[Trading] Technical Stock Analysis - Bollinger Bands and RSI

- 格式:pdf

- 大小:103.33 KB

- 文档页数:6

历史上30本值得一读的交易书籍(ZT)Top 30 history trading books虽然很长,但我想你应该认真的看完.我之所以用这个题目,而不用top 30 financial books, or top 30 investing books, or top 30 speculation books, 因为想从一个交易者的角度来看历史上排名的书籍, 虽然我用了多年的时间,每天消耗在美国图书馆达十几个小时,但这不表明这些推荐的书是最好的,当然有个人的偏见和爱好,公正在这个社会是不存在的,但合理是尽量的.法律没有完美的,但自律是应该的.所有图书基本上不是启蒙的. 所有这些书籍在东方华尔街论坛都有下载.我不是说中国的交易分析书籍不好,当然也有很经典的,遗憾的是我读过一些,感到还是英语的比较好,这是我的偏见,可能也是我愚钝的缘故.以下这些书籍我大多读过,有些还读过几十遍, 我个人的看法,如果人只是为了钱来到这个社会,那么要读的书籍真是太少了,因为你读过的非金融方面的书会成为你正统负担,而这些将为你的交易带来偏见,以至于你不得不一层层的剥皮,而成为一个好的交易师.给你的孩子一个忠告,我在一个讲座中也讲过这句话,当然遭到很多谴责. 如果你想让孩子成为亿万富翁,那么就应该让他读最值得读的书,很多书只能是浪费青春,读了太多只能加重交易的负担, 最值得读的书太少了,当然投资中的经典是最值得终身研究的. 什么佛教基督华伦功最好不要碰.做人和炒股完全是悖论, 当然这也不意味着我做人不怎么样. 高学位并不能带来最高受益, 看看炒股的巴菲特,读了什么书,当然是那本他老师经典的<证券分析学>了,我这里并不提倡你去读那本书,因为经典的基本分析已经被经典的投机分析取代了.这是我个人的观点.另外就是翻译问题,很多书翻译作者还没弄清书的真谛,为商业利益而翻译,建议能读英文原著最好,当然不能读的只好撮合翻译了.这里我尽力提供准确的翻译,当然我的水平也不是最好的,.我也想写一本经典的书,可是那是我退休以后的事情了.一. 10本经典的所有交易员需要终身领会的投资投机书籍1. How to Trade In Stocks 怎样交易股票by Jesse Livermore (Author)这本书是关于这个自杀者的总结,假使这本书出的早些,作者又会名扬天下的,这个人就是李佛摩尔.子书: Jesse Livermore: World's Greatest Stock Trader 李佛摩尔:世界最伟大的股票交易者by Richard Smitten (Author)其实瑞秋的这个标题不好,书中讲了很多除股市外的交易,如期货等.读这本书是不够的,你应该将这四本书一起读,仔细的领悟.子书: Reminiscences of a Stock Operator Illustrated (A Marketplace Book) 《股票作手回忆录》(大家都这么用这个题目,我也用了,因为太流行了,当然准确的翻译应该是: 一个股票操盘手回忆录的历程.by Edwin Lefevre (Author), Marketplace Books (Author), William J. O'Neil (Author)子书: Reminiscences of a Stock Operator (Wiley Investment Classics) 《股票作手回忆录》by Edwin Lefèvre (Author), Roger Lowenstein (Foreword)说明:这本书排名第一当之无愧, 它是立志于华尔街的案头书.2. 《华尔街四十五年》江恩华尔街四十五年英文版(William D. Gann - 45 Years In Wall Street一代大师江恩,当然是奇人,但要辩证的分析,早年的江恩近于玄学,这本书是它的心血结晶. 国内出版过中文版,翻译的不是非常理想。

最经典的50本金融书籍1.《证券分析》(Security Analysis)作者:Benjamin Graham,David Dodd,2008年版2.《货币金融学》(Monetary Theory and Practice)作者:Milton Friedman,2000年版3.《投资之道》(The Intelligent Investor)作者:Benjamin Graham,2006年版4.《证券市场分析》(The Analysis of Financial Statements)作者:Benjamin Graham,2004年版5.《股票投资艺术》(The Art of Investing)作者:Philip Fisher,1996年版6.《股票作手回忆录》(Reminiscences of a Stock Operator)作者:Edwin Lefevre,1923年版7.《价值投资:原理与技能》(Value Investing: Principles and Techniques)作者:James Montier,2007年版8.《古代的黄金法则》(The Ancient Rule for Investing)作者:George S. Clason,1926年版9.《证券分析与组合》(Security Analysis and Portfolio Management)作者:Donald E. Fischer,Ronald J. Jordan,2006年版10.《收入投资:股息股利的能力》(Income Investing: The Ability to Grow Dividends)作者:Richard S. Lehman,Lawrence G. McMillan,David M. Modest,2009年版11.《价值型股票投资》(Value Investing in Growth Companies)作者:RussellJ. Wild,2002年版12.《通货膨胀投资》(Inflation-Proof Your Portfolio: How to Protect Your Money from the Coming Government Hyperinflation)作者:David Voda,2007年版13.《证券分析与管理》(Investment Analysis and Portfolio Management)作者:Frank K. Reilly,Keith C. Brown,2008年版14.《投资神话》(Investing Myths, Legends and Other Tall Tales)作者:Alan Skrainka,Barry R. James,2004年版15.《升势股票的投资法则》(The Little Book That Beats the Market)作者:Joel Greenblatt,2005年版16.《个人投资的艺术》(The Art of Personal Investing)作者:John L. Marietta,2006年版17.《股票分析与筛选总论》(The Complete Guide to Fundamental Analysis)作者:Rajiv Jackson,2004年版18.《股东人本主义》(The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public)作者:Lynn A. Stout,2012年版19.《领袖的经济学》(Leadership Economics)作者:Sam Allred,2003年版20.《散户投资指南》(The Individual Investor's Guide to the T op Mutual Funds and ETFs 2007-2008)作者:Morningstar,2007年版21.《股票市场分析方法》(Technical Analysis of Stock Trends)作者:RobertD. Edwards,John Magee,W.H.C. Bassetti,2006年版22.《金融政策》(Monetary Policy)作者:Axel Weber,2011年版23.《证券分析的寻找未来》(Looking Forward: The New Science of Financial Success)作者:Kenneth G. Winans,2002年版24.《超越普通股票评级》(Beyond the Wall Street Journal Guide to Understanding Money and Investing)作者:Byron R. Wien,2001年版25.《股票市场的历史》(A History of the Stock Market)作者:Mark R. Shenkman,2005年版26.《个人理财》(Personal Finance)作者:E. Thomas Garman,Raymond E. Forgue,2009年版27.《投资之道(译本)》(The Intelligent Investor)作者:Benjamin Graham,2006年版28.《投资学》(Investments)作者:Bodie/Kane/Marcus,2008年版29.《股票投资商》(Stock Investing for Everyone)作者:David Holt,2003年版30.《修建股票投资的基础设施》(Building the Stock Investing Infrastructure)作者:Brad R. Houk,2003年版31.《投资幸存指南》(Survival Guide for Investors)作者:Karen Lee,2009年版32.《股票市场不是超自然场所》(The Stock Market is Not a Supernatural Place)作者:Nicholas J. Darvas,2005年版33.《外汇交易从零开始》(Forex from Scratch: A Quick Course on Tradingthe Foreign Exchange Markets)作者:Alex Douglas,2004年版34.《利用技术分析的股票投资》(Stock Investing with Technical Analysis)作者:Bollinger John,2001年版35.《股票市场之心》(The Heart of the Stock Market)作者:Marvin Appel,2002年版36.《股票投机》(Stock Speculation)作者:Henry Clews,2005年版37.《理解股票市场》(Understanding the Stock Market)作者:Marc Chandler,2003年版38.《利用技术分析洞察股票行情》(Technical Analysis for the Trading Professional)作者:Constance M. Brown,2009年版39.《股票市场投资艺术》(The Art of Investing in the Stock Market)作者:Evans Alonzo,2008年版40.《投资新博弈》(The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns)作者:Lois Peltz,1998年版41.《股票市场投资战略分析》(The Investor's Guide to Active Asset Allocation)作者:Kayes Neil,2008年版42.《金融与金融市场》(Finance and Financial Markets)作者:Keith Pilbeam,2006年版43.《英美经济史》(An Economic History of England: 1066-1990)作者:George Clark,2006年版44.《金融危机》(Financial Crises and What to Do About Them)作者:Barry Eichengreen,2002年版45.《马倌经济学家》(The Marek Fuchs Economist)作者:Marek Fuchs,2008年版46.《交叉货币汇率的利益与缺陷》(The Benefits and Flaws of Cross-Currency Exchange Rates)作者:Janet M. Gorrie,2009年版47.《股票交易时代》(Trading the Stock Market)作者:Tom Connor,2009年版48.《策略型股市投资》(Strategic Stock Trading)作者:Simon Vine,2002年版49.《稳盈股票交易》(Steady-State Stock Trading)作者:Keith Schap,2003年版50.《基于Silicon Valley思维的股票投资》(Venture Investing: Silicon Valley Thinking and Silicon Alley Investing)作者:David Kline,2009年版。

