declaration to China Bank?If you believe that you qualify as a tax resident of China, you can make a tax resident identity declaration to China Bank by following these steps:1. Download the Tax Resident Identity Declaration Form from the China Bank website or visit your nearest branch to collect a physical copy.2. Fill out the form with accurate and up-to-date information about your tax residency status.3. Submit the completed form to your relationship manager or any customer service representative at China Bank.4. Upon receiving your declaration, China Bank will update its records accordingly and notify you of any further actions required.It is important to note that failure to make a tax resident identity declaration to China Bank may result in penalties or sanctions imposed by the tax authorities.ConclusionAs a responsible citizen, it is important to comply with the tax laws and regulations of your country. By making a tax resident identity declaration to China Bank, you are not onlyfulfilling your legal obligations but also ensuring that your banking transactions are in line with the requirements of the law.If you have any questions or need assistance with your tax resident identity declaration, please do not hesitate to contact your relationship manager or visit your nearest China Bank branch. We are here to help you navigate the complexities of tax residency and ensure that your financial affairs are in order. Thank you for your cooperation.。

英文回答:In order to apply for the low-ie assistance scholarship in the state of New York, prospective students mustmence the process bypleting the Free Application for Federal Student Aid (FAFSA). The FAFSA serves as the determinant for a student's eligibility for both federal and state financial aid programs, inclusive of the Tuition Assistance Program (TAP) and other state-issued scholarships. The application window for the FAFSA traditionallymences on October 1st of each year, and it is strongly rmended that students submit their applications at their earliest convenience to optimize their likelihood of securing financial aid. It is imperative that all requisite documentation, such as tax returns and bank statements, bepiled prior tomencing the application process. Upon submission of the FAFSA, students will be supplied with a Student Aid Report (SAR) outlining their financial particulars, including their Expected Family Contribution (EFC), which is pivotal in ascertaining eligibility for need-based financial aid programs.为了申请纽约州低额援助奖学金,未来学生必须加入联邦学生援助免费申请程序。

2024考研法硕真题:税法学英文版2024 Postgraduate Entrance Exam LLM Tax Law (Complete Version)In 2024, the postgraduate entrance exam for LLM candidates included a comprehensive section on tax law. This section covered various aspects of tax law, including principles, regulations, and case studies. The exam aimed to test candidates' understanding of tax law and their ability to apply it in real-life scenarios.Candidates were required to demonstrate their knowledge of tax law principles, such as taxation theories, tax structure, and tax planning strategies. They were also tested on their understanding of tax regulations, including tax policies, tax rates, and tax incentives. In addition, candidates were presented with case studies that required them to analyze complex tax issues and propose solutions based on their understanding of tax law.Overall, the 2024 LLM tax law exam was designed to evaluate candidates' proficiency in tax law and their ability to think critically and analytically in applying tax law principles to practical situations. It was a challenging but rewarding test that allowed candidates to showcase their expertise in tax law and demonstrate their readiness for a career in the field of taxation.。

在美国交税税收是美国政府赖以生存的财政基础,而个人所得税则是美国政府财政的重要来源。

因此,上到美国总统,下到平民百姓,纳税成为每个人的义务和职责。

美国是根据个人收入情况逐步提高税率,从而以此来减少低收入者的负担和控制高收入者的收入过快增长。

最基本的原则是多收入多交税,收入低的先交税,后退税。

以下简要说明留学生和美国永久居民的交税情况,税率等依据纽约州规定。

F-1 学生签证报税1.CPT期间收入持有F-1签证的留学生,在下列情况下享有免报税:1)每周最多20小时(暑假40小时)的校园(on-campus)工作;2)USCIS批准的校园外(off-campus)工作;3)社会实践(Practical Training)。

特别注意的是所有工作必须被美国移民局(USCIS)批准,与专业相关。

如果CPT期间身份发生转变,则也不能享受免报税。

2.无收入F-1 OPT目前在美国的留学生(F-1)、学者(J-1),无正式收入,只需要填写Form 8843(个人资料说明书)证明自己在美国的身份即可。

无需报税的收入:奖学金,学费见面,非商业用途的银行存款利息,购物时的现金或支票的返利(Cash/Check Refund),信用卡积分换礼等等。

德克萨斯州财务部:Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215寄送日期:6月15日之前问:什么是Substantial Presence Test(实质性存在检测)?答:如果根据条件满足居住在美国183天,留学生或学者则应该作为美国居民报税。

