财会专业英语期末试卷及答案

- 格式:docx

- 大小:23.03 KB

- 文档页数:14

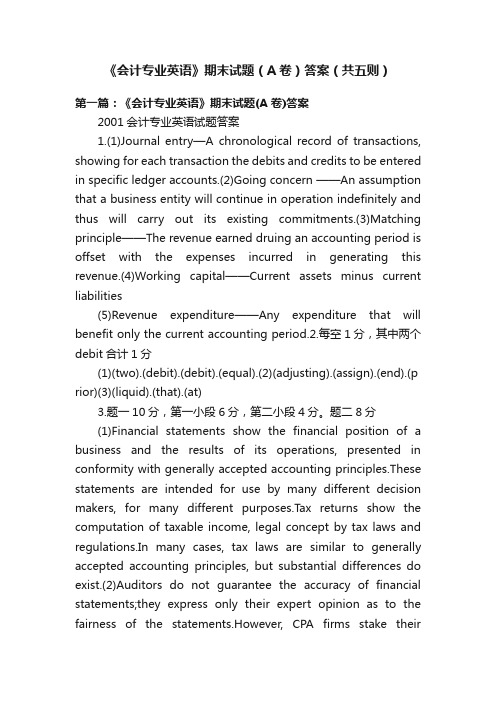

《会计专业英语》期末试题(A卷)答案(共五则)第一篇:《会计专业英语》期末试题(A卷)答案2001会计专业英语试题答案1.(1)Journal entry—A chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts.(2)Going concern ——An assumption that a business entity will continue in operation indefinitely and thus will carry out its existing commitments.(3)Matching principle——The revenue earned druing an accounting period is offset with the expenses incurred in generating this revenue.(4)Working capital——Current assets minus current liabilities(5)Revenue expenditure——Any expenditure that will benefit only the current accounting period.2.每空1分,其中两个debit合计1分(1)(two).(debit).(debit).(equal).(2)(adjusting).(assign).(end).(p rior)(3)(liquid).(that).(at)3.题一10分,第一小段6分,第二小段4分。

题二8分(1)Financial statements show the financial position of a business and the results of its operations, presented in conformity with generally accepted accounting principles.These statements are intended for use by many different decision makers, for many different purposes.Tax returns show the computation of taxable income, legal concept by tax laws and regulations.In many cases, tax laws are similar to generally accepted accounting principles, but substantial differences do exist.(2)Auditors do not guarantee the accuracy of financial statements;they express only their expert opinion as to the fairness of the statements.However, CPA firms stake theirreputations on the thoroughness of their audits and the dependability of their audit reports.4.每小题6分,每小题包括三小句,每小句2分。

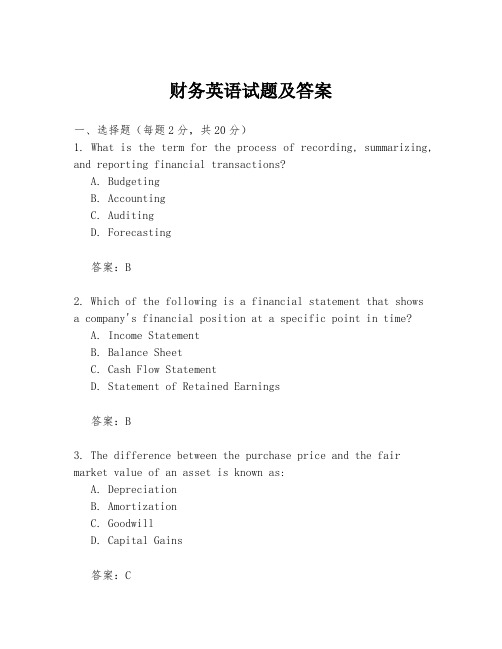

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

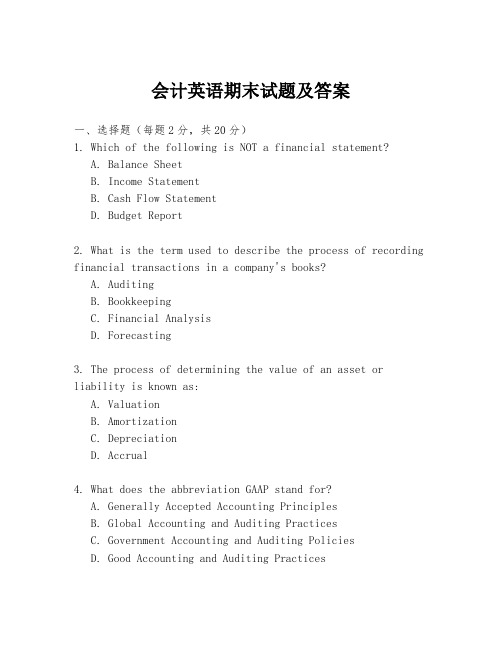

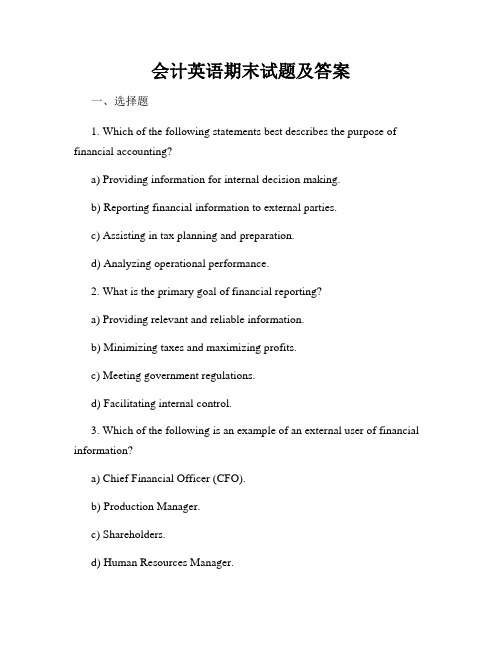

会计英语期末试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Budget Report2. What is the term used to describe the process of recording financial transactions in a company's books?A. AuditingB. BookkeepingC. Financial AnalysisD. Forecasting3. The process of determining the value of an asset orliability is known as:A. ValuationB. AmortizationC. DepreciationD. Accrual4. What does the abbreviation GAAP stand for?A. Generally Accepted Accounting PrinciplesB. Global Accounting and Auditing PracticesC. Government Accounting and Auditing PoliciesD. Good Accounting and Auditing Practices5. The term "revenue recognition" refers to the process of:A. Recording expenses when they are incurredB. Recording revenues when they are earnedC. Allocating costs to products or servicesD. Matching revenues with their related expenses6. Which of the following is a non-current asset?A. InventoryB. Accounts ReceivableC. LandD. Prepaid Expenses7. The matching principle in accounting requires that:A. All expenses must be recorded in the same period as the revenues they generateB. All assets must be listed on the balance sheetC. All liabilities must be paid off within one yearD. All revenues must be recognized in the period they are received8. What is the purpose of adjusting entries?A. To increase the company's reported profitsB. To ensure that financial statements reflect the current financial position of the companyC. To prepare the company for an auditD. To reduce the company's tax liability9. The accounting equation is:A. Assets = Liabilities + EquityB. Liabilities = Assets - EquityC. Equity = Assets - LiabilitiesD. All of the above10. Which of the following is a type of depreciation method?A. FIFOB. LIFOC. Straight-lineD. FIFO and LIFO are both inventory valuation methods答案:1. D2. B3. A4. A5. B6. C7. A8. B9. D10. C二、填空题(每空1分,共10分)11. The primary financial statements include the ______,______, and ______.12. The accounting cycle consists of several steps, including journalizing, ______, posting, and preparing financial statements.13. In accounting, the term "double-entry" refers to the practice of recording each transaction in ______ accounts. 14. The accounting equation shows the relationship between assets, liabilities, and ______.15. The accrual basis of accounting records revenues andexpenses when they are ______, not necessarily when cash is received or paid.答案:11. Balance Sheet, Income Statement, Cash Flow Statement12. footing13. two14. equity15. earned or incurred三、简答题(每题5分,共20分)16. 简述会计信息的四个主要特征。