股票术语中英文对照以及解释套利 (Arbitrage)在不同的市场同时买入和卖出单一证券,以赚取差价。

资产 (Assets)公司的所有权,可以是有形的、无形的、固定或流动的。

自行处理权 (At Discretion)客户给经纪买或卖处理权的指示类型。

限额 (At Limit)客户给股票经纪不能买超过或卖低于某一价位的限制。

At The Market以现行价格买或卖证券的订单。

额定资本 (Authorized Capital)在公司联合备忘录中协订的实缴资本的最高金额。

平均 (Averaging)以不同的价格买或卖同样的股票的过程,以建立平均成本。

基本点(Basic Points)指债券收益率。

债券收益率中每一个百分点等于100个基本点。

如果债券收益率从7.25%变为7.39%,即升高了14个基本点。

熊市(Bear)预测股价将跌落而抛售股票。

熊市是股价下跌的延伸期,通常为下跌20%或更多。

牛市(Bull)预期股价将上扬而买入股票。

牛市表明市场持续上扬走势。

B系数(Beta)衡量股市风险的一种尺度。

0.7意味着股价可能按市场同样方向移动70%。

-1.3意味着股价可能与市场相反方向移动130%。

蓝筹股(Blue Chip)在投资中级别最高的普通股。

债券(Bond)记录借款的凭证,承诺在特定时间支付债券持有人特别利息,并于到期日偿还借款额。

发行红(利)股(Bonus Issue)以无偿发行股票的形式(通常是以资本项目)分配资金给股东。

簿记截止日(Book Closing Date)公司股东记录截止登记日,以决定股息、红利或附加股的授权。

簿记价值(Book value)公司资产簿记帐面价值。

簿记价值不必与购买成本或市场价值一致。

经纪费,佣金(Brokerage)股票经纪人因其买或卖股票服务而收取的费用。

业务循环(Business Cycle)经济活动的周期性变动,带动收入和就业变动。

确保买进(Buying-in)买入证券,而由卖方承担风险。

股票英语术语常用的股票英语术语:1.Stock/Share:股票,表示公司的所有权单位。

2.Equity:股本,代表公司所有权的总值。

mon Stock:普通股,享有公司盈利的分红权和投票权。

4.Preferred Stock:优先股,享有优先分红权,但通常没有投票权。

5.Dividend:股息,公司向股东支付的现金或股票形式的利润。

6.Market Capitalization:市值,公司所有股票的市场价值总和。

7.Bull Market:牛市,股票价格持续上涨的市场。

8.Bear Market:熊市,股票价格持续下跌的市场。

9.Stock Price:股票价格,指单股股票的交易价格。

10.IPO (Initial Public Offering):首次公开募股,公司首次在公开市场上发行股票。

11.Trading Volume:交易量,一定时间内买卖的股票数量。

12.Broker:经纪人,帮助投资者买卖股票的金融中介。

13.Portfolio:投资组合,投资者持有的所有股票和其他投资的总和。

14.Blue Chip Stock:蓝筹股,指大型、稳定且通常具有良好盈利记录的公司股票。

15.Penny Stock:低价股,价格极低的股票,通常具有较高的风险。

16.Growth Stock:成长股,指具有高增长潜力的公司股票。

17.Value Stock:价值股,指市场价格低于其内在价值的股票。

18.Market Maker:做市商,负责在交易市场上提供买卖报价并维持市场流动性的金融机构。

19.Technical Analysis:技术分析,通过分析历史价格和交易量数据来预测未来股价走势的方法。

20.Fundamental Analysis:基本面分析,通过分析公司的财务数据、经营情况和行业趋势来评估股票价值的方法。

我的投资目标英语作文带翻译Learn how to invest in the stock market.If you are a beginner or expert,before investing in the stock market,you can find basic and advanced trading skills and ideas about stock investment on this website.You'd better learn some investment market skills.In other words,understanding the market is necessary for beginners.Investment skills and ideas(how to start):to start investing in the stock market,you must choose A stockbroker a stockbroker who trades financial instruments on the stock market as an agent for a client.You know that many people have the same trading opportunities in the stock market,but very few of them make money in the stock market.Many of them can't earn enough returns and have enough information to invest in the stock market.They will make some common mistakes,and you should avoid these mistakes through a high level of understanding of the market.There are two ways to invest in the stock market:technical analysis and fundamental analysis.Technical analysis is based on price and trading volume.Technical investors believe that price and volume canexplain everything in the market.They study charts to predict future changes in stock prices or financial prices.Learning technical analysis does not require academic knowledge.Fundamental analysis is a kind of use of financial and trading volume Economic analysis to predict stock price changes stock valuation method idea:learn more technical tips:you can learn about Fibonacci sequence,Elliott wave theory,Dow Theory and other stock trading strategies stock market risk:what do you know about risk and how do you know that risk is quantifiable how to manage risk concept and management is investment capital A complex part of Automated Trading:you can learn and use trading software to automate your stock investment strategies.Many investors use stock trading software to control their emotions,so that they can focus on stock trading strategies.There are many other advantages to using trading software and systems,such as saving time and managing risks,enjoying making money on stocks.We hope you can get through the software Read and learn these skills and ideas to improve your understanding of the stock market.中文翻译:学习如何投资股市如果你是初学者或专家,在投资股市之前,你可以在这个网站找到关于股票投资的基本和高级交易技巧和想法,你最好学习一些投资市场的技巧,换句话说,了解市场是必需的初学者投资技巧和想法(如何开始):开始投资股票市场,你必须选择一个股票经纪人股票经纪人作为客户的代理人在股票市场上进行金融工具的交易。

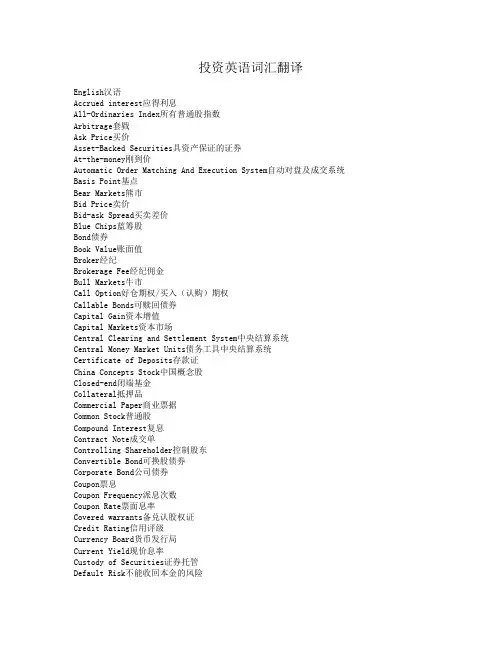

投资英语词汇翻译English汉语Accrued interest应得利息All-Ordinaries Index所有普通股指数Arbitrage套戥Ask Price买价Asset-Backed Securities具资产保证的证券At-the-money刚到价Automatic Order Matching And Execution System自动对盘及成交系统Basis Point基点Bear Markets熊市Bid Price卖价Bid-ask Spread买卖差价Blue Chips蓝筹股Bond债券Book Value账面值Broker经纪Brokerage Fee经纪佣金Bull Markets牛市Call Option好仓期权/买入(认购)期权Callable Bonds可赎回债券Capital Gain资本增值Capital Markets资本市场Central Clearing and Settlement System中央结算系统Central Money Market Units债务工具中央结算系统Certificate of Deposits存款证China Concepts Stock中国概念股Closed-end闭端基金Collateral抵押品Commercial Paper商业票据Common Stock普通股Compound Interest复息Contract Note成交单Controlling Shareholder控制股东Convertible Bond可换股债券Corporate Bond公司债券Coupon票息Coupon Frequency派息次数Coupon Rate票面息率Covered warrants备兑认股权证Credit Rating信用评级Currency Board货币发行局Current Yield现价息率Custody of Securities证券托管Default Risk不能收回本金的风险Derivative Call衍生认购(认沽)认股权证Derivative Instrument衍生产品Direct Business直接成交Discount Bond折扣债券Diversification分散风险Duration期限Earnings收益Earnings per Share每股盈利Earnings Yield盈利率Equity股本Equity Call Warrants股本认购认股权证Ex-dividend除息Face Value/ Nominal Value面值Fixed Rate Bonds定息债券Fixed-income securities定息证券Floating Rate Bonds浮息债券Fundamental Analysis基本分析Future Value未来值Future Value of an Annuity定期供款之未来值Futures contract期货合约Hang Seng China Enterprises index恒生香港中资企业指数Hang Seng Index香港恒生指数Hang Seng London Reference Index恒生伦敦参考指数Hedge对冲Hong Kong Inter-Bank Offered Rate香港银行同业拆息Hong Kong Monetary Authority香港金融管理局Hong Kong Securities Clearing Company Ltd.香港中央结算有限公司H-Share股HSI Futures Contract恒生指数期货合约Income收入Index Fund指数基金Initial Public Offering首次公开招股Inside Information内幕消息Insider Trading内幕交易Intrinsic Value内在价值Investment投资Investment Adviser投资顾问IPO price首次公开招股价Junk Bond垃圾债券Leverage Ratio杠杆比率Limit Order限价指示Limited Company有限公司Liquidity变现能力Listing挂牌Listing Date上市日期Margin Call补仓Market Capitalisation市价总值Market Maker庄家Market Order市场指示Money Market货币市场Mutual Fund互惠基金Net Asset Value资产净值Offer For Sale公开发售Offer For Subscription公开认购Open Offer公开供股Open-end开放基金Option期权Oversubscribed超额认购Par Bond平价债券Par Value票面值Perpetual Bonds永久债券Placing配售Portfolio投资组合Preference Shares优先股Premium溢价(认股证)Premium Bond溢价债券Present Value现时值Present Value of An Annuity定期供款之现时值Price/Earnings Ratio市盈率Privatisation私有化Professional Conduct Regulations专业操守规例Prospectus招股书Put Option淡仓期权/卖出(认沽)期权Rate of Return收期率Real Interest Rate实质利率Red Chip红筹股Redemption Value赎回价值Reinvestment Value再投资利率Relative Strength Index/RSI相对强弱指数Repurchase Agreement回购协议Resistance Level阻力价位Return回报Rights Issue供股发行Risk-Averse, Risk-Neutral, Risk-Taking风险厌恶,风险中立,追求风险Securities And Futures Commission证券及期货事务监察委员会Securities Dealers´ Representatives证券交易商SEHK联交所Senior Bond优先债券Settlement结算Short Hedge空头对冲Short Position空仓Short Selling抛空/沽空Speculation投机Stock Splits股票分拆Subordinated Bond后偿债券Substantial Shareholder大股东Support Level支持价位Technical Analysis技术分析The Stock Exchange of Hong Kong Ltd.香港联合交易所有限公司Time Horizon投资期Trading Hours of SEHK联合交易所的交易时间Trading Rules交易规则Trust Deed信托契约Underlying Security认股权证相关的股份Unified Exchange Compensation Fund Scheme联合交易所赔偿基金Valuation估价Warrant认股权证Window Dressing粉饰橱窗Yield盈利率Yield To Maturity到期孳息率Zero Coupon Bond无息债券。

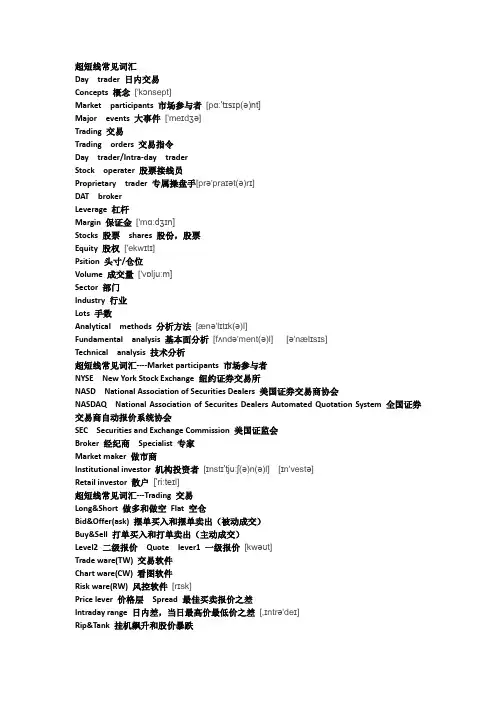

超短线常见词汇Day trader 日内交易Concepts 概念['kɔnsept]Market participants 市场参与者[pɑː'tɪsɪp(ə)nt]Major events 大事件['meɪdʒə]Trading 交易Trading orders 交易指令Day trader/Intra-day traderStock operater 股票接线员Proprietary trader 专属操盘手[prə'praɪət(ə)rɪ]DAT brokerLeverage 杠杆Margin 保证金['mɑːdʒɪn]Stocks 股票shares 股份,股票Equity 股权['ekwɪtɪ]Psition 头寸/仓位Volume 成交量['vɒljuːm]Sector 部门Industry 行业Lots 手数Analytical methods 分析方法[ænə'lɪtɪk(ə)l]Fundamental analysis 基本面分析[fʌndə'ment(ə)l] [ə'nælɪsɪs]Technical analysis 技术分析超短线常见词汇----Market participants 市场参与者NYSE New York Stock Exchange 纽约证券交易所NASD National Association of Securities Dealers 美国证券交易商协会NASDAQ National Association of Securites Dealers Automated Quotation System 全国证券交易商自动报价系统协会SEC Securities and Exchange Commission 美国证监会Broker 经纪商Specialist 专家Market maker 做市商Institutional investor 机构投资者[ɪnstɪ'tjuːʃ(ə)n(ə)l] [ɪn'vestə]Retail investor 散户['riːteɪl]超短线常见词汇---Trading 交易Long&Short 做多和做空Flat 空仓Bid&Offer(ask) 摆单买入和摆单卖出(被动成交)Buy&Sell 打单买入和打单卖出(主动成交)Level2 二级报价Quote lever1 一级报价[kwəʊt]Trade ware(TW) 交易软件Chart ware(CW) 看图软件Risk ware(RW) 风控软件[rɪsk]Price lever 价格层Spread 最佳买卖报价之差Intraday range 日内差,当日最高价最低价之差[,ɪntrə'deɪ]Rip&Tank 挂机飙升和股价暴跌超短线常见词汇---Trading orders 交易指令Limit order 限价指令Limit buy/Limit sell 限制购买/限制出售Stop order 止损指令Order routing 买卖盘传递/指令路由['ru:tiŋ]Hybrid trading 混合交易制度['haɪbrɪd]Trading mechanism 交易机制['mek(ə)nɪz(ə)m]经济新闻词汇(一)Blue chip shares 热门股票Blue chip stocks 蓝筹股Bearish 看跌的,卖空的['beərɪʃ]Bears 空头Bullish 看多的,牛市的['bʊlɪʃ]Bulls 多头Rally 价格止跌回稳['rælɪ]Recover 恢复经济新闻词汇(二)在证券交易所Active trading 交易活跃Moderate trading 交易适度['mɒd(ə)rət]Over/excessive trading 过度交易[ɪk'sesɪv]Change hands 易手,交易成功Turnover 成交金额['tɜːnəʊvə]经济新闻词汇(三)Dull 乏味的,阴沉的,低沉的,笨的Hesitant 迟疑的,犹豫不定的['hezɪt(ə)nt]Lackluster 无光泽的,死气沉沉的,无生气的['læk,lʌstə] Light 轻的Negligible 可以忽略不计的['neglɪdʒɪb(ə)l]Quiet 安静的,轻声的Slow 慢的,不忙碌的Sluggish 怠慢的['slʌgɪʃ]Thin薄,细,瘦,稀薄Weak 虚弱的能力差的经济新闻词汇(四)股票的价格趋向不清晰时,用下列形容词Bumpy 颠簸的,起伏不平的['bʌmpɪ]Choppy 波涛汹涌的['tʃɒpɪ]Hesitant 迟疑的,犹豫不定的Mixed 混合的,形形色色的,弄糊涂的[mɪkst] Uncertain 不定的,不可靠的[ʌn'sɜːt(ə)n]。

