行为金融学课后答案1至5章anawer

- 格式:doc

- 大小:330.00 KB

- 文档页数:5

引言概述:行为金融学是一门将心理学和经济学结合起来研究人们投资和决策行为的学科。

通过研究人类的行为模式和认知偏差,行为金融学试图解释为什么人们在投资决策中往往会出现非理性行为,从而进一步揭示市场行为背后的心理原因。

本文将对行为金融学的第一章进行详细阐述,包括理论基础、决策过程和认知偏差等方面。

正文内容:1.理论基础1.1行为金融学的起源行为金融学是由传统金融学和心理学相结合而成的学科,起源于1980年代。

傅尔德和肯特纳等学者首次提出了行为金融学的概念,并提出了人们在投资决策中存在着非理性行为。

1.2行为金融学的理论框架行为金融学的理论框架包括认知心理学、行为经济学和实证金融学等多个学科的内容。

认知心理学研究人们的思维方式和对信息的处理方式,行为经济学研究人们的行为模式和决策规律,实证金融学研究市场行为和投资效应。

1.3行为金融学的价值和应用行为金融学的研究成果可以帮助投资者理解市场行为背后的心理原因,更好地进行投资决策。

行为金融学也提供了更全面的投资策略,比如基于认知偏差的交易策略等。

2.决策过程2.1决策理论的基本原理决策理论研究人们在面临不确定性和风险时做出决策的过程。

基于效用理论,人们在决策中追求最大化的效用,但实际情况中往往存在认知偏差。

2.2决策的认知偏差保守主义偏差:人们在新信息面前往往保持原有观点,对新信息的接受存在偏差。

锚定效应:人们在做决策时容易受到周围环境的影响,产生特定的心理锚点。

过度自信:人们对自己的能力和知识容易过度自信,影响投资决策的准确性。

前景理论:人们在对待利益和损失时表现出不对称的态度,对损失更为敏感。

群体决策偏差:人们在群体决策中容易受到他人的影响,忽视个人观点。

3.认知偏差3.1选择框架选择框架研究人们如何对不同选项进行分类和选择。

人们在对待相同概率的风险时,会受到不同的选择框架的影响,偏好避免损失。

3.2信息处理信息过载:人们在面对大量信息时容易选择性检索和过滤信息,造成信息过载。

第一章货币的微观功能和效用1.怎样理解货币的不同定义?货币的不同定义主要是由于研究货币问题时着眼点、目的性的不同,或在依据的理论基础和分析方法上存在差异所造成的。

2.马克思的货币定义是什么?马克思认为货币是一种作为一般等价物的特殊商品。

首先,货币作为一种商品,它同时具有价值和使用价值两种属性。

其次,由于货币使用价值的特殊性,使得货币与一般商品又有所区别,这种区别表现在货币不仅具有以其自然属性所决定的特定使用价值,又有以其社会属性所决定的一般的使用价值,即充当一般等价物和交换手段。

总得来说,货币即是一种由商品交换发展所产生的固化的一般等价物。

3.从价值形式的演变导出货币的产生,其思想逻辑是什么?简单价值形式中的等价物———扩大的价值形式证明价值的无差别性,暴露了物物直接交换的缺陷———一般等价物的出现———货币的产生。

4.为什么说货币是核算社会劳动的工具?在商品经济中,商品价值量的能否实现、具体劳动和私人劳动的能否向抽象劳动和社会劳动转化,以能否实现向货币的转化为标志,并最终以能否转化为货币来体现。

在市场经济条件下,货币的这种核算作用实现了产业之间、产品结构之间的自发调解,使之达到按比例发展。

5.怎样从流动性角度理解货币的定义和范围?定义:在凯恩斯的货币理论中,货币是一种为人们提供流动性效用或灵活性效用的资产,对货币的需求就是一种对流动性或灵活性的偏好。

范围:拉德克利夫的报告认为,在大量非银行金融中介机构存在的情况下,真正影响经济的不是狭义的货币供给,而是整个社会的流动性,应该用流动性来定义货币,货币的范围不仅包括传统意义上的只具有货币交易媒介功能的货币供给,还应包括银行和非银行金融机构所创造的所有的短期流动资产,这些流动资产不直接作为交易媒介,是作为价值储藏手段的货币,是能够对经济产生重要影响的货币。

6.怎样理解货币是信用关系的载体?在流通中,人们需要的是一种如愿实现商品交换的保证或信用,而不是货币材料本身。

行为金融第一二章习题二问答题1 代表性偏差可能导致什么错误?2 ?3 锚定可导致什么偏差?4 在什么情况下,最有可能导致人们使用启发法?5 为什么依靠可得性进行预测可能会导致偏差?67 为什么理性是有限的?8.简述行为金融学进展历程。

一名词解释行为金融信息加工心理学实验经济学金融学态度感情纳什均衡理性人贝叶斯法则同质期望性有限理性同一价格法则二问答题1 行为金融与标准金融的具体差异表现在什么方面?2 行为学的基本原则是什么?3 行为经济学具有什么特点?4 传统经济学中理性人的假设是什么?行为金融学如何对其进行了修正?5 行为金融学与标准金融学的差异表现在什么方面?6 请举例说明人类心理与行为会对证券价格的影响并进行。

7 人类历史上曾出现过郁金香泡沫、南海泡沫是否与人类的某些心理或者行为特征有关系。

谈谈你的看法。

三案例分析证券市场自其诞生以来就是一个震荡不安的地带,从1929年的股市大萧条到70年代中期的“石油危机”,再到1987年美国的“金融地震”,与1997年的亚洲金融危机,其规模与影响力不断加强。

每一次的危机周期中,股票市场上的股票指数都经历了一个先节节攀升,继而急剧下滑的曲线。

从2000年到2008年美国标准普尔指数的季度涨跌幅变化图,我们看到美国股市所经历的剧烈震荡。

在中国刚刚过去的三年里,股票市场也有这样一段疯狂的经历。

以我国2005年4月股权分置改革政策的提出为导火线,在一系列利好政策的刺激下,我国股市迎来了又一轮大好牛市。

在经历了数年的萎靡不振之后, 2006年至2007年中国股市峰回路转,一路飙升。

特别是自2007年年初以来,上证综指从2700多点节节攀升,一度突破6000点大关。

截止到2007年11月22日,沪深两市账户已新增5600万,达到13500万户,与2006年相比,几乎增加72%。

然而,进入2007年11月份以来,中国股市出现了调整性的下跌,上证综指还一度跌破5000点关口。

行为金融学_中南大学中国大学mooc课后章节答案期末考试题库2023年1.期望效用理论建立在决策主体偏好满足一系列严格的公理化假定的基础之上,下列哪一个不是这些公理化的价值衡量标准的假定条件答案:对称性2.阿莱悖论验证了什么效应?答案:确定性效应3.人的大脑存在“快系统”与“慢系统”两套判断与决策系统,下列哪一个是快系统的特征答案:下意识的执行4.有人在掷骰子时想掷出“双六"心中就在想“六、六、六”,口中也唠叨出来,用手逐渐加力捏骰子。