英语会计期末考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a primary financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D2. The process of recording financial transactions is known as:A. BudgetingB. AccountingC. AuditingD. ForecastingAnswer: B3. What is the formula for calculating the current ratio?A. Current Assets / Current LiabilitiesB. Total Assets / Total LiabilitiesC. Current Assets / Total AssetsD. Current Liabilities / Total AssetsAnswer: A4. Which of the following is not an accounting principle?A. Going ConcernB. Accrual BasisC. Cash BasisD. ConsistencyAnswer: C5. What is the purpose of depreciation?A. To increase the value of assetsB. To allocate the cost of a tangible asset over its useful lifeC. To reduce taxesD. To increase profitsAnswer: B二、填空题(每题1分,共10分)6. The _________ is a summary of a company's financial position at a particular point in time.Answer: Balance Sheet7. An _________ is a liability that is due within one year. Answer: Current Liability8. The _________ is the difference between the cost of an asset and its accumulated depreciation.Answer: Book Value9. The _________ is the process of determining the value of a company's assets.Answer: Valuation10. _________ is a method of accounting where revenues and expenses are recognized when they are earned or incurred.Answer: Accrual Accounting三、简答题(每题5分,共20分)11. Explain the difference between a debit and a credit in accounting.Answer: In accounting, a debit is an entry that increases assets or expenses and decreases liabilities, equity, or revenues. Conversely, a credit is an entry that increases liabilities, equity, or revenues and decreases assets or expenses.12. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to verify the accuracy of the accounting entries by ensuring that the total debits equal the total credits.13. Describe the accounting equation.Answer: The accounting equation is Assets = Liabilities + Owner's Equity. It represents the basic principle that the total assets of a company are financed by its liabilities and the owner's equity.14. What is the purpose of an income statement?Answer: An income statement is used to summarize acompany's revenues, expenses, and net income over a specific period of time, providing an overview of the company's financial performance.四、计算题(每题10分,共20分)15. Given the following data for a company, calculate the current ratio and the debt-to-equity ratio.- Current Assets: $50,000- Current Liabilities: $20,000- Total Liabilities: $80,000- Owner's Equity: $120,000Answer:- Current Ratio = Current Assets / Current Liabilities = $50,000 / $20,000 = 2.5- Debt-to-Equity Ratio = Total Liabilities / Owner's Equity = $80,000 / $120,000 = 0.6716. A company purchased equipment for $100,000 and expects it to have a useful life of 5 years with no residual value. Calculate the annual depreciation expense using the straight-line method.Answer:- Annual Depreciation Expense = (Cost of Equipment - Residual Value) / Useful Life- Annual Depreciation Expense = ($100,000 - $0) / 5 = $20,000五、案例分析题(每题15分,共30分)17. A small business has the following transactions for the month of January:- Purchased inventory on credit for $15,000.- Sold goods for $25,000 cash.- Paid $5,000 in salaries.- Received $10,000 in advance for services to be provided in the future.Prepare the journal entries for these transactions.Answer:- Purchase of Inventory:- Debit: Inventory $15,000- Credit: Accounts Payable $15,000- Sale of Goods:- Debit: Cash $25,000- Credit: Sales Revenue $25,000。

财经英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial instrument?A. StockB. BondC. CommodityD. Insurance policyAnswer: D2. In financial markets, what is the term for the difference between the buying and selling prices of a security?A. SpreadB. DividendC. YieldD. Interest rateAnswer: A3. What is the term used to describe the risk of a security's value changing due to market fluctuations?A. Credit riskB. Market riskC. Liquidity riskD. Operational riskAnswer: B4. Which of the following is not a type of financial statement?A. Balance sheetB. Income statementC. Cash flow statementD. Profit and loss statementAnswer: D5. What is the term for the process of evaluating an investment based on various factors to determine its potential return and risk?A. Due diligenceB. Portfolio managementC. Financial analysisD. Risk assessmentAnswer: C6. What does GDP stand for in economics?A. Gross Domestic ProductB. Gross Domestic ProfitC. Gross Domestic PerformanceD. Gross Domestic PriceAnswer: A7. In the context of finance, what does the acronym "IPO" stand for?A. Initial Public OfferingB. International Profit OrganizationC. International Portfolio OrganizationD. International Product OfferingAnswer: A8. What is the term for a financial contract that gives the buyer the right, but not the obligation, to buy or sell anunderlying asset at a specified price on or before a certain date?A. Call optionB. Put optionC. Forward contractD. Futures contractAnswer: A9. Which of the following is not a component of the financial system?A. BanksB. Securities exchangesC. Insurance companiesD. Manufacturing companiesAnswer: D10. What is the term used to describe the process of determining a company's value based on its financial performance and potential for future growth?A. ValuationB. ForecastingC. BudgetingD. AuditingAnswer: A二、填空题(每题2分,共20分)1. The process of converting cash into other assets is known as ____________.Answer: investing2. A __________ is a financial institution that acceptsdeposits, offers loans, and provides other financial services. Answer: bank3. The __________ is a document that outlines the terms and conditions of a loan, including the interest rate and repayment schedule.Answer: loan agreement4. __________ is the risk that a borrower may default ontheir loan payments.Answer: credit risk5. A __________ is a financial statement that shows acompany's financial position at a specific point in time. Answer: balance sheet6. __________ is the process of evaluating a company'sfinancial health by analyzing its financial statements. Answer: financial analysis7. The __________ is a financial statement that shows a company's revenues, expenses, and net income over a specific period.Answer: income statement8. __________ is the risk that a security's value maydecrease due to a decline in the overall market.Answer: market risk9. A __________ is a financial instrument that represents an ownership interest in a company.Answer: stock10. __________ is the risk that a security may be difficult to sell at a desired price.Answer: liquidity risk三、简答题(每题10分,共20分)1. Explain the difference between a stock and a bond. Answer: A stock represents ownership in a company and typically offers the potential for capital appreciation and dividends. A bond, on the other hand, is a debt instrument issued by a company or government, promising to pay periodic interest and return the principal at maturity.2. What are the main factors that influence a company'scredit rating?Answer: The main factors that influence a company's credit rating include its financial stability, debt levels, profitability, management quality, industry position, and economic conditions. Credit rating agencies assess these factors to determine the likelihood of the company meetingits financial obligations.四、论述题(每题15分,共30分)1. Discuss the importance of diversification in an investment portfolio.Answer: Diversification is crucial in an investment portfolio as it helps to spread risk across a variety of investments, reducing the impact of a poor-performing asset on the overall portfolio. By investing in different asset classes, sectors, and geographical regions, investors can potentially achievebetter returns and lower volatility. Diversification also allows for the exploitation of different market opportunities and can protect against unforeseen events that may affect specific investments.2. Explain the role of financial statements in business decision-making.Answer: Financial statements play a vital role in business decision。