投资词汇中英对照投资词汇中英对照:SEHK联交所SeniorBond优先债券Settlement结算ShortHedge空头对冲ShortPosition空仓ShortSelling抛空/沽空Speculation投机StockSplits股票分拆SubordinatedBond后偿债券SubstantialShareholder大股东SupportLevel支持价位TechnicalAnalysis技术分析TheStockExchangeofHongKongLtd.香港联合交易所有限公司TimeHorizon投资期TradingHoursofSEHK联合交易所的交易时间TradingRules交易规则TrustDeed信托契约UnderlyingSecurity认股权证相关的股份UnifiedExchangeCompensationFundScheme联合交易所赔偿基金Valuation估价Warrant认股权证WindowDressing粉饰橱窗Yield盈利率YieldToMaturity到期孳息率ZeroCouponBond无息债券Accruedinterest应得利息All-OrdinariesIndex所有普通股指数Arbitrage套戥AskPrice买价Asset-BackedSecurities具资产保证的证券At-the-money刚到价AutomaticOrderMatchingAndExecutionSystem自动对盘及成交系统BasisPoint基点BearMarkets熊市BidPrice卖价Bid-askSpread买卖差价BlueChips蓝筹股Bond债券BookValue账面值Broker经纪BrokerageFee经纪佣金BullMarkets牛市CallOption好仓期权/买入(认购)期权CallableBonds可赎回债券CapitalGain资本增值CapitalMarkets资本市场CentralClearingandSettlementSystem中央结算系统CentralMoneyMarketUnits债务工具中央结算系统CertificateofDeposits存款证ChinaConceptsStock中国概念股Closed-end闭端基金Collateral抵押品CommercialPaper商业票据CommonStock普通股CompoundInterest复息ContractNote成交单ControllingShareholder控制股东ConvertibleBond可换股债券CorporateBond公司债券Coupon票息CouponFrequency派息次数CouponRate票面息率Coveredwarrants备兑认股权证CreditRating信用评级CurrencyBoard货币发行局CurrentYield现价息率CustodyofSecurities证券托管DefaultRisk不能收回本金的风险DerivativeCall衍生认购(认沽)认股权证DerivativeInstrument衍生产品DirectBusiness直接成交DiscountBond折扣债券Diversification分散风险Duration期限Earnings收益EarningsperShare每股盈利EarningsYield盈利率Equity股本EquityCallWarrants股本认购认股权证Ex-dividend除息FaceValue/NominalValue面值FixedRateBonds定息债券Fixed-incomesecurities定息证券FloatingRateBonds浮息债券FundamentalAnalysis基本分析FutureValue未来值FutureValueofanAnnuity定期供款之未来值Futurescontract期货合约HangSengChinaEnterprisesindex恒生香港中资企业指数HangSengIndex香港恒生指数HangSengLondonReferenceIndex恒生伦敦参考指数Hedge对冲HongKongInter-BankOfferedRate香港银行同业拆息HongKongMonetaryAuthority香港金融管理局HongKongSecuritiesClearingCompanyLtd.香港中央结算有限公司H-Share股HSIFuturesContract恒生指数期货合约Income收入IndexFund指数基金InitialPublicOffering首次公开招股InsideInformation内幕消息InsiderTrading内幕交易IntrinsicValue内在价值Investment投资InvestmentAdviser投资顾问IPOprice首次公开招股价JunkBond垃圾债券LeverageRatio杠杆比率LimitOrder限价指示LimitedCompany有限公司Liquidity变现能力Listing挂牌ListingDate上市日期MarginCall补仓MarketCapitalisation市价总值MarketMaker庄家MarketOrder市场指示MoneyMarket货币市场MutualFund互惠基金NetAssetValue资产净值OfferForSale公开发售OfferForSubscription公开认购OpenOffer公开供股Open-end开放基金Option期权Oversubscribed超额认购ParBond平价债券ParValue票面值PerpetualBonds永久债券Placing配售Portfolio投资组合PreferenceShares优先股Premium溢价(认股证)PremiumBond溢价债券PresentValue现时值PresentValueofAnAnnuity定期供款之现时值Price/EarningsRatio市盈率Privatisation私有化ProfessionalConductRegulations专业操守规例Prospectus招股书PutOption淡仓期权/卖出(认沽)期权RateofReturn收期率RealInterestRate实质利率RedChip红筹股RedemptionValue赎回价值ReinvestmentValue再投资利率RelativeStrengthIndex/RSI相对强弱指数RepurchaseAgreement回购协议ResistanceLevel阻力价位Return回报RightsIssue供股发行Risk-Averse,Risk-Neutral,Risk-Taking风险厌恶,风险中立,追求风险SecuritiesAndFuturesCommission证券及期货事务监察委员会SecuritiesDealers´Representatives证券交易商。

