财务管理专业英语 句子及单词翻译

- 格式:docx

- 大小:49.60 KB

- 文档页数:4

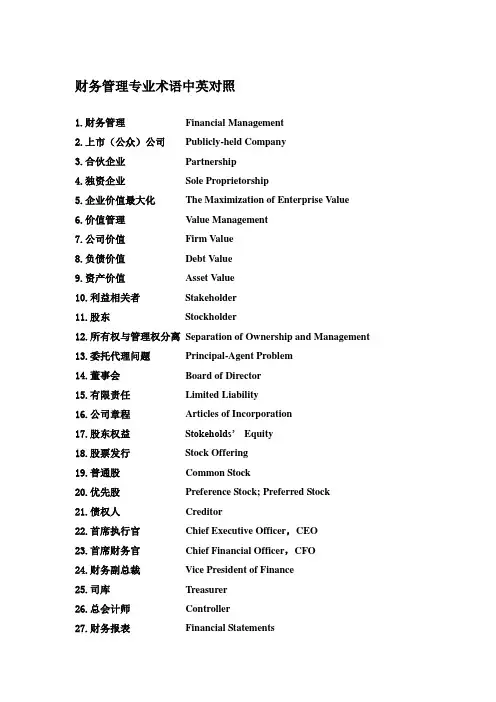

财务管理专业术语中英对照1.财务管理Financial Management2.上市(公众)公司Publicly-held Company3.合伙企业Partnership4.独资企业Sole Proprietorship5.企业价值最大化The Maximization of Enterprise Value6.价值管理Value Management7.公司价值Firm Value8.负债价值Debt Value9.资产价值Asset Value10.利益相关者Stakeholder11.股东Stockholder12.所有权与管理权分离Separation of Ownership and Management13.委托代理问题Principal-Agent Problem14.董事会Board of Director15.有限责任Limited Liability16.公司章程Articles of Incorporation17.股东权益S tokeholds’ Equity18.股票发行Stock Offering19.普通股Common Stock20.优先股Preference Stock; Preferred Stock21.债权人Creditor22.首席执行官Chief Executive Officer,CEO23.首席财务官Chief Financial Officer,CFO24.财务副总裁Vice President of Finance25.司库Treasurer26.总会计师Controller27.财务报表Financial Statements28.资产负债表Balance Sheet29.损益表Income Statement30.现金流量表Cash Flow Statement31.复利Compound Interest32.现值Present Value33.终值Future Value34.年金Annuity35.后付年金Ordinary Annuity36.先付年金Annuity Due37.延期年金Deferred Annuity38.永续年金Perpetual Annuity39.风险报酬Risk Premiums40.违约风险Default Risk41.市场收益率Market Return, RM42.方差Variance43.标准差Standard Deviation44.系统风险Systematic Risk45.非系统风险Unsystematic Risk46.最低报酬率Hurdle Rate47.资本资产定价模型Capital Asset Pricing Model, CAPM48.贝塔系数Beta Coefficient, β49.边际资金成本Marginal Cost of Capital,MCC50.净现值Net Present Value,NPV51.净现值率Net Present Value Rate,NPVR52.内含报酬率Internal Rate of Return,IRR53.获利指数Profitability Index,PI54.投资回收期Payback Period,PP55.平均报酬率Average Rate of Return,ARR56.投资利润率Return on Investment, ROI57.机会成本Opportunity Cost58.相关成本Relevance Cost59.沉没成本Sunk Cost60.资金成本Cost of Funds61.加权平均资本成本Weighted Average Cost of Capital,WACC62.经营杠杆Operating Leverage63.财务杠杆Financial Leverage64.综合杠杆Comprehensive Leverage / Total Leverage65.营运资金Working Capital66.流动资产Current Asset67.流动负债Current Liability68.经济订货批量Economic Order Quantity, EOQ69.资本预算Capital Budgeting70.筹资组合Financing Mix71.资本结构Capital Structure72.负债与股票的组合Mix of Debt and Equity73.融资租赁Financial Leasing74.股利政策Dividend Policy75.现金股利Cash Dividend76.股票股利Stock Dividend77.股利支付率Dividend-Payout Ratio78.股票回购Stock Repurchase79.股票分割Share Split80.市净率Book-to-Market Ratio81.市盈率Price-Earnings Ratio, P/E82.账面收益率Book rate of Return83.自由现金流量Free Cash Flow, FCF84.小盘股Small-Cap Stocks85.大盘股Large-Cap Stocks86.蓝筹股Blue-Chip Stocks87.成长股Growth Stock89.90.。

financial management 财务管理chief financial officer 首席财务官hurdle rate 最低报酬率capital structure 资本结构cash dividend 现金股利dividend-payout ratio 股利支付率financial risk 财务风险earnings per share 每股盈余net present value 净现值stock option 股票期权earnings per share 每股收益time value of money 货币时间价值simple interest 单利annuity 年金future value 终值present value 现值compound interest 复利capital 本金d iscount rate 折现率opportunity cost 机会成本cost of capital 资本成本ordinary annuity 普通年金annuity due 先付年金deferred annuity 递延年金perpetuity 永续年金liquidity ratio 流动性比率nominal interest rate 名义利率marker value 市场价值intrinsic value 内在价值discounted cash flow valuation 折现现金流量模型earnings before interest and taxes 息税前利润par value 票面价值dividend payout 股利支付率dividend discount model 股利折现模型diversifiable risk可分散风险market risk 市场风险expected return 期望收益volatility 流动性权益融资equity financial债务融资debt financial利润最大化profit maximization股东财富最大化shareholders wealth maximization 每股收益最大化maximization of earning per share 11、投资报酬return on investment风险溢价risk premium货币市场money market偿债基金sinking fund1.financial markets 金融市场2.资本结构capital structure3.risk premium 风险报酬4.净现金流量net cash flow5.credit policy 信用政策6.终值future value7.moral hazard 道德风险8.收账政策collection policy1.chief financial officer 首席财务官2.财务管理financial management3.credit standard 信用标准4.流动性liquidity5.earnings before interest and taxes 息税前利润6.市场价值market value7.capital assets pricing model资本资产定价模型8.每股收益earnings per share。

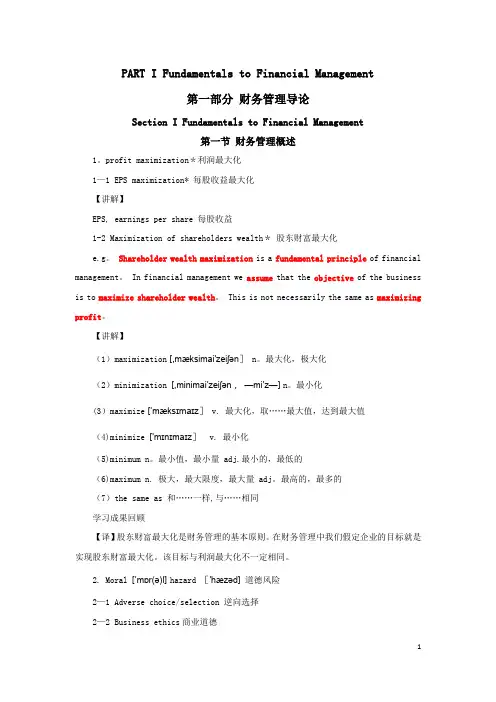

PART I Fundamentals to Financial Management第一部分财务管理导论Section I Fundamentals to Financial Management第一节财务管理概述1。

profit maximization*利润最大化1—1 EPS maximization* 每股收益最大化【讲解】EPS, earnings per share 每股收益1-2 Maximization of shareholders wealth*股东财富最大化e.g。

Shareholder wealth maximization is a fundamental principle of financial management。

In financial management we assume that the objective of the business is to maximize shareholder wealth。

This is not necessarily the same as maximizing profit。

【讲解】(1)maximization[,mæksimai'zeiʃən]n。

最大化,极大化(2)minimization [,minimai’zeiʃən,—mi’z—]n。

最小化(3)maximize[’mæksɪmaɪz]v. 最大化,取……最大值,达到最大值(4)minimize ['mɪnɪmaɪz] v. 最小化(5)minimum n。

最小值,最小量 adj.最小的,最低的(6)maximum n. 极大,最大限度,最大量 adj。

最高的,最多的(7)the same as 和……一样,与……相同学习成果回顾【译】股东财富最大化是财务管理的基本原则。

在财务管理中我们假定企业的目标就是实现股东财富最大化。

财务管理的英文翻译financial managementmanagement through finance1. In running a company, strict financial management means everything.经营一家公司, 严格的财务管理是至关重要的.2. Prudent financial management products to the attention of only bonds, the market.稳健理财产品的注意力只能转向债券、票据市场.3. Then in 2021 the currency - type sound financial management will be going?那么2021年的外币稳健型理财将走向何方?4. Financial management is key in any company or enterprise.在任何公司和企业单位中财务管理是关键.5. My assignment of strategy Financial Management is due today.我的转让的战略财务管理,是今天上交.6. Corporate enterprise, there are three levels of financial management.公司制企业财务管理存在着三个层次.7. Budgetary management is the financial management means of current west popularity.预算治理是当今西方流行的财务治理方式.8. Financing is an eternal topic in business development and financial management.融资是企业经营发展和财务管理的永恒话题.9. Outside the financial management division of the income disparity.在境外,理财师的收入相当悬殊.10. Traditional financial management software, request that you rivets attention and dedication kanpan.传统的理财软件, 要求您目不转睛、专心致志看盘.n.财政; 金融; 财源; 资金vt.为…供给资金,从事金融活动; 赊货给…; 掌握财政;1. The finance minister will continue to mastermind Poland's economic reform.财政部长将继续策划波兰的经济改革。

