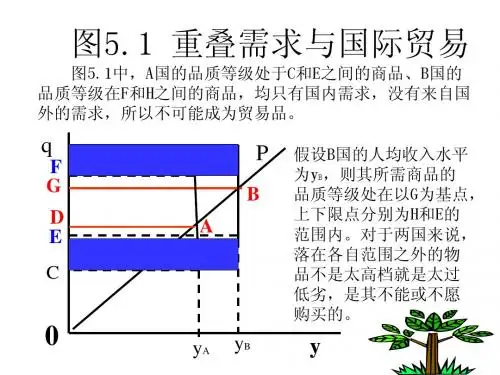

国际经济学(第10版)第五章

- 格式:ppt

- 大小:294.50 KB

- 文档页数:34

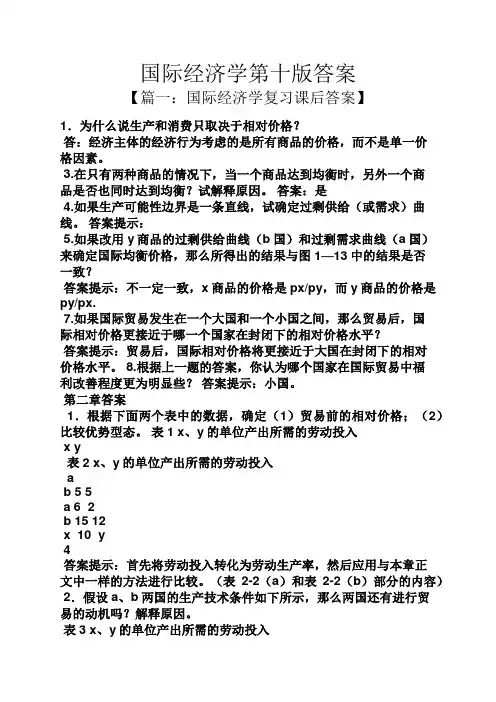

国际经济学第十版答案【篇一:国际经济学复习课后答案】1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案:是4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用y商品的过剩供给曲线(b国)和过剩需求曲线(a国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是px/py,而y商品的价格是py/px.7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 x、y的单位产出所需的劳动投入x y表2 x、y的单位产出所需的劳动投入ab 5 5a 6 2b 15 12x 10 y4答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容) 2.假设a、b两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 x、y的单位产出所需的劳动投入x ya 4 2b 8 4答案提示:从绝对优势来看,两国当中a国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗?答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5.假设某一国家拥有20,000万单位的劳动,x、y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

《国际经济学》(第10版)保罗·R·克鲁格曼重点笔记第三章劳动生产率与比较优势:李嘉图模型1.机会成本:利用一定资源或时间生产一种商品时,而失去的利用这些资源生产其他最佳替代品的机会。

2.比较优势:如果一个国家在本国生产一种产品的机会成本(用其他产品来衡量)低于在其他国家生产该种产品的机会成本,则这个国家在生产该种产品上就具有比较优势。

比较优势和国际贸易的基本原理:如果每个国家都出口本国具有比较优势的商品,则两国之间的贸易能使两国都受益。

英国经济学家大卫·李嘉图提出的国际贸易模型。

他指出,国际劳动生产率的不同是国际贸易的唯一决定因素。

该理论被称为李嘉图模型。

3.单一要素经济单位产品劳动投入(a L):生产率的倒数,用来表示劳动生产率。

生产可能性边界(PPF):一个国家的资源是有限的,它所能生产的产品也是有限的,因此就存在着产品替代的问题:多生产一种产品就意味着要牺牲另一种产品的产量。

一个经济体的生产可能性边界(PPF)显示了其固定数量资源所能生产的商品的最大数量。

本国资源对产出的限制:a LC Q C + a LW Q W≤ L(斜率的绝对值等于横轴商品的机会成本)Q W = L/a LW– (a LC /a LW )Q C,k= - a LC /a LW =奶酪的机会成本相对价格与供给简化模型中,劳动是唯一的生产要素,奶酪和葡萄酒的供给是由劳动力的流向决定的,而劳动力总会流向工资比较高的部门。

单一要素模型中不存在利润,奶酪部门每小时的工资率等于一个工人在1小时内创造的价值P C/a LC,葡萄酒部门每小时的工资率等于P W/a LW。

当P C /P W > a LC /a LW时,奶酪部门的工资率就比较高,该国会专业化生产奶酪;当P C /P W < a LC /a LW时,葡萄酒部门的工资率就比较高,该国会专业化生产葡萄酒;当P C /P W = a LC /a LW 时,该国会生产奶酪和葡萄酒两种产品。

国际经济学第十版答案【篇一:国际经济学复习课后答案】1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案:是4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用y商品的过剩供给曲线(b国)和过剩需求曲线(a国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是px/py,而y商品的价格是py/px.7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 x、y的单位产出所需的劳动投入x y表2 x、y的单位产出所需的劳动投入ab 5 5a 6 2b 15 12x 10 y4答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容) 2.假设a、b两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 x、y的单位产出所需的劳动投入x ya 4 2b 8 4答案提示:从绝对优势来看,两国当中a国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗?答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5.假设某一国家拥有20,000万单位的劳动,x、y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