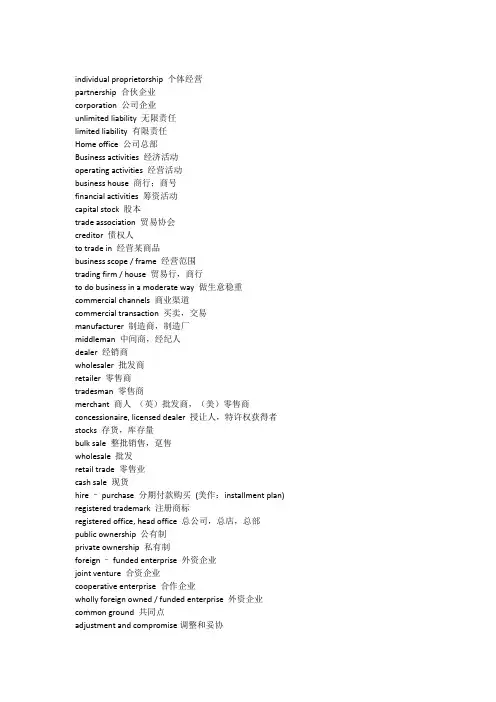

individual proprietorship 个体经营partnership 合伙企业corporation 公司企业unlimited liability 无限责任limited liability 有限责任Home office 公司总部Business activities 经济活动operating activities 经营活动business house 商行;商号financial activities 筹资活动capital stock 股本trade association 贸易协会creditor 债权人to trade in 经营某商品business scope / frame 经营范围trading firm / house 贸易行,商行to do business in a moderate way 做生意稳重commercial channels 商业渠道commercial transaction 买卖,交易manufacturer 制造商,制造厂middleman 中间商,经纪人dealer 经销商wholesaler 批发商retailer 零售商tradesman 零售商merchant 商人(英)批发商,(美)零售商concessionaire, licensed dealer 授让人,特许权获得者stocks 存货,库存量bulk sale 整批销售,趸售wholesale 批发retail trade 零售业cash sale 现货hire – purchase 分期付款购买(美作:installment plan) registered trademark 注册商标registered office, head office 总公司,总店,总部public ownership 公有制private ownership 私有制foreign – funded enterprise 外资企业joint venture 合资企业cooperative enterprise 合作企业wholly foreign owned / funded enterprise 外资企业common ground 共同点adjustment and compromise调整和妥协common interest 共同利益advantageous contract 有利的合同bargaining range 谈判范围concede ground 让步,屈服bargaining strength 谈判实力concession trading 让步贸易bargaining 讨价还价conflicting interests利益冲突basic interests基本利益conflicting objectives冲突的目标behavioral norms 行为规范core outcomes 核心结果bottom line 谈判底线defensive - offensive posture 防守—进攻立场breakdown in negotiation 谈判破裂collective well - being 集体利益difficult decisions 决策困难dogmatic negotiator 独断的谈判者negotiation sketch 谈判简图equitable agreement 公平合理的协议negotiation skills 谈判技巧exaggerated positions 言过其实的的立场on the routine basis 在惯例的基础上expected benefits 期待的谈判结果one-off business 一锤子买卖face-to-face negotiation 面对面谈判opening position 初步价位factual information 实际信息optimal timing 最佳时机fail to reach any agreement 无法达成协议optimize the interests使利益最优化pull tricks 耍花招failure of negotiation 谈判失败renounce a negotiation 放弃谈判favorable outcomes 利好结果reservation price 保留价格give-and-take 给予和索取room for maneuver 周旋的余地good joint outcome 互惠的共同结果rough style 激烈的谈判风格scheduling of concessions 让步进程information loophole 信息空缺settle differences 解决分歧sham position 虚假立场signal firmness 表现出坚定立场knock-down fight 强力反击stakes 投资资金leverage 手段,优势straight compromise 彻底妥协mange concessions 掌握让步的分寸strategic activity 策略活动strategic ploy 战略手段margins of maneuver 机动空间strategy formulation 策略构想marked disadvantage 明显的劣势stumbling block 绊脚石maximize the interests 使利益最大化successful implementation 成功实施tactical moves 谈判技巧minimum level of acceptance 最底的接受底线terms and conditions 条款和条件negotiation processes 谈判过程access to power 利用权力choice assignments 选择权的分配achieve recognition 得到公认continual compliance 一味迁就acquire power 获取权力courage under fire 应对责难的勇气analytical ability 分析能力create opportunities 创造机会breed resistance 导致怨恨critical task 重要任务breed resistance 导致反抗decisional role 决策作用build reputation 树立威信delegate responsibilities 授权build trusting relationships 建立依赖关系direct intervention 直接干预eliminate the bottleneck 消除瓶颈问题chaotic situation 混乱局面enhance the power 增强权力norm of reciprocity 互利互惠的规范exert influence 施加影响exert information 提取信息office layout 办公室布局follow directions 遵从指示organizational capacity 组织目标formal influence 正式影响organizational principle 组织原则gain power 获得权力organizational structure 组织结构give recommendation 提供建议organizationally ambitious 对组织工作有远大抱负的good judgment 正确的判断organization’s ends 组织目标higher-up 上级personal attractiveness 个人魅力holder of an office 公职人员power acquisition 赢得权力individual goal 个人目标power seeker 权力的追求者induce cooperation 促使合作pressing deskwork 紧迫的案头工作informal influence 非正式影响promote visibility 提高显著程度informational function 信息功能public speaking skills 演讲技能interactions 相互交流relevance of the work 工作的实用性interpersonal activities 交际活动leader power 领导权力sense of timing 选择时机的意识leadership arts 领导艺术serve on committee 在委员会任职leadership position 领导职位sheer willingness 完全积极主动leadership responsibility 领导责任show one’s stuff 展现自我leadership science 领导科学sincere interest 真诚的兴趣legitimate reason 正当理由sneaky tactics 卑鄙的手段low-power position 低等的权利职务subgroup goal 子群体目标subordinate 下属make a good impression 留下好印象technical decision-making 技术决策technical expertise 专业技术managerial job 管理工作managerial skills 管理技能workers’ grievnances 工人的抱怨net influence 净影响account holder 开户人account number 账号automatic teller machine 自动取款机average rate of interest 平均利率balance 余额bank depositor 银行储户bank teller 银行出纳员banking regulations 银行管理制度bounce burglar alarm 被银行退票cancelled check 防盗警报certificate of deposit 已注销的支票checking account 存单close an account 结清账户demand account 活期账户demand deposit 活期存款deposit inducement 吸纳存款deposit interest 银行利息depositor 存款人deposit 存款overdrawn 透支的paid check 已付支票passbook saving 存折储蓄payee 收款人petty current deposit 小额活期存款predetermined maturity 预先规定的到期日rate limit 利率限制receiving teller 收款员record keeping 记账saver 储户saving account 储蓄账户saving deposit 储蓄存款savings bank 储蓄银行service charge 服务费source of funding 资金来源statement 结算清单early withdrawal 提前取款effective overall cost 实际总成本explicit interest 现付利息fixed maturity 规定到期日fixed rate 固定利率flexible maturity 灵活到期日insufficient funds 资金不足interest penalty 罚息interest – bearing deposit 计息liquidity reserves 流动性储备资金make additions 增加存款make withdrawals 提款maturity 到期日negotiable certificates of deposit 可转让存单negotiable instrument 流通票据negotiable order of withdrawal accounts 可转让提款单账户nonnegotiable 不能转让的note circulation 钞票流通open an account 开户头a order of withdrawal 提款命令out of business 破产outstanding check 未竞现支票overdrawn account 透支账户stop payment order 止付令stopping payment on a check 停付支票terminate the account 结束账户time deposit 定期存款trustworthy 可依赖的uniformed guard 便衣保安unobstructed counter 没有障碍的护栏variable – rate 浮动利率vaults 保管库volume of deposits 存款量withdrawal application 提款申请withdrawal order 提款命令,支取单withdrawal receipt 提款收据withdrawal 取款working balance 往来余额accounting 会计、会计学financial transactions 金融交易financial statements 财务报表public accountant 公共会计师、会计师certified public accountant 执业会计师Accepted Accounting Principles 公认会计原则audit 审计statement 报表periodic statements 定期报表balance sheet 资产负债表income statement 收益表、损益表asset accounts 资产账户current assets 流动资产revenue 收入、收益expenses 支出、开支net income 净利润operating income 营业收入interest expense 利息支出income before tax 税前收入gross profit 毛利depreciation 折旧accumulated depreciation 累计折旧owner’s equity 业主权益、业主产权bad debt 坏账备抵savings and loans 储蓄与放款、信用合作社brokerage firms 经纪人事务所control operations 控制经营活动cost – effectiveness balance 成本效益平衡原则creditor 债权人net profit margin 纯利润率notes payable 应付票据posting 过账solvency 偿付能力working capital 运营资本、流动资本informed decisions 精明的决策internal control 内部控制原则account payable 应付账款accounts receivable 应收账款accumulated deficit 累计亏损absentee ballot 缺席投票balance sheet 资产负债表better returns 更好的回报broker 股票经纪人business prospects 业务展望buy a call 买进期权call price 股票购进价格chart 走势图common stock 普通股company effect 公司的影响core businesses 核心行业current price of gold 黄金现价current share price 股票现价dividend 股息dominant factor 决定因素draw lines to find resistance 找阻力线draw lines to find support 找支持势线draw lines to find trends 画走势线earnings outlook 盈利潜能earnings per share 第股盈利earnings trend 赢利趋势economic uncertainty 经济不稳定exercise price 认购价exercise the option 行使有关期权external factor 外在因素financial ratios 财务比率financial strength 财务实力forward contract 远期合同fundamental analysis 基本面分析fundamental of the company 公司的基本面future price movement 未来股价走势futures contract 期货合同hire-purchase company 租赁信托公司historical records 历史记录income statement 损益表stock return 股票回报stock trading 股票交易strong economic growth强势经济增长superior returns 优厚的回报supply-demand balance 供求平衡sustain a loss 蒙受亏损balance sheet items 资产与负债表的项目indicator 指标,指数information economy 信息经济initial public stock offerings 公开发行的原始股intrinsic value 实际价值investor 投资人issue additional stock 增发股票joint stock company 合股公司market factor 市场因素market movement 市场行情market prices 市场价格market system 市场经济体制move in a uptrend 持续攀升normal economic forces 正常经济力量option 期权overwhelming evidence 非常明确的证据part – owner 合伙股东price movements 股价走势price of a stock 股价price of the call 买进期权的价格price of the put 卖出期权的价格price – earnings ratio 价格收益比率professional investor 专业投资者proxy 代理投票sell short the shares 卖空股票sequence of analysis 分析的先后顺序share price 股价shareholder 股东size of the loss 亏损程度stock exchange 证券交易所stock information 股票信息stock market 股市stock price 股价tech stock 高科技股票technical analysis 技术分析undervalued 贬值的unstableness of market 市场不稳定upward price trend 股价逐步升高volume of a stock 成交量voting power 表决权share, equity, stock 股票、股权bond, debenture, debts 债券negotiable share 可流通股份convertible bond 可转换债券treasury/ government bond 国库券/ 政府债券corporate bond 企业债券closed – end securities investment fund封闭式证券投资基金open – end securities investment fund 开放式证券投资基金fund manager 基金经理/ 管理公司fund custodian bank 基金托管银行market capitalization 市值p/ e (price/ earning) ratio 市盈率mark – to – market 逐日盯市payment versus delivery 银券交付clearing and settlement 清算/ 结算commodity/ financial derivatives 商品/ 金融衍生产品put/ call option 看跌/ 看涨期权margins, collateral 保证金rights issue/ offering 配股bonus share 红股dividend 红利/ 股息ADR (American Depository Receipt) 美国存托凭证/ 存股证GDR (Global Depository Receipt) 全球存托凭证/ 存股证retail/ private investor 个人投资者/ 散户institutional investor 机构投资者broker/ dealer 券商proprietary trading 自营insider trading/ dealing 内幕交易market manipulation 市场操纵prospectus 招股说明书IPO (Initial Public Offering) 新股/ 初始公开发行merger and acquisition 收购兼并marketing concept 营销观念,营销概念marketing program 营销计划marketing mix 营销组合marketing channel 营销渠道marketing research 市场调研,营销调研target market 目标市场marketer 市场商人,商家production-oriented 面向生产的consumer-oriented 面向消费者的consumer satisfaction 消费者感到满意distribution system 销售系统,分销渠道distribution channel 销售渠道sales force 销售队伍promotion 促销advertising 广告personal selling 向个人推销publicity 宣传,媒体宣传sales promotion 促销promotion activity 促销活动demonstration 展示,展示会sweepstake 抽奖free sample 免费赠送的样品coupon 赠券,订货附单resaler 转售商intermediary 中间商,中间人middleman 中间商,中间人mass selling 大批销售research method 研究方法potential customer 潜在客户primary data 原始数据,原始资料,第一手资料consumer reaction 消费者的反应inventory control 存货,库存warehousing 仓储storing 储存grading 分类,分级risk taking 承担风险wholesale 批发retail 零售to identify customer needs 认清客户需求to obtain information 获得信息to collect/ gather data 收集资料to interpret data 分析资料to run the risk of failure 冒失败的风险tangible product 有形产品intangible product 无形产品consumer product 消费产品industrial product 工业产品,供工业使用的产品competing product 竞争产品sample product 样品产品potential product 潜在产品life cycle of a product 产品生命周期introduction 引入期growth 成长期maturity 成熟期decline 衰退期potential profitability 潜在获利可能性marketing mix 营销组合promotion 促销promotion cost 促销成本gross national product (GNP) 国民生产总值research and development (R&D) 研究与开发market research 市场调查product development 产品开发text marketing 试营销customer loyalty 顾客忠诚度distribution channels 销售渠道consumer taste 消费者爱好buying motive 购买动机purchasing habits 购买习惯expert examination专家鉴定opinion leader 引导舆论的专家或行家packaging 包装brand 商标,牌号label 标识,标签to make a purchase 购买to fend off competitors 排除竞争者to break even 收支相抵,持平to meet the needs and expectations of customers 满足消费者的需求和期望to be outdated 过时ad valorem tariff 从价关税balance of payment 国际收支balance – of – payments deficit 国际收支逆差bill of exchange 汇票business norms 商业准则capital resources 资本财源commercial credit 商业信用competitive advantage 竞争优势conflicts of interest 利益矛盾consumer protection 消费者保护currency 货币customs duty 关税deficit 逆差depreciate 贬值documentary credit 跟单信用证domestic demand 国内需求domestic trade 国内贸易dominate 支配,占优势dumping 倾销economic motivation 经济动机encash 兑现ethnocentric 种族中心倾向excessive interventionism 过度干预主义exchange rate 兑换率export intelligence department 出口信息部export market 出口市场export subsidies 出口补贴exportable commodities 可供出口的商品favorable balance of payments 国际收支顺差financial assistance 财政资助fluctuation 波动foreign currency 外币free interflow 自由流通free trading system 自由贸易体系government intervention 政府干预government purchases政府采购high technology 高科技技术import commitment 进口承诺importing agent 进口代理商importing and exporting firms 进出口公司importing channel 进口渠道independent currency system 独立货币体系infant industry argument 幼稚工业保护论international trade 国际贸易intervene with trade 干预贸易interventionist 干涉主义者invisible trade 无形贸易locally produced products 本地生产的产品market economy 市场经济mercantilism 营利主义mercantilist theory 重商主义者的理论merchant 商人monetary conversion 货币兑换national security 国家安全nonsubsidized industry 非补贴工业profit margins 利润幅度quota 配额redistribution of resources 资源重新分配register of shipping 船籍登记relative differences 相对差异retaliatory tariff 报复性关税run deficits 遭受逆差separate treatment 分别对待start – up period 起步阶段surplus 顺差tariff for retaliation 报复关税tariff 关税technical assistance 技术协助trade barrier 贸易壁垒Trade Protectionism 贸易保护主义trade restrictions 贸易限制trade surplus 贸易顺差trade theory 贸易理论trade – expanding devices 贸易扩张手段trade – restricting devices 贸易限制手段trading partner 贸易伙伴unfamiliar territories 陌生的地域unfavorable 逆差的values of imports 进口价值visible trade 有形贸易welfare economy 福利经济welfare state 福利国家career planning 职业计划career path 职业道路career development 职业发展self-assessment 自我评价career anchors 职业动机incentive compensation 奖金profit sharing 分红制frequency rate 频率stress 紧张role conflict 角色冲突union 工会local union 地方工会craft union 行业工会industrial union 产业工会national union 全国工会bargaining union 谈判组collective bargaining 劳资谈判arbitration 仲裁strike 罢工internal employee relations 内部员工关系discipline 纪律disciplinary action 纪律处分grievance 申诉demotion 降职transfer 调动promotion 晋升corporate culture 企业文化organizational culture 企业文化esprit de corps [法]团结精神;集体精神sense of identity 认同感sense of togetherness 团结一致的感觉shared values 员工共同拥有的价值观念organizational motto 企业格言role models 模范;学习榜样number 1 rule 最重要的规则;头等大事informal system of rules 不成文的规章制度bureaucracy 官僚主义company uniform 公司制服probation period 试用期proving period 证明自己的阶段;试用期standard of performance 衡量工作表现或业绩的标准quality product 优质产品timely service 及时服务rites and rituals 仪式employee stock ownership plan 员工拥有股份的计划profit-sharing program 利润分享方案to indoctrinate 灌输信仰或意识to brainwash 洗脑to communicate culture 传播企业文化to promote corporate culture 促进企业文化to fashion a specific value system 形成具体的价值体系to emulate somebody 学习某人to motivate employees 激励员工organization development, OD 组织发展survey feedback 调查反馈quality circles 质量圈management by objective, MBO 目标管理Total Quality Management, TQM 全面质量管理team building 团队建设cohesive force in enterprise 企业凝聚力detail management 细节管理core value 核心价值corporate principle 企业准则organizational effectiveness 机构效能result oriented 结果定向stability 稳定性innovation 创新initiative 主动human relationship 人际关系competitive 竞争enterprising 进取心loyalty 忠诚ambition 雄心cooperation 合作integrity 诚信teamwork 团队execution 执行tenacity 坚韧glory 辉煌ethics 道德标准business concept 经营理念cohesive force in enterprise 企业凝聚力corporate image (CI) / enterprise image 企业形象EOI 意向申请。

十本你必须读的投资类书籍投资是一个复杂而高风险的领域,需要深入的知识和洞察力才能获得成功。

为了帮助你更好地理解投资的本质和技巧,下面是十本你必须读的投资类书籍。

1. 《聪明的投资者》(The Intelligent Investor)- 本·格雷厄姆(Benjamin Graham)作为一本经典之作,这本书教会了读者如何以价值投资的方法来选择股票和证券。

格雷厄姆的理论和策略仍然被广泛应用于当今的股市。

2. 《投资者的工具箱》(The Little Book of Common Sense Investing)- 约翰·博格尔(John C. Bogle)博格尔是指数基金的创始人,他通过这本书向读者展示了通过低成本、长期的指数投资策略来取得成功的重要性。

这本书强调了投资者应该专注于长期投资而不是短期赌博。

3. 《华尔街的顿悟》(A Random Walk Down Wall Street)- 伯顿·马尔基尔(Burton Malkiel)马尔基尔解释了市场的随机性以及如何利用指数基金和长期持有来实现长期投资的成功。

这本书在解释个人投资者如何击败市场方面提供了一些重要的洞见。

4. 《股票市场的常识》(Common Stocks and Uncommon Profits)-菲利普·费舍(Philip Fisher)费舍是一位著名的价值投资者,他通过这本书向读者介绍了他的投资方法和对公司分析的重要性。

这本书的内容对于那些想要了解公司基本面和投资于高质量股票的人来说非常有价值。

5. 《巴菲特致股东的信》(Berkshire Hathaway Letters to Shareholders)- 沃伦·巴菲特(Warren Buffett)这本书收集了巴菲特在股东信中对投资哲学和企业管理的见解。

