《金融专业英语》习题答案

- 格式:doc

- 大小:48.00 KB

- 文档页数:7

⾦融英语练习题(附答案)Multiple Choice1. The People’s Bank of China shall have the power to demand financial institutions to submit balance sheets, statements ofD and other financial and accounting reports and materials in pursuance of regulations.A. accountB. financial positionC. cash flowD. profit and loss2. A credit card such as Visa will D .A. gurantee chequesB. enable the holder to cash cheques at any bankC. enable the holder to buy goods on creditD. enable the holder to buy goods, up to certain amounts, on credit from certain persons3. Foreign trade can be conducted on the following terms except for DA. open accountB. documentary collectionC. documentary creditsD. public bonds4. Customers trading abroad in foreign currencies may protect against the exchange risk by arranging C .A. a contract of international sale of goodsB. a contract of marine insuranceC. a forward contract to fix the exchange rate in advance5. The danger to the exporter in open account trading is that by surrendering the shipping documents to the importer, heB before he has obtained payment for them.A. is in control of the goodsB. losses control of the goodsB. retain control of the goods D. gives up control of the goods6. Leasing is an arrangement whereby one party obtains on a long-term basis A which belongs to another party.A. the use of a capital assetB. the use of a current assetC. the use of working capitalD. the use of current liabilities7. From a Chinese bank’s point of view, the currency account which it maintains abroad is known as , while a RMB account operated in China for a foreign bank is termed B .A. a vostro account, a nostro accountB. a nostro account, a vostro accountC. a mirror account, a nostro accountD. a vostro account, a mirror account8. Find the interest on US $65,000 for 14 days at 3 percent per annum.B .A. US $37.91B. US $75.83C. US $113.74D. US $227.499. Which of the following can not be included in the functions ofmoney?D 。

金融英语练习题答案对于金融从业者和学习金融专业的学生而言,加强对金融英语的练习和理解是非常重要的。

下面将提供一些金融英语练习题的答案,并解释相关的金融术语和概念,帮助读者更好地掌握金融英语知识。

1. What is the meaning of IPO?IPO stands for Initial Public Offering. It refers to the first sale of stock by a company to the public. It is often used by private companies to go public and raise capital for various purposes, such as expanding their business or paying off debts.2. What does ROI stand for?ROI stands for Return on Investment. It is a measure used to evaluate the efficiency or profitability of an investment. ROI is calculated by dividing the net profit of an investment by the initial cost of the investment and expressing it as a percentage.3. What is a bull market?A bull market refers to a financial market characterized by rising stock prices and optimistic investor sentiment. It is associated with strong economic growth and positive market trends. In a bull market, investors are generally confident and willing to buy stocks, anticipating further price increases.4. What is a bear market?A bear market is the opposite of a bull market. It refers to a financial market characterized by falling stock prices and pessimistic investor sentiment. It is associated with economic downturns and negative market trends. In a bear market, investors tend to sell stocks to avoid further losses, leading to a downward spiral of prices.5. What is the difference between stocks and bonds?Stocks represent ownership in a company, while bonds represent debt issued by companies or governments. When an individual purchases stocks, they become a shareholder of the company and have the potential to earn dividends and capital gains. On the other hand, bonds are considered loans made by investors to the issuer, and they earn fixed interest payments over a specified period.6. What is diversification?Diversification is a risk management strategy that involves spreading investments across different assets, sectors, or regions to reduce exposure to any single investment. By diversifying their portfolio, investors aim to minimize the impact of potential losses from any individual investment and increase the likelihood of achieving positive returns overall.7. What is a hedge fund?A hedge fund is an investment fund that pools capital from accredited investors or institutional investors and uses various strategies to generate high returns. Hedge funds typically have more flexibility and can invest in a wide range of assets, including stocks, bonds, derivatives, and currencies.They also tend to use leverage and alternative investment techniques to achieve their investment objectives.8. What is a credit rating?A credit rating is an assessment of the creditworthiness of a borrower, such as a company or government, which indicates the likelihood of defaulting on its debt obligations. Credit rating agencies assign ratings based on various factors, including financial stability, repayment history, and market conditions. The ratings range from AAA (highest quality) to D (default).以上是对金融英语练习题的解答以及相关金融术语和概念的讲解。