这反映了哪一种非理性偏误答案:控制幻觉5.汽车广告里描述该车每公里省多少油,而不告知每升油能跑多少公里。

这是利用了消费者的哪种心理效应答案:框架效应6.成语“敝帚自珍”反映了什么心理偏好答案:禀赋效应7.关于前景理论中的价值函数,以下说法错误的是答案:价值函数分为盈利和损失两个区域,盈利区域为凸函数,损失区域为凹函数8.对“股权溢价之谜”的行为金融学解释是答案:短视损失厌恶9.关于有效市场假说的解释,下列不正确的是答案:有效市场假说认为价格可能是长期不正确的10.下列哪些研究证据或事实支持了半强式有效市场假说答案:大部分共同基金并不能获得超过市场基准收益的回报11.如果投资者偏好现金股利,则公司支付高股利可以答案:提高公司股票价格12.关于主动型投资策略与被动投资策略,下列描述错误的是答案:巴菲特是被动型投资策略的代表人物13.关于"羊群行为"的说法,下列不正确的是答案:羊群行为是一种完全非理性的行为,不具有降低成本或增加收益的作用14.下列不属于“赢者诅咒”的表现是答案:投资项目后出现亏损15.下列哪些因素导致经理人恶性增资现象?答案:损失厌恶16.有效市场假说成立需具备哪些前提假设答案:投资者都是理性的,能对证券做出合理的价值评估非理性投资者之间的交易是随机的,非理性策略相互抵消市场上的理性套利者能够消除非理性投资者产生的误定价17.对市场有效性的检验,下列表述正确的是答案:检验相同资产的交易价格是否满足一价定律检验在无信息的条件下,资产价格是否发生异动检验在有信息的条件下,资产价格是否正确、及时的反应检验市场上是否存在超额收益18.对一价定律的基本内涵,下列表述正确的是答案:一价定律依赖于理性套利者的无风险与无成本的套利交易一价定律充分反映了有效市场的观点即资产的价格总是等于价值一价定律是指两个具有相同回报(即价值相同)的资产应该具有相同的价格19.下列哪个因素会影响公司的并购活动?答案:损失厌恶投资者情绪从众心理20.以下哪些属于违背一价定律的市场异象答案:AH股长期溢价母子公司谜团荷兰皇家石油和壳牌的股价21.判断下列哪些现象属于无信息的股价异动答案:川普当选,A股“川大智胜”出现异常上涨行情雾霾天气,股票市场普遍下跌领导人视察某上市公司,该公司股价立刻上涨22.AH同时两地上市的股票长期溢价的表现,下列说法正确的是答案:总体来讲,A股股价相对于H股股价长期溢价沪港通、深港通相继开通,市场分割局面的改善有利于溢价率的减小23.下列哪些反映了封闭式基金折价之谜答案:投资者以高于基金面值的价格购买新发行的基金基金折价率存在较大的波动性当封闭式基金即将到期或转变为开放式基金时,其价格会向资产净值趋近24.关于博傻机制,下列描述正确的是答案:博傻过程中物品的真实价值已经不再重要即使明白存在泡沫,投资者依旧会高价交易资产博傻过程总会出现更傻的人接手交易物品25.下列投资案例中,哪些属于资产价格对信息反应不足答案:某公司发布盈利公告,市场在随后的1个月内出现持续上涨现象上市公司喜欢在周末发布差的盈利公告26.关于新闻媒体在市场交易中的角色,下列描述正确的是答案:媒体可能强化某一观点并进行乐观报道媒体可能通过选择信息、处理信息进行选择性报道媒体可能营造市场非理性繁荣或恐慌的氛围27.关于“反应不足”,下列表述正确的是答案:投资者被过去的凸显信息所锚定投资者对最新的信息视而不见28.下列哪些描述符合“过度反应”现象答案:引起了股价的超涨或超跌投资者过于重视最新的信息而轻视了以往的信息29.导致资产价格泡沫产生的群体行为因素包括以下哪些正反馈机制从众心理博傻机制30.在投机性泡沫后期,市场会出现哪些现象从而引起泡沫破裂答案:投资者的投资者盲目相信资产价格会持续上涨,选择加杠杆购买资产投资者对资产价格的预期回报率远远高于实体经济的财富增长率不同资产之间的关联性不断增强,金融资产出现脆弱性市场普遍弥漫着乐观、狂热的情绪,实体经济虚拟化倾向严重31.基于有效市场理论,股票的价格已经反映所有市场可用的信息,因此不存在超额收益答案:正确32.预期效用理论认为人们对待风险的态度始终不变。

一名词解释1.拇指法则2.代表性启发法3.可得性启发法4.锚定与调整启发法5.启发式偏差6.赌徒谬误7.有效性幻觉8.关联幻觉9.框定依赖 10. 损失厌恶 11.后悔厌恶 12.心理账户 13.行为金融 14.心理学 15.个性 16.气质 17.性格 18.行为学 19.算法 20.启发法 21.黑天鹅事件 22.禀赋效应 23.处置效应 24.二问答题1 代表性偏差可能导致哪些错误?2 ?3 锚定可导致哪些偏差?4 在什么情况下,最有可能导致人们使用启发法?5 为什么依靠可得性进行预测可能会导致偏差?67 为什么理性是有限的?8.简述行为金融学发展历程。

三案例分析公司更名会导致价值的增长吗?有个成语叫“人如其名”,说的是一个人的本质往往和他的名字相关联,从心理学的角度讲,人的名字会从某种程度上对这个人产生一定的心理暗示,使其朝暗示的这个方向演变。

那么,公司的名称是不是对公司的未来预期收益产生影响呢?公司改了名称是否意味着其内在价值发生了变化?20世纪90年代,网络股繁荣的时候,美国股票市场上出现了一个现象:许多公司将公司的名称改为互联网有关的名称。

他们是为了达到“司如其名”吗?这些公司新的名称为.com(例如 )或者为.net(例如),或者在新的名称中加入Internet这一词汇(例如 Internet Solutions for Business Inc.)。

有学者(谁?)对1998年6月-1999年8月间更改名称的95个公司更名后市值的变化进行了研究,他将这些公司按其业务与互联网的相关度分成四类:第一类为更名前后都为纯粹的互联网公司;第二类为更名之前该公司同互联网有一定的关系,更名能更准确地反映这种关系;第三类为公司将业务从与互联网没有关系的业务改为与互联网相关的业务;第四类为在更名前后,公司核心业务都与互联网没有关系。

以更名的时间为第0天,那么,更名前后不同时间区间内样本股票的累积超额收益率统计如下:公司更改名称后股票的累积超额收益率(CAR,%)从表中可以发现,更名以后,所有公司的市值都出现了变化。

金融学课后习题参考答案第一题:货币政策理论货币政策是指由中央银行制定和执行的旨在调控货币供应量和利率水平以达到宏观经济稳定的政策。

货币政策的目标通常包括保持物价稳定、促进经济增长和维护金融稳定。

下面是对货币政策理论的详细解答:1. 名义货币供应量(M)的组成包括现金(C)和存款(D)。

通常情况下,中央银行通过购买或出售政府债券来控制货币供应量。

如果中央银行出售政府债券,存款减少,货币供应量减少;如果中央银行购买政府债券,存款增加,货币供应量增加。

2. 通货膨胀率是衡量物价水平变化的指标,它与货币供应量的增长率和经济产出的增长率密切相关。

若货币供应量增长速度高于经济增长速度,通货膨胀率将上升;反之,通货膨胀率将下降。

3. 货币与经济产出之间的关系可以通过费雪方程(MV = PY)来描述。

其中,M为货币供应量,V为货币速度,P为物价水平,Y为实际产出。

通过调控货币供应量和利率水平,中央银行可以影响经济产出和通货膨胀率。

4. 货币政策工具包括公开市场操作、存款准备金率、利率调整等。

公开市场操作是指中央银行通过购买或出售政府债券来调节货币供应量;存款准备金率指的是商业银行需按一定比例保留在中央银行的存款;利率调整则是通过调整短期利率或长期利率来引导经济走向。

第二题:投资组合理论投资组合理论是指通过合理配置不同资产的比例和权重,以降低风险并提高收益的投资策略。

下面是对投资组合理论的详细解答:1. 投资组合的关键是在不同的资产之间寻求相关性较小或负相关的资产以降低系统风险。

相关性较小的资产可以互相抵消风险,从而提高组合的整体表现。

2. 投资者可以通过构建有效前沿曲线来选择最优投资组合。

有效前沿曲线代表了在给定风险水平下,可以获得的最大收益。

投资者可以在有效前沿曲线上选择适合自己风险偏好的投资组合。

3. 马科维茨提出了资本资产定价模型(CAPM),该模型可以帮助投资者确定资产的预期收益率。

CAPM模型认为,资产的预期收益率与市场风险有关,市场风险可以通过贝塔系数来度量。

第1章概论一名词解释行为金融: 行为经济学的一个分支,它研究人们在投资决策过程中认知、感情、态度等心理特征,以及由此而引起的市场非有效性。

行为经济学:是一门研究在复杂的、不完全理性的市场中投资、储蓄、价格变化等经济现象的学科,是经济学和心理学的有机组合。

经济心理学: 是关于经济心理与行为研究的学科,应用社会心理学的一个重要分支,它的研究对象为个体及群体在经济活动中的心理现象和心理规律,强调经济个体的非理性方面及其重要影响。