通过阅读巴菲特的思考和行动,读者可以学到很多关于投资和价值创造的重要教训。

individual proprietorship 个体经营partnership 合伙企业corporation 公司企业unlimited liability 无限责任limited liability 有限责任Home office 公司总部Business activities 经济活动operating activities 经营活动business house 商行;商号financial activities 筹资活动capital stock 股本trade association 贸易协会creditor 债权人to trade in 经营某商品business scope / frame 经营范围trading firm / house 贸易行,商行to do business in a moderate way 做生意稳重commercial channels 商业渠道commercial transaction 买卖,交易manufacturer 制造商,制造厂middleman 中间商,经纪人dealer 经销商wholesaler 批发商retailer 零售商tradesman 零售商merchant 商人(英)批发商,(美)零售商concessionaire, licensed dealer 授让人,特许权获得者stocks 存货,库存量bulk sale 整批销售,趸售wholesale 批发retail trade 零售业cash sale 现货hire – purchase 分期付款购买(美作:installment plan) registered trademark 注册商标registered office, head office 总公司,总店,总部public ownership 公有制private ownership 私有制foreign – funded enterprise 外资企业joint venture 合资企业cooperative enterprise 合作企业wholly foreign owned / funded enterprise 外资企业common ground 共同点adjustment and compromise调整和妥协common interest 共同利益advantageous contract 有利的合同bargaining range 谈判范围concede ground 让步,屈服bargaining strength 谈判实力concession trading 让步贸易bargaining 讨价还价conflicting interests利益冲突basic interests基本利益conflicting objectives冲突的目标behavioral norms 行为规范core outcomes 核心结果bottom line 谈判底线defensive - offensive posture 防守—进攻立场breakdown in negotiation 谈判破裂collective well - being 集体利益difficult decisions 决策困难dogmatic negotiator 独断的谈判者negotiation sketch 谈判简图equitable agreement 公平合理的协议negotiation skills 谈判技巧exaggerated positions 言过其实的的立场on the routine basis 在惯例的基础上expected benefits 期待的谈判结果one-off business 一锤子买卖face-to-face negotiation 面对面谈判opening position 初步价位factual information 实际信息optimal timing 最佳时机fail to reach any agreement 无法达成协议optimize the interests使利益最优化pull tricks 耍花招failure of negotiation 谈判失败renounce a negotiation 放弃谈判favorable outcomes 利好结果reservation price 保留价格give-and-take 给予和索取room for maneuver 周旋的余地good joint outcome 互惠的共同结果rough style 激烈的谈判风格scheduling of concessions 让步进程information loophole 信息空缺settle differences 解决分歧sham position 虚假立场signal firmness 表现出坚定立场knock-down fight 强力反击stakes 投资资金leverage 手段,优势straight compromise 彻底妥协mange concessions 掌握让步的分寸strategic activity 策略活动strategic ploy 战略手段margins of maneuver 机动空间strategy formulation 策略构想marked disadvantage 明显的劣势stumbling block 绊脚石maximize the interests 使利益最大化successful implementation 成功实施tactical moves 谈判技巧minimum level of acceptance 最底的接受底线terms and conditions 条款和条件negotiation processes 谈判过程access to power 利用权力choice assignments 选择权的分配achieve recognition 得到公认continual compliance 一味迁就acquire power 获取权力courage under fire 应对责难的勇气analytical ability 分析能力create opportunities 创造机会breed resistance 导致怨恨critical task 重要任务breed resistance 导致反抗decisional role 决策作用build reputation 树立威信delegate responsibilities 授权build trusting relationships 建立依赖关系direct intervention 直接干预eliminate the bottleneck 消除瓶颈问题chaotic situation 混乱局面enhance the power 增强权力norm of reciprocity 互利互惠的规范exert influence 施加影响exert information 提取信息office layout 办公室布局follow directions 遵从指示organizational capacity 组织目标formal influence 正式影响organizational principle 组织原则gain power 获得权力organizational structure 组织结构give recommendation 提供建议organizationally ambitious 对组织工作有远大抱负的good judgment 正确的判断organization’s ends 组织目标higher-up 上级personal attractiveness 个人魅力holder of an office 公职人员power acquisition 赢得权力individual goal 个人目标power seeker 权力的追求者induce cooperation 促使合作pressing deskwork 紧迫的案头工作informal influence 非正式影响promote visibility 提高显著程度informational function 信息功能public speaking skills 演讲技能interactions 相互交流relevance of the work 工作的实用性interpersonal activities 交际活动leader power 领导权力sense of timing 选择时机的意识leadership arts 领导艺术serve on committee 在委员会任职leadership position 领导职位sheer willingness 完全积极主动leadership responsibility 领导责任show one’s stuff 展现自我leadership science 领导科学sincere interest 真诚的兴趣legitimate reason 正当理由sneaky tactics 卑鄙的手段low-power position 低等的权利职务subgroup goal 子群体目标subordinate 下属make a good impression 留下好印象technical decision-making 技术决策technical expertise 专业技术managerial job 管理工作managerial skills 管理技能workers’ grievnances 工人的抱怨net influence 净影响account holder 开户人account number 账号automatic teller machine 自动取款机average rate of interest 平均利率balance 余额bank depositor 银行储户bank teller 银行出纳员banking regulations 银行管理制度bounce burglar alarm 被银行退票cancelled check 防盗警报certificate of deposit 已注销的支票checking account 存单close an account 结清账户demand account 活期账户demand deposit 活期存款deposit inducement 吸纳存款deposit interest 银行利息depositor 存款人deposit 存款overdrawn 透支的paid check 已付支票passbook saving 存折储蓄payee 收款人petty current deposit 小额活期存款predetermined maturity 预先规定的到期日rate limit 利率限制receiving teller 收款员record keeping 记账saver 储户saving account 储蓄账户saving deposit 储蓄存款savings bank 储蓄银行service charge 服务费source of funding 资金来源statement 结算清单early withdrawal 提前取款effective overall cost 实际总成本explicit interest 现付利息fixed maturity 规定到期日fixed rate 固定利率flexible maturity 灵活到期日insufficient funds 资金不足interest penalty 罚息interest – bearing deposit 计息liquidity reserves 流动性储备资金make additions 增加存款make withdrawals 提款maturity 到期日negotiable certificates of deposit 可转让存单negotiable instrument 流通票据negotiable order of withdrawal accounts 可转让提款单账户nonnegotiable 不能转让的note circulation 钞票流通open an account 开户头a order of withdrawal 提款命令out of business 破产outstanding check 未竞现支票overdrawn account 透支账户stop payment order 止付令stopping payment on a check 停付支票terminate the account 结束账户time deposit 定期存款trustworthy 可依赖的uniformed guard 便衣保安unobstructed counter 没有障碍的护栏variable – rate 浮动利率vaults 保管库volume of deposits 存款量withdrawal application 提款申请withdrawal order 提款命令,支取单withdrawal receipt 提款收据withdrawal 取款working balance 往来余额accounting 会计、会计学financial transactions 金融交易financial statements 财务报表public accountant 公共会计师、会计师certified public accountant 执业会计师Accepted Accounting Principles 公认会计原则audit 审计statement 报表periodic statements 定期报表balance sheet 资产负债表income statement 收益表、损益表asset accounts 资产账户current assets 流动资产revenue 收入、收益expenses 支出、开支net income 净利润operating income 营业收入interest expense 利息支出income before tax 税前收入gross profit 毛利depreciation 折旧accumulated depreciation 累计折旧owner’s equity 业主权益、业主产权bad debt 坏账备抵savings and loans 储蓄与放款、信用合作社brokerage firms 经纪人事务所control operations 控制经营活动cost – effectiveness balance 成本效益平衡原则creditor 债权人net profit margin 纯利润率notes payable 应付票据posting 过账solvency 偿付能力working capital 运营资本、流动资本informed decisions 精明的决策internal control 内部控制原则account payable 应付账款accounts receivable 应收账款accumulated deficit 累计亏损absentee ballot 缺席投票balance sheet 资产负债表better returns 更好的回报broker 股票经纪人business prospects 业务展望buy a call 买进期权call price 股票购进价格chart 走势图common stock 普通股company effect 公司的影响core businesses 核心行业current price of gold 黄金现价current share price 股票现价dividend 股息dominant factor 决定因素draw lines to find resistance 找阻力线draw lines to find support 找支持势线draw lines to find trends 画走势线earnings outlook 盈利潜能earnings per share 第股盈利earnings trend 赢利趋势economic uncertainty 经济不稳定exercise price 认购价exercise the option 行使有关期权external factor 外在因素financial ratios 财务比率financial strength 财务实力forward contract 远期合同fundamental analysis 基本面分析fundamental of the company 公司的基本面future price movement 未来股价走势futures contract 期货合同hire-purchase company 租赁信托公司historical records 历史记录income statement 损益表stock return 股票回报stock trading 股票交易strong economic growth强势经济增长superior returns 优厚的回报supply-demand balance 供求平衡sustain a loss 蒙受亏损balance sheet items 资产与负债表的项目indicator 指标,指数information economy 信息经济initial public stock offerings 公开发行的原始股intrinsic value 实际价值investor 投资人issue additional stock 增发股票joint stock company 合股公司market factor 市场因素market movement 市场行情market prices 市场价格market system 市场经济体制move in a uptrend 持续攀升normal economic forces 正常经济力量option 期权overwhelming evidence 非常明确的证据part – owner 合伙股东price movements 股价走势price of a stock 股价price of the call 买进期权的价格price of the put 卖出期权的价格price – earnings ratio 价格收益比率professional investor 专业投资者proxy 代理投票sell short the shares 卖空股票sequence of analysis 分析的先后顺序share price 股价shareholder 股东size of the loss 亏损程度stock exchange 证券交易所stock information 股票信息stock market 股市stock price 股价tech stock 高科技股票technical analysis 技术分析undervalued 贬值的unstableness of market 市场不稳定upward price trend 股价逐步升高volume of a stock 成交量voting power 表决权share, equity, stock 股票、股权bond, debenture, debts 债券negotiable share 可流通股份convertible bond 可转换债券treasury/ government bond 国库券/ 政府债券corporate bond 企业债券closed – end securities investment fund封闭式证券投资基金open – end securities investment fund 开放式证券投资基金fund manager 基金经理/ 管理公司fund custodian bank 基金托管银行market capitalization 市值p/ e (price/ earning) ratio 市盈率mark – to – market 逐日盯市payment versus delivery 银券交付clearing and settlement 清算/ 结算commodity/ financial derivatives 商品/ 金融衍生产品put/ call option 看跌/ 看涨期权margins, collateral 保证金rights issue/ offering 配股bonus share 红股dividend 红利/ 股息ADR (American Depository Receipt) 美国存托凭证/ 存股证GDR (Global Depository Receipt) 全球存托凭证/ 存股证retail/ private investor 个人投资者/ 散户institutional investor 机构投资者broker/ dealer 券商proprietary trading 自营insider trading/ dealing 内幕交易market manipulation 市场操纵prospectus 招股说明书IPO (Initial Public Offering) 新股/ 初始公开发行merger and acquisition 收购兼并marketing concept 营销观念,营销概念marketing program 营销计划marketing mix 营销组合marketing channel 营销渠道marketing research 市场调研,营销调研target market 目标市场marketer 市场商人,商家production-oriented 面向生产的consumer-oriented 面向消费者的consumer satisfaction 消费者感到满意distribution system 销售系统,分销渠道distribution channel 销售渠道sales force 销售队伍promotion 促销advertising 广告personal selling 向个人推销publicity 宣传,媒体宣传sales promotion 促销promotion activity 促销活动demonstration 展示,展示会sweepstake 抽奖free sample 免费赠送的样品coupon 赠券,订货附单resaler 转售商intermediary 中间商,中间人middleman 中间商,中间人mass selling 大批销售research method 研究方法potential customer 潜在客户primary data 原始数据,原始资料,第一手资料consumer reaction 消费者的反应inventory control 存货,库存warehousing 仓储storing 储存grading 分类,分级risk taking 承担风险wholesale 批发retail 零售to identify customer needs 认清客户需求to obtain information 获得信息to collect/ gather data 收集资料to interpret data 分析资料to run the risk of failure 冒失败的风险tangible product 有形产品intangible product 无形产品consumer product 消费产品industrial product 工业产品,供工业使用的产品competing product 竞争产品sample product 样品产品potential product 潜在产品life cycle of a product 产品生命周期introduction 引入期growth 成长期maturity 成熟期decline 衰退期potential profitability 潜在获利可能性marketing mix 营销组合promotion 促销promotion cost 促销成本gross national product (GNP) 国民生产总值research and development (R&D) 研究与开发market research 市场调查product development 产品开发text marketing 试营销customer loyalty 顾客忠诚度distribution channels 销售渠道consumer taste 消费者爱好buying motive 购买动机purchasing habits 购买习惯expert examination专家鉴定opinion leader 引导舆论的专家或行家packaging 包装brand 商标,牌号label 标识,标签to make a purchase 购买to fend off competitors 排除竞争者to break even 收支相抵,持平to meet the needs and expectations of customers 满足消费者的需求和期望to be outdated 过时ad valorem tariff 从价关税balance of payment 国际收支balance – of – payments deficit 国际收支逆差bill of exchange 汇票business norms 商业准则capital resources 资本财源commercial credit 商业信用competitive advantage 竞争优势conflicts of interest 利益矛盾consumer protection 消费者保护currency 货币customs duty 关税deficit 逆差depreciate 贬值documentary credit 跟单信用证domestic demand 国内需求domestic trade 国内贸易dominate 支配,占优势dumping 倾销economic motivation 经济动机encash 兑现ethnocentric 种族中心倾向excessive interventionism 过度干预主义exchange rate 兑换率export intelligence department 出口信息部export market 出口市场export subsidies 出口补贴exportable commodities 可供出口的商品favorable balance of payments 国际收支顺差financial assistance 财政资助fluctuation 波动foreign currency 外币free interflow 自由流通free trading system 自由贸易体系government intervention 政府干预government purchases政府采购high technology 高科技技术import commitment 进口承诺importing agent 进口代理商importing and exporting firms 进出口公司importing channel 进口渠道independent currency system 独立货币体系infant industry argument 幼稚工业保护论international trade 国际贸易intervene with trade 干预贸易interventionist 干涉主义者invisible trade 无形贸易locally produced products 本地生产的产品market economy 市场经济mercantilism 营利主义mercantilist theory 重商主义者的理论merchant 商人monetary conversion 货币兑换national security 国家安全nonsubsidized industry 非补贴工业profit margins 利润幅度quota 配额redistribution of resources 资源重新分配register of shipping 船籍登记relative differences 相对差异retaliatory tariff 报复性关税run deficits 遭受逆差separate treatment 分别对待start – up period 起步阶段surplus 顺差tariff for retaliation 报复关税tariff 关税technical assistance 技术协助trade barrier 贸易壁垒Trade Protectionism 贸易保护主义trade restrictions 贸易限制trade surplus 贸易顺差trade theory 贸易理论trade – expanding devices 贸易扩张手段trade – restricting devices 贸易限制手段trading partner 贸易伙伴unfamiliar territories 陌生的地域unfavorable 逆差的values of imports 进口价值visible trade 有形贸易welfare economy 福利经济welfare state 福利国家career planning 职业计划career path 职业道路career development 职业发展self-assessment 自我评价career anchors 职业动机incentive compensation 奖金profit sharing 分红制frequency rate 频率stress 紧张role conflict 角色冲突union 工会local union 地方工会craft union 行业工会industrial union 产业工会national union 全国工会bargaining union 谈判组collective bargaining 劳资谈判arbitration 仲裁strike 罢工internal employee relations 内部员工关系discipline 纪律disciplinary action 纪律处分grievance 申诉demotion 降职transfer 调动promotion 晋升corporate culture 企业文化organizational culture 企业文化esprit de corps [法]团结精神;集体精神sense of identity 认同感sense of togetherness 团结一致的感觉shared values 员工共同拥有的价值观念organizational motto 企业格言role models 模范;学习榜样number 1 rule 最重要的规则;头等大事informal system of rules 不成文的规章制度bureaucracy 官僚主义company uniform 公司制服probation period 试用期proving period 证明自己的阶段;试用期standard of performance 衡量工作表现或业绩的标准quality product 优质产品timely service 及时服务rites and rituals 仪式employee stock ownership plan 员工拥有股份的计划profit-sharing program 利润分享方案to indoctrinate 灌输信仰或意识to brainwash 洗脑to communicate culture 传播企业文化to promote corporate culture 促进企业文化to fashion a specific value system 形成具体的价值体系to emulate somebody 学习某人to motivate employees 激励员工organization development, OD 组织发展survey feedback 调查反馈quality circles 质量圈management by objective, MBO 目标管理Total Quality Management, TQM 全面质量管理team building 团队建设cohesive force in enterprise 企业凝聚力detail management 细节管理core value 核心价值corporate principle 企业准则organizational effectiveness 机构效能result oriented 结果定向stability 稳定性innovation 创新initiative 主动human relationship 人际关系competitive 竞争enterprising 进取心loyalty 忠诚ambition 雄心cooperation 合作integrity 诚信teamwork 团队execution 执行tenacity 坚韧glory 辉煌ethics 道德标准business concept 经营理念cohesive force in enterprise 企业凝聚力corporate image (CI) / enterprise image 企业形象EOI 意向申请。