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

金融英语练习答案:Lesson 1I. 1.need 2.specialization 3.double coincidence of wants 4.exchange rate 5. money6.medium of exchange7. Commodity money such as cornmodity / common standard value9. store of wealth 10.parchasing power 11.Banknotes. 12.Fiduciary money 13.redemption rate 14.Fiat money 15. legal tender 16.fiduciary money 17.paper money 18.price level 19.reserve rax 20. checkII Translation:1.Money mainly serves three functions :a medium of exchange, a standard of value and a store ofwealth.2.The greater the specialization in the division of labor increased ,the more difficult in finding goodsthat have a double coincidence of wants.3.The value of money is reflected by its purchasing power.4.Fiat money is declared legal tender by the government ,meaning that creditors must accept it aspayment for debt.5.The bearers/holders of fiduciary money may require bank to redeem for gold or other valuablecommodity.6.The fractional reserve banking system requires the banks to keep certain reserve ratio.7.The money that most countries in the world use today is fiat money.8.The wide application of fiduciary money reduces that cost of transactions.9.There were several metals which have been used as commodity money in the history, such as iron,copper, gold ,silver and so on.10.The value of fiat money lies in that people believe that it can be exchanged for commodity andservice.Lesson 2:I.1.investors 2.consumoption / saving 3.enterprises 4. savings 5.investment 6.home7.loan 8.deposit 9.uill rise 10.fallII1.The interest rate refers to the ratio of the interest amount to the proceeds deposited and loaned in agiven period.2.Interest is the price of capital; which is like the market price for general commodity .Theoretically ,itis determined by demand and supply.3.China’s interest rate has been adjusted and reformed for several times .Before 1978,the policy ofgradually rising interest rate was adopted.4.The mutual relation of all kinds of interest rate comprises the structure of interest rate. Generally ,theinterest rate of longer tenor is higher than that of shorter tenor in terms of the same kind of interest rate.5.Among various interest rate, the interest rate for deposit is lower that for loan; the interest rate offeredby commercial bank is higher than discount rate offered by the central bank.6.At present ,China’s interest rate system consists of the interest rate of bank, non-bank financialinstitution, portfolio and market.7.The discount rate offered by central bank refers to the discount rate for the instrument held by thecommercial banks. it reflects the redemption rate for the amounts of rediscount instrument.8.Due to free competition ,the demand and supply of currency borrowing and lending tend to bebalanced out through market mechanism .in this case ,the market interest rate is called equilibrium rate.9.The bond interest rate is interest rate paid by the government, banks and corporation for theaccommodation in the form of issuing, securities in domestic or foreign financial markets.10.The interest rate for corporate bond is basically determined by the bond issuing corporation itself, butthe government exercises control by setting the ceiling.Lesson 3:I.1.Firrancial intermediary 2.demard deposit /checking account 3.savings and loan associations, mutual savings bank and credit union. 4.Federal reserve system ernment securities/require that member banks hold reserves equal to some fraction of their deposits. 6.Feder Reserve Board 7.Federal Open market committee 8.reserve requirements 9.the ceiling 10. interest rate level 11.portfolios 12.outstanding loans 13.were deregulated 14.deposit insurance 15.merge with other banks 16. automatic teller machines 17.By pooling funds of many share holders 18.branches 19.The banking holding company 20.financialII1.Federal Reserve System was established in 1914,with its aim to stabilize the banking system. thepower of the Federal Reserve System was enhanced and centralized after the failures of many American banks in the Great Depression. The Arts passed in1980s authorized the Federal Reserve System with the power to regulate all the saving institutions. The main powers of Federal Reserve System were:(1)guide the transactions of open market so to control supply of money by buying and selling government securities,(2)determine the reserve requirements for saving institution (3)setting rediscount rate.2.The banking regulations in Great Depression made bank a trade that closely controlled andpredictable. But the high interest rate in 1970s disturbed the peaceful days of saving institutions. But many banks still couldn’t survive in the transive period of keen competition.Lesson 4:1.as a result of /helped to /by the time2.concerned about/at the outset3.offerd to take/in dollars/departure fromTransaction account is checking account which can write checks on deposits balance. They have three forms, the first one is “Demand Deposit”which banks don’t pay explicit interest; the second one is “ other checkable deposits”, which includes NOW(Negotiable Order of Withdrawal)accounts; the third one is Money Market Deposit accounts. Although banks can’t pay explicit interest on demand deposit, they can pay implicit interest in the form of proving free services. Different from NOW accounts, commercial banks don’t need to maintain reserves, so banks pay higher interest on the NOW accounts. At present, transaction account is the second largest debt form of the commercial banks.Lesson 5I1.as well as 2.in total assets 3.intermediate 4. title 5.an agent 6.Financial instruments 7.pay 8.as par 9.documentary letters of credit 10.prof-of –shipment documents . 11. HedgingII. Translation:Lesson 6I.1.bank 2.discount 3.buyers/sellers 4.short-term 5.borrowing/lending 6.deposits7.brokers 8.loans 9.linked 10.marketII Translation:1.The activities of money market mainly aim at keeping the liquidity of assets so that they can bechanged into cash on demand.2.On one hand, the money market meets the demand for short-term money of borrowers, one the otherhand, it finds a way out for lenders who have temporary excessive money.3.The Financial instruments of money market mainly are short-term treasury bill, commercial bill, bankacceptance, certificate of deposits, the tenors of these instruments range from one day shortest to one year longest.4.The participants of buying and selling short-term assets in the money market are individuals, businessfirms, various financial institutions, and governments. They act either as the provider of funds or as the demander of funds.5.As the intermediary of money market, various financial institutions have different functions inaffecting the demand for and supply of funds in the capital market, because their stress of importance on business if different.6.The commercial banks provide the money market mainly with short-term loans mainly with themoney obtained from deposits and other sources.7.In many countries, commercial banks are in the position of key importance in the money market,while the central bank controls commercial banks by various means so as to control money market. 8.Just as a country can’t be without a government, the money market can’t be without a central bank,whose activities in money market will affect the volume of money and interest rate at any time.9.The inter-bank market refers to the market where financial institutions solve the problem of excessiveor short of money by financing one another.10.With the development of the reform of financial system in our country, the inter-bank markets startedto develop rapidly.Lesson 7I.1.firms 2.inter rate /exchange 3. regional exchange 4.negotiable 5.exchange6.bond7.funds8.outstanding9.brokers 10.dealers.II. Translation:1.According to the situation of various countries, the issuance of government bonds adopts the methodof raising money from public, which can be divided into direct and indirect ones.2.The government bonds outstanding are not all held by individuals, but by the government units,financial institutions and the public commonly.3.The government should keep a stable increase for the issuance of securities, if the market price for thegovernment bonds often fluctuate, the investors will be reluctant to hold the government bonds.4.Corporate bonds are the certificates that the business owes to the public, it is the issuing corporationthat makes a promise to pay certain amount of money plus interest at a fixed date in future.5.The better the credit standing of a company, the longer maturity of the bond is ,but the solvency ofcorporate bonds cannot be compared with that of government, so the longest tenor of corporate bond will not be very long.pared with stock investment, the holders of corporate bonds can only have the interest income asthe fixed reward for the investment, but they can’t share the profit of the corporation like share holders.pared with stocks, corporation bonds have lower risks, but the safety can’t be compared to that ofgovernments bonds, that’s why the return ration is always higher than government bonds.8.With the rapid development of capitalist industry, shareholding corporation system becomesirresistible trend.9.The price of stocks are of substantial fluctuation, which makes investment of stocks very speculative.10.The market price of stocks is subject to the status of operation, allocation of profits, as well as to theeconomical, political social factors that make the price of stocks more volatile.Lesson 8I. 1.foreign 2.activities/lend 3.standing 4.role 5.independent 6.consortium banks7.money 8.bond 9.subsidiary 10.EurocurrencyII. Translation:1.In most countries, commercial banks all establish international department or foreign department inorder to deal in foreign exchange or to raise money for foreign trade.2.Due to the development of international banking business and the establishment of the bank’soverseas network organization, commercial banks of western countries become real multinational banks.3.The international network of the multinational bank includes branch, subsidiary, correspondent,resident representative and so on.4.The activities of the multinational bank through exclusive international network are retail deposit,money market activities, foreign trade financing, corporation loans, foreign trade business, investment business, trust business and so on .5.Because most of the clients of the multinational bank are large corporations and banks, they mainlydeal in retail deposits with few retail loans.6.The multinational banks put surplus money into money market when the demand is low, but raisemoney when demand is on rise.7.The tenor of foreign