财务管理专业英语句子及单词翻译Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

财务管理专业英语词汇表(很全面)Chapter 1 An Overview of Financial Management business 企业,商业,业务finance 财务,理财management 管理,管理层revenue 收入return 回报shareholder 股东stakeholder 利益相关者stock 股票profit maximization 利润最大化shareholder wealth maximization 股东财富最大化enterprise value maximization 企业价值最大化hedge risks 规避风险inventory 存货current assets 流动资产current liabilities 流动负债financing 筹资corporation 股份公司earning per share(EPS)每股收益exchange rate 汇率inflation 通货膨胀Chapter 3 Risk and Rewardcapital asset pricing model(CAPM)资本资产定价模型diversification 分散化efficient capital market 有效资本市场expected return 期望回报market, systematic, or undiversifiable risk 市场风险、系统风险或不可分散风险portfolio 组合reward 收益,溢酬,溢价risk-aversion 风险厌恶risk-neutrality 风险中性risk preference 风险偏好risk premium 风险溢价security markets line(SML)证券市场线semi-strong capital market efficiency 半强式资本市场有效spread out 分散square root 平方根standard deviation 标准差strong capital market efficiency 强式资本市场有效transaction cost 交易成本unique, firm-specific, idiosyncratic, unsystematic, or diversifiable risk 特殊风险、特有风险、虚假风险、非系统风险或可分散风险variance 方差volatility 波动性weak capital market efficiency 弱式资本市场有效Chapter 4 Financial Assets and Their Valuation asset 资产security 证券issue (股票,钞票)分发,发行coupon rate 票面利率,息面利率annual 每年的,年度的,一年一次的obligate 使(某人)负有责任或义务outstanding 未解决的,未偿付的,杰出的calculate 估计,预测compensation 报酬,工资,补偿物perpetual 永久的,永恒的infinite 无限的,无穷的substitute 替代,取代yield 出产,产,出(果实、利润、结果)approximation 相似,近似trial-and-error 试误法illustrate 说明,阐明entitle 使人有权拥有……liability 负债intrinsic value 内在价值asymmetry 不对称constant 不变的,可靠的phase 阶段,时期preferred stock 优先股Chapter 5 Capital Budgeting and Investment Decision capital budgeting 资本预算estimating net present value 预期净现值the average accounting return 平均会计报酬率stand-alone principle 独立原则the internal rate of return 内部收益率the payback rule 回收期法erosion 侵蚀net working capital 净营运资本opportunity cost 机会成本hard rationing 硬约束soft rationing 软约束sunk cost 沉没成本incremental cash flow 增量现金流量pro forma financial statement 预估财务报表forecasting risk 预测风险scenario analysis 情景分析investment criteria 投资决策标准cash flow 现金流量project cash flow 项目现金流量depreciation 折旧capital spending 资本性支出garbage-in garbage-out system 垃圾进、垃圾出系统best case and worst case 最优情形和最差情形Chapter 6 Working Capital Management working capital 营运资本speculative 投机precautionary 预防的buffer 缓冲器invoice 发票deposit 存款disbursement 支付expenditure 消费trade-off 权衡attorney 代理人applicant 申请人utilization 应用dampen 使沮丧ordering cost 订货成本carrying cost 储存成本raw material 原材料insurance 保险linear 线性的bad-debt 坏账Chapter 7 Financing Mod es debt financing 债务筹资equity financing 权益投资prospectus 招股说明书the general cash offer 普通现金发行the rights offer 配股发行initial public offering(IPO) 首次公开发行underwriting discount 承销折价the subscription price 认购价格collateral 抵押品mortgage securities 抵押债券debenture 信用债券sinking fund 偿债基金call provision 赎回条款call-protected 赎回保护operating leases 经营性租赁financial leases 融资租赁sale and lease-back 售后租回leveraged leases 杠杆租赁warrants 认股权证convertibles 可转换债券call options 看涨期权straight bond value 纯粹债券价值conversion value 转换价值secured loans 抵押贷款committed lines of credit 承诺式信贷额度compensating balances 补偿性余额trust receipt 信托收据Chapter 8 Capital Structure capital structure 资本结构optimal capital structure 最佳资本结构financial leverage 财务杠杆homemade leverage 自制杠杆payoff 回报proceeds 收益financial risk 财务风险interest tax shield 利息税盾direct bankruptcy costs 直接破产成本indirect bankruptcy costs 间接破产成本liquidation 清偿reorganization 重组absolute priority rule 绝对优先原则qualification 限定条件cost of equity 股权成本business risk 经营风险pie model 饼状模型break-even point 收益均衡点indifference point 无差异点Chapter 9 Divid end Distribution dividend irrelevance theory 股利无关理论retained earnings 留存收益capital surplus 资本公积earned surplus 盈余公积legal surplus 法定盈余公积free surplus reserves 任意盈余公积stockholder meeting 股东会declaration date 宣告日holder-of-record date 股权登记日ex-dividend date 除息日stock split 股票分割stock dividend 股票股利stock repurchase 股票回购declaration date 股利宣布日record date 股权登记日regular dividend 正常股利cash dividend 现金股利stock dividend 股票股利stock price appreciation 股价增值open market 公开市场payment date 股利支付日going concern 持续经营。

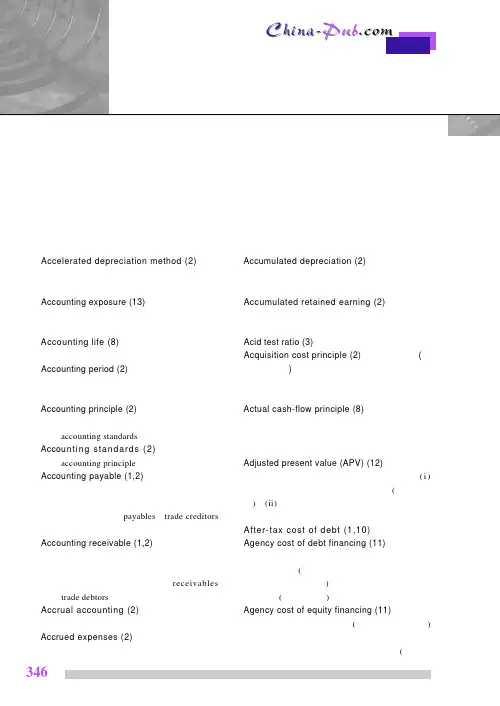

财务管理术语表Absorption costing 吸收成本法:Total Cost Methods全部成本法: 将某会计期间内发生的固定成本除以销售量,得出单位产品的固定成本,再加上单位变动成本,算出单位产品的总成本。

Accounting 会计:对企业活动的财务信息进行测量和综合,从而向股东、经理和员工提供企业活动的信息。

请参看管理会计和财务会计。

Accounting convention会计原则:会计师在会计报表的处理中所遵循的原则或惯例。

正因为有了这些原则,不同企业的会计报表以及同一企业不同时期的会计报表才具有可比性。

如果会计原则在实行中发生了一些变化,那么审计师就应该在年度报表附注中对此进行披露。

Accounts 会计报表和账簿: 这是英国的叫法,在美国,会计报表或财务报表叫做Financial Statements,是指企业对其财务活动的记录。

Chief financial officerAccounts payable应付账款: 这是美国的叫法,在英国,应付账款叫做Creditors,是指公司从供应商处购买货物、但尚未支付的货款。

Accounts receivable 应收账款:这是美国的叫法,在英国,应收账款叫做Debtors,是指客户从公司购买商品或服务,公司已经对其开具发票,但客户尚未支付的货款。

