高顿CFA优秀教师——Feng

- 格式:docx

- 大小:85.92 KB

- 文档页数:1

金融分析师CFA 1级考试经验分享正在备考CFA1的考生们,小编这里与大家分享一篇超级强悍的经验帖。

他山之石可以攻玉,希望能够帮助到大家!一、本文适用范围:1、全文适用于准备CFA1 的在校学生不限专业。

2、全文适用于准备CFA1 有3 个月以上准备时间的在职人员。

3、部分适用于准备CFA1 不符合以上两条的考生4、CFA2、3 级考生请绕道。

二、作者背景1. 学历:低于北京TP 二校的理工科本科2. 复习时间:2 个月左右的脱产复习3. 复习方式:在南京某知名高校内与两名candidate 一起复习4. 复习遍数:大概notes2.5 遍。

习题3 遍5. 考试成绩:除alternative investment B,其余A6. 考试用时:上午1 小时20 分钟,下午1 小时30 分钟三、正文3.1 复习资料、习题a) Schweser Notes 5 本(课本部分)5 星推荐必看b) Schweser Notes 5 本(习题部分)5 星推荐必做c) 某机构中文翻译(广告位招租)5 星推荐必购d) 官方Reading(课本部分)负5 星推荐(学术型人才推荐)e) 官方Reading(习题部分)6 星推荐必做f) 近两年官方mock (俗称模拟题)5 星推荐必做g) 近两年官方sample (俗称样题)6 星推荐必做h) 某机构百题预测(广告位招租)4 星推荐选作i) Notes 练习(也就是6、7 两本)1 星推荐蛋疼者做之j) 官方道德手册3 星推荐选看k) 辅导班视频(广告位招租)3 星推荐选看l) 老婆一只自己看着办吧m) 辅导班(广告位招租)本3.5 没上n) 其他本3.5 没看3.1.1 阅读资料说到考试资料,那官方的Reading 就是纯扯淡,如果在今年能够收到电子版的情况下,还去花着N 百刀买那自己用着都心疼的铜版纸教材,绝对是烧包的表现,一来不支持低碳生活,二来过于支持CFA 的宗旨——骗钱第一,考试第二。

何旋职称:金程教育高级培训师、通过CFA三级、通过FRM 工作经验:2009年至今,担任金程教育CFA(注册金融分析师)高级培训师,主要负责《经济 学》、《固定收益》、《衍生产品》和《组合管理》的课程讲解;2007年2011年4月,在金程教 育金融研究院内担任研究员,主要负责包括CFA项目研发以及的相关内训课程的课程体系开 发,主要项目经验包括:摩根史丹利项目(组长):组织小组内成员定期讨论;搜集金融基础 知识方面的英文资料,撰写英文课件,确保项目质量;中国银行项目:负责企业财务报表粉饰 及合并报表、关联交易模块的研究与课件撰写;中国工商银行CFA培训项目:CFA一级二级辅 导员;金程教育CFA三级课程体系的整体开发及相关课件、资料制作;金融热点专题研究,包 括:次级债、IPO、一行三会等,形成研究报告,并开发相关课程(形成大纲,研究编写课件 及各类辅助材料);基于内训客户的培训课程体系开发:南京银行、兴业基金、瑞穗实业银行 等。

