最新布兰查德《宏观经济学》第五版课后题答案

- 格式:doc

- 大小:391.50 KB

- 文档页数:63

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的.例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低.同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响.2。

第17章 预期、产出和政策一、概念题1.总私人支出(aggregate private spending ,or private spending ) 答:总私人支出包括消费和投资两部分,表示为:。

总私人支出是收入的递增函数:收入越高,消费和投资越高;它是税收的递减函数:高税收使得消费下降;它是实际利率的递减函数:高实际利率使得投资下降。

2.动物精神(animal spirits )答:动物精神又称为“血气冲动”、“本能冲动”、“动物本能”、“创业冲动”,是指用来说明企业家作出投资决策时的心理状态,以及这种心理状态对投资的影响。

凯恩斯认为,企业家是否进行一项投资,并不是十分理性地进行冷静周密的计算后作出决定,而是一时“动物本能”的结果。

因此,投资是一种动物本能影响的活动。

私人投资不仅取决于企业家对未来投资收益的估算,而且还受到企业家一时一地的心理状态和情绪的影响。

以后,英国经济学家J.罗宾逊在分析投资问题时,也运用了动物本能这一概念。

3.适应性预期(adaptive expectations )答:适应性预期是一种预期形成理论,指对某一经济变量,不仅依据其现期的实际值,而且依据其现期实际值与在上一期对其做出的本期的估计值之间的误差,进行相应调整,得()()(),,,A Y T r C Y T I Y r ≡-+Y T r出对其未来估计值的预期。

适应性预期产生于20世纪50年代,是由菲利普·卡甘在一篇讨论恶性通货膨胀的文章中提出来的,很快在宏观经济学中得到广泛的应用。

适应性预期假定经济人根据以前的预期误差来修正以后的预期。

适应性预期模型的要点是预期变量依赖于该变量的历史信息。

某个时期的适应性预期价格等于上一时期预期的价格加上常数与上期价格误差(上个时期实际价格与预期价格之差)之和。

即预期价格是过去所有实际价格的加权平均数,权数是常数的函数。

适应性预期在物价较为稳定的时期能较好地反映经济现实。

第19章 开放经济中的物品市场一、概念题1.国内产品的需求(demand for domestic goods )答:在开放经济中,对国内产品的需求可表示为:其中,前面的三项——消费()、投资()和政府支出()——构成了产品的国内需求;是实际汇率,即用国内产品形式表示的国外产品的价格,因此就是用国内产品表示的进口价值;是出口价值。

部分为对国内产品的国内需求,X 是对国内产品的国外需求,两者相加即表示对国内产品的总需求。

2.产品的国内需求(domestic demand for goods )答:假定消费与可支配收入()正相关;投资与产出()正相关,与实际利率()负相关;政府支出()是给定的,暂时不考虑预期对影响支出的作用。

则产品的国内需求可以表示为:3.协调,七国集团(coordination ,G7)答:协调是指为了减少国际间的经济波动或金融动荡,政府间所进行的一系列谈判、合/Z C I G IM X ε≡++-+C I G ε/IM εX /C I G IM ε++-Y T -Y r G ()()()(),国内需求 C I G C I GY T Y r =++=++-++-,作、妥协的过程。

从实际情况看,由于各国间的利益冲突,国家间的宏观协调非常有限。

这可能有以下原因:①协调就意味着一些国家可能比其他国家贡献得更多,但它们可能并不愿意这样做。

②假定只有一些国家处于衰退中,那些并没有处于衰退之中的国家可能就不愿意提高它们自己的需求;但是如果它们不这么做,那些扩张的国家相对于不扩张的国家就可能会出现贸易赤字。

