公司理财精要版原书第12版英文版最新精品课件Ross_12e_PPT_Ch11

- 格式:pptx

- 大小:296.36 KB

- 文档页数:28

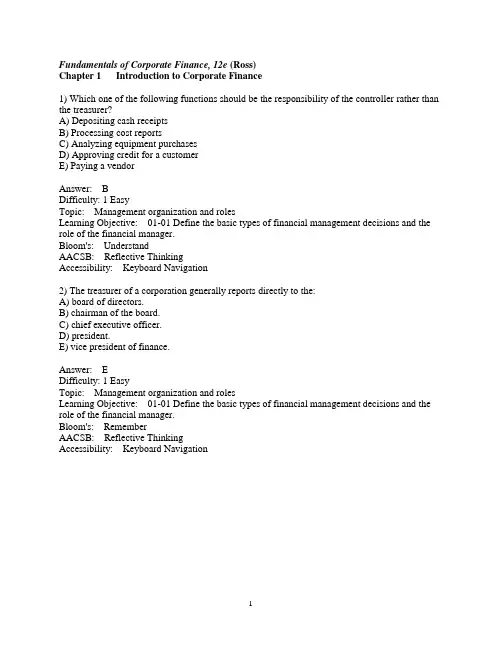

Fundamentals of Corporate Finance, 12e (Ross)Chapter 1 Introduction to Corporate Finance1) Which one of the following functions should be the responsibility of the controller rather than the treasurer?A) Depositing cash receiptsB) Processing cost reportsC) Analyzing equipment purchasesD) Approving credit for a customerE) Paying a vendorAnswer: BDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation2) The treasurer of a corporation generally reports directly to the:A) board of directors.B) chairman of the board.C) chief executive officer.D) president.E) vice president of finance.Answer: EDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation3) Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A) The vice president of finance reports to the chairman of the board.B) The chief executive officer reports to the president.C) The controller reports to the chief financial officer.D) The treasurer reports to the president.E) The chief operations officer reports to the vice president of production.Answer: CDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation4) An example of a capital budgeting decision is deciding:A) how many shares of stock to issue.B) whether or not to purchase a new machine for the production line.C) how to refinance a debt issue that is maturing.D) how much inventory to keep on hand.E) how much money should be kept in the checking account.Answer: BDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation5) When evaluating the timing of a project's projected cash flows, a financial manager is analyzing:A) the amount of each expected cash flow.B) only the start-up costs that are expected to require cash resources.C) only the date of the final cash flow related to the project.D) the amount by which cash receipts are expected to exceed cash outflows.E) when each cash flow is expected to occur.Answer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation6) Capital structure decisions include determining:A) which one of two projects to accept.B) how to allocate investment funds to multiple projects.C) the amount of funds needed to finance customer purchases of a new product.D) how much debt should be assumed to fund a project.E) how much inventory will be needed to support a project.Answer: DDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation7) The decision to issue additional shares of stock is an example of:A) working capital management.B) a net working capital decision.C) capital budgeting.D) a controller's duties.E) a capital structure decision.Answer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation8) Which one of the following questions is a working capital management decision?A) Should the company issue new shares of stock or borrow money?B) Should the company update or replace its older equipment?C) How much inventory should be on hand for immediate sale?D) Should the company close one of its current stores?E) How much should the company borrow to buy a new building?Answer: CDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation9) Which one of the following is a working capital management decision?A) What type(s) of equipment is (are) needed to complete a current project?B) Should the firm pay cash for a purchase or use the credit offered by the supplier?C) What amount of long-term debt is required to complete a project?D) How many shares of stock should the firm issue to fund an acquisition?E) Should a project should be accepted?Answer: BDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation10) Working capital management decisions include determining:A) the minimum level of cash to be kept in a checking account.B) the best method of producing a product.C) the number of employees needed to work during a particular shift.D) when to replace obsolete equipment.E) if a competitor should be acquired.Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation11) Which one of the following terms is defined as the management of a firm's long-term investments?A) Working capital managementB) Financial allocationC) Agency cost analysisD) Capital budgetingE) Capital structureAnswer: DDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation12) Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A) Working capital managementB) Cash managementC) Cost analysisD) Capital budgetingE) Capital structureAnswer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation13) A firm's short-term assets and its short-term liabilities are referred to as the firm's:A) working capital.B) debt.C) investment capital.D) net capital.E) capital structure.Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation14) Which one of the following questions is least likely to be addressed by financial managers?A) How should a product be marketed?B) Should customers be given 30 or 45 days to pay for their credit purchases?C) Should the firm borrow more money?D) Should the firm acquire new equipment?E) How much cash should the firm keep on hand?Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation15) A business owned by a solitary individual who has unlimited liability for the firm's debt is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation16) A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation17) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A) general partner.B) sole proprietor.C) limited partner.D) corporate shareholder.E) zero partner.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation18) A business created as a distinct legal entity and treated as a legal "person" is called a(n):A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) unlimited liability company.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation19) Which one of the following statements concerning a sole proprietorship is correct?A) A sole proprietorship is designed to protect the personal assets of the owner.B) The profits of a sole proprietorship are subject to double taxation.C) The owner of a sole proprietorship is personally responsible for all of the company's debts.D) There are very few sole proprietorships remaining in the U.S. today.E) A sole proprietorship is structured the same as a limited liability company.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation20) Which one of the following statements concerning a sole proprietorship is correct?A) The life of a sole proprietorship is limited.B) A sole proprietor can generally raise large sums of capital quite easily.C) Transferring ownership of a sole proprietorship is easier than transferring ownership of a corporation.D) A sole proprietorship is taxed the same as a C corporation.E) A sole proprietorship is the most regulated form of organization.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation21) Which of the following individuals have unlimited liability for a firm's debts based on their ownership interest?A) Only general partnersB) Only sole proprietorsC) All stockholdersD) Both limited and general partnersE) Both general partners and sole proprietorsAnswer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation22) The primary advantage of being a limited partner is:A) the receipt of tax-free income.B) the partner's active participation in the firm's activities.C) the lack of any potential financial loss.D) the daily control over the business affairs of the partnership.E) the partner's maximum loss is limited to their capital investment.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation23) A general partner:A) is personally responsible for all partnership debts.B) has no say over a firm's daily operations.C) faces double taxation whereas a limited partner does not.D) has a maximum loss equal to his or her equity investment.E) receives a salary in lieu of a portion of the profits.