授课:讲授CFA® Level I 20次,CFA® Level II 15次等。

授课范围广泛:经济学、固定收益投资、 衍生品投资、投资组合、资产配置、个人理财、数量分析等。

专业能力:金融理论知识扎实,在金融教学中有自己独到的方法。

多年对CFA考试体系的研究 使她全面掌握考试重点,尤其擅长经济学课程的讲授,能将复杂的理论具体化。

,在授课过程 中能够从考生角度出发,提供自己在备考过程中的经验和方法,帮助考生更好的准备考试。

客户:摩根史丹利、工商银行、中国银行、瑞穗实业银行、南京银行、兴业基金等。

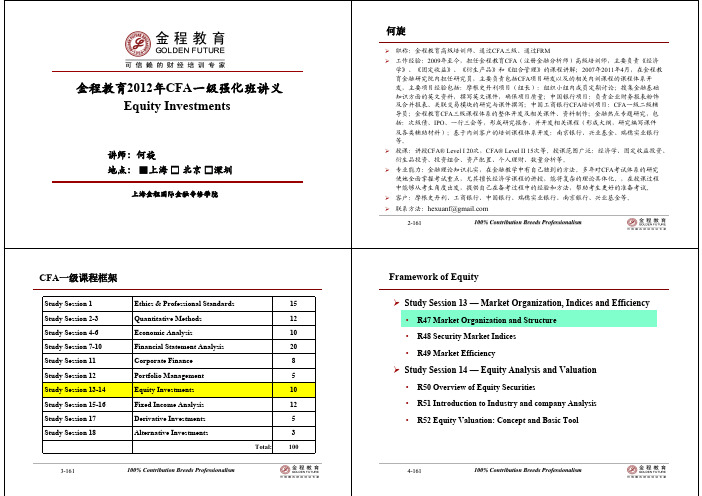

联系方法:hexuanf@金程教育2012年CFA一级强化班讲义 Equity Investments讲师:何旋 地点: ■上海 □ 北京 □深圳上海金程国际金融专修学院12-161100% Contribution Breeds ProfessionalismCFA一级课程框架Study Session 1 Study Session 2-3 Study Session 4-6 Study Session 7-10 Study Session 11 Study Session 12 Study Session 13-14 Study Session 15-16 Study Session 17 Study Session 18 Ethics & Professional Standards Quantitative Methods Economic Analysis Financial Statement Analysis Corporate Finance Portfolio Management Equity Investments Fixed Income Analysis Derivative Investments Alternative InvestmentsTotal:Framework of Equity15 12 10 20 8 5 10 12 5 3100Study Session 13 — Market Organization, Indices and Efficiency• • • R47 Market Organization and Structure R48 Security Market Indices R49 Market EfficiencyStudy Session 14 — Equity Analysis and Valuation• • • R50 Overview of Equity Securities R51 Introduction to Industry and company Analysis R52 Equity Valuation: Concept and Basic Tool3-161100% Contribution Breeds Professionalism4-161100% Contribution Breeds ProfessionalismOutlook of R.47 Market Organization and StructureR.47.1 Characteristics of a Financial MarketR.47.1 Characteristics of a Financial Market R.47.2 Classification of assets and markets R.47.3 Organization of the securities market R.47.4 Instructions of transaction processes5-161100% Contribution Breeds Professionalism6-161100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketLos 47.a: Explain the main functions of the financial systemR.47.1 Characteristics of a Financial MarketFirst function: fulfill different entities’ requirements• Risk management: Entities face risks from changing interest rates, currency management values, commodities values, and defaults on debt, among other things. So they would like to find a way to manage these risks. Hedgers enter a financial market with the purpose of reducing the risk of the transaction. Hedging instruments are available from exchanges, investment banks, insurance firms, and other institutions. • Exchanging assets: The financial market also allows entities to exchange assets assets with other entities. For example: currency exchange • Utilizing information: Investors with correctly analyzed information expect to information earn an additional return by identifying assets that are currently undervalued or overvalued.First function: fulfill different entities’ requirements function• Savings: stocks, bonds, certificates of deposit, real assets, and other assets are tools for Savings saving. Individuals save to gain interest. Firms save a portion of their profits for future expenditures. Borrowing: Borrow money from lenders who require collateral, take an equity position, Borrowing or investigate the credit risk of the borrower to protect themselves in case of borrower defaults. Individuals may borrow in order to buy a house or for other purposes. Firms may borrow to meet their finance capital expenditures and for other activities. Governments may issue debt to meet their expenditures. Issuing equity: Another method of raising capital beside borrowing is to issue equity, equity where the capital providers will share in any future profits. Investment bank help with issuance. Analysts value the equity. Regulators and accountants encourage the dissemination of information.7-161 100% Contribution Breeds Professionalism••8-161100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketSecond function: Determine interest rates• Interest rates are justified according to the total supply of savings and the total demand of borrowings. • Equilibrium interest rate: rate when the interest rate at which the entities are willing to borrow is equal to the amount that entities are willing to lend, we say that the supply and demand are balanced, and such balanced interest rate is called the equilibrium interest rate. Equilibrium rates for different types of borrowing and lending will differ due to differences in risk, liquidity, and maturity.R.47.1 Characteristics of a Financial MarketThird function: Allocate capital to its most efficient uses• Investors have to weigh the expected risks and returns of different investments to determine their most preferred investments due to limited availability of capital. • This would result in an allocation to capital to its most valuable uses.9-161100% Contribution Breeds Professionalism10-161 10-100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketLos d: Describe the types of financial intermediaries and the services that they provideR.47.1 Characteristics of a Financial MarketBrokers, Dealers and Exchange (Cont.)• Dealers: trade by buying for or selling from their own inventory and thus Dealers provide liquidity in the market and profit primarily from the differences of buy and sell prices. Dealers that trade with central banks to affect the money supply are referred to as primary dealers. dealers Broker-dealers: Some dealers also act as brokers. Broker-dealers have an inherent conflict of interest. Brokers: should seek the best prices for their clients; Dealers: are to profit through prices or spreads.Brokers, Dealers and Exchange• • • • • Brokers: Brokers help their clients buy and sell securities by finding Brokers counterparties to trades in a cost efficient manner. Block brokers: help with the placement of Large trades. Typically, large trades brokers are difficult to place without moving the market. Investment banks: help corporations sell common stock, preferred stock, and banks debt securities to investors. Exchanges: provide a venue whew traders can meet. Exchanges sometimes act Exchanges as brokers by providing electronic order matching. Alternative trading systems (ATS): serve the same trading function as exchanges but have no regulatory function, are also known as electronic communication networks (ECNs) or multilateral trading facilities (MTFs). ATS that do not reveal current client orders are known as dark pools. pools (used to reduce market impact)11-161 11100% Contribution Breeds Professionalism12-161 12-100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketSecuritizers• Securitizers pool large amounts of securities or other assets together and sell interests in the pool to other investors. By securitizing the assets, the securitizer creates a diversified pool of assets with more predictable cash flows than the individual assets in the pool. This creates liquidity in the assets, because the ownership interests are more easily valued and traded. There are also economies of scale in the management costs of large pools of assets and potential benefits from the manager’s selection of assets.R.47.1 Characteristics of a Financial MarketSecuritizers (Cont.)• • Assets that are often securitized include mortgages, car loans, credit card receivables, bank loans, and equipment leases. A firm may set up a special purpose vehicle (SPV) or special purpose entity (SPE) to buy firm assets, which removes them from the firm’s balance sheet and may increase their value by removing the risk that financial trouble at the firm will give other investors a claim to the assets’ cash flows. Absorb deposits by paying interest on customer deposits Provide transaction services on one hand, and then make loans with the deposits on the other hand.Depository Institutions• •13-161 13-100% Contribution Breeds Professionalism14-161 14-100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketInsurance Companies• • • Insurance companies collect insurance premiums in return for providing risk reduction to the insured. Such intermediaries are able to do this by pooling policyholders with uncorrelated risk of losses. Insurance firms also provide a benefit to investors by managing the risks: Moral hazard occurs because the insured may take more risks once they are protected against losses. Adverse selection occurs when those most likely to experience losses are the predominant buyers of insurance. In fraud, the insured purposely cause damage or claim fictitious losses so they can collect on their insurance policies.R.47.1 Characteristics of a Financial MarketArbitrageurs• • Arbitrageurs are intermediaries who seek to gain certain return without bearing any risk. In markets with good information, pure arbitrage is rare because traders will favor the markets with the best prices. Clearinghouses: act as buyers when customers want to sell assets and as sellers when customers want to buy assets, and thus limit counterparty risk. Custodians: also improve market integrity by holding client securities and Custodians preventing their loss due to fraud or other events that affect the broker or investment manager.Clearinghouses and Custodians• •15-161 15-100% Contribution Breeds Professionalism16-161 16-100% Contribution Breeds ProfessionalismR.47.1 Characteristics of a Financial MarketLos k. describe the