股市术语大全1. 股票(Stocks)。

2. 股价(Stock Price)。

3. 股票市值(Market Cap)。

4. 交易所(Exchange)。

5. 股票代码(Ticker)。

6. 涨跌幅(Change)。

7. 涨停板(Limit Up)。

8. 跌停板(Limit Down)。

9. 市盈率(PE Ratio)。

10. 市净率(PB Ratio)。

11. 现金流量(Cash Flow)。

12. 股息收益率(Dividend Yield)。

13. 股票回购(Stock Buyback)。

14. 融资融券(Margin Trading)。

15. IPO(Initial Public Offering)。

16. 流通股(Outstanding Shares)。

17. 预发布财报(Earnings Preview)。

18. 发布财报(Earnings Release)。

19. 财报连续增长(Earnings Growth)。

20. 股票套利(Arbitrage)。

21. 股票价格波动(Volatility)。

22. 股票期权(Stock Options)。

23. 基本面分析(Fundamental Analysis)。

24. 技术面分析(Technical Analysis)。

25. 股票指数(Stock Index)。

26. 圆形交易(Circular Trading)。

27. 股票回报率(Return On Investment)。

28. 杠杆(Leverage)。

29. 外汇走势(Forex)。

30. 股票策略(Stock Strategies)。

31. 股票分析软件(Stock Analysis Software)。

32. 股票交易平台(Stock Trading Platform)。

33. 股票交易费用(Trading Fees)。

34. 股票分红(Stock Dividends)。

35. 股票配股(Stock Rights Offering)。

股票交易量分析方法→ 证券交易量分析方法证券交易量分析方法引言本文提供了一些简单但有效的证券交易量分析方法,旨在帮助投资者更好地理解和利用交易量数据来做出投资决策。

方法一:平均交易量平均交易量是一种基本的交易量分析方法。

它可通过计算一段时间内的平均每日交易量来了解证券的整体交易水平。

通常情况下,较高的平均交易量意味着较强的市场流动性和更好的买卖机会。

投资者可以通过比较不同证券的平均交易量来找到潜在的热门股票。

方法二:交易量变化率交易量的变化率可以提供有关市场情绪和趋势的信息。

若证券的交易量呈上升趋势,可能表明市场对该股票的兴趣逐渐增加,反之则可能表明投资者对该股票的兴趣逐渐减少。

投资者可以通过比较过去一段时间内的交易量变化率来发现市场的转折点或趋势变化。

方法三:交易量与价格的关系交易量和股票价格之间存在一定的关系。

通常情况下,交易量增加且股票价格上涨可能表明市场对该股票的买盘增加;交易量增加但股票价格下跌可能表明市场对该股票的卖盘增加。

投资者可以通过观察交易量和股票价格的波动情况来判断市场买卖力量的变化。

结论以上所提供的证券交易量分析方法是基于简单的原理和常识。

投资者在使用这些方法时应结合其他的技术分析工具和基本面分析,以获得更全面的市场信息和更准确的投资判断。

同时,投资者应关注数据的准确性和可靠性,避免使用无法确认的引用内容。

本文提供的方法只是一些基本的分析思路,投资者可以根据自身情况和需求进行适当调整和深入研究。

参考文献- Smith, J. (2018). Trading Volume Analysis: The Key to Unlocking Market Timing. Wiley.- Brown, B. D. (2017). Technical Analysis for Stock Trading: A Beginner’s Guide. CreateSpace Independent Publishing Platform.- Edwards, R. D., & Magee, J. (2011). Technical Analysis of Stock Trends. American Management Association.。

看懂期货专用词汇(中英文对照)期货Futures期货交易Futures Trading商品期货Commodity Futures金融期货Financial Futures期货市场Futures Market保证金制度Margin System当日无负债结算Marking-to-Market衍生品Derivatives场内交易Curb Trading Exchange Trading场外交易over-the-Counter Trading期货佣金商Futures Commission Merchant (FCM)介绍经纪商Introducing Broker商品交易顾问Commodity Trading Advisor商品投资基金Commodity Pool对冲基金Hedge Fund交易单位,合约规模Contract Size最小变动价位Tick Size Minimum Price Fluctuation每日价格最大波动限制Daily Price Limit Daily Price Fluctuation 涨停板Up Limit跌停板Down Limit合约交割月份Contract Month最后交易日Last Trading Day交割日期Delivery Day交割等级Delivery Grade持仓限额制度Position Limits下单Place an Order平仓Offset Close out市价指令Market Order限价指令Limit Order停止限价指令Stop Limit Order止损指令Stop Order触价指令Market If Touched Order (MIT) 限时指令Time Limit Order长效指令Good-till-Cancelled Order套利指令Spread Order取消指令Cancel Order结算价Settlement Price实物交割Physical Delivery现金交割Cash Delivery套期保值Hedger套期保值比率Hedge Ratio卖出套期保值Selling Hedging买入套期保值Buying Hedging完全套期保值Perfect Hedging不完全套期保值Imperfect Hedging基差Basis持仓费Carrying Charge正向市场Normal Market反向市场Inverted Market期货转现货交易Exchange of Futures for Physical(EFP)点价交易Pricing基差交易Basis Trading期货投机Futures Speculation止损Stop-Loss跨期套利Calendar Spread牛市套利Bull Spread熊市套利Bear Spread蝶式套利Butterfly Spread跨品种套利Intercommodity Spread 跨市套利Inter-Exchange Spread 程序化交易Program Trading开盘价Opening Price收盘价Closing Price成交量Volume持仓量Open Interest基本分析Fundamental Analysis技术分析Technical Analysis支撑线Support Line阻力线Resistance Line移动平均线Moving Average相对强弱指数Relative Strength Index (RSI)外汇期货Foreign Exchange Futures远期外汇交易Forward Exchange Transaction外汇保证金交易Foreign Exchange Margin Trade 利率期货Interest Rate Futures欧洲美元Eurodollar股票指数期货Stock Index Futures股票期货Stock Futures期权Options看涨期权Call Options看跌期权Put Options美式期权American Options欧式期权European Options执行价格Exercise Price期权的内涵价值Intrinsic Value期权的时间价值Time Value实值期权In-the-Money Options虚值期权Out-of-the-Money Options 平值期权At-the-Money Options权利金,期权费,期权价格Premium。

