《2004-2005中国资本市场研究报告》(pdf 140)

- 格式:pptx

- 大小:303.41 KB

- 文档页数:85

中国资本市场分析报告一、引言资本市场作为现代金融体系的重要组成部分,对于中国经济的发展起着至关重要的作用。

它不仅为企业提供了融资渠道,促进了资源的优化配置,也为投资者提供了多样化的投资机会,推动了金融创新和经济结构的调整。

本报告旨在对中国资本市场的现状进行全面分析,探讨其面临的挑战,并对未来的发展趋势进行展望。

二、中国资本市场的发展历程中国资本市场的发展可以追溯到上世纪 90 年代初,上海证券交易所和深圳证券交易所的相继成立标志着中国资本市场的正式起步。

在过去的几十年里,中国资本市场经历了从无到有、从小到大的快速发展过程。

在发展初期,资本市场主要以股票市场为主,上市公司数量较少,市场规模较小,交易机制和监管制度也不够完善。

随着中国经济的快速发展和改革开放的不断深入,资本市场逐渐壮大,债券市场、期货市场、基金市场等相继发展起来,市场结构不断优化,交易品种日益丰富。

三、中国资本市场的现状(一)股票市场截至目前,中国股票市场市值规模位居全球前列。

上市公司数量不断增加,涵盖了各个行业和领域。

2、交易机制股票交易机制不断完善,包括引入了集合竞价、连续竞价等交易方式,提高了市场的流动性和交易效率。

3、投资者结构个人投资者仍然占据较大比例,但机构投资者的比重逐渐上升,市场投资理念逐渐成熟。

(二)债券市场1、规模与品种中国债券市场规模持续扩大,债券品种不断丰富,包括国债、地方政府债券、企业债券、公司债券等。

2、市场流动性债券市场的流动性有所提高,但与发达国家相比仍有一定差距。

(三)期货市场1、交易品种期货市场交易品种涵盖了农产品、金属、能源等多个领域,为企业提供了风险管理工具。

监管制度不断加强,市场运行更加规范。

(四)基金市场1、规模增长基金市场规模迅速增长,包括公募基金、私募基金等多种类型。

2、投资策略投资策略多样化,满足了不同投资者的需求。

四、中国资本市场面临的挑战(一)市场波动较大中国资本市场的波动性相对较高,受宏观经济政策、国际市场波动等因素的影响较大,投资者信心容易受到冲击。

中国资本市场研究报告中国资本市场研究报告一、背景介绍中国资本市场是指中国内地的证券市场和期货市场。

近年来,随着中国经济的快速发展,中国资本市场逐渐成为全球投资者关注的热点。

本报告旨在对中国资本市场进行深入研究,并分析其发展趋势和风险。

二、市场规模中国证券市场由上海证券交易所和深圳证券交易所组成,截至2020年底,中国A股市场总市值超过60万亿人民币。

中国期货市场由大连商品交易所、上海期货交易所和郑州商品交易所组成,截至2020年底,中国期货市场总交易量达到45亿手。

三、市场趋势1. 场外资本市场的发展。

随着中国资本市场对外开放的不断推进,越来越多的外资机构涌入中国市场,加速了中国资本市场的国际化进程。

2. 科创板的建设。

科创板是中国资本市场的创新举措之一,旨在为科技创新企业提供更多融资渠道,促进科技创新发展。

3. 机构投资者的增加。

中国政府鼓励社保基金、保险机构等机构投资者进入资本市场,以提高市场的稳定性和流动性。

四、投资机会1. 低估值蓝筹股。

中国A股市场中,一些高质量的蓝筹股由于估值偏低,具有较大的投资潜力。

2. 科技创新企业。

随着中国经济的转型升级,科技创新企业的发展前景广阔,具有较高的投资回报率。

3. 新兴产业。

中国政府大力支持新兴产业的发展,如新能源、互联网、生物医药等,投资新兴产业有望获得高额收益。

五、投资风险1. 宏观经济风险。

中国经济面临着不确定性和波动性,投资者需要密切关注宏观经济数据的变化,以及国际经济环境的影响。

2. 政策风险。

中国资本市场的发展受到政府政策的直接影响,政策风险需要投资者密切关注。

3. 市场风险。

股市和期货市场的价格波动较大,投资者需要具备一定的风险承受能力,并制定合理的投资策略。

六、结论中国资本市场在近几年取得了快速发展,吸引了全球投资者的目光。

未来,随着中国经济的持续增长和资本市场的不断改革,中国资本市场的前景仍然广阔。

投资者可以抓住低估值蓝筹股、科技创新企业和新兴产业等投资机会,但需要注意宏观经济风险、政策风险和市场风险。

2004—2005年民营投资形势分析与预测2004年,我国经济取得了令世界瞩目的发展成绩,而民营投资成为我国经济各投资主体中最活跃、增长最快、也最“市场化”的部分。