characteristics of a well-functioning financial system A well functioned financial market:• allows entities to achieve their purposes.R.47.1 Characteristics of a Financial MarketLos l. describe the objectives of market regulation.Problems when there are no regulations Fraud and theft: the potential for theft and theft fraud increases because investment managers take advantage of unsophisticated investors. Objectives of market regulations Protect unsophisticated investors. Require minimum standards of competency to make it easier to perform valuation.Characteristics of a well functioned financial Market• Complete markets: Savers receive a return, borrowers can obtain capital. markets hedgers can manage risks, and traders can acquire needed assets. • Operational efficiency: Trading costs are low. efficiency • Informational efficiency: Prices reflect fundamental information quickly. efficiency • Allocational efficiency: Capital is allocated to its most productive use. efficiencyInsider trading: Investors would exit the Prevent insiders from exploiting other trading market and thus reduced liquidity if they believe investors. traders with inside information will exploit them. Costly information: If obtaining information is information relatively expensive, markets will not be as informationally efficient and investors will not invest as much. Defaults: Parties might not honor their Defaults obligations in markets. Require common financial reporting requirements.Require minimum levels of capital so that participants will honor long-term commitments.17-161 17-100% Contribution Breeds Professionalism18-161 18-100% Contribution Breeds ProfessionalismOutlook of R.47 Market Organization and StructureR.47.2 Classification of assets and marketsR.47.1 Characteristics of a Financial Market R.47.2 Classification of assets and markets R.47.3 Organization of the securities market R.47.4 Instructions of transaction processes19-161 19-100% Contribution Breeds Professionalism20-161 20-100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsLos 47.b.c: Describe classification of assets and markets Classification of assets-Financial Assets• Security (Fixed income vs. Equity Securities ) Fixed income securities: make sure the borrowed funds can be repaid securities Bonds Generally long-term (with maturity longer than 10 years) Notes Bills Commercial paper Certificates of deposit Intermediate term (with maturity between 2 to 10 years) Short term (with maturity less than 1 year) Short term issued by firms (with maturity less than 1-2 years) Issued by banksR.47.2 Classification of assets and marketsClassification of assets-Financial Assets-Security• Security (Fixed income vs. Equity Securities ) Equity securities: represent ownership in a firm securities Common stock Residual claim on a firm’s assets. Dividends are paid only after interest is paid to debt holders and dividends are paid to preferred stockholders. Debt holders and preferred stockholders have priority over common stockholders in the event of firm liquidation Is an equity security with scheduled dividends that typically do not change over the security’s life and must be paid before any dividends on common stock may be paid. Are similar to options in that they give the holder the right to buy a firm’s equity shares (usually common stock) at a fixed exercise price prior to the warrant’s expiration.Preferred stockRepurchase agreements Borrower sells a high quality asset and has both the right and obligation to repurchase it (at a higher price) in the future. Repurchase agreements can be for terms as short as one day. Convertible debt21-161 21-WarrantsIs debt that an investor can exchange for a specified number of equity shares of the issuing firm100% Contribution Breeds Professionalism 22-161 22100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsClassification of assets-Financial Assets-Security• Security (Fixed income vs. Equity Securities ) Pooled investment vehicles: vehicles individual securities can be combined in pooled investment vehicles. Include mutual funds, depositories, and hedge funds. The investor’s ownership interests are referred to as shares, units, depository receipts, or limited partnership interests.R.47.2 Classification of assets and marketsClassification of assets-Financial Assets-Security• Security (Fixed income vs. Equity Securities ) Pooled investment vehicles: vehicles Mutual funds are pooled investment vehicles in which investors can purchase shares, either from the fund itself (open-end funds) or in the secondary market (closed-end funds) trade like closed-end funds, but have special provisions allowing conversion into individual portfolio securities, or exchange of portfolio shares for ETF shares, that keep their market prices close to the value of their proportional interest in the overall portfolio. represent a claim to a portion of a pool of financial assets such as mortgages, car loans, or credit card debt. organized as limited partnerships( investors limited partners; fund manager general partner). Hedge funds often use leverage. Hedge fund managers are compensated based on the amount of assets under management as well as on their investment results.100% Contribution Breeds ProfessionalismExchange-traded funds (ETFs) & exchange-traded notes (ETNs) Asset-backed securities Hedge funds23-161 23-100% Contribution Breeds Professionalism24-161 24-ExampleThe Standard & Poor's Depositary Receipts (SPDRs) is an investment that tracks the S&P 500 stock market index. Purchases and sales of SPDRs during an average trading day are best described as: A. primary market transactions in a pooled investment. B. secondary market transactions in a pooled investment. C. secondary market transactions in an actively managed investment.R.47.2 Classification of assets and marketsClassification of assets-Financial Assets• Derivative Contract: Contract are agreements between two parties that require some action in the future, such as exchanging an asset for cash. Forward contract Futures contracts Swap contracts Option contracts Insurance contracts Credit default swaps Is an agreement to buy or sell an asset in the future at a price specified in the contract at its inception Are similar to forward contracts except that they are standardized, and are traded on an exchange so that they are liquid investments. A series of forward contracts Gives its owner the right to buy or sell an asset at a specific exercise price at some specified time in the future. Pays a cash amount if a future event occurs. They are used to hedge against unfavorable, unexpected events. Are a form of insurance that makes a payment if an issuer defaults on its bonds.100% Contribution Breeds Professionalism25-161 25-100% Contribution Breeds Professionalism26-161 26-R.47.2 Classification of assets and marketsClassification of assets-Real Assets• Commodity: Commodity Commodities are goods like precious metals, industrial metals, agricultural products, energy products, and credits for carbon reduction that are traded in spot, forward, and futures markets. Note: Spot markets are for immediate delivery while forwards, futures, and options markets are for the future delivery of physical and financial assets.R.47.2 Classification of assets and marketsClassification of assets-Real Assets (Cont.)• Real Assets: Assets Examples of real assets are real estate, equipment, and machinery. Characteristics: Provide income, tax advantage, diversification benefits Entail substantial management costs Require substantial due diligence before investing Investor may choose to buy real assets indirectly: REIT (real estate investment trust) MLP (master limited partnership)27-161 27-100% Contribution Breeds Professionalism28-161 28-100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsLos e. compare the positions an investor can take in an asset Long Position• • An investor who owns an asset, or has the right or obligation under a contract to purchase an asset, is said to have a long position. Benefit form an increase in the priceR.47.2 Classification of assets and marketsShort Position• For a short-sale, the procedure is as below: Borrow the stock through your broker and simultaneously sell it in the market. Return the stocks upon your brokers request Maintain the proceeds of short-sales as collateral. • • • Benefit from a decrease in the price Unlike a long position, the potential loss of a short sale is unlimited Payment-in-lieu: the received dividends and interests must be paid back to the Payment- in- lieu investor who lent the stockStock Lender Div.29-161 29100% Contribution Breeds Professionalism 30-161 30-Deposit Short Seller Interest Broker100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsLeveraged Positions• Margin Requirement: the required equity position is called the margin requirement. Initial Margin: a minimum amount of equity at the time of a new margin purchase Maintenance Margin: is the investor’s required equity position in the Margin account. Margin Call: if an investor’s margin account balance falls below the Call maintenance margin, the