trade financing is usually short with high return, mostly denominated in thecurrency other that of the country where the bank locates.8.Corporation loans refer to the loans given to private business, state-owned business, especially to themultinational corporation.9.Foreign exchange business includes buying and selling foreign exchange and hedging conducting inforeign exchange market for the clients.10.Investment business refers to the underwriting of international securities and the distribution activities,as well as advisory service for customers and governments in the issue of securities.Lesson 9I.1.short-term 2.medium-term /long-term 3.restrictions 4.deposits 5.absence6.Euro currencies7.borrowers abroad8.entities9.deposits 10. convertibleII. Translation:1.Eurodollar refers to the deposits denominated in US dollar in various banks outside USA andEuropean branches of American banks, as well as the loans obtained by these banks.2.Off-shore money market is concentrated by Eurocurrency market , which is habitually called theEurodollar market, because the currency traded in this market is mainly Eurodollar.3.Eurobanks deal in Eurocurrency business which is strictly separated from domestic banking.4.London in the largest Eurodollar market, engaging in both deposit and loan, with huge volume oftransactions.5.Eurobank’s business usually not subject to local banking rules, such as deposit rate and maturity,therefore, banks can compete freely to attract customers.6.The interest rate for Eurodollar deposit is higher than for US domestic deposit since there is noreserve requirement for Eurodollar deposit nor premium insurance.7.The emergence of Eurodollar is due to the deficit of American balance of payments The accumulationof huge deficit and the outflow of large amount of US dollar resulted in substantial increase of Eurodollar deposits.8.The brokers or dealers of American stock Exchange often borrow Eurodollars from Eurodollarmarket.9.The Eurodollar market is a short-term wholesale market of inter bank, it functions in Europe asproviding banks with liquidity like the federal fund market in USA.10.Banks put the money in the Eurodollar market when the liquidity is excessive and borrow moneywhen the liquidity is in squeeze.Lesson 10I. Part(1)1.the creation of money 2.cooperative /voluntarily 3.external/economic reforms4.the par value system5.on demand6.stable/predictable/disadvantages7.float8.quota subscriptions 9.needy/favorable 10.buying power/importsPart(2)1.subsidize 2. internal 3.bargain 4.peg 5.payments 6.assistance/sufficient7.stabilizing/strengthening 8.repay/repayment period 9.effectively11.lower/export/governmentII. Translation:1.The fund shows great concern over the internal economic policies of its member countries.2.The Fund is a cooperative institution, overseeing/supervising and monitoring the foreign exchangepolicies its member countries.3.The exchange of currency is the center of financial connection/relation among various countries, aswell as a dispensable tool of world trade.4.Due to constant fluctuation of exchange rate for major/leading currency, the dealers of foreignexchange may gain profit or suffer loss.5.The convertibility of currencies facilitates tourism, trade and investment in a worldwide scale.6.By analyzing the wealth and economic status of each member the fund determines the quotasubscription for each member. The richer the country is, the higher quota it Subscribes.7.Since the abandonment of the par value system, the membership of the Fund has agreed to allow eachmember to choose its own method of determine an exchange value for its money.8.Man large industrial nations allow their currencies to float, other countries peg the value of theircurrency to that of a major currency of a group of currencies so that, for example, as the U.S. dollar rises in value their own currencies rise too.9.The source of finance of the Fund mainly comes from the quota subscription of its member countriesat the same time, the Fund also borrows money from member governments or their monetary authorities.10.The Fund lends money according to regulation to the member countries with a payments problem,due to their expenditure in foreign exchange exceeding income.Lesson 11I. Part(1)1.catalyst 2.equity 3. creditworthy 4.reschedule/made 5.carry6.fourfold7.share8.foreign exchange9.attained 10.indexPart(2)1.productivity 2.affiliates 3.self-sustaining 4.call up 5.quota/economic strength6.a third/raised7.politicalitary/political9.enjoined 10.indexII Translation:1.The IBRD has more than 140 member countries, which all subscribe quotas to the bank.2.The IBRD gives loans only to creditworthy borrowing countries for the project that has a high realrates of economic return.3.The IDA gives loans only to poorest countries with a annual GNP per capita lower than $795.Actually, 80% of IDA’s loans are given to the countries with annual per capita GNP lower than $410.4.The IDA gives loans only to the government of the borrowing countries, with maturity of 50 years(repayable over 50 years) with grace period of 10 years, no interest.5.In the past decade, the volume of the IBRD’s loans have increased by fourfold.6.The IBRD has helped to develop agriculture, improve education, increase the output of energy,expand industry, create better urban facilities, promote family planning, extend telecommunications network, modernize transportation systems, improve water supply and sewerage facilities, and establish medical care.7.It’s hard to say that the IBRD’s decisions on loans are not influenced by the political character of theborrowing countries.8.Some of the earliest borrowing countries of the IBRD have graduated from the reliance on the IBRD’sloans, in return they become the provider of the IBRD’s finance source.9.The IBRD and IFC jointly provide funds for many projects.10.The more quota the member country subscribes, the more votes it gains.Lesson 12I . Part(1) 1.foster 2.raise 3.subregional/regional 4.multilateral 5.cost-effective6.evaluation7.weighted8.proportional9.paid in 10.developrnental Part(2) 1.equity 2.private 3.subscriptions 4.installment 5.subscribed6.coordinate7.procurement8.absorb9.pooling 10.bidsII. Translation:1.The purpose of the ADB is to provide fund and technical assistance to its developing membercountries in the Asia-Pacific region and to promote investment and foster economic growth.2.The shortage of capital, lack of skilled labor, poor technology, limited markets and the vagaries ofnature have impeded the economic development of the developing countries.3.The Bank’s Charter provides that the capital owned by the Asia-Pacific member countries should notbe less than 60% of total equity.4.Multilateral institution plays an important role in the economic development.5.The projects for bank financing are identified after strictly evaluated.6.The ADB keeps close working relationship with the United Nations as well as all kinds of specialinstitution.7.Some member countries in Asia-Pacific region voluntarily increase their subscriptions.8.The main subscribers of the ADB have no veto. In practice, decisions are reached by process ofdiscussion rather than by voting.9.The capital structure of the ADB is crucial/vital key to its loan/financing capacity.10.The ADB is authorized to make and guarantee loans to its member countries.Lesson 13I 1. surplus 2.surplus 3.deficit 4.capital 5.demand 6.supply 7.supply/demand8.outstanding 9.demand 10.supplyII. Translation:1.Just as a country’s domestic economy should have a financial record, a country’s authority should alsohave a statistical summery for all the external economic and financial transaction of its residents.2.The content of the balance of payments concept differs in different historical stage.3.In narrow sense, the balance of payments is defined as the receipts and payments arising frominternational trade or receipt and payments in foreign exchange.4.The balance of payments is a kind of statistic statement in the given period, which reflects thetransactions of goods, services and incomers of an economy.5.The statement of balance of payments is a kind of material that statistical financial transactions in thegiven period according to the form stipulated by IMF.6.The items entering into credit includes goods and services provided from abroad and so on.7.The items entering into debit includes goods and services obtained from abroad and so on.8.Receipts and payment arising from international trade is the most important item in current account,which comprise export and import of various commodities. Generally, the export and import of commodities account for the biggest proportion in the international transactions.9.Capital account reflects the changed of a country’s foreign assets and liabilities. The financial assethere doesn’t include monetary gold and Special Drawing Rights.10.In order to alter the deficits of our country’s balance of payments, the government adopts a series ofpolicies and measures, for examples, reduce domestic basis construction, adjust the structure of exporting and importing commodity, improve the environment for foreign investment, lower the exchange rate of our currency to the main currencies in the world, and so on.Lesson 14I .1.strike 2.The exchange rate 3.bank deposits 4.coordinates5.Arbitraggeurs6.discrepancies7.depreciation8.appreciation9.foreign exchange market 10.speculatorsII. Translation:1.It’s vitally important for those who are engaged in international finance to be aware of the tender offoreign exchange market.2.As long as the foreign exchange floats, there always exist the risks of change of foreign exchange rateand interest rate.3.The arbitrageurs make profits by taking advantage rate across markets to buy low and sell high.4.The buyers and sellers come to an agreement of transaction according to the exchange rate of twocurrencies.5. A greater demand for foreign goods and services means a greater demand for foreign exchange.6.The view that the price of us dollar will fall might note be wrong.7.If more people want to exchange pound into US dollar, the change of exchange rate is favorable to USdollar, and unfavorable to pound when the demand exceeds the supply.8.If the supply of certain goods is excessive, the demand for the goods will go down/decline.9.To devaluate a country’s currency can encourage export.10.There are tow ways to express foreign exchange rate.Lesson 15I. Part (1) 1. fluctuate 2.predictable 3.Capital flows 4.manufactured 5.speed6. refinements7.open/bonds/exchange8.devaluation9.nominal10.halvePart(2) 1.devalues 2.priced 3.demand 4.expectations 5.profit 6.fund7.closed 8.reduces 9.real 10.verticalII. Translation:。

