FRM二级模拟题(6)

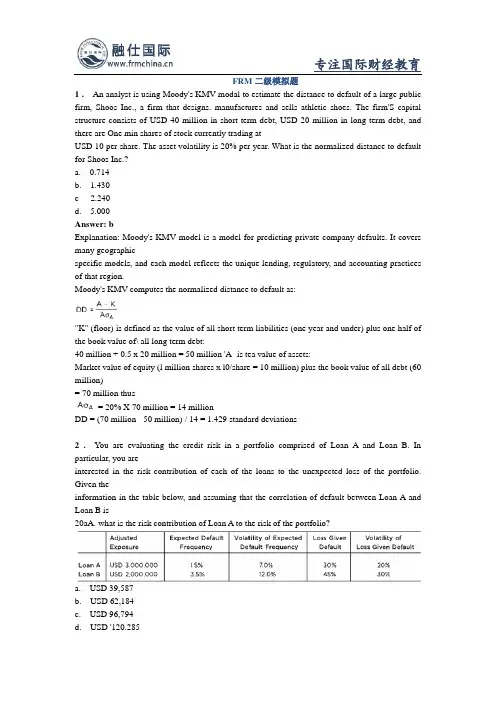

- 格式:pdf

- 大小:1.85 MB

- 文档页数:9

二级ACCESS分类模拟题选择题(六)选择题1、若窗体Frml中有一个命令按钮Cmd1,则窗体和命令按钮的Click事件过程名分别为______。

A.Form_Click()和Command1_Click() B.Frm1_Click()和Commamd1_Click() C.Form_Click()和Cmd1_Click() D.Frm1_Click()和Cmd1_Click()2、因修改文本框中的数据而触发的事件是______。

A.Change B.Edit C.Getfocus D.LostFocus3、下列关于报表的叙述中,正确的是______。

A.报表只能输入数据 B.报表只能输出数据C.报表可以输入和输出数据 D.报表不能输入和输出数据4、报表的作用不包括______。

A.分组数据 B.汇总数据 C.格式化数据 D.输入数据5、在一份报表中设计内容只出现一次的区域是______。

A.报表页眉 B.页面页眉 C.主体 D.页面页脚6、要指定在报表每一页的底部都输出的内容,需要设置______。

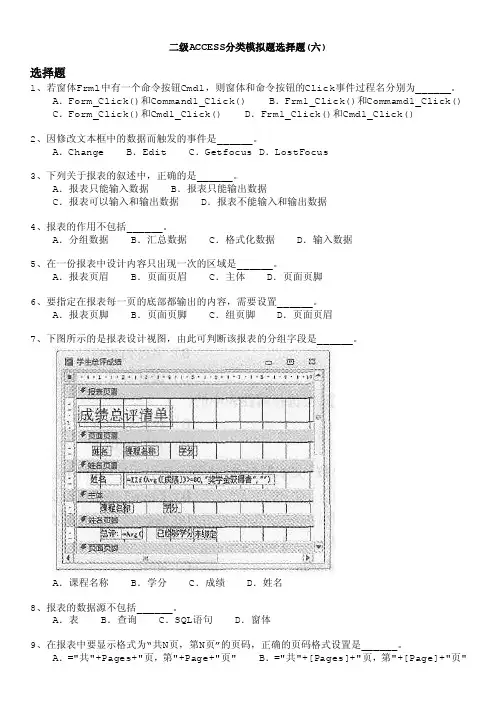

A.报表页脚 B.页面页脚 C.组页脚 D.页面页眉7、下图所示的是报表设计视图,由此可判断该报表的分组字段是______。

A.课程名称 B.学分 C.成绩 D.姓名8、报表的数据源不包括______。

A.表 B.查询 C.SQL语句 D.窗体9、在报表中要显示格式为“共N页,第N页”的页码,正确的页码格式设置是______。

A.="共"+Pages+"页,第"+Page+"页" B.="共"+[Pages]+"页,第"+[Page]+"页"C.="共"&Pages&"页,第"&Page&"页" D.="共"&[Pages]&"页,第"&[Page]&"页"10、要求在页面页脚中显示“第X页,共Y页”,则页脚中的页码“控件来源”应设置为______。

FRM二级模拟题(一)1. Katherine McCollin is a risk manager who has been assigned the task of designing a riskengine for VaR mapping. Which of the following statements accurately describes VaRmapping?a. Beta is an important factor in mapping fixed-income portfolios.b. Duration mapping is an appropriate method for estimating VaR for mapping forwardsand interest-rate swaps.c. VaR mapping involves identifying common risk factors among positions in a portfolioand mapping all positions to an equity index.d. A return-based analysis may fail to spot style drift or hidden risks.Answer: dVaR mapping involves identifying common risk Factors among positions in a portfolioand mapping those positions to risk factors. A return-based analysis may fail to spot style drift or hidden risks. Duration is an important factor in mapping fixed-income portfolios. The delta-normal method is an appropriate method for estimating VaR for mapping forwards and interest-rare swaps.2. A portfolio manager currently holds 20,000 shares of Costiuk Inc. in a particular portfolio.The daily volume of Costiuk shares traded on the stock exchange is 50,000. Additionally, on any given day, the portfolio manager wishes to trade no more than 15% of the daily trading volume of Cosriuk. Which of the following amounts is closest to the liquidity duration of Cosciuk in this portfolio?a. 0.06.b. 0.375.c. 2.67.d. 16.67.Answer: cLiquidity duration is an approximation of the number of days necessary to dispose of aportfolio's holdings (of a particular share in this case) without a significant market impact.It is calculated as: 20,000 / (0.15 x 50,000) = 2.67.3. A firm has determined that the risk-adjusted return on capital (RAROC) for a particularproject is 14%. To evaluate whether the firm should accept the project, an analyst determines that the firm's beta is l.3, the expected market return is 13%, and the risk-free interest rate is5.5%. If the analyst uses the adjusted RAROC (ARAROC) methodology to make anaccept/reject decision, should the project be accepted?a. No, because the computed ARAROC is approximately l% less than the market riskpremiumb. No, because the RAROC is l.25% less than the return predicted by the CAPM.c. Yes, because the computed ARAROC is approximately l% more than the market riskpremium.d. Yes, because the ARAROC is approximately 4% more than the return predicted by theCAPM.Answer: aARAROC = (RAROC – R F) / βE = (0.14 – 0.055) / 1.3 = 0.06538, or 6.54%.The appropriate decision is to accept the project if the ARAROC > R M - R F. 13% - 5.5% =7.5%. The project should not be accepted since the ARA ROC is approximately 1% less than the market risk premium.4. Which of the following statements regarding the marked-to-market value of a credit defaultswap is correct?I. The value of a CDS at inception is zero.II. If the present value of the expected payout is greater than the present value of the expected payments, the CDS has a negative value for the buyer.a. I only.b. II only.c. Both I and II.d. Neither I nor II.Answer: aAt inception, the value of a CDS is zero because the CDS will be priced so that the present value of expected payments made by the swap buyer is exactly equal to the present value of the expected payout in the event of default When the CDS is marked-to-market afterinception, a gain for one counterparty results in an equal loss for the other counterparty,meaning that marking a CDS to marker is a zero-sum game. If the PV of expected payout isgreater than the PV of the expected payments made, the CDS will have a positive value for the buyer since the buyer receives the larger expected payout. If the PV of the expectedpayout is less than the PV of the expected payments, the CDS has a positive value for the seller because the seller receives the expected payments.5. The Basel regulatory framework uses a "building block" approach, whereby a bank'sregulatory capital requirement is the sum of the capital requirements for various riskcategories. Among the risk categories relevant for the banking book and trading book withina financial institution, which of the following risks would be contained within Pillar I on thetrading book side?a. Interest rate risk.b. Business risk.c. Concentration risk.d. Liquidity risk.Answer: aPillar l, on the trading book side, contains counterparty credit risk, interest rate risk, equity risk, foreign exchange risk, commodity risk, and operational risk.。