③假定一些国家已经有巨大的贸易赤字。

这些国家可能就不愿意削减税收或者进一步提高支出,因为这样会更加提高它们的贸易赤字。

它们会要求其他国家作出更多的调整,然而其他的国家可能并不愿意这么做。

④各个国家都会承诺协调,然后并不实现其诺言。

一旦所有的国家都同意提高支出,那么,每一个国家都会有不实行的动机,以从其他国家的需求提高中获益,从而改善其贸易状况。

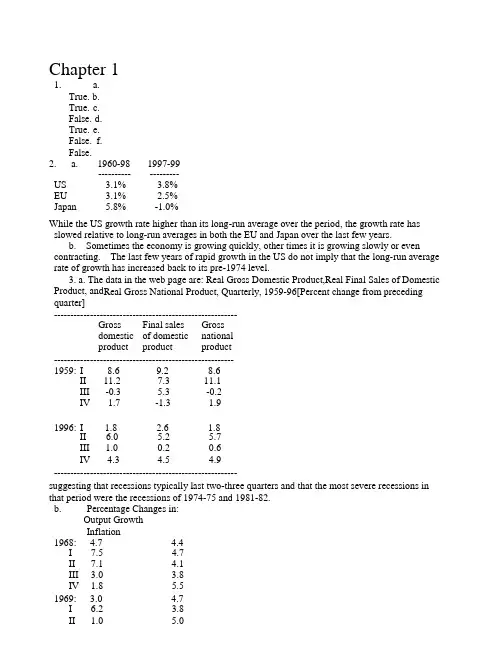

Chapter 11. a.True. b.True. c.False. d.True. e.False. f.False.2. a. 1960-98 1997-99-------------------US 3.1% 3.8%EU 3.1% 2.5%Japan 5.8%-1.0%While the US growth rate higher than its long-run average over the period, the growth rate has slowed relative to long-run averages in both the EU and Japan over the last few years.b. Sometimes the economy is growing quickly, other times it is growing slowly or even contracting. The last few years of rapid growth in the US do not imply that the long-run average rate of growth has increased back to its pre-1974 level.3. a. The data in the web page are: Real Gross Domestic Product,Real Final Sales of Domestic Product, and Real Gross National Product, Quarterly, 1959-96[Percent change from preceding quarter]--------------------------------------------------------Gross Final sales Grossdomestic of domestic nationalproduct product product-------------------------------------------------------1959: I 8.6 9.2 8.6II11.27.311.1III-0.3 5.3-0.2IV 1.7-1.3 1.91996: I 1.8 2.6 1.8II 6.0 5.2 5.7III 1.00.20.6IV 4.3 4.5 4.9--------------------------------------------------------suggesting that recessions typically last two-three quarters and that the most severe recessions in that period were the recessions of 1974-75 and 1981-82.b. Percentage Changes in:Output GrowthInflation1968: 4.7 4.4I7.5 4.7II7.1 4.1III 3.0 3.8IV 1.8 5.51969: 3.0 4.7I 6.2 3.8II 1.0 5.0III 2.3 5.8IV-2.0 5.11970: 0.1 5.3I-0.7 6.0II0.6 5.7III 3.7 3.4IV-3.9 5.41971: 3.3 5.2I11.3 6.4II 2.3 5.5III 2.6 4.4IV 1.1 3.3If history simply repeats itself, the United States might have a short recession (lasting perhaps oneyear) accompanied by an acceleration in the rate of inflation by about one percentage point.4. a. Banking services, business services.b. Not only has the relative demand for skilled workers increased but the industries wherethis effect is the strongest are making up a greater fraction of the economy.5. 1. Low unemployment might lead to an increase in inflation.2. Although measurement error certainly contributes to the measured slowdown ingrowth, there are other issues to consider as well, including the productivity of newresearch and accumulation of new capital.3. Although labor market rigidities may be important, it is also important to consider thatthese rigidities may not be excessive, and that high unemployment may arise from flawed macroeconomic policies.4. Although there were serious problems with regard to the management of Asian financial systems, it is important to consider the possibility that the flight of foreign capital from thesecountries worsened the situation by causing a severe stock market crash and exchange rate depreciation.5. Although the Euro will remove obstacles to free trade between European countries,each country will be forced to give up its own monetary policy.* 6. a. From Chapter 1: US output 1997=$8b; Ch ina output 1996=$.84b. Note that China’s outputin 1997 is $(.84)*(1.09) b. Equating output for some time t in the future:8*(1.03)t=(.84*1.09)*(1.09)t8/(.84*1.09)=(1.09/1.03)t8.737=(1.058)tt =ln(8.737)/ln(1.058) H38yrsb. From Chapter 1: US output/worker in 1997=$29,800; China output/per worker in1996=$70029.8*(1.03)t=(.7*1.09)*(1.09)tt H65 yearsChapter 21. a. False.b. Uncertain: real or nominalGDP. c. True.d. True.e. False. The level of the CPI means nothing. Its rate of change tells us about inflation.f. Uncertain. Which index is better depends on what we are trying to measure—inflationfacedby consumers or by the economy as a whole.2. a. +$100; Personal ConsumptionExpenditures b. nochange:intermediategoodc. +$200 million; Gross PrivateDomesticFixedInvestmentd. +$200 million; Net Exportse. no change: the jet was already counted when it was produced, i.e., presumably whenDelta(or some other airline) bought it new as an investment.*3. a. Measured GDP increases by $10+$12=$22.b. True GDP should increase by much less than $22 because by working for an extra hour,you are no longer producing the work of cooking within the house. Since cooking within the house is a final service, it should count as part of GDP. Unfortunately, it is hard to measure the value of work within the home, which is why measured GDP does not include it.4. a. $1,000,000 the value of the silver necklaces.b. 1st Stage:$300,000.2ndStage:$1,000,00-$300,000=$700,000.GDP: $300,000+$700,000=$1,000,000.c. Wages: $200,000 + $250,000=$450,000.Profits: ($300,000-$200,000)+($1,000,000-$250,000-300,000)=$100,000+$450,000=$550,000.GDP:$450,000+$550,000=$1,000,000.5. a. 1998 GDP: 10*$2,000+4*$1,000+1000*$1=$25,0001999 GDP: 12*$3,000+6*$500+1000*$1=$40,000Nominal GDP has increased by 60%.b. 1998 real (1998) GDP: $25,0001999 real (1998) GDP: 12*$2,000+6*$1,000+1000*$1=$31,000Real (1998) GDP has increased by 24%.c. 1998 real (1999) GDP: 10*$3,000+4*$500+1,000*$1=$33,0001999 real (1999) GDP: $40,000.Real (1999) GDP has increased by 21.2%.d. True.6. a. 1998 base year:Deflator(1998)=1; Deflator(1999)=$40,000/$31,000=1.29Inflation=29%b. 1999 base year:Deflator(1998)=$25,000/$33,000=0.76; Deflator(1999)=1Inflation=(1-0.76)/0.76=.32=32% c. Yes7. a. 1998 real GDP = 10*$2,500 + 4*$750 + 1000*$1 = $29,0001999 real GDP = 12*$2,500 + 6*$750 + 1000*$1 = $35,500b. (35,500-29,000)/29,000 = .224 = 22.4%c. Deflator in 1998=$25,000/$29,000=.86Deflator in 1999=$40,000/$35,500=1.13Inflation = (1.13 -.86)/.86 = .314 = 31.4%.8. a. The quality of a routine checkup improves over time. Checkups now may includeEKGs, for example. Medical services are particularly affected by this problem due toconstant improvements in medical technology.b. You need to know how the market values pregnancy checkups with and withoutultra-sounds in that year.c. This information is not available since all doctors adopted the new technologysimultaneously. Still, you can tell that the quality adjusted increase will be lower than20%.