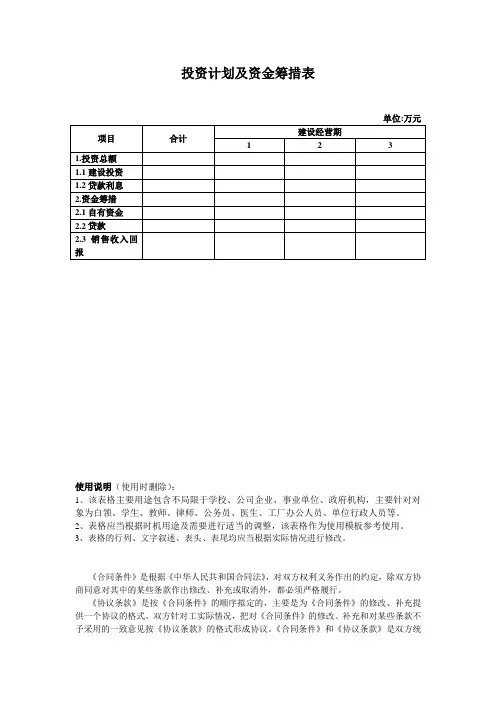

投资计划及资金筹措表

- 格式:docx

- 大小:26.49 KB

- 文档页数:11

项目资金筹措方案(一)项目总投资本项目总投资估算约人民币,具体构成包括但不限于以下费用:1.前期征地和拆迁费用;2.土建工程费用;3.装饰装修工程费用;4.水电安装工程费用;5.其他配套工程费用。

(二)项目投资计划1.项目投资计划表为保证项目建设的顺利实施,优化各种资金的利用,根据主管部门对项目所要求的开发顺序和时间要求,以及根据项目本身的实际情况和项目建设进度计划。

具体投资计划投资计划安排如下表:项目投资计划表2.项目建设投资计划横道图经研读招标及相关文件,根据本建设项目的特点,以及优化资金使用,将整个项目分专项工程实施建设,进行流水作业施工,优化投资方案,优化配套机械设备,对期中进度及投资目标进行跟踪管理,严格按计划控制进度及投资,通过进度及投资计划的对比分析,采取相应措施作出调整,确保工期以及投资目标。

具体投资计划见《建设项目投资控制计划横道图》。

建设项目投资控制计划横道图(三)项目融资资金来源我公司具有良好的融资能力,项目公司成立后,设立融资管理组,随即着手项目资金融资工作,本项目融资由六部分组成:一是公司银行账户上的流动资金;二是银行贷款,我公司已与湖北英山农村合作银行签订了流动资金贷款合同;三是公司全体股东及部分员工筹措的资金;四是我公司即将回笼嘉城名居项目的部分工程款;五是与我公司长期合作的材料供应商同意延期支付部分材料款,现已取得材料供应商就该项目建设可延期支付材料款的承诺书;六是英山县五环新型墙材有限公司注资。

以上融资将是我公司对本项目建设投资的有力保障。

本项目资金来源如下表所示:资金筹措来源一览表(四)资金到位承诺资金到位承诺书见附件1。

(五)投资收益投资收益定为本项目建设总投资的8%。

即:6000万元×8%=480万元。

(六)项目建设投资保证措施为确保本项目按进度计划顺利进行,根据本项目特点,我们将采取如下具体措施:1.将投资密度比较大的分部工程尽量押后施工,诸如其他配套工程等。

总投资和资金筹措12.1 项目总投资本项目总投资为29200万元,生产线设备投资为20000万元,其他投资7200万(包含土地2100万元,厂房建筑等5100万元),铺底流动资金2000万元。