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation24) A limited partnership:A) has an unlimited life.B) can opt to be taxed as a corporation.C) terminates at the death of any one limited partner.D) has at least one partner who has unlimited liability for all of the partnership's debts.E) consists solely of limited partners.Answer: DDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation25) A partnership with four general partners:A) distributes profits based on percentage of ownership.B) has an unlimited partnership life.C) limits the active involvement in the firm to a single partner.D) limits each partner's personal liability to 25 percent of the partnership's total debt.E) must distribute 25 percent of the profits to each partner.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation26) One disadvantage of the corporate form of business ownership is the:A) limited liability of its shareholders for the firm's debts.B) double taxation of distributed profits.C) firm's greater ability to raise capital than other forms of ownership.D) firm's potential for an unlimited life.E) firm's ability to issue additional shares of stock.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation27) Which one of the following statements is correct?A) The majority of firms in the U.S. are structured as corporations.B) Corporate profits are taxable income to the shareholders when earned.C) Corporations can have an unlimited life.D) Shareholders are protected from all potential losses.E) Shareholders directly elect the corporate president.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation28) Which one of the following statements is correct?A) A general partnership is legally the same as a corporation.B) Income from both sole proprietorships and partnerships that is taxable is treated as individual income.C) Partnerships are the most complicated type of business to form.D) All business organizations have bylaws.E) Only firms organized as sole proprietorships have limited lives.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation29) The articles of incorporation:A) describe the purpose of the firm and set forth the number of shares of stock that can be issued.B) are amended periodically especially prior to corporate elections.C) explain how corporate directors are to be elected and the length of their terms.D) sets forth the procedures by which a firm regulates itself.E) include only the corporation's name and intended life.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation30) Corporate bylaws:A) must be amended should a firm decide to increase the number of shares authorized.B) cannot be amended once adopted.C) define the name by which the firm will operate.D) describe the intended life and purpose of the organization.E) determine how a corporation regulates itself.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation31) A limited liability company:A) can only have a single owner.B) is comprised of limited partners only.C) is taxed similar to a partnership.D) is taxed similar to a C corporation.E) generates totally tax-free income.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation32) Which business form is best suited to raising large amounts of capital?A) Sole proprietorshipB) Limited liability companyC) CorporationD) General partnershipE) Limited partnershipAnswer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation33) A ________ has all the respective rights and privileges of a legal person.A) sole proprietorshipB) general partnershipC) limited partnershipD) corporationE) limited liability companyAnswer: DDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation34) Sam, Alfredo, and Juan want to start a small U.S. business. Juan will fund the venture but wants to limit his liability to his initial investment and has no interest in the daily operations. Sam will contribute his full efforts on a daily basis but has limited funds to invest in the business. Alfredo will be involved as an active consultant and manager and will also contribute funds. Sam and Alfredo are willing to accept liability for the firm's debts as they feel they have nothing to lose by doing so. All three individuals will share in the firm's profits and wish to keep the initial organizational costs of the business to a minimum. Which form of business entity should these individuals adopt?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) General partnershipE) CorporationAnswer: CDifficulty: 2 MediumTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: ApplyAACSB: Knowledge ApplicationAccessibility: Keyboard Navigation35) Sally and Alicia are equal general partners in a business. They are content with their current management and tax situation but are uncomfortable with their unlimited liability. Which form of business entity should they consider as a replacement to their current arrangement assuming they wish to remain the only two owners of the business?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) Limited liability companyE) CorporationAnswer: DDifficulty: 2 MediumTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: ApplyAACSB: Knowledge ApplicationAccessibility: Keyboard Navigation36) The growth of both sole proprietorships and partnerships is frequently limited by the firm's:A) double taxation.B) bylaws.C) inability to raise cash.D) limited liability.E) agency problems.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation37) Corporate dividends are:A) tax-free because the income is taxed at the personal level when earned by the firm.B) tax-free because they are distributions of aftertax income.C) tax-free since the corporation pays tax on that income when it is earned.D) taxed at both the corporate and the personal level when the dividends are paid to shareholders.E) taxable income of the recipient even though that income was previously taxed.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation38) Financial managers should primarily focus on the interests of:A) stakeholders.B) the vice president of finance.C) their immediate supervisor.D) shareholders.E) the board of directors.Answer: DDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation39) Which one of the following best states the primary goal of financial management?A) Maximize current dividends per shareB) Maximize the current value per shareC) Increase cash flow and avoid financial distressD) Minimize operational costs while maximizing firm efficiencyE) Maintain steady growth while increasing current profitsAnswer: BDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation40) Which one of the following best illustrates that the management of a firm is adhering to thegoal of financial management?A) An increase in the amount of the quarterly dividendB) A decrease in the per unit production costsC) An increase in the number of shares outstandingD) A decrease in the net working capitalE) An increase in the market value per shareAnswer: EDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation41) Financial managers should strive to maximize the current value per share of the existing stock to:A) guarantee the company will grow in size at the maximum possible rate.B) increase employee salaries.C) best represent the interests of the current shareholders.D) increase the current dividends per share.E) provide managers with shares of stock as part of their compensation.Answer: CDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation42) Decisions made by financial managers should primarily focus on increasing the:A) size of the firm.B) growth rate of the firm.C) gross profit per unit produced.D) market value per share of outstanding stock.E) total sales.Answer: DDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation43) The Sarbanes-Oxley Act of 2002 is a governmental response to:A) decreasing corporate profits.B) the terrorist attacks on 9/11/2001.C) a weakening economy.D) deregulation of the stock exchanges.E) management greed and abuses.Answer: EDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation44) Which one of the following is an unintended result of the Sarbanes-Oxley Act?A) More detailed and accurate financial reportingB) Increased management awareness of internal controlsC) Corporations delisting from major exchangesD) Increased responsibility for corporate officersE) Identification of internal control weaknessesAnswer: CDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation45) A firm which opts to "go dark" in response to the Sarbanes-Oxley Act:A) must continue to provide audited financial statements to the public.B) must continue to provide a detailed list of internal control deficiencies on an annual basis.C) can provide less information to its shareholders than it did prior to "going dark".D) can continue publicly trading its stock but only on the exchange on which it was previously listed.E) ceases to exist.Answer: CDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation46) The Sarbanes-Oxley Act of 2002 holds a public company's ________ responsible for the accuracy of the company's financial statements.A) managersB) internal auditorsC) external legal counselD) internal legal counselE) Securities and Exchange Commission agentAnswer: ADifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation。