*9. a. approximately 2.5% b. 1992 real GDP growth: 2.7%;unemployment rate Jan 92: 7.3%; unemployment rate Jan 93: 7.3%Supports Okun's law because the unemployment rate does not change when the growth rate of real GDP is near 2.5% c. -2 percentage points change in the unemployment rate; 5percent GDP growth d. The growth rate of GDP must increase by 2.5 percentage points.Chapter 31. a. True.b. False. Government spending was 18% if GDP without transfers.c. False. The propensity to consume must be less than one for our model to be welldefined.d.True.false.f. False. The increase in output is one times the multiplier.2. a. Y=160+0.6*(Y-100)+150+150 0.4Y=460-60 Y=1000b. Y D=Y-T=1000-100=900c. C=160+0.6*(900)=7003. a. No. The goods market is not in equilibrium. Frompart 2a, Demand=1000=C+I+G=700+150+150b. Yes. The goods market is in equilibrium.c. No. Private saving=Y-C-T=200. Public saving =T-G=-50. National saving (or inshort, saving) equals private plus public saving, or 150. National saving equalsinvestment.4. a. Roughly consistent. C/Y=700/1000=70%; I/Y=G/Y=150/1000=15%.b. Approximately -2%.c. Y needs to fall by 2%, or from 1000 to 980. The parameter c0needs to fall by20/multiplier,or by 20*(.4)=8. So c0needs to fall from 160 to 152.d. The change in c0(-8) is less than the change in GDP (-20) due to the multiplier.5. a. Y increases by 1/(1-c1) b. Y decreases by c1/(1- c1)c. The answers differ because spending affects demand directly, but taxes affectdemand through consumption, and the propensity to consume is less than one.d. The change in Y equals 1/(1-c1) - c1/(1- c1) = 1. Balanced budget changes in G and Tare not macroeconomically neutral.e. The propensity to consume has no effect because the balanced budget tax increase abortsthe multiplier process. Y and T both increase by on unit, so disposable income, and hence consumption, do not change.*6. a. The tax rate ilessthanone.b.Y=c0+c1Y D+I+G impliesY=[1/(1-c1+c1t1)]*[c0-c1t0+I+G]c. The multiplier = 1/(1-c1+c1t1) <1/(1- c1), so the economy responds less to changes inautonomous spending when t1is positive.d. Because of the automatic effect of taxes on the economy, the economy responds less tochanges in autonomous spending than in the case where taxes are independent of income. So output tends to vary less, and fiscal policy is called an automatic stabilizer.*7. a. Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G] b. T = c1t0+ t1*[1/(1-c1+c1t1)]*[c0-c1t0+I+G]c. Both Y and T decrease.d. If G is cut, Y decreases even more.Chapter 41.a.True.b.Fals.c.True.d.True.e.False.f.False.g.True.2. a. i=0.05: Money demand = $18,000; Bond demand = $32,000i=.1: Money demand = $15,000; Bond demand = $35,000b. Money demand decreases when the interest rate increases; bond demand increases. Thisis consistent with the text.c. The demand for money falls by 50%. d. The demand formoney falls by 50%.e. A 1% increase (decrease) in income leads to a 1% increase (decrease) in money demand.This effect is independent of the interest rate.3. a. i=100/$P B–1; i=33%; 18%; 5% when $P B=$75; $85; $95.b. Negative.c. $P B=100/(1.08) $934. a. $20=M D=$100*(.25-i) i=5%b. M=$100*(.25-.15)M=$105. a. B D= 50,000 - 60,000 (.35-i)An increase in the interest rate of 10% increases bond demand $6,000.b. An increase in wealth increases bond demand, but has no effect on money demand.c. An increase in income increases money demand, but decreases bond demand.d. When people earn more income, this does not change their wealth right away. Thus,they increase their demand for money and decrease their demand for bonds.6. a. Demand for high-powered money=0.1*$Y*(.8-4i)b. $100 b = 0.1*$5,000b*(.8-4i) i=15%c. M=(1/.1)*$100 b=$1,000 b M= M d at the interest derived in part b.6. d. If H increases to $300, falls to 5%.e. M=(1/.1)*$300 b=$3,000 b7. a. $16 is withdrawn on each trip to the bank.Money holdings—day one: $16; day two: $12; day three: $8; day four: $4.b. Average money holdings are $10.c. $8 dollar withdrawals; money holdings of $8; $4; $8; $4.d. Average money holdings are $6.e. $16 dollar withdrawals; money holdings of $0; $0; $0; $16.f. Average money holdings are $4.g. Based on these answers, ATMs and credit cards have reduced money demand.8. a. velocity=1/(M/$Y)=1/L(i)b. Velocity roughly doubled between the mid 1960s and the mid 1990s.c. ATMS and credit cards reduced L(i) so velocity increased.Chapter 51.a.Trub.Truc.Fal.d. False. The balanced budget multiplier is positive (it equals one), so the IS curve shiftsright.e. False.f. Uncertain. An increase in G leads to an increase in Y (which tends to increaseinvestment), but an increase in the interest rate (which tends to reduce investment).g. True.*2. Firms deciding how to use their own funds will compare the return on bonds to the return on investment. When the interest rate on bonds increases, they become more attractive, and firms are more likely to use their funds to purchase bonds, rather than to finance investment projects.a.Y=[1/(1-c1)]*[c0-c1T+I+G]The multiplier is 1/(1-c1).b. Y=[1/(1-c1-b1)]*[c0-c1T+ b0-b2i +G]The multiplier is 1/(1-c1-b1). Since the multiplier is larger than the multiplier in part a, the effect of a change in autonomous spending is bigger than in part a.c. Substituting for the interest rate in the answer to partb: Y=[1/(1-c1-b1+ b2d1/d2)]*[c0-c1T+ b0+(b2*M/P)/d2+G]The multiplier is 1/(1-c1-b1+ b2d1/d2).d. The multiplier is greater (less) than the multiplier in part a if (b1- b2d1/d2) is greater (less)than zero. The multiplier is big if b1is big, b2is small, d1is small, and/or d2is big, i.e., if investment is very sensitive to Y, investment is not very sensitive to i, money demand is not very sensitive to Y, money demand is very sensitive to i.4. a. The IS curve shifts left. Output and the interest rate fall. The effect on investmentis ambiguous because the output and interest rate effects work in opposite directions: the fall in output tends to reduce investment, but the fall in the interest rate tends to increase it.b. From 3c: Y=[1/(1-c1-b1)]*[c0-c1T+ b0-b2i +G]c. From the LM relation: i= Y*d1/d2–(M/P)/d2To obtain the equilibrium interest rate, substitute for Y from part b.d. I= b0+ b1Y- b2i= b0+ b1Y- b2Y* d1/d2+ b2(M/P)/d2To obtain equilibrium investment, substitute for Y from part b.e. Holding M/P constant, I increases with equilibrium output when b1>b2d1/d2.Since a decrease in G reduces output, the condition under which a decrease in G increases investment is b1<b2d1/d2.f. The interpretation of the condition in part e is that the effect on I from Y has to be lessthan the effect from i after controlling for the endogenous response of i and Y, determined by the slope of the LM curve, d1/d2.5. a. Y=C+I+G=200+.25*(Y-200)+150+.25Y-1000i+250Y=1100-2000ib.M/P=1600=2Y-8000i i=Y/4000-1/5c. Substituting b into a: Y=1000d. Substituting c into b: i=1/20=5%e. C=400; I=350; G=250; C+I+G=1000f. Y=1040; i=3%; C=410; I=380. A monetary expansion reduces the interest rate andincreases output. The increase in output increases consumption. The increase in output and the fall in the interest rate increase investment.g. Y=1200; i=10%; C=450; I=350. A fiscal expansion increases output and the interestrate. The increase in output increases consumption.h. The condition from problem 3 is satisfied with equality (.25=1000*(2/8000)), socontractionary fiscal policy will have no effect on investment. When G=100: i=0%;Y=800; I=350; and C=350.