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

1.银行是什么?无论是对于整个经济还是对于某一地区的经济而言,银行都是很重要的,同样地,人们对银行的准确含义也充满了困惑。

当然,可以通过银行在经济中的职能(服务或作用)来给银行下定义。

问题在于,不仅仅银行的职能在变化,其主要竞争对手的职能也在变化。

事实上,从提供的服务上来看,许多金融机构(包括主要的证券承销商、经纪公司、共同基金和保险公司)都类似于银行。

相反,银行家们则通过游说方式争取权力以便能够开展房地产和全面证券经纪业务、保险理赔业务、共同基金投资和其他许多新的服务,藉此向非银行竞争对手挑战。

许多法规发生变化的结果是,导致了对于什么是银行什么不是银行这一问题,目前公众心里一片茫然。

根据这些机构对公众提供服务的种类来评价,或许是最保险的做法。

银行是提供最广泛金融服务(尤其是信贷、储蓄和支付业务)的金融机构,并执行经济中所有商业形式的最广泛的金融职能。

这种服务和职能的多样性,使银行被称为“金融百货公司”。

2.货币政策间接工具的运用在20世纪70年代末期,有些工业化国家开始逐步摒弃一些曾经用来实施货币政策的直接工具,包括信贷控制,利率上限,有时是直接存款,并开始完全采用间接工具,比如,公开市场操作、再贴现和准备金要求。