investor will receive a margin call and will be required to either liquidate the position or bring the account back to its maintenance (minimum) margin requirementR.47 Leverage ratioLos f. Calculate and interpret the leverage ratio, the rate of return on a margin transaction, and the security price at which the investor would receive a margin callLeverage ratioLeverage ratio=•value of the asset value of the equity positionPrice Triggering a Margin Call Margin Call Price for a Long Position⎛ 1 − IM ⎞ PL' = P0 ⎜ ⎟ ⎝ 1 − MM ⎠ Margin Call Price for a Short Position⎛ 1 + IM ⎞ PS' = P0 ⎜ ⎟ ⎝ 1 + MM ⎠31-161 31100% Contribution Breeds Professionalism 32-161 32100% Contribution Breeds ProfessionalismExampleA trader has purchased 200 shares of a non-dividend-paying firm on margin at a price of $50 per share. The leverage ratio is 2.5. Six months later, the trader sells these shares at $60 per share. Ignoring the interest paid on the borrowed amount and the transaction costs, what was the return to the trader during the six-month period? A. 20 percent.. B. 33.33 percent. C. 50 percent. The current price of a stock is $25 per share. You have $10,000 to invest. You borrow an additional $10,000 from your broker and invest $20,000 in the stock. If the maintenance margin is 30 percent, at what price will a margin call first occur? A. $9.62. B. $17.86. C. $19.71.33-161 33100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsLos i. describe the primary and secondary markets and explain how secondary markets support primary markets Classification of markets• Primary vs. Secondary markets Primary market: is the market where newly issued securities are sold. market Newly issued securities involve: IPO (initial public offerings): first-time issues by firms whose shares are not currently publicly traded. Seasoned offerings (secondary issues): new shares issued by firms whose shares are already trading in the marketplace. • Money vs. Capital markets • Traditional vs. Alternative markets34-161 34-100% Contribution Breeds ProfessionalismR.47.2 Classification of assets and marketsClassification of markets• Primary vs. Secondary markets • Money vs. Capital markets Money markets: refer to markets for debt securities with maturities of one markets year or less. Capital markets: refer to markets for longer-term debt securities and markets equity securities that have no specific maturity date. • Traditional vs. Alternative marketsR.47.2 Classification of assets and marketsClassification of markets• Primary vs. Secondary markets • Money vs. Capital markets • Traditional vs. Alternative markets Traditional investment markets: refer to markets for debt and equity. Alternative markets: refer to markets for hedge funds, commodities, real markets estate, collectibles, gemstones, leases, and equipment.35-161 35-100% Contribution Breeds Professionalism36-161 36-100% Contribution Breeds ProfessionalismOutlook of R.47 Market Organization and StructureR.47.3 Organization of the securities marketR.47.1 Characteristics of a Financial Market R.47.2 Classification of assets and markets R.47.3 Organization of the securities market R.47.4 Instructions of transaction processes37-161 37-100% Contribution Breeds Professionalism38-161 38-100% Contribution Breeds ProfessionalismR.47.3 Organization of the securities marketHow securities are sold through primary market• Sold Publicly : Underwritten Offering (the most common way) Best Efforts Indications of Interest • Sold Privately Private placement • Other transaction methods Shelf registration Dividend Reinvestment Plan Rights Offering Competitive bids Negotiated salesR.47.3 Organization of the securities marketHow securities are sold through primary market- Sold Publicly :• Difference between underwritten offering and best efforts Underwritten offering Obligated to buy the unsold portion Investment bank would prefer that the price be set low enough to gain more profit Best Efforts Not obligated to buy the unsold portion Investment bank sets the issue price as high as possible to raise the most funds for the issuer39-161 39-100% Contribution Breeds Professionalism40-161 40-100% Contribution Breeds ProfessionalismR.47.3 Organization of the securities marketHow securities are sold through primary market- Sold Publicly :• Indications of Interest Indications of interest: the investment bank finds investors who agree to interest buy part of the issue. This process of gathering indications of interest is called book building, building and the investment bank during this process is called book builder or book runner. runner If securities must be issued quickly, the process is called accelerated book building. buildingR.47.3 Organization of the securities marketHow securities are sold through primary market- Sold Privately :• Private placement Securities are sold directly to qualified investors, typically with the assistance of an investment bank. • Shelf registration In a shelf registration a firm makes its public disclosures as in a regular offering, but then issues the registered securities over time when it needs capital and when the markets are favorable. • Dividend Reinvestment Plan A dividend reinvestment plan (DRP or DRIP) allows existing shareholders to use their dividends to buy new shares from the firm at a slight discount. • Rights Offering In rights offering, existing shareholders are given the right to buy new shares at a discount to the current market price.41-161 41-100% Contribution Breeds Professionalism42-161 42-100% Contribution Breeds ProfessionalismExampleA German publicly traded company, to raise new capital, gave its existing shareholders the opportunity to subscribe for new shares. The existing shareholders could purchase two new shares at a subscription price of €4.58 per share for every 15 shares held. This is an example of a(n): A. rights offering. B. private placement. C. initial public offering.R.47.3 Organization of the securities marketSecondary Capital Markets• • The secondary market is the place where securities are traded after their initial offerings. The secondary market supports the primary market by providing: Liquidity Investors who buy stocks in the primary markets want to sell then again to acquire other securities such as risk free bonds and cash. Price discovery New issues of stocks and bonds are based on prices in the secondary markets.43-161 43-100% Contribution Breeds Professionalism44-161 44-100% Contribution Breeds ProfessionalismR.47.3 Organization of the securities marketSecondary Capital Markets• When securities are traded in a secondary market Call Markets Trading for individual stocks occurs at specific times. All bids and asks are gathered and then a negotiated price is produced to make the demand quantity as close as possible to the supply quantity. Continuous Markets Trades occur at any time when market is open. The price is determined either by an auction process or through a dealer bid-ask process. There are differences between dealer markets and an auction market in continuous markets.R.47.3 Organization of the securities marketLos j. describe how securities, contracts, and currencies are traded in quotedriven markets, order-driven markets and brokered markets; Secondary Capital Markets• How securities are traded in Secondary Markets Order-Driven Market Quote-Driven Market Brokered Markets45-161 45-100% Contribution Breeds Professionalism46-161 46-100% Contribution Breeds ProfessionalismR.47.3 Organization of the securities marketSecondary Capital Markets• • How securities are traded in Secondary Markets- Order-Driven Market Two sets of rules are used in these markets: Order matching rules: establish an order precedence hierarchy. Price priority: trades with the highest bid (buy) and lowest ask (sell) prices are traded first, this is so-called price priority. Secondary precedence rule: if orders are at the same prices, the earliest arriving orders are traded first. Trade pricing rules: are used to determine the price after orders are created using order matching rules. Under the uniform pricing rule, all orders trade at the same price, which is the price that results in the highest volume of trading. The discriminatory pricing rule uses the limit price of the order that arrived first as the trade price.47-161 47100% Contribution Breeds ProfessionalismR.47.3 Organization of the securities marketSecondary Capital Markets• How securities are traded in Secondary Markets Quote-Driven Market QuoteQuote-driven market is also referred to as a dealer market, a pricedriven market or an over-the-counter market. Individual dealers provide liquidity for investors by buying and selling the shares of stock for themselves. Numerous dealers compete against each other to provide the highest bid prices when investors are selling and the lowest asking price when investors are buying stock. Brokered Markets In brokered markets, brokers trade with the counterparty they find. This service is especially valuable when the trader has a security that is unique or illiquid.48-161 48100% Contribution Breeds Professionalism。