*6. a. The LM curve is flatb. Japan was experiencing a liquidity trap. c. Fiscal policy is more effective.7. a. Increase G (or reduce T) and increase M.b. Reduce G (or increase T) and increase M. The interest rate falls. Investment increases,since the interest rate falls while output remains constant.CHAPTER 61.a.Fals.b.Fals.c.Falsd.False.Truf.Falsg.Uncertaih.True.i. False.2. a. (Monthly hires+monthly separations)/monthly employment =6/93.8=6.4%b. 1.6/6.5=25%c. 2.4/6.5=37%. Duration is 1/.37 or 2.7 months.d. 4.9/57.3=9%.e. new workers: .35/4.9=7%; retirees: .2/4.9=4%.3. a and b. Answers will depend on when the page is accessed.c. The decline in unemployment does not equal the increase in employment, because thelabor force is not constant. It has increased over the period.4. a. 66%; 66%*66%*66%= 29%; (66%)6= 8%b. (66%)6= 8%c. (for 1998): 875/6210= .145. a. Answers will vary.b and c. Most likely, the job you will have ten years later will pay a lot more thanyour reservation wage at the time (relative to your typical first job).d. The later job is more likely to require training and will probably be a much harderjob to monitor. So, as efficiency wage theory suggests, your employer will be willing to pay a lot more than your reservation wage for the later job, to ensure low turnover and low shirking.6. a. The computer network administrator has more bargaining power. She is muchharder to replace.6. b. The rate of unemployment is a key statistic. For example, when there are manyunemployed workers it becomes easier for firms to find replacements. This reduces the bargaining power of workers.7. a. W/P=1/(1+ )=1/1.05=.95 b. Price setting: u=1-W/P=5%c. W/P=1/1.1=.91; u=1-.91=9%. The increase in the markup lowers the real wage.From the wage-setting equation, the unemployment rate must rise for the real wage to fall.So the natural rate increases.CHAPTER 71.a.Trub.Trc.Falsd.Fale.Truf.Falg.Fal2. a. IS right, AD right, AS up, LM up, Y same, i up, P upb. IS left, AD left, AS down, LM down, Y same, i down, P down3. a.WS PS AS AD LM IS Y i PShort run:up same up same up same down up upMedium run:up same up same up same down up upb.WS PS AS AD LM IS Y i PShort run:same up down same down same up down downMedium run:same up down same down same up down down4. a. After an increase in the level of the money supply, output and the interest-rate eventually return to the same level. However, monetary policy is useful, because it can accelerate the return to the natural level of output.b. In the medium run, investment and the interest rate both change with fiscal policy.c. False. Labor market policies, such as unemployment insurance, can affect the naturallevel of output.*5. a. Open answer. Firms may be so pessimistic about sales that they do not want to borrow at any interest rate.b. The IS curve is vertical; the interest rate does not affect equilibrium output.c. No change.d. The AD curve is vertical; the price level does not affect equilibrium output.e. The increase in z reduces the natural level of output and shifts the AS curve up. SincetheAD curve is vertical, output does not change, but prices increase. Note that output is above its natural level.f. The AS curve shifts up forever, and prices keep increasing forever. Output does notchange, and remains above its natural level forever.6. a. The natural level of output is Y n. Assuming that output starts at is naturallevel, P0= M0- (1/c)*Y nb. Assuming that P e=P0: Y = 2cM0-cP=2cM0-cP0-cdY+cdY nRecalling that Y n=c(M0-P0): Y= Y n+ (c/(1+c d))*M0c. Investment goes up because output is higher and the interest rate is lower.d. In the medium run, Y = Y ne. In the medium run, investment returns to its previous level, because output and the interestrate return to their previous levels.CHAPTER 81.a.Trb.Fac.Fad.Tre.Faf.Tr2. a. No. In the 1970s, we experienced high inflation and high unemployment. The expectations- augmented Phillips curve is a relationship between inflation and unemployment conditional on the natural rate and inflation expectations. Given inflation expectations,increases in the natural rate (which result from adverse shocks to labor market institutions—increases in z—or from increases in the markup—which encompass oil shocks) lead to an increase in both theunemployment rate and the inflation rate. In addition, increases in inflation expectations imply higher inflation for any level of unemployment and tend to increase the unemployment rate inthe short run (think of an increase in the expected price level, given last period’s price,in the AD-AS framework). In the 1970s, both the natural rate and expected inflation increased, so both unemployment and inflation were relatively high.b. No. The expectations-augmented Phillips curve implies that maintaining a rate ofunemployment below the natural rate requires increasing (not simply high) inflation. This is because inflation expectations continue to adjust to actual inflation.3. a. u n=0.1/2 =5%b. t=0.1-2*.03 = 4% every year beginning with year t.c. e= 0 and =4% forever. Inflation expectations will be forever wrong. This isunlikely.t td. ⎝ might increase because pe ople’s inflation expectations adapt to persistently positiveinflation. The increase in ⎝ has no effect on u n.e. 5= 4+.1-.06=4%+4%=8%For t>5, repeated substitution implies, t= 5+(t-5)*4%.So, 10=28%; 15=48%.f. Inflation expectations will again be forever wrong. This is unlikely.4. a. t= t-1+ 0.1 - 2u t= t-1+ 2%t=2%; t+1=4%; t+2=6%; t+3=8%.b. t=0.5 t+ 0.5 t-1+ 0.1 - 2u tor, t= t-1+ 4%4. c. t=4%; t+1=8%; t+2=12%; t+3=16%d. As indexation increases, low unemployment leads to a larger increase in inflation overtime.5. a. A higher cost of production means a higher markup.b. u n=(0.08+0.1⎧)/2; Thus, the natural rate of unemployment increases from 5% to 6% as⎧increases from 20% to 40%.6. a. Yes. The average rate of unemployment is down. In addition, the unemploymentrate is at a historical low and inflation has not risen.b. The natural rate of unemployment has probably decreased.7. An equation that seems to fit well is: t- t-1=6-u t, which implies a natural rate of approximately 6%.8. The relationships imply a lower natural rate in the more recent period. CHAPTER 91. F TT F FT TT2. a. The unemployment rate will increase by 1% per year when g=0.5%. Unemploymentwill increase unless the growth rate exceeds the sum of productivity growth and labor force growth.b. We need growth of 4.25% per year for each of the next four years.c. Okun’s law is likely to beco me: u t-u t-1=-0.4*(g yt-5%)3. a. u n= 5%b. g yt= 3%; g mt=g yt+ t= 11%c. u g yt g mtt-1:8%5%3%11%t:4%9%-7%-3%t+1:4%5%13%17%t+2:4%5%3%7%4. a. t- t-1= -(u t-.05)u t- u t-1= -.4*(g mt- t-.03)b. t=6.3%; u t=8.7%t+1=1%; u t+1=10.3%c. u=5%; g y=3%; =-3%;5. a. See text for full answer. Gradualism reduces need for large policy swings, with effectsthat are difficult to predict, but immediate reduction may be more credible and encourage rapid, favorable changes in inflation expectations. On the other hand, the staggering ofwagedecisions suggests that, if the policy is credible, a gradual disinflation is the optionconsistent with no change in the unemployment rate.b. Not clear, probably fast disinflation, depending on the features inc.5. c. Some important features: the degree of indexation, the nature of the wage-settingprocess, and the initial rate of inflation.