University of Cambrid g e ESOL ExaminationsWhat does YLE Movers involve?This booklet is a brief introduction to YLE Movers.We show examples from each part of the test,but in some cases we do not show the full text or all of the questions.If you would like to see full sample papers for YLE Movers you can download them from our website at:/support/dloads/yle_downloads.htmThere is a defined set of vocabulary and structures for each level of YLE and you should make sure that you are familiar with the vocabulary and structures you need to know for YLE Movers.This list of grammar and structures and a list of vocabulary (in alphabetical order) is also available from our website.The table below shows the different parts of YLE Movers and how long each paper takes.I Listeningapprox.25 minutes (25 questions)There are five parts in the Listening test.You hear all the parts of the test twice.In the test,all the parts include an example.Information for candidates – YLE MoversDear ParentThank you for encouraging your child to learn English and to take this YLE (Young Learners English) Movers test.We believe that learning English should be fun and stimulating for children and we hope it will also be interesting for you to watch your child grow in confidence as he or she learns more and more English.Taking a test such as YLE Movers is an excellent way of motivating your child to learn and showing how much progress he or she has made.We have prepared this booklet to give you and your child a brief introduction to the different parts of YLE Movers and the type of questions you can expect to find.We hope you will take the time to read the booklet together with your child and that it will give you a clear picture of what we expect children to be able to do in English when taking YLE Movers.Young Learners English tests come to you from Cambridge ESOL (English for Speakers of Other Languages) which is part of Cambridge Assessment,a department of the world-famous University of Cambridge in the UK.So,you can be sure that we have created a test you can trust which will help your child to do his or her very best at English.We hope you enjoy preparing for and taking YLE Movers!With best wishesCambridge ESOLIn Part 1 you see a big picture which shows different people doing different things.There are seven names round the picture.You hear an adult and a child talking about the people in the picture.You have to draw a line from the name you hear to the correct person in the big picture.In the test,there are three more dialogues like the ones to the left of the picture.Part 2 (5 questions)In Part 2 you hear a conversation between two speakers.On the question paper there is a form or a page on a notepad.You have to write a word or a number in five places on the form or notepad.You do not have to spell words perfectly if they are not spelled out for you.In the test,there are three more dialogues and three more questions like the ones below.Peter Jim John SallyJane Daisy AnnaThis is what you hear …Can you see the line? This is an example.Now you listen and draw lines.OneMan:That’s a beautiful rainbow.Girl:Yes,it is.John’s very good at painting.Man:Who’s the girl that’s helping to paint it?Girl:The one who’s standing on a box?Man:Yes.Girl:That’s Sally.T woMan:Who’s the boy that’s painting the leaves?Girl:Which one?Man:The one with jeans and a blue T-shirt.Girl:Oh,he’s called Peter.Man:I love those leaves!This is what you hear …OneWoman:How many different kinds of animals did you see at the zoo?Boy:That’s difficult.Woman:Well,think about it.Boy:Oh … thirty,I think.Woman:Thirty! Good.T woWoman:What were the biggest animals that you saw?Boy:Erm … the giraffes,I think.Woman:Weren’t there any elephants?Boy:Oh yes,that’s right.The elephants were the biggest!In Part 3 you hear a conversation between a child and an adult.The child is telling the adult about what they did on different days during one week.You have to draw a line from the day of the week to the picture which shows what the child did on that day.In the test,there are three more dialogues like the ones below.We have done one example for you.Can you see the line from Sunday?This is what you hear …OneMan:What did you do on Saturday? Girl:I went for a long walk with my mum and dad.We took our dogwith us.Man:Did you enjoy it?Girl:It was OK,but it was verywindy that day.In the evening,we were all tired.T woMan:Did you go shopping last week, Sally?Girl:Yes,we did.We went to theshops in town on Mondayafternoon.I bought a presentfor my grandpa.Man:Did you drive into town?Girl:Yes.The weather was terrible that day and we didn’t want towalk.In Part 3 you hear five little dialogues.There is a question about each dialogue and you have to choose which of three pictures gives the answer to the question.You must put a tick ( ) under the correct picture.In the test,there are three more questions like the ones below.Part 5 (5 questions)In Part 5 you see a big picture.You listen to a dialogue between an adult and a child and must colour specific objects using the colour that you are instructed to use.You will also be asked to draw a simple object or write a short word somewhere in the picture.In the example below,we have already coloured the teacher’s hair for you.In the test,there are three more dialogues to listen to and three more objects to colour.Where did Jim see the film?AB C1 Where did the rabbits in the film go?Z OOA B CWhere did Jim see the film?12This is what you hear …OneBoy:I saw a good film last week.Woman:Oh,did your Mum take you to the cinema?Boy:No …Woman:Was it at your school,then?Boy:No,it was at my birthday party.Woman:Oh,I see!Boy:It was a DVD.T woBoy:The film was about some rabbits.Woman:Oh.I know the one.They have to find a new home.Did they go to live with the animals in a zoo?Boy:No,they didn’t do that!Woman:Oh.Well,did they go to a farm then?Boy:No.They went to live in a big forest.This is what you hear …OneMan:Now,do you want to colour something?Girl:Yes,please.Can I colour the clock?Man:OK,what colour?Girl:Blue is my favourite.Man:OK,that’s a good colour for the clock,then.T woMan:Now,would you like to write something for me?Girl:What? A word?Man:Yes,can you see the map on the wall?Girl:Behind the teacher?Man:That’s right.Can you write the word MAP below it?Girl:OK.I’m writing that now.I Reading and Writing30 minutes/40 questionsThere are six parts in the Reading and Writing test.In the test,all the parts include at least one example.You do not have to write much but you must take care to spell all your answers correctly.Part 1 (6 questions)In Part 1 you look at pictures of objects with their names written under them.You then read some definitions and must decide which picture matches each definition.You must copy that word next to its definition.In the test,there are four more questions like the ones below.Part 2 (6 questions)In Part 2 you look at a big picture and read six sentences about it.Some of the sentences describe the picture correctly and some do not.If the sentence says something true about the picture,then you write ‘yes’ after that sentence.If what the sentence says about the picture is not true,then you write ‘no’ after the sentence.In the test,there areQuestions 1You can eat this from a bowl. Sometimes there are vegetables in it._________________________________2This is the biggest animal in the world. It lives in the sea._________________________________Questions 1A big brown bear is having a shower.______________________________2There are some glasses below the mirror.______________________________3The yellow bear is fatter than the blue bear.______________________________In Part 3 you read a short conversation between two people.You have to choose what the second speaker says each time from a set of three choices (A,B or C).There is a picture on the question paper to set the scene.You should put a circle around the correct answer,like this, B .In the test,there are three more questions like the ones below.Part 4 (7 questions)In Part 4 you read a text which has six gaps in it.The missing words may be nouns,adjectives or verbs.Next to the text there is a box with labelled pictures.You choose the correct word from the box and copy it into each gap.Then you must choose the best title for the text from a choice of three possible titles.Jane:What’s the matter? Have you got a headache?Peter: A No, thank you. I don’t want one.B No, I’ve got toothache.C No, I haven’t got it.Jane:Would you like to come to my house?Peter: A Yes, I went home quickly.B No, thanks. I want to go home.C Well, I like my house a lot.3Jane:Have you got a coat?Peter: A Yes, it does.B OK, he’s here.C No, I haven’t.My name is Daisy. I like toys, but I like books and ___________ best. I lovestories about men on the moon and about (1)___________ who live in different countries.I read a good story yesterday. In this story, a boy climbed a(2)___________. At the top, there was a lot of snow. It was evening, but the boy could see the forest below him.He (3)___________ down on a rock to have a drink and to look up at all the (4)___________. But then he (5)___________ something that he didn’t understand. Something very big and round flew quietly and quickly behind a cloud. What was it? The boy didn’t know and he didn’t wait to see it again.He (6)___________ home to his village because he was very afraid. I wasn’t afraid! I enjoyed the story a lot!(7)Now choose the best name for the story.Tick one box.A boy that Daisy knows IA film that Daisy watched A story that Daisy likedcomicsIn Part 5 you read a story which is in three parts.Each part has a picture.There are sentences after each part of the story.You must complete the sentences,using one,twofamily went to the cinema.3Paul didn’t enjoy seeing _____________________ in the film.On Thursday, Paul thought aboutthe film. He didn’t want to swimin the sea. He sat on the beachand watched Sam and Vicky.They played in the water. Mumgave Paul an ice cream but hedidn’t want it. Then Dad said,‘Come on Paul! Let’s go for aswim.’ But Paul didn’t want to.4Sam and Vicky ________________________ in the sea.5Paul didn’t want the ice cream that his _________________________ gave him.6Dad wanted to go for __________________________ with Paul.If you want to read the end of the story,you can download a sample paper from our website at :/support/dloads/yle-downloads.htmIn Part 6 you read a factual text which has five gaps.The gaps are for grammar words like prepositions,pronouns and verbs.You have a choice of three words to fill each gap and must choose the correct word and copy it into the gap.I Speaking5–7 minutes/4 partsIn the Speaking test someone,perhaps your own teacher,will explain the test to you in your own language.That person will then take you into the exam room and will introduce you to the examiner.The examiner will give you marks for understanding what he or she says,for responding appropriately in English and for pronunciation.CatsCatshavegood eyes. They can see verywell at night.cats climb treesand eat meat. They can move very quietly and catch animals. Then they eat them. They have strong teeth.Theresmall cats and big cats like lionsand tigers. Only tigers livethe jungle.Lions don’t. Some people go and see lions and tigers at the zoo.A lot of p eop le have small cats in homes. These cats are pets. People thembecause they are beautiful.Example12345Example 12 34 5had Allam atyour likehave Everyare ontheir likinghas Anyis inour likesPart 1First the examiner will greet you and will ask you your name.Then he or she will show you two pictures which are similar but which have some differences.You must tell the examiner about four of the differences.Part 2In Part 2 the examiner will show you four pictures which tell a story.The examiner tells you about the first picture and then asks you to continue the story.The examiner might say,for example,‘Fred is sad.He can’t play football.His ball is very old.His mum is saying ‘Take the dog to the park’.You must then talk about the other three pictures.Part 3In Part 3 the examiner will show you four sets of four pictures.You must say which picture is the odd one out in each set and explain why.Part 4In Part 4 the examiner will ask you some questions about yourself.He or she might ask you,for example,about school,what you do at the weekends,your hobbies or your friends.Preparing for MoversIf you would like more practice material to help you prepare for the revised YLE Movers exam,past paper packs,including an audio CD of the Listening test (published by Cambridge University Press),will be available in late 2006.You can find more information,prices and details of how to order on our website at:/support/pastpapers.htmNext stepsWe wish you every success in taking Movers and we hope that you will take other Cambridge ESOL exams in future.Flyers is the next level of the Cambridge YLE tests.Youcan find more information about Flyers on our website at:/exams/yle.htmyle movers information for candidates11What do I get after I take the test?When you take a Young Learners English test,you get an award from Cambridge ESOLshowing how well you have done in each part of the test – Listening,Reading andWriting and Speaking.For each part of the test you get one or more Cambridge shields (up to a maximum offive,so you could get a total of 15 shields for the whole test if you do really well!).Belowis a picture of the award which shows you and your family how well you have done./YLEUniversity of CambridgeESOL Examinations1 Hills RoadCambridgeCB1 2EUUnited KingdomTel.+44 1223 553355Fax.+44 1223 460278email ESOL@© UCLES2006 EMC| 3697 | 6Y07 NOT FOR RESALE。