信息加工心理学: 或狭义的认知心理学。

它是用信息加工的理论来研究、解释人类认知过程和复杂行为的科学。

实验经济学: 是在可控的条件下,针对某一现象,通过控制某些条件,观察决策者的行为并分析实验结果,以检验、比较和完善经济理论,目的是通过设计和模拟实验环境,探求经济行为的因果机制,验证经济理论或帮助政府制定经济政策。

理性人:在决策时以效用最大化为目标,并能够对已知信息做出正确的加工处理,对市场做出无偏估计的人。

有限理性: 人们在认知与判断上存在很多局限性,其活动受到自身的心理活动、个人情绪的影响.二问答题1行为学的基本原则是什么?(1)回报原则。

那些经常给行为主体带来回报的行为比那些不带来回报的行为更可能被主体重复;(2)激励原则。

那些曾诱发了回报行为的外界激励比那些不曾诱发回报行为的外界激励更容易诱发主体的同类行为;(3)强化原则。

行为主体在没有获得对其行为的预期回报,甚至为此遭到惩罚的时候,会被激怒,进而强烈地要施能够补偿损失的行为。

相反,如果某类行为给行为主体带来了出乎意料的回报,或没有带来预期的惩罚,行为主体将更主动地实施同类行为。

2行为经济学具有哪些特点?行为经济学具有三个重要的特点:(1)其出发点是研究一个国家中某个时期的消费者和企业经理人员的行为,以实际调查为根据,对在不同环境中观察到的行为进行比较,然后加以概括并得出结论;(2)其研究集中在人们的消费、储蓄、投资等行为的决策过程,而不是这些行为所完成的实绩;(3)它更重视人的因素。

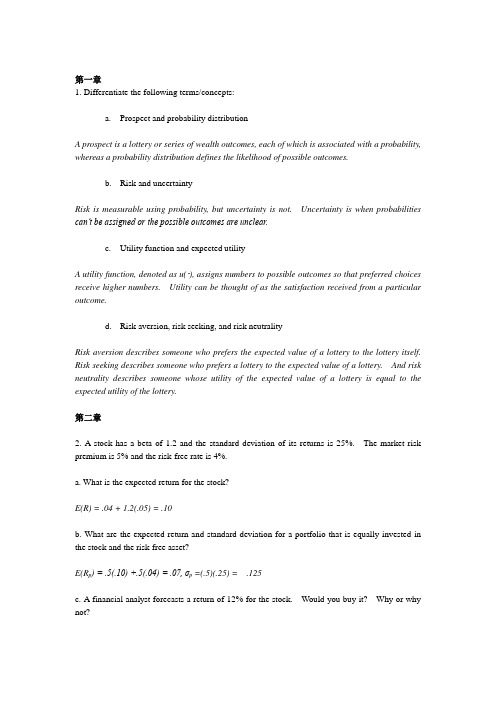

第一章1. Differentiate the following terms/concepts:a.Prospect and probability distributionA prospect is a lottery or series of wealth outcomes, each of which is associated with a probability, whereas a probability distribution defines the likelihood of possible outcomes.b.Risk and uncertaintyRisk is measurable using probability, but uncertainty is not. Uncertainty is when probabilities can’t be assigned or the possible outcomes are unclear.c.Utility function and expected utilityA utility function, denoted as u( ), assigns numbers to possible outcomes so that preferred choices receive higher numbers. Utility can be thought of as the satisfaction received from a particular outcome.d.Risk aversion, risk seeking, and risk neutralityRisk aversion describes someone who prefers the expected value of a lottery to the lottery itself. Risk seeking describes someone who prefers a lottery to the expected value of a lottery. And risk neutrality describes someone whose utility of the expected value of a lottery is equal to the expected utility of the lottery.第二章2. A stock has a beta of 1.2 and the standard deviation of its returns is 25%. The market risk premium is 5% and the risk-free rate is 4%.a. What is the expected return for the stock?E(R) = .04 + 1.2(.05) = .10b. What are the expected return and standard deviation for a portfolio that is equally invested in the stock and the risk-free asset?E(R p) = .5(.10) +.5(.04) = .07, σp =(.5)(.25) = .125c. A financial analyst forecasts a return of 12% for the stock. Would you buy it? Why or why not?If you believe the source is very credible, buy it as it is expected to generate a positive abnormal (or excess) return.5. You are considering whether to invest in two stocks, Stock A and Stock B. Stock A has a beta of 1.15 and the standard deviation of its returns has been estimated to be 0.28. For Stock B, the beta is 0.84 and standard deviation is 0.48.a.Which stock is riskier?Stock A is riskier, though stock B has greater total risk.b.If the risk-free rate is 4% and the market risk premium is 8%, what is the expectedreturn for a portfolio that is composed of 60% A and 40% B?R p = .6(.132) + .4 (.1072) = .12208c.If the correlation between the returns of A and B is 0.50, what is the standarddeviation for the portfolio that includes 60% A and 40% B?σp2 = (.6)2(.28)2 + (.4)2(.48)2+ 2*.5(.6)(.4)(.28)(.48) = 9.7%, σp = 31.2%第三章2. According to prospect theory, which is preferred?a. Prospect A or B?Decision (i). Choose between:A(0.80, $50, $0)and B(0.40, $100, $0)Prospect A is preferred due to risk aversion for gains. While both have the same expected change in wealth, A has less risk.b. Prospect C or D?Decision (ii). Choose between:C(0.00002, $500,000, $0) and D(0.00001, $1,000,000, $0)Prospect D, with more risk, is preferred due to the risk seeking that occurs when there are very low probabilities of positive payoffs.c. Are these choices consistent with expected utility theory? Why or why not?Violation of EU theory because preferences are inconsistent. The same sort of Allais paradox proof from chapter 1 can be used. It is also necessary to make the assumption of preference homogeneity, which means that if D is preferred to C, it will also be true that D* is preferred to C* where these are:C*:(0.00002, $50, $0) and D*: (0.00001, $100, $0)3. Consider a person with the following value function under prospect theory:v(w) = w.5when w > 0= -2(-w) .5when w < 0a. Is this individual loss-averse? Explain.This person is loss averse. Losses are felt twice as much as gains of equal magnitude.b. Assume that this individual weights values by probabilities, instead of using a prospect theory weighting function. Which of the following prospects would be preferred?P1(.8, 1000, -800)P2(.7, 1200, -600)P3(.5, 2000, -1000)We calculate the value of each prospect:V(P1) = .8(31.62)+.2(-2)(28.27)= 13.982V(P2) = .7(34.64)+.3(-2)(24.49)= 9.55V(P3) = .5(44.72)+.5(-2)(31.62)= 9.265Therefore prospect P1 is preferred.4. Now consider a person with the following value function under prospect theory:v(z) = z.8whe n z ≥ 0= -3(-z).8when z < 0This individual has the following weighting function:错误!未找到引用源。

金融市场学课后答案金融市场学课后答案第一章:金融市场概述1. 金融市场的定义是什么?金融市场是指以金融资产为交易对象的场所或机构,供买卖双方进行资金融通和资本配置的地方。

在金融市场中,资金可以从拥有盈余资金的个体转向资金需求者,实现资源的有效配置。

2. 金融市场的特点有哪些?(1)金融市场的流动性较高,交易双方可以随时买入和卖出金融资产;(2)金融市场具有全球性和连通性,金融资产可以在国际市场上进行交易;(3)金融市场具有高度专业化和复杂性,需要各类专业机构和人员参与;(4)金融市场具有风险传导和扩大的特征,金融市场的波动会对实体经济产生较大影响。

3. 金融市场的分类有哪些?金融市场可以按照交易方式、金融资产类型、期限等因素进行分类。

(1)按照交易方式分类:现货市场、期货市场、衍生品市场等;(2)按照金融资产类型分类:证券市场、货币市场、银行市场等;(3)按照期限分类:一级市场、二级市场等。

第二章:金融市场的参与者1. 金融市场的参与者有哪些?金融市场的参与者主要包括金融机构、非金融企业、个人投资者和政府机构等。

(1)金融机构:包括银行、证券公司、保险公司等;(2)非金融企业:包括各类企业、事业单位等;(3)个人投资者:包括个人、家庭、基金等;(4)政府机构:包括央行、金融监管机构等。

