California Board of Equalization Audit Manual Chapter 01

- 格式:pdf

- 大小:560.14 KB

- 文档页数:41

优先绩效目标:美国联邦政府绩效管理的新工具2014年08月08日08:49 来源:《山东社会科学》(济南)2013年10期作者: 字号打印纠错分享推荐浏览量 177 【作者简介】胡业飞,复旦大学国际关系与公共事务学院博士研究生;敬乂嘉,复旦大学国际关系与公共事务学院教授一、引言绩效管理就是美国公共管理领域经久不衰的主题之一。

从1970年代开始,美国国会先后颁布了包括《首席财务官法》在内的9项影响财政管理的法律,以求提升政府项目的财务管理水平与整体工作效率。

此外,历届联邦政府还先后探索使用了计划项目预算系统、目标管理等绩效管理方法,但效果参差不齐,都未能延续至今。

1993年《政府绩效与结果法案》(简称GPRA法案)的颁布就是美国联邦政府绩效管理发展的一个里程碑。

它直接构建了近二十年美国联邦政府绩效管理的制度框架,确立了联邦政府绩效管理活动的具体流程。

在此之后,美国联邦政府的绩效管理工作进入了稳步发展的阶段。

经过克林顿两个总统任期的试点与推广,《政府绩效与结果法案》的绩效管理框架(以下简称GPRA绩效管理框架)在2000年前后正式搭建完成。

在此之后,美国联邦政府开始探索怎样使用绩效管理工具来更好地完成绩效管理工作。

在小布什的总统任期内,项目绩效评级工具(简称PART工具)在联邦政府中得到了广泛应用。

PART工具的施用受益于两方面的推动力:一方面国会要求联邦政府提供更多清晰、直观的信息证明项目的绩效有效性;另一方面,总统为了向国会争取更多的预算,也要求联邦机构证明项目的有效性,在预算过程中争夺更多话语权。

因此,PART工具凭借它的直观性与可操作性优势,成为了小布什执政时期的核心绩效管理工具。

尽管PART工具的使用效果显著,但该工具也引发了不少争议。

部分公共管理专家与一线联邦雇员认为,PART工具使政府雇员过分关注于评级得分,这不仅就是一种“目标转换”,也给政府雇员加重了工作负担。

奥巴马就任美国总统之后,即以此为由,宣布对联邦政府的绩效管理制度进行改革,重点使用优先绩效目标工具(Priority Goals Tool)。

1美国萨班斯法案──────────────────────────────针对安然、世通等财务欺诈事件,美国国会出台了《2002 年公众公司会计改革和投资者保护法案》。

该法案由美国众议院金融服务委员会主席奥克斯利和参议院银行委员会主席萨班斯联合提出,又被称作《2002年萨班斯—奥克斯利法案》(简称萨班斯法案)。

法案对美国《1933 年证券法》、《1934 年证券交易法》作了不少修订,在会计职业监管、公司治理、证券市场监管等方面作出了许多新的规定。

──────────────────────────────美国萨班斯法案2目录萨班斯法案摘要萨班斯法案一、萨班斯法案正文目录二、萨班斯法案正文三、萨班斯法案关于SEC 的规定及执行四、萨班斯法案有关定义3萨班斯法案摘要萨班斯法案主要包括以下几个方面的内容:一、成立独立的公众公司会计监察委员会,监管执行公众公司审计职业公众公司会计监察委员会(以下简称PCAOB)负责监管执行公众公司审计的会计师事务所及注册会计师。

法案规定:(一)PCAOB 拥有注册、检查、调查和处罚权限,保持独立运作,自主制定预算和进行人员管理,不应作为美国政府的部门或机构,遵从哥伦比亚非赢利公司法,其成员、雇员及所属机构不应视为联邦政府的官员、职员或机构。

(二)授权美国证券交易委员会(以下简称SEC)对PCAOB 实施监督。

PCAOB 由5 名专职委员组成,由SEC 与美国财政部长和联邦储备委员会主席商议任命,任期5 年。

5 名委员应熟悉财务知识,其中可以有2 名是或曾经是执业注册会计师,其余3 名必须是代表公众利益的非会计专业人士。

(三)要求执行或参与公众公司审计的会计师事务所须向PCAOB 注册登记。

PCAOB 将向登记会计师事务所收取“注册费”和“年费”,以满足其运转的经费需要。

(四)PCAOB 有权制定或采纳有关会计师职业团体建议的审计与相关鉴证准则、质量控制准则以及职业道德准则等。

美国会计准则制定模式面临重大变革:安然事件后,美国的证券监管和准则再度成为世界注目的焦点。

美国后安然的会计准则制定模式、独立审计监管模式、有关各方的会计责任的改革动向,将在很大程度上引领21世纪世界会计审计准则和实务的方向。

鉴于安然事件后美国各界对财务会计准则委员会(FASB)制定会计准则的模式提出责难,加之2002年7月美国国会通过的《萨班斯――奥克斯莱法案》(Sarbanes-0xleyAct,简称SOX法案)明确要求证券交易管理委员会(sEC)就采用以原则为基础的财务报告体系进行,并必须在一年内(即到2003年7月份)向国会提交研究报告。

在上述背景下,FASB于2002年10月21日发表一份题为《美国准则制定的原则基础法》(Principles-basedApproachtoU.S.StandardsSetting)的征求意见稿,讨论了以规则为基础(Rule-based)的准则制定模式(以下简称RBA模式)存在的缺陷,描述了以原则为基础(Principles-based)的准则制定模式(以下简称PBA模式)的主要特点及其对现有会计准则的可能。

本文首先概括上述征求意见稿的主要,然后简要地讨论PBA模式对会计、审计的潜在影响。

一、RBA模式的主要问题安然事件后,美国各方面对财务会计信息质量和财务报告的透明度深表怀疑:一是认为美国以规则为基础的会计准则过于详细、过于复杂,导致美国会计职业界很难跟上步伐,从而使会计准则的格外困难,成本高昂;二是规则驱动(rule-driven)式的应用指南导致会计准则太过详细和复杂,从而诱使人们从事围绕规则而构造交易但又不符合准则目的和精神的和会计工程(financialandaccountingengineering),以达到特定的会计结果。