Table of ContentsIntroduction to 2020 FRM Part II Practice Exam (3)2020 FRM Part II Practice Exam – Statistical Reference Table (5)2020 FRM Part II Practice Exam – Special Instructions and Definitions (6)2020 FRM Part II Practice Exam – Candidate Answer Sheet (7)2020 FRM Part II Practice Exam – Questions (8)2020 FRM Part II Practice Exam – Answer Key (44)2020 FRM Part II Practice Exam – Answers & Explanations (45)IntroductionThe FRM Exam is a practice-oriented examination. Its questions are derived from a combination of theory, as set forth in the core readings, and “real-world” work experience. Candidates are expectedto understand risk management concepts and approaches and how they would apply to a risk manager’s day-to-day activities.The FRM Exam is also a comprehensive examination, testing a risk professional on a number of risk management concepts and approaches. It is very rare that a risk manager will be faced with an issue that can immediately be slotted into one category. In the real world, a risk manager must be able to identify any number of risk-related issues and be able to deal with them effectively.The 2020 FRM Part I and Part II Practice Exams have been developed to aid candidates in their preparation for the FRM Exam in May and November 2020. These Practice Exams are based on a sample of questions from prior FRM Exams and are suggestive of the questions that will be on the 2020 FRM Exam.The 2020 FRM Part I Practice Exam contains 100 multiple-choice questions and the 2020 FRM PartII Practice Exam contains 80 multiple-choice questions, the same number of questions that theactual 2020 FRM Exam Part I and 2020 FRM Exam Part II will contain. As such, the Practice Exams were designed to allow candidates to calibrate their preparedness both in terms of material and time.The 2020 FRM Practice Exams do not necessarily cover all topics to be tested in the 2020 FRM Examas any test samples from the universe of testable possible knowledge points. However, the questions selected for inclusion in the Practice Exams were chosen to be broadly reflective of the material assigned for 2020 as well as to represent the style of question that the FRM Committee considers appropriate based on assigned material.For a complete list of current topics, core readings, and key learning objectives, candidatesshould refer to the 2020 FRM Exam Study Guide and 2020 FRM Learning Objectives.Core readings were selected by the FRM Committee to assist candidates in their review of the subjects covered by the Exam. Questions for the FRM Exam are derived from the core readings. It is strongly suggested that candidates study these readings in depth prior to sitting for the Exam.Suggested Use of Practice Exams:To maximize the effectiveness of the practice exams, candidates are encouraged to follow these recommendations:1.Plan a date and time to take the practice exam.•Set dates appropriately to give sufficient study/review time for the practice exam prior to the actual exam.2.Simulate the test environment as closely as possible.•Take the practice exam in a quiet place.•Have only the practice exam, candidate answer sheet, calculator, andwriting instruments (pencils, erasers) a vailable.•Minimize possible distractions from other people, cell phones, televisions,etc.; put away any study material before beginning the practice exam.•Allocate 4 hours to complete FRM Part I Practice Exam and 4 hours to complete FRM Part II Practice Exam and keep track of your time. The actual FRM Exam Part I and FRMExam Part II are 4 hours each.•Complete the entire exam and answer all questions. Points are awarded for correct answers. There is no penalty on the FRM Exam for an incorrect answer.•Follow the FRM calculator policy. Candidates are only allowed to bring certain types of calculators into the exam room. The only calculators authorized for use on the FRMExam in 2020 are listed below; there will be no exceptions to this policy. You will not beallowed into the exam room with a personal calculator other than the following: TexasInstruments BA II Plus (including the BA II Plus Professional), Hewlett Packard 12C(including the HP 12C Platinum and the Anniversary Edition), Hewlett Packard 10B II,Hewlett Packard 10B II+ and Hewlett Packard 20B.3.After completing the FRM Practice Exams•Calculate your score by comparing your answer sheet with the practice exam answer key.•Use the practice exam Answers and Explanations to better understand the correct and incorrect answers and to identify topics that require additional review. Consultreferenced core readings to prepare for the exam.•Remember: pass/fail status for the actual exam is based on the distribution of scores from all candidates, so use your scores only to gauge your ownprogress and level of preparedness.Special Instructions and Definitions1.Unless otherwise indicated, interest rates are assumed to be continuously compounded.2.Unless otherwise indicated, option contracts are assumed to be on one unit of the underlying asset.3.bp(s) = basis point(s)4.CAPM = capital asset pricing modelP = central counterparty or central clearing c ounterparty6.CDO = collateralized debt obligation(s)7.CDS = credit default swap(s)8.CEO, CFO, CIO, and CRO are: chief executive, financial, investment, and risk officers, respectively9.CVA = credit value adjustment10.ERM = enterprise risk management11.ES = expected shortfall12.EWMA = exponentially weighted moving average13.GARCH = generalized auto-regressive conditional heteroskedasticity14.LIBOR = London interbank offered rate15.MBS = mortgage-backed-security(securities)16.OIS = overnight indexed swap17.OTC = over-the-counter18.RAROC = risk-adjusted return on capital19.VaR = value-at-risk20.The following acronyms are used for selected c urrencies:2020 FRM Part II Practice Exam – Candidate Answer Sheet1. A global bank possesses subsidiaries with banking licenses in various countries, including Singapore, Australia,and UK. Regulators in these countries have recently announced their intention to examine the bank’s risk culture framework and its policies regarding conduct and culture. According to best practices described in recent publications, which of the following actions would the regulators most likely perform?A. Increase the bank’s operational risk capital requirementsB.Review the bank’s accountability standards for its senior managementC.Require that the bank implement quantitative approaches to model conduct and cultureD.Recommend that the bank increase the proportion of incentive compensation for its traders andinvestment bankers2. A risk manager is estimating the market risk of a portfolio using both the arithmetic returns with normaldistribution assumptions and the geometric returns with lognormal distribution assumptions. The manager gathers the following data on the portfolio:• Annualized average of arithmetic returns: 12%• Annualized standard deviation of arithmetic returns: 30%• Annualized average of geometric returns: 11%• Annualized standard deviation of geometric returns: 41%• Current portfolio value: EUR 5,200,000• Trading days in a year: 252Assuming both daily arithmetic returns and daily geometric returns are serially independent, which of the following statements is correct?A.1-day normal 95% VaR = 3.06% and 1-day lognormal 95% VaR = 4.12%B.1-day normal 95% VaR = 3.57% and 1-day lognormal 95% VaR = 4.41%C.1-day normal 95% VaR = 4.12% and 1-day lognormal 95% VaR = 3.57%D.1-day normal 95% VaR = 4.46% and 1-day lognormal 95% VaR = 4.49%3. A credit manager in the counterparty risk division of a large bank uses a simplified version of the Mertonmodel to monitor the relative vulnerability of its largest counterparties to changes in their valuation andfinancial conditions. To assess the risk of default of three particular counterparties, the manager calculates the distance to default assuming a 1-year horizon (t=1). The counterparties: Company P, Company Q, andCompany R, belong to the same industry, and are non-dividend-paying firms. Selected information on thecompanies is provided in the table below:Using the information above with the assumption that a zero-coupon bond maturing in 1 year is the onlyliability for each company, and the approximation formula of the distance to default, what is the correctranking of the counterparties, from most likely to least likely to default?A. P; R; QB. Q; P; RC.Q; R; PD. R; Q; P4. Bank HJK has written puts on Bank PQR stock to a hedge fund and sold CDS protection on Bank PQR to amanufacturer. Bank HJK and Bank PQR operate in several of the same businesses and geographies and their performances are highly correlated. Many in the market are concerned that rising interest rates couldnegatively impact the credit quality of Bank HJK’s numerous borrowers, which in turn would increase thecredit spread of Bank HJK. From the perspectives of the hedge fund and the manufacturer, which of thefollowing is correct with respect to their counterparty risk exposure to Bank HJK?Hedge Fund ManufacturerA. Right-way risk Wrong-way riskB. Wrong-way risk Right-way riskC.Right-way risk Right-way riskD. Wrong-way risk Wrong-way risk5. A risk consultant has been tasked with assessing a small bank’s liquidity risk profile. While reviewing apresentation produced by the bank, the consultant comes across a list of early warning indicators used to signal