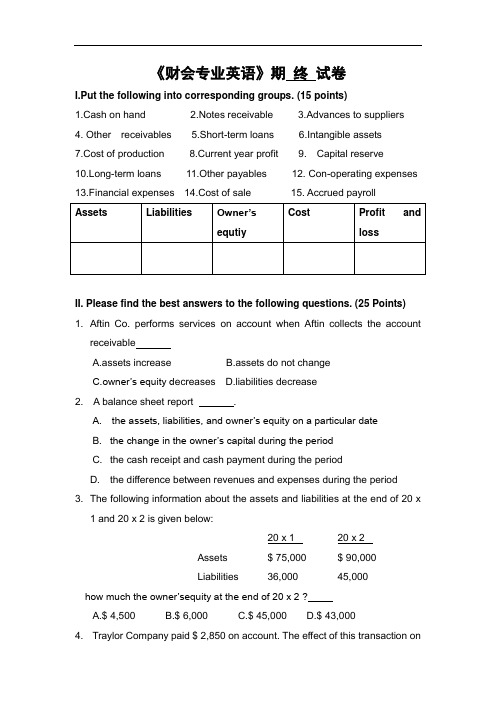

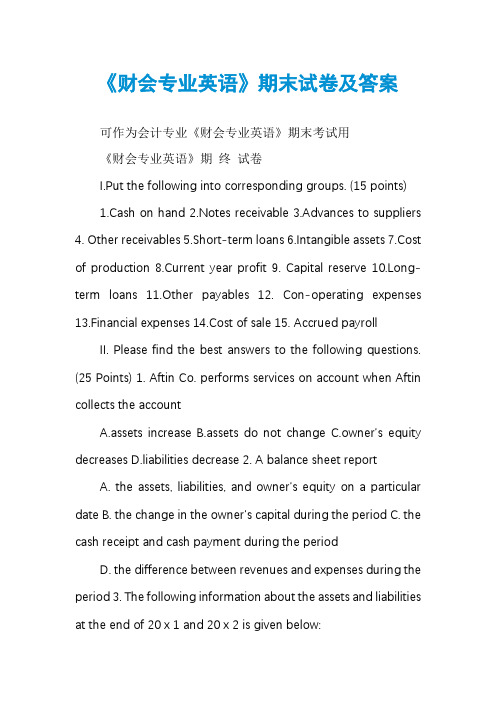

《财会专业英语》期终试卷I.Put the following into corresponding groups. (15 points)1.Cash on hand2.Notes receivable3.Advances to suppliers4. Other receivables5.Short-term loans6.Intangible assets7.Cost of production 8.Current year profit 9. Capital reserve10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payrollII.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the accountreceivableA.assets increaseB.assets do not changeC.owner’s equity d ecreasesD.liabilities decrease2. A balance sheet report .A. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period3. The following information about the assets and liabilities at the end of 20 x1 and 20 x2 is given below:20 x 1 20 x 2Assets $ 75,000 $ 90,000Liabilities 36,000 45,000how much the owner’sequity at the end of 20 x 2 ?A.$ 4,500B.$ 6,000C.$ 45,000D.$ 43,0004. Traylor Company paid $ 2,850 on account. The effect of this transaction onthe accounting equation is to .A. Decreas e assets and decrease owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities5. The entry to record the collection of $ 890 from a customer on account is .A. Dr.Accounts Payable 890Cr. Cash 890B. Dr.Cash 890Cr. Accounts Receivable 890C. Dr.Cash 890Cr. Account Payable 890D. Dr.Cash 890Cr. Service Revenue 8906. The ending Cash account balance is $ 57,600. During the period, cash receipts equal $ 124,300. If the cash payments during the period total $ 135,100, then the beginning Cash amount must haveA. $ 68,400B.$ 46,800C. $ 181,900D.annot be determined from theinformation given7. Use the following selected information for the Alecia Company to calculate the correct credit column total for a trial balance .Accounts receivable $ 7,200Accounts payable $ 6,900Building $ 179,400Cash $ 15,800Capital $ 64,000Insurance expense $ 6,500Salary expense $ 56,100Salary payable $ 3,600Service revenue $ 190,500A. $ 201,000B. $ 137,100C. $ 265,000D. $ 74,5008. ABC paid $500 for inventories in cash ,and purchased additional inventories on account for $700 in the month. At the end of the month,ABC paid $300 of the account payable.what is the balance in the inventoryies account?A $ 500B. $ 900C. $ 1,200D. $ 1,5009.The debit side of an account is used to recordA.increasesB.decreasesC. increases or decreases,depending on the type of accountD.decline10.ABC ,began the year with total assets of $120,000,liabilities of $70,000,and owner’s equit y of $50,000.during the year ABC earned revenue of $110,000 and paid espenses of $30,000.and also invensted an additional $20,000 in the business .how much is the owner’s equity at the end of the year?A. $150,000B.$180,000C.$190,000D.$220,00011.Which of the following is true? __________.A. Owners’ Equity - Assets = LiabilitiesB. Assets –Owners’ Equity = LiabilitiesC. Assets + Liabilities = Owners’ EquityD. Liabilities = Owners’ Equity + Assets12.Which of these is an example of an liability account? _____ ________.A. Service RevenueB. CashC. Accounts ReceivableD. Short-term loans13.Which of the following is a correct statement of the rules of debit and credit? ______.A. Debits increase assets and decrease liabilitiesB. Debits increase assets and increase owners’ equityC. Credits decrease assets and decrease liabilitiesD. Credits increase assets and increase owners’ equity14.If earnings haven’t been distributed as dividends, it should have been retained in the company. The name of this portion of number listed in the balance sheet is ____________.A. paid-in capitalB. retained earningsC. dividendD. cash15.Please select the components which should be deducted from the original value of plant assets when we compute their net value _______.A. Merchandise inventoryB. Income tax payableC. Accumulated depreciationD. Retained earnings16.Which of the following would not be included on a balance sheet?A. Accounts receivable.B. Accounts payable.C. Sales.D. Cash.17. Remington provided the following information about its balance sheet:Cash $ 100Accounts receivable 500Stockholders' equity 700Accounts payable 200Short-term loans 1,000Based on the information provided, how much are Remington's liabilities?A. $200.B. $900.C. $1,200.D. $1,700.18. Gerald had beginning total stockholders' equity of $160,000. During theyear, total assets increased by $240,000 and total liabilities increased by $120,000. Gerald's net income was $180,000. No additional investments were made; however, dividends did occur during the year. How much were the dividends?A. $20,000.B. $60,000.C. $140,000.D. $220,000.19.If the assets of a business are $162,600 and the liabilities are $86,000,howmuch is the owner’s equity?A..$76,600B. $248,600.C. $147,000.D. $250,000.20.Aftin Co. purchases on account when Aftin pay the account payableA.assets increaseB.assets do not changeC.owner’s equity decreasesD.liabilities decrease21.A income statement reports .A. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period22.The following information about the assets and liabilities at the end of 20 x 1and 20 x 2 is given below: 20 x 1 20 x 2Assets $ 75,000 $ 90,000Liabilities 36,000 45,000 If net income in 20 x 2 was $ 1,500 and there were no withdrawals, how much did the owner invest?A.$ 4,500B.$ 6,000C.$ 45,000D.$ 43,00023.Traylor Company receive $ 2 850 on account. The effect of this transactionon the accounting equation is to .A. Decrease assets and decreas e owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities24.The entry to record the collection of $ 8000 from a customer on accountis .A. Dr.Accounts Payable 8000Cr.Cash 8000B. Dr.Cash 8000Cr.Accounts Receivable 8000C. Dr.Cash 8000Cr.Account Payable 8000D. Dr.Cash 8000Cr.Service Revenue 800025.A list of a business entitys assests,liabilities,and owner’s equity on a givendate isA.a balance sheetB.an income statementC.a statement of cash flow C. A retained earnings statementIII. Translate the following sentences into Chinese.(10 points)1. The accounting profession today is changing rapidly.2. Assets are what you own.Liabilities are what you owe.Owner’s Equty iswhat’s left over .3. The original voucher is obtained or filled in what business transactions tookplace.4. Normally an asset account will have a debit balance.5. The term “debit” is often abbreviated to “Dr.”IV. Prepare a convenient bank reconciliation form according to the following bank statement and depositor’s book.(10 points)Bank StatementDepositor’s RecordBank ReconciliationDate MonthV. Put the correct answer into the blanks.(6points)1.The basic Accouting equation is: .2.The rule of debits and credits is: ,.3. Using straight-line depreciation,Annual Dpreciation=( - )/VI. Translate The Following Terms Into Chinese . (10 points).1. surplus reserve2.manufacturing machine3. Construction in progress worth5. promissory note6. in other words7.profit distribution 8. storage room9.principal plus interest 10. accounting statementVII. The following is transactions of ABC company.please make entries.(24 poins)1. .ABC company was established on Jan.1,2010,when the owners,MrsSmiths and his friends,invested $30,000 in cash,patent X,valuing $24,000 and equipment A,valuing $40,000 into the company.2. ABC sells merchandise to another customer and send the customer a$2,500 bill for the products they provide. They allows the customer to pay these goods within 30 days.3. A customer buys $3,000 worth of goods from ABC ,and draws a promissorynote from a lacal bank.4. ABC buys a machine for $20,000,and pays the bill in cash.5. ABC paid the telephone bill for $700 in cash.6. ABC paid $3,800 on the accounts payable.7. ABC determine the month depreciation of the manufactory bulding for$5,000.8. ABC purchasese materials of $5,000 on account.9. ABC sells some goods to a client and receives a check from the customerfor $ 2,000 for the goods provided.10.ABC issues a 9%-5,$100,000 bond at its face amount. The bond is dated January 1, 2010 and requires interest payments until the bond principal at the end of 5 years.(1) Entry to bonds issued;(2) Entry to record the accrual interest for each year;(3) 2014 the company repays the principal plus interest.《财会专业英语》期末试卷答卷I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions. (25 Points)III. Translate the following sentences into Chinese.(10 points)1.2.3.4.5.IV. (10points)Bank ReconciliationDate MonthV. Put the correct answer into the blanks.(6points)1.The basic Accouting equation is: .2.The rule of debits and credits is: ,.3. Using straight-line depreciation,Annual Dpreciation=( - )/VI. Translate The Following Terms Into Chinese . (10 points).1. 2.3. 4.5. 6.7. 8.9. 10.VII. The following is transactions of ABC company.please make entries.(24 poins)《财会专业英语》答案I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions. (25 Points)III. Translate the following sentences into Chinese.(10 points) (略)IV. (10points)Bank ReconciliationDate 31 Month MayV. Put the correct answer into the blanks.(6points)1.Assets=Liabilities+Owner’s equity .2. Every debit must have a credit,all debits must equal all credits. ,3. Using straight-line depreciation,Annual Dpreciation=( Original Cost- Salvage Value) /Years of Service LifeVI. Translate The Following Terms Into Chinese . (10 points).(略)VII. The following is transactions of ABC company.please make entries.(24 poins)(略)。

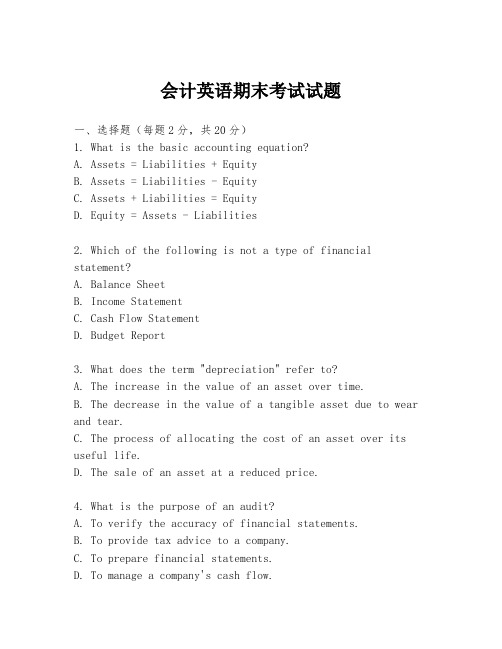

会计英语期末考试试题一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets + Liabilities = EquityD. Equity = Assets - Liabilities2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget Report3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The decrease in the value of a tangible asset due to wear and tear.C. The process of allocating the cost of an asset over its useful life.D. The sale of an asset at a reduced price.4. What is the purpose of an audit?A. To verify the accuracy of financial statements.B. To provide tax advice to a company.C. To prepare financial statements.D. To manage a company's cash flow.5. Which of the following is an example of a current asset?A. InventoryB. LandC. MachineryD. Building6. What is the accounting term for the cost of goods sold?A. COGSB. CGSC. COSD. COTS7. In accounting, what is the term for the net income of a business after all expenses have been deducted?A. Gross ProfitB. Net ProfitC. Operating ProfitD. Earnings Before Tax8. What is the process of adjusting the accounts at the end of an accounting period to show the correct financial position of a company?A. Closing the accountsB. Posting the accountsC. Adjusting entriesD. Balancing the accounts9. Which of the following is a non-current liability?A. Accounts PayableB. Notes PayableC. Long-term DebtD. Sales Tax Payable10. What does the acronym GAAP stand for?A. Globally Accepted Accounting PrinciplesB. Generally Accepted Accounting PracticesC. Government Accounting and Auditing PrinciplesD. Global Accounting and Auditing Principles二、简答题(每题5分,共20分)1. Explain the difference between a debit and a credit in accounting.2. Describe the purpose of a trial balance in the accounting process.3. What are the main components of a balance sheet?4. How does the matching principle affect the calculation of net income?三、计算题(每题10分,共30分)1. Calculate the net income for a company with the following figures:- Revenue: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $50,000- Depreciation: $20,000- Interest Expense: $10,0002. A company has the following assets at the end of the year: - Cash: $10,000- Accounts Receivable: $15,000- Inventory: $20,000- Equipment: $50,000 (with accumulated depreciation of $10,000)Calculate the total current assets and total assets.3. If a company has a balance of $75,000 in its retained earnings account at the beginning of the year and a net income of $30,000, calculate the ending balance of retained earnings.四、案例分析题(共30分)A company has just completed its fiscal year and is preparing its financial statements. The following information is available:- Sales Revenue: $1,500,000- Cost of Goods Sold: $900,000- Selling and Administrative Expenses: $200,000- Depreciation Expense: $50,000- Interest Expense: $30,000- Taxes Payable: $100,000- Dividends Paid: $50,000Based on the information provided, prepare an income statement for the company. Explain any assumptions made during the preparation of the income statement.五、论述题(共30分)Discuss the importance of ethical behavior in the field of accounting. Provide examples of ethical dilemmas that an accountant might face and how they can be resolved.请注意,本试题仅为示例,实际考试内容和格式可能会有所不同。