Accrual accounting 权责发生制会计:这种方法在确认收入和费用时,不考虑交易发生时有没有现金流的变化。

比如,公司购买一项机器设备,要等到好几个月才支付现金,但会计师却在购买当时就确认这项费用。

如果不使用权责发生制会计,那么该会计系统称作“收付制”或“现金会计”。

Accumulated depreciation 累计折旧:它显示截止到目前为止的折旧总额。

将资产成本减去累计折旧,所得结果就是账面净值。

Acid test 酸性测试:这是美国的叫法,请参看quick ratio速动比率(英国叫法)。

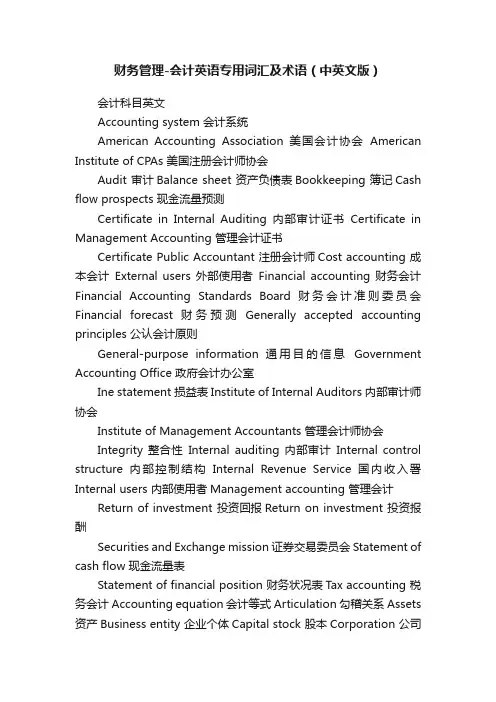

财务管理-会计英语专用词汇及术语(中英文版)会计科目英文Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeeping 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant 注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Ine statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange mission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure disclose 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owner’s equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业 Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders’ equity 股东权益Window dressing 门面粉饰Account 帐户会计英文(中英文对照)一、资产类 Assets流动资产 Current assets货币资金 Cash and cash equivalents1001 现金 Cash1002 银行存款 Cash in bank1009 其他货币资金 Other cash and cash equivalents'100901 外埠存款 Other city Cash in bank'100902 银行本票 Cashier's cheque'100903 银行汇票 Bank draft'100904 信用卡 Credit card'100905 信用证保证金 L/C Guarantee deposits'100906 存出投资款 Refundable deposits1101 短期投资 Short-term investments'110101 股票 Short-term investments - stock'110102 债券 Short-term investments - corporate bonds'110103 基金 Short-term investments - corporate funds'110110 其他 Short-term investments - other1102 短期投资跌价准备 Short-term investments falling price reserves 应收款 Account receivable1111 应收票据 Note receivable银行承兑汇票 Bank acceptance商业承兑汇票 Trade acceptance1121 应收股利 Dividend receivable1122 应收利息 Interest receivable1131 应收账款 Account receivable1133 其他应收款 Other notes receivable1141 坏账准备 Bad debt reserves1151 预付账款 Advance money1161 应收补贴款 Cover deficit by state subsidies of receivable 库存资产 Inventories1201 物资采购 Supplies purchasing1211 原材料 Raw materials1221 包装物 Wrappage1231 低值易耗品 Low-value consumption goods1232 材料成本差异 Materials cost variance1241 自制半成品 Semi-Finished goods1243 库存商品 Finished goods1244 商品进销差价Differences between purchasing and selling price1251 委托加工物资 Work in process - outsourced1261 委托代销商品 Trust to and sell the goods on a mission basis1271 受托代销商品 missioned and sell the goods on a mission basis1281 存货跌价准备 Inventory falling price reserves1291 分期收款发出商品Collect money and send out the goods by stages1301 待摊费用 Deferred and prepaid expenses长期投资 Long-term investment1401 长期股权投资 Long-term investment on stocks'140101 股票投资 Investment on stocks'140102 其他股权投资 Other investment on stocks1402 长期债权投资 Long-term investment on bonds'140201 债券投资 Investment on bonds'140202 其他债权投资 Other investment on bonds1421 长期投资减值准备 Long-term investments depreciation reserves股权投资减值准备Stock rights investment depreciation reserves债权投资减值准备 Bcreditor's rights investment depreciation reserves1431 委托贷款 Entrust loans'143101 本金 Principal'143102 利息 Interest'143103 减值准备 Depreciation reserves固定资产 Fixed assets1501 固定资产 Fixed assets房屋 Building建筑物 Structure机器设备 Machinery equipment运输设备 Transportation facilities工具器具 Instruments and implement1502 累计折旧 Accumulated depreciation1505 固定资产减值准备 Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciationreserves1601 工程物资 Project goods and material'160101 专用材料 Special-purpose material'160102 专用设备 Special-purpose equipment'160103 预付大型设备款 Prepayments for equipment'160104 为生产准备的工具及器具 Preparative instruments and implement for fabricate1603 在建工程 Construction-in-process安装工程 Erection works在安装设备 Erecting equipment-in-process技术改造工程 Technical innovation project大修理工程 General overhaul project1605 在建工程减值准备 Construction-in-process depreciation reserves1701 固定资产清理 Liquidation of fixed assets无形资产 Intangible assets1801 无形资产 Intangible assets专利权 Patents非专利技术 Non-Patents商标权 Trademarks, Trade names著作权 Copyrights土地使用权 Tenure商誉 Goodwill1805 无形资产减值准备Intangible Assets depreciation reserves专利权减值准备 Patent rights depreciation reserves商标权减值准备 trademark rights depreciation reserves1815 未确认融资费用 Unacknowledged financial charges待处理财产损溢 Wait deal assets loss or ine1901 长期待摊费用 Long-term deferred and prepaid expenses1911 待处理财产损溢 Wait deal assets loss or ine'191101待处理流动资产损溢 Wait deal intangible assets loss or ine'191102待处理固定资产损溢 Wait deal fixed assets loss or ine二、负债类 Liability短期负债 Current liability2101 短期借款 Short-term borrowing2111 应付票据 Notes payable银行承兑汇票 Bank acceptance商业承兑汇票 Trade acceptance2121 应付账款 Account payable2131 预收账款 Deposit received2141 代销商品款 Proxy sale goods revenue2151 应付工资 Accrued wages2153 应付福利费 Accrued welfarism2161 应付股利 Dividends payable2171 应交税金 Tax payable'217101 应交增值税 value added tax payable'21710101 进项税额 Withholdings on VAT'21710102 已交税金 Paying tax'21710103 转出未交增值税 Unpaid VAT changeover'21710104 减免税款 Tax deduction'21710105 销项税额 Substituted money on VAT'21710106 出口退税 Tax reimbursement for export'21710107 进项税额转出 Changeover withnoldings on VAT'21710108 出口抵减内销产品应纳税额 Export deduct domestic sales goods tax'21710109 转出多交增值税 Overpaid VAT changeover'21710110 未交增值税 Unpaid VAT'217102 应交营业税 Business tax payable'217103 应交消费税 Consumption tax payable'217104 应交资源税 Resources tax payable'217105 应交所得税 Ine tax payable'217106 应交土地增值税 Increment tax on land value payable '217107 应交城市维护建设税 Tax for maintaining and building cities payable'217108 应交房产税 Housing property tax payable'217109 应交土地使用税 Tenure tax payable'217110 应交车船使用税Vehicle and vessel usage license plate tax(VVULPT)payable'217111 应交个人所得税 Personal ine tax payable2176 其他应交款 Other fund in conformity with paying2181 其他应付款 Other payables2191 预提费用 Drawing expense in advance其他负债 Other liabilities2201 待转资产价值 Pending changerover assets value2211 预计负债 Anticipation liabilities长期负债 Long-term Liabilities2301 长期借款 Long-term loans一年内到期的长期借款 Long-term loans due within one year 一年后到期的长期借款 Long-term loans due over one year2311 应付债券 Bonds payable'231101 债券面值 Face value, Par value'231102 债券溢价 Premium on bonds'231103 债券折价 Discount on bonds'231104 应计利息 Accrued interest2321 长期应付款 Long-term account payable应付融资租赁款 Accrued financial lease outlay一年内到期的长期应付 Long-term account payable due withinone year一年后到期的长期应付Long-term account payable over one year2331 专项应付款 Special payable一年内到期的专项应付 Long-term special payable due within one year一年后到期的专项应付Long-term special payable over one year2341 递延税款 Deferral taxes三、所有者权益类 OWNERS' EQUITY资本 Capita3101 实收资本(或股本) Paid-up capital(or stock)实收资本 Paicl-up capital实收股本 Paid-up stock3103 已归还投资 Investment Returned公积3111 资本公积 Capital reserve'311101 资本(或股本)溢价 Cpital(or Stock) premium'311102 接受捐赠非现金资产准备Receive non-cash donate reserve'311103 股权投资准备 Stock right investment reserves'311105 拨款转入 Allocate sums changeover in'311106 外币资本折算差额 Foreign currency capital'311107 其他资本公积 Other capital reserve3121 盈余公积 Surplus reserves'312101 法定盈余公积 Legal surplus'312102 任意盈余公积 Free surplus reserves'312103 法定公益金 Legal public welfare fund'312104 储备基金 Reserve fund'312105 企业发展基金 Enterprise expansion fund'312106 利润归还投资Profits capitalizad on return of investment利润 Profits3131 本年利润 Current year profits3141 利润分配 Profit distribution'314101 其他转入 Other changeover in'314102 提取法定盈余公积 Withdrawal legal surplus'314103 提取法定公益金Withdrawal legal public welfare funds'314104 提取储备基金 Withdrawal reserve fund'314105 提取企业发展基金Withdrawal reserve for business expansion'314106 提取职工奖励及福利基金Withdrawal staff and workers' bonus and welfarefund'314107 利润归还投资Profits capitalized on return of investment'314108 应付优先股股利 Preferred Stock dividends payable'314109 提取任意盈余公积Withdrawal other mon accumulation fund'314110 应付普通股股利 mon Stock dividends payable'314111 转作资本(或股本)的普通股股利mon Stock dividends change to assets(orstock)'314115 未分配利润 Undistributed profit四、成本类 Cost4101 生产成本 Cost of manufacture'410101 基本生产成本 Base cost of manufacture'410102 辅助生产成本 Auxiliary cost of manufacture4105 制造费用 Manufacturing overhead材料费 Materials管理人员工资 Executive Salaries奖金 Wages退职金 Retirement allowance补贴 Bonus外保劳务费 Outsourcing fee福利费 Employee benefits/welfare会议费 Conference加班餐费 Special duties市内交通费 Business traveling通讯费 Correspondence电话费 Correspondence水电取暖费 Water and Steam税费 Taxes and dues租赁费 Rent管理费 Maintenance车辆维护费 Vehicles maintenance油料费 Vehicles maintenance培训费 Education and training接待费 Entertainment图书、印刷费 Books and printing运费 Transportation保险费 Insurance premium支付手续费 mission杂费 Sundry charges折旧费 Depreciation expense机物料消耗 Article of consumption劳动保护费 Labor protection fees季节性停工损失 Loss on seasonality cessation 4107 劳务成本 Service costs五、损益类 Profit and loss收入 Ine业务收入 OPERATING INE5101 主营业务收入 Prime operating revenue产品销售收入 Sales revenue服务收入 Service revenue5102 其他业务收入 Other operating revenue材料销售 Sales materials代购代售包装物出租 Wrappage lease出让资产使用权收入 Remise right of assets revenue返还所得税 Reimbursement of ine tax其他收入 Other revenue5201 投资收益 Investment ine短期投资收益 Current investment ine长期投资收益 Long-term investment ine计提的委托贷款减值准备 Withdrawal of entrust loans reserves 5203 补贴收入 Subsidize revenue国家扶持补贴收入 Subsidize revenue from country其他补贴收入 Other subsidize revenue5301 营业外收入 NON-OPERATING INE非货币性交易收益 Non-cash deal ine现金溢余 Cash overage处置固定资产净收益 Net ine on disposal of fixed assets出售无形资产收益 Ine on sales of intangible assets固定资产盘盈 Fixed assets inventory profit罚款净收入 Net amercement ine支出 Outlay业务支出 Revenue charges5401 主营业务成本 Operating costs产品销售成本 Cost of goods sold服务成本 Cost of service5402 主营业务税金及附加 Tax and associate charge营业税 Sales tax消费税 Consumption tax城市维护建设税 Tax for maintaining and building cities 资源税 Resources tax土地增值税 Increment tax on land value5405 其他业务支出 Other business expense销售其他材料成本 Other cost of material sale其他劳务成本 Other cost of service其他业务税金及附加费 Other tax and associate charge 费用 Expenses5501 营业费用 Operating expenses代销手续费 Consignment mission charge运杂费 Transpotation保险费 Insurance premium展览费 Exhibition fees广告费 Advertising fees5502 管理费用 Administrative expenses职工工资 Staff Salaries修理费 Repair charge低值易耗摊销 Article of consumption办公费 Office allowance差旅费 Travelling expense工会经费 Labour union expenditure研究与开发费 Research and development expense福利费 Employee benefits/welfare职工教育经费 Personnel education待业保险费 Unemployment insurance劳动保险费 Labour insurance医疗保险费 Medical insurance会议费 Coferemce聘请中介机构费 Intermediary organs咨询费 Consult fees诉讼费 Legal cost业务招待费 Business entertainment技术转让费 Technology transfer fees矿产资源补偿费 Mineral resources pensation fees排污费 Pollution discharge fees房产税 Housing property tax车船使用税 Vehicle and vessel usage license plate tax(VVULPT) 土地使用税 Tenure tax印花税 Stamp tax5503 财务费用 Finance charge利息支出 Interest exchange汇兑损失 Foreign exchange loss各项手续费 Charge for trouble各项专门借款费用 Special-borrowing cost5601 营业外支出 Nonbusiness expenditure捐赠支出 Donation outlay减值准备金 Depreciation reserves非常损失 Extraordinary loss处理固定资产净损失 Net loss on disposal of fixed assets出售无形资产损失 Loss on sales of intangible assets固定资产盘亏 Fixed assets inventory loss债务重组损失 Loss on arrangement罚款支出 Amercement outlay5701 所得税 Ine tax以前年度损益调整 Prior year ine adjustment专业术语consistency 一贯性substance over form 实质重于形式materiality 重要性prudence 谨慎性current asset 流动资产non-current asset 非流动资产round it up, round it down 四舍五入contingent liability 或有负债creditor 债权人rendering of service 提供劳务royalties 版税bonus share 分红股redempte share 赎回股份debenture 债券credit 贷方depreciation 折旧residual value 剩余价值accounting treatment 会计处理accrual concept 权责发生制概念net book value 账面净值straight line method 直线法carrying amount 资产净值(资产-累计折旧-减值)rule of thumb 经验法contribution margin 边际贡献deferred ine 递延收入finance lease 融资租赁cash equivalents 现金等价物operating lease 经营租赁capital appreciation 资本增值amortization 分摊incremental budget 增量预算zero based budget 零基预算continuous budget 滚动预算deferred tax 递延税款permanent difference 永久性差异timing difference 时间性差异flow through method 应付税款法events after balance sheet date 资产负债表日后事项return on investment (ROI) 投资回报率profit before interest and tax 息税前利润profit margin 利润率retrospective application 追溯调整法prospective application 未来适用法英文会计报表利润表INE STATEMENT 项目ITEMS 产品销售收入Sales of products其中:出口产品销售收入Including:Export sales 减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products 减:产品销售税金Less:Sales tax产品销售成本Cost of sales 其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales 减:销售费用Less:Selling expenses管理费用General and administrative expenses 财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minus interest ine)汇兑损失(减汇兑收益) Exchange losses(minus exchange gains)产品销售利润Profit on sales 加:其他业务利润Add:profit from other operations营业利润Operating profit 加:投资收益Add:Ine on investment加:营业外收入Add:Non-operating ine 减:营业外支出Less:Non-operating expenses 加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit 减:所得税Less:Ine tax 净利润Net profit 资产负债表 BALANCE SHEET资产ASSETS 流动资产CURRENT ASSETS 现金Cash on hand 备用金Pretty cash银行存款Cash in banks 有价证券Marketable receivable 应收票据Notes receivable应收帐款Accounts receivable 减:坏帐准备Less:allowance for bad debts 预付货款Prepayments-supplies内部往来Inter-pany accounts 其他应收款Other receivables 待摊费用Prepaid and deferred expenses存货Inventories 减:存货变现损失准备: Less:allowance on inventory reduction to market已转未完工生产成本Transferred in production cost transforming一年内到期的长期投资Matured long time investments within a year流动资产合计Total current assets 长期投资:LONG TERM INVESTMENT长期投资Long term investments拨付所属资金Funds to burnchs一年以上的应收款项Accounts receivable over a year 固定资产:FIXED ASSETS固定资产原价Fixed assets-cost 减:累计折旧Less:accumulated depreciation固定资产净值Fixed assets-net value 固定资产清理Disposal of fixed assets融资租入固定资产原价:Fixed assets-cost on financial lease减:融资租入固定资产折旧Less:accumulated depreciation 融资租入固定资产净值:Fixed assets-net value on financial lease在建工程:CONSTRUCTION WORK IN PROCESS 无形资产INTANGIBLE ASSETS场地使用权Right to the use of a site 工业产权及专有技术Industrial property right and patents其他无形资产Other intangibles 无形资产合计T otal intangible assets其它资产OTHER ASSETS 开办费Organization expenses 递延投资损失Deferred investment筹建期间汇兑损失Exchange losses during organization period losses递延税款借项Debit side of deferred tax 其他递延支出Other deferred expenditures待转销汇兑损益Prepaid and deferred exchange loss 其他递延借款Debit side of other deferred其他资产合计Total other Assets 资产总计TOTAL ASSETS负债及所有者权LIABILITIES AND CAPITAL 流动负债:CURRENT LIABILITIES短期借款Short term loans 应付票据Notes payable 应付帐款Accounts payable内部往来Inter-pany accounts 预收货款Items received in advance-supplies应付工资Accrued payroll 应交税金T axes payable 应付股利Dividends payable其他应付款Other payables 预提费用Accrued expenses职工奖励及福利费用Bonus and welfare funds一年内到期的长期负债Matured long term liabilities within a year其他流动负债Other current liabilities 流动负债合计Total current liabilities长期负债:LONG TERM LIABILITIES 长期借款long term loans 应付公司债Bonds payable 应公司债溢价(折价)Premium on bonds payable(discount)一年以上的应付款项Accounts payable over a year 长期负债合计:Total long term liabilities其他负债:OTHER LIABILITIES 筹建期间汇兑收益Exchange gains during organization period 递延投资收益Deferred investment gains 递延税款贷项Credit side of deferred tax 其他递延贷项Credit side of other tax 待转销汇兑收益Prepaid and deferred exchange profit其他负债合计Total other liabilities 负债合计T otal liabilities 所有者权益Investor’s equity委托加工材料Materials processed on mission受托代销商品Goods in consignment代管商品物资Good held in our custos 本年支付的进口环节税金Import tax paid this year由企业负责的应收票据贴现Contingent Liability incurred by discounted notes receivable租入固定资产Leasehold fixed assets应付帐款 Trade creditors 应收票据 Notes receivable 预收帐款Advances from customers应收股利Dividends receivable 代销商品款Consignment-in payables 应收利息 Interest receivable 应付工资 Payroll payable 应收帐款 Trade debtors 应付福利费 Welfare payable其他应收款 Other debtors 应付股利 Proposed dividends 坏帐准备 Provision for doubtful debts 应付短期债券 Short-term bonds payable 预付帐款 Prepayment 应交税金 Tax payable应收补贴款 Allowance receivable 其他应交款 Other payable to government待摊费用 Prepaid expenses 其他应付款 Other creditors待处理流动资产损益 Unsettled G/L on current assets 预提费用Accrued expenses存货 Inventories 一年内到期长期负债 Long term liabilities due within one year存货跌价准备Provision for obsolete stocks 其他流动负债Other current liability其他流动资产Other current 流动负债合计TOTAL CURRENT LIABILITIES流动资产合计TOTAL CURRENT ASSETS 长期股权投资Long term equity investment 应付债券Bonds payable 长期债券投资Long term securities investment长期应付款 Long term payable 长期投资减值准备 Provision for long-term investment 住房周转金Housing fund 其他长期负债Other long term liabilities长期投资合计 TOTAL LONG-TERM INVESTMENT长期负债合计 TOTAL LONG-TERM LIABILITIES 固定资产 Fixed assets累计折旧Accumulated depreciation 递延税款Deferred taxation 工程物资 Project material在建工程Construction in progress 其他负债合计TOTAL OTHER LIABILITIES固定资产减值准备Imparement 待处理固定资产损益Unsettled G/L on fixed assets负债合计TOTAL LIABILITIES 固定资产合计TOTAL FIXEDASSETS股本 Share capital资本公积 Capital surplus 无形资产 Intangible assets 盈余公积Surplus reserves开办费Pre-operating expenses 期初未分配利润Retained earnings, beginning of the year长期待摊费用Deferred assets 本年净利润NET INE FOR THE YEAR其他长期资产Other long term assets 所有者权益合计TOTAL EQUITIES无形及其他资产合计 TOTAL INTANGIBLE AND ASSETS 资产总计TOTAL ASSETS 负债及所有者权益总计TOTAL LIABILITIES AND EQUITY。