potentially heightened liquidity risk. Which of the following trends should the consultant consider as thestrongest warning signal for potential liquidity risk at the bank?A. Decrease in stock price of the bank’s peers but not in the stock price of the bank itselfB. Increase in credit lines received from other financial institutionsC.Widening spreads on the bank’s issued debt and credit default swapD. Significant asset growth funded by an increase in stable liabilities6. An investment bank has a one-way credit support annex (CSA) on a bilateral transaction with a hedge fundcounterparty. Under the terms of the CSA, the mark-to-market value of the transaction forms the basis of the hedge fund’s collateral requirements, which are provided below:Assuming the net exposure increases to CNY 27,000,000 and the mark-to-market value of collateral posted has not changed, how much additional collateral will the hedge fund have to post?A. CNY 0B. CNY 1,990,000C. CNY 2,000,000D. CNY 2,500,0007. The board of directors of an insurance company has identified a number of potential growth opportunities forthe company to consider. To help assess these opportunities and determine an optimal risk structure to use across the organization, the risk committee has recommended that the company implement an ERMprogram. Which of the following would best represent an appropriate goal for the firm to state as part of the ERM program?A. Determine a risk-return trade-off that reflects the company’s target credit rating and ensure that businessunit managers evaluate new projects with this firm-wide target in mind.B. Attempt to eliminate the company’s probability of financial distress t o maximize company value.C. Maximize the firm's leverage ratio within its risk tolerance to ensure the highest expected return on equity.D. Establish a target minimum level of annual earnings and guarantee to shareholders that it will maintain thislevel.8. A US pension fund had assets and liabilities valued at USD 840 million and USD 450 million, respectively, atthe end of 2017. The fund’s assets were fully invested in equities and commodities while its liabilitiesconsisted entirely of fixed-income obligations. The fund reported that by the end of 2018 the value of assets decreased by 14.0% and the value of liabilities increased by 3.5%. Assuming no changes were made to the composition of the assets and liabilities during the yea r, what was the change in the pension fund’s surplus over the 1-year period?A. USD -133.4 millionB. USD -117.6 millionD 256.7 millionD. USD 390.0 million9. A wealth management firm has a portfolio consisting of USD 37 million invested in US equities and USD 48million invested in emerging markets equities. The US equities and emerging markets equities both have a 1-day 95% VaR of USD 1.3 million. The correlation between the returns of the US equities and emergingmarkets equities is 0.25. While rebalancing the portfolio, the manager in charge decides to sell USD 7million of the US equities to buy USD 7 million of the emerging markets equities. At the same time, the CRO of the firm advises the portfolio manager to change the risk measure from 1-day 95% VaR to 10-day 99% VaR. Assuming that returns are normally distributed and that the rebalancing does not affect the volatility of the individual equity positions, by how much will the portfolio VaR increase due to the combined effect of portfolio rebalancing and change in risk measure?A. USD 4.373 millionB. USD 6.428 millionD 7.034 millionD. USD 9.089 million10. An operational risk manager is asked to report a bank’s operational risk capital under the StandardizedMeasurement Approach (SMA) proposed by the Basel Committee in March 2016. The treasury department produces the following data for the bank, calculated according to the SMA guidelines:•Business Indicator (BI): EUR 1,200 million•Internal Loss Multiplier: 1In addition, the manager uses the Business Indicator buckets in the Business Component presented inthe table below:What is the correct operational risk capital that the bank should report under the SMA?A. EUR 120 millionB. EUR 150 millionC.EUR 158 millionD. EUR 180 million11. A credit manager who is well versed in lessons learned from the 2007–2009 subprime mortgage crisis in the USis overseeing the structured credit book of a bank in order to identify potential problems of information flow (frictions) between the parties involved in the securitization process. Which of the following is a correctcombination of a potential friction in the securitization process and an appropriate mechanism to mitigate that friction?A. Friction between the asset manager and the investor: Adverse selection problem. This problem canbe mitigated by the asset manager charging due diligence fees to the investor.B. Friction between the arranger and the originator: Model error problem. This problem can be mitigated bythe arranger providing a credit enhancement to the securitized products with its own funding.C.Friction between the investor and credit rating agencies: Principal-agent conflict. This problem can bemitigated by requiring credit rating agencies to be paid by originators and not by investors for theirrating services.D. Friction between the servicer and the mortgagor: Moral hazard problem. This problem can be mitigatedby requiring the mortgagor to escrow funds for insurance and tax payments.12. A risk manager is backtesting a company’s 1-day 99.5% VaR model over a 10-year horizon at the 95%confidence level. Assuming 250 trading days in a year and the daily returns are independently and identically distributed, which of the following is closest to the maximum number of daily losses exceeding the 1-day99.5% VaR in 10 years that is acceptable to conclude that the model is calibrated correctly?A. 19B. 25C.35D. 3913. A portfolio manager is mapping a fixed-income portfolio into exposures on selected risk factors. The manageris analyzing the comparable mechanics and risk measurement outputs of principal mapping, durationmapping, and cash-flow mapping. Which of the following is correct?A. Cash-flow mapping groups cash flows into buckets based on their size.B. Cash-flow mapping uses the average rates in each risk group as a discount factor.C.Principal mapping incorporates correlations among zero-coupon bonds.D. Duration mapping replaces the portfolio with a zero-coupon bond with maturity equal to the duration of theportfolio.14. A CRO of a hedge fund is asking the risk team to develop a term-structure model that is appropriate for fittinginterest rates for use in the fund’s options pricing practice. The risk team is evaluating several interest rate models with time-dependent drift and time-dependent volatility functions. Which of the following is a correct description of the specified model?A. In the Ho-Lee model, the drift of the interest rate process is presumed to be constant.B. In the Ho-Lee model, when the short-term rate is above its long-run equilibrium value, the drift ispresumed to be negative.C.In the Cox-Ingersoll-Ross model, the basis-point volatility of the short-term rate is presumed to beproportional to the square root of the rate, and short-term rates cannot be negative.D. In the Cox-Ingersoll-Ross model, the volatility of the short-term rate is presumed to decline exponentiallyto a constant long-run level.15.Due to lack of available investment opportunities in public markets, a pension fund decided to hire aninvestment consultant to assess the potential for investing in illiquid markets in the US. Which of the following characteristics of illiquid markets in the US should the consultant present to the pension managers?A. Municipal bonds are usually more liquid than pink-sheet over-the-counter equitiesB. The traditional public, liquid markets of stocks and bonds are larger than the total wealth held in illiquidassets.C. The share of illiquid assets in institutional portfolios has generally gone up in the past 2 decades.D. During the 2008-2009 Financial Crisis, liquidity dried up in repo markets but not in commercial papermarkets.16. A mid-size investment bank conducts several trades. As part of its risk control, it has entered into nettingagreements on 8 equity trade positions with an average correlation of 0.28. The firm believes that it canimprove upon the diversification benefit of netting by revising the current agreement. Assuming values of future trade positions are normally distributed, which of the following trade combinations would increase the firm’s expected netting benefit the most from the current level?A. Trade combination ABCB. Trade combination LMNC. Trade combination PQRD. Trade combination TUV17. A regional bank wants to improve its operational resilience to help keep pace with emerging best practices inthis area. A consultant hired by the bank recommends that it establish a set of impact tolerances to improve its resilience. Which of the following correctly describes a potential benefit to the bank of establishing an impact tolerance?A.It will enhance the bank’s ability to identify and limit concentration risk.B.It will accurately estimate the severity of a potential disruption to an operational process and the amountof downtime that would result.C.It will help the bank optimize its allocation of resources to its most important business services.D.It will prevent failures