以下是满足条件:1)本年度居住满31天;2)包括本年的连续三年居住时间满183天。

具体计算公式:本年度居住时长+前一年居住时长×⅙+连续三年中的第一年居住时长×⅓。

问:如果不填写Form 8843,会有什么后果么?答:一般来说,您所有在美天数可能都被用来进行实质性存在检测,即被视为美国居民纳税的机会增加,您的全球收入都将可能被征税。

美国打工要诚实报税

据报道,正值报税季节,一些留学生和持工作签证的新移民因为对美国税务规定不了解,在报税时容易受到误导,华人律师提醒新移民们,部分税务优惠只限绿卡持有者和公民,在美国要诚实报税。

近来一部分留学生中在流传着这样一个不实信息:在美国上学的留学生如果学费超过若干元即可拿到国税局的退税,这一传言还附会某些留学生已通过某某会计事务所拿到了退税。

目前,这一传言在部分留学生中传得沸沸扬扬,为此已受到洛杉矶总领馆官员的重视。

根据美国的法律规定,2011年和2012年度的美国机会抵税额(AOTC)可以让学生们最多获得2500元的抵税,但条件是报税者如果单身,年收入必须在8万元以下,如果结了婚年收入必须在16万元以下才符合申请要求。

联邦国税局的发言人玛克斯(Anabel Marquez)在接受采访时指出,国税局在报税的时候不会问报税者的种族或者移民身份,但是AOTC 并不适用于非居民外国人(Non-resident Alien),也就是说,只有美国绿卡持有者和公民身份的人才可以申请。