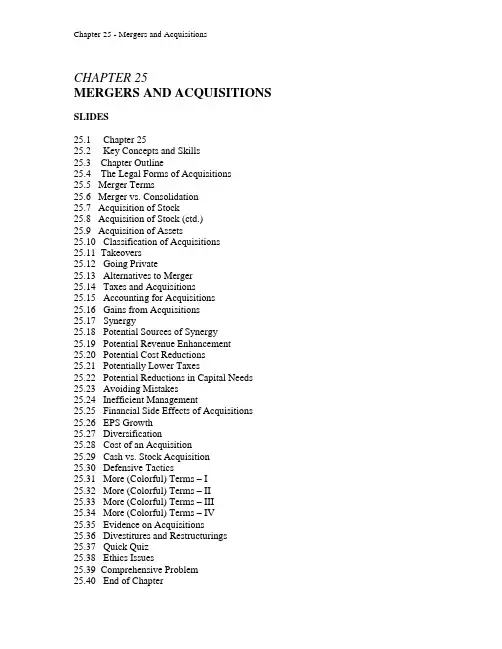

CHAPTER 25MERGERS AND ACQUISITIONS SLIDES25.1 Chapter 2525.2 Key Concepts and Skills25.3 Chapter Outline25.4 The Legal Forms of Acquisitions25.5 Merger Terms25.6 Merger vs. Consolidation25.7 Acquisition of Stock25.8 Acquisition of Stock (ctd.)25.9 Acquisition of Assets25.10 Classification of Acquisitions25.11 Takeovers25.12 Going Private25.13 Alternatives to Merger25.14 Taxes and Acquisitions25.15 Accounting for Acquisitions25.16 Gains from Acquisitions25.17 Synergy25.18 Potential Sources of Synergy25.19 Potential Revenue Enhancement25.20 Potential Cost Reductions25.21 Potentially Lower Taxes25.22 Potential Reductions in Capital Needs 25.23 Avoiding Mistakes25.24 Inefficient Management25.25 Financial Side Effects of Acquisitions 25.26 EPS Growth25.27 Diversification25.28 Cost of an Acquisition25.29 Cash vs. Stock Acquisition25.30 Defensive Tactics25.31 More (Colorful) Terms – I25.32 More (Colorful) Terms – II25.33 More (Colorful) Terms – III25.34 More (Colorful) Terms – IV25.35 Evidence on Acquisitions25.36 Divestitures and Restructurings25.37 Quick Quiz25.38 Ethics Issues25.39 Comprehensive Problem25.40 End of ChapterCHAPTER WEB SITESCHAPTER ORGANIZATION25.1 The Legal Forms of AcquisitionsMerger or ConsolidationAcquisition of StockAcquisition of AssetsAcquisition ClassificationsA Note about TakeoversAlternatives to Merger25.2 Taxes and AcquisitionsDeterminants of Tax StatusTaxable versus Tax-Free Acquisitions 25.3 Accounting for AcquisitionsThe Purchase MethodMore about Goodwill25.4 Gains from AcquisitionsSynergyRevenue EnhancementCost ReductionsLower TaxesReductions in Capital NeedsAvoiding MistakesA Note about Inefficient Management25.5 Some Financial Side Effects of AcquisitionsEPS GrowthDiversification25.6 The Cost of an AcquisitionCase I: Cash AcquisitionCase II: Stock AcquisitionCash versus Common Stock25.7 Defensive TacticsThe Corporate CharterRepurchase and Standstill AgreementsPoison Pills and Share Rights PlansGoing Private and Leveraged BuyoutsOther Devices and Jargon of Corporate Takeovers25.8 Some Evidence on Acquisitions: Does M&A Pay?25.9 Divestitures and Restructurings25.10 Summary and ConclusionsANNOTATED CHAPTER OUTLINEVideo Note: See “Mergers and Acquisition”Slide 1: Chapter 25Slide 2: Key Concepts and SkillsSlide 3: Chapter Outline25.1 The Legal Forms of AcquisitionsSlide 4: The Legal Forms of AcquisitionsSlide 5: Merger TermsBidder firm – the company making an offer to buy the stock or assets ofanother firmTarget firm – the firm that is being soughtConsideration – cash or securities offered in an acquisition or mergerLecture Tip: Overall, the massive wave of mergers and restructurings ofthe 1980s resulted in increased competitiveness, lower costs, and greaterefficiency. A not-uncommon downside to the picture, however, is the jobloss and dislocation associated with the redeployment of corporate assets.Unfortunately, popular press writers rarely grasp the true causes of suchevents. One person who does is Peter Lynch, the successful formermanager of the Fidelity Magellan fund. Consider some of his statements.“It’s amazing that the basic cause of downsizing is sorarely acknowledged: these companies have more workersthan they really need – or can afford to pay.CEOs aren’t callous Scrooges shouting ‘Bah, humbug!’ asthey shove people out the door; they are responding to acompetitive situation that demands that they become moreproductive.If we must blame somebody for the layoffs, it ought to beyou and me. All of us are looking for the best deals inclothing, computers and telephone service – and rewardingthe high-quality, low-cost providers with our business. Ihaven’t met one person who would agree to pay AT&Ttwice the going rate for phone service if AT&T wouldpromise to stop laying people off. These companies areresponding to the constant pressure from consumers andshareholders.”A.Merger or ConsolidationSlide 7: Merger vs. ConsolidationMerger – the complete absorption of one company by another(assets and liabilities). The bidder remains and the target ceases toexist.Advantage – legally simple and relatively cheapDisadvantage – must be approved by a majority vote of theshareholders of both firms, usually requiring the cooperation ofboth managementsConsolidation – a new firm is created. Joined firms cease theirprevious existence.Lecture Tip: Appearing relatively infrequently in previousdecades, the use of the hostile takeover bid to acquire control of atarget firm exploded in the 1980s. The term “corporate raider”(used previously to describe someone who attempted to acquireboard seats via a proxy contest) entered the mainstream and thestereotypical raider was cemented in the public consciousness inthe guise of the Gordon Gekko character from the movie “WallStreet.”Hostile takeover bids are often made via tender offer to currentshareholders, which obviates the need to obtain approval from thetarget firm board. The rapid growth of hostile takeovers resulted inthe creation of an array of defensive mechanisms with which tofight them off.Often, but not always, hostile bids are launched against firms thathave been performing poorly; the combination of a depressedshare price and dissatisfaction with management increases thebidder’s chance of success. Of course, bids occur for otherreasons; the series of attempts by Kirk Kerkorian against Chryslercame following tremendous firm growth. Kerkorian, however,wanted management to release some of the $7 billion in cashreserves the firm had built up.B.Acquisition of StockSlide 7: Acquisition of StockSlide 8: Acquisition of Stock (ctd.)Taking control by buying the voting stock of another firm withcash, securities, or both.Tender offer – offer by one firm or individual to buy shares inanother firm from any shareholder. Such deals are often contingenton the bidder obtaining a minimum percentage of the shares;otherwise no go.Some factors involved in choosing between a tender offer and amerger:1. No shareholder vote is required for a tender offer. Shareholderschoose to sell or not.2. The tender offer bypasses the board and management of thetarget firm.3. In unfriendly bids, a tender offer may be a way around unwillingmanagers.4. In a tender offer, if the bidder ends up with less than 80% of thetarget firm’s stock, it must pay taxes on any dividends paid by thetarget.5. Complete absorption requires a merger. A tender offer is oftenthe first step toward a formal merger.C.Acquisition of AssetsSlide 9: Acquisition of AssetsIn an acquisition of assets, one firm buys most or all of another’sassets, but liabilities are not involved as with a merger.Transferring titles can make the process costly. The selling firmmay remain in business.D.Acquisition ClassificationsSlide 10: Classification of Acquisitions1. Horizontal acquisition – firms in the same industry2. Vertical acquisition – firms at different steps of in theproduction process3. Conglomerate acquisition – firms in unrelated industriesReal-World Tip: It is useful to give names to the various types ofmergers. For example, McDonnell-Douglas/Boeing,Conoco/Phillips, and SBC/AT&T are all examples of horizontalmergers. An example of a vertical merger would be Texaco (excessrefining capacity) and Getty Oil (significant oil reserves). U.S.Steel’s acquisition of Marathon Oil would be a conglomerateacquisition.E. A Note about TakeoversLecture Tip: The popularity of proxy contests as a means ofgaining control has waxed and waned over the last severaldecades. In the 