未来一段时期,民营企业无论是在打造民族产业核心竞争力、促进技术创新、制度创新,还是在参与国企改造、创造新增就业机会等方面,都将继续发挥重要的作用。

一、2004年民营投资基本状况2004年,全国民营投资。

达到27534.1亿元,与2。

03年的19457.9亿元相比增长了41.5%,高于全社会投资25.8%及城镇固定资产投资27.6%的增速,更明显高于国有投资1 2.1%的增速。

民营投资占城镇固定资产投资的比重达47.0%,与2003年相比,提高了约4.5个百分点。

在各种类型的民营投资中,股份制经济(包括股份合作、有限责任公司及股份有限公司)投资19809.5亿元,比上年增长39.1%,占城镇投资总额的比重为33.8%;联营经济投资456.6亿元,比上年增长28.7%,比重为0.8%;私营个体投资6539.6亿元,比上年增长44.7%,比重为11.1%;其它内资728.45亿元,比上年增长110.6%,比重为1.2%。

近两年民营投资的发展主要呈现出以下几个特点:(一)随着宏观调控政策的实施,民营投资从过热状态回落到正常区间2004年5月份以来,政府宏观调控措施的效果逐渐显示出来,过热的全社会固定投资增速开始大幅度回落,逐步进入较正常、平稳的增长区间。

由于投资在我国经济增长中起着主导作用,因此经济增长能否“软着陆”主要就看投资是否能够“软着陆”。

而由于民营投资已占据全社会投资的“半壁江山”,其走势对全社会投资的“起伏”乃至整个国民经济的走势都有着举足轻重的影响,全社会投资能否“软着陆”,又不得不看民营投资能否“软着陆”。

因此,民营经济已成为政府此次宏观调控的重点对象之一,民营投资从过热状态回落到正常增长区间,对于整个宏观调控政策达到预期效果,至关重要。

?2005年投资分析报告自从2001年股指出现较大幅度调整之后,2004年仍然没有能够摆脱震荡整理的箱体运行走势,只不过市场的重心继续有所下移。

由于众多引起股价结构性调整的原因并没有得到根本性的消除,预计2005年股指仍然将维持箱体震荡的运行格局,只不过市场的重心很有可能被继续降低。

一、宏观面的分析。

首先,解决股权分置的问题也就是解决非流通股流通问题是2001年之后股指出现调整的主因。

证监会主席同志近期就公开表示要:在保持市场融资总规模和投资需求相适应的基础上,积极支持业绩优良、具有良好投资价值的蓝筹企业发行上市,逐步优化我国上市公司的规模结构。

积极推动解决股权分置问题,完善有利于健全公司治理的上市公司股权结构。

解决股权分置问题,国务院《若干意见》已经提出了明确的原则,即"尊重市场规律,有利于市场的稳定和发展,切实保护投资者特别是公众投资者的合法权益"。

解决股权分置问题要在这一原则的指导下,积极稳妥地推进。

应该说到目前为止还没有找到合适的解决方法,随着时间的推移解决股权分置的问题也就越来越强烈,这其中有着许多不确定因素将会引起股价继续进行着结构性调整。

而近几年来股价结构性调整所导致的市场运行情况也就是箱体震荡。

其次,虽然QDII到目前为止还没有正式实施,但是有关于社保基金率先获准投资香港市场的消息不绝于耳,看来QDII的正式实施未期也不会特别遥远。

如果QDII一旦实施,由于H股与A.B股之间的巨大价差,对A.B股市场的冲击将是巨大的。

一旦QDII正式推出的话,就会对原本已经脆弱的A股、B股市场造成新的压力,资金抽血在所难免。

目前内地市场谈QDII"色变",很重要的因素在于人们心中有两大疑虑。

其一,目前整体估值偏高的A 股,是否会在QDII引入后出现暴跌;其二,基金、券商、保险公司等境内机构投资者是否有能力应对国际市场的激烈竞争。

QDII 确实可能会在一段时间内对境内股票市场造成冲击,然而这不能成为阻碍最终在国际市场投资的充分理由。

?2005年投资分析报告自从2001年对股票指数进行重大调整以来,2004年的波动趋势一直未能摆脱冲击,但市场的重心仍在继续下降。

由于导致股价结构调整的许多原因尚未得到根本消除,因此,预计2005年的股票指数将继续保持类似盒式的操作模式,但市场的重心可能会继续被降低。

1.宏观分析。

首先,解决股权分置问题,即解决非流通股发行问题,是2001年以后调整股指的主要原因。

中国证监会主席同志最近公开表示:有必要在维持市场融资和投资需求总体规模的基础上,积极支持业绩良好,投资价值好的蓝筹公司的发行和上市,逐步优化我国上市公司的规模结构。