另外一项低收入抵税额(EITC),也是只适用于美国公民或者绿卡持有者,以及那些与公民或者绿卡持有者结婚并共同报税的非居民外国人。

华人税务律师说,这个项目其实并不是给外国人准备的,所以不要贪图这一两千元的小便宜,因为在将来入籍的时候会让纳税人交报税单,这样就会带来很大麻烦。

此外,EITC还会问你其他收入有没有超过50%, 一些人其实有家里的经济支持但是仍然说没有,如果被抓到绿卡会取消,如果是留学生就会被驱逐出境。

税务律师说,今年报EITC要非常注意,因为国税局认为有很多人有欺骗政府的行为,所以会对此严查。

Prentice Hall's Federal Taxation 2013 Corporations, 26e (Pope)Chapter C15 Administrative Procedures1) The majority of the individual tax returns that are audited are selected under the DIF program. Answer: FALSEPage Ref.: C:15-5Objective: 22) The IRS will issue a 90-day letter (a Statutory Notice of Deficiency) if the taxpayer does not file a protest letter within 30 days of the date of the 30-day letter.Answer: TRUEPage Ref.: C:15-7Objective: 33) The 90-day letter (Statutory Notice of Deficiency) gives the taxpayer 90 days to file a petition with the Tax Court or to pay the disputed tax.Answer: TRUEPage Ref.: C:15-7Objective: 34) If the taxpayer has credible evidence, the IRS bears the burden of proof in a tax dispute.Answer: TRUEPage Ref.: C:15-8Objective: 35) A letter ruling is a written determination that interprets and applies the tax laws to the taxpayer's specific set of facts.Answer: TRUEPage Ref.: C:15-9Objective: 46) The "automatic" extension period for filing an individual return is seven months.Answer: FALSEPage Ref.: C:15-11Objective: 47) The maximum failure to file penalty is a total of 25% of the underpayment.Answer: TRUEPage Ref.: C:15-16Objective: 68) A taxpayer who fails to file and fails to pay taxes is subject to a combined 5% monthly penalty on the underpayment.Answer: TRUEPage Ref.: C:15-16Objective: 69) The statute of limitations, which stipulates the time frame within which either the government or the taxpayer may request a redetermination of tax due, usually expires 6 years after the date on which the return is filed.Answer: FALSEPage Ref.: C:15-24Objective: 810) The statute of limitations is unlimited for a tax return that is never filed.Answer: TRUEPage Ref.: C:15-26Objective: 811) Treasury Department Circular 230 regulates the practice of attorneys, CPAs, enrolled agents, and enrolled actuaries before the IRS.Answer: TRUEPage Ref.: C:15-31Objective: 1012) Anyone who prepares a tax return is subject to the provisions of Circular 230.Answer: FALSEPage Ref.: C:15-31Objective: 1013) The Internal Revenue Service is part of theA) Congress.B) Treasury Department.C) Federal Bureau of Investigation.D) U.S. Customs Department.Answer: BPage Ref.: C:15-2Objective: 114) The program specifically designed to identify returns with a high potential for a deficiency assessment is theA) TCMP.B) DIF program.C) instant audit program.D) 1040 program.Answer: BPage Ref.: C:15-3Objective: 215) Identify which of the following statements is false.A) The majority of the individual tax returns that are audited are selected under the DIF program.B) The TCMP audit program has been temporarily suspended by the IRS and replaced in part by lifestyle audits.C) The IRS is authorized to pay a reward to individuals who provide information resulting in increased collections.D) All of the above are false.Answer: APage Ref.: C:15-3 through C:15-5Objective: 216) Identify which of the following statements is true.A) If a taxpayer has been audited in at least one of the two previous years on the same item and the earlier audit did not result in any additional tax owed, the taxpayer may qualify for the special audit relief rule.B) A taxpayer can request and always receive an exemption from an audit by the IRS if his return was audited in at least one of the two previous years and the previous audit did not result in any change to his tax liability.C) The signing of Form 870 allows the taxpayer to wait for 30 interest-free days after the billing date to pay the tax.D) All of the above are true.Answer: APage Ref.: C:15-5Objective: 217) Identify which of the following statements is false.A) A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.B) If the taxpayer being audited does not concur with the proposed assessment, the Service is required to send the taxpayer a 30-day letter detailing the proposed changes and the available appeals process.C) During the audit process, if the taxpayer concurs with the assessment of tax by the IRS and signs Form 870 (Waiver of Restrictions on Assessment and Collection of Deficiency in Tax), then the taxpayer is precluded from filing a refund suit.D) Interest on a deficiency accrues from the due date of the return through the payment date. Answer: CPage Ref.: C:15-6Objective: 218) Identify which of the following statements is false.A) Appeals officers usually have the operating authority to settle disputes with taxpayers based on the "hazards of litigation."B) When an appeals officer is dealing with an "appeals coordinated issue," he has the authority to settle with the taxpayer based on the "hazards of litigation."C) A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.D) If the taxpayer and the appeals officer fail to reach agreement, the IRS issues a 90-day letter. Answer: BPage Ref.: C:15-6 and C:15-7Objective: 219) The IRS provides advice concerning an issue that arises during an audit by issuingA) a revenue ruling.B) an audit memorandum.C) a technical advice memorandum.D) a private letter ruling.Answer: CPage Ref.: C:15-6Objective: 220) In order to appeal to the Appeals Division, a taxpayer must submit a protest letter to the IRSA) if an office audit