2. 金融市场参与者的作用是什么?金融市场参与者在金融市场中扮演不同的角色,发挥不同的作用。

(1)金融机构:提供各类金融服务,例如银行贷款、证券交易、保险保障等;(2)非金融企业:通过金融市场融资,进行投资和经营活动;(3)个人投资者:参与金融市场交易,实现财富增值和风险管理;(4)政府机构:对金融市场进行监管和调控,维护金融市场的稳定和安全。

第三章:金融市场的功能1. 金融市场的功能有哪些?(1)资源配置功能:金融市场通过资金融通,将闲置资金引导到有效投资领域,实现资源的优化配置;(2)风险管理功能:金融市场提供各类金融工具,帮助投资者分散风险、转移风险;(3)信息传递功能:金融市场通过价格和交易活动,传递各类经济信息,反映市场预期和供需关系;(4)流动性功能:金融市场提供资金的流动性,方便交易双方进行买卖;(5)利率形成功能:金融市场价格反映了市场对资金的需求和供应,进而影响利率的形成。

第一章货币与货币制度1.钱、货币、通货、现金是一回事吗?银行卡是货币吗?答:(1)钱、货币、通货、现金不是一回事,虽然其内容有所重叠,但这几个概念之间是有区别的。

钱是人们对货币的俗称。

经济学中被称为货币的东西,就是在日常人们生活中被称为钱的东西。

货币是由国家法律规定的,在商品劳务交易中或债务清偿中被社会普遍接受的东西。

通货即流通中的货币,指流通于银行体系外的货币。

现金就是指家庭个人、工商企业、政府部门所拥有的现钞,包括纸币现钞、硬币现钞。

现金是货币的一部分,这部分货币的流动性强,使用频率高,对人们日常消费影响大。

(2)银行卡亦称“塑料货币”,是由银行发行,供客户办理存取款等业务的新型服务工具的总称,包括信用卡、支票卡、记账卡、自动出纳机卡、灵光卡等。

各种银行卡是用塑料制作的,可用于存取款和转账支付。

现在,特别在西方发达国家,各种银行卡正逐步取代现钞和支票,成为经济生活中广泛运用的支付工具。

因此,在现代社会银行卡也属于货币。

2.社会经济生活中为什么离不开货币?为什么自古至今,人们又往往把金钱看作是万恶之源?答:(1)社会经济生活离不开货币,货币的产生和发展都有其客观必然性。

物物交换的局限性要求有某种商品充当共同的、一般的等价物,而金银的特性决定其成为货币的天然材料。

作为货币的金银等贵金属,便于携带、铸造和分割,大大推动了商品经济的发展。

随着经济的发展,货币形态不断发生变化。

经历了实物货币阶段、贵金属货币阶段、代用货币阶段和信用货币阶段。

当今货币正朝着专门化、无体化、扩张化、电子化的趋势发展。

但不管货币的具体形态如何,都是媒介商品经济所必需的。

货币节省了社会劳动,促进了市场经济的有效率的发展。

对货币的使用是实现市场对资源合理配置的必要条件,也是市场经济正常运行的必要条件。

从这个意义上说,市场经济实际上是一种货币经济:货币方便了市场交换,提高了市场效率;货币保证了社会需求的实现,促进了市场对资源的有效配置。

第一章1. Differentiate the following terms/concepts:a.Prospect and probability distributionA prospect is a lottery or series of wealth outcomes, each of which is associated with a probability, whereas a probability distribution defines the likelihood of possible outcomes.b.Risk and uncertaintyRisk is measurable using probability, but uncertainty is not. Uncertainty is when probabilities can’t be assigned or the possible outcomes are unclear.c.Utility function and expected utilityA utility function, denoted as u( ), assigns numbers to possible outcomes so that preferred choices receive higher numbers. Utility can be thought of as the satisfaction received from a particular outcome.d.Risk aversion, risk seeking, and risk neutralityRisk aversion describes someone who prefers the expected value of a lottery to the lottery itself. Risk seeking describes someone who prefers a lottery to the expected value of a lottery. And risk neutrality describes someone whose utility of the expected value of a lottery is equal to the expected utility of the lottery.2. When eating out, Rory prefers spaghetti over a hamburger. Last night she had a choice of spaghetti and macaroni and cheese and decided on the spaghetti again. The night before, Rory had a choice between spaghetti, pizza, and a hamburger and this time she had pizza. Then, today she chose macaroni and cheese over a hamburger. Does her selection today indicate that Rory’s choices are consistent with economic rationality? Why or why not?Rory’s pref erences are consistent with rationality. They are complete and transitive. We see that her preference ordering is:Pizza spaghetti macaroni and cheese hamburger3. Consider a person with the following utility function over wealth: u(w) = e w, where e is the exponential function (approximately equal to 2.7183) and w = wealth in hundreds of thousands of dollars. Suppose that this person has a 40% chance of wealth of $50,000 and a 60% chance of wealth of $1,000,000 as summarized by P(0.40, $50,000, $1,000,000).a. What is the expected value of wealth?E(w) = .4 * .5 + .6 * 10 = 6.2U(P) = .4e0.50 + .6e10 = 13,216.54b. Construct a graph of this utility function.The function is convex.c. Is this person risk averse, risk neutral, or a risk seeker?Risk seeker because graph is convex.d. What is this person’s certainty equivalent for the prospect?e w = 13,216.54 gives w = 9.4892244 or $948,922.444. An individual has the following utility function: u(w) = w.5 where w = wealth.a. Using expected utility, order the following prospects in terms of preference, from the most to the least preferred:P1(.8, 1,000, 600)P2(.7, 1,200, 600)P3(.5, 2,000, 300)Ranking: P2, P3, P1 with expected utilities 31.5972, 31.0209, and 30.1972 for prospects 2, 3, and1, respectivelyb. What is the certainty equivalent for prospect P2?998.3830c. Without doing any calculations, would the certainty equivalent for prospect P1 be larger or smaller? Why?The certainty equivalent for P1 would be smaller because P2 is ranked higher than P1.5. Consider two prospects:Problem 1: Choose betweenProspect A: $2,500 with probability .33,$2,400 with probability .66,Zero with probability .01.And Prospect B: $2,400 with certainty.Problem 2: Choose betweenProspect C: $2,500 with probability .33,Zero with probability .67.And Prospect D: $2,400 with probability .34,Zero with probability .66.It has been shown by Daniel Ka hneman and Amos Tversky (1979, “Prospect theory: An analysis of decision under risk,” Econometrica 47(2), 263-291) that more people choose B when presented with problem 1 and when presented with problem 2, most people choose C. These choices violate expected utility theory. Why?This is an example of the Allais paradox. The first choice suggests thatu(2,400) > .33u(2,500) + .66u(2,400) or .34u(2,400) > .33 u(2,500)while the second choice suggests just the opposite inequality.第二章1. Differentiate the following terms/concepts:a. Systematic and nonsystematic riskNondiversifiable or systematic risk is risk that is common to all risky assets in the system and cannot be diversified. Diversifiable or unsystematic risk is specific to the asset in question and can be diversified.b. Beta and standard deviationBeta is the CAPM’s measure of risk. It takes into account an asset’s sensitivity to the market and only measures systematic, nondiversifiable risk. The standard deviation is a measure of dispersion that includes both diversifiable and nondiversifiable risks.c. Direct and indirect agency costsAgency costs arise when managers’ incentives are not consistent with maximizing the value of the firm. Direct costs include expenditures that benefit the manager but not the firm, such as purchasing a luxury jet for travel. Other direct costs result from the need to monitor managers, including the cost of hiring outside auditors. Indirect costs are more difficult to measure and result from lost opportunities.d. Weak, semi-strong, and strong form market efficiencyWith weak form market efficiency prices reflect all the information contained in historical returns. With semi-strong form market efficiency prices reflect all publicly available information. With strong form market efficiency prices reflect information that is not publicly available, such as insiders’ information.2. A stock has a beta of 1.2 and the standard deviation of its returns is 25%. The market risk premium is 5% and the risk-free rate is 4%.a. What is the expected return for the stock?E(R) = .04 + 1.2(.05) = .10b. What are the expected return and standard deviation for a portfolio that is equally invested in the stock and the risk-free asset?E(R p) = .5(.10) +.5(.04) = .07, σp =(.5)(.25) = .125c. A financial analyst forecasts a return of 12% for the stock. Would you buy it? Why or why not?If you believe the source is very credible, buy it as it is expected to generate a positive abnormal (or excess) return.3. What is the joint hypothesis problem? Why is it important?If when testing one hypothesis another must be assumed to hold, a joint-hypothesis problem arises. For us, this is of particular interest when we are testing market efficiency because of the need to utilize a particular risk-adjustment model to produce required returns, that is, to risk-adjust.This would not be a problem if we knew with certainty what the correct risk adjustment model is, but unfortunately we do not. If a test rejects the EMH, is it because the EMH does not hold, or because we did not properly measure abnormal returns? We simply do not know for certain the answer to this question.4. Warren Buffett has been a very successful investor. In 2008 Luisa Kroll reported that Buffett topped Forbes Magazine’s list of the world’s richest people with a fortune estimated to be worth $62 billion (March 5, 2008, "The world's billionaires," Forbes). Does this invalidate the EMH?Warren Buffett’s experience does not necessarily invalidate the EMH. There is the possibility that he is just lucky: given that there are numerous money managers, some are bound to perform well just by luck. Still many would question this here because Buffett’s track record has been consistently strong.5. You are considering whether to invest in two stocks, Stock A and Stock B. Stock A has a beta of 1.15 and the standard deviation of its returns has been estimated to be 0.28. For Stock B, the beta is 0.84 and standard deviation is 0.48.a.Which stock is riskier?Stock A is riskier, though stock B has greater total risk.b.If the risk-free rate is 4% and the market risk premium is 8%, what is the expectedreturn for a portfolio that is composed of 60% A and 40% B?R p = .6(.132) + .4 (.1072) = .12208c.If the correlation between the returns of A and B is 0.50, what is the standarddeviation for the portfolio that includes 60% A and 40% B?