在最近几年,发展中国家和过渡经济体也开始采用这些间接工具,而且呈上升趋势。

间接货币政策在货币领域里发挥着日益重要的作用,就如同经济中价格信号的功能日益广泛一样。

二者有着共同的目标:提高市场效率。

或许更为重要的是,转向间接工具的行为发生在一个日益开放的经济环境里,“经常性项目可兑换”被广泛采用。

在这样一种环境下,直接工具的效果越来越差,最终会导致完全无效和非居间化投资。

如果没有货币政策的间接工具,管理当局就没有办法解决任何过剩流动性带来的问题,而过剩的流动性会妨碍他们稳定经济的努力。

3.为什么要对银行进行严格管制?为什么要对银行进行严格管制?有很多理由可以解释政府监管这一重负,这已经有几个世纪的历史了。

金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of financial instrument?A. StockB. BondC. DerivativeD. Commodity2. The term "leverage" in finance refers to:A. The use of borrowed funds to increase the potential return of an investment.B. The amount of money invested in a project.C. The process of buying and selling securities.D. The risk associated with a particular investment.3. What does the acronym "IPO" stand for?A. International Public OfferingB. Initial Public OfferingC. Internal Private OfferingD. International Private Offering4. The primary market is where:A. Securities are issued for the first time to the public.B. Securities are traded after they have been issued.C. Companies buy back their own securities.D. Investors sell their securities to other investors.5. A bear market is characterized by:A. A prolonged period of falling prices.B. A period of economic growth.C. A period of high inflation.D. A period of low unemployment.6. The term "risk management" in finance involves:A. Predicting future market trends.B. Identifying potential risks and taking steps tomitigate them.C. Maximizing returns on investments.D. Managing the day-to-day operations of a financial institution.7. A "blue chip" stock refers to:A. A stock that is considered to be of high quality and carries a lower risk.B. A stock that is traded on a blue-colored chip.C. A stock that is considered to be very risky.D. A stock that is traded on a major stock exchange.8. The process of "short selling" involves:A. Borrowing securities and selling them in the hope of buying them back at a lower price.B. Selling securities that the investor does not own.C. Buying securities with the expectation that their price will increase.D. Holding securities for a long period of time.9. What is the role of a "broker" in finance?A. To provide financial advice to clients.B. To facilitate the buying and selling of securities between investors.C. To manage a company's financial transactions.D. To underwrite securities for companies.10. The "efficient market hypothesis" suggests that:A. Stock prices fully reflect all available information.B. It is possible to consistently beat the market by picking individual stocks.C. Investors are irrational and make poor decisions.D. The market is always undervalued.二、填空题(每题1分,共10分)11. The _______ is the process by which a company raisescapital by issuing shares to the public for the first time. 12. A _______ is a financial contract that obligates thebuyer to purchase an asset or the seller to sell an asset ata predetermined future date and price.13. The _______ is the market where existing securities are bought and sold.14. The _______ is a measure of the risk of an investment compared to the return it is expected to generate.15. When the stock market is experiencing a significant and sustained increase in prices, it is known as a _______ market.16. A _______ is a financial institution that acceptsdeposits and provides various types of loans to customers. 17. The _______ is a measure of the ability of a company to pay its current debts with its current assets.18. A _______ is a financial statement that shows a company's financial performance over a period of time.19. The _______ is a type of investment strategy that focuseson long-term growth potential.20. An _______ is a financial instrument that derives its value from an underlying asset.三、简答题(每题5分,共30分)21. Explain the difference between a "mutual fund" and a "hedge fund".22. Describe the concept of "diversification" in investment.23. What is "inflation" and how does it affect the value of money?24. Discuss the role of "central banks" in the economy.四、论述题(每题20分,共20分)25. Discuss the impact of globalization on the financial markets and provide examples to support your argument.五、案例分析题(每题20分,共20分)26. Analyze a recent financial crisis and discuss the factors that contributed to it, the impact it had on the global economy, and the lessons that can be learned from it.答案:一、选择题1-5 D A B A A6-10 B A A B A二、填空题11. Initial Public Offering (IPO)。

Chapter1Ⅰ.1. Money and risk and how they are interrelated.2. Recently a number of websites have been created to give consumers basic price comparisons for services.3. Allows a company to determine how much credit it can extend to customers before it begins to have liquidity problems.4. refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e., retail, corporate, investment banking.5. A new discipline that uses mathematical and statistical methodology to understand behavioral biases in conjunction with valuation.6. An area of finance dealing with the financial decisions corporations make and the tools and analysis used to make these decisions.7. A main branch of applied mathematics concerned with the financial markets.8. The application of the principles of finance to the monetary decisions of an individual or family unit.Ⅱ.1.maximize risks2. mathematics statistics3. money offering4. determine liquidity5. aggregates accepts6. economics behavioralⅢ.translate the following sentences into English.1.The commercial management is the important aspects of the business management,Do not have the appropriate financial plan, the enterprise is not likely to be successful.2. Financial institutions is the basic aim of the public welcome by the financial assets into they can accept financial assets.3. Enterprise management is risky, so financial manager must evaluate the risks and management.4. Investment decision first refers to the investment opportunity, often referring to capital investment projects.5. Cash budget is often used to assess whether is the enterprise have enough cash to maintain the daily operation of the enterprise operation and if there is too much cash surplus.6. According to the view of finance, capital is the enterprise to the purchase of goods to produce other goods or provide services of currencyⅣ. Translate the following sentences into chinese.1.现金预算非常重要,特别是为小型企业,因为它允许公司确定多少信用可以向客户开始之前就有流动性问题。

金融英语课后练习答案APPENDIXKEYTOTHEEXERCISESCHAPTER 1 The Gold Standard Era, 1870 — 19144. automatic mechanism of adjustment 自动调节机制5. achievement of balance of payments equilibrium 达到国际收支平衡6. the response of central banks to gold flows across their borders各国央行对跨国境黄金流动量的反应7. meet their obligation to redeem currency notes 履行(他们的)职责兑换流通券8. ensure full employment 确保全民就业9. subordination of economic policy to external objectives 对外部目标经济政策的依赖性10. tried to reconcile the goals of internal and external balance 试图调整对内对外收支的目标Ⅱ. Give the Chinese meaning of these plurals.1. international reserves 国际储备(额/量)2. gold flows 黄金流通量3. net imports 净进口(量)4. capital outflows 资金外流量5. domestic assets 国内资产Ⅲ. Put these paragraphs into Chinese.1. However, research has shown that countries often reversed the steps mentionedabove and sterilized gold flows, that is, sold domestic assets when foreign reserves were rising and bought domestic assets as foreign reserves fell.Government interference with private gold exports alsoundermined the system.The picture of smooth and automatic balance of payments adjustment before World War I therefore did not always match reality. 然而,研究表明各国经常反道而行之,他们制止黄金的流动,也就是说,当外国储备升高时他们售出国内资产,而当外国储备下降时,他们购买国内资产。