FASB认为,会计准则的制定受到许多因素的影响,会计准则的许多细节和复杂性均系需求驱动(demand-driven)。

美国会计准则的复杂性主要来自于准则中的大量例外和数量繁多的由FASB及其他机构提供的会计准则解释和应用指南。

美国联邦证据规则介绍:首席大法官沃伦于1965年任命一个顾问委员会为联邦法院起草证据规则。

该委员会起草的初稿于1969年发表以征求意见。

修订稿于1971年公布。

1972年,联邦最高法院将其命名为《联邦证据规则》,于1973年7月1日生效。

道格拉斯大法官持不同意见。

根据有关授权法案,首席大法官伯格将该证据规则提交国会审议,国会将其搁置以作进一步的研究。

经过广泛详尽的研究,国会将该规则作有关修改后颁布为法律。

1975年1月2日批准,1975年2月1日生效。

这样,联邦证据规则是联邦最高法院制订规则的程序与国会的立法程序相结合的产物。

至少,广泛收集普通法的案例与有关的制订法是同等重要,两者共同构成证据规则演进的背景。

在理解证据规则时,这些立法渊源都必须加以考虑。

-----爱德华特W.克利瑞美国联邦证据规则第一章一般规定第101条适用范围本规则根据第1101条规定的范围和例外,适用于在联邦法院、联邦破产法院和联邦治安法院进行的诉讼。

(根据1987年3月2日的修改,同年10月1日生效;1988年4月25日的修改,同年11月1日生效)第102条目的和结构本规则将用以保证公正施行,消除不合理的耗费和延误,促进证据法的发展壮大,以实现确定事实真相,公正处理诉讼。

第103条关于证据的裁定(a)错误裁定的后果除非影响到当事人的实体权利和具有下列情况,否则错误可以不作为采纳或排除证据的依据:(1)异议对于一项采纳证据的裁定,适时提出要求撤消的异议,或申请记录在案并阐明异议的具体理由,如果该理由未能从上下文中显露出来;或者(2)提供证明对于一项排除证据的裁定,可以提供该证据的要旨使法庭了解或者使其从所提问题的内容中显露出来。

(b)关于提供证据和裁定的记录法庭可以增加任何与表明证据特征、证据被提供的方式、提出的异议和相关的裁定有关的其他的或进一步的证词,可以指示用提问和回答的方式来提供。

(c)陪审团审理在陪审团审理的情况下,法官将指导诉讼,以防止不能采纳的证据通过各种手段,如作出陈述、提供证明或进行提问等,对陪审团产生影响。

美国洛杉矶联合学区的内部审计○张师广财务审计和经营审计三种类型。

遵循性审计主要是检查和评价内部控制结构的适当性及实际运行情况;财务审计主要检查学区各单位财务收支是否合规、是否得到批准或授权;经营审计主要评价学区各单位财务活动的合理性、有效性。

在实际执行审计业务时,这三种审计类型即可以结合在一起进行,也可以单独进行。

三、洛杉矶联合学区内部审计的标准洛杉矶联合学区内部审计在执行审计业务时所遵循的审计标准主要有以下四项:1.美国注册会计师协会(AICPA)审计标准委员会发布的公认审计标准(GAAS);2.美国审计总署(GAO)颁布的政府审计标准(GAS);3.加利福尼亚州主计审计长办公室颁布的加利福尼亚地方教育机构审计标准和程序;4.内部审计师协会(ⅡA)发布的内部审计实务标准。

四、洛杉矶联合学区内部审计的审计程序洛杉矶联合学区的内部审计工作是按照严格的程序进行的。

具体来说,有以下12个步骤;1.准备审计计划。

这个步骤主要的工作内容有:检查审计环境,确定本年度优先考虑的审计重点,征求外部注册会计师及审计委员会的意见,确定可以运用的审计人员和时间,制定本年度的审计计划。

2.学区财务主管检查、批准审计计划。

学区内部审计部将拟订的审计计划提交给学区的财务主管,由其审查批准。

此后,内部审计部再将财务主管批准的审计计划送交审计委员会。

3.审计委员会批准审计计划。

审计委员会对财务主管批准的审计计划进行检查修改,之后批准审计计划。

4.选择进行审计的学校。

根据批准的审计计划,内部审计部选择进行审计的学校和机构。

同时,内部审计部还征求学校校长和其他学校职员、学生家长、居民以及学区的行政管理人员对审计的特殊要求。

5.审前准备。

审计人员应检查被审计单位的永久性档案,建立工作底稿及其它文件,拟定审计方案并送交内部审计管理部门审批。

6.现场审计和准备审计报告。

在这个步骤,审计人员要实施现场的审计检查,取得对有关问题的说明和解释,并分类汇总审计发现。

美国司法部2020《企业合规机制评估指南》内容概览及解读华盛顿特区的美国司法部大楼。

司法部再次更新了关于如何评估公司合规项目的指南。

图片来源:MARY F. CALVERT/REUTERS 美国司法部(Justice Department)周一表示,已经更新了一份文件,概述了如何评估公司为防止员工违规的指引。

2017年,司法部首次发布了关于如何评估企业合规项目的指导意见,此后多次更新该文件,最近一次是在2019年。

一名官员说,周一发布的版本没有改较大改动,并补充说,这些更新是司法部提高透明度和改善政策的努力表现。

司法部刑事部门助理总检察长布莱恩·本茨科夫斯基(Brian Benczkowski)在一份声明中表示:“今天修订的企业合规项目评估指南,反映了我们基于自身经验和来自企业和合规界的重要反馈而增加的内容。

”公司合规措施的力度是检察官在决定如何解决针对公司的刑事案件时所权衡的因素之一。

周一更新的指导意见以一系列问题的形式编写,检察官可以在刑事调查期间询问公司的合规程序。

该指南还作为一套非正式的标准,公司可以在设计合规程序时使用。

新修订的指南对部分内容进行了重新措辞。

比如,检察官被告知要询问公司“是否有足够的资源和权力来有效运作”,而不是询问合规项目是否“有效执行”。

另外,新修订的指南更明确的表示,检方将对潜在违规行为防范,以及违规行为之后的纠正措施进行评估,这在一定程度上是为了检验公司为防止问题行为再次发生所采取的措施。

新修订的指南还要求检察官“理解公司为什么选择以目前的方式设立合规项目,以及公司的合规项目为什么会随着时间而演变,又是如何演变的。

”还有一些变化提醒检方,要确保企业有从之前的问题或其他公司的“前车之鉴”中吸取教训的程序,并要询问企业是否只在聘用第三方中介时才对其进行审查,还是在业务关系的整个过程中才对其进行审查。