*6. a. u n=K/2; sacrifice ratio=.5 b. t=10%; t+1=8%; t+2=6%; t+3=4%; t+4=2%c. 5 years; sacrifice ratio=(5 point years of excess unemployment)/(10 percentage pointreduction in inflation)=.5d. t=7.5%; t+1=4.125%; t+2=1.594%; 3 years of higher unemployment for a reduction of10%: sacrifice ratio=0.3 e. t+1f. Take measures to enhance credibility.7. a. Inflation will start increasing.b.It should let unemployment increase to its new, higher, natural rate.Chapter 101. TTTFFFTU2. a. Example: France: (1.042)48*5.150=$37.1 k.Germany: $43.4 k; Japan: $76.5 k; UK: $22.5 k; U.S.:$31.7k b. 2.4c. yes.3. a. $5,000b. 2,500 pesos c. $500d. $1,000e. Mexican standard of living relative to the U.S.—exchange rate method:1/10; PPP method: 1/54. a. Y=63b. Y doubles. c. Yes.d. Y/N=(K/N)1/2e. K/N=4 implies Y/N=2. K/N=8 implies Y/N=2.83. Output less than doubles.f. No.g. No. In part f, we are looking at what happens to output when we increasecapital only, not capital and labor in equal proportion. There are decreasing returns tocapital.h. Yes.5. The United States was making the most important technical advances. However, theother countries were able to make up much of their technological gap by importing thetechnologies developed in the United States, and hence, have higher technological progress.6.Convergence for the France, Belgium, and Italy; no convergence for the second set ofcountriesChapter 111. a. Uncertain. True if saving includes public and private saving. False if saving onlyincludes private saving.b. False.c.Uncert UTFFd2. a. No. (1) The Japanese rate of growth is not so high anymore. (2) If the Japanesesaving rate has always been high, then this cannot explain the difference between the rate of growth inJapan and the US in the last 40 or 50 years. (3) If the Japanese saving rate has been higher thanit used to be, then this can explain some of the high Japanese growth. The contribution of high saving to growth in Japan should, however, come to an end.3. After a decade: higher growth rate. After five decades: growth rate back to normal, higher level of output per worker.4. a. Higher saving. Higher output per workerb. Same output per worker. Higher output per capita.5.*YYYd. Y/N = (K/N)1/3e. In steady state, sf(K/N) = ™K/N, which, given the production function in part d,implies: K/N=(s/™)3/2f. Y/N =(s/™)1/2g. Y/N = 2h. Y/N = 21/26.* a. 1b. 1c. K/N=.35; Y/N=.71d. Using equation (11.3), the evolution of K/N is: 0.9, 0.82, 0.757. a. K/N=(s/(2™))2; Y/N=s/(4™) b. C/N=s(1-s)/(4™)c-e. Y/N increases with s; C/N increases until s=.5, then decreases. CHAPTER 121.TFTFTFTUF2. a. Lower growth in poorer countries. Higher growth in rich countries.b. Increase in R&D and in output growth.c. A decrease in the fertility of applied research; a (small) decrease in growth.d. A decrease in the appropriability of drug research. A drop in the development of newdrugs. Lower technological progress and lower growth.3. See discussion in section 12.2.4. Examples will vary. Weakening patent protection would accelerate diffusion, but mightalso discourage R&D.5. a. Year 1: 3000; Year 2: 3960b. Real GDP: 3300; output growth: 10%c. 20%d. Real GDP/Worker=30 in both years; productivity growth is zero.e. RealGDP:3990;outputgrowth:33%.f. -0.8%g. Proper measurement implies real gdp/worker=36.3 in year 2. With improper measurement, productivity growth would be 21 percentage points lower and inflation 21% points higher.6. a. Both lead to an initial decrease in growthb. Only the first leads to a permanent decrease in growth7. a. (K/(AN))*=(s/(™+g A+g N))2=1; (Y/(AN))*=(1)1/2; g Y/(AN)=0; g Y/N=4%; g Y=6%b. (K/(AN))=(4/5)2; (Y/(AN))*=(4/5); g Y/(AN)=0; g Y/N=8%; g Y=10%c. (K/(AN))=(4/5)2; (Y/(AN))*=(4/5); g Y/(AN)=0; g Y/N=4%; g Y=10%People are better off in case a. Given any set of initial values, the level of technology is the same in cases a and c, but the level of capital per effective worker is higher atevery point in time in case a. Thus, since Y/N=A*(Y/(AN))=A*(K/(AN))1/2, output per worker is always higher in case a.8. There is a slowdown in growth and the rate of technological progress in the modernperiod. Japan’s growth rate of technological progress is higher because it is catching upto the U.S. level of technology. Not all of the difference in growth rates of output per worker is attributable to the difference in rates of technological progress. A big part is attributable to the difference in rates of growth of capital per worker.9.* a. ProbablyaffectsA.Thinkofclimate.b.Affects H.c. Affects A. Strong protection tends to encourage more R&D but also to limit diffusion of technology.d. May affect A through diffusion.e. May affect K, H, and A. Lower tax rates increase the after-tax return on investment,and thus tend to lead to more accumulation of K and H and more R&D spending.f. If we interpret K as private capital, than infrastructure affects A—e.g., bettertransportation networks may make the economy more productive by reducing congestion time.g. Assuming no technological progress, lower population growth implies highersteady-state level of output per worker. Lower population growth leads to higher capital per worker. Ifthere is technological progress, there is no steady-state level of output per worker. In this case, however, lower population growth implies that output per worker will be higher at every point in time, for any given path of technology. See the answer to problem 7c.Chapter 131.FFTTTTTTF2. a. u=1-(1/(1+⎧))(A/A e)b. u=1-(1/(1+⎧))=4.8%c. No. Since wages adjust to expected productivity, an increase in productivityeventuallyleads to equiproportional increases in the real wage implied by wage setting and price setting, at the original natural rate of unemployment. So equilibrium can bemaintained without any change in the natural rate of unemployment.3.* a. P=P e(1+⎧)(A e/A)(Y/L)(1/A)b. AS shifts down. Given A e/A=1, an increase in A implies a fall in P, given Y. Thisoccurs because for a given level of Y, unemployment is higher, so wages are lower and so, in turn, is the price level.c. There is now an additional effect, a fall in A e/A. In effect, workers do not receive asmuchof an increase in wages as warranted by the increase in productivity. Compared to part b, nominal wages are lower, leading to a lower value of P given Y.4. Discussion question.5. a. Reduce the gap, if this leads to an increase in the relative supply of skilled workers.b. Reduce the gap, since it leads to a decrease in the relative supply of unskilled workers.c. Reduce the gap, since it leads to an increase in the relative supply of skilled workers.d. Increase the gap, if U.S. firms hire unskilled workers in Central America, since itreduces the relative demand for U.S. unskilled workers.6. a. Textiles production is moving to low wage countries.b. Possibly demographic changes, increased availability of child care outside the home,decline in labor supply for these positions.c. Technological progress.7. Discussion question.CHAPTER 14。