cfa2级奶茶课讲义

CFA Level II奶茶课讲义主要涉及的内容包括:

1. 财务分析:包括财务报表分析、财务比率分析、财务预测和财务估值等内容。

2. 投资组合管理:包括投资组合理论、风险和回报、资产配置、投资组合业绩评估等内容。

3. 经济学:包括宏观经济学、微观经济学、国际经济学、货币政策和财政政策等内容。

4. 公司金融:包括公司治理、资本预算、资本结构、企业融资等内容。

5. 金融市场和产品:包括金融市场和机构、金融产品(如股票、债券、衍生品等)、金融市场法规和监管等内容。

需要注意的是,具体的讲义内容可能因不同的培训机构或个人而有所不同。

如果您需要具体的讲义内容,建议您联系相关的培训机构或个人获取。

CFA成绩全球top10的女学霸:得财报者得天下!前几天,高顿君给大家陆续带来了固收、衍生品、数量分析等CFA一级考试科目重点,不知道同学们消化的如何了~今天呢,高顿君又来给大家做分享了!今天要分享的科目是CFA一级最重要、最让人头疼也最占分的科目——财务分析!希望备考的同学看完后,能理清楚考试重点,更加有效地复习在CFA的考试中,素来有“得财报者得天下,失道德者say拜拜”的说法,可见,财报分析在CFA考试科目中的重要性。

在CFA一级的考试中,要论分数占比最高的,非财务报告与分析(Financial Reporting and Analysis)莫属。

在二级的考试中,财务报告与分析的比重下降;到三级的考试中,则完全没有直接的考试内容了。

但是,无可否认的是,决定CFA考试成败的,除了伦理道德(Ethical andProfessional Standards)的一票否决之外,最最重要的就是这个科目了。

财务报告与分析在CFA一级中占比20%,上下午各24道题,一共48道题,考生在学习这部分知识的时候一定要引起重视。

首先,财务报告与分析中章节的设置是循序渐进、逐层深入的,前面介绍的术语在后面还会有详细的解释与探讨。

其次,由于财务报告与分析本身自成体系,它是上市公司和报表使用人之间沟通交流的语言,所以学起来与外语学习有几分相似。

财务报告与分析一共分为四大部分:第一部分是扫盲阶段,主要介绍财务术语、体系等基本知识。

在此基础上,第二部分更深入地讲解财务报表编制以及财务报表分析的方法。

进一步地,第三部分针对存在利润操纵空间的重点科目做详细、深入的讨论。

最后,第四部分是前面三部分内容的综合应用。

四大部分在考试中占比最大的是第二部分和第三部分,大概占财报分析所有题目的80%以上。

其次是第一部分,占比10%左右。

由于第四部分是财务分析的综合应用,不太适合一级的出题形式,所以出题比例相对比较少,大概占5%左右。

关于财务报告与分析的框架,如下所示:我们一起来看看,它都有哪些考试重点...财务报表分析基本概念本章的重点是掌握财务报告相关术语以及组成部分,考生需要确保能够辨析财务报告各个组成部分披露的信息。

清华大学经管金融硕士导师简介-高峰高峰金融系助理教授办公室伟伦楼327个人简介研究成果研究项目凯程教育是五道口金融学院和清华经管考研黄埔军校,在2014年,凯程学员考入五道口金融学院28人,清华经管11人,五道口状元武xy出自凯程, 在2013年,凯程学员考入五道口金融学院29人,清华经管5人,状元李少h出在凯程, 在凯程网站有很多凯程学员成功经验视频,大家随时可以去查看. 2016年五道口金融学院和清华经管考研保录班开始报名!高峰,清华大学经济管理学院金融系助理教授。

于2006年获得清华大学经管学院金融学博士学位,1999年获得清华大学经管学院金融学学士学位。

他的主要研究领域为资产定价、风险管理、金融计量学。

讲授课程包括投资学、国际金融、实分析等。

他曾在国内外学术刊物上发表多篇论文,如《健康险市场道德风险的检验》(《管理世界》)、《现金分红对股票收益率波动和基本面信息相关性的影响》(金融研究)、《中国股市理性预期的检验》(经济研究),《AdverseSelectionorAdvantageousSelection?RiskandUnderwritinginChinasHealth-InsuranceMar ket》(Insurance:MathematicsandEconomics)、《EstimationRiskinGARCHVaRandESEstimates》(EconometricTheory)等等。