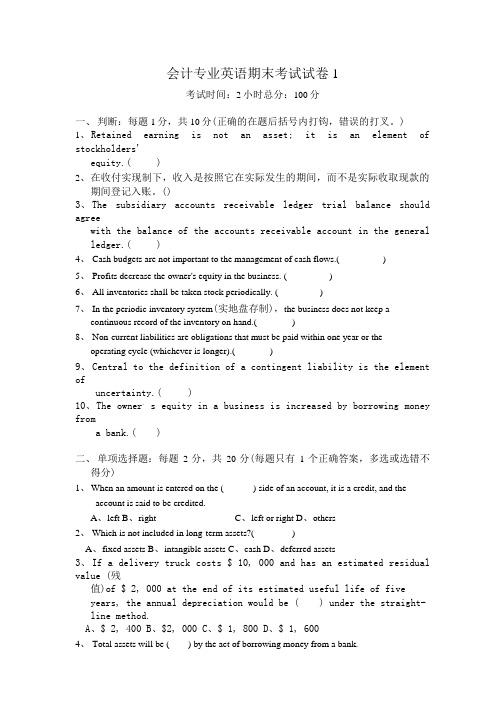

会计专业英语期末考试试卷1考试时间:2小时总分:100分一、判断:每题1分,共10分(正确的在题后括号内打钩,错误的打叉。

)1、R etained earning is not an asset; it is an element of stockholders'equity.( )2、在收付实现制下,收入是按照它在实际发生的期间,而不是实际收取现款的期间登记入账。

()3、The subsidiary accounts receivable ledger trial balance should agreewith the balance of the accounts receivable account in the general ledger.( )4、Cash budgets are not important to the management of cash flows.( )5、Profits decrease the owner's equity in the business. ( )6、All inventories shall be taken stock periodically. ( )7、In the periodic inventory system(实地盘存制),the business does not keep acontinuous record of the inventory on hand.( )8、Non-current liabilities are obligations that must be paid within one year or theoperating cycle (whichever is longer).( )9、Central to the definition of a contingent liability is the element ofuncertainty.( )10、T he owner, s equity in a business is increased by borrowing money froma bank.( )二、单项选择题:每题2分,共20分(每题只有1个正确答案,多选或选错不得分)1、W hen an amount is entered on the ( ) side of an account, it is a credit, and theaccount is said to be credited.A、leftB、rightC、left or rightD、others2、Which is not included in long-term assets?( )A、fixed assetsB、intangible assetsC、cashD、deferred assets3、If a delivery truck costs $ 10, 000 and has an estimated residual value (残值)of $ 2, 000 at the end of its estimated useful life of fiveyears, the annual depreciation would be ( ) under the straight-line method.A、$ 2, 400B、$2, 000C、$ 1, 800D、$ 1, 6004、Total assets will be ( ) by the act of borrowing money from a bank.A、decreasedB、increasedC、remained (保持不变)D、uncertain5、The owners of a corporation (股份公司)are termed (称为)( )A、stockholdersB、investorsC、creditorsD、none of above (都不是)6、()是指会计忽略通货膨胀影响,对货币价值变动不作调整。

财务会计题库英文及答案1. Question: What is the purpose of the statement of cash flows in financial accounting?Answer: The purpose of the statement of cash flows is to provide information about the cash receipts and cash payments of an entity, showing how the changes in balance sheet accounts and income affect cash and cash equivalents, and to reveal the entity's financing and investing activities.2. Question: Explain the difference between a debit and a credit in double-entry bookkeeping.Answer: In double-entry bookkeeping, a debit is an entry on the left side of an account that either increases an asset or expense, or decreases a liability, equity, or revenue. A credit is an entry on the right side of an account that increases a liability, equity, or revenue, or decreases an asset or expense.3. Question: What is the accrual basis of accounting?Answer: The accrual basis of accounting is a method of accounting in which revenues and expenses are recognized when they are earned or incurred, not when cash is received or paid. This method provides a more accurate picture of a company's financial performance over a period of time.4. Question: How does depreciation affect a company's financial statements?Answer: Depreciation is a non-cash expense that allocates the cost of a tangible asset over its useful life. It affects the company's financial statements by reducing the asset's carrying value on the balance sheet and decreasing the net income on the income statement, which in turn can affect the retained earnings.5. Question: What is the primary goal of financial statement analysis?Answer: The primary goal of financial statement analysis is to assess the performance and financial condition of a company. It helps investors, creditors, and other stakeholders make informed decisions by evaluating the company's profitability, liquidity, solvency, and overall financial health.6. Question: What is the difference between a journal entry and a ledger entry?Answer: A journal entry records the initial transaction in the general journal, showing the date, accounts affected, and the amounts debited and credited. A ledger entry, on the other hand, is the posting of the journal entry to the appropriate accounts in the general ledger, which summarizes the transactions for each account.7. Question: Explain the matching principle in financialaccounting.Answer: The matching principle in financial accounting requires that expenses be recognized in the same period asthe revenues they helped to generate. This principle ensures that the income statement reflects the actual economic performance of the period and avoids distortions that could arise from recognizing revenues and expenses in different periods.8. Question: What is the purpose of adjusting entries?Answer: Adjusting entries are made at the end of an accounting period to ensure that the financial statements reflect the current financial position and performance of the company. They adjust for revenues and expenses that have been incurred but not yet recorded, or cash received or paid butnot yet recognized.9. Question: What is the difference between a budget and a forecast?Answer: A budget is a detailed financial plan thatoutlines expected revenues and expenses for a specific period, often used for internal management and control. A forecast,on the other hand, is a projection of future financial performance based on assumptions and trends, and is typically used for strategic planning and decision-making.10. Question: What is the role of the balance sheet infinancial accounting?Answer: The balance sheet is a financial statement that presents a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial stability. The balance sheet must always balance, with total assets equaling the sum of liabilities and equity.。