积极推进股权分置解决方案,完善上市公司股权结构,有利于改善公司治理。

为解决股权分置问题,国务院《若干意见》提出了明确的原则,即“尊重市场法,有利于市场的稳定与发展,有效保护投资者的合法权益,特别是公共投资者。

”在这一原则的指导下,必须积极稳定地解决股权分割问题。

应该说,到目前为止没有找到合适的解决方案。

随着时间的流逝,股权分割问题将变得越来越严重。

有许多不确定因素会导致股价继续进行结构调整。

近年来,由股价结构调整引起的市场运作也受到冲击。

其次,尽管到目前为止,QDII尚未正式实施,但总有消息称,社会保障基金是第一个获准投资香港市场的基金。

看来QDII的正式实施不会太遥远。

如果实施QDII,由于H股与A.B股之间的巨大价差,对A.B股市场的影响将是巨大的。

QDII正式启动后,将给本来就脆弱的A股和B股市场带来新的压力,这是不可避免的。

目前,大陆市场谈论QDII“变色”,一个非常重要的因素是人们有两个主要的疑问。

首先,引入QDII后,整体估值较高的A股是否会暴跌?第二,基金,证券公司,保险公司等国内机构投资者是否有能力应对国际市场的激烈竞争。

QDII可能确实会在一段时间内对国内股票市场产生影响,但这并不是阻碍国际市场最终投资的充分理由。

Once again, since the implementation of the tight economic policy in April 2004, it is estimated that there will not be much relaxation in 2005. From December 3 to 5, the Central Economic Work Conference held by the CPC Central Committee and the State Council in Beijing put forward the main tasks for next year's economic work. Among them, the first is "continue to strengthen and improve macro-control to ensure stable and rapid economic development... We must implement prudent fiscal and monetary policies, and continue to control the excessive growth of fixed asset investment." This indicates that the Chinese government has been implementing the proactive fiscal policy for nearly seven years and is about to adjust its orientation. In addition, the 2004 fourth quarter regular meeting of the Monetary Policy Committee of the People's Bank of China held in Beijing believed that since this year, mycountry's national economy has continued to maintain steady and rapid growth. In accordance with the unified deployment of the Party Central Committee and the State Council, the People's Bank of China continues to implement a prudent monetary policy, strengthen and improve financial regulation, rationally control the total amount of money and credit, and strive to optimize the credit structure. Generally speaking, the monetary and credit policy measures adopted have achieved initial results, the growth of money and credit is generally reasonable, and financial operations are stable. The meeting analyzed the current international and domestic economic and financial situations in depth, and believed that it is necessary to fully implement the spirit of the Central Economic Work Conference, use the scientific development concept as the guiding ideology, continue to strengthen and improve financial macro-control, and promote stable and rapid economic development and basic price stability. The meeting studied the monetary policy orientation and measures for the next stage, and believed that prudent monetary policy should continue to be implemented to further improve the forward-looking, scientific and effective financial regulation. Comprehensively use a variety of monetary policy tools to properly regulate the liquidity of the financial system in a timely manner. Steadily promote the reform of interest rate marketization, furtherimprove the RMB exchange rate formation mechanism, maintain the basic stability of the RMB exchange rate at a reasonable and balanced level, and promote the balance of international payments. Actively promote the reform of financial enterprises, encourage financial innovation, improve financial services, vigorously develop the financial market, promote the coordinated development of direct financing and indirect financing, and improve the efficiency of monetary policy transmission. Therefore, as macroeconomic policies continue to be tight, it is difficult for listed companies to obtain a loose development environment, and the increase in profitability is also restricted to a certain extent. Also, expectations for continued interest rate hikes in 2005 are high. The Federal Reserve Board of the United States decided on December 14 to increase the federal funds rate from 2% to 2.25%. This is the fifth consecutive rate hike by the Fed since June this year. The Federal Reserve stated in the interest rate hike statement that monetary policy remains accommodative. Although energy prices have risen this year, output still has moderate growth, and inflation and long-term inflation expectations have also remained unchanged. The Fed said it will continue to raise interest rates "at a pace that may be prudent." "For a period of time in the future, the level of interest rates will continue to rise." In response, Yi Xianrong, director of the FinancialDevelopment Office of the Institute of Finance of the Chinese Academy of Social Sciences, said that using interest rates as a market-based measure to regulate economic overheating is more effective than administrative measures. , The impact on the market is also smaller. In view of the fact that the current macro-control has only achieved initial results, and some prominent contradictions in economic operations have yet to be resolved, interest rate tools may be used as economic trends change. Therefore, the expectation of continuing to raise interest rates is not a good thing for the market. On the contrary, it has a certain effect of pulling away market funds. Finally, after experiencing a substantial increase in the profitability of listed companies from 2003 to 2004, the possibility of continuing to fluctuate sharply in 2005 has been greatly reduced, and many cyclical economic industries will usher in an adjustment after experiencing a peak. The changes will also cause market volatility. Moreover, the continued improvement of the macro economy does not mean that the stock market can reverse. Since its founding at the end of 1990, the Chinese stock market has experienced thirteen cold and hot springs and autumns. The phenomenon of "economic divergence" is not an overnight phenomenon. The divergence of the market since June 2001 is particularly obvious. It should be said that the proactive fiscal policy has led to the rapid economic growth ofgovernment investment, but many listed companies may not be able to directly benefit from it. It is estimated that the current gross national product created by non-state holding enterprises has exceeded 50%, and this proportion is still rising. However, their share in the stock market is still less than 10% of the total stock market value, which means that my country's economic growth is more dependent on government spending and non-state-owned enterprises that have not yet been listed, rather than derived from listed companies. Therefore, the listed companies and the stock market lack sufficient coverage and representativeness relative to the national economy, and it is naturally difficult for the stock market to fully and accurately reflect economic operations. Although the overall stock market has maintained a long-term upward trend. However, the long-term rise does not mean the rise all the time, and it is impossible to complete the bull-bear conversion without adequate adjustment. Of course, investors should also see that the "National Nine Articles" are gradually being implemented, and there are positive aspects of macroeconomic policies. This also destined that the stock index cannot undergo a collapse-like adjustment. On the whole, the macroeconomic outlook next year will not be enough to change the current structural adjustment and operation of the market. Under the influence of many uncertain factors, it will bedifficult for stock indexes to get out of the bear market and embark on a bull road. 2. Technical analysis: First, take the theoretical analysis of the form: the above stock index as an example, the stock index has clearly broken through the large consolidation pattern that began in June 2001, and the stock index has broken through after a continuous shock rebound at the beginning of the year. The connection between the high point of 2245.13 in June 2001 and the high point of 1649.60 on April 16, 2003 has been established. Therefore, the current pattern has got rid of the original pattern. Therefore, the pattern of operation thereafter is no longer possible. If it overlaps with the previous pattern, it can avoid the possibility of a thousand points in the market next year. Of course, from the perspective of recent trends, the stock index has gradually declined since the market reached 1783.00 points on April 7, 2004, and the process of rebounding at the bottom of 1259 points has clearly established a typical convergence. In the triangle pattern, the lower support line position when it is broken downward is approximately 1316 points. According to the triangle theory, the adjustment amount after the downward breakthrough should be the height of the triangle pattern, which is 1496-1259=237 points, then the target of the market adjustment The position should be at 1316-237=1079 points. If the rebound pattern after September looks like a descendingtriangle, then the position of the lower edge of the triangle table is about 1290 points, then the depth of adjustment should be 1496-1290=206 points, and the target position for stock index adjustment is 1290-206= 1084 points. The target for stock index adjustment will be around 1100 points. Secondly, analyze with wave theory: At present, the market is in the process of adjusting the second cyclic wave (the reason why the stock index is in the second cyclic wave adjustment has been analyzed in detail in the previous two years, so I will not repeat it here), and the wave theory points out "The second wave of adjustment often goes out of a zigzag adjustment wave, and the fourth wave is rarely the case." The adjustment from the highest point of 2245.43 on June 14, 2001 is the second cyclic wave (III) II adjustment, and the adjustment process from the highest point of 2245.43 on June 14, 2001 to 1339.20 on January 29, 2002 has The obvious three-wave structure characteristics can be clearly identified from the monthly K line. However, due to the adjustment from the highest point of 2245.43 on June 14, 2001 to 1339.20 on January 29, 2002, neither the time span (only half a year) nor the magnitude of the adjustment are far from the second cycle wave (III) II adjustment requirements, so the adjustment during this period is only a sub-wave of the second cyclic wave adjustment. (III) II W (if it is a 5-wave pattern, it should be abig A wave, but this is a 3-wave pattern and can only constitute a big wave. W wave). It is precisely because the wave theory also tells us: "Sometimes the zigzag will happen twice, or even three times in a row, especially when the first zigzag does not reach the normal goal. In these cases, each The zigzag adjustment wave will be separated by the inserted "three waves", resulting in the so-called double zigzag adjustment wave or triple zigzag adjustment wave. These structures are similar to the prolonged wave of the impulse wave." It can be marked as WXY (-XZ), so The adjustment from the highest point of 2245.43 on June 14, 2001 to 1339.20 on January 29, 2002 is the W wave of the second cyclic wave marked as (III) IIW adjustment. The ABC three-wave rebound from 1339.20 on January 29, 2002 to 1748.89 on June 25, 2002 is the X-wave (III) IIX adjustment inserted after the zigzag adjustment is completed. It has an obvious three-wave structure and a big B Characteristics of waves. According to the trend analysis of the market, after the 6.24 market, the market has completed the W and X big waves, and the next step is the adjustment of the Y big wave, and it will be the new ABC three-wave structure, Y(A) mid-wave will reach January 2003 June 6 is over. From the trend analysis, it has a three-wave structure (also can be seen very clearly from the monthly K-line chart). According to wave theory, “the A of the five-wave structure means that thewave B is a zigzag adjustment wave, and the wave A of the three-wave structure means a platform or a triangle adjustment wave.” Therefore, the big Y wave as a whole is a platform or a triangle adjustment wave. Big Y wave Y(B) Zhonglang is destined to be unable to make a new high. The stock index began to adjust after it hit a new high of 1496 points in the year on April 16, 2003. As a rebound of the nature of the B wave, it is destined to be completely covered by the big Y(C) middle wave, and the stock index also hit 1307 points before ending this round of adjustment. The rebound from the end of last year to April of this year should be said to be another X-wave rebound. This rebound is always considered by many investors to be a bullish marching wave. It will not change their views until the stock index hits a new low. From the perspective of the rebound schedule, it is obvious that there is a combination of 3 to 3, that is, the rebound of oversold stocks, especially technology stocks + the rebound of large-cap blue chip stocks, constituted the first wave of upswing. Of course, it can be divided into 5 waves by force and regarded as a rising wave. The result proves that only the division of 3 to 3 is correct, and the rise of 1 wave is also unreal. And the market is destined to go out of another Z wave adjustment after the rebound of the X wave. And it is a 3-3-3 structure. Corresponding to the current stock index should be in theprocess of Z(A) mid-wave adjustment. From a morphological point of view, there are two ways to understand the adjustment of the Z(A) wave: one is to adjust the small a wave of the Z(A) from 1783 to 1508 points, then the adjustment after the rebound of 1580 points can be done It is adjusted for the small c wave of Z(A) wave. Another way of understanding is to adjust the small a wave belonging to the Z(A) wave from 1783 to 1259. Then the rebound after the 9.14 market can be understood as the small b wave of the Z(A) wave. , The subsequent adjustment is the adjustment of the small c wave. No matter how the wave theory is understood, the current stock index should be in the process of adjustment of the small c wave. From the perspective of the monthly line, the latter way of understanding is more appropriate. After the adjustment of the Z(A) wave, there will be a rebound of the Z(B) wave. This may be the best investment opportunity next year. The adjusted target position can be analyzed with the golden section theory. If the current adjustment of wave Z(A)a ends at 1259, the target position of wave c adjustment in the market outlook should have three results, one is the adjustment range of 0.618 times, and the other The two are equal length and 1.618 times the adjustment range. According to the current operation of the stock index, the possibility of a huge adjustment is not very large. If its adjustment range is 0.618 times ofZ(A)A, that is, (1783-1259)*0.618=324 poi nts, then the market’s The adjustment target should be 1496-324=1172 points. If the market completes the adjustment of wave Z(A)a at 1508, then there is no doubt that the adjustment of wave Z(A)c is a prolonged wave adjustment, and its adjustment range is (1783-1508)*1.618=445 points , The market adjustment target is 1580-445=1135 points. Therefore, the market adjustment target should be around 1150 points. 