他参与了多项科研项目,其中2007年至2008年由国家林业局委托的项目“小额林权抵押贷款和政策性森林保险研究”获得了北京市科学技术三等奖。

他于2006年至2008年为清华大学经管学院博士后,2008年至今为清华大学经管学院金融系助理教授。

2010年8月至12月,以访问学者身份,访问了美国麻省理工学院斯隆管理学院。

期刊论文(国内)王珺,高峰,中国健康险市场逆向选择和正向选择并存现象的研究,金融研究,11期,160-170页,2008-11-16高峰,信用组合风险度量研究,运筹与管理,5期,17卷,114-119页,2008-10-25高峰,王珺,小额保险需求分析,保险研究,10期,2008-10-16王珺,高峰,保险需求悖论的解释-来自中国汽车险市场的实证研究,南开管理评论,5期,11卷,2008-10-08王珺,高峰,逆向选择现象实证研究评述,经济学动态,8期,2008卷,2008-08-18高峰,机构投资者交易行为特征研究,金融研究,4期,122-130页,2008-04-16王珺,高峰,我国汽车保险市场逆向选择实证研究,金融研究,12期,2007-12-01高峰,上证综指脱离中国经济吗?—兼论如何改进上证综指,金融研究,9期,173-183页,2007-09-01期刊论文(国际)宋逢明,高峰,关于开展小额林权抵押贷款的政策建议,林业经济,2009-04-25FengGAO,FengmingSONG,JunWANG,RationalorirrationalexpectationsevidencefromChinastockm arket,TheJournalofRiskFinance,V ol.9No.p432-448,2008-11-16FengGAO,FengmingSONG,ESTIMA TIONRISKINGARCHVaRANDESESTIMA TES,econometri ctheory,Vol.24No.5p1404-1424,2008-10-16凯程教育:凯程考研成立于2005年,国内首家全日制集训机构考研,一直从事高端全日制辅导,由李海洋教授、张鑫教授、卢营教授、王洋教授、杨武金教授、张释然教授、索玉柱教授、方浩教授等一批高级考研教研队伍组成,为学员全程高质量授课、答疑、测试、督导、报考指导、方法指导、联系导师、复试等全方位的考研服务。

cfa一级中文精讲

CFA(Chartered Financial Analyst)一级考试是金融分析师的入门级考试,涵盖了广泛的金融知识体系。

对于中文学习者来说,CFA一级中文精讲是一个很好的学习资源,可以帮助他们系统地掌握金融理论和实践。

CFA一级中文精讲通常会涵盖以下几个方面的内容:

一、金融基础知识

CFA一级考试要求考生掌握基本的金融概念和原理,如金融市场、金融工具、金融风险管理等。

精讲课程会对这些基础知识进行详细解读,帮助考生建立扎实的金融知识体系。

二、财务报表分析

财务报表分析是CFA一级考试的重要组成部分。

精讲课程会教授考生如何分析企业的财务报表,包括资产负债表、利润表和现金流量表等,从而评估企业的财务状况和经营业绩。

三、投资组合管理

投资组合管理是CFA一级考试的另一个重要领域。

精讲课程会介绍投资组合的基本概念、投资策略和风险管理方法,帮助考生了解如何构建和管理投资组合,以实现资产增值。

四、道德规范与职业操守

CFA考试非常注重金融分析师的职业道德和操守。

精讲课程会详细讲解CFA道德规范和职业操守的重要性,帮助考生理解并遵守行业规范,树立良好的职业形象。

总之,CFA一级中文精讲是一个全面、系统的学习资源,可以帮助中文学习者深入理解金融理论和实践,为未来的金融职业发展奠定坚实基础。

北京市高等学校精品课程申报文件之四《金融经济学导论》教学大纲《金融经济学导论》教学大纲项目负责人: 林桂军教授对外经济贸易大学金融学院《金融经济学导论》课题组二零零五年六月课程名称 《金融经济学导论》 Introduction of Financial Economics林桂军 教 授郭 敏 副教授余 湄 讲 师吴卫星 讲 师办公地点 博学楼908 接待时间 周四下午3:00-4:50任课教师联系电话 64495048 E-MAIL minguo992002@yumei@wxwu@课程性质 金融学院专业基础课学分学时 3学分, 3学时(18周),共54学时授课对象 金融学院本科生及全校各年级本科生先修课程 微观经济学 宏观经济学 金融市场:机构与工具 微积分 概率论与数理统计 平时作业计成绩。

考试方式期中、期末考试均为闭卷考试。

考试成绩 平时作业占20%,期中占20%,期末占60%,考勤要求教师可根据作业、考勤情况确定是否允许参加考试和扣减成绩。

教学目标 通过该课程的学习,将实现如下教学目标1.使学生了解金融经济学的基本思想和基本理论框架,为进一步学习现代金融理论打下基础;2.介绍资本市场的基本理论模型,包括马科维茨投资组合模型、资本资产定价模型、套利定价模型、MM模型、有效市场假说等;3. 从经济学和金融学角度了解金融商品相对于一般实际商品的特殊性,以及金融市场均衡的形成过程,掌握金融市场均衡机制相对于一般商品市场的均衡机制的共性与差异。

4.掌握金融经济学的基本分析方法,如金融商品的未来回报的不确定性的刻划方法、处理风险和收益之间关系的定量方法、证券投资组合方法、资本资产定价的原理和无套利均衡方法等。

教学方法 本课程属理论性较强的专业基础课,教学以讲授为主,辅以讨论.为在实证角度上增强学生对理论模型的深入了解,在部分章节安排了上机试验课。

课程简介 参见本课《课程介绍》。

教材 指定参考教材和授课教案结合《金融经济学》毛二万 编著,辽宁教育出版社,2002年。

CFA考试一次没通过,就要放弃?看他怎么做!CFA证书为国际证书,考试分为三个等级,需要用英文进行考试,固然有一定的难度,有的CFA考生选择坚持学习考过CFA,而有的考生选择中途放弃,如果是你,你怎么选择?今天高顿君给大家分享一个经验帖,关于失败也关于成功,一位CFA一级失败后的小哥哥通过努力获得了成功。

“每一位成功人士都是从失败中走出来的”,这句话高顿君认为是有道理的。

CFA考试亦是如此,有成功也有失败;其实失败并不可怕,可怕的是我们无法从失败中走出来。

个人背景:管理类专业,无金融背景,平时比较关注财经新闻,喜欢看一些财经类的节目和经济学的书,从事行政相关工作。

考试历程:2018年在职准备6月的CFA考试,在职准备了1.5月,结果挂了。

2018年在职准备12月的CFA考试,准备了6个月,顺利通过。

总结:小白同学,建议备考时间大于300小时。

2018年6月,初次报考,不知深浅,盲目自信,简单过了一遍,就去考试了,结果可想而知,一个小白的悲惨结局。

2018年12月,有了一次备考的教训,这一次,早早就开始复习了,从头到尾老老实实地学了一遍,准备还是比较充分的,所以小白也能顺利通过。

复习策略:所有知识点和公式要做到烂熟于胸。

要制定合理的学习时间进度表并严格按照计划进行学习复习。

CFA考试的准备过程是对你耐力和意志力的考验,要根据自身专业背景和金融基础详细制定学习计划,建议每周复习约10至15小时,临考前预留四到六周时间反复操练习题并进行模拟考试,考试前两个学习日强化公式记忆,做最后的一搏。