12.1.1 生产线设备投资共20000万元,具体组成如下:年产1.8万立方米的COMPAK生产线设备8套,价格为2500万元×8=2亿元。

12.1.2 其他投资共7200万元,具体组成如下:1、土地款:购买140亩土地,15万元/亩,计2100万元2、场地开发费用:共5000万元。

①生产车间:3000万元;②成品仓库、料场:1200万元;③办公楼及宿舍食堂:260万元;④公用工程(配电、给排水、除尘、空压机、消防等):300万元⑤其他工程(道路、围墙、绿化、车库、车位):240万元3、开办费:共100万元①项目前期费:30万元。

②备品备件及工器具购置费: 20万元;③本项目联合试车费:25万元;④办公及生活家具购置费:25万元。

合计:2100万元+5000万元+100万元=7200万元12.1.3 流动资金:达产年流动资金需要额为8000万元,铺底流动资金约2000万元。

项目投资估算汇总表12.2 资金筹措12.2.1 资金来源组成:自有资金7200万元,需融资和贷款约22000万元。

融资计划:本项目缺口2.2亿元,可以采取银行贷款一部分,申请国家发改委和环保扶持资金一部分,设备租赁融资一部分或分期付款,京都协议的CO2销售收入一部分。

其中:1、计划申请银行贷款7000万元,以项目土地(价值2800万元)、房产(价值8000万元)合计1.08亿元做抵押,贷款7000万元;2、计划以融资租赁方式引进设备,设备贷款50%-70%,设备价款2亿元计划采取融资租赁方式或分期付款,可以申请设备按揭贷款50%-70%即1亿元-1.4亿元;3、计划申请国家发改委政策资金3000万元;4、计划申请地方环保支持资金2000万元。

投资使用计划与资金筹措总表英语Investment Utilization Plan and Fund Raising Summary.1. Introduction.The investment utilization plan and fund raising summary is a crucial document that outlines the detailed strategy for allocating funds raised to various investment projects. It serves as a roadmap for investors, stakeholders, and other interested parties to understand the financial strategy behind a given investment opportunity. This document aims to provide transparency, accountability, and clarity on how funds will be used, the expected returns, and the overall financial viability of the proposed investment.2. Investment Objectives.The first section of the investment utilization plan defines the objectives of the investment. This includes theexpected returns, risk tolerance, time horizon, and any specific strategic goals that the investment is designed to achieve. These objectives form the foundation for all subsequent decisions regarding fund allocation.3. Fund Raising Strategy.The fund raising strategy section details the methods that will be used to gather the necessary capital for the investment. This may include equity financing, debt financing, grants, or a combination of these sources. The section also outlines the target amount to be raised, the expected cost of capital, and the timeline for raising the funds.4. Investment Allocation.The investment allocation section specifies how the raised funds will be distributed across different investment projects or assets. This allocation is typically based on a variety of factors such as risk, return potential, market conditions, and strategic fit with theoverall investment objectives. The section details the amount allocated to each project, the expected returns, and the rationale behind the allocation decisions.5. Risk Management.Risk management is a crucial aspect of any investment decision. This section identifies the potential risks associated with each investment project and outlines the strategies and measures that will be implemented tomitigate these risks. This may include diversification, hedging, insurance, or other risk reduction techniques.6. Monitoring and Evaluation.The monitoring and evaluation section details the processes that will be used to track the performance of the investments and ensure that they align with the original objectives. This includes regular reporting, financial analysis, and performance metrics that will allow stakeholders to assess the progress of the investments and make informed decisions about future allocations.7. Financial Projections.The financial projections section provides an overviewof the expected financial outcomes of the investments. This includes projections for returns, cash flows, profitability, and other key financial metrics. These projections arebased on market research, historical data, and assumptions about future market conditions.8. Conclusion.The conclusion summarizes the key points of the investment utilization plan and fund raising summary. It restates the investment objectives, outlines the fundraising strategy, and provides an overview of theinvestment allocation, risk management, monitoring, evaluation, and financial projections. The conclusion also highlights the benefits of the proposed investment to investors, stakeholders, and other interested parties.9. Appendices.The appendices section includes any additional documents or information that supports the investment utilization plan and fund raising summary. This may include market research reports, financial models, legal documents, or any other relevant materials that provide additional context or detail for the investment decision.Overall, the investment utilization plan and fund raising summary is a comprehensive document that provides a detailed roadmap for allocating raised funds to investment projects. It ensures transparency, accountability, and clarity on how funds will be used, the expected returns, and the overall financial viability of the proposed investment. By carefully considering each section of the plan, investors and stakeholders can make informed decisions about allocating capital and achieving their investment objectives.。