σp2 = (.6)2(.28)2 + (.4)2(.48)2+ 2*.5(.6)(.4)(.28)(.48) = 9.7%, σp = 31.2%第三章1. Differentiate the following terms/concepts:a. Lottery and insuranceA lottery is a prospect with a low probability of a high payoff. Many people buy lottery tickets, even with negative expected values. These same people buy insurance to protect themselves from risk. Normally, insurance is a hedge against a low-probability large loss. These choices are inconsistent with traditional expected utility framework but can be explained by prospect theory.b. Segregation and integrationIntegration occurs when positions are lumped together, while segregation occurs when situations are viewed one at a time.c. Risk aversion and loss aversionA person who is risk averse prefers the expected value of a prospect to the prospect itself, whereas for a person who is loss averse, losses loom larger than gains.d. Weighting function and event probabilityEvent probability is simply the subjective view on how likely an event is. The weighting function is associated with the probability of an outcome, but is not strictly the same as the probability as in expected utility theory.2. According to prospect theory, which is preferred?a. Prospect A or B?Decision (i). Choose between:A(0.80, $50, $0)and B(0.40, $100, $0)Prospect A is preferred due to risk aversion for gains. While both have the same expected change in wealth, A has less risk.b. Prospect C or D?Decision (ii). Choose between:C(0.00002, $500,000, $0) and D(0.00001, $1,000,000, $0)Prospect D, with more risk, is preferred due to the risk seeking that occurs when there are very low probabilities of positive payoffs.c. Are these choices consistent with expected utility theory? Why or why not?Violation of EU theory because preferences are inconsistent. The same sort of Allais paradox proof from chapter 1 can be used. It is also necessary to make the assumption of preference homogeneity, which means that if D is preferred to C, it will also be true that D* is preferred to C* where these are:C*:(0.00002, $50, $0) and D*: (0.00001, $100, $0)3. Consider a person with the following value function under prospect theory:v(w) = w.5when w > 0= -2(-w) .5when w < 0a. Is this individual loss-averse? Explain.This person is loss averse. Losses are felt twice as much as gains of equal magnitude.b. Assume that this individual weights values by probabilities, instead of using a prospect theory weighting function. Which of the following prospects would be preferred?P1(.8, 1000, -800)P2(.7, 1200, -600)P3(.5, 2000, -1000)We calculate the value of each prospect:V(P1) = .8(31.62)+.2(-2)(28.27)= 13.982V(P2) = .7(34.64)+.3(-2)(24.49)= 9.55V(P3) = .5(44.72)+.5(-2)(31.62)= 9.265Therefore prospect P1 is preferred.4. Now consider a person with the following value function under prospect theory:v(z) = z.8when z ≥ 0= -3(-z).8when z < 0This individual has the following weighting function:where we set =.65.a. Which of the following prospects would he choose?PA(.001, -5000)PB(-5)Compare the value of each prospect:V(P A) = .983(0) + (-3)(910.28)(.011) = -30.15 (note use of weights)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer B.b. Repeat the calculation but using probabilities instead of weights. Whatdoes this illustrate?V(P A) = .999 * 0 + 3 * .001 * -910.28 = -2.73 (note use of probability)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer A. The reason for the switch is that risk seeking is maintained in the domain of losses (implying rejection of losses) if probabilities are used instead of weights.5. Why might some prefer a prix fixe (fixed price) dinner costing about the same as an a la carte one (where you pay individually for each item)? (Assume the food is identical.)Payment decoupling is encouraged with prix fixe. You only face the loss of money once rather than multiple times (occurring if you have to face the cost of each item individually using an à la carte scheme).第五章1. Differentiate the following terms/concepts:a.Primacy and recency effectsA primacy effect is the tendency to rely on information that comes first when making an assessment, whereas a recency effect is the tendency to rely on the most recent information when making an assessment.b.Salience and availabilityThe salience of an event refers to how much it stands out relative to other events, whereas the availability refers to how easily the event is recalled from memory.c.Fast-and-frugal heuristics and bias-generating heuristicsFast and frugal heuristics require a minimum of time, knowledge and computation in order to make choices. Often they lead to very good choices. Sometimes however heuristics go astray and generate behavioral bias.d.Autonomic and cognitive heuristicsAutonomic heuristics are reflexive, autonomic, non-cognitive, and require low effort levels. Cognitive heuristics require more deliberation. Autonomic heuristics are appropriate when a very quick decision must be made or when the stakes are low, whereas cognitive heuristics are appropriate when the stakes are higher.2. Which description of Mary has higher probability?a. Mary loves to play tennis.b. Mary loves to play tennis and, during the summer, averages at least a game aweek.Explain your answer. Define the conjunction fallacy. How does it apply here?Assume for the purpose of illustration that the probability that someone loves to play tennis is .2; the probability that someone plays tennis once or more a week during the summer is .1; and the probability of one or the other of these things is .22.Pr(loves tennis) = .2Pr(loves tennis AND averages 1+)= Pr(loves tennis) + Pr(averages 1+) - Pr(loves tennis OR averages 1+)= .2 + .1 - .22 = .08The second probability has to be less because it has one more requirement (not only do you have to love tennis but you also have to play regularly, but some tennis lovers might just be too busy to do this). When people commit the conjunction fallacy (the belief that the joint probability is more likely than one of its components), they will think the second (joint) event is more likely because it sounds logical that someone who loves tennis will also play regularly.3. Rex is a smart fellow. He gets an A in a course 80% of the time. Still helikes his leisure, only studying for the final exam in half of the courses he takes.Nevertheless when he does study, he is almost sure (95% likely) to get an A.Assuming he got an A, how likely is it he studied? If someone estimates the above to be 75%, what error are they committing? Explain.P(studied|A) = P(A|studied) * [P(studied)/P(A)]= .95 * (.5 / .8) = .59375The “sample” is that he got an A. Without knowing this you would have said the probability that he studied was .5. You rightfully shifted the probability upwards based on the sample, but you moved it too much. You should have stayed closer to the base rate, so you have committed base weight underweighting.Another example of this is, when watching sports and noticing that someone is playing better than they normally do, believing that they have permanently improved.4. Why are two people who witnessed the same event last month likely to describeit differently today?Memory is very imprecise. The common view that past experiences have somehow been writtento the brain’s hard-drive and are then retrieved, even if at considerable effort, is not the way our brain works. In fact, memory is reconstructive. Therefore people in remembering some event will reconstruct it in different ways.5. How do gambling fallacy and clustering illusion relate to representativeness?Provide examples from sports. In what way are they different? Representativeness exists when one thinks that A should look like B. A can be the sample and B the distribution, or vice-versa. A belief in a hot hand is thinking the conditional distribution should look like the sample. But sometimes it seems that people think the reverse, namely that the sample, however small, should look like the distribution, in the sense that essential features should be shared. A hot hand often comes into play in sports when people don’t know for certain the skill level of an athlete, and the extent to which it may change. Gambler’s fallacy is likely to exist when the underlying distribution (e.g., cards or dice) is well-known.。