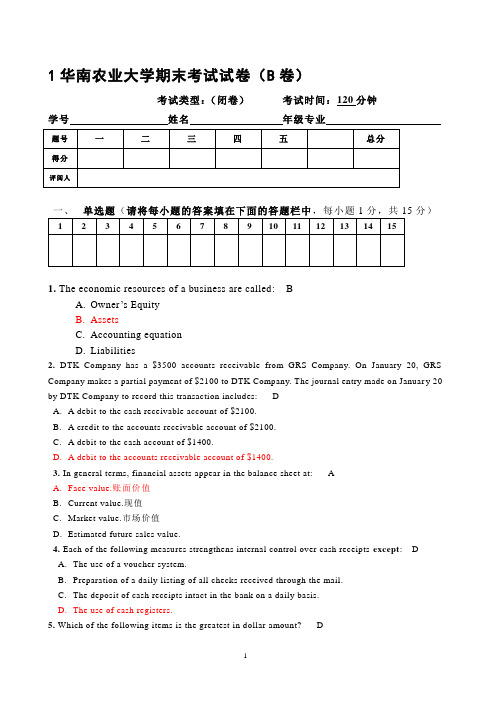

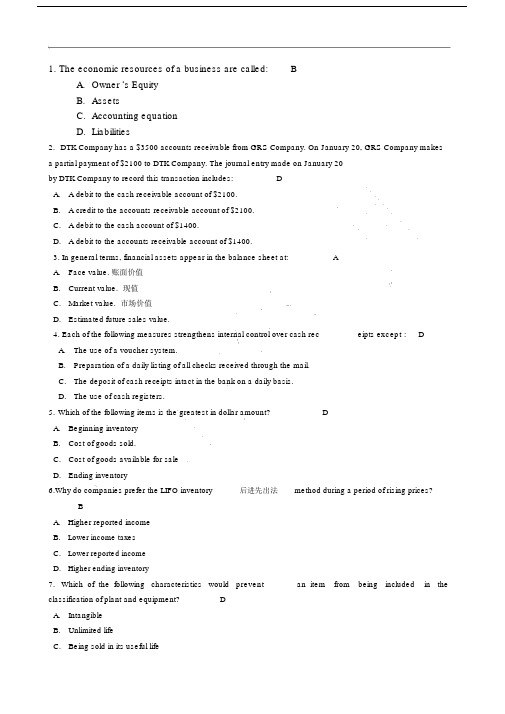

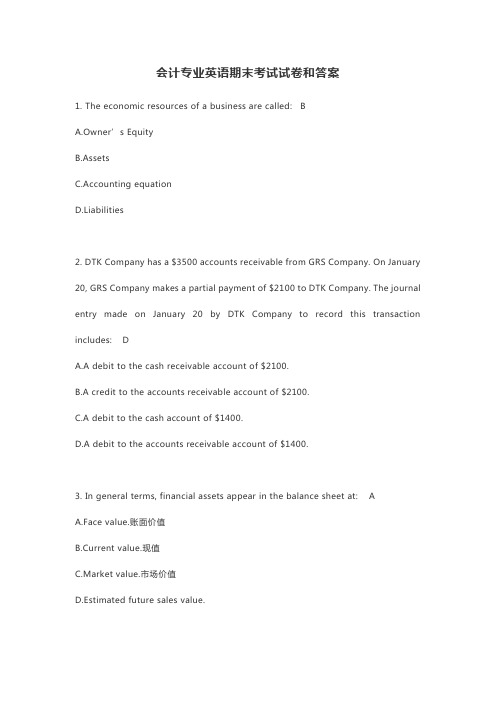

1华南农业大学期末考试试卷(B卷)考试类型:(闭卷)考试时间:120分钟学号姓名年级专业一、单选题(请将每小题的答案填在下面的答题栏中,每小题1分,共15分)1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2.DTK Company has a $3500 accounts rec eivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on Januar y 20 by DTK Company to rec ord this transaction inc ludes: DA. A debit to the c ash rec eivable acc ount of $2100.B. A c redit to the acc ounts rec eivable account of $2100.C. A debit to the c ash account of $1400.D. A debit to the accounts rec eivable acc ount of $1400.3. In general terms, financ ial assets appear in the balanc e sheet at: AA.Fac e value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Eac h of the follow ing measures strengthens internal control over c ash receipts exce pt: DA.The use of a vouc her system.B.Preparation of a daily listing of all c hecks rec eived through the mail.C.The deposit of c ash rec eipts intact in the bank on a daily basis.D.The use of c ash registers.5. Whic h of the follow ing items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法method during a period of rising pric es?BA.Higher reported inc omeB.Low er inc ome taxesC.Low er reported inc omeD.Higher ending inventory7. Whic h of the follow ing c harac teristics w ould pre vent an item from being inc luded in thec lassific ation of plant and equipment? DA.IntangibleB.Unlimited lifeC.Be ing sold in its useful lifeD.Not c apable of rendering benefits to the business in the future.8. Whic h account is not a c ontra-asset account? BA.Deprec iation ExpenseB.Accumulated DepletionC.Accumulated Deprec iationD.Allowanc e for Doubtful Acc ounts9.What are the tw o factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agenc y and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agenc y.D.Double taxation and mutual agency10.Whic h of the follow ing types of business owners do not take an ac tive role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a public ly ow ned corporation11. Analysts c an use the footnotes to the financ ial statements to DA.Help their analysis of financ ial statementsB.Help their understanding of financ ial statementsC.Help their chec king of financ ial statements.D.All of the above12. The current liabilit ies are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financ ial trendsB.Evaluating financ ial struc tureC.Assessing the pat performanc esD.Measuring the term-paying ability14.Among the follow ing ratios, w hic h is used for long-term solvenc y analysis?长期偿债能力分析AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating c yc leD.Book value per share15.A profit-making business that is a separate legal entity and in w hic h ownership is divided into shares of stoc k is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司二、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transac tions into acc ounting journal items. It can c onsist of several items, eac h of w hic h is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanc ed". Journal entries c an rec ord unique items or rec urring items such as deprec iation or bond amortization.(2) Going c onc ern:持续经营The company w ill continue to operate in the near future, unless substantia l evidenc e to the c ontrary exists.(3) Matc hing princ iple:一致性原则(4) Working c apital:营运资金(5) Revenue expenditure:收入费用三、会计业务(共35分)1. On Dec ember 1, ME Company borrow ed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to rec ord obtaining the lo an from the bank on Dec ember 1.(2)Prepare the adjusting journal entry to rec ord accrual of the interest payable on the loan onDec ember 31.(3)Prepare the presentation of the liability to the bank on ME’s Dec ember balanc e sheet.Answer:(1)Debit: c ash $250000Credit: c urrent liabilities $250000(2)Debit: Acc rual Expense $5000 不确定Credit: Interest Payable $5000(3) P392.The follow ing information relating to the bank chec king account is available for Music Ha ll at July 31:Ba lanc e per bank statement at July 31$20 0000Ba lanc e per depositor’s rec ords18 860 Outstanding c hecks 2 000Deposits in transit 800Servic e c harge by bank 60Prepare a bank rec onc iliat ion银行对账工作fro Music Ha ll at July 31.Answer:P423. Please prepare the related entries according to the follow ing acc ounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollec ted at December 31. The c redit manager estimates that $12,000 of these sales w ill be unc ollectible. Please prepare the adjusting entry to rec ord the estimated unc ollectible.2) On Marc h 1, 2003 the manager of financ e of Hea ly Furniture authorizes a write-off of the $500 balanc e owed by Nic k Company. Please make the entry to rec ord the write-off.3) On July 1, Nic k Company paid the $500 amount that had been written off on March 1. Answer:(1)Debit: Unc ollectible Acc ounts Expense坏账损失$12000Credit: Allow anc e for Doubtful Acc ounts坏账准备$12000(2)Debit: Allow anc e for Doubtful Accounts $500Credit: Acc ounts Rec eivable $500(3)Debit: Acc ounts Rec eivable $500Credit: Allow anc e for Doubtful Acc ounts $500Debit: Cash $500Credit: Acc ounts Rec eivable $500四、英译汉(40分)(1) Accounting princ iples are not like physic al laws; they do not exist in nature, aw aiting disc overy man. Rather, they are developed by man, in light of w hat we consider to be the most imp ortant objectives of financ ial reporting. In many w ays generally accepted accounting princ iples are similar to the rules established for an organized sport suc h as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

会计英语期末试题及答案第一部分:单项选择题(共20题,每题1分,共20分)1. The ________ principle states that expenses should be recorded and recognized in the accounting period in which they are incurred.a) Materialityb) Matchingc) Conservatismd) Historical cost答案:b) Matching2. In accounting, the term "debit" refers to:a) An increase in an asset or expense accountb) An increase in a liability or revenue accountc) A decrease in an asset or expense accountd) A decrease in a liability or revenue account答案:a) An increase in an asset or expense account3. The ________ principle states that all relevant information that could affect the decision-making of users should be included in the financial statements.a) Materialityb) Faithful representationc) Comparabilityd) Relevance答案:d) Relevance4. The balance sheet reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:b) Assets, liabilities, and equity5. Which of the following statements about the accrual basis of accounting is true?a) Revenues and expenses are recognized when cash is received or paidb) Transactions are recorded when they occur, regardless of when cash is received or paidc) Only cash transactions are recorded in the financial statementsd) Liabilities and expenses are recognized when they are incurred, and revenues are recognized when cash is received答案:b) Transactions are recorded when they occur, regardless of when cash is received or paid6. The financial statement that shows a company's revenues, expenses, and net income or loss for a specific period of time is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:a) Income statement7. A decrease in an asset account is recorded as a ________.a) Debitb) Creditc) Liabilityd) Equity答案:b) Credit8. The accounting equation can be expressed as:a) Assets = Liabilities + Equityb) Assets + Liabilities = Equityc) Equity = Assets + Liabilitiesd) Liabilities + Equity = Assets答案:a) Assets = Liabilities + Equity9. The financial statement that shows the changes in equity during the accounting period is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:d) Statement of retained earnings10. Which of the following is an example of an intangible asset?a) Landb) Buildingsc) Inventoryd) Goodwill答案:d) Goodwill11. The ________ principle states that assets should be recorded at their original cost.a) Objectivityb) Consistencyc) Historical costd) Materiality答案:c) Historical cost12. The statement of cash flows reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:c) Cash flows from operating, investing, and financing activities13. Which of the following is a current liability?a) Accounts payableb) Bond payable due in 10 yearsc) Mortgage payable due in 5 yearsd) Long-term note payable答案:a) Accounts payable14. The ________ principle states that the financial statements should be prepared assuming that the entity will continue to operate indefinitely.a) Going concernb) Revenue recognitionc) Materialityd) Consistency答案:a) Going concern15. Which financial statement reports the financial position of a company at a specific point in time?a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:c) Balance sheet16. The ________ states that an entity should use the same accounting methods and procedures from period to period.a) Materialityb) Going concernc) Consistencyd) Historical cost答案:c) Consistency17. What type of account is "Accounts Receivable"?a) Assetb) Liabilityc) Revenued) Expense答案:a) Asset18. The financial statement that shows the cash inflows and outflows from operating, investing, and financing activities is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:b) Statement of cash flows19. If a company has a current ratio greater than 1, it means that:a) The company has more assets than liabilitiesb) The company has more liabilities than assetsc) The company is profitabled) The company can pay its current liabilities with its current assets答案:d) The company can pay its current liabilities with its current assets20. Which of the following is considered an external user of financial statements?a) Company managementb) Employeesc) Suppliersd) Creditors答案:d) Creditors第二部分:填空题(共10题,每题2分,共20分)1. The periodicity assumption assumes that a company's activities can be divided into ________ periods of equal length.答案:accounting2. The ________ principle states that an entity should recognize revenues when they are earned, regardless of when cash is received.答案:revenue recognition3. The adjusting entry to record the use of supplies during an accounting period would include a ________ to the Supplies Expense account.答案:debit4. The adjusting entry to recognize revenue that has been earned but not yet collected would include a ________ to the Accounts Receivable account.答案:credit5. The ________ principle requires that expenses be reported in the same period as the revenue that is earned as a result of those expenses.答案:matching6. The financial statement that reports the financial position of a company at a specific point in time is the ________.答案:balance sheet7. The accounting equa tion can be expressed as: ________ = Assets − Liabilities.答案:Equity8. The financial statement that shows the changes in equity during the accounting period is the ________.答案:statement of retained earnings9. The adjusting entry to record the portion of prepaid rent that has been used during an accounting period would include a ________ to the Rent Expense account.答案:debit10. The unearned revenue account is a ________ account.答案:liability第三部分:简答题(共4题,每题10分,共40分)1. What is the matching principle in accounting? Why is it important?答案:The matching principle in accounting states that expenses should be recorded and recognized in the accounting period in which they are incurred, regardless of when the cash is paid. This principle is important to ensure that the expenses are properly matched with the revenues that theyhelp generate. By matching expenses with revenues, the financial statements provide a more accurate representation of the company's financial performance during a specific period. This helps users of the financial statements make informed decisions based on reliable financial information.2. Explain the difference between an asset and a liability. Provide an example of each.答案:An asset is a resource owned by a company that has economic value and is expected to provide future benefits. Examples of assets include cash, accounts receivable, inventory, and property, plant, and equipment.A liability, on the other hand, is an obligation or debt owed by a company to external parties. It represents an economic sacrifice that the company is required to make in the future. Examples of liabilities include accounts payable, loans payable, and accrued expenses.3. What is the purpose of the statement of cash flows? How is it prepared?答案:The purpose of the statement of cash flows is to provide information about the cash inflows and outflows from operating, investing, and financing activities during a specific period. It helps users understand how a company generates and uses its cash resources.The statement of cash flows is prepared using the indirect method or the direct method. In the indirect method, the net income from the income statement is adjusted for non-cash items and changes in working capital to arrive at the net cash provided by operating activities. Cash flows from investing and financing activities are directly reported. In the direct method,the actual cash receipts and payments are directly reported in each category of cash flows.4. What is the purpose of the adjusting entries? Provide two examples of adjusting entries and explain their impact on the financial statements.答案:The purpose of adjusting entries is to ensure that the revenues and expenses are properly recognized in the accounting period in which they are incurred, and that the balance sheet accounts reflect the true financial position of the company at the end of the period.Two examples of adjusting entries are:- Accrued expenses: An adjusting entry is made to recognize expenses that have been incurred but not yet paid or recorded. For example, at the end of the accounting period, salaries for the last few days of the period may not have been paid. An adjusting entry is made to recognize the expense for the unpaid salaries, which increases the expenses on the income statement and decreases the retained earnings on the balance sheet.- Prepaid expenses: An adjusting entry is made to recognize expenses that have been paid in advance but have not yet been used. For example, if a company pays rent for the next three months in advance, an adjusting entry is made to allocate a portion of the prepaid rent to the current accounting period. This decreases the prepaid rent on the balance sheet and increases the rent expense on the income statement.。