is involved.B) as a response to receiving a 30-day letter.C) in a field audit involving a assessment of taxes, interest, and penalties in excess of $25,000.D) if a TCMP audit is involved.Answer: CPage Ref.: C:15-6Objective: 221) A taxpayer will receive a 30-day letterA) to notify him that the return was selected for audit.B) after a response to the 90-day letter with a protest.C) only if the taxpayer does not sign Form 870.D) only if the taxpayer is more than 30 days late in filing the tax return.Answer: CPage Ref.: C:15-6Objective: 322) How long does a taxpayer have to file a petition with the U.S. Tax Court following the date of the Statutory Notice of Deficiency?A) 90 daysB) three monthsC) 180 daysD) 30 daysAnswer: APage Ref.: C:15-7Objective: 323) The court in which the taxpayer does not have to pay the tax and then litigate for a refund is theA) U.S. Court of Federal Claims.B) Federal district court.C) Tax Court.D) all of the aboveAnswer: CPage Ref.: C:15-7Objective: 3A) Form 870-AD is used if the taxpayer and IRS representative agree to a lesser tax liability than that originally proposed by the Service.B) Signing of Form 870-AD by the taxpayer does not generally preclude the subsequent filing of a refund claim.C) The IRS will issue a 90-day letter (a Statutory Notice of Deficiency) if the taxpayer does not file a protest letter within 10 days of the date of the 30-day letter.D) All of the above are false.Answer: APage Ref.: C:15-7Objective: 325) Identify which of the following statements is true.A) The 90-day letter offers the taxpayer the choice of paying the tax assessed or filing a petition refuting the tax assessment with the Tax Court.B) A taxpayer can choose to initiate tax litigation in a U.S. district court, the Tax Court, or a Court of Appeals.C) The IRS cannot raise a new tax issue after issuance of the Statutory Notice of Deficiency (90-day letter).D) All of the above are false.Answer: APage Ref.: C:15-7Objective: 326) Identify which of the following statements is false.A) In general, the taxpayer has the burden of proof in Tax Court cases. However, the IRS has the burden of proof for issues raised after the issuance of the 90-day letter.B) A taxpayer may want to avoid using the Tax Court to litigate an issue because decisions from this court cannot be appealed.C) The Tax Court can be used to litigate a tax issue without first paying the tax assessment.D) In order to litigate in the Tax Court, a petition must be filed within 90 days of the issuance of a notice of deficiency.Answer: BPage Ref.: C:15-8Objective: 327) Identify which of the following statements is false.A) If the phrase "Entered under Rule 155" appears at the end of the Tax Court's opinion, the litigating parties must jointly determine the additional tax due.B) A taxpayer does not have to pay the tax assessment before filing suit in a U.S. district court or the U.S. Court of Federal Claims.C) Either the taxpayer or the government can appeal the decision of a court of original jurisdiction to the next higher court with the potential for a final ruling from the U.S. Supreme Court if a writ of certiorari is granted.D) All of the above are false.Answer: BPage Ref.: C:15-8Objective: 3A) So-called private letter rulings are made public after confidential information is eliminated.B) A letter ruling is a written statement issued to a taxpayer by the IRS that interprets and applies the tax laws to that taxpayer's specific set of facts.C) Only the taxpayer can appeal the decision of a court of original jurisdiction to the next higher court.D) If the Supreme Court decides to hear a case, it grants certiorari.Answer: CPage Ref.: C:15-8Objective: 329) Which one of the following statements about letter rulings is false?A) If a taxpayer requests and pays for a ruling, the IRS must respond to his request by issuing a ruling.B) A ruling is a response to a taxpayer's specific set of facts.C) Rulings become public information.D) The IRS issues revenue procedures periodically, which prescribe the information that must be supplied with a ruling request.Answer: APage Ref.: C:15-9 through C:15-10Objective: 430) Which of the following items can be omitted from a taxpayer's request for a ruling?A) names, addresses, and taxpayer identification numbers of all interested partiesB) a detailed explanation of the transactionC) the particular conclusion desired by the taxpayerD) the location of the IRS district office that has examination jurisdictionAnswer: CPage Ref.: C:15-9Objective: 431) The IRS will issue a rulingA) on prospective transactions only.B) only if regulations have been issued on the subject.C) on a completed transaction for which a return has been filed.D) to clarify the tax treatment of a transaction.Answer: DPage Ref.: C:15-10Objective: 4A) The IRS issues annually a revenue procedure that prescribes how a letter ruling should be requested and the information to be contained in the ruling request.B) The request for a ruling may contain a suggested conclusion (or answer) that the taxpayer proposes that the IRS adopt in the described situation.C) As a practical consideration, taxpayers always find it preferable to obtain an advance ruling on questionable tax situations.D) Third parties may not cite private letter rulings as authority for the tax consequences of their transactions.Answer: CPage Ref.: C:15-9 through C:15-10Objective: 433) Identify which of the following