1950s, this approach was a relatively popularmeans of removing target firm management; as noted previously,those who initiated proxy contests were even referred to in thepopular pre ss as “corporate raiders!” Empirical evidencesuggests, however, that proxy contests are time-consuming,expensive for the dissident shareholder, and unlikely to result incomplete victory.Tender offers came to the fore in the 1960s and 1970s. Somebelieve that the use of the proxy battle waned because of itsrelatively high cost and low probability of success. However, theubiquity of takeover defenses and regulatory constraints hascontributed to the return of the importance of the proxy battle as ameans of gaining control.Real-World Tip: An interesting example of a long, drawn-outproxy battle appeared in The Wall Street Journal on October 8,1996. Physician Steven Scott founded Coastal Physicians Group,Inc., but was subsequently ousted by its board of directors. Dr.Scott then filed suit and launched a proxy fight. In return, thefirm’s management counter-sued and blamed him for the firm’spoor performance. Following several months of wrangling, twocandidates backed by Dr. Scott won board seats. The struggle forcontrol of Coastal is not unlike many proxy fights, in that they areoften associated with claims and counter-claims, lawsuits, and agreat deal of acrimony and expense.Slide 11: TakeoversSlide 12: Going PrivateFour means to gain control of a firm:1. Acquisitions – merger or consolidation, tender offer, acquisitionof assets2. Proxy contests – gain control by electing directors using proxies3. Going private – all shares bought by a small group of investors4. Leveraged buyouts (LBOs) – going private with borrowedmoneyF.Alternatives to MergerSlide 13: Alternatives to MergerFirms could simply agree to work together via a joint venture orstrategic alliance.25.2 Taxes and AcquisitionsG.Determinants of Tax StatusSlide 14: Taxes and AcquisitionsTax-free – acquisitions must be for a business purpose, and theremust be a continuity of equity interestTaxable – if cash or a security other than stock is used, theacquisition is taxableH.Taxable versus Tax-Free AcquisitionCapital gains effect –if taxable, the target’s shareholders may endup paying capital gains taxes, driving up the cost of the acquisitionWrite-up effect –if taxable, the target’s assets may be revalued,i.e., written up and depreciation increased. However, the TaxReform Act of 1986 made the write-up a taxable gain, making theprocess less attractive.25.3 Accounting for AcquisitionsSlide 15: Accounting for AcquisitionsIn 2001, FASB eliminated the pooling of interest option.There are no cash flow consequences stemming from theaccounting method used.A.The Purchase MethodThe target firm’s assets are reported at fair market value on thebidder’s books. The difference between the assets’ market valueand the acquisition price is goodwill.Below is an additional example depicting the balance sheet effectsof the purchase method.Example: Firm X borrows $10 million to acquire Firm Y, creatingFirm XY.Balance Sheets (in millions) prior to the acquisition:Firm Y’s fixed assets have a market value of $8 million, makingtotal assets worth $9 million.Balance Sheet after the acquisition:Firm XYWorking Capital $ 3 Debt $10Fixed Assets 26 Equity 20Goodwill 1Total Assets $30 Total L & E $30B.More about GoodwillBecause of the requirement that all mergers be accounted for usingthe purchase method, the FASB changed the rules on Goodwill.Companies are no longer required to amortize goodwill. However,it must be reduced in the case where the value has decreased.25.4 Gains from AcquisitionsSlide 16: Gains from AcquisitionsC.SynergySlide 17: SynergyThe difference between the value of the combined firms and thesum of the individual firms is the incremental gain, ∆V = V AB−(V A + V B).Synergy – the value of the whole exceeds the sum of the parts(∆V > 0)Slide 18: Potential Sources of SynergyThe value of Firm B to Firm A = V B* = ∆V + V B. V B* will begreater than V B if the acquisition produces positive incrementalcash flows, ∆CF.∆CF = ∆EBIT + ∆Depreciation + ∆Taxes − ∆CapitalRequirements∆CF = ∆Revenue − ∆Costs − ∆Taxes − ∆Capital RequirementsD.Revenue EnhancementSlide 19: Potential Revenue Enhancement1. Marketing gains – changes in advertising efforts, changes in thedistribution network, changes in the product mix2. Strategic benefits (beachheads) – acquisitions that allow a firmto enter a new industry that may become a platform for furtherexpansion3. Market power – reduction in competition or increase in marketshareLecture Tip: The text notes several reasons for M&A activity. Thefollowing was sent via email to members of a mergers andacquisitions listserv.“Do you know a business experiencing a decline insales, loss of direction, no longer competitive,ineffective management, … Or a business that’s beingneg lected by its corporate parent … Or a [sic] ownerlooking to retire that built a once successful businessnow needing reinventing … or a company that needsstrong marketing, finance, and manufacturingdisciplines … If you know such a business … it will beworth your while to reply.”E.Cost ReductionsSlide 20: Potential Cost Reductions1. Economies of scale – per unit costs decline with increasingoutput2. Economies of vertical integration – coordinating closely relatedactivities or technology transfers3. Complementary resources (economies of scope) – example:banks that allow insurance or stock brokerage services to be soldon premisesF.Lower TaxesSlide 21: Potentially Lower Taxes1. Net operating losses (NOL) – a firm with losses and not payingtaxes may be attractive to a firm with significant tax liabilities-In fact, a firm with losses can carryforward these to offsetfuture income (the carryback provision was eliminated in theTax Cuts and Jobs Act of 2017)-The IRS may disallow an acquisition if the principal purposeof the acquisition is to avoid federal tax2. Unused debt capacity – adding debt can provide important taxsavings (although, the new tax law has put some limits on thedeductibility of interest)3. Surplus funds – firms with significant free cash flow can:-Pay dividends-Repurchase shares-Acquire shares or assets of another firm4. Asset Write-Ups – if assets are written UP to market value, thenthe tax deduction for depreciation could increaseLecture Tip: The IRS requires that the merger must havejustifiable business purposes for the NOL carryforward to beallowed. And, if the acquisition involves a cash payment to thetarget firm’s shareholders, the acquisition is considered a taxablereorganization that results in a loss of NOLs. NOL carryforwardsare allowed in a tax-free reorganization that involves an exchangeof the acquiring firm’s common stock for the acquired firm’scommon stock. Additionally, if the target firm operates as aseparate subsidiary within the acquir ing firm’s organization, theIRS will allow the carry-over to shelter the subsidiary’s futureearnings, but not the acquiring firm’s future earnings.G.Reductions in Capital NeedsSlide 22: Potential Reductions in Capital Needs1. A firm needing capacity acquires a firm with excess capacityrather than building new facilities2. Possible advantages to raising capital given economies of scalein issuing securities3. May reduce the investment in working capitalH.Avoiding MistakesSlide 23: Avoiding Mistakes1. Do not ignore market values. Use the current market value as astarting point and ask “What will change if the merger oracquisition takes place?”2. Estimate only incremental cash flows. These are the basis ofsynergy.3. Use the correct discount rate. Make sure to use a rate appropriateto the risk of the cash flows.4. Be aware of transaction costs. These can be substantial andshould include fees paid to investment bankers and lawyers, aswell as disclosure costs.I. A Note about Inefficient ManagementSlide 24: Inefficient ManagementIf management isn’t doing its job well, or others may be able to dothe job better, acquisitions are one way to replace management.The threat of takeover may be enough to make managers act in thebest interest of shareholders.Lecture Tip: One of the fathers of modern takeover theory isHenry Manne, who published “Mergers