会计专业英语期末试题及答案1、In many cities, a low-carbon lifestyle has become(). [单选题] *A. more popular and more popularB. more and more popular(正确答案)C. the most popularD. most and most popular2、We all wondered()Tom broke up with his girlfriend. [单选题] *A. thatB. whatC. whoD. why(正确答案)3、He went to America last Friday. Alice came to the airport to _______ him _______. [单选题] *A. take; offB. see; off(正确答案)C. send; upD. put; away4、The rain is very heavy _______ we have to stay at home. [单选题] *A. butB. becauseC. so(正确答案)D. and5、______! It’s not the end of the world. Let’s try it again.()[单选题] *A. Put upB. Set upC. Cheer up(正确答案)D. Pick up6、--_______ do you have to do after school?--Do my homework, of course. [单选题] *A. What(正确答案)B. WhenC. WhereD. How7、39.—What do you ________ my new dress?—Very beautiful. [单选题] * A.look atB.think aboutC.think of(正确答案)D.look through8、They may not be very exciting, but you can expect ______ a lot from them.()[单选题] *A. to learn(正确答案)B. learnC. learningD. learned9、The hall in our school is _____ to hold 500 people. [单选题] *A. big enough(正确答案)B. enough bigC. very smallD. very big10、What do you think of the idea that _____ honest man who married and brought up a large family did more service than he who continued single and only talked of _____ population. [单选题] *A. a, /B. an, /C. a, theD. an, the(正确答案)11、20.Jerry is hard-working. It’s not ______ that he can pass the exam easily. [单选题] * A.surpriseB.surprising (正确答案)C.surprisedD.surprises12、You wouldn't have seen her if it _____ not been for him . [单选题] *A. hasB. had(正确答案)C. haveD.is having13、My home is about _______ away from the school. [单选题] *A. three hundred metreB. three hundreds metresC. three hundred metres(正确答案)D. three hundreds metre14、30.I want to find ______ and make much money. [单选题] *A.worksB.jobC.a job(正确答案)D.a work15、Many people prefer the bowls made of steel to the _____ made of plastic. [单选题] *A. itB. ones(正确答案)C. oneD. them16、The red jacket is _______ than the green one. [单选题] *A. cheapB. cheapestC. cheaper(正确答案)D. more cheap17、Grandfather lives with us. We all _______ him when he gets ill. [单选题] *A. look after(正确答案)B. look atC. look forD. look like18、By the end of this month, all this _____. [单选题] *A. is changedB.will changeC. will have changed(正确答案)D. has changed19、Customers see location as the first factor when_____a decision about buying a house. [单选题] *A.makeB.to makeC.making(正确答案)D.made20、Can I _______ your order now? [单选题] *A. makeB. likeC. giveD. take(正确答案)21、Which animal do you like _______, a cat, a dog or a bird? [单选题] *A. very muchB. best(正确答案)C. betterD. well22、Now people can _______ with their friends far away by e-mail, cellphone or letter. [单选题] *A. keep onB. keep in touch(正确答案)C. keep upD. keep off23、If we want to keep fit, we should try to _______ bad habits. [单选题] *A. keepB. haveC. getD. get rid of(正确答案)24、Her ideas sound right, but _____ I'm not completely sure. [单选题] *A. somehow(正确答案)B. somewhatC. somewhereD. sometime25、The flowers _______ sweet. [单选题] *A. tasteB. smell(正确答案)C. soundD. feel26、( ) You had your birthday party the other day,_________ [单选题] *A. hadn't you?B. had you?C. did you?D. didn't you?(正确答案)27、The work will be finished _______ this month. [单选题] *A. at the endB. in the endC. by the endD. at the end of(正确答案)28、The students _____ outdoors when the visitors arrived. [单选题] *A. were playing(正确答案)B. have playedC. would playD. could play29、Why don’t you _______ the bad habit of smoking. [单选题] *A. apply forB. get rid of(正确答案)C. work asD. graduate from30、pencil - box is beautiful. But ____ is more beautiful than ____. [单选题] *A. Tom's; my; heB. Tom's; mine; his(正确答案)C. Tom's; mine; himD. Tom's; my; his。

南开】《会计专业英语》20春期末考核答卷(标准答案)1.When using accrual accounting。

XXX incurred。

regardless of whether or not cash is paid。

This means that expenses are recognized when they are earned。

not when the cash is XXX.2.Notes may be issued for us reasons。

such as purchasing assets。

XXX.3.A capital expenditure results in a debit to an asset account。

as it represents an investment in a long-term asset that will provide XXX to the company。

This is different from an expense。

which is a cost incurred in the current d and does not provide XXX.4.Postage stamps XXX。

as they are not readily convertible to cash and do not represent a liquid asset that can be used to pay debts or expenses.5.Current XXX one year。

This includes items such as accounts payable。

wages payable。

and short-term loans。

It does not include debts that are due but not payable for more than one year.6.The excess of the issue price over the par value of common stock is known as a premium.7.The n of n requires the cost。