of critical operational processes and the systems that support these processes.18. A manager is evaluating the risks of a portfolio of stocks. Currently, the portfolio is valued at CNY 124 millionand contains CNY 14 million in stock Y. The annualized standard deviations of returns of the overall portfolio and of stock Y are 16% and 12%, respectively. The correlation of returns between the portfolio and stock Y is0.52. Assuming the risk analyst uses a 1-year 95% VaR and the returns are normally distributed, what is thecomponent VaR of stock Y?A. CNY 0.103 millionB. CNY 1.437 millionY 2.032 millionD. CNY 3.685 millionQUESTIONS 19 AND 20 REFER TO THE FOLLOWING INFORMATION:XYZ, a small investment management firm, specializes in structuring small business loans and selling the government guaranteed portion to other institutional investors while retaining the riskier portions for high net worth investors. XYZ funds its operations by engaging in overnight repurchase agreements (repos) with three firms, but primarily with ABC, a firm that XYZ also has a large line of credit with. ABC specializes in pooling funds from community banks and local government agencies and investing them in short-term, high-quality, government-secured investments.Last week, XYZ was informed by ABC that its line of credit had been frozen. XYZ learned that ABC had been defrauded by Repo Co., another of its repo borrowers, who had provided false documentation of non-existent collateral of government-guaranteed loans. ABC feared a run by its investors as news of the fraud spread.The diagram below illustrates the parties involved:19.The use of a central clearinghouse to handle the transactions executed between XYZ's main funding source,ABC and ABC's client, Repo Co., would likely have resulted in a reduction in:A. ABC's funding liquidity riskB. Repo Co.'s default riskC.XYZ's lending riskD. ABC's operational risk20.By using a clearinghouse to handle the repo transactions between ABC Co. and Repo Co., obligations owedbetween the two could have been netted once the fraudulent documentation was discovered. Which of the following is the most appropriate type of netting to use in this situation and what would be a likely additional impact from using this netting?A. Payment netting would be used, which would reduce ABC's counterparty risk, but this risk would betransferred to other creditors outside the clearinghouse.B. Payment netting would be used, which would reduce Repo Co.'s counterparty risk, but ABC's counterpartyrisk would be increased.C.Closeout netting would be used, which would reduce ABC's counterparty risk, but this risk would betransferred to other creditors outside the clearinghouse.D. Closeout netting would be used, which would reduce Repo Co.'s counterparty risk, but ABC's counterpartyrisk would be increased.21.The CRO at a bank wants to strengthen the bank’s capability to defend itself against emerging cyber-threats. Tohelp achieve this goal, the CRO is assessing the current range of practices regarding the sharing ofcybersecurity information between different types of institutions, as well as the potential benefits from sharing information. Which of the following statements would be most appropriate for the CRO to make?A. The sharing of cybersecurity information among banks is less frequently observed and generally consideredto be less effective than other cyber-security information-sharing practices.B. The scope and depth of information-sharing practices among banks may significantly vary between financialmarkets, depending on the level of trust among participating banks.rmation-sharing among different national regulators has evolved significantly over the past several yearsand is now a widespread practice at a large majority of jurisdictions.D. Existing peer-sharing mechanisms among banks focus on the exchange of information related to cyber-security incidents, but such information is generally not shared from banks to regulators.22.A risk manager is training junior risk analysts at an international bank. The manager is instructing them about thedifference between repurchase agreements (repos) and reverse repurchase agreements (reverse repos), as well as the relevant market participants. Which of the following is a correct statement for the manager to present to the class?A. A trader who would like to short a bond could enter into a repo to borrow the bond.B. Haircuts on collateral are typically charged to those who lend collateral in repo transactions, but margin callsare usually not made.C.When financing a purchase of securities, financial institutions often sell the repo to avoid putting up fullpurchase price for the securities.D. Money market mutual funds tend to enter into a repo to invest short-term liquid instruments.23.The risk audit committee of an equity mutual fund is reviewing a portfolio construction technique proposed by anew portfolio manager who has recently been allocated capital to manage. The fund typically grants its portfolio managers flexibility in selecting and implementing appropriate portfolio construction procedures but requires that any methodology adopted fulfills key risk control objectives set by the firm. Which of the following portfolio construction techniques and its capability for risk control in portfolio construction is correct?A. Quadratic programming allows for risk control through parameter estimation but generally requires manymore inputs estimated from market data than other portfolio construction techniques require.B. The screening technique provides superior risk control by concentrating stocks in selected sectors based onexpected alpha.C.When using the stratification technique, risk control is implemented by overweighting the categories withlower risks and underweighting the categories with higher risks.D. When using the linear programming technique, risk is controlled by selecting the portfolio with the lowestlevel of active risk.24.An analyst reports the following fund information to the advisor of a pension fund that currently invests ingovernment and corporate bonds and carries a surplus of USD 40 million:To evaluate the sufficiency of the fund's surplus, the advisor estimates the possible surplus values at the end of 1 year. The advisor assumes that annual returns on assets and the annual growth of the liabilities are jointly normally distributed and their correlation coefficient is 0.68. Assuming that the volatility of surplus is USD35.76 million, what is the lower bound of the 95% confidence interval for the expected end-of-year surplusthat the advisor can report?A. USD -76.4B. USD -58.2D -33.3D. USD -22.025. A treasurer at a small regional bank is assessing the bank’s liquidity position. The treasurer estimates that thefollowing cash inflows and outflows will occur in the next week:Which of the following is the correct amount, at the week’s end, for the bank’s net liquidity position?A. -80B. -20C.40D. 10026. A packaging materials manufacturer is considering a project that has an estimated risk-adjusted return oncapital (RAROC) of 15%. Suppose that the risk-free rate is 3% per year, the expected market rate of return is 11% per year, and the company's equity beta is 1.8. Using the criterion of adjusted risk-adjusted return on capital (ARAROC), the company should:A. Reject the project because the ARAROC is higher than the market expected excess return.B. Accept the project because the ARAROC is higher than the market expected excess return.C.Reject the project because the ARAROC is lower than the risk-free rate.D. Accept the project because the ARAROC is lower than the risk-free rate.27. A derivative trading firm only trades derivatives on rare commodities. The company and a handful of otherfirms, all of whom have large notional outstanding contracts with the company, dominate the market for such derivatives. The company’s management would like to mitigate its overall counter party exposure, with the goal of reducing it to almost zero. Which of the following methods, if implemented, could best achieve this goal?A. Ensuring that sufficient collateral is posted by counterpartiesB. Diversifying among counterpartiesC.Cross-product netting on a single counterparty basisD. Purchasing credit derivatives, such as credit default swaps28.HIP Bank (HIP) often enters into interest rate swaps with ADB Banking Corporation (ADB) on terms that reflectappropriate counterparty risk. Earlier in the year, HIP and ADB entered into a 3-year swap in which ADBagreed to pay HIP a fixed rate of 5% in return for 6-month LIBOR plus a spread. Since the swap was entered into, both banks were downgraded. As a result of the ratings changes, the credit spread for HIP has increased from 36 bps to 144 bps, while the credit spread for ADB has increased from 114 bps to 156 bps. Assuming no change in the LIBOR curve, if an identical 3-year swap was entered into today, which of the following is the most likely to be correct?A. Since HIP’s spread increased more than ADB’s spread, HIP’s DVA will increase and ADB’s DVA willdecrease.B. Since HIP’s spread increased more than ADB’s spread, HIP’s CVA will increase and ADB’s CVA willdecrease.C.Since both banks’ spreads increased, the CVA on both sides of the contract will be higher.D. Since both banks’ spreads increased, the DVA on both sides of the contract will be lower.。

