固定收益证券第一章(英文教学)

- 格式:pdf

- 大小:508.22 KB

- 文档页数:12

固定收益证券课程教学大纲《固定收益证券》课程教学大纲一、课程名称:固定收益证券 Fixed Income Securities 二、课程编码:0200791三、学时与学分:32/2四、先修课程:财务管理五、课程教学目标1、帮助学生掌握固定收益证券基本内容,包括:固定收益证券的计价习惯,零息债券,附息债券,债券持续期、凸性和时间效应,利率期限结构模型,债券定价等;2、引导学生理解并掌握固定收益证券行业中的重要术语;掌握分析利率变化和评估固定收益证券及其衍生品价值的工具;学会管理固定收益证券的利率风险;3、使学生了解固定收益证券的现状和发展,深入研究固定收益证券分析,以深刻的掌握固定收益证券定价方法及使用。

六、适用学科专业金融工程七、基本教学内容与学时安排第一部分金钱的时间价值(2学时)第二章未来价值第三章现时价值第四章收益率(内部收益率)第二部分无期权债的定价和收益率测度(6学时)第五章债券的价格第六章债券的传统收益率侧度第七章收益曲线、即期利率曲线和远期利率第三部分投资收益分析(4学时)第八章潜在的美元收益来源第九章总收益率第十章测量历史业绩第四部分无期债券的价格波动率(8学时)第十一章无期债券的价格波动率特性第十二章价格波动率测度:PVBP和价格变化的YV第十三章价格波动率测度:久期第十四章价格波动率测度:凸性第十五章久期与收益曲线第五部分分析含内嵌期权的债券(6学时)第十六章买权:投资特征和价格特征第十七章含内嵌期权的债券的定价和价格波动率第六部分(略) 第七部分统计和优化技术(4学时)概率理论第二十一章第二十二章模拟第二十三章回归分析第二十四章优化模型八、教材及参考书弗兰克. J. 法博齐 (美) 著,俞卓菁译,固定收益数学:分析与统计技术,上海人民出版社,2005。

九、考核方式书面考试、作业。

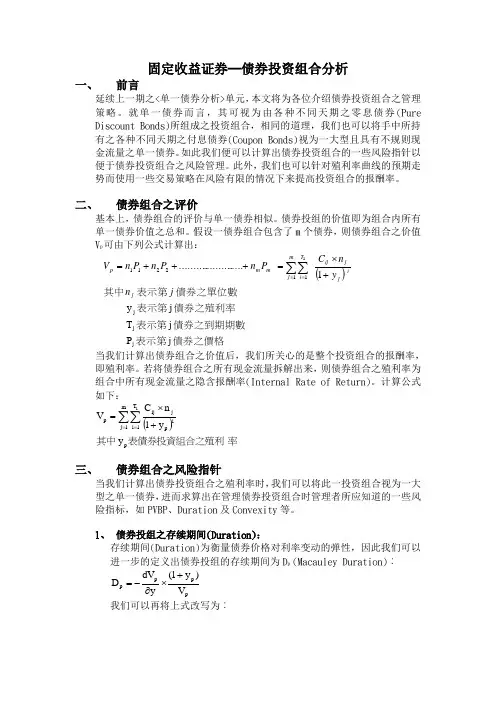

固定收益证券─债券投资组合分析一、 前言延续上一期之<单一债券分析>单元,本文将为各位介绍债券投资组合之管理策略。

就单一债券而言,其可视为由各种不同天期之零息债券(Pure Discount Bonds)所组成之投资组合,相同的道理,我们也可以将手中所持有之各种不同天期之付息债券(Coupon Bonds)视为一大型且具有不规则现金流量之单一债券。

如此我们便可以计算出债券投资组合的一些风险指针以便于债券投资组合之风险管理。

此外,我们也可以针对殖利率曲线的预期走势而使用一些交易策略在风险有限的情况下来提高投资组合的报酬率。

二、 债券组合之评价基本上,债券组合的评价与单一债券相似。

债券投组的价值即为组合内所有单一债券价值之总和。

假设一债券组合包含了m 个债券,则债券组合之价值V p 可由下列公式计算出:()債券之價格表示第債券之到期期數表示第債券之殖利率表示第債券之單位數表示第其中 j P j T j y 1 ......................... j j j 11 22111j n y n C P n P n P n V j m j T i ij jij m m p ∑∑==+⨯=+++=当我们计算出债券组合之价值后,我们所关心的是整个投资组合的报酬率,即殖利率。

若将债券组合之所有现金流量拆解出来,则债券组合之殖利率为组合中所有现金流量之隐含报酬率(Internal Rate of Return)。

计算公式如下:()率表債券投資組合之殖利其中p m 1j T 1i ip jij p y y 1n C V 1∑∑==+⨯=三、 债券组合之风险指针当我们计算出债券投资组合之殖利率时,我们可以将此一投资组合视为一大型之单一债券,进而求算出在管理债券投资组合时管理者所应知道的一些风险指标,如PVBP 、Duration 及Convexity 等。

1、 债券投组之存续期间(Duration):存续期间(Duration)为衡量债券价格对利率变动的弹性,因此我们可以进一步的定义出债券投组的存续期间为D p (Macauley Duration)︰pp p p V )y 1(y dV D +⨯∂-=我们可以再将上式改写为︰[]()Duration Macauley y j D j x D x ..........................D x D x P )y 1(y P V P n ...........P )y 1(y P V P n P )y 1(y P V P n y P n ..............y P n y P n V )y 1(D p j j m m 2211m p m p m m 2p 2P 221p 1p 11m m2211p p p 計算之以投組之殖利率債券的存續期間表示第的比重債券在投資組合中所佔表示第其中+++=⎥⎥⎦⎤⎢⎢⎣⎡+∂∂--+∂∂-+∂∂-=⎥⎦⎤⎢⎣⎡∂∂⨯++∂∂⨯+∂∂⨯+-=若再根据Dollar Duration = Macauley Duration * P / (1+y p ) 的定义,则我们可得知投资组合之Dollar Duration 为组合中各单一债的Dollar Duration 之加权平均值。