statements is false.A) The IRS will not issue a ruling on the topic of whether compensation is reasonable.B) Tax returns for all taxpayers must be filed on or before the fifteenth day of the fourth month following the year-end.C) A corporation must file a tax return even if it has no gross income.D) Extensions of time for filing tax returns may be obtained.Answer: BPage Ref.: C:15-10Objective: 434) Identify which of the following statements is true.A) A partnership is not required to file a return if the partnership has no income for the year.B) The "automatic" extension period for filing an individual return is five months.C) Individuals and corporations may obtain six-month extensions for paying taxes and filing their returns for the taxable year by filing the appropriate extension requests.D) All of the above are false.Answer: CPage Ref.: C:15-11Objective: 435) An automatic extension of time from the regular filing date for an individual tax return may be received, without giving the IRS a reason, forA) 2 months.B) 3 months.C) 4 months.D) 6 months.Answer: DPage Ref.: C:15-11Objective: 436) If a return's due date is extended, a taxpayerA) also extends the period in which to pay taxes without interest.B) still should pay the tax by the original return due date.C) has 30 days following the original due date to pay estimated taxes without penalty.D) has 30 days following the original due date to pay estimated taxes without interest.Answer: BPage Ref.: C:15-11Objective: 437) In which of the situations below will a taxpayer not be assessed interest on the tax remitted?A) An extension is obtained and the tax is paid within the extension period.B) A timely return is filed but the taxpayer must delay payment of the taxes.C) The return is audited and additional tax is owed.D) None of the above situations.Answer: DPage Ref.: C:15-12Objective: 538) Identify which of the following statements is false.A) Interest is imposed on any tax not paid by the due date of the return (determined without regard to extensions).B) Interest is charged on underpayments, or paid on overpayments, at a rate of three percentage points higher than the federal short-term rate.C) Interest on underpayments is calculated using daily compounding and covers a time period from the original due date of the return until the date of payment.D) Any tax not paid by the due date for the return is subject to an interest charge.Answer: BPage Ref.: C:15-12Objective: 539) Identify which of the following statements is false.A) In addition to interest, taxpayers may be subject to penalties for failure to file on time and failure to pay taxes by the due date for the return.B) The failure-to-file penalty is levied against taxpayers who do not file a return by its due date at a rate of 5% per month (or fraction of a month) with a maximum additional penalty of 25%.C) The failure-to-pay penalty is imposed at a rate of 5% per month (or fraction of a month) with a maximum penalty of 25%.D) A different interest rate is charged to corporate and noncorporate taxpayers.Answer: CPage Ref.: C:15-13 through C:15-17Objective: 540) A calendar-year individual taxpayer files last year's income tax return on October 17 of the current year. No extension was requested, and there is not a reasonable cause for the late filing. The return shows a balance due of $1,500 of tax. The late filing penalty isA) $0.B) $75.C) $375.D) $450.Answer: CExplanation: C) The penalty is 5% per month (or fraction thereof) with a maximum of 25%. In this case, the maximum applies. 0.25 × $1,500 = $375Page Ref.: C:15-16Objective: 641) A calendar-year individual taxpayer files last year's income tax return on July 1 of the current year. No extension was requested, and there is not a reasonable cause for the late filing. The return shows a balance due of $800 of tax. The late filing penalty isA) $0.B) $40.C) $80.D) $120.Answer: DExplanation: D) The penalty is 5% per month (or fraction thereof). 0.05 × 3 months × $800 = $120.Page Ref.: C:15-16Objective: 642) Gerald requests an extension for filing his last year's individual income tax return. His tax liability is $10,000, of which $8,000 was withheld, leaving a balance due of $2,000 when he files on August 1 of the current year. His penalty for failure to pay the tax on time isA) $0.B) $40.C) $300.D) $400.Answer: BExplanation: B) 0.005 × 4 months × $2,000 = $40Page Ref.: C:15-16Objective: 643) If Brad files his last year's individual tax return on July 5 of the current year after having requested an extension, what is the amount of his failure-to-pay penalty if his total tax is $10,000 and he paid $9,500 through timely withholding and $500 with the return?A) $0B) $6C) $60D) none of the aboveAnswer: AExplanation: A) His balance due is $500, which is not more than 10% of his total tax of $10 ,000. There is no penalty.Page Ref.: C:15-16Objective: 644) Identify which of the following statements is true.A) The failure-to-pay penalty is waived if the additional tax due with the filing of the extended return does not exceed 15% of the tax owed for the year.B) If both the failure-to-file and the failure-to-pay penalties are owed, the taxpayer will incur a maximum addition to tax of 5.5% per month.C) Individuals having substantial income from sources not subject to regular withholding generally should make quarterly estimated tax payments to the IRS.D) All of the above are false.Answer: CPage