Answer the questions1、What are the ways by which the money flows from individual surplus unitsto deficit units?financial markets facilitate the flow of funds from surplus units to deficit units. Those financial markets that facilitate the flow of short-term funds (with maturities of lessthan one year) are known as money markets.Those that facilitate the flow of long-term funds are known as capital markets.Debt bond stock fund deritives2、How does the level of tax, do you think, affect the demand of household forloanable funds? (please explain by pictures)if tax rates on household income are expected to significantly decrease in the future, households might believe that they can more easily afford future loan repaymentand thus be willing to borrow more funds. For any interest rate, the quantity ofloanable funds demanded by households would be greater as a result of tax law adjustment. This represents an outward shift in the demand schedule.tax rates on household income (income tax decreases →the line of household demand moves right)3、What is the relationship between the government demand for loanable fundsand interest rate? (explain by pictures)Whenever a government’s planed expenditures cannot be completely covered by its incoming revenues from taxes and other sources, it demands loanable funds.The way to obtain fund: Municipal (state and local) governments issue municipalbonds to obtain funds, while the federal government and its agencies issue Treasury securities and federal agency securitiesInterest-inelastic (insensitive to interest rates): federal governmentexpenditure and tax policies are generally thought to be independent ofinterest rate. Thus the federal government demand for funds is said to beInterest-inelastic, or insensitive to interest rates. In contrast, municipalgovernments sometimes postpone proposed expenditures if the cost offinancing is too high, implying that their demand for loanable funds issomewhat sensitive to interest rates.?Like the household and business demand, the government demand for loanable funds can shift in response to various events.Deficit increases →move rightExhibit 2.3 impact of increased government budget deficit on the governmentdemand for loanable fundsThe federal government demand-for-loanable-funds schedule is Dg1, if newbills are passed that cause a net increase in the deficit of USD20 billion, thefederal government demand for loanable funds will increaseby that amount.The new demand schedule is Dg2.4、What are the economic factors that affect interest rates?1)Impact of Economic Growth on Interest Rates2)Impact of Inflation on Interest Rates3)Impact of the Money Supply on Interest Rates4)Impact of the Budget Deficit on Interest Rates5)Impact of foreign Flows of Funds on Interest Rates6)Summary of Forces that Affect Interest Rates-out effect” please.5、Explain “crowdingThe deficit might not necessarily place upward pressure on interest rates.Given a certain amount of loanable funds supplied to the market( through saving), excessive government dem and for these funds tends to “crowd out” the private demand (by consumer and corporation) for funds. The federal government may bewilling to pay whatever is necessary to borrow these funds, but the private sectormay not. This impact is known as the crowding-out effect.6、What are the monetary policy tools?Open market operationsAdjustments in the discount rateAdjustments in the reserve requirement ratio7、What are the ways by which the money flows from individual surplus unitsto deficit units?8、How does the Fed use the monetary policy tools to adjust the money supply?(答案待定)1.Open Market OperationsThe buying and selling of government securities (through the Trading Desk) isreferred to as open market operations.When the Fed issues securities, the commercial banks purchase those thatare most attractive. The total funds decrease and the money supply falls.When the Fed purchase securities, the total funds increase, which representsa loosening of money supply growth.Adjusting the Discount RateThe interest rate that an eligible(有资格的) depository institution is chargedto borrow short-term funds directly from a Federal Reserve Bank.To increase the money supply, the Fed can authorized a reduction in thediscount rate; to decrease the money supply, the Fed can increase thediscount rate.3.Adjusting the Reserve Requirement RatioReserve Requirement Ratio is the proportion of their deposit accounts thatmust be held as reserves.The lower the reserve requirement ratio, the greater the lending capacity ofdepository institutions, so a larger money supply.When the fed manipulates the money supply to influence economic variables, itmust decide what form of money to manipulate. The optimal form of money should (1)be controllable by the fed and (2)have a predictable(可预测的) impact on economic variables when adjusted by the fed. The most narrow form of money, known as M1, includes currency held by the public and checking deposits(such as demand deposits, NOW accounts, and automatic transfer balances) at depository institutions.9、What are the differences between the general obligation bonds and revenuebonds both of which belong to municipal bonds?Like the federal government, state and local government frenquently spend more than the revenues they receive. To finance the difference, they issue municipal bonds, most of which can be classified as either General obligation bonds or revenue bonds. payments on General obligation bonds are supported by the municipals must be generated government’s ability to tax, whereas payments on revenue bondby revenues of the project( tollway, toll bridge, state college dormitory, etc) forwhich the bonds were issued.Material: municipal bond10、What are the characteristics of corporate bonds?The bond indenture, trusteeCorporate bonds can be described according to a variety of characteristics. The bond indenture(契约) is a legal document specifying the rights and obligations of both the issuing firm and the bondholders. It is very comprehensive( normally several hundred pages) and is designed to address all matters related to the bond issue( collateral, payment dates, default provision, call provisions, etc)Sinking-Fund Provision(偿债基金准备)Bond indentures frequently include a sinking-fund provision, or a reqirement thatthe firm retire a certain amount of bond issue each year. This provision is considered to be an advantage to the remaining bondholders because it reduces the payments necessary at maturity.Protective Covenants(保护条款)Bond indentures normally place restrictions on the issuing firm that are designed to protest the bondholders from being exposed to increasing risk during the investment period. Those so called Protective Covenants frequently limit the amount ofestrict the dividends and corporate officers’ salaries the firm can pay and also ramount of additional debt the firm can issue. Other financial policies may berestricted as well.10、What are the main differences between common stock and preferredstock?The ownership of common stock entitles shareholders to a number of rights notavailable to other individuals. Normally, only the owner of common stock arepermitted to vote on certain key matters concerning the firm,such as theelection of the board of directors, authorization to issue new shares of commonstock, approval of amendments to the corporate charter, and adoption ofbylaws(附例).Usually not allow for significant voting rights,The preferred stockholders have the priority to earn dividends compared withcommon stockholders .But a firm is not legally required to pay preferred stock dividends.11、What are the similarities and differences between forward contract andfuture contract?Futures and forward contracts are similar in the following ways:Both are derivative securities for future delivery. The parties agree today onprice and quantity for settlement in the future.Both are used to hedge currency risk, interest rate risk or commodity pricerisk.They differ in these ways:Forward contracts are private, customized定制contracts between a bankand its clients depending on the client’s needs (OTC). There is no secondary market for forward contracts since they are private contractual agreements.Forward contracts are settled at expiration. Futures contracts are continuallysettled (mark to market)12、What are the risks of trading futures contracts?Market riskBasis riskLiquidity riskCredit riskPrepayment riskOperational risk13、What are the determinants of call option premiums?Market price of the underlying instrumentInfluence of the market price: the higher the existing market price of the underlyingfinancial instrument relative to the exercise price, the higher the call option premium,other things being equal.Volatility of the underlying instrumenthe underlying stock,Influence of the stock’s volatility: the greater the volatility of tthe higher the call option premium, other things being equal.Time to maturity of the call optionInfluence of the call option’s time to maturity: the longer the call option’s t maturity, the higher the call option premium, other things being equal14、What are the reasons that the Eurodollar market is attractive for bothdepositors and borrowers?the spread between the rate banks pay and the rate they charge is relativelysmallOnly governments and large corporations participate in this market—lowerriskInvestors in the market avoid some costs (no deposit insurance, lower taxes,no government-mandated credit allocations)Eurodollar CDs are not subject to reserve requirementsLess regulations and restrictions【本文档内容可以自由复制内容或自由编辑修改内容期待你的好评和关注,我们将会做得更好】。

金融专业英语第二版课后答案1、During the Spring Festival, people in Northern China usually eat _______ as a traditional Chinese food. [单选题] *A. pizzaB. dumplings(正确答案)C. hamburgersD. noodles2、The plane arrived at London airport _______ Wednesday morning. [单选题] *A. on(正确答案)B. atC. inD. for3、The little girl held _____ in her hand. [单选题] *A. five breadsB. five piece of breadsC. five piece of breadD. five pieces of bread(正确答案)4、Many people prefer the bowls made of steel to the _____ made of plastic. [单选题] *A. itB. ones(正确答案)C. oneD. them5、You have been sitting on my hat and now it is badly out of(). [单选题] *A. dateB. shape(正确答案)C. orderD. balance6、You cannot see the doctor _____ you have made an appointment with him. [单选题] *A. exceptB.evenC. howeverD.unless(正确答案)7、There are trees on both sides of the broad street. [单选题] *A. 干净的B. 狭窄的C. 宽阔的(正确答案)D. 宁静的8、One effective()of learning a foreign language is to study the language in its cultural context. [单选题] *A. approach(正确答案)B. wayC. mannerD. road9、62.--There is? ? ? ? ? sale on in the shop today. Let’s go together.--Please wait? ? ? ? ? ?minute. I’ll finish my homework first. [单选题] *A.a; theB.a; a(正确答案)C.the; aD.the; the10、We sent our children to school to prepare them for the time _____ they will have to work for themselves. [单选题] *A. thatB. when(正确答案)C. whileD. as11、We have ______ homework today. ()[单选题] *A. too manyB. too much(正确答案)C. much tooD. very much12、My English teacher has given us some _______ on how to study English well. [单选题] *A. storiesB. suggestions(正确答案)C. messagesD. practice13、31.That's ______ interesting football game. We are all excited. [单选题] *A.aB.an(正确答案)C.theD./14、( )Keep quiet, please. It’s ________ noisy here. [单选题] *A. many tooB. too manyC. too muchD. much too(正确答案)15、—Look at those purple gloves! Are they ______, Mary?—No, they aren’t. ______ are pink. ()[单选题] *A. you; IB. your; MyC. yours; Mine(正确答案)D. you; Me16、The twins _______ us something about their country. [单选题] *A. told(正确答案)B. saidC. talkedD. spoke17、Neither she nor her friends ______ been to Haikou. [单选题] *A. have(正确答案)B. hasC. hadD. having18、I often _______ music from the Internet. [单选题] *A. download(正确答案)B. spendC. saveD. read19、It is reported()three people were badly injured in the traffic accident. [单选题] *A. whichB. that(正确答案)C.whileD.what20、Everyone here is _______ to me. [单选题] *A. happyB. wellC. kind(正确答案)D. glad21、His mother’s _______ was a great blow to him. [单选题] *A. diedB. deadC. death(正确答案)D. die22、Grandpa pointed to the hospital and said, “That’s _______ I was born?”[单选题] *A. whenB. howC. whyD. where(正确答案)23、45.—Let's make a cake ________ our mother ________ Mother's Day.—Good idea. [单选题] *A.with; forB.for; on(正确答案)C.to; onD.for; in24、69.Online shopping is easy, but ________ in the supermarket usually ________ a lot of time. [单选题] *A.shop; takesB.shopping; takeC.shop; takeD.shopping; takes(正确答案)25、80.Thousands of ________ from other countries visit the village every year. [单选题] *A.robotsB.postcardsC.tourists(正确答案)D.bridges26、Chinese people spend _____ money on travelling today as they did ten years ago. [单选题] *A. more than twiceB. as twice muchC. twice as much(正确答案)D. twice more than27、How beautiful the flowers are! Let’s take some _______. [单选题] *A. photos(正确答案)B. potatoesC. paintingsD. tomatoes28、Don’t ______. He is OK. [单选题] *A. worriedB. worry(正确答案)C. worried aboutD. worry about29、His father always _______ by subway. [单选题] *A. go to workB. go to schoolC. goes to bedD. goes to work(正确答案)30、____ is standing at the corner of the street. [单选题] *A. A policeB. The policeC. PoliceD. A policeman(正确答案)。