3. Investment strategy Based on the above analysis, the stock index will continue to show a fluctuating operation trend in 2005, but the market's volatility center will decline. It is expected that valuation will develop in three dimensions: some stocks that perform well and continue to grow but are undervalued by the market return to a reasonable price; some stocks that continue to grow and are currently considered to be reasonably valued are held by institutions for a long time because of the natural growth of performance. Valuations go up again; other stocks that have neither improved nor grown are discarded by the market. The overall valuation level of the market will show the characteristics of volatile operation, and the equilibrium valuation level is determined by the implicit cost of capital in the market. The growth of institutional investors accelerates market differentiation and moves closer to mature markets. The market liquidity structure has undergone significantchanges: the momentum and dynamic development of the market will be more dominated by the stocks of institutional investors; the stocks that are not traded by institutions lose their liquidity, and the phenomenon of "bad money driving out good money" in stock trading Fading out gradually. It is important to note that before the bull market has begun, a bear market investment strategy is still needed. In terms of investment opportunities in the stock market, investors should focus on the following aspects: First, make corresponding speculation and investment hype in the process of the Z(B) wave rebound of the stock index. After the stock index dropped at the beginning of the year, the bottom of the first half of the year will be found, especially when the stock index reaches below the set 1150 point, investors should pay attention to the market rebound opportunity. Among them, a batch of oversold Under the requirements of a technical rebound, the low-priced stocks of China will produce an incredible increase of 30-50%. Investors should not give up such speculative opportunities. Of course, in the course of the stock index Z(B) rebound, some products with investment value will also see a larger rise. In addition, after the Z(B) wave rebounds, it is expected that the stock index will rise from 1550 points to 1650 points and there will still be a Z(C) wave drop. At this time, investors should pay attention to rallies to reduce their pounds andwait for Z(C) Completion of wave adjustment. Second, after more than two years of value investment philosophy cultivation, the structural adjustment of the market continues. It is not ruled out that some individual stocks will move out of the trend completely independent of the market. This requires investors to have strong fundamental analysis capabilities and predictive capabilities. Forward-looking. Investors should pay close attention to the following types of companies: 1. Stocks that continued to grow in 2005. Steady growth of consumer products company. In the environment of declining profitability of investment products and steady growth of social consumption, such companies should have higher investment value. In terms of the structure of consumer goods, pay attention to the investment opportunities of rising demand for mass consumer goods in rural consumption; agriculture-related industries, such as urea, potash, agricultural production materials, agricultural enterprises, etc.; can also focus on traditional Chinese medicine, retail, food, wine, tourism, etc. Leading company in the industry. The upstream cost stabilizes or declines, and the downstream demand can maintain stable growth in the manufacturing industry should have better investment value. Among them, the focus is on leading enterprises in the chemical and machinery manufacturing industries. 2. It is a stock whose industryfundamentals and stock prices have suffered a short-term impact, and the long-term contradiction between supply and demand has not improved. Such companies are affected by macro-control or industry cycles in the short-term, and their stock prices are temporarily impacted, but their fundamentals are still in good condition, but the growth of production capacity and profit has not been released for the time being. Once the industry warms up, their advantages will be reflected. . 3. It is a monopoly industry. Since the purpose of macro-control is more to restore the "endogenity" of economic growth, with the marketization tendency of regulation, there is still room for the price of products in some monopolistic industries, especially regulated sectors, to rise, and relevant monopolistic industries are listed. The company's performance will also be further improved. 4. It is the industry leader. These companies usually have sustained and good capacity growth capabilities, competitive products and market positions, and have strong investment value. 5. It is a stock that is at the bottleneck of the industrial chain. This round of macro-control has had a greater impact on most cyclical industries, and those companies that are at the bottleneck of the industry chain are relatively less affected, and they are good varieties that are resistant to falling. 6. It is a bank stock. The main content of bank reform is to reduce non-performing loan ratio, increase capitaladequacy ratio, introduce overseas strategic investors, and expand capital through listing. Encourage the expansion of capital quotas through listing. According to Su Shumin's prediction, there are also many investment opportunities in these reorganizations involving private enterprises and other social capitals. In particular, these enterprises will be listed in the domestic market after the reorganization, which will greatly improve the structure of the domestic stock market. 7. Actively pay attention to industries that may benefit if the renminbi appreciates, such as aviation, papermaking, non-tradable industries that may increase in asset value and profitability. The third is the upcoming large-cap stocks. Due to the inquiry system adopted for the issuance of new shares, the issue price of the newly issued large-cap blue chip stocks will naturally become more reasonable, and their pricing will definitely be lower than the existing large-cap blue chip varieties in the market. In addition, this batch of newly listed Large-cap blue chip stocks have good qualifications and should be favored by institutional investors. In the medium and long term, they will have the ability to oscillate upward. Therefore, investors will pay close attention to the "aircraft carrier" stocks to be issued in the first half of next year, such as PetroChina, Bank of China, and China Construction Bank. Especially if they release and open the primary market forsubscription, it will be an excellent opportunity for intervention. . On the whole, the stock market will still be in the process of structural adjustment. Poor-performing stocks can only participate in speculative short-term, while large capital and medium- and long-term perspectives should still emphasize value investment.【翻译失败,可能限速延时太小!】。