第24章政策制定者是否应当受到限制一、概念题1.微调(fine-tuning)答:微调是指政府在宏观调控中,针对经济运行中的小冲击、小波动而相机地作出轻微的政策调整以保持产出和失业恒定的政策行为。

微调是针对经济运行中所发生的较小波动,为防止较大波动的出现而在宏观调控政策及其目标变量上不断地加以小幅度相机调整的政策操作。

通过宏观经济的微调,一方面增强了经济的稳定性,另一方面也起到对经济危机防微杜渐的作用。

由于经济中经常发生的是较小的波动,如果对这些较小的波动不及时采取措施加以调整,就会酿成不稳定因素,因此需要经常地、及时地用小的政策变动来消除经济中的小波动。

微调中应注意政策的时间一致性,前后出台的政策要求做到逻辑一致,不存在内在矛盾。

微调可以是财政政策,也可以是货币政策。

在进行微调时要尽量缩短政策时滞,以便更好地稳定经济。

凯恩斯主义认为,微调政策无论在长期还是在短期中对稳定经济都有积极作用;货币主义者认为,微调政策在短期内有用,但因政策本身的多变和不稳定性,在长期中不仅无用,反而会破坏市场经济本身的稳定机制。

在现实的政策操作中,诸多大型的宏观计量模型对于未来经济前景的预测有时大相径庭,因此如何精确地把握微调的力度和方向是进行微调所面临的重大课题。

2.最优控制(optimal control)答:从广义上讲,最优控制是现代控制理论的一个组成部分。

其基本内容和常用方法是动态规划、最大值原理和变分法;其主要工具是庞特里亚金极大值原理和贝尔曼动态规划。

最优控制的主要研究内容是:在被控对象数学模型已知且满足一定的约束条件下,寻求一个最优控制规律(或最优控制函数),使系统从某一个初始状态到达最终状态,并使性能指标(泛函)为极大或极小,即使控制系统的性能在某种意义下是最优的。

从狭义上讲,最优控制是指经济学中用于设计宏观经济政策的一种最佳控制方法。

这种方法最初是为控制和引导火箭而开发的,后来逐渐被用于设计宏观经济政策。

第十二章国民收入核算1。

宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同.微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同.微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法. 两者之间的联系主要表现在:(1)相互补充.经济学研究的目的是实现社会经济福利的最大化.为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源.它们共同构成经济学的基本框架.(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法.(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

课后练习答案详解第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

P38013.假定一国有下列国民收入统计资料:单位:亿美元 国内生产总值 4 800总投资 800净投资 300消费 3 000政府购买 960政府预算盈余 30试计算:(1) 国内生产净值;(2) 净出口;(3) 政府税收减去转移支付后的收入;(4) 个人可支配收入;(5) 个人储蓄。

解答:(1) 国内生产净值=国内生产总值-资本消耗补偿,而资本消耗补偿即折旧等于总投资减净投资后的余额,即500=800-300,因此国内生产净值=4 800-500=4 300(亿美元)。

(2) 从GDP =c +i +g +nx 中可知nx =GDP -c -i -g ,因此,净出口nx =4 800-3 000-800-960=40(亿美元)。

(3) 用BS 代表政府预算盈余,T 代表净税收即政府税收减去转移支付后的收入,则有BS =T -g ,从而有T =BS +g =30+960=990(亿美元)。

(4) 个人可支配收入本来是个人收入减去个人所得税后的余额,本题条件中没有说明间接税、公司利润、社会保险税等因素,因此,可从国民生产净值中直接得到个人可支配收入,即y d =NNP -T =4 300-990=3 310(亿美元)。

(5) 个人储蓄S =y d -c =3 310-3 000=310(亿美元)。

14.假定国内生产总值是5 000,个人可支配收入是4 100,政府预算赤字是200,消费是3 800,贸易赤字是100(单位都是亿元)。

试计算:(1) 储蓄;(2) 投资;(3) 政府支出。

解答:(1) 用s 代表储蓄(即私人储蓄s p ),用y d 代表个人可支配收入,则s =y d -c =4 100-3 800=300(亿元)(2) 用i 代表投资,用s p 、 s g 、 s r 分别代表私人部门、政府部门和国外部门的储蓄,则s g =t -g =BS ,在这里,t 代表政府税收收入,g 代表政府支出,BS 代表预算盈余,在本题中,s g =BS =-200。