Topic1:决策:decision-making上市公司:publicly-traded corporations波动、变化的:volatility资本预算:capital budgeting流动负债:current liability产生、繁殖:beget /breed职员:personnel稀释:dilute观念、想法:notion总裁、首席执行官:CEO chief executive officer 发行股票:stock offeringTopic2:拒绝:rebuff整合、调整:align缺点:drawback起诉:sue失职、玩忽职守:malpractice度量、尺寸:dimension学术论文:dissertation先决条件:prerequisite征用、没收:expropriate分歧、差异:divergence奢华的:lavish控股公司:closely held corporation社会福利:social good个人独资企业:sole proprietorship要约收购:tender offer委托-代理关系(代理关系):principal-agent/agency relationship 股票期权:stock optionsTopic5:本能的、固有的:instinctive先付年金:annuity due吸引人:appealing关于、涉及:pertain to剧烈的、敏锐的:acutely或有要求权股价:contingent claim valuation到期、期满:expire诱惑:enticement偿债基金条款:a sinking fund provision遵守:comply信用债券:debenture年金终值系数:future value interest factor for annuities年金现值系数:present value interest factor for annuitiesTopic6:忽视:disregard概率分布函数:probability distribution function参数:parameter对称的:symmetrical无弹性的:inelastic察觉:discern引起、引发:trigger合理性、可信性:plausibility贝塔系数(β系数):beta coefficient价格接受者:price taker期后盈余披露:post-earnings announcement drift均值方差有效边际:mean-variance efficient frontiers 套利定价理论(APT):arbitrage pricing theoryTopic7:验证、使有效:validate互不相容的项目:mutually exclusive projects阻止、排除:preclude放弃:forgo制造费用:overhead残余价值:residual value折现回收期:discounted payback period 倾向于:incline to资本限额:capital rationing出错:go awryTopic8:开始进行、继续下去:proceed to收益:proceeds放下、寄存:deposit存款:deposits禁止、阻止:prohibit特权、优先增股权:privilege赋予、赠予:confer期货合约:future contract足够的、充分的:sufficient不愿意:reluctance获得、导出:derive from包销:underwriting随后的、接着发生的:subsequent激励性股票期权:incentive stock option 优先权:preemptive right可转债:convertible debt构成:constituteTopic9:摩擦:friction混合证券:hybrid security风险资本:venture capital认股权证:warrant类期权证券:option-like security 融资租赁:capital lease经营杠杆:operating leverage津贴:subsidy刺激的:provocative。

1.1、the financial manager plays a dynamic role in a modern company's development. this has not always been the case. until around the first half of the 1900s financial managers primarily raised funds and managed their firms' cash positions-and that was pretty much it. in the 1950s, the increasing acceptance of present value concepts encouraged financial managers to expand their responsibilities and to become concerned with the selection of capital investment projects.财务经理的能动作用,在现代公司的发展。

这并非总是如此。

直到1900财务经理上半年各地主要募集资金和管理他们公司的现金头寸,这是差不多了。

在20世纪50年代,目前的价值观念越来越多地接受,鼓励财务经理去扩大自己的责任,并涉及资本投资项目的选择。

1.2、T oday, external factors have an increasing impact on the financial manager. Heightened corporate competition, technological change, volatility in inflation and interest rates, worldwide economic uncertainty, fluctuating exchange rates, tax law changes, and ethical concerns over certain financial dealings must be dealt with almost daily. As a result, finance is required to play an ever more vital strategic role within the corporation. The financial manager has emerged as a team player in the overall effort of a company to create value. The “old ways of doing things” simply are not good enough in the world where old ways quickly become obsolete. Thus, today’s financial mana ger must have the flexibility to adapt to the changing external environment if his or her firm is to survive.如今,外部因素对财务经理的影响越来越大。