2005年年度宏观经济分析报告行业投资策略:上下搜索双向防御1.行业业绩回顾从2004年年11自每月市场开始以来,主流基金的行业投资思路大致经历了三个阶段:在第一阶段,整体经济仍处于加速期,早期蓝筹股市场持续,有色金属,采矿,电子和通讯设备等周期性行业表现良好。

第二阶段,4随着宏观调控的推出,加速相关行业的低迷或期望,自行车行业被一一抛弃,防御策略成为主流,这些领域的能源,运输和特殊设备行业具有稳定的表现或可持续的增长能力,一些消费品和制药公司已成为避风港。

第三阶段是9月中之后,市场政策因素成为关注焦点,行业内缺乏连续热点,周期性和防御性公司陷入僵局,缺乏新的投资产品。

市场正在寻找新的方向,这要求我们进一步了解宏观,行业和行业的最新趋势。

2.宏观经济适度减速对于当前的经济,我们认为我们正处于适度减速的轨道上,前三个季度国内生产总值增长率显示逐渐下降。

从历史经验,这种下降是相对温和的。

另外,投资增速经历了1个,2一季度的跌宕起伏,也正在稳定,2,3环比增长率接近历史平均水平。

对于下一阶段的监管,中央经济工作会议提议”适当控制总量,着力调整结构”目标,和双”稳定”财政货币政策,从这个角度来看,稳定将是下一阶段”基调”,在此基础上,我们预计明年可能加息的可能性更大”中性”政策,这是从行政总管制到市场价格调整的过渡,可以通过调整利率来实现”巩固宏观调控成果”目标,选择的时间和范围应避免对经济产生重大影响。

在整体经济放缓的背景下,今年的消费表现更为突出。

今年1-10消费品月度零售额同比增长13.1%,排除价格和非典影响力,应该说,保持了快速增长的势头。

消费升级趋势更加明显,过去两年家庭支出结构的长期变化和新的消费热点的出现,所有这些都充分体现了这一点。

总体,尽管经济呈现减速迹象,但是它仍然处于健康运行的轨道上。

我们相信2005年年国内生产总值增长率将适度回落至8%-8.5%间隔,历史仍然处于更好的水平。

3.行业趋势:失衡将得到缓解从最近的宏数据,我国的整体经济增长正在逐步放缓,主要经济指标正在接近控制目标。

2004—2005年股票市场发展状况与趋势一、2004年股票市场发展现状2004年1月3 1 日,国务院发布了《关于推进资本市场改革开放和稳定发展的若干意见》(简称“国九条”),其内容覆盖了市场投资理念、多层次市场建设、上市公司治理、投资者权益保护、机构投资者队伍建设、股权分置等诸多方面。

在其指导下,证券市场的制度建设和体系建设等都取得了一定进步,市场规模进一步扩大,上市公司数量、投资者人数、基金数量、保险资金、企业年金、社保资金、QFII机构投资者等都有了很大的发展。