Ref.: C:15-16Objective: 645) Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.A) $7,650B) $7,750C) $8,750D) $11,000Answer: AExplanation: A) Use the lesser of 90% of this year's tax or 100% of last year's tax.This amount is less than 25% of last year's tax liability ($40,000) minus the amount withheld ($9,000) or $7,750.Page Ref.: C:15-17 through C:15-20Objective: 546) A taxpayer can automatically escape the penalty for underpayment of taxes byA) owing less than $1,000 in taxes over and above the taxes withheld from wages.B) owing taxes in the previous year.C) having a casualty loss.D) none of the aboveAnswer: APage Ref.: C:15-19Objective: 747) A taxpayer's return is audited and additional taxes are assessed. The IRS also asserts that a negligence penalty should be assessed. The taxpayer concurs with the additional $15,000 tax liability; $7,000 of this amount is attributable to negligence. What is the amount of the penalty for negligence?A) $700B) $1,400C) $5,600D) $1,750Answer: BExplanation: B) 0.20 × $7,000 = $1,400Objective: 748) A substantial understatement of tax liability involves which of the following?A) understatement of tax exceeding the greater of 10% of tax required to be shown on the return or $5,000 for individualsB) underpayment of tax exceeding the greater of 15% of the tax required to be shown on the return or $5,000 for individualsC) underpayment of tax exceeding the lesser of 25% of the tax required to be shown on the return or $5,000 for individualsD) $10,000 or more difference between the amount shown on the return and the correct amount due Answer: APage Ref.: C:15-21Objective: 749) Which of the following is not a reason for relief from the substantial understatement penalty?A) disclosure of the relevant facts pertaining to the questionable tax return positionB) substantial authority for the tax return positionC) reliance on a tax return preparerD) reasonable cause and a good faith effort to comply with the tax lawAnswer: CPage Ref.: C:15-21Objective: 750) What is the requirement for a substantial understatement of tax for individuals?A) The understatement exceeds 10% of the tax required to be shown on the return.B) The understatement exceeds $5,000.C) The understatement exceeds the lesser of 10% of the tax required to be shown on the return or $5,000.D) The understatement exceeds the greater of 10% of the tax required to be shown on the return or $5,000. Answer: DPage Ref.: C:15-21Objective: 751) Identify which of the following statements is true.A) An individual taxpayer may be subject to a penalty for underpayment of estimated taxes if his balance of tax due when he files is $500.B) A penalty for substantial understatement will potentially be assessed on an individual if the underpayment of tax exceeds the greater of 15% of the tax shown on the return or $5,000.C) Substantial authority exists for a position that is supported by a decision rendered by the Court of Appeals for the taxpayer's own circuit.D) All of the above are true.Answer: CPage Ref.: C:15-22Objective: 752) Identify which of the following statements is false.A) If fraud is asserted in a tax transaction, the burden of proof falls on the IRS.B) The civil fraud penalty consists of 75% of the tax underpayment attributable to fraud plus 25% of the interest payable on the portion of the underpayment resulting from the fraud.C) The government must prove its case "beyond a reasonable doubt" in order for the court or jury to convict a taxpayer of criminal fraud.D) The fraud penalty can be imposed with respect to income, gift, and estate tax returns.Answer: BPage Ref.: C:15-23Objective: 753) A six-year statute of limitation rule applies if the taxpayerA) understates taxable income by 25%.B) understates AGI by 25%.C) understates gross income by 25%.D) none of the aboveAnswer: CPage Ref.: C:15-24Objective: 854) On April 15, 2010, a married couple filed their joint 2009 tax return showing gross income of $120,000. Their return was prepared by a professional tax preparer who mistakenly omitted $45,000 of income, which the preparer in good faith considered to be nontaxable. No information with regard to this omitted income was disclosed on the return or attached statements. By what date must the IRS assert a notice of deficiency before the statute of limitations expires?A) April 15, 2015B) December 31, 2011C) April 15, 2009D) December 31, 2009Answer: APage Ref.: C:15-24Objective: 855) Identify which of the following statements is true.A) The statute of limitations, which stipulates the time frame within which either the government or the taxpayer may request a redetermination of tax due, usually expires six years after the date on which the return is filed.B) The statute of limitations limits the time during which a taxpayer may claim a refund of an overpayment of tax.C) If a taxpayer omits from gross income an amount in excess of 25% of the gross income shown on his return, the statute of limitations is five years.D) All of the above are true.Answer: BPage Ref.: C:15-27Objective: 1056) Terry files his return on March 31. The return shows taxes of $6,000, and Terry pays this entire amount when he files his return. By what time must he file a claim of refund?A) the later of two years from the return filing or three years from the date the tax is paidB) the later of three years from the return due date or two years from the date the tax is paidC) two years