Dylan T okarJune 3, 2020 7:09 pm ET注:本文版权归道琼斯公司所有。

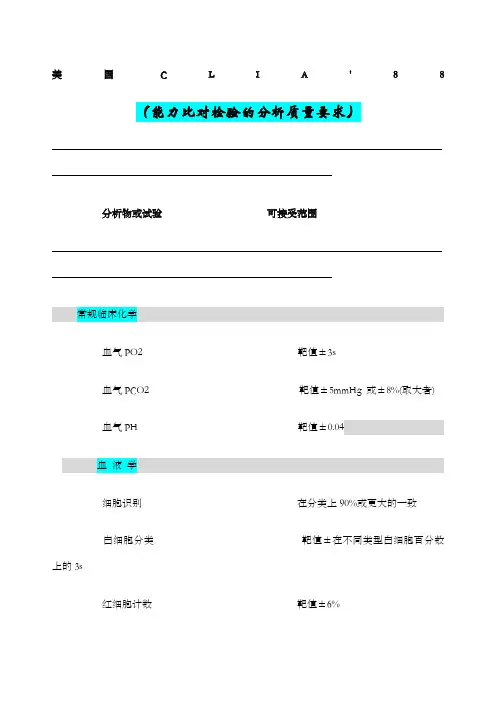

美国C L I A'88 (能力比对检验的分析质量要求)───────────────────────────────────────────────────────────────────分析物或试验可接受范围───────────────────────────────────────────────────────────────────常规临床化学血气PO2 靶值±3s血气PCO2 靶值±5mmHg 或±8%(取大者)血气PH 靶值±0.04血液学细胞识别在分类上90%或更大的一致白细胞分类靶值±在不同类型白细胞百分数上的3s红细胞计数靶值±6%血细胞容积靶值±6%血红蛋白靶值±7%白细胞计数靶值±15%血小板计数靶值±25%纤维蛋白原靶值±20%激活部分凝血酶时间靶值±15%凝血酶原时间靶值±15%附录2常用质控规则及含义:质控规则是解释质控数据和判断分析批控制状态的标准。

以符号AL(或A-L)表示, 其中A 是测定质控标本数或超过控制限(L)的质控测定值的个数,L是控制界限。

当控制测定值满足规则要求的条件时,则判断该分析批违背此规则。

常用质控规则有:(: 平均数;s:标准差)12s : 一个质控结果超过±2s,为违背此规则,提示警告。

12.5s : 一个质控结果超过±2.5s,为违背此规则,提示存在随机误差。

13s: 一个质控结果超过±3s,为违背此规则,提示存在随机误差。

R4s: 同批两个质控结果之差值超过4s, 即一个质控结果超过+ 2s,另一质控结果超过- 2s。

也适用于超过+ 2.5s及- 1.5s,为违背此规则,表示存在随机误差。

22s : 两个连续质控结果同时超过+ 2s 或- 2s,为违背此规则,表示存在系统误差。

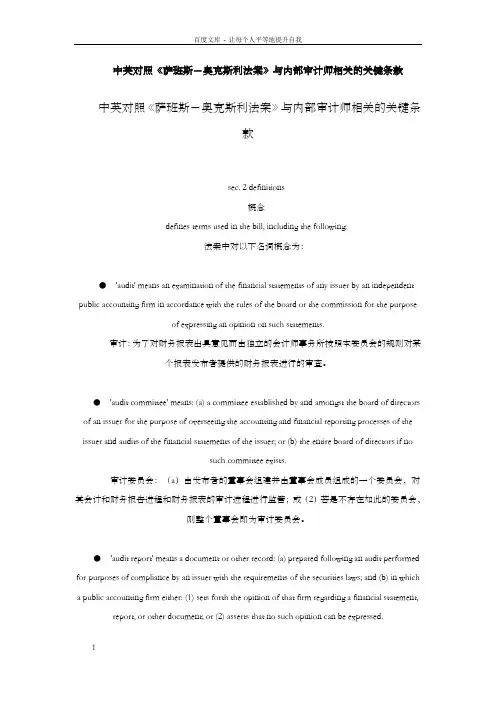

中英对照《萨班斯-奥克斯利法案》与内部审计师相关的关键条款中英对照《萨班斯-奥克斯利法案》与内部审计师相关的关键条款sec. 2 definitions概念defines terms used in the bill, including the following:法案中对以下名词概念为:●'audit' means an examination of the financial statements of any issuer by an independent public accounting firm in accordance with the rules of the board or the commission for the purposeof expressing an opinion on such statements.审计:为了对财务报表出具意见而由独立的会计师事务所按照本委员会的规则对某个报表发布者提供的财务报表进行的审查。

●'audit committee' means: (a) a committee established by and amongst the board of directors of an issuer for the purpose of overseeing the accounting and financial reporting processes of the issuer and audits of the financial statements of the issuer; or (b) the entire board of directors if nosuch committee exists.审计委员会:(a)由发布者的董事会组建并由董事会成员组成的一个委员会,对其会计和财务报告进程和财务报表的审计进程进行监管;或(2)若是不存在如此的委员会,则整个董事会即为审计委员会。

一、美国审计准则概况美国政府审计准则适用于对政府机构、项目、活动和职能,以及政府资助并有合同管理的机构、非营利组织的审计和鉴证业务。

当法令要求或自愿选择公认的政府审计标准(GAGAS)作为审计准则时,也适用于对其他非政府机构的审计和鉴证业务。

但GAGAS不适用于按照需求方要求提供信息和数据、开发标准和方法,与其他职业组织开展的审计合作、为立法机构和外部机构提供援助和专门技术、提供培训和讲座服务、帮助用户识别良好工作实务等非审计服务.GAGAS的框架结构和主要内容如下:除附录外,GAGAS共八章:第一章是GAGAS的应用.说明GAGAS的目的和应用、审计报告对遵循GAGAS的陈述、GAGAS与其他职业准则的关系、审计和鉴证业务类型。