1•价值2•时间3•复利4•贴现率5•普通年金6•终值1.ABCD2.ABE3.A4.B5.A6.A7.C8.C 1•什么是货币的时间价值,怎样计算货币的时间价值?货币资金的时间价值是指货币经历一定时间的投资和再投资所增加的价值。

货币时间价值有两种表示方法:(1)绝对数,即增值额(△G): (2)相对数,即增值额(△G)和本金(P)的比率,它是相当于在没有风险和通货膨胀条件下的社会平均资金利润率。

计算利息有两种方法,单利法和复利法单利是指在计算利息时,不论期限长短,仅对本金计算利息,本金所生利息不再加入本金计算下期利息。

单利计算公式为:I=P • r•nS=P(l+r • n)式中,I表示利息额,P表示本金,r表示利息率,n表示借贷期限,S表示本金和利息Z 和,简称本息和。

复利是指计算利息时,不仅对本金计息,而且对本金在上一时期所生利息加入木金一并计算利息,逐期滚算。

其计算公式为:S=P - (1+r)*I=S - P在复利计息方式下,在到期R之前每一年所生的利息将被进行再投资并获得利息,即利滚利。

由于复利计息有利于加强资金的时间观念,而且便于比较不同期限的资金使用效益,更符合资金的时间价值概念a2.如何理解终值和现值?利率的变动对现值和终值有什么影响?终值是指现在的一定资金按复利计息方法计算在将来某一时期结束后获得的本金和利息之和,用FV表示。

如果我们用PV表示初始的资金,用r表示利率, 用n表示计息的期数,则FV二PV(l+r)%现值是在复利计息方式下,未來一定金额按照某一利率折算到现在的价值,或者说为取得将来一定的本利和,现在需要付出的本金。

通过复利的终值计算公式FV=PVX(l+r)^我们可以倒推出现值的计算公式:由公式可知,终值同利率同方向变动,现值同利率反方向变动。

3.年度百分率和有效年利率之间的关系是怎样的?年度百分比率(annual percent age rate, APR )是指银行等金融机构提供 的利率,也叫做报价利率。

第一章测试1【多选题】(1分)现代经济学的核心概念是:A.最优化B.心理C.基本D.均衡2【判断题】(1分)棉花糖实验反映的是人类自我控制的问题.A.错B.对3【判断题】(1分)标准的金融学的假设是建立在投资者应该如何决策的基础上的,行为金融学的假设是建立在现实中可以观察到的投资行为。

前者是规范性的,后者则是实证性的。

A.错B.对4【判断题】(1分)作为经济学术语的动物精神指的是导致经济动荡不安和反复无常的元素,它还用来描述人类与模糊性和不确定性之间的关系。

A.错B.对5【判断题】(1分)在认知论领域中,有一个命题被称为是“可误论”。

可误论是美国哲学家、心理学家威廉·詹姆斯提出的,这个理论主张人永远不会对一种观点给予盖棺定论式的肯定。

A.对B.第二章测试1【判断题】(1分)根据期望效用理论,人们的风险态度是不变的,而在现实中,人们有时会选择规避风险,有时则会寻求风险。

A.对B.错2【判断题】(1分)损失规避指的是,损失所造成的心理大于收益。

A.错B.对【判断题】(1分)在前景理论中,取代效用函数的是价值函数。

A.对B.错4【判断题】(1分)根据价值函数的描述,人们在收益域内是规避风险的,在损失域内是寻求风险的。

A.错B.对5【判断题】(1分)在迷恋小概率事件和确定性效应双重作用之下,加权函数变成了这个倒s型了。

A.对B.错6【判断题】(1分)迷恋小概率事件表现在加权函数中,就是概率为0的邻域内曲线斜率较大。

A.对B.错7【判断题】(1分)确定性效应告诉我们,人们会对确定性的结果,也就是百分之百的结果赋予更大的权重,那么表现在加权函数中,就是概率为1的邻域内所对应的曲线更加平缓。

A.错B.对8【单选题】(1分)风险态度的四重性说明,人们在面对小概率的损失的时候,表现为A.规避风险B.寻求风险9【判断题】(1分)遭受损失之后愿意承担更高风险的现象,我们称之为赌场盈利效应。