布兰查德《宏观经济学》第五版课后题答案ANSWERS TO END-OF-CHAPTER PROBLEMS CHAPTER 1Quick Check1. a. True.b. True.c. False.d. False/uncertain. The rate of growth was higher during the decade beginning in 1996 than duringthe previous two decades, but it is probably unrealistic to expect productivity to continue to grow at such a fast pace.e. False. There are problems with the statistics, but the consensus is that growth in China has beenhigh.f. False. The European “unemployment miracle” refers t o the relatively low Europeanunemployment rate in the 1960s and the early 1970s.g. True.h. True.2. a. More flexible labor market institutions may lead to lower unemployment, but there are questionsabout how precisely to restructure these institutions. The United Kingdom has restructured itslabor market institutions to resemble more closely U.S. institutions and now has a lower unemployment rate than before the restructuring. On the other hand, Denmark and the Netherlands have relatively low unemployment rates while maintaining relatively generous social insurance programs for workers.In addition, some economists argue that tight monetary policy has at least something to do with the high unemployment rates in Europe.b. Although the Euro will remove obstacles to free trade between European countries, each countrywill be forced to give up its own monetary policy.Dig Deeper3. a. The Chinese government has encouraged foreign firms to produce in China. Since foreign firmsare typically more productive than Chinese firms, the presence of foreign firms has lead to an increase in Chinese productivity. The Chinese government has also encouraged joint ventures between foreign and Chinese firms. These joint ventures allow Chinese firms to learn from more productive foreign firms.b. The recent increase in U.S. productivity growth has been a result of the development andwidespread use of information technologies.c. The United States is a technological leader. Much of U.S. productivity growth is relatedto the development of new technologies. China is involved in technological catch-up.Much of Chinese productivity growth is related to adopting existing technologies developed abroad.d. It’s not clear to what extent Ch ina provides a model for other developing countries. Highinvestment seems a good strategy for countries with little capital, and encouragingforeign firms to produce (and participate in joint ventures) at home seems a good strategy for countries trying to improve productivity. On the other hand, the degree to which China’s centralized political control has been important in managing thepace of the transition and in protecting property rightsof foreign firms remains open to question.4. a. 10 years: (1.018)10=1.195 or 19.5 % higher20 years: 42.9% higher50 years: 144% higherb. 10 years: 31.8 % higher20 years: 73.7 % higher50 years: 297.8% higherc. Take output per worker as a measure of the standard of living.10 years: 1.195/1.318=1.103, so the standard of living would be 10.3% higher;20 years: 21.6 % higher50 years: 63% higherd. No. Labor productivity growth fluctuates a lot from year to year. The last few years mayrepresent good luck. It is too soon to tell whether there has been a change in the trend observed since 1970.5. a. 13.2(1.034)t=2.8(1.088)tt = ln(13.2/2.8)/[ln(1.088/1.034)]t ≈ 30.5 yrsThis answer can be confirmed with a spreadsheet, for students unfamiliar with the use of logarithms.b. No. At current growth rates, Chinese output will exceed U.S. output within 31 years, but Chineseoutput per person (the Chinese standard of living) will still be less than U.S. output per person.Explore Further6. a/c. As of February 2008, there had been 5 recessions (according to the traditional definition) since1960. Seasonally-adjusted annual percentage growth rates of GDP (in chained 2000 dollars) are given below.1969:4 -1.9 1981:4 -4.91970:1 -0.7 1982:1 -6.41974:3 -3.8 1990:4 -3.01974:4 -1.6 1991:1 -2.01975:1 -4.71980:2 -7.81980:3 -0.7With respect to the note on 2001, the growth rates for 2001 are given below.2001:1 -0.5%2001:2 1.2%2001:3 -1.4%2001:4 1.6%7. a-b. % point increase in the unemployment rate for the 5 recessions1969-70 0.7 1981-82 1.11974-75 3.1 1990-91 0.91980 0.6The unemployment rate increased by 1.5 percentage points between January 2001 andJanuary 2002.CHAPTER 2Quick Check1. a. True.b. True/Uncertain. Real GDP increased by a factor of 25; nominal GDP increased by afactor of 21. Real GDP per person increased by a factor of 4.c. False.d. True.e. False. The level of the CPI means nothing. The rate of change of the CPI is onemeasure of inflation.f. Uncertain. Which index is better depends on what we are trying to measure—inflation faced by consumers or by the economy as a whole.g. False. The underground economy is large, but by far the majority of the measuredunemployed in Spain are not employed in the underground economy.2. a. No change. This transaction is a purchase of intermediate goods.b. +$100: personal consumption expendituresc. +$200 million: gross private domestic fixed investmentd. +$200 million: net exportse. No change. The jet was already counted when it was produced, i.e., presumablywhen Delta (or some other airline) bought it new as an investment.3. a. The value of final goods =$1,000,000, the value of the silver necklaces.b. 1st Stage: $300,000. 2nd Stage: $1,000,00-$300,000=$700,000.GDP: $300,000+$700,000=$1,000,000.c. Wages: $200,000 + $250,000=$450,000.Profit: ($300,000-$200,000)+($1,000,000-$250,000-300,000)=$100,000+$450,000=$550,000.GDP: $450,000+$550,000=$1,000,000.4. a. 2006 GDP: 10($2,000)+4($1,000)+1000($1)=$25,0002007 GDP: 12($3,000)+6($500)+1000($1)=$40,000Nominal GDP has increased by 60%.b. 2006 real (2006) GDP: $25,0002007 real (2006) GDP: 12($2,000)+6($1,000)+1000($1)=$31,000Real (2006) GDP has increased by 24%.c. 2006 real (2007) GDP: 10($3,000)+4($500)+1,000($1)=$33,0002007 real (2007) GDP: $40,000.Real (2007) GDP has increased by 21.2%.d. The answers measure real GDP growth in different units. Neither answer isincorrect, just as measurement in inches is not more or less correct thanmeasurement in centimeters.5. a. 2006 base year:Deflator(2006)=1; Deflator(2007)=$40,000/$31,000=1.29Inflation=29%b. 2007 base year:Deflator(2006)=$25,000/$33,000=0.76; Deflator(2007)=1Inflation=(1-0.76)/0.76=.32=32%c. Analogous to 4d.6. a. 2006 real GDP = 10($2,500) + 4($750) + 1000($1) = $29,0002007 real GDP = 12($2,500) + 6($750) + 1000($1) = $35,500b. (35,500-29,000)/29,000 = .224 = 22.4%c. Deflator in 2006=$25,000/$29,000=.86Deflator in 2007=$40,000/$35,500=1.13Inflation = (1.13 -.86)/.86 = .31 = 31%.d. Yes, see appendix for further discussion.Dig Deeper7. a. The quality of a routine checkup improves over time. Checkups now may includeEKGs, for example. Medical services are particularly affected by this problemsince there are continual improvements in medical technology.b. The new method represents a 10% quality increase.c. There is a 5% true price increase. The other 10% represents a quality increase.The quality-adjusted price of checkups using the new method is only 5% higherthan checkups using the old method last year.d. You need to know the relative value of pregnancy checkups with and withoutultra-sounds in the year the new method is introduced. Still, since everyonechooses the new method, we can say that the quality-adjusted price of checkupshas risen by less than 15%. Some of the observed 15% increase represents anincrease in quality.8. a. Measured GDP increases by $10+$12=$22. (Strictly, this involves mixing thefinal goods and income approaches to GDP. Assume here that the $12 per hour ofwork creates a final good worth $12.)b. No. The true value of your decision to work should be less than $22. If youchoose to work, the economy produces the value of your work plus a takeout meal.If you choose not to work, presumably the economy produces a home-cookedmeal. The extra output arising from your choice to work is the value of yourwork plus any difference in value between takeout and home-cooked meals. Infact, however, the value of home-cooked meals is not counted in GDP. (Ofcourse, there are other details. For example, the value of groceries used toproduce home-cooked meals would be counted in GDP. Putting such detailsaside, however, the basic point is clear.)Explore Further9. a. Quarters 2000:III, 2001:I, and 2001:III had negative growth.b. The unemployment rate increased after 2000, peaked in 2003, and then began to fall. Theparticipation rate fell steadily over the period—from 67.1% in 2000 to 66% in 2004.Presumably, workers unable to find jobs became discouraged and left the labor force.c. Employment growth slowed after 2000. Employment actually fell in 2001. Theemployment-to-population ratio fell between 2000 and 2004.d. It several years after the recession for the labor market to recover.CHAPTER 3Quick Check1. a. True.b. False. Government spending excluding transfers was 19% of GDP.c. False. The propensity to consume must be less than one for our model to make sense.d. True.e. False.f. False. The increase in output is one times the