第二章是职业道德原则.要求审计人员维护公共利益,正直,客观,恰当运用政府信息、资源和地位,保持职业素质。

第三章是一般准则.主要规范审计独立性、职业判断的运用、职业胜任能力。

同时,确立了质量控制准则,包括建立质量控制责任、遵守职业道德、接受和保持某一审计和鉴证业务、配置人力资源、依据法律和准则实施审计和报告结果、跟踪监督审计质量的政策措施和定期接受同业外部检查。

第四章是财务审计现场准则。

规定适用美国注册会计师协会(AICPA)财务审计现场准则,同时,附加八项审计准则。

第五章是财务审计报告准则.规定适用AICPA财务审计报告准则,同时附加了九项审计准则。

第六章是鉴证业务的一般准则、现场准则和报告准则。

规定适用AICPA鉴证业务一般准则、现场准则和报告准则,并附加了八项现场准则和五项报告准则。

第七章是绩效审计现场准则.规范了绩效审计中的合理保证,重要性和审计风险,计划审计工作,收集充分,适当的审计证据并加以评价;揭示问题应考虑标准、事实、原因和影响四个要素等。

第八章是绩效审计报告准则。

规范了绩效审计报告的内容、形式和分发.二、美国政府审计的演变过程美国审计署在制定审计准则方面迈出的艰难却最重要的一步是在20世纪70年代,当时,AICPA公布了第一部全国性审计准则,但这些准则适用于民间审计领域,而没有完全包括政府审计师的工作。

美国评估机构美国评估机构是指美国政府或相关组织设立的机构,负责对各种事物进行评估和监督。

这些评估机构的目的是为了提供独立的评估结果和建议,以帮助政府和公众做出明智的决策。

以下是美国几个重要的评估机构的介绍。

美国政府 accountability office(GAO)是最重要的评估机构之一。

GAO成立于1921年,是负责对联邦政府各个部门和机构进行管理、财务和绩效评估的机构。

GAO的使命是支持国会的监督工作,提供独立和客观的评估结果和建议。

GAO的评估范围包括政府项目和计划的成本效益、合规性和绩效等方面。

GAO的评估结果对政府的决策和预算分配具有重要影响力。

美国环境保护署的科学顾问委员会(SAB)是负责对该机构的科学和技术工作进行评估的机构。

SAB由25名来自学术界和工业界的专家组成,他们负责对环保署的政策和决策进行独立评估,并提供科学性、可行性和有效性的建议。

SAB的评估涵盖了环境政策、环境标准和环境技术等各个方面。

美国医学研究院(NAM)是一个独立的组织,由国家科学院设立,负责评估医学研究和医疗保健政策。

NAM的成员包括来自医学、生物科学、社会科学和工程学等领域的专家。

NAM的评估涵盖了医学研究和医疗保健体系的各个方面,为政府、医疗机构和公众提供相关政策的科学依据和建议。

美国贸易代表办公室(USTR)是负责制订和推动美国对外贸易政策的机构。

USTR负责评估和监测国际贸易的各个方面,包括市场准入、贸易协议和贸易争端等。

USTR的评估结果对美国政府的贸易政策和谈判具有重要影响,同时也对全球经济和贸易关系产生重要影响。

上述只是美国评估机构的几个例子,其他还有很多重要的评估机构,如美国国家安全局(NSA)、FBI、CIA等。

这些评估机构在各自的领域发挥着重要的作用,为政府和公众提供了独立、客观和可靠的评估结果和建议,促进了政府决策的科学性和透明度。

美国加州65号提案合规指南下载温馨提示:该文档是我店铺精心编制而成,希望大家下载以后,能够帮助大家解决实际的问题。

文档下载后可定制随意修改,请根据实际需要进行相应的调整和使用,谢谢!并且,本店铺为大家提供各种各样类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,如想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by the editor. I hope that after you download them, they can help yousolve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you!In addition, our shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts,other materials and so on, want to know different data formats and writing methods, please pay attention!在当前数字化时代,随着信息的爆炸性增长,人们对个人数据隐私和信息安全的关注也日益增加。

北美加州固定资产标准1. 引言在管理会计中,固定资产是企业核心资本的重要组成部分。

它们不仅可以增加企业的生产力和效率,还可以为企业创造更多的价值和财富。

然而,由于不同国家和地区的法规和会计准则的差异,企业在固定资产的管理和评估方面面临着一些挑战和差异。

本文将聚焦于北美加州的固定资产标准,探讨该地区的相关法规和准则对企业固定资产管理的影响及其应对策略。

2. 加州固定资产标准概述2.1 加州固定资产会计准则加州固定资产会计准则是加州政府根据国际会计准则制定的一套具体适用于加州企业的准则。

该准则主要涵盖了固定资产的计量、折旧、报废等方面的规定,以确保企业在计提折旧、资产评估和资产处置等方面的准确性和透明度。

2.2 加州固定资产管理法规加州政府制定了一系列固定资产管理法规,以保护企业和投资者的权益,防止资产浪费和滥用。

这些法规主要包括资产登记、资产处置、定期盘点等方面的规定,力图提高固定资产的管理效率和效果。

3. 加州固定资产计量和折旧准则3.1 加州固定资产计量标准根据加州固定资产会计准则,企业在购置固定资产时应将其成本纳入会计记录,并按照固定资产的实际价值进行计量。

实际价值可以通过市场评估或其他可靠的评估方式确定。

计量准则的合理性和准确性对于企业的财务状况和业绩分析具有重要意义。

3.2 加州固定资产折旧方法加州固定资产会计准则规定了多种折旧方法,企业可以根据实际情况选择合适的折旧方法。

常见的折旧方法包括直线法、加速法和减值法等。

这些方法在计提折旧和资产价值评估方面具有不同的特点和适用性,企业应根据实际情况选择合适的折旧方法。

4. 加州固定资产报废和处置规定4.1 加州固定资产报废标准加州政府制定了一套固定资产报废标准,以规范企业对于老化、损坏或无效的固定资产的处理方式。

根据这些标准,企业需要及时报废无效的固定资产,并在会计记录中进行相应的处理和调整,以确保财务数据的准确性和可靠性。

4.2 加州固定资产处置程序加州政府对于固定资产的处置程序也进行了明确规定。

美国财务报告内容控制审计准则解读

王军只

【期刊名称】《中国注册会计师》

【年(卷),期】2008(000)008

【摘要】@@ 一、财务报告内部控制审计准则的演变rn2002年,美国国会通过了萨班斯法案,要求制定新的财务报告内部控制审计准则.