翻译:(1) Although banks share many comm on features with other profit-seeki ng busi n esses, they playa unique role in the economy through mobilizing savings, allocating capital funds to finaneeproductive investment, transmitting monetary policy, providing a payment system andtransforming risks.尽管银行与其他以盈利为目的的企业具有许多共同的特征,但它在国民经济中还发挥着特殊的作用。

银行可以动员储蓄,为生产性企业投资调配资金,传递货币政策,提供支付系统,转化风险。

(2) The past few years have seen marked acceleration of China's banking reform, particularly significa nt st re ngthe ning of the cen tral bank's capacity for supervisi on and macroeconomic management, substantial improvement in the management of the commercial banks, andgreater ope rm ess of the banki ng in dustry.在过去的几年中,中国银行业的改革速度显著加快,特别是强化了中央银行的监管职能和对宏观经济的管理职能,对商业银行的管理能力也有了显著的提高,同时银行业也更加开放。

(3) The reform of the financial system and particularly the diversification of banking in stituti onshave in creased competiti on in the banking sector and improved fin ancial services in China.金融体系的改革尤其是金融机构的多元化都增加了银行部门的竞争并且提升了中国的金融服务。

What is Money?1. (b)3. Cavemen did not need money. In their primitive economy, they did not specialize inproducing one type of good and they had little need to trade with other cavemen.5. Wine is more difficult to transport than gold and is also more perishable. Gold is thus a betterstore of value than wine and also leads to lower transactions cost. It is therefore a better candidate for use as money.7. Not necessarily. Checks have the advantage in that they provide you withreceipts, are easier to keep track of, and may make it harder for someone to steal money out of your account. These advantages of checks may explain why the movement toward a checkless society has been very gradual.8. The ranking from most liquid to least liquid is: (a), (c), (e), (f), (b), and (d).10.Because of the rapid inflation in Brazil, the domestic currency, the real, is apoor store of value. Thus many people would rather hold dollars, which are a better store of value, and use them in their daily shopping.14. (a) M1, M2, and M3, (b) M2 and M3 for retail MMFs and M3 for institutional MMFs, (c) M3,(d) M2 and M3, (e) M3, (f) M1, M2, and M3.Understanding Interest Rates2.No, because the present discounted value of these payments is necessarily lessthan $20 million as long as the interest rate is greater than zero.4. The yield to maturity is less than 10 percent. Only if the interest rate was lessthan 10 percent would the present value of the payments add up to $4,000, which is more than the $3,000 present value in the previous problem.6. 25% = ($1,000 – $800)/$800 = $200/$800 = .25.8. If the interest rate were 12 percent, the present discounted value of the payments on thegovernment loan are necessarily less than the $1,000 loan amount because they do not start for two years. Thus the yield to maturity must be lower than 12 percent in order for the present discounted value of these payments to add up to $1,000.10. The current yield will be a good approximation to the yield to maturity whenever the bondprice is very close to par or when the maturity of the bond is over ten years.12. You would rather be holding long-term bonds because their price wouldincrease more than the price of the short-term bonds, giving them a higher return.14.People are more likely to buy houses because the real interest rate whenpurchasing a house has fallen from 3 percent (=5 percent - 2 percent) to 1 percent (= 10 percent - 9 percent). The real cost of financing the house is thus lower, even though mortgage rates have risen. (If the tax deductibility of interest payments is allowed for, then it becomes even more likely that people will buy houses.)The Behavior of Interest Rates1. (a) Less, because your wealth has declined; (b) more, because its relative expected return hasrisen; (c) less, because it has become less liquid relative to bonds; (d) less, because its expected return has fallen relative to gold; (e) more, because it has become less risky relative to bonds.3. (a) More, because it has become more liquid; (b) less, because it has become more risky; (c)more, because its expected return has risen; (d) more, because its expected return has risen relative to the expected return on long-term bonds, which has declined.5. The rise in the value of stocks would increase people’s wealth and therefore the demand forRembrandts would rise.7. In the loanable funds framework, when the economy booms, the demand forbonds increases: the public’s income and wealth rises while the supply of bonds also increases, because firms have more attractive investment opportunities. Both the supply and demand curves (B d and B s) shift to the right, but as is indicated in the text, the demand curve probably shifts less than the supply curve so the equilibrium interest rate rises. Similarly, when the economy enters a recession, both the supply and demand curves shift to the left, but the demand curve shifts less than the supply curve so that the interest rate falls. The conclusion is that interest rates rise during booms and fall during recessions: that is, interest rates are procyclical. The same answer is found with the liquidity preference framework. When the economy booms, the demand for money increases: people need more money to carry out an increased amount of transactions and also because their wealth has risen. The demand curve, M d, thus shifts to the right, raising the equilibrium interest rate.When the economy enters a recession, the demand for money falls and the demand curve shifts to the left, lowering the equilibrium interest rate. Again, interest rates are seen to be procyclical.10. Interest rates fall. The increased volatility of gold prices makes bonds relatively less riskyrelative to gold and causes the demand for bonds to increase. The demand curve, B d, shifts to the right and the equilibrium interest rate falls.12. Interest rates might rise. The large federal deficits require the Treasury to issue more bonds;thus the supply of bonds increases. The supply curve, B s, shifts to the right and the equilibrium interest rate rises. Some economists believe that when the Treasury issues more bonds, the demand for bonds increases because the issue of bonds increases the public’s wealth. In this case, the demand curve, B d, also shifts to the right, and it is no longer clear that the equilibrium interest rate will rise. Thus there is some ambiguity in the answer to this question.14. The price level effect has its maximum impact by the end of the first year, and since the pricelevel does not fall further, interest rates will not fall further as a result of a price level effect.On the other hand, expected inflation returns to zero in the second year, so that the expected inflation effect returns to zero. One factor producing lower interest rates thus disappears, so, in the second year, interest rates may rise somewhat from their low point at the end of the second year.16. If the public believes the president’s program will be successful, interest rateswill fall. The president’s announcement will lower expected inflation so that the expected return on goods decreases relative to bonds. The demand for bonds increases and the demand curve, B d, shifts to the right. For a givennominal interest rate, the lower expected inflation means that the real interest rate has risen, raising the cost of borrowing so that the supply of bonds falls.The resulting leftward shift of the supply curve, B s, and the rightward shift of the demand curve, B d, causes the equilibrium interest rate to fall.18. Interest rates will rise. The expected increase in stock prices raises the expected return onstocks relative to bonds and so the demand for bonds falls. The demand curve, B d, shifts to the left and the equilibrium interest rate rises.20. The slower rate of money growth will lead to a liquidity effect, which raises interest rates,while the lower price level, income, and inflation rates in the future will tend to lower interest rates. There are three possible scenarios for what will happen: (a) if the liquidity effect is larger than the other effects, then interest rates will rise; (b) if the liquidity effect is smaller than the other effects and expected inflation adjusts slowly, then interest rates will rise at first but will eventually fall below their initial level; and (c) if the liquidity effect is smaller than the expected inflation effect and there is rapid adjustment of expected inflation, then interest rates will immediately fall.The Risk and Term Structure of Interest Rates1. The bond with a C rating should have a higher interest rate because it has a higher default risk,which reduces its demand and raises its interest rate relative to that on the Baa bond.3. During business cycle booms, fewer corporations go bankrupt and there is less default risk oncorporate bonds, which lowers their risk premium. Similarly, during recessions, default risk on corporate bonds increases and their risk premium increases. The risk premium on corporate bonds is thus anticyclical, rising during recessions and falling during booms.5. If yield curves on average were flat, this would suggest that the risk premium on long-termrelative to short-term bonds would equal zero and we would be more willing to accept the expectations hypothesis.7. (a) The yield to maturity would be 5 percent for a one-year bond, 5.5 percentfor a two-year bond, 6 percent for a three-year bond, 6 percent for a four-year bond, and 5.8 percent for a five-year bond; (b) the yield to maturity would be5 percent for a one-year bond, 4.5 percent for a two-year bond, 4 percent for athree-year bond, 4 percent for a four-year bond, and 4.2 percent for a five-year bond. The upward- and then downward-sloping yield curve in (a) would tend to be even more upward sloping if people preferred short-term bonds over long-term bonds because long-term bonds would then have a positive risk premium. The downward- and then upward-sloping yield curve in (b) also would tend to be more upward sloping because of the positive risk premium for long-term bonds.9. The steep upward-sloping yield curve at shorter maturities suggests that short-term interestrates are expected to rise moderately in the near future because the initial, steep upward slope indicates that the average of expected short-term interest rates in the near future are above the current short-term interest rate. The downward slope for longer maturities indicates that short-term interest rates are eventually expected to fall sharply. With a positive risk premium on long-term bonds, as in the preferred habitat theory, a downward slope of the yield curve occurs only if the average of expected short-term interest rates is declining, which occurs only if short-term interest rates far into the future are falling. Since interest rates and expected inflation move together, the yield curve suggests that the market expects inflation to rise moderately in the near future but fall later on.11. The government guarantee will reduce the default risk on corporate bonds,making them more desirable relative to Treasury securities. The increased demand for corporate bonds and decreased demand for Treasury securities will lower interest rates on corporate bonds and raise them on Treasury bonds. 13. Abolishing the tax-exempt feature of municipal bonds would make them lessdesirable relative to Treasury bonds. The resulting decline in the demand for municipal bonds and increase in demand for Treasury bonds would raise the interest rates on municipal bonds, while the interest rates on Treasury bonds would fall.15. The slope of the yield curve would fall because the drop in expected future short rates meansthat the average of expected future short rates falls so that the long rate falls.The Stock Market, the Theory of Rational Expectations, and the Efficient Market Hypothesis1. The value of any investment is found by computing the value today of all cashflows the investment will generate over its life.3. $1/(1+ .15) + $20/(1+.15) = $18.265. A stock market bubble can occur if market participants either believe that dividends will haverapid growth or if they substantially lower the required return on their equity investments, thus lowering the denominator in the Gordon model and thereby causing stock prices to climb. By raising interest rates the central bank can cause the required rate of return on equity to rise, thereby keeping stock prices from climbing as much. Also raising interest rates may help slow the expected growth rate of the economy and hence of dividends, thus also keeping stock prices from climbing.7. Although Joe’s expectations are typically quite accurate, they could still beimproved by his taking account of a snowfall in his forecasts. Since his expectations could be improved, they are not optimal and hence are not rational expectations.9. True, as an approximation. If large changes in a stock price could be predicted, then theoptimal forecast of the stock return would not equal the equilibrium return for that stock. In this case, there would be unexploited profit opportunities in the market and expectations would not be rational. Very small changes in stock prices could be predictable, however, and the optimal forecast of returns would equal the equilibrium return. In this case, an unexploited profit opportunity would not exist.11. The stock price will rise. Even though the company is suffering a loss, the price of the stockreflects an even larger expected loss. When the loss is less than expected, efficient markets theory then indicates that the stock price will rise.13. Probably not. Although your broker has done well in the past, efficient markets theorysuggests that she has probably been lucky. Unless you believe that your broker has better information than the rest of the market, efficient markets theory indicates that you cannot expect the broker to beat the market in the future.15. False. All that is required for the market to be efficient so that prices reflect information on themonetary aggregates is that some market participants eliminate unexploited profit opportunities. Not everyone in a market has to be knowledgeable for the market to be efficient.17. Because inflation is less than expected, expectations of future short-term interest rates wouldbe lowered, and as we learned in Chapter 7, long-term interest rates would fall. The decline in long-term interest rates implies that long-term bond prices would rise.19. No, because this expected change in the value of the dollar would imply thatthere is a huge unexploited profit opportunity (over a 100% expected return at an annual rate). Since rational expectations rules out unexploited profit opportunities, such a big expected change in the exchange rate could not exist.An Economic Analysis of Financial Structure1. Financial intermediaries can take advantage of economies of scale and thus lower transactionscosts. For example, mutual funds take advantage of lower commissions because the scale of their purchases i s higher than for an individual, while banks’ large scale allows them to keep legal and computing costs per transaction low. Economies of scale which help financial intermediaries lower transactions costs explains why financial intermediaries exist and are so important to the economy.3. No. If the lender knows as much about the borrower as the borrower does,then the lender is able to screen out the good from the bad credit risks and so adverse selection will not be a problem. Similarly, if the lender knows what the borrower is up to, then moral hazard will not be a problem because the lender can easily stop the borrower from engaging in moral hazard.5. The lemons problem would be less severe for firms listed on the New YorkStock Exchange because they are typically larger corporations that are better known in the market place. Therefore it is easier for investors to get information about them and figure out whether the firm is of good quality or isa lemon. This makes the adverse selection–lemons problem less severe.7. Because there is asymmetric information and the free-rider problem, not enough informationis available in financial markets. Thus there is a rationale for the government to encourage information production through regulation so that it is easier to screen out good from bad borrowers, thereby reducing the adverse selection problem. The government can also help reduce moral hazard and improve the performance of financial markets by enforcing standard accounting principles and prosecuting fraud.9. Yes, this is an example of an adverse selection problem. Because a person is rich, the peoplewho are most likely to want to marry him or her are gold diggers. Rich people thus may want to be extra careful to screen out those who are just interested in their money from those who want to marry for love.11. The free-rider problem means that private producers of information will not obtain the fullbenefit of their information-producing activities, and so less information will be produced.This means that there will be less information collected to screen out good from bad risks, making adverse selection problems worse, and that there will be less monitoring of borrowers, increasing the moral hazard problem.13. A financial crisis is more likely to occur when the economy is experiencing deflation becausefirms find that their real burden of indebtedness is increasing while there is no increase in the real value of their assets. The resulting decline in a firm’s net worth increases adverse selection and moral hazard problems facing lenders, making it more likely a financial crisis will occur in which financial markets do not work efficiently to get funds to firms with productive investment opportunities.15. A sharp increase in interest rates can increase the adverse selection problem dramaticallybecause individuals and firms with the riskiest investment projects are the ones who are most willing to pay higher interest rates. A sharp rise in interest rates which increases adverse selection means that lenders will be more reluctant to lend, leading to a financial crisis in which financial markets do not work well and thus to a declining economy.Banking and the Management of Financial Institutions1. Because if the bank borrows too frequently from the Fed, the Fed may restrict its ability toborrow in the future.3. The T-accounts for the two banks are as follows:First National Bank Second National BankAssets Liabilities Assets Liabilities5. The $50 million deposit outflow means that reserves fall by $50 million to $25 million. Sincerequired reserves are $45 million (10 percent of the $450 million of deposits), your bank needs to acquire $20 million of reserves. You could obtain these reserves by either calling in or selling off $20 million of loans, by borrowing $20 million in discount loans from the Fed, by borrowing $20 million from other banks or corporations, by selling $20 million of securities, or by some combination of all of these.7. Because when a deposit outflow occurs, a bank is able to borrow reserves inthese overnight loan markets quickly; thus, it does not need to acquire reserves at a high cost by calling in or selling off loans. The presence of overnight loan markets thus reduces the costs associated with deposit outflows, so banks will hold fewer excess reserves.9. To lower capital and raise ROE holding its assets constant, it can pay out more dividends orbuy back some of its shares. Alternatively, it can keep its capital constant, but increase the amount of its assets by acquiring new funds and then seeking out new loan business or purchasing more securities with these new funds.11. In order for a banker to reduce adverse selection she must screen out good from bad creditrisks by learning all she can about potential borrowers. Similarly in order to minimize moral hazard, she must continually monitor borrowers to ensure that they are complying with restrictive loan covenants. Hence it pays for the banker to be nosy.13. False. Although diversification is a desirable strategy for a bank, it may stillmake sense for a bank to specialize in certain types of lending. For example, a bank may have developed expertise in screening and monitoring a particular kind of loan, thus improving its ability to handle problems of adverse selection and moral hazard.15. The gap is $10 million ($30 million of rate-sensitive assets minus $20 millionof rate-sensitive liabilities). The change in bank profits from the interest rate rise is +0.5 million (5% ⨯ $10 million); the interest rate risk can be reduced by increasing rate-sensitive liabilities to $30 million or by reducing rate-sensitive assets to $20 million. Alternatively, you could engage in an interest rate swap in which you swap the interest on $10 million of rate-sensitive assets for the interest on another bank’s $10 million of fixed-rate assets.。