投资计划及资金筹措表

使用说明(使用时删除):

1、该表格主要用途包含不局限于学校、公司企业、事业单位、政府机构,主要针对对象为白领、学生、教师、律师、公务员、医生、工厂办公人员、单位行政人员等。

2、表格应当根据时机用途及需要进行适当的调整,该表格作为使用模板参考使用。

3、表格的行列、文字叙述、表头、表尾均应当根据实际情况进行修改。

《合同条件》是根据《中华人民共和国合同法》,对双方权利义务作出的约定,除双方协商同意对其中的某些条款作出修改、补充或取消外,都必须严格履行。

《协议条款》是按《合同条件》的顺序拟定的,主要是为《合同条件》的修改、补充提供一个协议的格式。

双方针对工实际情况,把对《合同条件》的修改、补充和对某些条款不予采用的一致意见按《协议条款》的格式形成协议。

《合同条件》和《协议条款》是双方统

一意愿的体现,成为合同文件的组成部分。

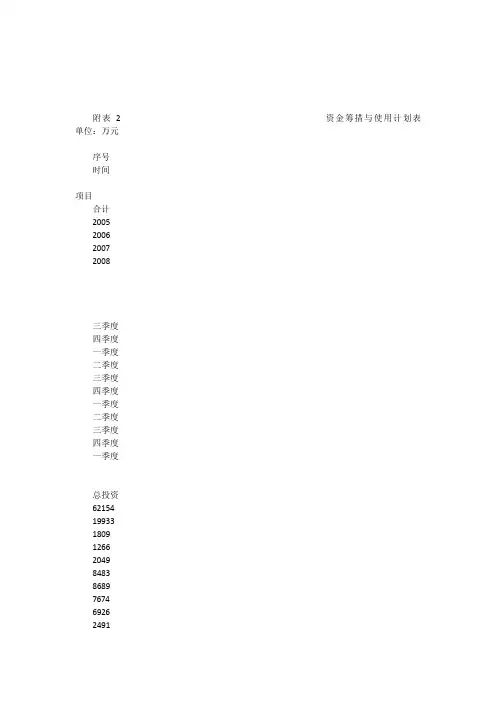

附表 2 资金筹措与使用计划表单位:万元序号时间项目合计2005200620072008三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度总投资6215419933180912662049848386897674692624915891建设投资59512 19933 1792 1207 1928 8163 8163 7090 6320 2084 22445891.1建设期利息264217591213215275836064071.2资金筹措62154 19933 1809 1266 2049 8483 8689 7674 692622445892自有资金4544219933896628670906320208422445892.1资本金20829199338962.1.1销售收入滚动使用24613628670902084 2244 5892.1.2长期借款16712913 1266 2049 8483 2404 5836064072.2贷款本金14070896 1207 1928 8163 18772.2.1利息264217591213215276064072.2.2总投资6215419933180912662049848386897674692624912244589附表 3 销售收入测算表单位:万元项目总面积㎡售价(元)2006200720082009四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度住宅29603 4430 1311 1967 2623 3279 3279 656写字楼94368 80801号570014606 4606 6909 6909 4606 4606 2303 2303 23032号373673019 3774 3774 4529 4529 3019 1510 755 755商业2918 8000584 700 700 350车位905个12.5万754754754754754754754754754754754总收入88556694579101400515416127631054475866076456715091509附表4 销售收入与销售税金及附加计算表单位:万元序号时间项目20052006200720082009三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度1销售收入6945791014005154161276310544758660764567150915092销售税金及附加38243577084870258041733425183832.1营业税34739670077163852737930422875752.2城市维护建设税242849544537272116552.3教育费附加101221231916119722营业税:销售收入的5% 城市维护建设税:营业税的7% 教育费附加:营业税的3%附表 5 项目现金流量表单位:万元序号时间2005200620072002009项目三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度1现金流入6945 7910 14005 15416 12763 10544 7586 6076 4567 1509 15091.1销售收入6945 7910 14005 15416 12763 10544 7586 6076 4567 1509 1509现金流出19933 1792 1207 1928 8163 8822 7842 7651 3548 3456 1264 2986 2392 1798 5945942.1建设投资19933 1792 1207 1928 8163 8163 7090 6320 2084 2244 5892.2销售费用27831656061751142230324318360602.3销售税金及附加38243577084870258041733425183832.4所得税33%-3272266181513644514513净现金流量-19933-1792-1207-1928-8163-187769635411867930692814600368427699159154累计净现金流量-19933-21725-22932-24860-33022-34899-34831-28476-16609-730319786578102621303113946148615所得税前净现金流量-19933-1792-1207-1928-8163-18776963541186793068954686554994133136613666所得税前净累计净现金流量-19933-21725-22932-24860-33022-34899-34831-28476-16609-73031651851614015181481951420879净现值(NPV):¥10233万元(税前)¥5851万元(税后)内部收益率:28.30%(税前)18.66%(税后)投资回收期: 2.75年(静态) 2.83年(动态)附表 6 资本金现金流量表单位:万元序号时间项目20052006200720082009三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度1现金流入6945791015416 12763 10544 7586 6076 4567 1509 15091.1销售收入6945 7910 14005 15416 12763 10544 7586 6076 4567 1509 15092现金流出19933 