【总页数】4页(P82-85)

【作者】王军只

【作者单位】中南财经政法大学会计学院

【正文语种】中文

【中图分类】F2

【相关文献】

1.美国财务报告内部控制审计的发展与启示——财务报告内部控制审计与财务报表审计的比较 [J], 裘宗舜;周洁

2.美国财务报告内部控制审计准则变化解析——PCAOB AS5和PCAOB AS2的比较 [J], 阚京华;曹俊

3.美国财务报告内部控制审计准则的新变化 [J], 阚京华;曹俊

4.国际财务报告准则、美国财务会计准则和企业会计准则关于股份支付准则的比较[J], 李正卫

5.美国财务报告内部控制审计准则的发展及其启示 [J], 王军只

因版权原因,仅展示原文概要,查看原文内容请购买。

美国司法部教你如何做公司内部合规调查2015年4到5月,美国司法部(DOJ)的助理司法部长(Assistant Attorney General)Leslie R. Caldwell女士(Caldwell)在不同场合作了几场演讲,演讲的主题是关于司法部刑事部门对公司提起调查和起诉的相关问题。

演讲透露了很多关于司法部刑事部门执法的重要信息。

尤其是关于在美国司法部参与的案件中,公司应当如何进行内部调查才能符合司法部要求,如何才能使公司减轻甚至免除处罚,这些演讲提供了很好的指引和方向。

对合规律师以及公司的法务合规官员来说,这些演讲是绝对不能错过的学习资料。

Caldwell其人其事Caldwell是在2014年6月被奥巴马任命为美国司法部助理部长兼司法部刑事部门的负责人。

拥有超过600名律师的司法部刑事部门负责大部分美国联邦刑事法律的执法和监督。

刑事部门下辖17个小组和办公室,其中的反欺诈组负责全美复杂经济犯罪、证券欺诈犯罪以及美国海外反腐败法(FCPA)的执法。

Caldwell在美国大名鼎鼎。

此前,她领导了著名的针对安然公司的调查和起诉,让这家拥有上千亿资产的公司在几周内破产。

她的起诉也让著名会计师事务所安达信土崩瓦解,成为历史。

Caldwell一贯秉持着对公司执法极其严厉的态度,甚至是被认为是“Anti-Business Activist”。

因此在她的任命通过之后,有媒体评论说“司法部放出了一只哥斯拉”。

Caldwell的前任们都被指责在2008年金融危机后对那些负有责任的银行家个人没有足够的调查和起诉,这也是奥巴马政府看上Caldwell的一大原因。

因为Caldwell最常说的就是“能起诉个人就别只起诉公司啊”(这个后面还会具体分析)。

看面相就是个非常强悍的人啊!公司为什么要做内部调查?为没有合规经验的读者做一个背景解释:中国的刑事调查和行政执法调查通常是执法机关单方面进行的,即使是针对公司的调查也是如此。