《财会专业英语》期末试卷及答案可作为会计专业《财会专业英语》期末考试用《财会专业英语》期终试卷I.Put the following into corresponding groups. (15 points)1.Cash on hand2.Notes receivable3.Advances to suppliers4. Other receivables5.Short-term loans6.Intangible assets7.Cost of production8.Current year profit9. Capital reserve 10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payrollII. Please find the best answers to the following questions.(25 Points) 1. Aftin Co. performs services on account when Aftin collects the accountA.assets increaseB.assets do not changeC.owner’s equity decreasesD.liabilities decrease 2. A balance sheet reportA. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period 3. The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below:$ 75,000 36,000$ 90,000 45,000AssetsLiabilitieshow much the owner’sequity at the end of 20 x 2 ?A.$ 4,500B.$ 6,000C.$ 45,000D.$ 43,0004. Traylor Company paid $ 2,850 on account. The effect of this transaction on可作为会计专业《财会专业英语》期末考试用the accounting equation is to .A. Decrease assets and decrease owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities5. The entry to record the collection of $ 890 from a customer on account isA. Dr.Accounts PayableCr. Cash890890B. Dr.Cash890890Cr. Accounts ReceivableC. Dr.Cash890890Cr. Account PayableD. Dr.Cash890890Cr. Service Revenue6. The ending Cash account balance is $ 57,600. During the period, cash receipts equal $ 124,300. If the cash payments during the period total $ 135,100, then the beginning Cash amount must haveA. $ 68,400B.$ 46,800C. $ 181,900D.annot be determined from theinformation given7. Use the following selected information for the Alecia Company to calculate the correct credit column total for a trial balanceAccounts receivable Accounts payable Building Cash Capital $ 7,200 $ 6,900 $ 179,400 $ 15,800 $ 64,000 $ 6,500 $ 56,100 Insurance expense Salary expense可作为会计专业《财会专业英语》期末考试用Salary payable Service revenue$ 3,600 $ 190,500A. $ 201,000B. $ 137,100C. $ 265,000D. $ 74,5008. ABC paid $500 for inventories in cash ,and purchased additional inventories on account for $700 in the month. At the end of the month,ABC paid $300 ofA $ 500 B. $ 900 C. $ 1,200 D. $ 1,5009.The debit side of an account is used to record A.increasesB.decreasesC. increases or decreases,depending on the type of accountD.decline10.ABC ,began the year with total assets of $120,000,liabilities of $70,000,and owner’s equity of $50,000.during the year ABC earned revenue of $110,000 and paid espenses of $30,000.and also invensted an additional $20,000 in the business .how much is the owner’s equity at the end of the year?A. $150,000 B.$180,000 C.$190,000 D.$220,00011.Which of the following is true? __________. A. Owners’ Equity - Assets = Liabilities B. Assets C Owners’ Equity = Liabilities C. Assets + Liabilities = Owners’Equity D. Liabilities = Owners’ Equity + Assets可作为会计专业《财会专业英语》期末考试用12.Which of these is an example of an liability account? _____ ________. A. Service Revenue B.CashC. Accounts ReceivableD. Short-term loans13.Which of the following is a correct statement of the rules of debit and credit? ______.A. Debits increase assets and decrease liabilitiesB. Debits increase assets and increase owners’ equityC. Credits decrease assets and decrease liabilitiesD. Credits increase assets and increase owners’ equity14.If earnings haven’t been distributed as dividends, it should have beenretained in the company. The name of this portion of number listed in the balance sheet is ____________.A. paid-in capitalB. retained earningsC. dividendD. cash15.Please select the components which should be deductedfrom the original value of plant assets when we compute their net value _______. A. Merchandise inventory B. Income tax payable C. Accumulated depreciation D. Retained earnings16.Which of the following would not be included on a balance sheet?A. Accounts receivable.B. Accounts payable.C. Sales.D. Cash.17. Remington provided the following information about its balance sheet: Cash $ 100 Accounts receivable 500 Stockholders' equity 700 Accounts payable 200 Short-term loans 1,000 Based on the information provided, how much are Remington's liabilities? A. $200. B. $900. C. $1,200. D. $1,700.18. Gerald had beginning total stockholders' equity of $160,000. During the可作为会计专业《财会专业英语》期末考试用year, total assets increased by $240,000 and total liabilities increased by $120,000. Gerald's net income was $180,000. No additional investments were made; however, dividends did occur during the year. How much were the dividends?A. $20,000.B. $60,000.C. $140,000.D. $220,000. 19.If the assets of a business are $162,600 and the liabilities are $86,000,how much is the owner’s equity?A..$76,600B. $248,600.C. $147,000.D. $250,000.A.assets increaseB.assets do not changeC.owner’s equity decreasesD.liabilities decreaseA. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period 22.The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below: Assets $ 75,000 36,000$ 90,000 45,000LiabilitiesIf net income in 20 x 2 was $ 1,500 and there were no withdrawals, how A.$ 4,500 B.$ 6,000 C.$ 45,000 D.$ 43,00023.Traylor Company receive $ 2 850 on account. The effect of this transaction on the accounting equation is to .A. Decrease assets and decrease owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities可作为会计专业《财会专业英语》期末考试用24.The entry to record the collection of $ 8000 from a customer on account isA. Dr.Accounts PayableCr.Cash8000 8000B. Dr.Cash80008000Cr.Accounts ReceivableC. Dr.Cash80008000Cr.Account PayableD. Dr.Cash80008000Cr.Service Revenue25.A list of a business ent itys assests,liabilities,and owner’s equity on a givenA.a balance sheetB.an income statementC.a statement of cash flow C. A retained earnings statementIII. Translate the following sentences into Chinese.(10 points) 1. The accounting profession today is changing rapidly.2. Assets are what you own.Liabilities are what you owe.Owner’s Equty is what’s left over .3. The original voucher is obtained or filled in what business transactions took place.4. Normally an asset account will have a debit balance.5. The term “debit” is often abbreviated to “Dr.”IV. Prepare a convenient bank reconciliation form according to the following bank statement and depositor’s book.(10 points) Bank Statement可作为会计专业《财会专业英语》期末考试用Depositor’s RecordBank ReconciliationV. Put the correct answer into the blanks.(6points)可作为会计专业《财会专业英语》期末考试用, . 3. Using straight-line depreciation,-VI. Translate The Following Terms Into Chinese . (10 points).1. surplus reserve2.manufacturing machine3. Construction in progress worth 5. promissory note 6. in other words 7.profitdistribution 8. storage room9.principal plus interest 10. accounting statementVII. The following is transactions of ABC company.please make entries.(24 poins)1. .ABC company was established on Jan.1,2022年,when the owners,Mrs Smiths and his friends,invested $30,000 in cash,patent X,valuing $24,000 and equipment A,valuing $40,000 into the company.2. ABC sells merchandise to another customer and send the customer a $2,500 bill for the products they provide. They allows the customer to pay these goods within 30 days.3. A customer buys $3,000 worth of goods from ABC ,and draws a promissory note from a lacal bank.4. ABC buys a machine for $20,000,and pays the bill in cash.5. ABC paid the telephone bill for $700 in cash.6. ABC paid $3,800 on the accounts payable.7. ABC determine the month depreciation of the manufactory bulding for $5,000.8. ABC purchasese materials of $5,000 on account.9. ABC sells some goods to a client and receives a check from the customer for $ 2,000 for the goods provided.可作为会计专业《财会专业英语》期末考试用10.ABC issues a 9%-5,$100,000 bond at its face amount. The bond is dated January 1, 2022年and requires interest payments until the bond principal at the end of 5 years. (1) Entry to bonds issued;(2) Entry to record the accrual interest for each year; (3) 2022年the company repays the principal plus interest.《财会专业英语》期末试卷答卷I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions.(25 Points)III. Translate the following sentences into Chinese.(10 points) 1. 2. 3. 4.可作为会计专业《财会专业英语》期末考试用5.IV. (10points)Bank ReconciliationV. Put the correct answer into the blanks.(6points), . 3. Using straight-line depreciation,-VI. Translate The Following Terms Into Chinese . (10 points).1. 2. 3. 4. 5. 6. 7. 8. 9. 10.VII. The following is transactions of ABC company.please make entries.(24 poins)可作为会计专业《财会专业英语》期末考试用《财会专业英语》答案I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions.(25 Points)III. Translate the following sentences into Chinese.(10 points) (略)IV. (10points)Bank ReconciliationV. Put the correct answer into the blanks.(6points)可作为会计专业《财会专业英语》期末考试用,3. Using straight-line depreciation,VI. Translate The Following Terms Into Chinese . (10 points). (略)VII. The following is transactions of ABC company.please entries.(24 poins) (略)。