8966945 7842 13399 14512 3456 1264 2986 23925945942.1资本金199338962.2借款本息偿还5748109632.3销售收入滚动使用628670906320208422445892.4销售税金及附加38243577084870258041733425183832.5销售费用27856061751142230324318360602.6所得税-3272266181513644514513税后净现金流量-19933-896696069049306928146002769915915累计净现金流量-19933-20829-20829-20829-20829-20829-20760-20155-19251-9944-664393676201038911304122194所得税前净现金流量-19933-896696069049306895468655499413313661366净现值(NPV):¥9238万元(税前)¥4855万元(税后)内部收益率:29.18%(税前)21.37%(税后)投资回收期: 2.75年(静态) 3.25年(动态)附表7 损益表单位:万元号时间项目20052006200720082009三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度1销售收入6945791014005154161276310544758660764567150915092销售税金及附加38243577084870258041733425183833销售费用4%27831656061751142230324318360604建设投资19933 1792 1207 1928 8163 8163 7090 6320 2084 22445895建设期利息017591213215275836064075利润总额-19933-1809-1266-2049-8483-2404-51557481146093068954686554994133136613666累计利润-19933-21742-23008-25057-33540-35944-36459-30710-19251-9944-9915875113741550716872182387所得税33%-3272266 1815 13644514518税后利润-19933-1809-1266-2049-8483-2404-5155748 11460 9306 9281 4600 3684 27699159159未分配利润-19933-1809-1266-2049-8483-2404-515574893069281460036842769915915累计未分配利润-19933-21742-23008-25057-33540-35944-36459-30710-19251-9944-66439367620103891130412219附表8 还本付息计算表单位:万元序号时间项目2006年2007年三季度四季度一季度二季度三季度四季度一季度二季度三季度1期初借款本息累计91321794228127111511515698105562本期借款89612071928816318773本期应计利息171213215275836064074偿还贷款本息来源4.1利润5748114604.2偿还本息574810963偿还本息后余额496借款回收期2年年利率 6.34% 季利率 3.86%附表9 资金来源与运用表单位:万元序号时间项目20052006200720082009三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度二季度1资金来源1993318091266204984839349849414611158231276310544758660764567150915091.1资本金19933 8961.2长期借款913 1266 2049 8483 2404 5836064071.3销售收入6945 7910 14005 15416 12763 10544 7586 6076 4567 1509 15092资金运用19933 1809 1266 2049 8483 9349 8425 14005 14919 3456 1591 2659 2392 1798 5945942.1建设投资19933 1792 1207 1928 8163 8163 7090 632022445892.2销售税金及附加38243577084870258041733425183832.3销售费用278316560617511422303243183602.4建设期利息17591213215275836064072.5所得税1939181513644514512.6长期借款本息偿还5748 109633盈余资金69606904 9306 8954 4927 3684 2769 9159154累计盈余69675157910885198392476528450312193213433049附录二财务评价报表附表 1 总投资估算表单位:万元序号时间项目合计2005200620072008三季度四季度一季度二季度三季度四季度一季度二季度三季度四季度一季度1土地费用18141.00 18141.002前期费用3440.94 1720.47 1720.473房屋开发费34205.53962.05 1682.61 7917.53 7917.53 6845.191494.70 1654.704室外工程费1376.28344.07 344.07 344.07 344.075建设监理费355.8239.54 39.54 39.54 39.54 39.54 39.54 39.54 39.54 39.546管理费用787.57 71.60 71.60 71.60 71.60 71.60 71.6071.60 71.60 71.60 71.607预备费1204.98133.89 133.89 133.89 133.89 133.89 133.89 133.89 133.89 133.89合计59512.12 19933.07 1792.07 1207.07 1927.62 8162.55 8162.55 7090.21 6320.32 2083.78 2243.78 589.098投资利息2677.2017.29 58.55 121.30 320.73593.19 616.09 418.38总投资62189.32 19933.07 1809.36 1265.61 2048.93 8483.28 8694.21 7683.41 6936.41 2502.17 2243.78 589.09。