期货期权术语中英文对照一、期货1 Futures market 期货市场2 Futures contract 期货合约3 Financial futures 金融期货4 Commodity futures 商品期货5 Financial futures contract 金融期货合约6 Currency futures contract 货币期货合约7 Interest rate futures contract 利率期货合约8 Stock index futures contract 股票指数期货合约9 Financial forward contract 金融远期合约10 Clearing house 清算所11 Initial margins 初始保证金12 Settlement 交割13 Short seller 卖空者14 The Gilts 金边债券15 Futures delivery 期货交割16 Futures transaction 期货交易17 Hedging mechanism 规避机制18 Market expectation 市场预期19 To defuseattempted monopoly positions 冲破形成的市场垄断状况20 Net settlement status 净结算状况,净结算头寸21 Synthetic financial futures position 综合金融期货头寸22 Status inquiry 信用状况调查23 Stock indexes 股票指数24 Stock index futures 股票指数期货25 Currency futures 外币期货26 Distant futures 远期期货27 Nearby futures 近期期货28 On a discount basis 以折价形式29 A long position 多头部位,利多形势30 A short position 空头部位,短缺头寸31 Short purchase 买空,空头补进32 Shifting risk 转嫁风险,转移风险33 Basis risk 基差风险34 Converge 集聚期货和现货价格35 Swing 变动幅度,摆动,涨跌36 Cross hedge 交叉套做37 Volatile 易变的,不稳定的38 Volatile market 不稳定的市场行情39 Margin money 预收保证金,开设信用证保证金40 position 头寸,交易部位,部位41 Long position 多头寸,买进的期货合同42 Short position 空头43 Exchange position 外汇头寸,外汇动态44 Interest position 利率头寸45 Swap position 调期汇率头寸46 Square position 差额轧平未抵冲的外汇买卖余额的轧平状况47 Brokerage firm 经纪商号48 Security bond 保付单49 Post 登记总帐,过帐50 Brokerage 经纪业,付给经纪人的佣金51 FX futures contract 外汇期货合约52 Foreign currency futures 外汇期货53 Futures price 期货价格54 Go long 入金,多头55 Total FX portfolio 外汇投资总额56 A long position 多头寸,买进的期货合约57 Go short 短缺,卖空,空头58 A short position 空头,卖出的期货合约59 Place an order 订购,下单60 Trading pit 交易场61 Open outcry 公开喊价,公开叫价62 Floor broker 场内经纪人63 Transactions costs 交易费用64 Zero-sum game 零和竞争游戏65 Current futures price 现时的期货价格66 The open interest 未结清权益67 Building agreement 具有约束力的协定68 Pay up 付清,缴清69 In force 法律上的有效的70 Kill a bet 终止赌博71 Settlement price 结算价格72 Date of delivery 交割期73 Point of delivery 交割地点74 Futures commission merchants 期货经纪公司75 Market order 市价订单76 Time order 限时订单77 Opening order 开市价订单78 Closing order 收市价订单79 Basis order 基差订单80 Corners 垄断81 Outright position 单笔头寸82 Direct hedging 直接套做83 Indirect hedging 间接套做84 Short hedging 空头套做85 Long arbitrage 多头套做86 Back spreads 反套利87 Margin call 保证金统治88 Price discovery 价格发现二、期权1 Option 期权,选择权,买卖期权2 Call and put options 买入期权和卖出期权3 Option buyer 期权的买方4 Option seller 期权的卖方5 Underlying securities 标的证券6 Exercise price, striking price 履约价格,认购价格7 Option fee =option premium or premium on option 期权费8 Intrinsic value 实际价值,内部价值9 Intrinsic utility 内在效用10 Arbitrage opportunity 套价机会11 Arbitrage 套购,套利,套汇12 Arbitrage of exchange or stock 套汇或套股13 Speculation on foreign exchange 外汇投机14 Speculation in stock 股票投机15 To be hedging 进行套期保值16 A put option on a debt security 债务证券的卖出期权17 Call options on an equity 权益证券的买入期权18 Cover 弥补,补进卖完的商品等19 Write 签发,签署,承保,编写20 Margin call 追加保证金的通知21 Close out 平仓,结清帐22 Notional sum 名义金额23 Notional principal 名义本金24 Equity portfolio 股票资产25 Predetermined 预先约定的26 Strike price 协定价格27 Put option 卖方期权,看跌期权28 Call option 买方期权,看涨期权29 Open market 公开市场30 Premium 期权费31 Downside 下降趋势32 Open-ended 开口的,无限制的,无限度的33 Out-of-the-money 无内在价值的期权34 In-the-money 有内在价值的期权35 At-the-money 平值期权36 Crop upout 出现,呈现37 Cap 带利率上限的期权38 Floor 带利率下限的期权39 Floor trader 交易员40 Break-even 不亏不盈,收支相抵41 Asymmetry 不对称42 Symmetry 对称43 Sell forward 远期卖出44 Up-front fee 预付费用,先期费用45 Change hands 交换,换手46 Contractual value 合同价格47 Over-the-counter 场外的,不同过交易所的48 Customize 按顾客要求制作49 Futures margin 期货保证金50 Initial margin 初始保证金51 Open position 头寸52 Maintenance margin 最低保证金,维持保证金53 Variation margin 盈亏保证金,变动保证54 Market makers 造市者55 Extrinsic value 外在价值56 Contracts of difference 差异合约57 Market-clearing 市场结算58 Adaptive expectations 适应性预期59 Bid-ask spread 递盘虚盘差价60 Small-order automatic system 小额定单执行系统61 Dealers 批发商62 Dual trading 双重交易63 Mature liquid contracts 到期合约64 Backwardation 现货溢价65 Nearby contract 近期合约66 Short-lived securities 短期有效证券67 Cash-and-carry arbitrage 现货持有套利68 Open positions 敞口头寸69 Uncovered interest arbitrage 未担保利率套利70 Premium 期权权利金71 Call-options 认购期权72 Put-options 认沽期权73 Speculation 投机74 Cross hedging 交叉保值75 Hedging risk 套期保值风险76 Synthetic options 合成期权77 Option purchase price 期权的购进价格78 Options on futures contract 期货合同的期权交易79 Forward swap 远期掉期80 Swap rate 掉期率81 Risk transformation 风险转移82 Contract size 合约容量83 Daily limit 每日涨跌停板84 Double option 双向期权三、市场1 Physical trading现货交易2 Arbitrage 市场间套利3 Basis Price/ Strike Price 基本价格,履约价格4 Bear 卖空者,看跌者5 Bear market 空头市场,熊市6 Bull market7 Bottom 底价:某时间段内的最低价8 Peak 高价:某时间段的最高价9 Business day 交易日10 Primary market 初级市场11 Secondary market 二级市场12 Principal 委托人,货主本人13 Profit Taking 获利回吐14 Prompt 即付15 Rally 回升16 Range 波幅17 Recovery 复苏18 Depression 萧条19 Scalp 小投机,日内多次交易20 Security deposit 保证金21 Session 交易时段22 Settlement price 结算价格23 Short hedge 卖出套期保值24 Long Hedge 买入套期保值25 Speculator 投机者26 Spot 现货27 Spread 价差:两个相关市场之间或相关商品之间的价格差异28 Switching转月:由一个期货合约转为另一个期货合约29 Technical analysis 技术分析法30 Tick size 最小价位31 Time value 时间价值32 Turnover/Volume 交易量33 Variation margin价格变动保证金34 Warehouse receipt 仓单35 American-style options 美式期权36 European-style options 欧式期权37 Arbitration 仲裁38 Assignment 转让39 Average daily volume 平均每日交易量40 Board of trade 交易委员会41 Breakeven 平衡点收支相抵42 Brokerage/Commission 佣金43 Brokerage house 经纪行44 Buy to close 买进平仓45 Buy to open 买入建仓46 Canceling order 取消订单47 Clearing fee 结算费48 Close 收盘、收市49 Closing price 收盘价50 Coupon 票面利率51 Customer margin 客户保证金52 Daily trading limits 日交易限制53 Day trader 当日交易者54 Deferred 延期55 Delivery 交割,交收56 Delivery month 交割月57 Delivery points 交割点58 Equilibrium price 均衡价格59 Exhaustion gap 消耗缺口60 Expanded trading hours 延迟交易时间61 Expiration 到期,截止期限62 Federal funds rate 联邦基金利率63 Financial instrument 金融工具64 Floor trader 场内交易员65 Gross domestic product GDP 国内生产总值66 High limit 涨停价67 Historical volatility 历史波幅68 Index 指数69 Initial margin 原始保证金70 Intrinsic value 内在价值71 Introducing broker IB 中介经纪商72 Lagging indicators 滞后指标73 Last trading day 最后交易日74 Lead month 最近合约月75 Leading indicators 领先指标76 Leverage 杠杆作用77 Limit order 限价委托单78 Liquid 流动性79 Liquidate 平仓,斩仓80 Mark-to-market 逐日结算81 Market order 市价委托单82 Market segment 市场划分83 Market value 市场价值84 Matched trade 配对交易85 Maturity 到期期间86 Notice day 通知日87 Position limit 持仓限额88 Purchasing power 购买力89 Quotation 报价90 Reference price 参考价格91 Resistance line 阻力线92 Retracement 背离93 Support line支撑线94 Symbol 符号95 Target price 目标价格96 Trade balance 贸易收支97 Treasury bill 美国短期国债98 Variable limit 可变限度99 Writer 期权卖家100 Yield 收益率101 Yield curve 收益率曲线102 Yield to maturity 到期收益率。

基于tifs技术指标选择法英语Technical Indicator-Based Stock Selection.Technical analysis is a method of evaluating securities by analyzing statistical trends gathered from trading activity, such as price and volume. Technical analysts believe that past behavior can be used to predict future results.There are many different technical indicators that can be used to identify potential trading opportunities. Some of the most popular indicators include:Moving averages: A moving average is a calculationthat smooths out price data by taking the average of the closing prices over a specified period of time. Moving averages can be used to identify trends and support and resistance levels.Relative strength index (RSI): The RSI is a momentumindicator that measures the magnitude of recent price changes. RSI values range from 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions.Stochastics: Stochastics is a momentum indicator that measures the relationship between the current price and the price range over a specified period of time. Stochastics values range from 0 to 100, with values above 80 indicating overbought conditions and values below 20 indicating oversold conditions.Moving average convergence divergence (MACD): The MACD is a trend-following indicator that measures the difference between two moving averages. MACD values can be positive or negative, with positive values indicating a bullish trend and negative values indicating a bearish trend.Technical indicators can be used to identify a variety of trading opportunities. For example, a moving average can be used to identify a trend, while an RSI or stochastic oscillator can be used to identify overbought or oversoldconditions.It is important to note that technical indicators are not perfect. They can sometimes give false signals, and they should never be used as the sole basis for making investment decisions. However, when used in conjunction with other analysis methods, technical indicators can be a valuable tool for identifying potential trading opportunities.Here are some tips for using technical indicators to select stocks:Use multiple indicators: No single indicator is perfect, so it is important to use multiple indicators to confirm your analysis.Consider the time frame: The time frame of your analysis will affect the results of your indicators. For example, a moving average with a shorter period will be more sensitive to recent price changes than a moving average with a longer period.Be aware of false signals: Technical indicators can sometimes give false signals. It is important to be aware of this and to use other analysis methods to confirm your findings.Technical indicators can be a valuable tool for identifying potential trading opportunities. However, it is important to use them in conjunction with other analysis methods and to be aware of their limitations.。

期货专业术语中英⽂对照期货专业术语中英⽂对照中⽂ 英语期货 Futures期货交易 Futures Trading商品期货 Commodity Futures⾦融期货 Financial Futures期货市场 Futures Market保证⾦制度 Margin System当⽇⽆负债结算 Marking-to-Market衍⽣品 Derivatives场内交易 Curb Trading, Exchange Trading场外交易 over-the-Counter Trading期货佣⾦商 Futures Commission Merchant, FCM介绍经纪商 Introducing Broker商品交易顾问 Commodity Trading Advisor商品投资基⾦ Commodity Pool对冲基⾦ Hedge Fund交易单位,合约规模 Contract Size最⼩变动价位 Tick Size, Minimum Price Fluctuation每⽇价格最⼤波动限制 Daily Price Limit, Daily Price Fluctuation涨停板 Up Limit跌停板 Down Limit合约交割⽉份 Contract Month最后交易⽇ Last Trading Day交割⽇期 Delivery Day交割等级 Delivery Grade持仓限额制度 Position Limits下单 Place an Order平仓 Offset, Close out市价指令 Market Order限价指令 Limit Order停⽌限价指令 Stop Limit Order⽌损指令 Stop Order触价指令 Market If Touched Order, MIT限时指令 Time Limit Order长效指令 Good-till-Cancelled Order套利指令 Spread Order取消指令 Cancel Order结算价 Settlement Price实物交割 Physical Delivery现⾦交割 Cash Delivery套期保值 Hedger套期保值⽐率 Hedge Ratio卖出套期保值 Selling Hedging买⼊套期保值 Buying Hedging完全套期保值 Perfect Hedging不完全套期保值 Imperfect Hedging基差 Basis持仓费 Carrying Charge正向市场 Normal Market反向市场 Inverted Market期货转现货交易 Exchange of Futures for Physical, EFP 点价交易 Pricing基差交易 Basis Trading期货投机 Futures Speculation⽌损 Stop-Loss跨期套利 Calendar Spread⽜市套利 Bull Spread熊市套利 Bear Spread蝶式套利 Butterfly Spread跨品种套利 Intercommodity Spread跨市套利 Inter-Exchange Spread程序化交易 Program Trading开盘价 Opening Price收盘价 Closing Price成交量 Volume持仓量 Open Interest基本分析 Fundamental Analysis技术分析 Technical Analysis⽀撑线 Support Line阻⼒线 Resistance Line移动平均线 Moving Average相对强弱指数 Relative Strength Index, RSI外汇期货 Foreign Exchange Futures远期外汇交易 Forward Exchange Transaction外汇保证⾦交易 Foreign Exchange Margin Trade利率期货 Interest Rate Futures欧洲美元 Eurodollar股票指数期货 Stock Index Futures股票期货 Stock Futures期权 Options看涨期权 Call Options看跌期权 Put Options美式期权 American Options欧式期权 European Options执⾏价格 Exercise Price期权的内涵价值 Intrinsic Value期权的时间价值 Time Value实值期权 In-the-Money Options虚值期权 Out-of-the-Money Options平值期权 At-the-Money Options权利⾦,期权费,期权价格 Premium。