财务管理英语词汇Financial Management Glossary[ A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X| Y | Z ]AABC存货制度:ABC inventory system Inventory management technique that divides inventory into three groups--A, B, and C, in descending order of importance and level of monitoring, on the basis of the dollar investment in each.偿债能力:Ability to service debts The ability of a firm to make the payments required on a scheduled basis over the life of a debt.同意或否决的方法:Accept-reject Approach The evaluation of capital expenditure proposals to determine whether they meet the firm's minimum acceptance criterion.会计风险:Accounting exposure The risk resulting from the effects of changes in foreign exchange rates on the translated value of a firm's financial statement accounts denominated in a given foreign currency.应付账款管理:Accounts payable management: Management by the firm of the time that elapses between its purchase of raw materials and its mailing payment to the supplier.权责发生制会计:Accrual basis In preparation of financial statements, recognizes revenue at the time of sale and recognizes expenses when they are incurred.应计的费用:Accruals Liabilities for services received for which payment has yet to be made.由自动清算所执行的自动转账:ACH (automated clearinghouse) transfer Preauthorized electronic withdrawal from the payer's account and deposit into the payee's account via a settlement among banks by the automated clearinghouse, or ACH.收购公司:Acquiring company: The firm in a merger transaction that attempts to acquire another firm.经营比率:Activity ratios: Measure the speed with which various accounts are converted into sales or cash--inflows or outflows.代理成本:Agency costs: The costs borne by stockholders to minimize agency problems.积极的筹资战略:Aggressive funding strategy: A funding strategy under which the firm funds its seasonal requirements with short-term debt and its permanent requirements with long-term debt.应收账款账龄分析:Aging of accounts receivable: A credit-monitoring technique that uses a schedule that indicates the percentages of the total accounts receivable balance that have been outstanding for specified periods of time.美国总统证劵托存收据:American depositary receipts (ADRs) : Claims issued by U.S. banks representing ownership of shares of a foreign company's stock held on deposit by the U.S. bank in the foreign market and issued in dollars to U.S. investors.天使资本家: Angel capitalists (angels) : Wealthy individual investors who do not operate as a business but invest in promising early-stage companies in exchange for a portion of the firm's equity.每年债务清理: Annual cleanup: The requirement that for a certain number of days during the year borrowers under a line of credit carry a zero loan balance (that is, owe the bank nothing).年利率: Annual percentage rate (APR) : The nominal annual rate of interest, found by multiplying the periodic rate by the number of periods in 1 year, that must be disclosed to consumers on credit cards and loans as a result of "truth-in-lending laws."年收益率:Annual percentage yield (APY) : The effective annual rate of interest that must be disclosed to consumers by banks on their savings products as a result of "truth-in-savings laws."按年度计算的净现值法:Annualized net present value (ANPV) approach: An approach to evaluating unequal-lived projects that converts the net present value of unequal-lived, mutually exclusive projects into an equivalent annual amount (in NPV terms).年金:Annuity: A stream of equal periodic cash flows, over a specified time period. These cash flows can be inflows of returns earned on investments or outflows of funds invested to earn future returns.即付年金Annuity due: An annuity for which the cash flow occurs at the beginning of each period.合伙契约:Articles of partnership: The written contract used to formally establish a business partnership.转让: Assignment: A voluntary liquidation procedure by which a firm's creditors pass the power to liquidate the firm's assets to an adjustment bureau, a trade association, or a third party, which is designated the assignee.信息不对称: Asymmetric information: The situation in which managers of a firm have more information about operations and future prospects than do investors.授权股份: Authorized shares: The number of shares of common stock that a firm's corporate charter allows it to issue.存货的平均周转期:Average age of inventory: Average number of days' sales in inventory.应收账款的平均收款期: Average collection period: The average amount of time needed to collect accounts receivable.应付账款平均付款期: Average payment period: The average amount of time needed to pay accounts payable.平均税率: Average tax rate: A firm's taxes divided by its taxable income.B资产负债表: Balance sheet: Summary statement of the firm's financial position at a given point in time.破产清算:Bankruptcy: Business failure that occurs when the stated value of a firm's liabilities exceeds the fair market value of its assets.图表法:B ar chart: The simplest type of probability distribution; shows only a limited number of outcomes and associated probabilities for a given event.每股基本盈利: Basic EPS: Earnings per share (EPS) calculated without regard to any contingent securities.基准: Benchmarking: A type of cross-sectional analysis in which the firm's ratio values are compared to those of a key competitor or group of competitors that it wishes to emulate.贝塔系数:Beta coefficient (b): A relative measure of non-diversifiable risk. An index of the degree of movement of an asset's return in response to a change in the market return.一鸟在手理论:Bird-in-the-hand argument: The belief, in support of dividend relevance theory, that investors see current dividends as less risky than future dividends or capital gains.董事会: Board of directors: Group elected by the firm's stockholders and having ultimate authority to guide corporate affairs and make general policy.债券: Bond: Long-term debt instrument used by business and government to raise large sums of money, generally from a diverse group of lenders.债券契约: Bond indenture: A legal document that specifies both the rights of the bondholders and the duties of the issuing corporation.账面价值: Book value: The strict accounting value of an asset, calculated by subtracting its accumulated depreciation from its installed cost.每股账面价值: Book value per share: The amount per share of common stock that would be received if all of the firm's assets were sold for their exact book (accounting) value and the proceeds remaining after paying all liabilities (including preferred stock) were divided among the common stockholders.账面价值加权:Book value weights: Weights that use accounting values to measure the proportion of each type of capital in the firm's financial structure.盈亏临界点分析: Breakeven analysis: Indicates the level of operations necessary to cover all operating costs and the profitability associated with various levels of sales.盈亏临界点现金流量:Breakeven- cash- inflow: The minimum level of cash inflow necessary for a project to be acceptable, that is, NPV > $0.盈亏临界点:Break point: The level of total new financing at which the cost of one of the financing components rises, thereby causing an upward shift in the weighted marginal cost of capital (WMCC).商业风险: Business risk: The risk to the firm of being unable to cover operating costs.C看涨期权: Call option: An option to purchase a specified number of shares of a stock (typically 100) on or before a specified future date at a stated price.提前赎回溢价:Call premium: The amount by which a bond's call price exceeds its par value.赎回价格Call price: The stated price at which a bond may be repurchased, by use of a call feature, prior to maturity.资本:Capital: The long-term funds of a firm; all items on the right-hand side of the firm's balance sheet, excluding current liabilities.资本定价模型:Capital asset pricing model (CAPM) : Describes the relationship between the required return, k s, and the non-diversifiable risk of the firm as measured by the beta coefficient, b.资本预算:Capital budgeting: The process of evaluating and selecting long-term investments that are consistent with the firm's goal of maximizing owner wealth.资本预算过程: Capital budgeting process: Five distinct but interrelated steps: proposal generation, review and analysis, decision- making, implementation, and follow-up.资本性支出:Capital expenditure: An outlay of funds by the firm that is expected to produce benefits over a period of time greater than 1 year.资本收益:C apital gain: The amount by which the sale price of an asset exceeds the asset's initial purchase price.资本市场:Capital market: A market that enables suppliers and demanders of long-term funds to make transactions.资本配额:Capital rationing: The financial situation in which a firm has only a fixed number of dollars available for capital expenditures, and numerous projects compete for these dollars.资本结构:Capital structure: The mix of long-term debt and equity maintained by the firm.资本化租赁: Capitalized lease: A financial (capital) lease that has the present value of all its payments included as an asset and corresponding liability on the firm's balance sheet, as required by Financial Accounting Standards Board (FASB) Standard No. 13. 经营成本: Carrying costs: The variable costs per unit of holding an item in inventory for a specific period of time.收付实现制:Cash basis: Recognizes revenues and expenses only with respect to actual inflows and outflows of cash.现金分红:Cash bonuses: Cash paid to management for achieving certain performance goals.现金预算: Cash budget (cash forecast) : A statement of the firm's planned inflows and outflows of cash that is used to estimate its short-term cash requirements.现金管理中心:Cash concentration: The process used by the firm to bring lockbox and other deposits together into one bank, often called the concentration bank.现金转换周期:C ash conversion cycle (CCC): The amount of time a firm's resources are tied up; calculated by subtracting the average payment period from the operating cycle.现金付款: Cash disbursements: All outlays of cash by the firm during a given financial period.现金折扣: Cash discount: A percentage deduction from the purchase price; available to the credit customer who pays its account within a specified time.现金折扣期: Cash discount period: The number of days after the beginning of the credit period during which the cash discount is available.现金收益: Cash receipts: All of a firm's inflows of cash in a given financial period. 自由浮动:Clearing float: The time between deposit of a payment and when spendable funds become available to the firm.变异系数: Coefficient of variation (CV) : A measure of relative dispersion that is useful in comparing the risks of assets with differing expected returns.商业金融公司: Commercial finance companies: Lending institutions that make only secured loans--both short-term and long-term--to businesses.商业票据: Commercial paper: A form of financing consisting of short-term, unsecured promissory notes issued by firms with a high credit standing.普通股Common stock: The purest and most basic form of corporate ownership. 垂直/同型损益表:Common-size income statement: An income statement in which each item is expressed as a percentage of sales.复利: Compound interest: Interest that is earned on a given deposit and has become part of the principal at the end of a specified period.保守的筹资战略:Conservative funding strategy: A funding strategy under which the firm funds both its seasonal and its permanent requirements with long-term debt.合并:Consolidation: The combination of two or more firms to form a completely new corporation.)连续复利:Continuous compounding: Compounding of interest an infinite number of times per year at intervals of microseconds.连续概率分布:Continuous probability distribution: A probability distribution showing all the possible outcomes and associated probabilities for a given event.控制拨付: Controlled disbursing: The strategic use of mailing points and bank accounts to lengthen mail float and clearing float, respectively.总会计师:Controller: The firm's chief accountant, who is responsible for thefirm's accounting activities, such as corporate accounting, tax management, financial accounting, and cost accounting.传统的现金流模式: Conventional cash flow pattern: An initial outflow followed only by a series of inflows.可转换股票价值: Conversion (or stock) value: The value of a convertible security measured in terms of the market price of the common stock into which it can be converted.转换价格: Conversion price: The per-share price that is effectively paid for common stock as the result of conversion of a convertible security.换股比率:Conversion ratio: The ratio at which a convertible security can be exchanged for common stock.可转换债劵:Convertible bond: A bond that can be changed into a specified number of shares of common stock.可转换优先股:Convertible preferred stock: Preferred stock that can be changed into a specified number of shares of common stock.企业债券: Corporate bond: A long-term debt instrument indicating that a corporation has borrowed a certain amount of money and promises to repay it in the future under clearly defined terms.企业重组: Corporate restructuring: The activities involving expansion or contraction of a firm's operations or changes in its asset or financial (ownership) structure. 企业:Corporation: An artificial being created by law (often called a "legal entity"). 相关:C orrelation: A statistical measure of the relationship between any two series of numbers representing data of any kind.相关系数: Correlation coefficient: A measure of the degree of correlation between two series.资本成本:Cost of capital: The rate of return that a firm must earn on the projects in which it invests to maintain its market value and attract funds.普通股股票成本:Cost of common stock equity, k s: The rate at which investors discount the expected dividends of the firm to determine its share value.长期债务成本:Cost of long-term debt, k i: The after-tax cost today of raising long-term funds through borrowing.发行新的普通股成本:Cost of a new issue of common stock, k n: The cost of common stock, net of under-pricing and associated flotation costs.优先股成本:Cost of preferred stock, k p: The ratio of the preferred stock dividend to the firm's net proceeds from the sale of preferred stock; calculated by dividing the annual dividend, D p, by the net proceeds from the sale of the preferred stock, N p.留存收益成本:Cost of retained earnings, k r: The same as the cost of an equivalent fully subscribed issue of additional common stock, which is equal tothe cost of common stock equity, k s.