Audit ManualChapter 1General InformationSales and Use Tax DepartmentCalifornia StateBoard of EqualizationThis is an advisory publication providing direction to staff administering the Sales and Use Tax Law and Regulations. Although this material is revised periodically, the most current material may be contained in other resources includingOperations Memoranda and Policy Memoranda.Please contact any board office if there are concerns regarding any section of this publication.A udit M AnuAlG enerAl i nforMAtion December 2011T able of C onTenTsGENERAL INFORMATION 0100.00INTRODUCTION ........................................................................................................0101.00Mission and Philosophy ...........................................................................................................0101.03Purpose of Audit Manual .........................................................................................................0101.05Audit Manual Revisions ...........................................................................................................0101.10Tax Audit Policies.....................................................................................................................0101.20Standards of Competency for an Experienced Tax Auditor .....................................................0101.25Knowledge of the Law .............................................................................................................0101.30Regulations and Publications of the Board..............................................................................0101.35Business Taxes Law Guide .....................................................................................................0101.45Use of Annotations ..................................................................................................................0101.47Terminology .............................................................................................................................0101.50Tax Auditors Not to Sign Taxpayers Documents ......................................................................0101.55Acceptance of Payments by Tax Auditors ...............................................................................0101.57Taxpayers’ Bill of Rights ..........................................................................................................0101.60Confidential Information ...........................................................................................................0101.65Authorization for Electronic Transmission of Data ...................................................................0101.67Taxpayer Correspondence in General .....................................................................................0101.70GUIDELINES FOR RTC SECTION 6596 RELIEF .....................................................0105.00General ....................................................................................................................................0105.02Qualified Erroneous Advice .....................................................................................................0105.04Reasonable Reliance on Written Misinformation .....................................................................0105.06Rescission of Erroneous Advice ..............................................................................................0105.08Request for Relief ....................................................................................................................0105.10ADJUSTMENTS TO BILLED DIFFERENCES ..........................................................0107.00Sample Review Process by Division/Section ..........................................................................0107.02GUIDELINES FOR PROCESSING REFUNDS ..........................................................0108.00CANCELLATIONS AND CREDITS ............................................................................0109.00EDUCATIONAL CONSULTATIONS ..........................................................................0110.00Background .............................................................................................................................0110.02Pre-Consultation Activities .......................................................................................................0110.04Consultation Activities..............................................................................................................0110.06Post-Consultation Activities .....................................................................................................0110.10PROCEDURE FOR OBTAINING AND SAFEGUARDING INFORMATION FROM THE IRS AND FTB ...............................................................0115.00Internal Revenue Service (IRS)...............................................................................................0115.02Franchise Tax Board ................................................................................................................0115.04DESTRUCTION OF FILE MATERIAL .......................................................................0117.00Audit Workpaper Retention Policy ...........................................................................................0117.02Information from the FTB .........................................................................................................0117.06REWARD PROGRAM ................................................................................................0122.00General ....................................................................................................................................0122.02A udit M AnuAlINFORMANT CONTACT PROCEDURES .................................................................0124.00 General ....................................................................................................................................0124.02 Guidelines................................................................................................................................0124.04 IDENTITY THEFT PROCEDURES —ABSOLVING THE INNOCENT PARTY ......................................................................0126.00 General ....................................................................................................................................0126.02 Procedures ..............................................................................................................................0126.04August 2007G enerAl i nforMAtionAugust 2007GENERAL INFORMATION0100.00INTRODUCTION 0101.00MISSION AND PHILOSOPHY 0101.03The mission of the State Board of Equalization (Board) is to serve the public through fair, effective, and efficient tax administration.The Board is committed to a philosophy of service and accountability to the public, whose interest is best served through sound administration of the tax laws. We believe this can be most effectively accomplished through programs that enable and encourage people to voluntarily comply with the laws. The Board’s audit program is one of many ways in which we provide assistance and information to the public while, at the same time, providing a fair and firm enforcement program that ensures that taxes are reported properly.PURPOSE OF AUDIT MANUAL 0101.05The Sales and Use Tax Department (SUTD) Audit Manual (AM) is a guide in conducting sales and use tax audits. It incorporates procedures and techniques that have evolved over a period of years and have proved to be sound and practical. Tax auditors should carefully study this manual to conduct audits and prepare reports in a uniform manner consistent with approved tax auditing practices.This manual, however, is not a substitute for experience, training in accounting and auditing, good judgment and active supervision. The procedures outlined in this manual are not inflexible. However, all sections of Chapter 2, Field Audit Reports, and the italicized portions of the other chapters are to be followed exactly. The audit supervisor must approve any deviation from these instructions.AUDIT MANUAL REVISIONS 0101.10Procedures have been developed to afford the Board the opportunity to review proposed changes to this manual and to ensure that taxpayers, taxpayers’ representatives and other interested parties are notified of changes in Board policies and procedures that may affect them. AM revisions are generally made to incorporate existing guidance to staff from management, to enhance clarity or to correct errors. All revisions undergo a clearance process. Board approval is obtained via the Business Taxes Committee (BTC) process or via the Board’s Administrative Agenda.Clearance ProcessDrafts of suggested revisions to AM chapters will complete a two-step clearance process, consisting of a preliminary review by all affected Board units and a selection of district offices, and a final review by SUTD management. At least one district office from each Equalization District will participate in the preliminary clearance process.Board Approval — BTC ProcessIf the proposed AM revisions involve policy or procedure modifications that would significantly impact the public, a recommendation will be made to the BTC Chair to place the matter on the BTC agenda as a separate topic in order to ensure participation by interested parties in discussing the change. This process will include the customary discussion and issue papers and interested parties meetings.A udit M AnuAlAugust 2007A udit MAnuAl revisions(C ont .) 