and the Market forCorporate Control” in 1965. In this seminal work, Manneproposes the (now commonly accepted) notion that poorly runfirms are natural takeover targets because their market values willbe depressed, permitting acquirers to earn larger returns byrunning the firms successfully. This proposition has been verifiedempirically in dozens of academic studies over the last fourdecades.25.5 Some Financial Side Effects of AcquisitionsSlide 25: Financial Side Effects of AcquisitionJ.EPS GrowthSlide 26: EPS GrowthAn acquisition may give the appearance of growth in EPS withoutactually changing cash flows. This happens when the bidd er’sstock price is higher than the target’s, so that fewer shares areoutstanding after the acquisition than before.Example: Pizza Shack wants to merge with Checkers Pizza. Themerger won’t create any additional value, so, assuming the marketisn’t fooled, the new firm, Stop ‘n Go Pizza, will be valued at thesum of the separate market values of the firms.Stop ‘n Go is valued at $1,875,000 and has 125,000 sharesoutstanding with a price of $15 per share. Pizza Shackstockholders receive 100,000 shares, and Checkers Pizzastockholders receive 25,000 shares.Before and after merger financial positionsLecture Tip: Who have been some of the top dealmakers? The February 2007 edition of Mergers and Acquisitions Journal indicates that six firms advised in 200 or more transactions during 2006. The number of deals and the dollar volume involved was as follows:2006 Leaders (200+ Deals) Company No. of M&ADeals$ Volume of M&ADeals (millions)1 Goldman Sachs 269 $735.42 JP Morgan 252 $554.53 Morgan Stanley 230 $616.44 Credit Suisse 226 $435.35 UBS 221 $375.66 Citigroup 217 $568.4K.DiversificationSlide 27: DiversificationA firm’s attempt at diversification does not create value becausestockholders could buy the stock of both firms, probably morecheaply. Firms cannot reduce their systematic risk by merging.Lecture Tip: In earlier chapters, we pointed out that conflicts ofinterest may exist between stockholders and managers in publiclytraded firms. As noted above, diversification-based mergers don’tcreate value for shareholders (this was illustrated using optionpricing theory in an earlier chapter); however, these mergers mayincrease sales and reduce the total variability of firm cash flows. Ifmanagerial compensation and/or prestige is related to firm size, orif less variable cash flows reduce the likelihood of managerialreplacement, then some mergers may be initiated for the wrongreasons—they may be in the best interest of managers but notstockholders.25.6 The Cost of an AcquisitionSlide 28: Cost of an AcquisitionThe NPV of a merger = V B*− Cost to Firm A of the acquisitionMerger premium – amount paid above the stand-alone valueReconsider Pizza Shack’s merger with Checkers Pizza. SupposePizza Shack acquires Checkers in a buyout. Pizza Shack hasestimated the incremental value of the acquisition, ∆V, to be$75,000. The value of Checkers to Pizza Shack is V C* = ∆V + V C= $75,000 + $375,000 = $450,000. Checkers shareholders arewilling to sell for $400,000. Thus, the merger premium is $25,000.A.Case I: Cash AcquisitionSuppose Pizza Shack pays Checkers’ stockholders $400,000 incash. Then, NPV = $450,000 − $400,000 = $50,000.The value of the combined firm = $1,500,000 + $50,000 =$1,550,000With 100,000 shares outstanding, the price per share becomes$15.50B.Case II: Stock AcquisitionSuppose, instead of cash, Pizza Shack gives Checkers stockholdersPizza Shack stock valued at $15 per share. Checkers stockholderswill get 400,000 ⁄ 15 = 26,667 shares (rounded). The new firm willhave 126,667 shares outstanding and a value of $1,500,000 +$375,000 + $75,000 = $1,950,000 for a per share price of $15.39.The total consideration is 26,667(15.39) = $410,405.13. The extra$10,405.13 comes from allowing Checkers stockholdersproportional participation in the $50,000 NPV.C.Cash versus Common StockSlide 29: Cash vs. Stock Acquisition1. Sharing gains –When cash is used, the target’s stockholderscan’t gain beyond the purchase price. Of course, they can’t fallbelow either.2. Taxes – Cash transactions are generally taxable; exchangingstock is generally tax-free.3. Control – Using stock may have implications for control of themerged firm.Lecture Tip: Emphasize that the logic used in determining theNPV of an acquisition is the same as that used to find the NPV ofany other project. The acquisition is desirable if the present valueof the incremental cash flows exceeds the cost of acquiring them.However, some financial theorists argue that many acquisitionscontain a “winner’s curse.” The argument is that the winner of anacquisition contest is the firm that most overestimates the truevalue of the target. As such, this bid is most likely to be excessive.For a more detailed discussion of the “winner’s curse,” see NikVaraiya and Kenneth Ferris, “Overpaying in CorporateTakeovers: The Winner’s Curse,” Financial Analysts Journal,1987, vol. 43. no. 3. Richard Roll, in “The Hubris Hypothesis ofCorporate Takeovers,” Journal of Business, 1986, vol. 59, no. 2,attributed the rationale for this behavior to hubris, i.e., theexcessive arrogance or greed of management.25.7 Defensive TacticsSlide 30: Defensive TacticsD.The Corporate Charter-Usually, 67% of stockholders must approve a merger. Asupermajority amendment requires 80% or more to approve amerger.-Staggered terms for board membersE.Repurchase and Standstill AgreementsA standstill agreement involves getting the bidder to agree to backoff, usually by buying the bidder’s stock back at a substantialpremium (targeted repurchase); also called greenmail.Example: Ashland Oil bought off the Belzbergs of Canada in atargeted repurchase. Ashland also had an established employeestock ownership with 27% of outstanding shares owned byemployees and had earlier adopted a supermajority provision.F.Poison Pills and Share Rights PlansIn a share rights plan, the firm distributes rights to purchase stockat a fixed price to existing shareholders. These can’t be detached orexercised until “triggered,” but they can be bought back by thefirm. They are usually triggered when a tender offer is made.Flip-over provision –the “poison” in the pill. Effectively, thetarget firm’s shareholders get to buy stock in the target firm at halfprice.G.Going Private and Leveraged BuyoutsGoing private can prevent takeovers that conflict withmanagement’s point of view.H.Other Devices and Jargon of Corporate TakeoversSlide 31: More (Colorful) Terms – ISlide 32: More (Colorful) Terms – IISlide 33: More (Colorful) Terms – IIISlide 34: More (Colorful) Terms – IV1. Golden parachutes – compensation to top management in theevent of a takeover2. Poison puts – forces the firm to buy stock back at a set price3. Crown jewels –a “scorched earth” strategy of threatening to sellmajor assets4. White knights – target of hostile bid hopes to find a friendly firm(white knight) to buy a large block of stock (often on favorableterms) to halt takeover5. Lockups – option granted to friendly firm giving it the right tobuy stock or major assets at a fixed price in the event of a hostiletakeover6. Shark repellent – any tactic designed to discourage unwantedtakeovers7. Bear hug –“an offer you can’t refuse”8. Fair price provision – all selling shareholders must receive thesame price from the bidder—eliminates the ability to make a two-tier offer to encourage shareholders to tender early9. Dual class capitalization – more than one class of common stockwith most of the voting power privately held10. Countertender offer –“Pac-Man” defense – target offers to buythe bidderEthics Note: In The Law and Finance of Corporate InsiderTrading: Theory and Evidence (Kluwer Publishing, 1993) Arshadiand Eyssell argue that an active market for corporate control willbe characterized by increases in the nature and complexity ofdefensive tactics and by an increasing volume of pre-announcement insider trading. In the case of the former, managersfacing an environment that is (from their perspective) increasinglyhostile and will seek to defend themselves and their positions.Defensive tactics will be implemented, tested by takeover bids andin the courts, and