FRM二级常见易错题1.For banks that use the advanced internal ratings-based(advanced IRB) approach to credit risk,the primary inputs to the capital calculations are:(保留)A.Credit assessments of external rating agencies.B.The banks'internal assessments ofkey risk drivers.C.Mandated by bank supervisors.D.Interest rates.2.The cumulative probability of default for a note over tvvo years is3.8%. If the probability of default during the first year is1.5%,the probability of default during the second year is closest to:(保留)A.2.96%B.2.34%C.3.17%D.3.28%3.Pillar III of the Basel II accord includes all ofthe following requirements for internationally active banks except:(保留)A.A formal disclosure policy should be established,and supported by a bank's board of directors.B.Banks should operate above minimum regulatory capital ratios.C.Financial statements that fairly retlect financial condition should be Pllblished reglllarly.D.There should be specific remedial actions in the event of nondisclosure.Answer:1.BUnder the advanced IRB approach,the bank uses its own intβmal measures of credit risk andexposure in capital calculations2.BThe cumulative probability of default is equal to one minus the probabiJity of surviving to the endofthe period without default:C2=1-(1-p1)(1-P2)0.038=1-(1-0.015)(1-P2)=>P2= 0.02343.BThe requirement to operate above minimum regulatory capital ratios is a requirement laid out in Pillar II regarding the interaction of supervisors and internationally active banks. Note that PillarIII relates to market discipline and disclosure.4.How many of the following statements concerning the capital structure in a securitization are most likely correct?(保留)I.The mezzanine tranche is typically the smallest tranche size.II.The mezzanine and equity tranches typicaUy offer fixed coupons.III.The senior tranche typically receives the lowest coupon.A.No statements are correct.B.One statement is correct.C.Two statements are correct.D.Three statements are correct.5.Identify the risks in a convertible arbitrage strategy that takes long positions in convertible bonds hedged with short positions in treasuries and the underlying stock.(保留)A.short implied volatilityB.long durationC.long stock deltaD.positive gamma6.A pool of high yield bonds is placed in an SPV and three tranches (including the equity tranche)of bonds are issued collateralized by the bondsto create a Collateralized Bond Obligation(CBO).Which of the following is true? (保留)A.At fair value,the value of the issued bonds should be less than the collateralB.At fair value,the total default probability,weighted by size of issue,of the issued bonds should equal the default probability of the collateral poolC.The equity tranche of the CBO has the least risk of defaultD.The yield on the low risk tranche must be greater than the yield on the collateral poolAnswer:4.BSenior tranches are perceived to be the safest,so they receive the lowest coupon.The equity tranche receives residual cash flows and no explicit coupon.Although the rnezzanine tranche is often thin,the equity tranche is typically the thinnest slice.5.DThis position is hedged against interest rate risk,so B is wrong.It is also hedged against directional movements in the stock,so C is wrong.The position is long an option (option to convert the bond into the stock)and so is long implied volatility,so A is wrong. Long options positions have positive gamma.6.BA Collateralized Bond Obligation and the underlying securities must have equal market value,similar cash flow pattern and identical risk,which eliminate choice A in favor of B. The equity tranche has the greatest risk of default;the yield on the low risk tranche must be less than the yield on the collateral pool.7.A risk analyst in a fund of funds is gauging the liquidity risk exposure of a hedge fund by examining the autocorrelation in the fund's returns.If found,a significant first-order autocorrelation coefficient of0.5for the monthly historical returns can be seen as an indicator of all of the following except: (保留)A.High market frictions.B.Historical return smoothing.C.Engaging in a managed futures strategy.D.Investments in the equity of non-public firms.Answer:7.CAutocorrelation(自相关):残差项之间存在correlation,市场越有效,自相关发生的可能性越小。