在认真学习完一遍Study Notes后,根据LOS的要求,找出考试要点、难点,逐个攻破。

每个Study session的学习内容都是自成体系,可分科目进行复习,总结各科目的理论、公式、经典题及难题。

在深入理解各科知识点的基础上,再将整个知识体系融会贯通,全面性、条理性、逻辑性地把握知识要点,构建自己的知识框架。

(1)抓住三个重点从考试内容比重来看,FRA,Equity,Ethics以及Fixed Income占分较多,应侧重学习。

高顿和金程cfa培训哪个好

高顿和金程cfa培训相比各有千秋,但是我个人还是推荐去高顿教育,师资水平比较高,

而且身边很多人都在这里报名,成功的通过了考试。

CFA是全球投资业里最为严格与高含

金量资格认证,被称为全球“金融第一考”的考试,为全球投资业在道德操守、专业标准

及知识体系等方面设立了规范与标准。

自1962年设立CFA课程以来,对投资知识、准则

及道德设立了全球性的标准,被广泛认知与认可。

目前市面关于特许金融分析师CFA认证

考试的辅导机构种类繁多,我们该如何在这么多机构中选择专业的适合自己的来辅助备考

无疑是重中之重。

高顿教育专注于财经网络教育,融合了上海财经大学百年教学辅导资源,拥有国内科学的网络教学体系,高顿网校将始终秉承”建立国际化财经培训基地,培养世

界级财务金融人才"的企业使命,加快国际化进程,打造全球专业的财经网络学习平台。

RFPI中国中心认可讲师梁辉Kasper liang香港大学MBA,RFP。

RFPI中国中心董事兼CEO。

亚洲地区第一位财富管理师FFSI,中国保险业第一位国际金融理财师CFP。

获得多项国际和国内的专业资格认证:寿险管理师(FLMI)、客户服务师(ACS)、寿险法规师(AIRC)、年金管理师(AAPA)、保险代理管理师(AIAA)等七项资格,同时获得保险代理、保险经纪及保险公估三项资格认证。

福布斯杂志《中国优选理财师》评选唯一两届全赛区及终审评委。

黄于成Jason HuangRFP,现任RFPI中国中心培训总监。

曾任海尔纽约人寿保险公司营销总监、中宏人寿保险公司培训部总监、首席培训师,金盛人寿保险公司培训部经理、分支机构负责人,海康人寿保险公司培训部经理。

王自生RFP,加拿大CFP。

武汉傲人理财投资有限公司总裁。

RFPI中国中心董事暨中南地区首席代表。

刘彦MBA,RFP。

陕西中阳财富管理顾问有限公司总裁。

RFPI中国发展中心董事暨西北地区首席代表,陕西省金融学会会员。

徐建明James Xu硕士,加拿大CFP。

上海理财专修学院执行院长,恒星理财顾问(上海)有限公司CEO,上海点金理财培训有限公司董事总经理,《理财周刊》杂志社首席理财顾问。

韦省民西北大学经济管理学院教授。

奥地利维也纳大学毕业,陕西省证券研究会常务副会长兼秘书长,陕西省区域经济研究会理事。

彭振武著名作家。

RFPI中国中心认可讲师。

搜狐网财经频道“量入为出”栏目主持人,北京《大众理财顾问》杂志专栏主持人,《湖南经济报》投资理财专栏特约理财师,《星沙之声》电台特约理财嘉宾。

张伯伦Dick Chang纽约市立大学工商管理硕士,RFP。

美国CFP、CLU(特许寿险核保师)、ChFC(特许财务顾问师)和RFC(国际认证财务顾问师);曾任国际保险经理协会GAMA讲师。

现为美国YFK Consulting总裁,美国华人保险同业公会准会长,美国保险理财协会(NAIFA)资深会员。

CFA考试见证了他的成长,成就了他的梦想!前些天,高顿君分享了一些关于CFA考生备考CFA+FRM的经历后,高顿君就看到了某位不甘落后的宝妈留言:这位宝妈称,自己96年年底(已经近97年了)的女儿,考CFA一级,成绩全部在90%以上,10A通过!FRM一级成绩1111(类似于CFA的10A),FRM二级成绩12222(上游水平)。

从年龄上以及考CFA的报名资格来看,该学霸妹子考CFA应该是在大四上学期,如今刚毕业。

而这时候的她,已经手握CFA一级和FRM二级,确实是非常优秀!高顿君已经为大家争取要经验分享了,有机会再分享给大家!高顿君曾经听到过某位名人的宣言:我要变的足够优秀,优秀到足矣让认识我的人在提起我名字的时候感到骄傲。

考友Alex对此深有体会,在毕业5年后,Alex赚到了人生的第一个一百万,而这一切,都要从当初在大学时立下的考证决定说起。

毕业时的竞争,在大学里已出现端倪学金融学的,毕业后做什么的都有,但基本上都可以看出,大学里最感兴趣什么,毕业后通常就从事了这一职业。

也就是,不同的选择决定了毕业后每个人的发展轨迹。

具体到大三学生,其实最重要的选择就是从一大堆金融类证书中找到最适合自己的一张。

对于金融专业学生来说,可以选择的证书其实说多也不多,主流证书大致有这么几张:CFA、FRM、CPA等……虽然是空闲时间很多的大学生,真正能用来考证的时间也是有限的,所以多数人只能从几张证书中选择一到两张报考。

当时也思考了很久,最后我选择报考CFA。

选择报考CFA,有3个原因。

1.这是张用途很广的证书,不仅仅是做会计,在金融,投行、信托、咨询,审计等领域都被视作高含金量证书,足以证明求职者对金融知识的掌握程度。

上次看到一则银行的招聘,直接将CFA三级视为加分项。

只要你通过三级,暂时没拿到证书照样是金融机构的香饽饽。

所以无论以后做不做金融,先拿下一张CFA都是不错的选择。

2.选择CFA的第二个理由是,这张证书报名门槛低,但是含金量超级高,而且许多前辈说过,这张证书越早考下来越好!3.之所以选择这张证书,主要还是因为这是张国际金融证书。

2019年cfa讲师哪个好?2019年cfa报名时间2019年cfa讲师哪个好2019年的CFA考试报名时间已经确定,CFA考试已经步步向我们走近,虽然说在2019年CFA考试之间还有一个12月份CFA一级的考试,但现在已经有一部分考生开始进入2019年的CFA考试备考中,因为他们知道越早备考对自己的CFA考试越有帮助,报考2019年CFA考试的考生中有部分是想要选择CFA培训机构来进行备考了,就有了这样的一个问题“2019年cfa讲师哪个好?”要说2019年cfa讲师哪个好,那我们就要说说高顿的CFA三巨头讲师——Feng、Jarod、JieFengCFA持证人;FRM持证人。