modified.Trading on nonpublic information has been shown in numerousacademic studies to be extremely profitable (albeit illegal), thusthe conclusion that financial markets are not strong-form efficient.In the case of takeover bids, insider trading is argued to beparticularly endemic because of the large potential profits involvedand because of the relatively large number of people “in on thesecret.” Managers, employees, investment bankers, attorneys, andfinancial printers have all been accused in various takeover-related insider trading cases.Lecture Tip:Less common, but not rare, are “reverse mergers,”in which a firm goes public by merging with a public (often shell)company. Ted Turner gained control of Rice Broadcasting (WJRJ-TV) in 1970 by doing a reverse merger. Rice Broadcasting was“virtually insolvent,” but by merging into a public company,Turner was obtaining financing for subsequent growth.25.8 Some Evidence on Acquisitions: Does M&A Pay?Slide 35: Evidence on AcquisitionsAvailable evidence suggests that target stockholders makesignificant gains—more in tender offers than in mergers. On theother hand, bidder stockholders earn comparatively little, breakingeven on mergers and making a few percent on tender offers.Lecture Tip: It is probably not overstating the matter to say thatthe accepted wisdom in modern finance is that, in the aggregate,more merger and acquisition activity is preferred to less. Dozensof event studies report that, on average, the wealth of target firmstockholders is greatly enhanced, while the wealth of acquiringfirm stockholders is unaffected, or at worst, slightly diminished.For many, the notion that an active market for corporate control isa good thing has become so ingrained that we are somewhatsurprised when others don’t view things the same way. However,in an interesting essay in the August 1998 issue of Harpersmagazine, Lewis H. Lapham likens the sequential announcementsof seemingly ever-larger corporate combinations to the elephantact at the circus:。

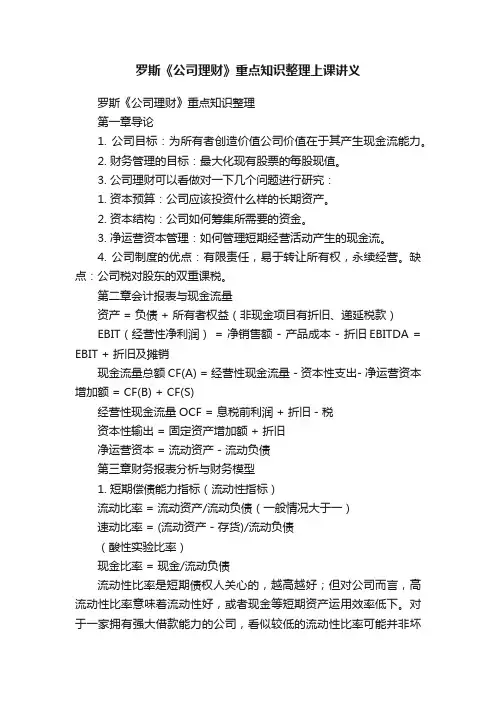

罗斯《公司理财》重点知识整理上课讲义罗斯《公司理财》重点知识整理第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出- 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数 = 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值+ 有息负债市值- 现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

Chapter 18SHORT-TERM FINANCE AND PLANNING SLIDES18.1Chapter 1818.2Key Concepts and Skills18.3Chapter Outline18.4Sources and Uses of Cash18.5The Operating Cycle18.6Cash Cycle18.7Figure 18.1: Cash Flow Time Line18.8Example Information18.9Example: Operating Cycle18.10Example: Cash Cycle18.11Short-Term Financial Policy18.12Carrying vs. Shortage Costs18.13Temporary vs. Permanent Assets18.14Figure 18.4: Total Asset Requirements over Time18.15Choosing the Best Policy18.16Figure 18.6: A Compromise Financing Policy18.17Cash Budget18.18Example: Cash Budget Information18.19Example: Cash Budget – Cash Collection18.20Example: Cash Budget – Cash Disbursements18.21Example: Cash Budget – Net Cash Flow and Cash Balance 18.22Short-Term Borrowing18.23Example: Compensating Balance18.24Example: Factoring18.25Short-Term Financial Plan18.26Quick Quiz18.27Ethics Issues18.28Comprehensive Problem18.29End of ChapterCHAPTER WEB SITESCHAPTER ORGANIZATION18.1Tracing Cash and Net Working Capital18.2The Operating Cycle and the Cash CycleDefining the Operating and Cash CyclesThe Operating Cycle and the Firm’s Organizational ChartCalculating the Operating and Cash CyclesInterpreting the Cash Cycle18.3Some Aspects of Short-Term Financial PolicyThe Size of the Firm’s Investment in Current AssetsAlternative Financing Policies for Current AssetsWhich Financing Policy Is Best?Current Assets and Liabilities in Practice18.4The Cash BudgetSales and Cash CollectionsCash OutflowsThe Cash Balance18.5Short-Term BorrowingUnsecured LoansSecured LoansOther Sources18.6 A Short-Term Financial Plan18.7Summary and ConclusionsANNOTATED CHAPTER OUTLINELecture Tip: For some reason, many students (and some faculty)view short-term finance generally, and working capitalmanagement specifically, as less important than capital budgetingor the risk-return relationship. You may find it useful to emphasizethe importance of short-term finance in introducing the currentchapter.First, discussions with CFOs quickly lead to the conclusion that, asimportant as capital budgeting and capital structure decisions are,they are made less frequently, while the day-to-day complexitiesinvolving the management of net working capital (especially cashand inventory) consume tremendous amounts of management time.Second, it is clear that while poor long-term investment andfinancing decisions will adversely impact firm value, poor short-term financial decisions will impair the firm’s ability to continueoperating. Finally, good working capital decisions can also have amajor impact on firm value.Slide 1: Chapter 18Slide 2: Key Concepts and SkillsSlide 3: Chapter Outline18.1Tracing Cash and Net Working CapitalSlide 4: Sources and Uses of CashDefining Cash in Terms of Other ElementsNet working capital + Fixed assets = Long-term debt + EquityNet working capital = Cash + Other current assets − CurrentliabilitiesSubstituting NWC into the first equation and rearranging;Cash = Long-term debt + Equity + Current Liabilities − Othercurrent assets − Fixed assetsSources of Cash (Activities that increase cash)Increase in long-term debt account (borrowed money)Increase in equity accounts (sold stock)Increase in current liability accounts (borrowed money)Decrease in current asset accounts, other than cash (soldcurrent assets)Decrease in fixed assets (sold fixed assets)Uses of Cash (Activities that decrease cash)Decrease in long-term debt account (repaid loans)Decrease in equity accounts (repurchased stock or paiddividends)Decrease in current liability accounts (repaid suppliers or short-term creditors)Increase in current asset accounts, other than cash (purchasedcurrent assets)Increase in fixed assets (purchased fixed assets)Lecture Tip: Concept question 18.1b asks students to considerwhether net working capital always increases when cashincreas es. The best way to illustrate why the answer to this is “no”is to work an example: Suppose a firm currently has $50,000 incurrent assets and $20,000 in current liabilities; so NWC =$50,000 − 20,000 = 30,000. Management decides to borrow$10,000 using long-term debt. What happens to cash and NWC?Cash increases by $10,000 and NWC = (50,000 + 10,000) −20,000 = 40,000. So, both cash and NWC increase by 10,000.Suppose, on the other hand, management borrowed the $10,000from a bank as a short-term loan. Cash still increases by $10,000,but net working capital doesn’t change ( NWC = (50,000 +10,000) − (20,000 + 10,000) = 30,000). The effect of an increasein cash on NWC depends on where the increase comes from; if theincrease comes from a change in long-term liabilities, equity orfixed assets, then there will be an increase in NWC. On the otherhand, if the increase comes from a change in current liabilities orcurrent assets, then there will be no impact on NWC.18.2 The Operating Cycle and the Cash CycleA.Defining the Operating and Cash CyclesSlide 5: The Operating CycleThe operating cycle is the average time required to acquireinventory, sell it, and collect for it.Operating cycle = Inventory period + Accounts receivableperiodThe inventory period is the time to acquire and sell inventory.Inventory turnover = Cost of goods sold ⁄ A verageinventoryInventory period = 365 ⁄ I nventory turnoverThe accounts receivable period (average collection period) isthe time to collect on the sale.Receivables turnover = Credit sales ⁄ Average receivablesAccounts receivable period = 365 ⁄ Receivables turnover Slide 6: Cash CycleThe cash cycle is the average time between cash disbursementfor purchases and cash received from collections.Cash cycle = Operating cycle − Accounts payable period Slide 7: Figure 18.1: Cash Flow Time LineThe accounts payable period is the time between receipt ofinventory and payment for it.Payables turnover = Cost of goods sold ⁄ Average payablesPayables period = 365 ⁄ Payables turnoverLecture Tip: Students should recognize that a company wouldprefer to take as long