然而,股票价格走势在短暂冲高后便持续下滑,股价结构继续保持调整趋势。

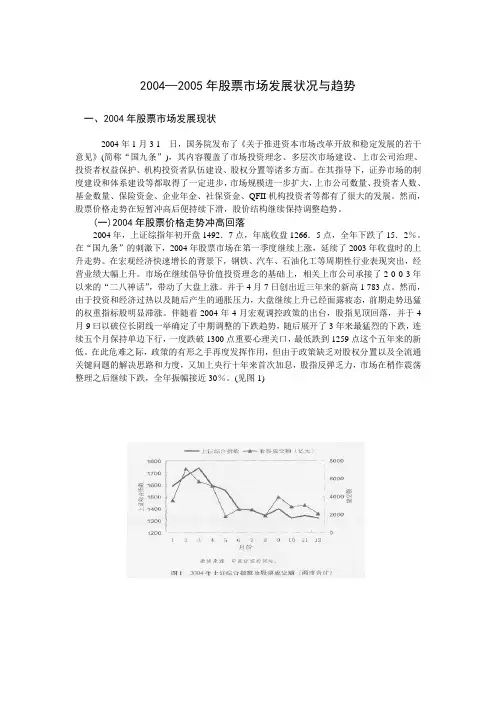

(一)2004年股票价格走势冲高回落2004年,上证综指年初开盘1492.7点,年底收盘1266.5点,全年下跌了15.2%。

在“国九条”的刺激下,2004年股票市场在第一季度继续上涨,延续了2003年收盘时的上升走势。

在宏观经济快速增长的背景下,钢铁、汽车、石油化工等周期性行业表现突出,经营业绩大幅上升。

市场在继续倡导价值投资理念的基础上,相关上市公司承接了2 0 0 3年以来的“二八神话”,带动了大盘上涨。

并于4月7日创出近三年来的新高1 783点。

然而,由于投资和经济过热以及随后产生的通胀压力,大盘继续上升已经面露疲态,前期走势迅猛的权重指标股明显滞涨。

伴随着2004年4月宏观调控政策的出台,股指见顶回落,并于4月9曰以破位长阴线一举确定了中期调整的下跌趋势,随后展开了3年来最猛烈的下跌,连续五个月保持单边下行,一度跌破1300点重要心理关口,最低跌到1259点这个五年来的新低。

在此危难之际,政策的有形之手再度发挥作用,但由于政策缺乏对股权分置以及全流通关键问题的解决思路和力度,又加上央行十年来首次加息,股指反弹乏力,市场在稍作震荡整理之后继续下跌,全年振幅接近30%。

(见图1)与股指走势相似,股票市场月成交额提前于2004年2月见顶,之后迅速萎缩,但是全年总成交额比上年有所增长。

2005年中国资本市场展望作者:华生来源:《新财经》2005年第01期2004年的中国股市已经降下帷幕。

自从2001年股市高峰时发表“漫漫熊市的信号”一文后,每年年初的资本市场展望,我总是令人扫兴地说市场的价值中心还会下移。

那么,熊市到底能在什么时候见到头?在近四年的熊市之后,今天我们第一次可以说,2005年是熊市以来首次可能出现的拐点。

2005年熊市可能终结首先是政治需要。

中国股市到今天的问题,已经不仅是广大投资者损失惨重,长期、普遍地赔钱,不仅是由于资本市场滞后,造成了银行间接金融畸形发展,加大了国家的金融风险,而且由于股市的几千万及其关联的中国社会中几亿积极人口的消极埋怨情绪和无端发泄,已经关系到政治和社会的稳定,直接威胁到和谐社会的建设。

2005年熊市可能终结其次是经济原因。

投资者固然损失惨重,不仅几乎所有的庄家都轰然倒地,中小投资者更是普遍损失过半;中介机构如券商大多实际上已经破产,要靠国家注资才能避免客户挤兑和社会恐慌;政府监管者疲于奔命,扶了东墙,倒了西墙,还备受责难;生态环境被破坏了,股市本来惟一的受益人融资者也每况愈下,股市融资额不断萎缩。

脆弱和草木皆兵的市场根本不可能承受扩大直接金融、分散金融风险和支持国民经济高速增长的重负。

证券市场各方参与者在经济利益上的多输,是求新求变的基础。

2005年熊市可能终结最后是思想认识上的共鸣。

股权分裂这个中国股市的最大国情从最初提出来无人理睬和问津,到国有股减持时的激烈争论,再到后来的全流通大讨论,多数人形成一定共识,直到今天在穷尽了包括分类表决制等所有治标不治本的办法都不奏效之后,人们的认识才算真正多少一致,股权分裂或分置这个中国股市制度构造的根本缺陷才可望在2005年真正开始得到纠正和突破。

所有这些因素,都几年来第一次决定了熊市不能或不会再继续。

但是,熊市不能继续,还不等于牛市就会到来。

影响股市出现拐点和牛市到来的也有几个大因素。

首先,管理层对当前股市总体状况的判断还存在很大偏差。

中国管理咨询市场发展年度研究报告(全文)第一部分:中国管理咨询业的现状分析2004年,中国的管理咨询业又增长了一年。

与去年一样,“发展”仍然是2004年咨询市场的主题。

但是在发展之后,管理咨询行业需要加快专业化的步伐。

本节从四个角度探讨了中国管理咨询业在2004年的发展,并从区域分布,服务业,业务类型和咨询公司类型等方面分析了管理咨询业的特征。

第一章:中国管理咨询业市场发展现状第一节2004年中国管理咨询业市场发展概况1. 2004年管理咨询行业市场覆盖率在2003年的基础上,管理咨询行业的客户数量和市场渗透率在2003年的基础上显着提高。