0101.10Board Approval — Administrative Agenda AM revisions that do not involve policy or procedure modifications that would significantly impact the public will be provided to Board Member staff and posted for two months to the Board’s Internet website located at /sutax/staxmanuals.htm. A “pending approval” icon on the website manuals page will identify chapters with pending revisions, and a cover letter attached to the proposed revisions will explain the origin and need for the revisions and invite public comment on these revisions only. Staff will acknowledge and address all comments, and once the final revisions are approved by management, will then schedule the revisions for approval on the Board’s Administrative Agenda. The materials provided to the Board will include a summary of the comments received and actions taken in response to the comments.TAX AUDIT POLICIES 0101.20Field auditing is of great importance in efficient administration of self-assessed taxes such as those provided by the California business tax laws. It assists in ensuring uniform enforcement and detects and aids in the timely correction of reporting errors. The SUTD audit program has resulted in the correction of tax underpayments and overpayments of many millions of dollars. In addition, there are educational benefits to the taxpayer which cannot be readily measured in terms of dollars but which undoubtedly are responsible for a large portion of the self-declared tax that would not otherwise be paid. On November 17, 1954, the Board by resolution adopted the original version of the following statement of tax audit policies (A–E below). It should be noted that this resolution has accurately reflected the intent and direction of the Board from 1954 through the present.A. Purpose of Tax Auditing • Because most of the taxes administered by the Board are self-assessed by the taxpayers, an audit program is essential in providing for the following objectives:• To assure all citizens of the state that the tax is being enforced uniformly;• To deter tax evasion and carelessness in self-assessments; and• To promote accuracy in self-assessments through aid extended to taxpayers with respect to the interpretation of the law and rules and regulations adopted thereunder.B. Relationship of Taxpayer and Tax Auditor • Consistent with the purpose of tax auditing as outlined above, there is no occasion for the tax auditor to harass taxpayers or to give the impression that the object of the audit is to find errors in the taxpayers’ self-assessments. The taxpayer should be assured that the tax auditor’s function is to determine whether the amount of tax has been reported correctly. The tax auditor should aid the taxpayer in gaining a correct understanding of the law and demonstrate that we are as willing to recommend a refund of an overpayment as we are to propose a deficiency determination. Care should be taken to inform taxpayers regarding taxpayers’ rights and privileges in connection with such determinations. The tax auditor should constantly keep in mind that it is our policy to administer the law fairly and uniformly, with minimum annoyance and interference in taxpayers’ business affairs, as well as at the lowest cost consistent with good tax administration.G enerAl i nforMAtionAugust 2007t Ax A udit P oliCies (C ont .) 0101.20C. Professional Status of Tax Auditors • Tax auditors are engaged in professional assignments. They are called upon to exercise their highest skill and best judgment throughout the performance of their official duties. All audits should be made in accordance with approved auditing and accounting principles. Sound professional judgment must be exercised in making tests that are representative in scope and character to ensure that the results are representative of the actual business operations during the audit period.• Tax auditors are expected to observe the rules of conduct of their profession and the Board’s guidelines set forth in the pamphlet, Ethics: Guidelines for Professional Conduct , available in the Board’s intranet website (eboe) located at http://eboe/docs/Forms/Ethics.pdf. Tax auditors are also expected to perform their duties with dignity and courtesy regardless of the industry being audited, the size of the business, the sophistication of the records, or any other consideration. The Board can maintain the public’s confidence only to the extent that all of our official activities and contacts with the public reflect the highest ethical and moral standards. Tax auditors must perform their duties with integrity and propriety, and do all in their power to ensure that their words or actions cannot be interpreted otherwise.D. Evaluation of a Tax Auditor’s Skills • In determining the skills of a tax auditor, the quantity and quality of the work will be evaluated in relation to these questions:• Is the tax auditor accurate and efficient in the analysis of taxpayer’s records to determine whether tax liability has been reported correctly?• Does the tax auditor explain to the taxpayer in clear terms the amounts of overpayment or underpayment identified by audit and provide a complete set of audit work papers so that the taxpayer is afforded a good understanding of what constitutes correct tax reporting?• Does the tax auditor use sound professional judgment and exercise alertness to determine the most appropriate type of audit for a specific assignment?• A tax auditor’s skill is not measured by the additional understatements and overstatements disclosed in his or her audits. Under no circumstances will a tax auditor’s performance be rated upon the basis of recovery, which is prohibited by law. Additionally, aged audits and other audit program-level performance measurements established by Board management to evaluate district offices are not designed nor should be used for evaluating a tax auditor’s performance. This does not mean that a tax auditor may waste time on assignments by using ineffective audit techniques and performing nonessential tasks and still receive a satisfactory rating. It does mean that if the tax auditor works diligently, uses the kind of verification methods best fitted to the particular assignment, and performs a professional job with a reasonable expenditure of time, the work performance will be satisfactory.E. Implementation of Auditing Policy • The Chief, Tax Policy Division, Chief, Field Operations Division, Equalization Districts 1 & 2 and Out-of-State District, Chief, Field Operations Division, Equalization Districts 3 & 4 and Centralized Collection Section, and District Administrators have the responsibility to effectively carry out the policy set forth in this statement. They will issue such instructions as it is deemed necessary to implement this policy.A udit M AnuAlAugust 2007STANDARDS OF COMPETENCY FOR AN EXPERIENCED TAX AUDITOR0101.25A. Ability to apply the following basic knowledge to practical situations:• Thorough knowledge of accounting principles and systems.• Thorough knowledge of auditing procedures and techniques.• A general knowledge of business law, practices and procedures.B. Ability to apply the following special knowledge to practical situations:• Knowledge of the California Revenue and Taxation Code (RTC) as it pertains to sales and use tax.• Thorough knowledge of the authorized rules and regulations of the Board.• Knowledge of established administrative policies.• Knowledge of special techniques peculiar to tax auditing and sales and use tax administration.• Effective use of tools, manuals, annotations, memorandum opinions and directives.C. Ability to prepare professional audit reports with particular reference to:• Use of computers.• Completeness of reports.• Clear and concise, well-organized comments with headings and captions.• A working paper technique which is readily understood by others.• Use of auditing procedures consistent with acceptable standards.• Accuracy in comments, facts, and calculations.• Ability to make decisions commensurate with duties and responsibilities.• Ability to clearly explain and support, verbally and in writing, audit procedures and findings. Such explanations must be readily understood by supervisors, reviewers, Appeals Division attorneys, taxpayers, and taxpayers’ representatives (i.e., accountants, attorneys, etc.).D. Judicious use of time such as:• Proper use of audit short-cut techniques.• Good organization and planning of work.• Recognition of the “Concept of Materiality” in making audit decisions.E. General work habits:• Good general and business-like appearance.• Promptness in keeping appointments.• Promptness in completing and submitting assignments.F. Attitude:• Enthusiasm in work.• Willingness to learn.• Open-minded approach to assignments.• Ability to accept responsibility.• Ability and willingness to accept direction.G enerAl i nforMAtion August 2007s tAndArds of C oMPetenCy for An e xPerienCed t Ax A uditor (C ont .) 0101.25 G. Use of initiative, inquisitiveness, and ingenuity:• Ability to adapt working habits and audit practices to differing environments.• Alertness to recognize situations involving possible tax liability even though not directly concerned with a specific assignment.• Willingness and ability to do research work on complex audit problems.• Willingness and ability to develop alternative approaches to particular problems.H. Relationship with people:• Ability to get along and work with fellow employees, supervisors, and staff from other districts and units.• Ability to get along and work with taxpayers and taxpayers’ employees, accountants, attorneys and other representatives.• Ability to instill confidence.• Ability to maintain an atmosphere of dignity and professionalism consistent with the auditing profession.• Ability to discuss with the public such things as:• The structure, history, mission, philosophy, and functions of the Board.• A general overview of the various tax programs.• Taxpayer benefits from tax revenues.• Some background knowledge of legislative intent in enacting law changes, exclusions, and exemptions.KNOWLEDGE OF THE LAW 0101.30Tax auditors must be familiar with the provisions and requirements of the laws they are assisting to administer, which are:• Division 2, Part 1, of the RTC, known as the Sales and Use Tax Law.