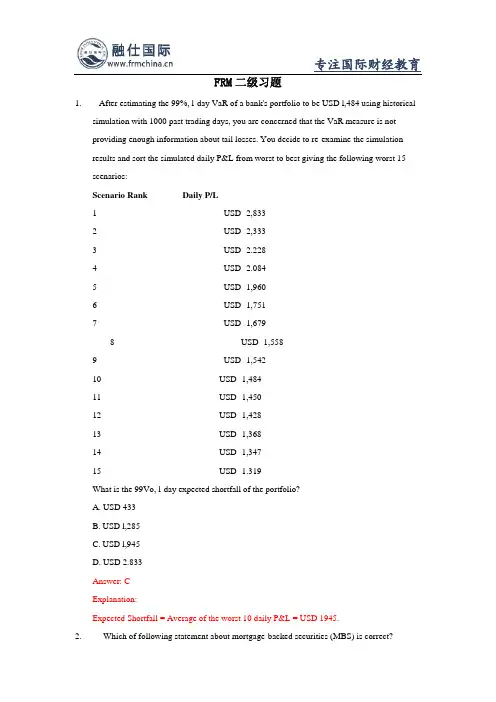

FRM二级习题1. After estimating the 99%, l-day VaR of a bank's portfolio to be USD l,484 using historicalsimulation with 1000 past trading days, you are concerned that the VaR measure is notproviding enough information about tail losses. You decide to re-examine the simulation results and sort the simulated daily P&L from worst to best giving the following worst 15 scenarios:Scenario Rank Daily P/L1 USD -2,8332 USD -2,3333 USD -2.2284 USD -2.0845 USD -1,9606 USD -1,7517 USD -1,6798 USD -1,5589 USD -1,54210 USD -1,48411 USD -1,45012 USD -1,42813 USD -1,36814 USD -1,34715 USD -1.319What is the 99Vo, l-day expected shortfall of the portfolio?A. USD 433B. USD l,285C. USD l,945D. USD 2.833Answer: CExplanation:Expected Shortfall = Average of the worst 10 daily P&L = USD 1945.2. Which of following statement about mortgage-backed securities (MBS) is correct?I The price of a MBS is more sensitive to yield curve twists than zero-coupon bonds.II When the yield is higher than the coupon rate of a MBS, the MBS behaves similar to corporate bonds as interest rates change.A. I onlyB. II onlyC. BothD. NeitherAnswer: CExplanation:I. This statement is correct. MBS' cash flows are like annuities, which are more sensitive toyield curve twist because of reinvestment risk. Normal bond has a lump sum payment atmaturity, which implies less reinvestment risk.II. This statement is correct. When yield is higher than MBSJ coupon rate, the embedded call option is out of the money. It is much the same as a normal bond.3. A fixed-income portfolio with market value of USD 60 million, modified duration of 2.53years and yielding 4.7Vo compounded semiannually. What would be the change in the value of this portfolio after a parallel rate decline of 20 basis points in the yield curve?A. A loss of USD 607,200B. A loss of USD 303,600C. A gain of USD 303,600D. A gain of USD 607,200Answer: CExplanation:By definition, D mod = (-l/P) * (dP/dy). So as a linear approximationAP = -l * Ay * D mod * P = -l * -0.0020 * 2.53 * 60 = 0.3036 million4. Assuming equal strike prices and expiration dates, which of the following options should bethe least expensive?A. American call optionB. Shout call optionC. European call optionD. Lookback call optionAnswer: CExplanation:C is correct. The shout call option and lookback call option are clearly wrong, since theygrant more rights to the buyer than the European call option. American calls also offer more to the buyer than the European calls.5. Edward Art, a CFO of Bank of Mitsubishi, has recently proposed to increase the bank'sliquidity by securitizing existing credit card receivables. Edward's proposed securitization includes tranches with multiple internal credit enhancements as shown in Exhibit l below.The total value of the collateral for the structure is USD 680 million, the lockout period is two years, and the subordinated tranche B bond class is the first loss piece:Exhibit l. Proposed ABS StructureBond Class Par ValueSenior tranche USD 270 millionJunior tranche A USD 230 millionJunior tranche B USD 80 millionSubordinated tranche A USD 60 millionSubordinated tranche B USD 40 millionTotal USD 680 million At the end of the fourteenth month after the securities were issued, the underlying credit card Accounts have prepaid USD 300 million in principal in addition to regularly scheduledprincipal and interest payments.What is the amount of the prepaid principal paid out to the holders of the junior tranche A bond class?A. USD 0 millionB. USD 30 millionC. USD 120 millionD. USD 230 millionAnswer: AExplanation:d: is correct. The securities have a two-year lockout period; all principal prepayments withinthe first two years will be used to fund new loans. No security tranche will receive principal prepayments until after the 24 months lockout period. Credit card prepayments are usually just rolled into new loans (not repaid to bondholders).。