as possible before paying bills. You mightmention that accounts payable is often viewed as “free credit;”however, the cost of granting credit is built into the cost of theproduct. Note that the operating cycle begins when inventory ispurchased and the cash cycle begins with the payment of accountspayable.B.The Operating Cycle and the Firm’s Organizational ChartShort-term financial management in a large firm involvescoordination between the credit manager, the marketing manager,and the controller. Potential for conflict may exist if particularmanagers concentrate on individual objectives as opposed tooverall firm objectives.C.Calculating the Operating and Cash CyclesLecture Tip: In this chapter, we use average values of inventory,accounts receivable, and accounts payable to compute values ofinventory turnover, accounts receivable turnover and accountspayable turnover, respectively. Remind students that the balancesheet represents a financial “snapshot” of the firm and, as such,balance sheet values literally change on a daily basis. One way toreduce the distortions caused by dividing a “flow” value (incomestatement numbers that represent what has happened over a periodof time) by a “snapshot” value is to use the average “snapshot”value computed over the same period.Slide 8: Example InformationSlide 9: Example: Operating CycleSlide 10: Example: Cash CycleConsider this example (similar to the one in the book):Item Beginning Ending AverageInventory 200,000 300,000 250,000Accounts Receivable 160,000 200,000 180,000Accounts Payable 75,000 100,000 87,500Net sales = 1,150,000; COGS = $820,000Finding inventory period:Inventory tu rnover = 820,000 ⁄ 250,000 = 3.28 timesInventory period = 365 ⁄ 3.28 = 111 daysFinding accounts receivables period:Receivables turnover = 1,150,000 ⁄ 180,000 = 6.39 timesAcc ounts receivables period = 365 ⁄ 6.39 = 57 daysOperating cycle = 111 + 57 = 168 daysFinding accounts payables period:Payables turnover = 820,000 ⁄ 87,500 = 9.37 timesAccounts payables period = 365 ⁄ 9.37 = 39 daysCash cycle = 168 − 39 = 129 daysD.Interpreting the Cash CycleA positive cash cycle means that inventory is paid for before it issold and the cash from the sale is collected. In this situation, a firmmust finance the current assets until the cash is collected. The nextsection addresses the issue of how to finance the cash cycle.Lecture Tip: It may be beneficial to have students consider theinteractions imbedded in the cash cycle. For example, studentsmay feel that the main demand on funds, for example, comes fromthe inventory period. However, the students should consider theinteractions involved when trying to speed up the inventoryturnover. Increasing inventory turnover may involve relaxingcredit terms, which will result in a lower receivables turnover. Theultimate effect will depend on the trade-off between the two and the cash flows that are generated.Real-World Tip: This discussion suggests that, depending oninventory needs and financing costs, some firms will find it usefulto hire others to “store inventory” for them. In fact,Boeing/McDonnell-Douglas Aircraft in St. Louis does exactlythat—small firms are paid to guarantee the delivery of rawmaterials (copper, sheet steel, etc.) to the firm at a moment’snotice. And while these firms also do some preliminary cutting andmachining, their primary role is to hold inventory thatBoeing/McDonnell-Douglas would otherwise have to hold. As aresult, the firm’s financing needs are lessened.The relationship between inventory turnover and financing needsis also apparent in industries with extremely long or short cashcycles. For example, cash cycles are relatively long in the jewelryretailing industry, and particularly short in the grocery industry.18.3 Some Aspects of Short-Term Financial PolicyA.The Size of the Firm’s Investment in Current AssetsSlide 11: Short-Term Financial PolicyIf cash was collected from sales when the bills had to be paid, thencash balances and net working capital could be zero. The greaterthe mismatch between collections and payment, and theuncertainty surrounding collections, the greater the need tomaintain some cash balances and to have positive net workingcapital.Flexible (conservative) policy – high levels of current assetsrelative to sales, relatively more long-term financing:-Keep large cash and securities balances (lower return, but cashavailable for emergencies and unexpected opportunities)-Keep large amounts of inventory (higher carrying costs, butlower shortage costs including lost customers due to stock-outs)-Liberal credit terms, resulting in large receivables (greaterprobability of default from customers and usually a longerreceivables period, but leading to an increase in sales)Restrictive (aggressive) policy – low levels of current assetsrelative to sales, relatively more short-term financing:-Keep low cash and securities balances (may be short of cashin emergencies or unable to take advantage of unexpectedopportunities, but higher return on long-term assets)-Keep low levels of inventory (high shortage costs, particularlybad in industries where there are plenty of close substitutes thatcustomers can turn to, lower carrying costs)-Strict credit policies, or no credit sales (may substantially cutsales level, reduce cash cycle, and need for financing)Slide 12: Carrying vs. Shortage CostsCarrying costs – costs that increase with investment in currentassets-Opportunity cost of investing in (and financing) low-yieldassets-Cost associated with storing inventoryShortage costs – costs that decrease with investment in currentassets-Trading and order costs – commissions, set-up, and paperwork-Stock-out costs – lost sales, business disruptions, and alienatedcustomersLecture Tip: The just-in-time inventory system is designed toreduce the inventory period. In essence, companies pay theirsuppliers to carry the inventory for them. Reducing the inventoryperiod reduces the operating cycle and thus the cash cycle. Thisreduces the need for financing. Ask the students to consider whattype of cost is being minimized and what costs are likely toincrease. Ask them if JIT inventory policies are appropriate for allindustries. It makes sense for industries that have substantialcarrying costs with relatively low shortage costs, but not forindustries where shortage costs outweigh carrying costs.B.Alternative Financing Policies for Current AssetsSlide 13: Temporary vs. Permanent AssetSlide 14: Figure 18.4: Total Asset Requirement over TimeIdeally, we could always finance short-term assets with short-termdebt and long-term assets with long-term debt and equity.However, this is not always feasible.Lecture Tip: Some students tend to think permanent assets consistonly of fixed assets. Emphasize that a certain level of currentassets is also “permanent.” Consider the following example:January February March AprilCurrent Assets 20,000 30,000 20,000 20,000Fixed Assets 50,000 50,000 50,000 50,000Permanent Assets 70,000 70,000 70,000 70,000Temporary Assets 0 10,000 0 0Ask students to consider what the levels of permanent assets andtemporary assets are for each month.A flexible policy would finance $80,000 with long-term debt andhave excess cash of $10,000 to invest in marketable securities inJanuary, March, and April. Overall, the interest expense on theextra $10,000 borrowed long-term will outweigh the interestreceived from the marketable securities.A restrictive policy would finance $70,000 with long-term debt. InFebruary, the firm would borrow $10,000 on a short-term basis tocover the cost of temporary assets in that month. The short-termloan would be repaid in March.C.Which Financing Policy is Best?Slide 15: Choosing the Best PolicySlide 16: Figure 18.6: A Compromise Financing PolicyThings to consider:1. Cash reserves – more important when a firm has unexpectedopportunities on a regular basis or where financial distress is astrong possibility2. Maturity hedging – match liabilities to assets as closely aspossible, avoid financing long-term assets with short-termliabilities (risky due to possibility of increase in rates and the riskof not being able to refinance)3. Relative interest rates – short-term rates are usually, but notalways, lower; they