Subject: Technical Stock AnalysisBollinger BandsDeveloped by John Bollinger, Bollinger Bands allows users to compare volatility and relative price levels over a period time. Bollinger Bands are envelopes which surround the price bars on a chart. They are plotted two standard deviations away from a simple moving average. Because standard deviation is a measure of volatility, the bands adjust themselves to ongoing market conditions. They widen during volatile market periods and contract during less volatile periods. Bollinger Bands are, essentially, moving standard deviation bands.Bollinger Bands are sometimes displayed with a third center line. This is the simple moving average line. Mr. Bollinger recommends using a 10 day moving average for short term trading, 20 days for intermediate term trading, and 50 days for longer term trading.The standard deviation value may be varied. Increase the value of the standard deviation from 2 standard deviations to 2-1/2 standard deviations away from the moving average when using a 50 day moving average. Conversely, lower the value of the standard deviation from 2 to 1-1/2 standard deviations away from the moving average when using a 10 day moving average. Bollinger Bands do not generate buy and sell signals alone. They should be used with another indicator. I use them with RSI, described below. This is because when price touches one of the bands, it could indicate one of two things. It could indicate a continuation of the trend; or it could indicate a reaction the other way. By themselves they do not tell us when to buy and sell. However, when combined with an indicator such as RSI, they become powerful. RSI is an excellent indicator with respect to overbought and oversold conditions. When price touches the upper band, and RSI is below 70, we have an indication that the trend will continue. When price touches the lower band, and RSI is above 30, we have an indication that the trend will continue. If we run into a situation where price touches the upper band and RSI is above 70 (possibly approaching 80) we have an indication that the trend may reverse itself and move downward. On the other hand, if price touches the lower band and RSI is below 30 (possibly approaching 20) we have an indication that the trend may reverse itself and move upward.Avoid using several different indicators all using same input data. If you're using RSI with the Bollinger Bands, don't use MACD too. They both use the same inputs. Consider using On Balance Volume, or Money Flow with RSI. Relying on different inputs they measure different things. They can be used together as further confirmation of a trend.While there are many ways to use Bollinger Bands, following are a few rules that serve as a good beginning point.1.Bollinger Bands provide a relative definition of high and low.2.That relative definition can be used to compare price action and indicator action to arrive atrigorous buy and sell decisions.3.Appropriate indicators can be derived from momentum, volume, sentiment, open interest,inter-market data, etc.4.Volatility and trend have already been deployed in the construction of Bollinger Bands, sotheir use for confirmation of price action is not recommended.5.The indicators used should not be directly related to one another. For example, you might useone momentum indicator and one volume indicator successfully.6.Bollinger Bands can also be used to clarify pure price patterns such as "M" tops and "W"bottoms, momentum shifts, etc.7.Price can, and does, walk up the upper Bollinger Band and down the lower Bollinger Band.8.Closes outside the Bollinger Bands are continuation signals, not reversal signals. (This hasbeen the basis for many successful volatility breakout systems.)9.The default parameters of 20 periods for the moving average and standard deviationcalculations, and two standard deviations for the bandwidth may be varied for the market. 10.The average deployed should not be the best one for crossovers. Rather, it should bedescriptive of the intermediate-term trend.11.If the average is lengthened the number of standard deviations needs to be increasedsimultaneously; from 2 at 20 periods, to 2.5 at 50 periods. If the average is shortened the number of standard deviations should be reduced; from 2 at 20 periods, to 1.5 at 10 periods.12.Bollinger Bands are based upon a simple moving average. This is because a simple movingaverage is used in the standard deviation calculation and we wish to be logically consistent.13.Make no statistical assumptions based on the use of the standard deviation calculation in theconstruction of the bands. The sample size in most deployments of Bollinger Bands is simply too small for statistical significance.14.Finally, tags of the bands are just that, tags not signals. Touching the upper band is NOT in-and-of-itself a sell signal and touching the lower band is NOT in-and-of-itself a buy signal. Again, this indicator consists of three bands encompassing a security's price action. Defaults are:1. A simple moving average in the middle, usually 20 days for intermediate investing.2.An upper band ( 20 day SMA plus 2 standard deviations)3. A lower band (20 day SMA minus 2 standard deviations)Standard deviation is a statistical term that provides a good indication of volatility. Using it ensures the bands will react quickly to price movements and reflect periods of high and low volatility. Sharp price changes and hence volatility, will lead to a widening of the bands. Closing prices are usually used to compute Bollinger Bands. Other variations can also be used. The length of the moving average and number of deviations can be adjusted to better suit individual preferences and specific characteristics of a security.One method to determine an appropriate moving average length is a visual assessment. Bollinger Bands should encompass the majority of price action, but not all. After sharp moves, penetration of the bands is normal. If prices appear to penetrate the outer bands too often, then a longer moving average may be required. If prices rarely touch the outer bands, then a shorter moving average may be required.A more exact method to determine moving average length is by matching it with a reaction low after a bottom. For a bottom to form and a downtrend to reverse, a security needs to form a low that is higher than the previous low. Properly set Bollinger Bands should hold support established by the second (higher) low. If the second low penetrates the lower band, then the moving average is too short. If the second low remains above the lower band, then the moving average is too long. The same logic can be applied to peaks and reaction rallies. The upper band should mark resistance for the first reaction rally after a peak.In addition to identifying relative price levels and volatility, Bollinger Bands can be combined with price action and other indicators to generate signals and foreshadow significant moves:Double bottom buy: A double bottom buy signal is given when prices penetrate the lower band and remain above the lower band after a subsequent low forms. Either low can be higher or lower than the other. The important thing is that the second low remains above the lower band. The bullish setup is confirmed when the price moves above the middle simple moving average.Double top sell: A sell signal is given when prices peak above the upper band and a subsequent peak fails to break above the upper band. The bearish setup is confirmed when prices decline below the middle band.Sharp price changes can occur after the bands have tightened and volatility is low. In this instance, Bollinger Bands do not give any hint as to the future direction of prices. Direction must be determined using other indicators and aspects of technical analysis. Many securities go through periods of high volatility followed by periods of low volatility. Using Bollinger Bands, these periods can be easily identified with a visual assessment. Tight bands indicate low volatility and wide bands indicate high volatility.Again, although Bollinger Bands can help generate buy and sell signals, they are not designed to determine the future direction of a security. The bands were designed to augment other analysis techniques and indicators. By themselves, Bollinger Bands serve two primary functions:•To identify periods of high and low volatility•To identify periods when prices are at extreme, and possibly unsustainable, levels.As stated above, securities can fluctuate between periods of high volatility and low volatility. Being able to identify a period of low volatility can serve as an alert to monitor the price action of a security. Other aspects of technical analysis, such as momentum, moving averages and retracements, can then be employed to help determine the direction of the potential breakout. Remember, buy and sell signals are not given when prices reach the upper or lower bands. Such levels merely indicate that prices are high or low on a relative basis. A security can become overbought or oversold for an extended period of time. Knowing whether prices are high or low on a relative basis enhances interpretation of other indicators and timing issues in trading. Bollinger Bands are a pair of values placed as an "envelope" around a data field. The values are calculated by taking the moving average of the data for the given period and adding or subtracting the specified number of standard deviations for the same period from the moving average. Since Bollinger Bands use a moving average, the value at the beginning of a data series is not defined until there are enough values to fill the given period. Used to confirm trading signals, normally from a Momentum Indicator, the bands indicate overbought and oversold levels relative to a moving average.The bands are calculated at specified standard deviations above and below the moving average, causing them to widen when prices are volatile and contract when prices are stable.Bollinger Bands are useful for determining whether current values of a data field are behaving normally or breaking out in a new direction. For example, when the closing price of a security increases above its upper Bollinger Band, it will typically increase in that direction.Bollinger Bands can also be used for identifying when trend reversals may occur. New highs or lows outside of the bands followed by another high/low inside of the bands typically indicates a reversal in the current trend.Since the standard deviation can be used as a volatility indicator, the current width of the envelope can also be used for trend information. A wide envelope indicates a high amount of volatility, while a narrow envelope indicates a lower amount. High volatility levels can sometimes be used to time trend reversals, such as market tops and bottoms. Low volatility levels can sometimes be used to time the beginning of new upward price trends following periods of consolidation.Another observable trait of Bollinger Bands is that moves that begin at one band tend to go all the way to the other band. This can be useful for forecasting future values. Bollinger Bands are similar to Trading Bands and share many of their characteristics. However, unlike Bollinger Bands, Trading Bands do not vary in width based on volatility.In this example Microsoft is charted using 20 day Bollinger bands at 2 standard deviations.Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. The first breakout is often a false move, preceding a strong trend in the opposite direction. A contracting range [C] is evident in June 1998: the bands converge to a width of $2, followed by a breakout in July to a new high.A move that starts at one band normally carries through to the other, in a ranging market. A move outside the band indicates that the trend is strong and likely to continue - unless price quickly reverses. Note the quick reversal [QR] in early August. A trend that hugs one band signals that the trend is strong and likely to continue. Wait for divergence on a Momentum Indicator to signal the end of a trend.In this example, 20 day Bollinger Bands at 2 standard deviations and 10 day Rate of Change.1.Go short [S] - bearish divergence on ROC.2.Contracting Bollinger Bands [C] warn of increased volatility. This begins with a false rally(note the ROC triple divergence) followed by a sharp fall.3.Go long [L] - price hugs the lower band, followed by a bullish divergence on ROC.4.Go short [S] - price hugs the upper band, followed by a bearish divergence on ROC.RSI – Relative Strength IndicatorDeveloped by J. Welles Wilder and introduced in his book, New Concepts in Technical Trading Systems, the Relative Strength Index (RSI) is an extremely popular momentum oscillator. The RSI compares the magnitude of a stock's recent gains to the magnitude of its recent losses and turns that information into a number that ranges from 0 to 100. It takes a single parameter, the number of time periods to use in the calculation. Wilder recommends using 14 periods.The RSI's full name is actually rather unfortunate as it is easily confused with other forms of Relative Strength analysis. Most other kinds of "Relative Strength" stuff involve using more than one stock in the calculation. Like most true indicators, the RSI only needs one stock to be computed. In order to avoid confusion, avoid using the RSI's full name and just call it "the RSI."To be used in conjunction with Bollinger Bands, the Relative Strength Indicator or index is based on a ratio of the average upward changes to the average downward changes over a given period of time. It has a range of 0 to 100 with values typically remaining between 30 and 70.Higher values indicate overbought conditions while lower values indicate oversold conditions. The Relative Strength Index at the beginning of a data series is not defined until there are enough values to fill the given period. In addition, the value is defined as 100 when no downward changes occur during the given period. The Relative Strength Index (RSI) is typically used with a 9, 14, or 25 calendar day (7, 10, or 20 trading day) period against the closing price of a security or commodity. The more days that are included in the calculation, the less volatile the value. The RSI usually leads the price by forming peaks and valleys before the price data, especially around the values of 30 and 70. In addition, when the RSI diverges from the price, the price will eventually correct to the direction of the index. The Relative Strength Index function determines the internal strength of a field using the number of upward and downward price changes over a given period of time. To simplify the formula, the RSI has been broken down into its basic components which are the Average Gain, the Average Loss, the First RS, and the subsequent Smoothed RS's.For a 14-period RSI, the Average Gain equals the sum total all gains divided by 14. Even if there are only 5 gains (losses), the total of those 5 gains (losses) is divided by the total number of RSI periods in the calculation (14 in this case). The Average Loss is computed in a similar manner. Calculation of the First RS value is straightforward: divide the Average Gain by the Average Loss. All subsequent RS calculations use the previous period's Average Gain and Average Loss for smoothing purposes.When the Average Gain is greater than the Average Loss, the RSI rises because RS will be greater than 1. Conversely, when the average loss is greater than the average gain, the RSI declines because RS will be less than 1. The last part of the formula ensures that the indicator oscillates between 0 and 100.Wilder recommended using 70 and 30 and overbought and oversold levels respectively. Generally, if the RSI rises above 30 it is considered bullish for the underlying stock. Conversely, if the RSI falls below 70, it is a bearish signal. Some traders identify the long-term trend and then use extreme readings for entry points. If the long-term trend is bullish, then oversold readings could mark potential entry points.Buy and sell signals can also be generated by looking for positive and negative divergences between the RSI and the underlying stock. For example, consider a falling stock whose RSI rises from a low point of (for example) 15 back up to say, 55. Because of how the RSI is constructed, the underlying stock will often reverse its direction soon after such a divergence. As in that example, divergences that occur after an overbought or oversold reading usually provide more reliable signals.The centerline for RSI is 50. Readings above and below can give the indicator a bullish or bearish tilt. On the whole, a reading above 50 indicates that average gains are higher than average losses and a reading below 50 indicates that losses are winning the battle. Some traders look for a move above 50 to confirm bullish signals or a move below 50 to confirm bearish signals.。