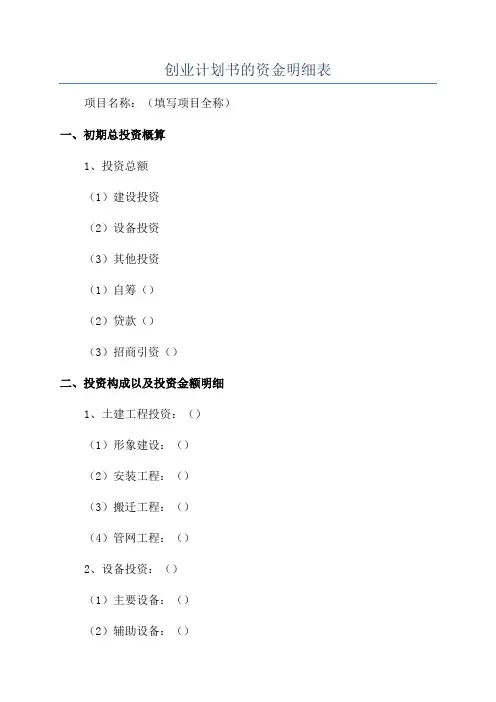

创业计划书的资金明细表项目名称:(填写项目全称)

一、初期总投资概算

1、投资总额

(1)建设投资

(2)设备投资

(3)其他投资

(1)自筹()

(2)贷款()

(3)招商引资()

二、投资构成以及投资金额明细

1、土建工程投资:()

(1)形象建设:()

(2)安装工程:()

(3)搬迁工程:()

(4)管网工程:()

2、设备投资:()

(1)主要设备:()

(2)辅助设备:()

(4)技术转让费:()

3、其他投资:()

(1)资金储备费用:()

(2)安全保护措施:()

(3)技术引进费用:()

(4)工程施工费用:()

(5)铺设费用:()

(6)其他:()

三、资金筹措

1、自筹资金:()

2、外部融资:()

(1)贷款:()