are almost always more volatileLecture Tip: Personal financial situations provide ample examplesof maturity matching. We tend to use 30-year loans when we buyhouses and 4–5 year loans for cars. Why wouldn’t we finance theseassets with short-term loans? What if you borrowed $200,000 tobuy a house using a 1-year note? In one year, you either have topay off the loan with cash or refinance. If you refinance, you havethe transaction costs associated with obtaining a new loan and thepossibility that rates increased substantially during the year.Adjustable loans adjust annually, the initial rate is generally lowerthan a fixed rate loan, and there are limits to how much the loanrate can increase in any given year and over the life of the loan.Also, there are no transaction costs associated with the rateadjustment on an ARM.D.Current Assets and Liabilities in PracticeThe level of current assets and current liabilities depends largelyon the industry involved. The same is true for the cash cycle.18.4The Cash BudgetA.Sales and Cash CollectionsSlide 17: Cash BudgetCash budget – a schedule of projected cash receipts anddisbursementsSlide 18: Example: Cash Budget InformationSlide 19: Example: Cash Budget – Cash CollectionsA cash budget requires sales forecasts for a series of periods. Theother cash flows in the cash budget are generally based on the salesestimates. We also need to know the average collection period onreceivables to determine when the cash inflow from sales actuallyoccurs.B.Cash OutflowsSlide 20: Example: Cash Budget – Cash DisbursementsCommon cash outflows:-Accounts payable – what is the accounts payables period?-Wages, taxes, and other expenses – usually expressed as a percentof sales (implies that they are variable costs)-Fixed expenses, when applicable-Capital expenditures – determined by the capital budget-Long-term financing expenses – interest expense, dividends,sinking fund payments, etc.-Short-term borrowing – determined based on the otherinformationC.The Cash BalanceSlide 21: Example: Cash Budget – Net Cash Flow and Cash BalanceNet cash inflow is the difference between cash collections and cashdisbursements18.5 Short-Term BorrowingSlide 22: Short-Term BorrowingA.Unsecured LoansLine of credit – formal or informal prearranged short-term loansCommitment fee – charge to secure a committed line of creditCompensating balance – deposit in a low (or no) interest accountas part of a loan agreementCost of a compensating balance – if the compensating balancerequirement is on the used portion, less money than what isborrowed is actually available for use. If it is on the unusedportion, the requirement becomes a commitment fee.Slide 23: Example: Compensating BalanceExample: Consider a $50,000 line of credit with a 5%compensating balance requirement. The quoted rate on the line isprime + 5%, and the prime rate is currently 8%. Suppose the firmwants to borrow $28,500. How much do they have to borrow?What is the effective annual rate?Loan Amount: 28,500 = (1 − .05)LL = 28,500 ⁄ .95 = 30,000Effective rate: Interest paid = 30,000(.13) = 3,900. Effective rate =3,900 ⁄ 28,500 = .1368 = 13.68%Lecture Tip: Credit cards are an excellent way to illustrate theconcept of a “personal” line of credit. The consumer c an use theline of credit on the credit card to purchase goods or services. Theline of credit remains active until we abuse the privilege (i.e., latepayments). There is often a cost for this line of credit in the form ofannual fees. This is in addition to the often high rates of interest.College students are targeted by credit card companies and canend up holding several cards at one time. The cost of the annualfees can add up—especially if they don’t need the additional creditto begin with. Students also have the habit of charging to theirlimits and then just making the minimum payment.Lecture Tip: Trade credit represents another source of unsecuredfinancing. However, the cost of this form of borrowing is largelyimplicit, since it is represented by the opportunity cost of nottaking the discount offered, if any. To compute the effective annualcost of trade credit, we first use the credit terms to determine aperiodic opportunity cost. For example, if the terms are 2/10 net30, rational managers will either pay $.98 per dollar of goodsordered on the 10th day, or the full invoice cost on the 30th day. Inthe latter case, the firm is actually paying $.02 to borrow $0.98 for20 da ys. In one year, there are 365 ⁄ 20 = 18.25 such periods.Therefore, the annualized cost is (1 + .02 ⁄ .98)18.25− 1 = 44.58%.B.Secured LoansAccounts Receivable Financing-Assigning receivables – receivables are security for a loan, butthe borrower retains the risk of uncollected receivablesSlide 24: Example: Factoring-Factoring – receivables are sold at a discountInventory Loans-Blanket inventory lien – all inventory acts as security for theloan-Trust receipt – borrower holds specific inventory in trust forthe lender (e.g., automobile dealer financing)-Field warehouse financing – public warehouse acts as acontrol agent to supervise inventory for the lenderLecture Tip: Inventory needs to be non-perishable, marketable,and not subject to obsolescence in order to be useful for inventoryloans. Some view inventory financing as a means of raisingadditional short-term funds after receivables financing has beenexhausted; however, it is standard practice in some industries,such as auto sales.Real-World Tip: An interesting discussion of inventory financingis the story of Tino De Angelis, who has come to be known as the“salad oil king.” Mr. De Angelis, a former butcher, constructed anempire with a reported value of $100 million (in 1963) basedlargely on his supposed acumen in buying and selling vegetableoil. The magnitude of his operation is apparent when you considerthat at one point, he had contracted to purchase 600 millionpounds of the product, or one-third of the total amount produceddomestically.Unfortunately, Mr. De Angelis’ business acumen was greatlyexaggerated. He resorted to borrowing against his inventory,which supposedly consisted of millions of gallons of vegetable oilheld in steel vats spread across New Jersey. Unfortunately for hiscreditors, the vats were largely empty. The resulting default caused millions of dollars in losses to banks, insurance companies,brokerage firms, and the New York Stock Exchange. Mr. DeAngelis was paroled in 1972 after serving seven years of a 20-yearprison sentence.C.Other Sources-Commercial paper – short-term publicly traded loans-Trade credit – accounts payableLecture Tip: In Corporate Liquidity, by Kenneth Parkinson andJarl Kallberg, commercial paper is called “the most importantsource of short-term borrowing for large U.S. companies.” Thecommercial paper market has grown dramatically over the last few years. Parkinson and Kallberg describe a typical commercialpaper transaction:-The issuer sells a note to an investor for an agreed-upon rate,principal (usually in $1 million increments), and maturity date(270 days or less).-The issuer contracts with the issuing bank to prepare the noteand deliver it to the investor’s custodial bank.-The investor instructs her bank to wire funds to thecommercial paper issuer upon delivery and verification of thenote. Since commercial paper is sold on a discounted basis, theamount of funds wired is less than the face amount of the note.-On the maturity date, the note is returned to the issuer’spaying agent and the face amount of the note is transferred tothe investor. The note is marked paid and returned to theissuer.18.6 A Short-Term Financial PlanSlide 25: Short-Term Financial PlanThe cash budget is used to determine how a firm will raise the cashto meet any cash deficits computed in the budget. It is also used todetermine when marketable security investments may benecessary. For temporary imbalances, short-term borrowing andmarketable securities are in order. For long-term short-falls,solutions include issuing bonds or equity. For long-term cashsurpluses, solutions include paying dividends, repurchasing shares,or refunding debt.18.7Summary and ConclusionsSlide 26: Quick QuizSlide 27: Ethics IssuesSlide 28: Comprehensive ProblemSlide 29: End of Chapter。