• Division 2, Part 1.5, of the RTC, known as the Bradley-Burns Uniform Local Sales and Use Tax Law.• Division 2, Part 1.6, of the RTC, known as the Transactions and Use Tax Law.• Division 2, Part 1.7, of the RTC, known as the Additional Local Taxes Law.REGULATIONS AND PUBLICATIONS OF THE BOARD 0101.35Regulations promulgated by the Board interpret the laws the Board administers and have the force and effect of law. The Board also publishes a number of publications designed to assist taxpayers with tax questions. Publication 51, Guide to Board of Equalization Services, contains a complete list of Board publications, many of which are available at .BUSINESS TAXES LAW GUIDE 0101.45Tax auditors are provided copies of the Business Taxes Law Guide (BTLG) that contain, in loose-leaf form, the laws, regulations, court decisions and summaries of the conclusions reached in selected legal rulings of counsel (annotations). The BTLG is also available on CD ROM and at .The hardcopy of the BTLG is the property of the Board and its safekeeping is the tax auditors’ responsibility.A udit M AnuAlFebruary 2011USE OF ANNOTATIONS 0101.47When using an annotation to clarify BOE’s position regarding a statute or regulation, a review of the annotated legal opinion is often helpful. In addition to the online Business Taxes Law Guides, a complete list of annotated opinions is available by subject area on the Sales and Use Tax Annotated Legal Opinion Letter web page at /sutax/annotations/menu.htm . This page also provides a link to the redacted copy of the annotated opinion, if available. If the electronic annotated opinion is not posted, use the online request form to receive a copy of the legal opinion. Suggestions and comments regarding published annotations may be submitted using the same online request form.Annotations do not have the force or effect of law, but are intended to provide guidance regarding the interpretation of the Sales and Use Tax Law with respect to specific factual situations. Annotations may be revised or deleted. Opinions supporting deleted annotations should not be retained in section or district libraries, reference files, or files maintained by BOE employees.For more information regarding annotations, refer to Regulation 5700, Annotations.TERMINOLOGY 0101.50The term “taxpayer” includes “seller” or “retailer” as defined in the Sales and Use Tax Law, as well as the person upon whom use tax is imposed.See Exhibit 1, Tax Code Table , for a listing of common sales and use tax program codes used to assign tax code account number prefixes. A complete listing of account characteristic codes can be found in Compliance Policy and Procedures Manual (CPPM) section 325.030.TAX AUDITORS NOT TO SIGN TAXPAYERS DOCUMENTS 0101.55Tax Auditors will not sign stipulations, agreements, or other documents offered by taxpayers or taxpayers’ representatives. Board printed forms or facsimiles thereof will be used.ACCEPTANCE OF PAYMENTS BY TAX AUDITORS 0101.57Tax Auditors must not accept payments in the office or field. If a taxpayer in the office wishes to make a payment, the taxpayer must be taken to the office cashier for processing of the funds. In instances where a taxpayer in the field insists on making an immediate payment of an audit liability , the auditor should call the field office and request that a tax representative contact the taxpayer and arrange for payment of the liability.TAXPAYERS’ BILL OF RIGHTS 0101.60The Harris-Katz California Taxpayers’ Bill of Rights, enacted on January 1, 1989, added RTC sections 7080 through 7099 and section 7156. Effective January 1, 1999, RTC sections 6593.5, 6832, 6964 and 7094.1 were added. The law guarantees that the rights, privacy, and property of taxpayers are protected during the course of assessment and collection activity. Tax auditors should be familiar with the provisions of the law. Publication 70, Understanding Your Rights as a California Taxpayer, which explains procedures, remedies, rights, and obligations of taxpayers and the Board, must be provided to taxpayers at the beginning of every audit. This publication is available at .G enerAl i nforMAtionAugust 2007CONFIDENTIAL INFORMATION 0101.65The Civil Code and most of the business tax laws contain provisions making it illegal to divulge to any unauthorized persons information regarding a taxpayer’s affairs obtained through audit investigation or from returns or reports. (This includes information contained in Forms BOE–1164 and BOE–1032; see AM section 0401.20). Information of this nature contained in Board records must be treated in strict confidence. The only exception is when the Governor, by general or special order, authorizes other state officers, tax officers of another state, the Federal Government (if a reciprocal agreement exists), or any other person to examine the records maintained by the Board. Requests for information of a confidential nature should be referred to a supervisor.Under the Sales and Use Tax program, all but the following information is confidential: account number, business name, names of general partners, business and mailing addresses, business code, ownership designation, start and close-out dates, status of permit (i.e., active/inactive), and tax area code. However, disclosure of the name and address of an individual may be prohibited by Civil Code section 1798.69. (Civil Code section 1798.69 provides in part that the Board may not release the names and addresses of taxpayers except to the extent necessary to verify resale certificates or administer the tax and fee provisions of the Revenue and Taxation Code.) You should be aware that nonconfidential information in other business tax and fee programs differs from that in the Sales and Use Tax program.The procedures for handling public requests for information (including requests for Statements of Economic Interests (SEI) — Form 700) are addressed on BOE–20, What You Need to Know About Requests for Information,” available in eboe located at http://eboe/docs/Forms/boe20.pdf .Requests by a taxpayer’s representative for information and records under the Information Practices Act (IPA) and the California Public Records Act (PRA) will be guided by the following policy:A taxpayer’s representative may examine and/or receive copies of the same information the taxpayer is entitled to, provided the representative presents a written authorization from the taxpayer. This includes copies of all correspondence and, if involved with an audit, petition for redetermination or claim for refund, a copy of the report findings. It is not necessary that the written authorization be notarized.A udit M AnuAlAugust 2007C onfidentiAl i nforMAtion (C ont .) 0101.65Exceptions to the written authorization rule:1. Taxpayer directed ― Written authorization is not required when supplying copies of audit working papers to the taxpayer’s bookkeeper or accountant when the taxpayer directed the Board to contact the taxpayer’s bookkeeper or accountant to conduct an audit and the audit was made based on information supplied by the bookkeeper or accountant.2. Oral inquiries ― Attorneys and accountants may examine and/or receive copies of information without having written authorization if the person is known by the Board to represent the taxpayer. Most oral requests are for an informal review of working papers before the audit is transmitted to Headquarters — generally when the representative has been working with district staff. Staff should screen for situations that may involve speculative inquiries by persons who may be aware of the general subject matter and a taxpayer’s business name or account number, but have not been asked by the taxpayer to represent them. Staff should check the taxpayer’s file and the appropriate Integrated Revenue and Information System (IRIS) screens to verify the person has represented the taxpayer in the past. (APL MH and TAR AI have fields for the name of the taxpayer’s accountant or representative; audit subsystem screens can be used to access the audit report or prior audit report to view comments indicating who maintained the records and who was involved in the discussion of audit findings.)• Preferably, a stream of correspondence exists for the current audit which clearly establishes the attorney’s or accountant’s relationship with the taxpayer. If the only information available on IRIS involves a prior audit, or the representative has recently been added, the file should be carefully reviewed to determine what event created the authorization. If staff is still unsure as to whether the attorney or accountant is in fact a representative of the taxpayer, staff may contact the taxpayer by telephone to confirm the authorization. Alternatively, staff should ask the person to put the request in writing and state specifically that he or she represents the taxpayer in question. Attorneys and accountants have an ethical responsibility not to misstate their authority to represent their clients.• Requests for copies of district, appeals, and central files must be obtained in writing.3. Written inquiries — Attorneys and accountants may examine and/or receive copies of information without having written authorization from the taxpayer if they request the information in writing and clearly indicate that they are authorized to represent the taxpayer. When copy requests are made for file information, the supervisor should review the appropriate IRIS screen printout indicating the representative’s name before the request is approved and copies mailed. As explained in (2) above, staff should review IRIS and the taxpayer’s file to screen for speculative inquiries. If staff still has doubts, they should contact the taxpayer to confirm authorization.。