FRM二级模拟题(二)1. Kate Harrison, FRM, is the risk manager for a medium-sized, regional depository institutionwith significant concentration risk in outstanding loans. She is trying to estimate and hedge the banks' exposure to credit losses. First, Kate has decided to estimate credit VaR usingCreditPortfolio View because of its use of macroeconomic transition matrices. She decided not to use the CreditRisk+ approach because of its reliance on non-parametric methods.Lastly, she is concerned that the proposed hedge bears counterparty risk and proposes avulnerable option calculation to evaluate this risk. Which of Kate's conclusions are accurate?a. Her statement about CreditPortfolioView and CreditRisk+ are correct, but her statementabout vulnerable options is not.b. Her statement about CreditPortfolioView is correct, but her statements about CreditRisk+and vulnerable options are not.c. Her statement about CreditRisk+ and vulnerable options are correct, but her statementabout CreditPortfolio View is not.d. Her statements about CreditPortfolioView and vulnerable options are correct, but herstatement about CreditRisk十 is not.Answer: dVulnerable options are options with positive probability of default. CreditRisk + assumes a specific functional Form and does not use non-parametric methods. CreditPortfolio View incorporates macroeconomic transition matrices since macro factors are the principal drivers of default.2. In determining thar prior capital asset pricing model (CAPM) tests of validity were flawed,Richard Roll and other researchers tried to correct for flawed security market line (SML) estimates by using portfolios rather than individual securities. How would the results of their first-pass and second-pass regression estimates be best described when the portfolio approach was used?a. The first-pass regression and second-pass regression were equally accurate.b. The second-pass regression was more accurate, improved by the portfolio approach.c. There were more observations in the second-pass regression, so portfolios wereconstructed with the smallest possible dispersion of beta coefficients.d. There were fewer observations in the second-pass regression, so portfolios wereconstructed with the greatest possible dispersion of beta coefficients.Answer: dAlthough the first-pass regression was estimated more accurately, it was at the expense of the second-pass regression due to fewer observations from the grouping of portfolios. To adjust, portfolios were constructed with the highest possible dispersion of beta coefficients.3. In Basel II, the foundation and advanced IRB approaches differ primarily in terms of theinputs that are provided by the bank based on its own estimates and those that have beenspecified by the supervisor. For the foundation approach, the inputs provided by the bank are the:a. probability of default.b. loss given default and exposure at default.c. probability of default and loss given default.d. probability of loss given default and maturity.Answer: aIn the foundation approach, only the probability of default is based on the bank's ownestimate.4. Trader A purchased a 3-month floating lookback call option on ABA stock three months ago.Trader B purchased a 3-month fixed lookback call option on the same stock during the same time period as Trader A. ABA stock finished at $50 at the end of the three-month option term, and the initial strike price was equal to $40. The minimum stock price over the investment horizon was $35, and the maximum stock price over the investment horizon was $53. The payoff difference between the floating lookback call and the fixed lookback call is closest to:a. $2.b. $3.c. $8.d. $10.Answer: aA floating lookback call pays the difference between the expiration price and the minimumprice of the stock over the horizon of the option. Therefore, its payoff is equal to: $50 - $35 = $15. A fixed lookback call has a payoff function equal to the difference between themaximum price during the option's life and the strike price. Therefore, its payoff is equal to: $53 - $40 = $13. The payoff difference between the two exotic options is equal to $2.5. An analyst has the following .information pertaining to Portfolio x:. Risk-free rate = 2%.. Actual portfolio return = 10% .. Relevant benchmark return - 8%.. Portfolio standard deviarion = 5%.. Observed tracking error = 3%.Which of the following statements regarding Portfolio X is correct?a. The information ratio is 0.67.b. The information ratio is l.60.c. The Sharpe ratio is 0.40.d. The Sharpe ratio is 2.67.Answer: aThe information ratio is calculated as: (10% - 8%) / 3% = 0.67The Sharpe ratio is calculated as: (l0% - 2%) / 5% = 1.60。

frm考试题及答案FRM(Financial Risk Manager)考试是由全球风险管理专业人士协会(GARP)提供的金融风险管理领域的专业认证考试。

以下是一份模拟的FRM考试题目及其答案:FRM考试模拟题一、单项选择题1. 在现代投资组合理论中,哪一项是投资组合风险的主要来源?A. 系统性风险B. 非系统性风险C. 利率变动D. 汇率波动答案:A2. 以下哪个不是信用评级机构?A. 标准普尔B. 穆迪C. 惠誉D. 花旗银行答案:D3. 风险价值(VaR)是一种衡量投资组合在一定置信水平下,一定时间内可能遭受的最大损失的方法。

它属于哪种风险管理技术?A. 敏感性分析B. 压力测试C. 极值理论D. 统计风险管理答案:D二、多项选择题4. 以下哪些因素会影响期权的时间价值?A. 期权的执行价格B. 期权到期前的时间长度C. 标的资产的波动性D. 无风险利率答案:B, C, D5. 在进行市场风险管理时,以下哪些措施是有效的?A. 多元化投资B. 风险对冲C. 增加杠杆D. 风险转移答案:A, B, D三、简答题6. 描述一下什么是流动性风险,并给出一个金融机构可能面临的流动性风险的例子。

答案:流动性风险是指金融机构在需要时无法以合理成本迅速出售资产或获得资金的风险。

一个例子是银行在金融危机期间面临大量客户同时提取存款,导致银行流动性枯竭。

四、计算题7. 假设一个投资组合由两种资产组成,资产A和资产B。

资产A的预期收益率为10%,标准差为15%,资产B的预期收益率为8%,标准差为10%。

如果投资组合由60%的资产A和40%的资产B组成,且两种资产的相关系数为0.5,请计算投资组合的预期收益率和标准差。

答案:预期收益率 = 0.6 * 10% + 0.4 * 8% = 9.2%标准差= √(0.6^2 * 15%^2 + 0.4^2 * 10%^2 + 2 * 0.6 * 0.4 * 0.5 * 15% * 10%) = √(10.125% + 4% + 6%) = √20.125% ≈ 14.17%结束语:以上题目仅供参考,实际FRM考试内容和难度可能会有所不同。