债券利率:Coupon interest rate: The percentage of a bond's par value that will be paid annually, typically in two equal semiannual payments, as interest.偿债保障比率:Coverage ratios: Ratios that measure the firm's ability to pay certain fixed charges.信贷监控: Credit monitoring: The ongoing review of a firm's accounts receivable to determine whether customers are paying according to the stated credit terms.信用期: Credit period: The number of days after the beginning of the credit perioduntil full payment of the account is due.信用评分: Credit scoring: A credit selection method commonly used with high-volume/small-dollar credit requests; relies on a credit score determined by applying statistically derived weights to a credit applicant's scores on key financial and credit characteristics. (Chapter 14)信用标准:Credit standards: The firm's minimum requirements for extending credit to a customer.信贷条件: Credit terms: The terms of sale for customers who have been extended credit by the firm.债权人控制: Creditor control: An arrangement in which the creditor committee replaces the firm's operating management and operates the firm until all claims have been settled.横向比较分析:Cross-sectional analysis: Comparison of different firms' financial ratios at the same point in time; involves comparing the firm's ratios to those of other firms in its industry or to industry averages累计优先股:Cumulative preferred stock: Preferred stock for which all passed (unpaid) dividends in arrears, along with the current dividend, must be paid before dividends can be paid to common stockholders.流动资产:Current assets: Short-term assets, expected to be converted into cash within 1 year or less.流动负债:Current liabilities: Short-term liabilities, expected to be paid within 1 year or less.现行汇率法:Current rate (translation) method: Technique used by U.S.-based companies to translate their foreign-currency-denominated assets and liabilities into dollars, for consolidation with the parent company's financial statements, using the exchange rate prevailing at the fiscal year ending date (the current rate).流动比率:Current ratio: A measure of liquidity calculated by dividing the firm's current assets by its current liabilities.D债务资本: Debt capital: All long-term borrowing incurred by a firm, including bonds.资产负债率:Debt ratio: Measures the proportion of total assets financed by the firm's creditors.拥有资产所有权的债权人:Debtor in possession (DIP) : The term for a firm that files a reorganization petition and then develops, if feasible, a reorganization plan. 财务杠杆作用程度:Degree of financial leverage (DFL) : The numerical measure of the firm's financial leverage.负债程度:Degree of indebtedness: Measures the amount of debt relative to other significant balance sheet amounts.经营杠杆作用程度:Degree of operating leverage (DOL) : The numerical measure of the firm's operating leverage.全部杠杆作用程度:Degree of total leverage (DTL) : The numerical measure of the firm's total leverage.折旧年限:Depreciable life: Time period over which an asset is depreciated.折旧:Depreciation: The systematic charging of a portion of the costs of fixed assets against annual revenues over time.衍生金融证劵:Derivative security: A security that is neither debt nor equity but derives its value from an underlying asset that is often another security; called "derivatives," for short.稀释的每股盈利:Diluted EPS: Earnings per share (EPS) calculated under the assumption that all contingent securities that would have dilutive effects are converted and exercised and are therefore common stock.稀释股权:Dilution of ownership: Occurs when a new stock issue results in each present shareholder having a claim on a smaller part of the firm's earnings than previously.直接租赁:Direct lease: A lease under which a lessor owns or acquires the assets that are leased to a given lessee.贴现:Discount: The amount by which a bond sells at a value that is less than its par value.贴息贷款:Discount loans: Loans on which interest is paid in advance by being deducted from the amount borrowed.贴现现金流量: Discounting cash flows: The process of finding present values; the inverse of compounding interest.可分散的风险:Diversifiable risk: The portion of an asset's risk that is attributable to firm-specific, random causes; can be eliminated through diversification. Also called unsystematic risk.Divestiture: The selling of some of a firm's assets for various strategic reasons.股利无关论:Dividend irrelevance theory: Miller and Modigliani's theory that in a perfect world, the firm's value is determined solely by the earning power and risk of its assets (investments) and that the manner in which it splits its earnings stream between dividends and internally retained (and reinvested) funds does not affect this value.股利支付率:Dividend payout ratio: Indicates the percentage of each dollar earned that is distributed to the owners in the form of cash. It is calculated by dividing the firm's cash dividend per share by its earnings per share.每股股息:Dividend per share (DPS) : The dollar amount of cash distributed during the period on behalf of each outstanding share of common stock.股利政策: Dividend policy: The firm's plan of action to be followed whenever a dividend decision is made.股利再投资计划:Dividend reinvestment plans (DRIPs) : Plans that enable stockholders to use dividends received on the firm's stock to acquire additional shares--even fractional shares--at little or no transaction cost.股利相关论:D ividend relevance theory: The theory, advanced by Gordon and Lintner, that there is a direct relationship between a firm's dividend policy and its market value.股利: Dividends: Periodic distributions of earnings to the stockholders of a firm. 双重征税: Double taxation: Occurs when the already once-taxed earnings of a corporation are distributed as cash dividends to stockholders, who must pay taxes on them.杜邦公式: DuPont formula: Multiplies the firm's net profit margin by its total asset turnover to calculate the firm's return on total assets (ROA).杜邦分析体系: DuPont system of analysis: System used to dissect the firm's financial statements and to assess its financial condition.E每股盈利:Earnings per share (EPS) : The amount earned during the period on behalf of each outstanding share of common stock, calculated by dividing the period's total earnings available for the firm's common stockholders by the number of shares of common stock outstanding.息税前利润与每股收益分析方法:EBIT-EPS approach: An approach for selecting the capital structure that maximizes earnings per share (EPS) over the expected range of earnings before interest and taxes (EBIT).经济风险:Economic exposure: The risk resulting from the effects of changesin foreign exchange rates on the firm's value.经济订货量(批量)模型: Economic order quantity (EOQ) model: Inventory management technique for determining an item's optimal order size, which is the size that minimizes the total of its order costs and carrying costs.经济增加值:Economic value added (EVA®): A popular measure used by many firms to determine whether an investment contributes positively to the owners' wealth; calculated by subtracting the cost of funds used to finance an investment from its after-tax operating profits.有效(真实)年率:Effective (true) annual rate (EAR) : The annual rate of interest actually paid or earned.实际利率: Effective interest rate: In the international context, the rate equal to the nominal rate plus (or minus) any forecast appreciation (or depreciation) of a foreign currency relative to the currency of the MNC parent.有效市场: Efficient market: A market that allocates funds to their most productive uses as a result of competition among wealth-maximizing investors that determines and publicizes prices that are believed to be close to their true value; a market with the following characteristics: many small investors, all having the same information and expectations with respect to securities; no restrictions on investment, no taxes, and no transaction costs; and rational investors, who view securities similarly and are risk-averse, preferring higher returns and lower risk.有效市场假设:Efficient-market hypothesis: Theory describing the behavior of an assumed "perfect" market in which (1) securities are typically in equilibrium, (2) security prices fully reflect all public information available and react swiftly to new information, and, (3) because stocks are fairly priced, investors need not waste time looking for mis-priced securities.有效组合:Efficient portfolio: A portfolio that maximizes return for a given level of risk or minimizes risk for a given level of return.期末现金Ending cash: The sum of the firm's beginning cash and its net cash flow for the period.股本:Equity capital: The long-term funds provided by the firm's owners, the stockholders.职业道德:Ethics: Standards of conduct or moral judgment.欧元Euro: A single currency adopted on January 1, 1999 by 12 of the 15 EU nations, who switched to a single set of euro bills and coins on January 1, 2002.欧洲债券:Eurobond: An international bond that is sold primarily in countries other than the country of the currency in which the issue is denominated.欧洲债券市场:Eurobond market: The market in which corporations and governments typically issue bonds denominated in dollars and sell them to investors located outside the United States.欧元市场:Eurocurrency market: International equivalent of the domestic money market.欧洲货币市场: Eurocurrency markets: The portion of the Euro-market that provides short-term, foreign-currency financing to subsidiaries of MNCs.欧洲股市:Euro-equity market: The capital market around the world that deals in international equity issues; London has become the center of Euro-equity activity. 欧洲资本市场:Euro-market: The international financial market that provides for borrowing and lending currencies outside their country of origin.欧洲开放市场:European Open Market: The transformation of the European Union into a single market at year-end 1992.欧洲共同体:European Union (EU) : A significant economic force currently made up of 15 nations that permit free trade within the union.除息股利日:Ex dividend: Period, beginning 2 business days prior to the date of record, during which a stock is sold without the right to receive the current dividend.过剩的现金余额:Excess cash balance: The (excess) amount available for investment by the firm if the period's ending cash is greater than the desired minimum cash balance; assumed to be invested in marketable securities.超额累积收益税: Excess earnings accumulation tax: The tax the IRS levies on retained earnings above $250,000 when it determines that the firm hasaccumulated an excess of earnings to allow owners to delay paying ordinary income taxes on dividends received.汇率风险:Exchange rate risk: The danger that an unexpected change in the exchange rate between the dollar and the currency in which a project's cash flows are denominated will reduce the market value of that project's cash flow; the risk caused by varying exchange rates between two currencies.认购(或期权)价格:Exercise (or option) price: The price at which holders of warrants can purchase a specified number of shares of common stock.期望理论:Expectations theory: The theory that the yield curve reflects investor expectations about future interest rates; an increasing inflation expectation results in an upward-sloping yield curve, and a decreasing inflation expectation results in a downward-sloping yield curve .预期回报率: E xpected return, ˆ [[kbar]]: The return that is expected to be earned on a given asset each period over an infinite time horizon.预期回报价值: Expected value of a return (k w) : The most likely return on a given asset.延期支付:Extension: An arrangement whereby the firm's creditors receive payment in full, although not immediately.外部融资需要:External financing required ("plug" figure) : Under the judgmental approach for developing a pro forma balance sheet, the amount of external financing needed to bring the statement into balance.外界预测: External forecast: A sales forecast based on the relationships observed between the firm's sales and certain key external economic indicators.额外红利:Extra dividend: An additional dividend optionally paid by the firm if earnings are higher than normal in a given period.F代理商:Factor: A financial institution that specializes in purchasing accounts receivable from businesses.应收账款让售:Factoring accounts receivable: The outright sale of accounts receivable at a discount to a factor or other financial institution.联邦基金:Federal funds: Loan transactions between commercial banks in which the Federal Reserve banks become involved.理财:Finance: The art and science of managing money.资金租赁:financial (or capital) lease: A longer-term lease than an operating lease that is noncancelable and obligates the lessee to make payments for the use of an asset over a predefined period of time; the total payments over the term of the lease are greater than the lessor's initial cost of the leased asset.财务会计准则委员会:Financial Accounting Standards Board (FASB) : The accounting profession's rule-setting body, which authorizes generally accepted accounting principles (GAAP).盈亏临界点:Financial breakeven point: The level of EBIT necessary to just cover all fixed financial costs; the level of EBIT for which EPS = $0.金融机构: Financial institution: An intermediary that channels the savings of individuals, businesses, and governments into loans or investments.财务杠杆乘数: Financial leverage multiplier (FLM) : The ratio of the firm's total assets to its common stock equity.财务杠杆:F inancial leverage: The potential use of fixed financial costs to magnify the effects of changes in earnings before interest and taxes on the firm's earnings per share.财务经理: Financial manager: Actively manages the financial affairs of any type of business, whether financial or nonfinancial, private or public, large or small, profit-seeking or not-for-profit.金融市场: Financial markets: Forums in which suppliers of funds and demanders of funds can transact business directly.金融合并:Financial merger: A merger transaction undertaken with the goal of restructuring the acquired company to improve its cash flow and unlock its hidden value. 财务规划流程: Financial planning process: Planning that begins with long-term, or strategic, financial plans that in turn guide the formulation of short-term, or operating, plans and budgets.财务风险:Financial risk: The risk to the firm of being unable to cover required financial obligations (interest, lease payments, preferred stock dividends).金融服务业:Financial services: The part of finance concerned with the design and delivery of advice and financial products to individuals, business, and government.。