from the payment of tax date, if the IRS mails a notice of deficiency in the third year following the due date of the returnD) four years from the payment of tax date, if the IRS mails a notice of deficiencyAnswer: BPage Ref.: C:15-27Objective: 1057) Steve files his return on April 1 and pays the entire amount of tax for the year at that time, $5,000. He is audited and pays the deficiency of $1,500 two years later. The maximum amount Steve may file a claim for refund for eighteen months later isA) $6,500.B) $5,000.C) $1,500.D) some other amount.Answer: CPage Ref.: C:15-27Objective: 1058) Identify which of the following statements is true.A) If a taxpayer fails to file a return, the statute of limitations is extended to 10 years.B) If a couple files a joint return but only one spouse had income, only the spouse with income is responsible for paying any tax due.C) Joint and several liability means that each spouse is potentially liable for the full amount of tax due.D) All of the above are false.Answer: CPage Ref.: C:15-27Objective: 1059) The innocent spouse relief provision from tax liability covers all of the following exceptA) improper deductions.B) improper credits.C) improper basis.D) All are understatements subject to minimum thresholds.Answer: DPage Ref.: C:15-28Objective: 1060) All of the following requirements must be met in order to establish innocent spouse relief except which of the following?A) The return contains an understatement of tax attributable to the erroneous item(s) of an individual filing it.B) The request for innocent spouse relief is made no later than one year after the IRS begins its collection efforts.C) The requesting individual establishes that he or she neither knew nor had reason to know of any or all of the understatement.D) Based on all the facts and circumstances, holding the other individual for the deficiency would be inequitable.Answer: BPage Ref.: C:15-28Objective: 1061) Tax return preparers can be penalized for the following activities exceptA) failure to sign a return.B) failure to give a copy of the return to the taxpayer.C) failure to maintain IRS continuing education requirements.D) failure to provide the preparer's identification number on the return.Answer: CPage Ref.: C:15-29Objective: 1062) What is the penalty for a tax return preparer who willfully attempts to understate taxes, or intentionally disregards the tax rules and regulations?A) $50B) $250C) $5,000D) 20% of the understatementAnswer: CPage Ref.: C:15-30Objective: 1063) What is the penalty for a tax return preparer who lacks substantial authority to take a return position?A) $50B) $250C) $1,000D) 20% of the understatementAnswer: CPage Ref.: C:15-29Objective: 1064) What is the IRS guideline for determining whether a tax return position has substantial authority?A) A person knowledgeable in the tax law concludes that the position has a something less than 50% likelihood of being supported.B) A person knowledgeable in the tax law concludes that the position has at least a 50% likelihood of being supported.C) A person knowledgeable in the tax law concludes that the position has at least a two-thirds likelihood of being supported.D) A person knowledgeable in the tax law concludes that the position has at least a 75% likelihood of being supported.Answer: APage Ref.: C:15-30Objective: 1065) Identify which of the following statements is true.A) The "innocent spouse provision," if applicable, relieves both spouses from an assessment of tax caused by a spouse's understating income or gain and/or overstating deductions, losses, or credits.B) The IRS is precluded from assessing any residual tax liability against transferees and fiduciaries because the initial filers are responsible for meeting the tax payments in a timely fashion.C) Treasury Department Circular 230 regulates the practice of attorneys, CPAs, enrolled agents, and enrolled actuaries before the IRS.D) All of the above are false.Answer: CPage Ref.: C:15-31Objective: 1066) According to Circular 230, what should a CPA do upon discovery of an error in a client's prior-year return?A) Notify the IRS of the error.B) Inform the client of the error and its tax consequences.C) File an amended return for the client.D) Do nothing.Answer: BPage Ref.: C:15-32Objective: 1067) Which of the following statements regarding Circular 230 is false?A) Circular 230 applies to all tax return preparers.B) Circular 230 defines practice before the IRS.C) Circular 230 provides guidance as to the level of authority necessary for a CPA to take a tax return position.D) Circular 230 applies to CPAs, enrolled agents, enrolled actuaries, and attorneys.Answer: APage Ref.: C:15-31Objective: 1068) The "Statement on Practice in the Field of Federal Income Taxation" includes all of the following areas of mutual competence exceptA) preparing federal income tax returns.B) determining the tax effect of proposed transactions.C) representing clients in criminal investigations.D) representing taxpayers before the U.S. Tax Court.Answer: CPage Ref.: C:15-35 and C:15-36Objective: 1069) Which of the following activities is protected by accountant-client privilege?A) written communications between a CPA and a corporation regarding a tax shelterB) communications related to tax return preparationC) communications related to criminal tax evasionD) advice given regarding tax issues in a divorceAnswer: DPage Ref.: C:15-36Objective: 10。