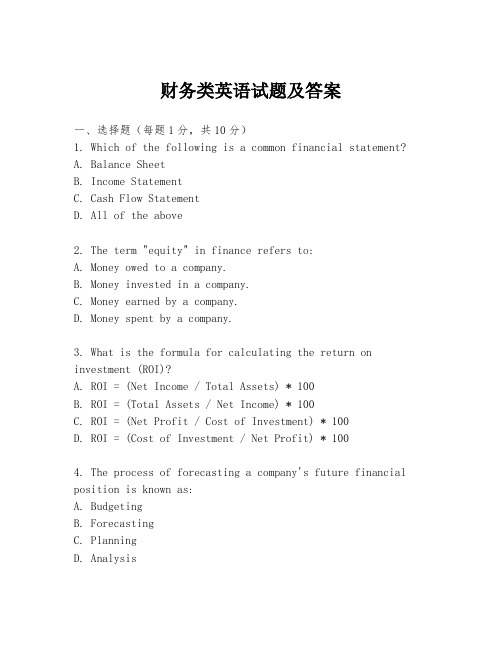

财务类英语试题及答案一、选择题(每题1分,共10分)1. Which of the following is a common financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. All of the above2. The term "equity" in finance refers to:A. Money owed to a company.B. Money invested in a company.C. Money earned by a company.D. Money spent by a company.3. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) * 100B. ROI = (Total Assets / Net Income) * 100C. ROI = (Net Profit / Cost of Investment) * 100D. ROI = (Cost of Investment / Net Profit) * 1004. The process of forecasting a company's future financial position is known as:A. BudgetingB. ForecastingC. PlanningD. Analysis5. Which of the following is not a type of financial risk?A. Credit riskB. Market riskC. Liquidity riskD. Fixed risk6. The term "leverage" in finance is used to describe:A. The use of borrowed money to increase potential returns.B. The process of selling a financial asset.C. The amount of money a company has in the bank.D. The ratio of a company's equity to its debt.7. What does "EBIT" stand for in financial analysis?A. Earnings Before Interest and TaxesB. Earnings Before Income and TaxesC. Earnings Before Interest and TotalD. Earnings Before Interest, Taxes, and Depreciation8. The "time value of money" concept implies that:A. Money received in the future is worth less than money received today.B. Money received in the past is worth more than money received today.C. Money has no value over time.D. The value of money is constant over time.9. Which of the following is a method of financial analysis?A. SWOT analysisB. PEST analysisC. Ratio analysisD. Porter's Five Forces analysis10. The "break-even point" in finance is the point at which:A. A company's revenue equals its expenses.B. A company's net income is zero.C. A company's assets equal its liabilities.D. A company's cash flow is positive.答案:1. D2. B3. C4. B5. D6. A7. A8. A9. C10. A二、填空题(每题1分,共5分)11. The __________ is a financial statement that shows a company's assets, liabilities, and equity at a particular point in time.Answer: Balance Sheet12. The __________ is the difference between revenue and expenses during a specific period.Answer: Net Income13. In finance, the term "capital" often refers to the__________ of the business.Answer: Owners' Equity14. If a company's current assets are greater than itscurrent liabilities, it is said to have a positive __________. Answer: Working Capital15. The __________ is a measure of how well a company can pay its current debts.Answer: Quick Ratio三、简答题(每题5分,共10分)16. What is the purpose of a financial statement analysis?Answer: The purpose of financial statement analysis is to assess the performance and financial health of a company. It helps investors, creditors, and other stakeholders to make informed decisions about the company's financial stability, profitability, and risk.17. Explain the difference between "operating activities" and "financing activities" in the context of a cash flow statement.Answer: Operating activities in a cash flow statement referto the cash transactions that are directly related to thecore business operations of the company, such as cashreceived from sales and cash paid for expenses. Financing activities, on the other hand, involve cash transactions related to the company's financing arrangements, such as issuing or repaying debt, issuing or buying back shares, and paying dividends.四、计算题(每题5分,共5分)18. If a company has a net profit of $100,000 and a cost of investment of $500,000, what is the ROI?Answer: ROI = (Net Profit / Cost of Investment) * 100ROI = (100,000 / 500,000) * 100ROI = 20%五、论述题(每题10分,共10分)19. Discuss the importance of financial planning in business management.Answer: Financial planning is a critical component of business management as it helps in setting financial goals, allocating resources efficiently, and forecasting。

1. The economic resources of a business are called:BA.Owner ’s EquityB.AssetsC.Accounting equationD.Liabilities2.DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makesa partial payment of $2100 to DTK Company. The journal entry made on January 20by DTK Company to record this transaction includes:DA. A debit to the cash receivable account of $2100.B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at:AA.Face value. 账面价值B.Current value. 现值C.Market value. 市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash rec eipts except : DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5.Which of the following items is the greatest in dollar amount?A.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法BA. Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7.Which of the following characteristics would prevent classification of plant and equipment?DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeDmethod during a period of rising prices?an item from being included in theD. Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account?BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9.What are the two factors that make ownership of an interest in a general partnership particularlyrisky?AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10.Which of the following types of business owners do not take an active role in the daily management of the business?DA. General partnersB. Limited liability partnersC. Sole proprietors个体经营者D. Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12.The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are$240 000. What is the debt ratio?CA.0.125B.0.208C.0.333D.3.013. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析AA. Current ratio流动比率B.Times-interest-earned ratioC.Operating cycleD. Book value per shareentity and in which ownership is divided into 15. A profit-making business that is a separate legalshares of stock is known as a DA. Sole proprietorship个体独资公司B.Single proprietorshipC.Partnership合伙公司D.Corporation 股份有限公司一、名词解释(10分 )(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. Itcan consist of several items, each of which is either a debit or a credit. The total of the debits mustequal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2)Going concern :持续经营 The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3)Matching principle:一致性原则(4)Working capital:营运资金(5)Revenue expenditure :收入费用二、会计业务(共 35 分)1.On December 1, ME Company borrowed $250 000 from a bank, and promise to repay thatamount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bank on December 1.(2)Prepare the adjusting journal entry to record accrual of the interest payable on the loanon December 31.(3) Prepare the presentation of the liability to the bank on ME’s December balance sheet. Answer:(1)Debit: cash$250000Credit: current liabilities $250000(2)Debit: Accrual Expense $5000不确定Credit: Interest Payable $5000(3) P392. The following information relating to the bank checking account is available for Music Hall at July 31:Balance per bank statement at July 31$20 0000Balance per depositor ’s records18 860Outstanding checks 2 000Deposits in transit800Service charge by bank60Prepare a bank reconciliation银行对账工作fro Music Hall at July 31.Answer:P423.Please prepare the related entries according to the following accounting events.1)Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales willbe uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2)On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500balance owed by Nick Company. Please make the entry to record the write-off.3)On July 1, Nick Company paid the $500 amount that had been written off on March 1.Answer:(1) Debit: Uncollectible Accounts Expense坏账损失$12000Credit: Allowance for Doubtful Accounts坏账准备$12000(2)Debit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)Debit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉( 40 分)(1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discoveryman. Rather, they are developed by man, in light of what we consider to be the most imp ortant objectives of financial reporting. In many ways generally accepted accounting principles are similarto the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

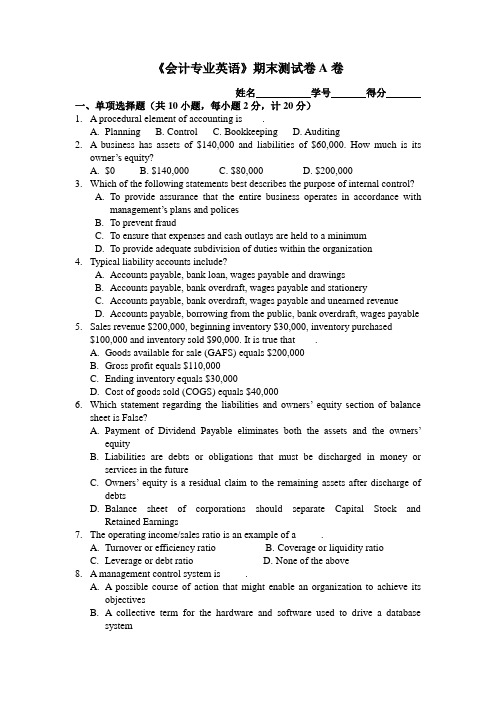

《会计专业英语》期末测试卷A卷姓名学号得分一、单项选择题(共10小题,每小题2分,计20分)1. A procedural element of accounting is____.A.PlanningB. ControlC. BookkeepingD. Auditing2. A business has assets of $140,000 and liabilities of $60,000. How much is itsowner’s equit y?A.$0B. $140,000C. $80,000D. $200,0003.Which of the following statements best describes the purpose of internal control?A.To provide assurance that the entire business operates in accordance withmanagement’s plans and policesB.To prevent fraudC.To ensure that expenses and cash outlays are held to a minimumD.To provide adequate subdivision of duties within the organization4.Typical liability accounts include?A.Accounts payable, bank loan, wages payable and drawingsB.Accounts payable, bank overdraft, wages payable and stationeryC.Accounts payable, bank overdraft, wages payable and unearned revenueD.Accounts payable, borrowing from the public, bank overdraft, wages payable5.Sales revenue $200,000, beginning inventory $30,000, inventory purchased$100,000 and inventory sold $90,000. It is true that____.A.Goods available for sale (GAFS) equals $200,000B.Gross profit equals $110,000C.Ending inventory equals $30,000D.Cost of goods sold (COGS) equals $40,0006.W hich statement regarding the liabilities and owners’ equity section of balancesheet is False?A.Payment of Dividend Payable eliminates both the assets and the owners’equityB.Liabilities are debts or obligations that must be discharged in money orservices in the futureC.Owners’ equity is a residual claim to the remaining assets after discharge ofdebtsD.Balance sheet of corporations should separate Capital Stock andRetained Earnings7.The operating income/sales ratio is an example of a_____.A.Turnover or efficiency ratioB. Coverage or liquidity ratioC.Leverage or debt ratioD. None of the above8. A management control system is_____.A.A possible course of action that might enable an organization to achieve itsobjectivesB. A collective term for the hardware and software used to drive a databasesystemC. A set up that measures and corrects the performance of activities ofsubordinates in order to make sure that the objectives of an organization are being met and their associated plans arebeing carried outD.A system that controls and maximizes the profits of an organizationpany A manufactures and sells only one product, the selling price per unit ofproducts is $20, and the variable cost per unit is $15, the total fixed cost for the year is $80,000. Then the break-even sales for Company A is_____.A. $400,000B.16, 000C.320, 000D. $240,00010.The total estimate sales for the coming year is 250,000 units. The estimatedinventory at the beginning of the year is 22,500 units, and the desired inventory at the end of the year is 30,000 units. The total production indicated in the production budget is_____.A. 242,500 unitsB. 280,000 unitsC. 257,000 unitsD. 302,500 units二、多项选择题(共5小题,每小题4分,计20分)1.Which of the following are fixed costs?A.Telephone billB.Annual salary of the chief accountantC.The management accountant's annual membership fee to ACCA (paid by thecompany)D.Wages of warehousemen2.For commercial bank, which two parts does the operating revenue mainlyinclude?A.Asset RevenueB. Rental RevenueC. Service RevenueD. Bond Revenue3.Which of these are the audit objectives?A.ValidityB. CompletenessC. TimingD. Valuation4.Which of the following statements regarding materiality and misstatements iscorrect?A.Materiality decisions are made relative to the size of the organization beingaudited.B. A lower materiality level would increase the extent of audit proceduresperformed.C.At the planning stage, the auditor should design specific procedures to detectmaterial qualitative misstatements.D.Likely aggregate misstatements include the net effect of uncorrectedmisstatements in opening equity.5.The audit report should include the following basic contents_____.A. The titleB. The introductory paragraphC. The scope paragraphD. The opinion paragraph三、判断题(正确写“T”,错误写“F”。