国际经济学(第五章)提取自陈爱贞老师的课件BY Clark•第五章标准贸易模型•章节结构•引言•开放经济的标准贸易模型•经济增长: RS曲线的移动•国际收入转移:RD曲线的移动•关税和出口补贴:RS和RD同时移动•总结•提供曲线•本章简介•前几章的贸易理论强调了比较优势的资源禀赋–劳动生产率差异(李嘉图模型)–资源禀赋差异(特定要素模型与赫克歇尔-俄林模型)•上述模型具有以下共同特征:–社会的生产能力可以用生产可能性边界来表示,生产可能性边界的不同导致了贸易的产生。

–生产可能性边界确定了一个国家的相对供给曲线。

–世界相对需求和(位于各国相对供给曲线之间的)世界相对供给曲线确定了世界的均衡点。

•上述模型是标准贸易模型的特例•两国封闭经济的一般均衡•两国的开放经济和国际贸易•开放经济的标准模型•标准贸易模型建立在四个重要关系的基础之上–生产可能性边界和相对供给曲线–相对价格和相对需求–世界相对供给和世界相对需求–贸易条件和国家福利生产可能性边界和相对供给曲线–模型假设:•每个国家生产两种产品:粮食(F)和棉布(C)•每个国家的生产可能性边界是一条光滑的曲线(TT)–生产可能性边界上的点代表社会实际产出的产品组合,它取决于棉布相对于粮食的价格PC/PF.–等价值线•同一条等价值线的市场产出价值相等且不变图5-1 :产品相对价格决定社会产出图5-2: 棉布的相对价格上升如何影响相对供给相对价格和相对需求–社会消费的价值等于社会生产的价值PCQC + PFQF = PCDC + PFDF = V–同一条等价值曲线上消费点的选择取决于社会的消费倾向,可以用一系列无差异曲线表示社会的消费倾向.–无差异曲线•无差异曲线是在同一消费效用水平上棉布(C)和粮食(F) 的消费组合轨迹•无差异曲线有三个特点:–向下倾斜–位置离原点越远,所对应的福利水平越高–曲线越往右越平坦图5-3:标准模型中的生产、消费和贸易–棉布的相对价格PC/PF升高,社会的消费选择将从D1 移到D2•从D1 移到D2反映了两种效应:–收入效应–替代效应•收入效应的影响可能非常大,以至于当PC/PF增加时两种产品的实际消费量都增加,而棉布相对于粮食的消费量却会下降.图5-4 棉布相对价格上升产生的影响贸易条件改变对福利的影响–贸易条件•贸易条件为一国出口产品的价格除以进口产品的价格•一国的福利水平随着贸易条件的改善而上升,随着贸易条件的恶化而下降•确定相对价格–假定世界由两个国家组成:•本国(出口棉布)–贸易条件为PC/PF–棉布和粮食的生产量为QC 和QF•外国(出口粮食)–贸易条件为PF /PC–棉布和粮食的生产量为Q*C和Q*F–为确定PC/PF,必须找到棉布的世界相对供给和相对需求的交点•世界相对供给曲线(RS)是一条向上倾斜的曲线,因为PC/PF上升将使各国都增加棉布的生产,减少粮食的生产。

国际经济学(第十版)多米尼克.萨尔瓦多(著)P16页练习题6.(1)根据消费者需求理论,当其他条件不变时,一种商品价格的提高(如由于税率的上浮所致),会带来需求量的什么变化?答:根据消费者需求理论,当其他条件不变时,一种商品价格的提高,则该商品的需求量将会下降。

(2)根据消费者需求理论,一种进口商品价格的提高(如由于进口关税的上浮所致),会带来需求量的什么变化?答:根据消费者需求理论,一种进口商品价格的提高,则该商品的出口量将会下降。

7.(1)一国政府如何能消除或减少预算赤字?答:一国政府可以通过减少政府支出、增加税收,来消除或者减少预算赤字。

(2)一个国家如何能消除或减少贸易逆差?答:一个国家要消除或减少其贸易逆差的方式有:对进口商品增税、补贴出口,借如更多的国外债券、减少借出外国债券,降低该国的国民收入水平。

8.(1)国际经济关系与地区经济关系有何区别?答:在国际经济关系下,国家通常限制在国际间的自由流动的货物、服务和因素,不同的语言、消费习惯和法律规定同样也阻碍了它们在国际间的流动,此外,国际收支会在各种货币收据和付款中流通。

而在地区经济关系下,就关税和进行相同的货币而言,区际流动的货物、服务和因素没有面临这样的限制因素,它们经常是在同样的语言环境下,在类似的消费习惯和法律规定下进行的,这就与国际经济关系形成了鲜明对比。

(2)它们在哪方面相似?答:国际经济关系和地区经济关系的相似点:两者都跨越了空间距离,事实上,它们都是在远距离贸易下的产物,把经济看待成在一个进行着生产、交换和消费的空间中的单一点,这也是从经济学的复位空间将它们区分。

10.如果说一个国家可以从国际贸易中获益,那么你如何解释为什么许多国家又要对国际贸易施加某些限制?答:国际贸易给本国消费者带来的是更低的价格,这样就会对本国的同种商品的生产商造成不利,挤兑了本国生产商的销售份额。

通常在这种情况下,本国的生产商就会失去大量的订单,并且向政府提议限制进口。