A.对B.错10【判断题】(1分)人在获得收益之后,愿意承担更高风险的行为,被称为是盈亏平衡效应。

CHAPTER 1: Discussion Questions and Problems1. Differentiate the following terms/concepts:a.Prospect and probability distributionA prospect is a lottery or series of wealth outcomes, each of which is associated with a probability, whereas a probability distribution defines the likelihood of possible outcomes.b.Risk and uncertaintyRisk is measurable using probability, but uncertainty is not. Uncertainty is when probabilities can’t be assigned or the possible outcomes are unclear.c.Utility function and expected utilityA utility function, denoted as u( ), assigns numbers to possible outcomes so that preferred choices receive higher numbers. Utility can be thought of as the satisfaction received from a particular outcome.d.Risk aversion, risk seeking, and risk neutralityRisk aversion describes someone who prefers the expected value of a lottery to the lottery itself. Risk seeking describes someone who prefers a lottery to the expected value of a lottery. And risk neutrality describes someone whose utility of the expected value of a lottery is equal to the expected utility of the lottery.2. When eating out, Rory prefers spaghetti over a hamburger. Last night she had a choice of spaghetti and macaroni and cheese and decided on the spaghetti again. The night before, Rory had a choice between spaghetti, pizza, and a hamburger and this time she had pizza. Then, today she chose macaroni and cheese over a hamburger. Does her selection today indicate that Rory’s choices are consistent with economic rationality? Why or why not?Rory’s preferences are consistent with rationality. They are complete and transitive. We see that her preference ordering is:Pizza spaghetti macaroni and cheese hamburger3. Consider a person with the following utility function over wealth: u(w) = e w, where e is the exponential function (approximately equal to 2.7183) and w = wealth in hundreds of thousands of dollars. Suppose that this person has a 40% chance of wealth of $50,000 and a 60% chance of wealth of $1,000,000 as summarized by P(0.40, $50,000, $1,000,000).a. What is the expected value of wealth?E(w) = .4 * .5 + .6 * 10 = 6.2U(P) = .4e0.50 + .6e10 = 13,216.54b. Construct a graph of this utility function.The function is convex.c. Is this person risk averse, risk neutral, or a risk seeker?Risk seeker because graph is convex.d. What is this person’s certainty equivalent for the prospect?e w = 13,216.54 gives w = 9.4892244 or $948,922.444. An individual has the following utility function: u(w) = w.5 where w = wealth.a. Using expected utility, order the following prospects in terms of preference, from the most to the least preferred:P1(.8, 1,000, 600)P2(.7, 1,200, 600)P3(.5, 2,000, 300)Ranking: P2, P3, P1 with expected utilities 31.5972, 31.0209, and 30.1972 for prospects 2, 3, and 1, respectivelyb. What is the certainty equivalent for prospect P2?998.3830c. Without doing any calculations, would the certainty equivalent for prospect P1 be larger or smaller? Why?The certainty equivalent for P1 would be smaller because P2 is ranked higher than P1.5. Consider two prospects:Problem 1: Choose betweenProspect A: $2,500 with probability .33,$2,400 with probability .66,Zero with probability .01.And Prospect B: $2,400 with certainty.Problem 2: Choose betweenProspect C: $2,500 with probability .33,Zero with probability .67.And Prospect D: $2,400 with probability .34,Zero with probability .66.It has been shown by Daniel Kahneman and Amos Tversky (1979, “Prospect theory: An analysis of decision under risk,” Econometrica 47(2), 263-291) that more people choose B when presented with problem 1 and when presented with problem 2, most people choose C. These choices violate expected utility theory. Why?This is an example of the Allais paradox. The first choice suggests thatu(2,400) > .33u(2,500) + .66u(2,400) or .34u(2,400) > .33 u(2,500)while the second choice suggests just the opposite inequality.Chapter 2: Discussion Questions and Problems1. Differentiate the following terms/concepts:a. Systematic and nonsystematic riskNondiversifiable or systematic risk is risk that is common to all risky assets in the system and cannot be diversified. Diversifiable or unsystematic risk is specific to the asset in question and can be diversified.b. Beta and standard deviationBeta is the CAPM’s measure of risk. It takes into account an asset’s sensitivity to the market and only measures systematic, nondiversifiable risk. The standard deviation is a measure of dispersion that includes both diversifiable and nondiversifiable risks.c. Direct and indirect agency costsAgency costs arise when managers’ incentives are not consistent with maximizing the value of the firm. Direct costs include expenditures that benefit the manager but not the firm, such as purchasing a luxury jet for travel. Other direct costs result from the need to monitor managers, including the cost of hiring outside auditors. Indirect costs are more difficult to measure and result from lost opportunities.d. Weak, semi-strong, and strong form market efficiencyWith weak form market efficiency prices reflect all the information contained in historical returns. With semi-strong form market efficiency prices reflect all publicly available information. With strong form market efficiency prices reflect information that is not publicly available, such as insiders’ information.2. A stock has a beta of 1.2 and the standard deviation of its returns is 25%. The market risk premium is 5% and the risk-free rate is 4%.a. What is the expected return for the stock?E(R) = .04 + 1.2(.05) = .10b. What are the expected return and standard deviation for a portfolio that is equally invested in the stock and the risk-free asset?E(R p) = .5(.10) +.5(.04) = .07, σp =(.5)(.25) = .125c. A financial analyst forecasts a return of 12% for the stock. Would you buy it? Why or why not?If you believe the source is very credible, buy it as it is expected to generate a positive abnormal (or excess) return.3. What is the joint hypothesis problem? Why is it important?If when testing one hypothesis another must be assumed to hold, a joint-hypothesis problem arises. For us, this is of particular interest when we are testing market efficiency because of the need toutilize a particular risk-adjustment model to produce required returns, that is, to risk-adjust. This would not be a problem if we knew with certainty what the correct risk adjustment model is, but unfortunately we do not. If a test rejects the EMH, is it because the EMH does not hold, or because we did not properly measure abnormal returns? We simply do not know for certain the answer to this question.4. Warren Buffett has been a very successful investor. In 2008 Luisa Kroll reported that Buffett topped Forbes Magazine’s list of the world’s richest people with a fortune estimated to be worth $62 billion (March 5, 2008, "The world's billionaires," Forbes). Does this invalidate the EMH?Warren Buffett’s experience does not necessarily invalidate the EMH. There is the possibility that he is just lucky: given that there are numerous money managers, some are bound to perform well just by luck. Still many would question this here because Buffett’s track record has been consistently strong.5. You are considering whether to invest in two stocks, Stock A and Stock B. Stock A has a beta of 1.15 and the standard deviation of its returns has been estimated to be 0.28. For Stock B, the beta is 0.84 and standard deviation is 0.48.a.Which stock is riskier?Stock A is riskier, though stock B has greater total risk.b.If the risk-free rate is 4% and the market risk premium is 8%, what is the expectedreturn for a portfolio that is composed of 60% A and 40% B?R p = .6(.132) + .4 (.1072) = .12208c.If the correlation between the returns of A and B is 0.50, what is the standarddeviation for the portfolio that includes 60% A and 40% B?σp2 = (.6)2(.28)2 + (.4)2(.48)2+ 2*.5(.6)(.4)(.28)(.48) = 9.7%, σp = 31.2%Chapter 3: Discussion Questions and Problems1. Differentiate the following terms/concepts:a. Lottery and insuranceA lottery is a prospect with a low probability of a high payoff. Many people buy lottery tickets, even with negative expected values. These same people buy insurance to protect themselves from risk. Normally, insurance is a hedge against a low-probability large loss. These choices are inconsistent with traditional expected utility framework but can be explained by prospect theory.b. Segregation and integrationIntegration occurs when positions are lumped together, while segregation occurs when situations are viewed one at a time.c. Risk aversion and loss aversionA person who is risk averse prefers the expected value of a prospect to the prospect itself, whereas for a person who is loss averse, losses loom larger than gains.d. Weighting function and event probabilityEvent probability is simply the subjective view on how likely an event is. The weighting function is associated with the probability of an outcome, but is not strictly the same as the probability as in expected utility theory.2. According to prospect theory, which is preferred?a. Prospect A or B?Decision (i). Choose between:A(0.80, $50, $0)and B(0.40, $100, $0)Prospect A is preferred due to risk aversion for gains. While both have the same expected change in wealth, A has less risk.b. Prospect C or D?Decision (ii). Choose between:C(0.00002, $500,000, $0) and D(0.00001, $1,000,000, $0)Prospect D, with more risk, is preferred due to the risk seeking that occurs when there are very low probabilities of positive payoffs.c. Are these choices consistent with expected utility theory? Why or why not?Violation of EU theory because preferences are inconsistent. The same sort of Allais paradox proof from chapter 1 can be used. It is also necessary to make the assumption of preference homogeneity, which means that if D is preferred to C, it will also be true that D* is preferred to C* where these are:C*:(0.00002, $50, $0) and D*: (0.00001, $100, $0)3. Consider a person with the following value function under prospect theory:v(w) = w.5when w > 0= -2(-w) .5when w < 0a. Is this individual loss-averse? Explain.This person is loss averse. Losses are felt twice as much as gains of equal magnitude.b. Assume that this individual weights values by probabilities, instead of using a prospect theory weighting function. Which of the following prospects would be preferred?P1(.8, 1000, -800)P2(.7, 1200, -600)P3(.5, 2000, -1000)We calculate the value of each prospect:V(P1) = .8(31.62)+.2(-2)(28.27)= 13.982V(P2) = .7(34.64)+.3(-2)(24.49)= 9.55V(P3) = .5(44.72)+.5(-2)(31.62)= 9.265Therefore prospect P1 is preferred.4. Now consider a person with the following value function under prospect theory:v(z) = z.8when z ≥ 0= -3(-z).8when z < 0This individual has the following weighting function:where we set =.65.a. Which of the following prospects would he choose?PA(.001, -5000)PB(-5)Compare the value of each prospect:V(P A) = .983(0) + (-3)(910.28)(.011) = -30.15 (note use of weights)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer B.b. Repeat the calculation but using probabilities instead of weights. Whatdoes this illustrate?V(P A) = .999 * 0 + 3 * .001 * -910.28 = -2.73 (note use of probability)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer A. The reason for the switch is that risk seeking is maintained in the domain of losses (implying rejection of losses) if probabilities are used instead of weights.5. Why might some prefer a prix fixe (fixed price) dinner costing about the same as an a la carte one (where you pay individually for each item)? (Assume the food is identical.)Payment decoupling is encouraged with prix fixe. You only face the loss of money once rather than multiple times (occurring if you have to face the cost of each item individually using an à la carte scheme).CHAPTER 5: Discussion Questions and Problems1. Differentiate the following terms/concepts:a.Primacy and recency effectsA primacy effect is the tendency to rely on information that comes first when making an assessment, whereas a recency effect is the tendency to rely on the most recent information when making an assessment.b.Salience and availabilityThe salience of an event refers to how much it stands out relative to other events, whereas the availability refers to how easily the event is recalled from memory.c.Fast-and-frugal heuristics and bias-generating heuristicsFast and frugal heuristics require a minimum of time, knowledge and computation in order to make choices. Often they lead to very good choices. Sometimes however heuristics go astray and generate behavioral bias.d.Autonomic and cognitive heuristicsAutonomic heuristics are reflexive, autonomic, non-cognitive, and require low effort levels. Cognitive heuristics require more deliberation. Autonomic heuristics are appropriate when a very quick decision must be made or when the stakes are low, whereas cognitive heuristics are appropriate when the stakes are higher.2. Which description of Mary has higher probability?a. Mary loves to play tennis.b. Mary loves to play tennis and, during the summer, averages at least a game aweek.Explain your answer. Define the conjunction fallacy. How does it apply here?Assume for the purpose of illustration that the probability that someone loves to play tennis is .2; the probability that someone plays tennis once or more a week during the summer is .1; and the probability of one or the other of these things is .22.Pr(loves tennis) = .2Pr(loves tennis AND averages 1+)= Pr(loves tennis) + Pr(averages 1+) - Pr(loves tennis OR averages 1+)= .2 + .1 - .22 = .08The second probability has to be less because it has one more requirement (not only do you have to love tennis but you also have to play regularly, but some tennis lovers might just be too busy to do this). When people commit the conjunction fallacy (the belief that the joint probability is more likely than one of its components), they will think the second (joint) event is more likely because it sounds logical that someone who loves tennis will also play regularly.3. Rex is a smart fellow. He gets an A in a course 80% of the time. Still helikes his leisure, only studying for the final exam in half of the courses he takes.Nevertheless when he does study, he is almost sure (95% likely) to get an A.Assuming he got an A, how likely is it he studied? If someone estimates the above to be 75%, what error are they committing? Explain.P(studied|A) = P(A|studied) * [P(studied)/P(A)]= .95 * (.5 / .8) = .59375The “sample” is that he got an A. Without knowing this you would have said the probability that he studied was .5. You rightfully shifted the probability upwards based on the sample, but you moved it too much. You should have stayed closer to the base rate, so you have committed base weight underweighting.Another example of this is, when watching sports and noticing that someone is playing better than they normally do, believing that they have permanently improved.4. Why are two people who witnessed the same event last month likely to describeit differently today?Memory is very imprecise. The common view that past experiences have somehow been written to the brain’s hard-drive and are then retrieved, even if at considerable effort, is not the way our brain works. In fact, memory is reconstructive. Therefore people in remembering some event will reconstruct it in different ways.5. How do gambling fallacy and clustering illusion relate to representativeness?Provide examples from sports. In what way are they different? Representativeness exists when one thinks that A should look like B. A can be the sample and B the distribution, or vice-versa. A belief in a hot hand is thinking the conditional distribution should look like the sample. But sometimes it seems that people think the reverse, namely that the sample, however small, should look like the distribution, in the sense that essential features should be shared. A hot hand often comes into play in sports when people don’t know for certain the skill level of an athlete, and the extent to whic h it may change. Gambler’s fallacy is likely to exist when the underlying distribution (e.g., cards or dice) is well-known.。