Chapter 1 An Overview of Financial Management business 企业,商业,业务finance 财务,理财management 管理,管理层revenue 收入return 回报shareholder 股东stakeholder 利益相关者stock 股票profit maximization 利润最大化shareholder wealth maximization 股东财富最大化enterprise value maximization 企业价值最大化hedge risks 规避风险inventory 存货current assets 流动资产current liabilities 流动负债financing 筹资corporation 股份公司earning per share(EPS)每股收益exchange rate 汇率inflation 通货膨胀contractual relations 契约关系- equity 所有者权益dividend 股利CFO(Chief Financial Officer)首席财务官,财务总监Chapter 2 The Time Value of Moneyaccrued 增值的,应计的annuity 普通年金annuity factor 年金系数compound interest 复利discounting 贴现future value 终值geometric series 等比数列mortgage 抵押ordinary annuity 普通年金perpetuity 永续年金present value 现值principal 本金reinvest 再投资simple interest 单利time value of money 货币时间价值compounding 复利计算Chapter 3 Risk and Reward- capital asset pricing model(CAPM)资本资产定价模型diversification 分散化efficient capital market 有效资本市场expected return 期望回报market, systematic, or undiversifiable risk 市场风险、系统风险或不可分散风险portfolio 组合reward 收益,溢酬,溢价risk-aversion 风险厌恶risk-neutrality 风险中性risk preference 风险偏好risk premium 风险溢价security markets line(SML)证券市场线semi-strong capital market efficiency 半强式资本市场有效spread out 分散square root 平方根standard deviation 标准差strong capital market efficiency 强式资本市场有效transaction cost 交易成本unique, firm-specific, idiosyncratic, unsystematic, or diversifiable risk 特殊风险、特有风险、虚假风险、非系统风险或可分散风险- variance 方差volatility 波动性weak capital market efficiency 弱式资本市场有效Chapter 4 Financial Assets and Their Valuationasset 资产security 证券issue (股票,钞票)分发,发行coupon rate 票面利率,息面利率annual 每年的,年度的,一年一次的obligate 使(某人)负有责任或义务outstanding 未解决的,未偿付的,杰出的calculate 估计,预测compensation 报酬,工资,补偿物perpetual 永久的,永恒的infinite 无限的,无穷的substitute 替代,取代yield 出产,产,出(果实、利润、结果)approximation 相似,近似trial-and-error 试误法illustrate 说明,阐明entitle 使人有权拥有……liability 负债- intrinsic value 内在价值asymmetry 不对称constant 不变的,可靠的phase 阶段,时期preferred stock 优先股Chapter 5 Capital Budgeting and Investment Decisioncapital budgeting 资本预算estimating net present value 预期净现值the average accounting return 平均会计报酬率stand-alone principle 独立原则the internal rate of return 内部收益率the payback rule 回收期法erosion 侵蚀net working capital 净营运资本opportunity cost 机会成本hard rationing 硬约束soft rationing 软约束sunk cost 沉没成本incremental cash flow 增量现金流量pro forma financial statement 预估财务报表forecasting risk 预测风险scenario analysis 情景分析- investment criteria 投资决策标准cash flow 现金流量project cash flow 项目现金流量depreciation 折旧capital spending 资本性支出garbage-in garbage-out system 垃圾进、垃圾出系统best case and worst case 最优情形和最差情形Chapter 6 Working Capital Managementworking capital 营运资本speculative 投机precautionary 预防的buffer 缓冲器invoice 发票deposit 存款disbursement 支付expenditure 消费trade-off 权衡attorney 代理人applicant 申请人utilization 应用dampen 使沮丧ordering cost 订货成本- carrying cost 储存成本raw material 原材料insurance 保险linear 线性的bad-debt 坏账Chapter 7 Financing Mod esdebt financing 债务筹资equity financing 权益投资prospectus 招股说明书the general cash offer 普通现金发行the rights offer 配股发行initial public offering(IPO) 首次公开发行underwriting discount 承销折价the subscription price 认购价格collateral 抵押品mortgage securities 抵押债券debenture 信用债券sinking fund 偿债基金call provision 赎回条款call-protected 赎回保护operating leases 经营性租赁financial leases 融资租赁- sale and lease-back 售后租回leveraged leases 杠杆租赁warrants 认股权证convertibles 可转换债券call options 看涨期权straight bond value 纯粹债券价值conversion value 转换价值secured loans 抵押贷款committed lines of credit 承诺式信贷额度compensating balances 补偿性余额trust receipt 信托收据Chapter 8 Capital Structurecapital structure 资本结构optimal capital structure 最佳资本结构financial leverage 财务杠杆homemade leverage 自制杠杆payoff 回报proceeds 收益financial risk 财务风险interest tax shield 利息税盾direct bankruptcy costs 直接破产成本indirect bankruptcy costs 间接破产成本liquidation 清偿reorganization 重组absolute priority rule 绝对优先原则qualification 限定条件cost of equity 股权成本business risk 经营风险pie model 饼状模型break-even point 收益均衡点indifference point 无差异点Chapter 9 Divid end Distribution dividend irrelevance theory 股利无关理论retained earnings 留存收益capital surplus 资本公积earned surplus 盈余公积legal surplus 法定盈余公积free surplus reserves 任意盈余公积stockholder meeting 股东会declaration date 宣告日holder-of-record date 股权登记日ex-dividend date 除息日stock split 股票分割stock dividend 股票股利stock repurchase 股票回购declaration date 股利宣布日record date 股权登记日regular dividend 正常股利cash dividend 现金股利stock dividend 股票股利stock price appreciation 股价增值open market 公开市场payment date 股利支付日going concern 持续经营。