(2)招商引资:()

(3)其他:()

四、资金使用

1、资金使用总体情况:()

2、资金使用细节:()

(1)土建工程投资:()

(3)其他投资:()。

项目资金筹措方案(一)项目总投资本项目总投资估算约人民币,具体构成包括但不限于以下费用:1.前期征地和拆迁费用;2.土建工程费用;3.装饰装修工程费用;4.水电安装工程费用;5.其他配套工程费用。

(二)项目投资计划1.项目投资计划表为保证项目建设的顺利实施,优化各种资金的利用,根据主管部门对项目所要求的开发顺序和时间要求,以及根据项目本身的实际情况和项目建设进度计划。

具体投资计划投资计划安排如下表:项目投资计划表2.项目建设投资计划横道图经研读招标及相关文件,根据本建设项目的特点,以及优化资金使用,将整个项目分专项工程实施建设,进行流水作业施工,优化投资方案,优化配套机械设备,对期中进度及投资目标进行跟踪管理,严格按计划控制进度及投资,通过进度及投资计划的对比分析,采取相应措施作出调整,确保工期以及投资目标。

具体投资计划见《建设项目投资控制计划横道图》。

建设项目投资控制计划横道图(三)项目融资资金来源我公司具有良好的融资能力,项目公司成立后,设立融资管理组,随即着手项目资金融资工作,本项目融资由六部分组成:一是公司银行账户上的流动资金;二是银行贷款,我公司已与湖北英山农村合作银行签订了流动资金贷款合同;三是公司全体股东及部分员工筹措的资金;四是我公司即将回笼嘉城名居项目的部分工程款;五是与我公司长期合作的材料供应商同意延期支付部分材料款,现已取得材料供应商就该项目建设可延期支付材料款的承诺书;六是英山县五环新型墙材有限公司注资。

以上融资将是我公司对本项目建设投资的有力保障。

本项目资金来源如下表所示:资金筹措来源一览表(四)资金到位承诺资金到位承诺书见附件1。

(五)投资收益投资收益定为本项目建设总投资的8%。

即:6000万元×8%=480万元。

(六)项目建设投资保证措施为确保本项目按进度计划顺利进行,根据本项目特点,我们将采取如下具体措施:1.将投资密度比较大的分部工程尽量押后施工,诸如其他配套工程等。

投资使用计划与资金筹措总表英语英文回答:Capital Investment and Funding Plan.Introduction.Capital investment is essential for businesses to grow and remain competitive. It involves acquiring long-term assets, such as property, equipment, and technology, that will provide benefits over multiple years. To ensure that capital investment decisions are made strategically and effectively, it is important to create a comprehensive capital investment and funding plan.Elements of a Capital Investment and Funding Plan.A capital investment and funding plan typically includes the following elements:Identification of Investment Opportunities: This involves identifying and assessing potential investment opportunities that align with the business's strategic goals.Project Evaluation and Selection: Each investment opportunity is evaluated based on its potential return, risk, and impact on the business.Capital Budgeting: This involves determining the total amount of capital that will be required for the investment projects and sources of funding.Funding Strategy: This outlines the specific sources of funding that will be used to finance the investment projects, such as equity, debt, or internal funds.Implementation and Monitoring: This includes the execution of the investment projects and ongoing monitoring of their progress and performance.Benefits of a Capital Investment and Funding Plan.A well-developed capital investment and funding plan offers several benefits, including:Improved Decision-Making: It provides a structured framework for evaluating investment opportunities and making informed decisions.Resource Allocation: It helps businesses optimize their use of financial resources by allocating capital to the projects with the highest potential return.Risk Management: By considering the risks associated with each investment opportunity, it helps businesses mitigate potential losses.Enhanced Competitiveness: Capital investment can lead to increased productivity, innovation, and customer satisfaction, ultimately enhancing the business's competitive position.Developing a Capital Investment and Funding Plan.The process of developing a capital investment and funding plan involves the following steps:1. Set Strategic Goals: Determine the business's long-term strategic goals that will guide the investment decisions.2. Identify Investment Opportunities: Conduct research to identify potential investment opportunities that align with the strategic goals.3. Evaluate and Select Projects: Assess each investment opportunity using financial analysis, market research, and risk assessment. Select the projects that have the highest potential return and lowest risk.4. Determine Capital Requirements: Calculate the total amount of capital required for the selected investment projects.5. Develop a Funding Strategy: Explore differentfunding options, including equity, debt, and internal funds. Determine the appropriate mix of funding sources based on cost, availability, and risk tolerance.6. Implement and Monitor: Execute the investmentprojects as planned and monitor their progress and performance regularly. Make adjustments as needed to ensure alignment with the strategic goals.Conclusion.A capital investment and funding plan is a crucial tool for businesses to make strategic investment decisions and secure the necessary financing. By following a systematic and comprehensive approach, businesses can optimize their capital allocation and enhance their long-term growth and success.中文回答:投资使用计划和资金筹措总表。