上海交通大学高等金融学院MBA,物理学硕士。

现担任高顿财经CFA/FRM研究中心主任、特级讲师,负责CFA和FRM项目的师资团队建设和产品研发,同时也担任CFA和FRM多门课程的授课工作。

曾就职世界百强企业,担任高等经理,负责公司亚太地区新业务的投资分析与决策,有多年实业投资的实务经验,擅长行业研究、投资分析与决策、战略企划。

擅长课程:金融数量方法、投资组合管理、固定收益、金融衍生品、公司金融、权益投资、等。

JarodCFA会员;FRM会员。

上海交通大学高等金融学院MBA,管理学硕士。

现担任高顿财经CFA/FRM研究中心高等讲师。

曾就职于中国建设银行上海市分行个人金融部,国内某知名公募基金风险管理部。

擅长财富管理,产品分析,风险管理等专业领域。

擅长课程:财务报表分析,固定收益,衍生品等。

客户口碑:客户涵盖国内多所知名大学,金融机构以及财经媒体。

上海财经大学MBA项目担任财务报表分析课程授课讲师;高顿财经与第一财经合作平台担任学术顾问。

JieCFA持证人;FRM持证人。

荷兰乌特勒支大学经济学硕士。

高顿财经CFA/FRM中心副主任、高等讲师。

曾就职全部大的金融集团之一ING。

从事金融分析工作。

擅长课程:职业伦理,经济学,权益投资,另类投资,衍生品,风险管理,等。

金融保险证券投资行业师资(附简介)师资一:宋劝其——主讲战略绩效管理体系建设及实施、战略性绩效管理的关键技巧国内知名战略绩效管理专家国家人力资源管理师教材编委会委员(主编绩效管理和薪酬福利部分),清华大学领导力项目核心讲师;北京大学EMBA课程教授;上海交通大学课程教授;国际人力资源管理师协会高级讲师;《中国电力教育》、中国制造业在线等多家网站和杂志的专家撰稿人。

现主要从事管理咨询和管理培训工作。

现任上海行隆企业管理咨询有限公司首席咨询师,先后为超过800家企事业单位提供咨询和培训服务,为超过300家的企业成功建设和实施绩效管理体系。

著有《高绩效管里的五项修炼》、《绩效管理》、《绩效激励》、《绩效管理与企业文化的最佳实践》等多部著作,论文《国有企业人力资源管理咨询研究》被荣选为第八届世界管理论坛交流文章。

师资二:荆涛——主讲激励沟通与团队建设、执行有理-企业执行力提升策略在读工商管理博士;国家注册高级职业经理人;首套本土MBA教材执行编委之一;“商业模型”系列课程创始人;国内体系化管理建设专家和营销专家;目前是百度、谷歌搜索“管理讲师”“企业管理讲师”排名第一的知名讲师。

曾任某投资公司核心项目组负责人,负责项目谈判和项目规划。

某全国知名化妆品公司全国市场总监,负责全国市场的销售。

国内首套本土MBA教材执行编委之一。

影响力教育训练集团培训中心总监、IT产品规划总监现任中华讲师网核心讲师之一;影响力讲师团核心讲师之一;国内体系化建设和营销专家,重点研究商业模型系列;曾参与国内大型投资项目,并在销售领域取得骄人业绩。

2005年决定做一个“传道授业解惑”的老师,将所学所得分享于众,于是加盟影响力。

凭借深厚的市场底蕴及犀利的授课风格,很快成为影响力讲师团实力派核心讲师之一。

师资三:莫志兵——主讲健康学、健康自己把握1994年毕业于苏州医学院,1997年毕业于上海医科大学,1997年起开始在交通大学医学院从事社会医学、卫生事业管理、健康学和健康管理的教学和科研工作,参加营养师、健康管理师的培训。

CFA三级组合管理重点解析:交易成本度量作者:高顿财经CFA讲师Oliver交易成本可以看作是投资业绩的抵消项,通过降低交易成本,投资经理可以将更加多的投资理念付诸实施,为客户创造价值。

理解交易成本的构成并对其进行准确地测算,有助于投资经理评估交易质量以及改善交易流程。

一、交易成本的构成(一)显性成本(explicit costs)显性成本是指由于进行交易活动而引起的各种费用,包括佣金、印花税、过户费等,所有的显性成本都将在会计上被确认为费用项目。

(二)隐形成本(implicit costs)隐形成本是指与理想的交易状态下所获得的投资利润相比,实际不完美的交易执行所丧失的投资利润。

与显性成本不同的是,隐形成本并不表现为对外支出的费用,因此在会计上也不被确认为费用项目。

隐形成本包括:大交易量使价格发生不利的变动(price impact)、由于交易延迟而遭受价格的不利变动(delay costs)、由于未能成交而丧失的投资利润(missed trade opportunity costs)。

二、度量交易成本的方法(一)有效利差(effective spread)effective spread = |实际平均成交价格– midquote|*2其中:midquote = (best bid + best ask) / 2当申报数量超过了best bid (best ask)所附带的、做市商所愿意交易的数量时,会有部分股票的成交价格比best bid (best ask)更差,所以effective spread比交易时点的market bid-ask spread1更大。

effective spread越大,代表交易成本越大。

effective spread是一个易于受到人为操纵(gaming)的指标,当申报订单类型赋予经纪商较大的自主决定权(discretion)时,经纪商有权决定交易的时点和交易的价格(limit order)。

全球最大的CFA(特许金融分析师)培训中心

总部地址:上海市虹口区花园路171号A3幢高顿教育

电话:400-600-8011网址:微信公众号:gaoduncfa 1

高顿CFA优秀教师——Feng

Feng

上海交通大学高金MBA 工学硕士 CFA/FRM

Feng曾在世界100强公司担任高级经理,有多年的实业投资分析经验。

现任高顿财经FRM/CFA全职讲师。

知识框架清晰,对重要的知识考点有深入研究;条理清晰,善于将复杂的知识讲解得通俗易懂。

学员评价:老师条理很清晰,上课节奏不快不慢,这样理解起来很容易。

老师长的萌萌哒

擅长科目:金融数量分析,投资组合管理,固定收益类证券,金融衍生类证券,企业理财等。

各位考生,2015年CFA备考已经开始,为了方便各位考生能更加系统地掌握考试大纲的重点知识,帮助大家充分备考,体验实战,网校开通了全免费的高顿题库(包括精题真题和全真模考系统),题库里附有详细的答案解析,学员可以通过多种题型加强练习,通过针对性地训练与模考,对学习过程进行全面总结。