第一章1. Differentiate the following terms/concepts:a.Prospect and probability distributionA prospect is a lottery or series of wealth outcomes, each of which is associated with a probability, whereas a probability distribution defines the likelihood of possible outcomes.b.Risk and uncertaintyRisk is measurable using probability, but uncertainty is not. Uncertainty is when probabilities can’t be assigned or the possible outcomes are unclear.c.Utility function and expected utilityA utility function, denoted as u( ), assigns numbers to possible outcomes so that preferred choices receive higher numbers. Utility can be thought of as the satisfaction received from a particular outcome.d.Risk aversion, risk seeking, and risk neutralityRisk aversion describes someone who prefers the expected value of a lottery to the lottery itself. Risk seeking describes someone who prefers a lottery to the expected value of a lottery. And risk neutrality describes someone whose utility of the expected value of a lottery is equal to the expected utility of the lottery.第二章2. A stock has a beta of 1.2 and the standard deviation of its returns is 25%. The market risk premium is 5% and the risk-free rate is 4%.a. What is the expected return for the stock?E(R) = .04 + 1.2(.05) = .10b. What are the expected return and standard deviation for a portfolio that is equally invested in the stock and the risk-free asset?E(R p) = .5(.10) +.5(.04) = .07, σp =(.5)(.25) = .125c. A financial analyst forecasts a return of 12% for the stock. Would you buy it? Why or why not?If you believe the source is very credible, buy it as it is expected to generate a positive abnormal(or excess) return.5. You are considering whether to invest in two stocks, Stock A and Stock B. Stock A has a beta of 1.15 and the standard deviation of its returns has been estimated to be 0.28. For Stock B, the beta is 0.84 and standard deviation is 0.48.a.Which stock is riskier?Stock A is riskier, though stock B has greater total risk.b.If the risk-free rate is 4% and the market risk premium is 8%, what is the expectedreturn for a portfolio that is composed of 60% A and 40% B?R p = .6(.132) + .4 (.1072) = .12208c.If the correlation between the returns of A and B is 0.50, what is the standarddeviation for the portfolio that includes 60% A and 40% B?σp2 = (.6)2(.28)2 + (.4)2(.48)2+ 2*.5(.6)(.4)(.28)(.48) = 9.7%, σp = 31.2%第三章2. According to prospect theory, which is preferred?a. Prospect A or B?Decision (i). Choose between:A(0.80, $50, $0)and B(0.40, $100, $0)Prospect A is preferred due to risk aversion for gains. While both have the same expected change in wealth, A has less risk.b. Prospect C or D?Decision (ii). Choose between:C(0.00002, $500,000, $0) and D(0.00001, $1,000,000, $0)Prospect D, with more risk, is preferred due to the risk seeking that occurs when there are very low probabilities of positive payoffs.c. Are these choices consistent with expected utility theory? Why or why not?Violation of EU theory because preferences are inconsistent. The same sort of Allais paradox proof from chapter 1 can be used. It is also necessary to make the assumption of preference homogeneity, which means that if D is preferred to C, it will also be true that D* is preferred to C* where these are:C*:(0.00002, $50, $0) and D*: (0.00001, $100, $0)3. Consider a person with the following value function under prospect theory:v(w) = w.5when w > 0= -2(-w) .5when w < 0a. Is this individual loss-averse? Explain.This person is loss averse. Losses are felt twice as much as gains of equal magnitude.b. Assume that this individual weights values by probabilities, instead of using a prospect theory weighting function. Which of the following prospects would be preferred?P1(.8, 1000, -800)P2(.7, 1200, -600)P3(.5, 2000, -1000)We calculate the value of each prospect:V(P1) = .8(31.62)+.2(-2)(28.27)= 13.982V(P2) = .7(34.64)+.3(-2)(24.49)= 9.55V(P3) = .5(44.72)+.5(-2)(31.62)= 9.265Therefore prospect P1 is preferred.4. Now consider a person with the following value function under prospect theory:v(z) = z.8when z ≥ 0= -3(-z).8when z < 0This individual has the following weighting function:错误!未找到引用源。

where we set =.65.a. Which of the following prospects would he choose?PA(.001, -5000)PB(-5)Compare the value of each prospect:V(P A) = .983(0) + (-3)(910.28)(.011) = -30.15 (note use of weights)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer B.b. Repeat the calculation but using probabilities instead of weights. Whatdoes this illustrate?V(P A) = .999 * 0 + 3 * .001 * -910.28 = -2.73 (note use of probability)V(PB) = 3 * 1 * -3.62 = -10.87Therefore you would prefer A. The reason for the switch is that risk seeking is maintained in the domain of losses (implying rejection of losses) if probabilities are used instead of weights.第五章1. Differentiate the following terms/concepts:a.Primacy and recency effectsA primacy effect is the tendency to rely on information that comes first when making an assessment, whereas a recency effect is the tendency to rely on the most recent information when making an assessment.b.Salience and availabilityThe salience of an event refers to how much it stands out relative to other events, whereas the availability refers to how easily the event is recalled from memory.c.Fast-and-frugal heuristics and bias-generating heuristicsFast and frugal heuristics require a minimum of time, knowledge and computation in order to make choices. Often they lead to very good choices. Sometimes however heuristics go astray and generate behavioral bias.d.Autonomic and cognitive heuristicsAutonomic heuristics are reflexive, autonomic, non-cognitive, and require low effort levels. Cognitive heuristics require more deliberation. Autonomic heuristics are appropriate when a very quick decision must be made or when the stakes are low, whereas cognitive heuristics are appropriate when the stakes are higher.。