当年有30.7%的公司购买了管理咨询服务。

与2003年相比,管理咨询行业的客户比例增加了3.9%。

截至2004年底,有50.9%的上市公司获得了管理咨询服务。

经过十多年的发展,中国的管理咨询业已初具规模。

由于以下三个原因,管理咨询行业可以拥有超过50%的客户群:1.市场需求在激烈的市场竞争中,商业运营商想要带领公司进入一个复杂多变的市场时,往往会蒙受损失。

许多公司遭受严重损失,效率低下,这是一个明证。

让管理咨询公司充当高级参与者,并作为市场运作的“外部大脑”。

2.管理咨询业为企业转型,重组和兼并提供指导市场不断推论有关公司转型,重组和合并活动的新闻。

对于企业家而言,如何计算和分析风险成本必须依靠管理咨询行业的指导,这可以事半功倍。

企业必须更有效地吸收新知识,学会制定更合理的策略并采取更明确的行动,能够灵活地应对市场变化,体谅而不是优柔寡断。

其中,管理咨询是必不可少的角色。

3.管理咨询业促进企业不断追求最高效率管理咨询是生产力,它可以产生收益。

管理咨询公司利用自己的智慧获得报酬。

在此管理咨询活动中,咨询公司必须为客户着想,考虑客户的想法,为客户着急,服务第一,并找到寻找公司发展的方法问题,提供解决方案并努力取得成果。

这是管理咨询成为一个行业,生存和发展的先决条件。

在稳健型宏观调控政策作用下,2004年中国经济实现了稳定快速增长的目标,国内生产总值预计增长9.1%,投资过快增长的趋势得到了较明显的遏制,通货膨胀明显上升但仍处于可调控、可承受的范围,消费增长稳中趋升,外贸出口大幅增长。

总的看来,2004年宏观经济运行是“有惊无险”,经济避免了一次因投资过热及经济变量间存在严重的不均衡增长而可能引起的“大起大落”。

展望2005年,在“双稳健”的政策作用下,经济增长将继续有所回落,达到8-8.5%,投资和出口双双将出现明显回落,但仍然保持较快增长水平,消费增长将继续保持平稳快速增长态势。

一、2004年宏观经济回顾(一)2004年宏观经济面临两大不稳定、不健康问题一是重化工业继续加速增长且出现明显的过热现象,影响经济的平稳协调增长。

2002年中期以来,工业增长明显提速,进入到一个新的加速增长轨道,其主要推动力是重化工业的加速增长,中国工业发展?M入到“内生性”的重化工业化新阶段(这明显区别于改革前以国家主导的重工业优先战略时的重工业增长)。

重工业增加值增长率由前期的10-13%上升到最近两年多来的18%左右的高水平(见图1)。

一批像汽车、电力、钢铁、化工等重化工业进入高增长阶段,成为推动产业升级的主要力量。

2004年上半年,重工业增长连创新高,重工业增加值月度增长率在2-4月份连续3个月超过20%,1-6月累计增长达19.7%;且上半年重工业对规模以上工业增加值增长的贡献率达76.1%,比上年的75.3%又提高了0.6个百分点。

重工业快速扩张导致相关的能源供给和运输均出现了高度紧张,说明重工业开始出现过热现象,特别是钢铁、有色金属和建材等与房地产相关性强的重型工业投资增长过猛、产出增长过快。

一些重化工业产能的过度扩张(其中不少产品技术含量低、生产的能耗高、污染大),对资源供给和环境保护及经济的协调发展产生巨大的压力。

二是内需的两个方面即消费与投资增长呈现严重的不平衡增长态势,而且投资结构和需求结构也存在相当大的扭曲问题。

2005年中国资本市场十大困惑2004-12-22 10:46:59 中国经济时报网站猴年象征机智。

2004年,随着《国九条》的推出,中国资本市场变革已经有了系统的方法。

鸡年象征勇敢。

2005年,资本市场是否会在《国九条》的指引下勇往直前,“闻鸡起舞”?2005年1月1日,IPO询价制正式开始施行,暂停四个月之久的新股发行恢复。

2005年1月1日,《上市公司非流通股股份转让业务办理规则》正式开始实施。

2005年1月1日,券商开始真正实施分户管理。

2005年是中国加入WTO过渡期的最后阶段。

“分类表决”第一例也将在2005年出现。

……这是一个重要的起点。

如果说2004年是中国资本市场一个重要里程碑,那么2005年毫无疑问将成为中国资本市场由熊转牛,由变革到发展的分水岭。

2005年是改革年,工作的着力点将是推进各项改革。

在《国九条》为资本市场变革的路径、方案作出选择后,在各项后续政策为资本市场变革作出更多铺垫之后,明年的政策重点将在于进一步的细化以及实施。

南方网讯投资者把《国务院关于推进资本市场改革开放和稳定发展的若干意见》当作阳光雨露,对之充满期待。

然而,人们并没有在2004年盼到资本市场的春天。

冬天来了,春天还会远吗?岁末之际,无论是央行还是国资委,无论是交易所还是证监会,都又有很多重大的政策出台。

2004年对中国资本市场变革的种种探索,为2005年留下种种悬念和猜想。

十大困惑之一:股市体制改革路在何方?关于国内股市体制弊端的讨论由来已久。

著名经济学家吴敬琏一针见血的把它概括为“政府托市,企业圈钱”。

《国九条》明确指出,推进资本市场改革开放和稳定发展遵循“公开、公平、公正”原则和“法制、监管、自律、规范”的方针,坚持依法治市,坚持市场化取向,充分发挥市场机制的作用,建设透明高效、结构合理、机制健全、功能完善、运行安全的资本市场。

应该说,今年以来管理层在股市体制改革方面作了一些有益的探索。

尤其是在股票发审制度方面,管理层力推了保荐制,并在年底之前推出了询价制。