Capital budgeting is an extremely important aspect of a firm’s financial management。

Although a single capital asset usually comprise a small percentage of a firm’s total assets,all capital assets are long-term。

Therefore,a firm that makes a mistake in its capital budgeting process has to live with that mistake for a long period of time。

资本预算是一个公司财务管理中一个极其重要的方面。

一个单向的资产通常由公司的一小部分总资产组成,所有的资产都是长期的。

因此,一个公司在它的资本预算过程中犯了一个错误,那这个错误也将持续一段时间。

For instance,management may wish to know the effect on net present value if a project’s net cash flows are either 20 percent less than,or20 percent greater than,those estimated。

Knowledge of the sensitivity of net present value to changes or errors in the variables places management in a better position to decide whether a project is too risky to accept。

例如,管理过程中希望知道如果一个项目的现金流量净额小于20%或者大于20%是否对净现值有影响。

Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

Maximization of shareholder wealth focuses only on stockholders whereas maximization of firm value encompasses all financial claimholders including common stockholders, debt holders, and preferred stockholders.股东财富最大化只集中于股东,而企业价值最大化包含所有的财务债券持有者,包括普通股股东,债权人和优先股股东。

Given these assumptions,shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run。

根据这些假设,从长期来看,股东财富最大化与利益相关者和社会的最好利润是相一致的。

No competing measure that can provide as comprehensive a measure of a firm’s standi ng. Given these assumptions, shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run.没有竞争措施,能提供由于全面的一个措施的一个公司的站。

给这些臆说,股东'财富最大化一贯不比任何人差项目干系人项目利益相关者的利益,社会从长远说来。

In reality, managers may ignore the interests of shareholders, and choose instead to make investment and financing decisions that benefit themselves.在现实中,经理可能忽视股东的利益,而是选择利于自身的投资和融资决策。

Financial statements are probably the important source of information from which these variousstakeholders(other than management) can assess afirm’s financial health.财务报表可能是最重要的信息来源,除管理者以外的各种利益相关者可以利用这些报表来评估一个公司的财务状况。

The stockholders’ equity section lists preferred stock, common stock and capital surplus and accumulated retained earnings.股东权益列示有优先股,普通股,资本盈余和累积留存收益。

The assets, which are the “things” the company owns, are listed in the order of decreasing liquidity, or length of time it typically takes to convert them to cash at fair market values, beginningwith the firm’s current assets.资产,也就是公司拥有的东西,是按照流动性递减的顺序或将它们转换为公允市场价值所需要的时间来排列的,通常从流动资产开始。

The market value of a firm’s equity is equal to the number of shares of common stock outstanding times the price per share, while the amoun t reported on the firm’s balance sheet is basically the cumulative amount the firm raised when issuing common stock and any reinvested net income(retained earnings).公司权益的市场价值等于其发行在外的普通股份数乘以每股价格,而资产负债表上的总额则主要是公司在发行普通股以及分配任何再投资净收益(留存收益)时累积的数额。

When compared to accelerated methods, straight-line depreciation has lower depreciation expense in the early years of asset life, which tends to a higher tax expense but higher net income.与加速折旧法相比,直线折旧法在资产使用年限的早期折旧费用较低,这也会趋向于较高的税金费用和较高的净收入。

The statement of cash flows consists of threesections:(1)operating cash flows,(2)investing cash flows,and(3)financing cash flows. Activities in each area that bring in cash represent sources of cash while activities that involve spending cash are uses of cash.该声明现金流量表包含三个部分:(1)经营现金流,(2)投资的现金流,(3)融资现金流。

在每个地区活动带来现金来源的现金而代表活动涉及到花钱是使用现金Financing activities include new debt issuances, debt repayments or retirements, stock sales and repurchases, and cash dividend payments.筹资活动,包括发行新债券,偿还债务,股票销售和回购,以及现金股利支付。

Not surprisingly, Enron’s executives had realized some $750 million in salaries, bonuses and profits from stock options in the 12 months before the company went bankrupt.毫不奇怪, 公司破产前的十二个月里,安然的高管们实现了7.5亿美金的工资、奖金和股票期权利润。

First, financial ratios are not standardized. A perusal of the many financial textbooks and other sources that are available will often show differences in how to calculate some ratios.首先,财务比率不规范。

一个参考的许多金融教科书及来源,可将经常表现出差异如何计算一些率。

Liquidity ratios indicate a firm’s ability to pay its obligations in the short run.流动性比率表明公司的支付能力在短期内它的义务。

Excessively high current ratios, however, may indicate a firm may have too much of its long-terminvestor-supplied capital invested in short-term low-earning current assets.当前的比率过高,然而,可能表明,一个公司可能有太多的长期investor-supplied资本投资于短期low-earning流动资产In an inflationary environment, firms that use last-in,first-out(LIFO)inventory valuation will likely have lower current ratios than firms that use first-in,first-out(FIFO).在一个通货膨胀的环境下,企业选择使用后进先出法对存货计价的公司比采用先进先出法的公司有一个低的流动比率。