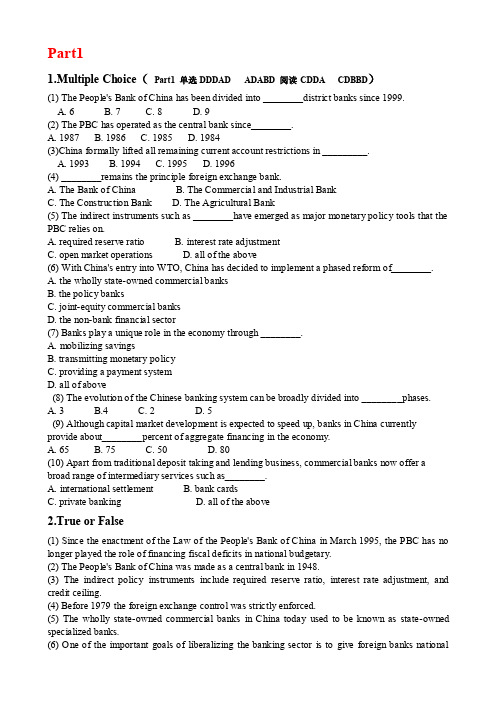

Part11.Multiple Choice(Part1 单选DDDAD ADABD 阅读CDDA CDBBD)(1) The People's Bank of China has been divided into ________district banks since 1999.A. 6B. 7C. 8D. 9(2) The PBC has operated as the central bank since________.A. 1987B. 1986C. 1985D. 1984(3)China formally lifted all remaining current account restrictions in _________.A. 1993B. 1994C. 1995D. 1996(4) ________remains the principle foreign exchange bank.A. The Bank of ChinaB. The Commercial and Industrial BankC. The Construction BankD. The Agricultural Bank(5) The indirect instruments such as ________have emerged as major monetary policy tools that the PBC relies on.A. required reserve ratioB. interest rate adjustmentC. open market operationsD. all of the above(6) With China's entry into WTO, China has decided to implement a phased reform of________.A. the wholly state-owned commercial banksB. the policy banksC. joint-equity commercial banksD. the non-bank financial sector(7) Banks play a unique role in the economy through ________.A. mobilizing savingsB. transmitting monetary policyC. providing a payment systemD. all of above(8) The evolution of the Chinese banking system can be broadly divided into ________phases.A. 3B.4C. 2D. 5(9) Although capital market development is expected to speed up, banks in China currently provide about________percent of aggregate financing in the economy.A. 65B. 75C. 50D. 80(10) Apart from traditional deposit taking and lending business, commercial banks now offer a broad range of intermediary services such as________.A. international settlementB. bank cardsC. private bankingD. all of the above2.True or False(1)Since the enactment of the Law of the People's Bank of China in March 1995, the PBC has no longer played the role of financing fiscal deficits in national budgetary.(2) The People's Bank of China was made as a central bank in 1948.(3) The indirect policy instruments include required reserve ratio, interest rate adjustment, and credit ceiling.(4) Before 1979 the foreign exchange control was strictly enforced.(5) The wholly state-owned commercial banks in China today used to be known as state-owned specialized banks.(6) One of the important goals of liberalizing the banking sector is to give foreign banks nationaltreatment.(7) The increase of the presence of foreign banks in China is likely to introduce new products and expertise.(8) Now China still remains some current account restrictions.(9) In recent years, there has been a great improvement in the conduct of monetary policy with great reliance on direct policy instruments.(10) Now China is an Article Ⅷ member of the International Monetary Fund.3.ClozeDirections: Read the following paragraphs and then put the suitable words or phrases into the blanks.The banking sector has played an important role in ________the implementation of the stabilization and structural measures as well as sustaining strong economic growth. The macroeconomic stability and ________improvement in turn have enabled the banking sector to________vigorously. Although capital market development is expected to speed up, banks in China, which currently provide about 75 percent of aggregate financing in the economy, are likely to continue playing a ________role in financing economic and technological development as well as the economic________ in the foreseeable future.1.facilitating2.reform3.structural4.develop5.dominantIn recent years, there has been a significant improvement in the ________of monetary policy with greater reliance on ________policy instruments. The central bank used to rely on credit ceilings for commercial banks as a major tool for monetary policy. This direct instrument has been abolished while such indirect instruments as required reserve ratio, interest rate adjustment and open market operations have ________as major monetary policy tools. The required reserve account and excess reserve account of the commercial banks with the central bank have been ________and the consolidated required reserve ratio has been reduced from 13 percent to 8 percent. Since 1996, the central bank has________ interest rates on many occasions to reflect the weakening domestic and global demand. These policy measures have helped sustain strong economic growth 1.emerged 2.conduct 3.lowered 4.indirect 5.mergedThe reform efforts have resulted in greater openness of the banking sector, integrated financial markets, increased diversification of banking institutions, strengthened competition and improved efficiency of ________allocation. Despite these achievements, the banking sector in China is faced with ________challenges, including the high level of ________loans and the need to prepare for greater competition from foreign banks, as China becomes a member of the World Trade Organization. These challenges call for ________efforts on the part of the authorities in institutional building to facilitate greater enforceability of bank claims, faster market infrastructure development and better ownership structure. These efforts have to be accompanied by parallel actions of the banks to improve corporate governance, particularly ________structure and internal controls.1.incentive2.non_performing3.resource4.formidable5.intensifying4. Translation(1) Although banks share many common features with other profit-seeking businesses, they play a unique role in the economy through mobilizing savings, allocating capital funds to finance productive investment,transmitting monetary policy, providing a payment system and transforming risks.尽管银行与其他以盈利为目的的企业具有许多共同的特征,但它在国民经济中还发挥着特殊的作用。

金融专业英语阅读(答案)Chapter OneMonetary Policy(货币政策) …………………………………Chapter TwoForeign Exchange Risk andWhy It Should Be Managed(外汇风险和进行外汇管理的原因)………………………………………Chapter ThreeTools and Techniques forThe Management of Foreign Exchange Risk(控制外汇风险的工具和方法) …………………………………Chapter FourU.S. Foreign ExchangeIntervention(美国对外汇交易的干预) …………………………………Chapter FiveHistory of Accounting(会计的历史起源) …………………………………Chapter SixAccounting and Bookkeeping(会计和簿记) …………………………………Chapter SevenFinancial Markets and Intermediaries(金融市场和中间业务) …………………………………Chapter EightHistory of Insurance(保险的历史起源) …………………………………Chapter NineInsurance Policy(保险单) …………………………………Chapter TenBank for International Settlements(国际清算银行) …………………………………Chapter ElevenCommercial Bank Lending(商业银行借贷) …………………………………Chapter TwelveCredit Analysis(信贷分析) …………………………………Chapter ThirteenWhat Kind of Mortgage Loan Should You Get?(何种抵押贷款更适合你?) …………………………………Chapter FourteenMutual Fund(共同基金) …………………………………Chapter FifteenBonds(债券) …………………………………Chapter SixteenOptions(期权) …………………………………Chapter OneMonetary Policy货币政策Answers:Multiple choices1.D2.B3.C4.C5.ATrue or False1.F2.T3.F4.T5.F6.TRead the following text and choose the best sentences for A to E below to fill in each of the gaps in text1. E2. B3. D4. A5. CCloseEmployment, demand, fiscal policy tools, monetary policy, central bank, interest rates, "stable" prices, inflation, "federal funds" rate, open market operationsTranslation:Translate the following passage into Chinese1.紧缩性货币政策和扩张性货币政策都涉及到改变一个国家的货币供应量水平。