一、投资估算1、投资估算范围本项目为新产品开发项目,利用原有厂房和设备,进行适当的扩建,根据拟定的技术方案和建设内容,本项目的投资估算范围包括:基本建设、设备购置、安装费、利息等费用。

2、投资估算的依据及说明(1)土建工程费参照当地同类结构的建、构筑物的造价并经实地调查后,根据现行建材市场价格进行估算。

(2)设备按现行市场价格估算。

(3)预备费中不可预见费按基本建设和设备购置费之和的10%估算。

(5)建设期贷款利息按年利率7.6%计算。

(6)流动资金总额以周转期为90天按经营成本计算。

3、投资总额本项目投资总额为221.53万元,由建设投资、建设期利息和流动资金三大部分组成,其中: (1)建设投资57.97万元,估算情况详见附表1.项目固定资产投资估算表。

其中:建设费用:52.7万元预备费:5.27万元(2)建设期利息4.41万元,详见附表1。

(3)流动资金总额为159.15万元,详见附表4。

二、资金筹措本项目的资金筹方案分为建设投资和流动资金两部分。

1、建设投资筹措本项目建设投资额为57.97万元,根据建设单位意见,计划从自筹资金和科技开发计划经费中两种渠道进行筹集。

(1)企业自筹资金37.97万元。

(2)申请科技开发经费20万元。

2、流动资金筹措经估算,项目正常生产需流动资金为159.15万元,向银行申请贷款88.05万元,企业自筹71.1万元,其中铺底流动资金106.1万元。

流动资金筹措详见附表7。

三、项目经济寿命期分析本项目是以开发平板型太阳能热水器,随着人们生活水平的提高,环保意识的加强,太阳能热水器必将逐步普及,考虑到利用自制的专用设备生产热水器的板芯,其产品在广西具有较大的价格优势和售后服务优势,但要面对今后同类产品的竞争及加入WTO 后环保型新产品技术开发步伐的加快,经模拟估算,确定本项目生产的产品的经济寿命为8年。

项目投资使用计划及资金筹措表用英文表达Investment projects are essential for businesses to grow and expand. Having a solid investment plan and funding strategy is crucial for the success of any project. It requires careful consideration and planning to ensure that the necessary resources are available and utilized effectively.项目投资是企业增长和扩张的必备条件。

拥有一个坚实的投资计划和资金筹措策略对于任何项目的成功至关重要。

需要仔细考虑和规划,以确保必要的资源可用并得到有效利用。

One key aspect of an investment plan is determining the amount of funding needed. This involves calculating the costs associated with the project, including expenses for equipment, labor, materials, and other resources. It is essential to conduct thorough research and analysis to accurately estimate the required funds to avoid any financial setbacks during the project implementation.投资计划的一个关键方面是确定所需资金的数量。

这涉及计算与项目相关的成本,包括设备、劳动力、材料和其他资源的费用。