multiplier.g. False.2. a. Y=160+0.6(Y-100)+150+150Y=1000b. Y D=Y-T=1000-100=900c. C=160+0.6(900)=7003. a. Equilibrium output is 1000. Total demand=C+I+G=700+150+150=1000. Totaldemand equals production. We used this equilibrium condition to solve foroutput.b. Output falls by (40 times the multiplier) = 40/(1-.6)=100. So, equilibrium outputis now 900. Total demand=C+I+G=160+0.6(800)+150+110=900. Again, totaldemand equals production.c. Private saving=Y-C-T=900-160-0.6(800)-100=160. Public saving =T-G=-10.National saving (or in short, saving) equals private plus public saving, or 150.National saving equals investment. This statement is mathematically equivalentto the equilibrium condition, total demand equals production. In other words,there is an alternative (and equivalent) equilibrium condition: national savingequals investment.Dig Deeper4. a. Y increases by 1/(1-c1)b. Y decreases by c1/(1-c1)c. The answers differ because spending affects demand directly, but taxes affect demandindirectly through consumption, and the propensity to consume is less than one.d. The change in Y equals 1/(1-c1) - c1/(1- c1)=1. Balanced budget changes in G and T arenot macroeconomically neutral.e. The propensity to consume has no effect because the balanced budget tax increaseaborts the multiplier process. Y and T both increase by one unit, so disposableincome, and hence consumption, do not change.5. a. Y=c0+c1Y D+I+G impliesY=[1/(1-c1+c1t1)][c0-c1t0+I+G]b. The multiplier=1/(1-c1+c1t1)<1/(1-c1), so the economy responds less to changes inautonomous spending when t1 is positive. After a positive change in autonomousspending, the increase in total taxes (because of the increase in income) tends tolessen the increase in output. After a negative change in autonomous spending,the fall in total taxes tends to lessen the decrease in output.c. Because of the automatic effect of taxes on the economy, the economy respondsless to changes in autonomous spending than in the case where taxes areindependent of income. Since output tends to vary less (to be more stable), fiscalpolicy is called an automatic stabilizer.6. a. Y=[1/(1-c1+c1t1)][c0-c1t0+I+G]b. T = t0 + t1[1/(1-c1+c1t1)][c0-c1t0+I+G]c. Both Y and T decrease.d. If G is cut, Y decreases even more. A balanced budget requirement amplifies the effectof the decline in c0. Therefore, such a requirement is destabilizing.7. a. In the diagram representing goods market equilibrium, the ZZ line shifts up. Outputincreases.b. There is no effect on the diagram or on output.c. The ZZ line shifts up and output increases. Effectively, the income transfer increases thepropensity to consume for the economy as a whole.d. The propensity to consume is likely to be higher for low-income taxpayers. Therefore,tax cuts will be more effective at stimulating output if they are directed towardlow-income taxpayers.8. a. Y=C+I+GY=[1/(1-c1-b1)]*[c0-c1T+b0+G]b. Including the b1Y term in the investment equation increases the multiplier. Increases inautonomous spending now create a multiplier effect through two channels:consumption and investment. For the multiplier to be positive, the conditionc1+b1<1 is required.c. Output increases by b0 times the multiplier. Investment increases by the changein b0plus b1 times the change in output. The change in business confidence leads to anincrease in output, which induces an additional increase in investment. Sinceinvestment increases, and saving equals investment, saving must also increase.The increase in output leads to an increase in saving.Explore Further9. a. Output will fall.b. Since output falls, investment will also fall. Public saving will not change. Privatesaving will fall, since investment falls, and investment equals saving. Sinceoutput and consumer confidence fall, consumption will also fall.c. Output, investment, and private saving would have risen.d. Clearly this logic is faulty. When output is low, what is needed is an attempt byconsumers to spend more. This will lead to an increase in output, andtherefore—somewhat paradoxically—to an increase in private saving. Note, however,that with a linear consumption function, the private saving rate (private savingdivided by output) will fall when c0 rises.10. Answers will vary depending on when students visit the website.CHAPTER 4Quick Check1. a. False.b. False.c. False. Money demand describes the portfolio decision to hold wealth in the form ofmoney rather than in the form of bonds. The interest rate on bonds is relevant tothis decision.d. True.e. False.f. False.g. True.h. True.2. a. i=0.05: money demand = $18,000i=0.10: money demand = $15,000b. Money demand decreases when the interest rate increases because bonds, whichpay interest, become more attractive.c. The demand for money falls by 50%.d. The demand for money falls by 50%.e. A 1% increase (decrease) in income leads to a 1% increase (decrease) in moneydemand. This effect is independent of the interest rate.3. a. i=100/$P B–1; i=33%; 18%; 5% when $P B =$75; $85; $95.b. When the bond price rises, the interest rate falls.c. $P B=100/(1.08) ≈ $934. a. $20=M D=$100(.25-i)i=5%b. M=$100(.25-.15)M=$10Dig Deeper5. a. B D = 50,000 - 60,000 (.35-i)If the interest rate increases by 10 percentage points, bond demand increases by $6,000.b. An increase in wealth increases bond demand, but has no effect on money demand, whichdepends on income (a proxy for transactions demand).c. An increase in income increases money demand, but decreases bond demand, since weimplicitly hold wealth constant.d. First of all, the use of “money” in this statement is colloquial. “Income” shouldbe substituted for “money.” Second, when people earn more income, their wealthdoes not change right away. Thus, they increase their demand for money anddecrease their demand for bonds.6. Essentially, the reduction in the price of the bond makes it more attractive. A bondpromises fixed nominal payments. The opportunity to receive these fixed payments at a lower price makes a bond more attractive.7. a. $16 is withdrawn on each trip to the bank.Money holdings are $16 on day one; $12 on day two; $8 on day three; and $4 on dayfour.b. Average money holdings are ($16+$12+$8+$4)/4=$10.c. $8 is withdrawn on each trip to the bank.Money holdings are $8, $4, $8, and $4.d. Average money holdings are $6.e. $16 is withdrawn on each trip to the bank. Money holdings are $0, $0, $0, and $16.f. Average money holdings are $4.g. Based on these answers, ATMs and credit cards have reduced money demand.8. a. All money is in checking accounts, so demand for central bank money equalsdemand forreserves. Therefore, demand for central bank money=0.1($Y)(.8-4i).b. $100B = 0.1($5,000B)(.8-4i)i=15%c. Since the public holds no currency,money multiplier = 1/reserve ratio = 1/.1=10.M=(10)$100B=$1,000BM= M d at the interest derived in part (b).d. If H increases to $300B the interest rate falls to 5%.e. The interest rate falls to 5%, since when H equals $300B, M=(10)$300B=$3,000B.9. The money multiplier is 1/[c+θ(1-c)], where c is the ratio of currency to deposits and θ isthe ratio of reserves to deposits. When c increases, as in the Great Depression, the money multiplier falls.Explore Further10. Answers will vary depending on when students visit the FOMC website.CHAPTER 5Quick Check1. a. True.b. True.c. False.d. False. The balanced budget multiplier is positive (it equals one), so the IS curveshifts right.e. False.f. Uncertain. An increase in government spending leads to an increase in output (whichtends to increase investment), but also to an increase in the interest rate (which tends toreduce investment).g. True.2. a. Y=[1/(1-c1)][c0-c1T+I+G]The multiplier is 1/(1-c1).b. Y=[1/(1-c1-b1)][c0-c1T+b0-b2i+G]The multiplier is 1/(1-c1-b1). Since the multiplier is larger than the multiplier inpart (a), the effect of a change in autonomous spending is bigger than in part (a).An increase in autonomous spending now leads to an increase in investment aswell as consumption.c. Substituting for the interest rate in the answer to part (b),Y=[1/(1-c1-b1+b2d1/d2)][c0-c1T+b0+(b2/d2)(M/P)+G].The multiplier is 1/(1-c1-b1+b2d1/d2).d. The multiplier is greater (less) than the multiplier in part (a) if (b1-b2d1/d2) isgreater (less) than zero. The multiplier as measured in part (c) measures themarginal effect of an increase in autonomous spending on equilibrium output. Assuch, the multiplier is the sum of two effects: a direct effect of output on demandand an indirect effect of output on demand via the interest rate. The direct effectis equivalent to the horizontal shift of the IS curve. The indirect effect depends onthe slope of the LM curve (since the equilibrium moves along the LM curve inresponse to a shift of the IS curve) and the effect of the interest rate on investmentdemand.The direct effect is captured by the sum c1+b1, which measures the marginal effectof an increase in output on the sum of consumption and investment demand. Asthis sum increases, the multiplier gets larger.The indirect effect is captured by the expression b2d1/d2 and tends to reduce thesize of the multiplier. The ratio d1/d2is the slope of the LM curve, and theparameter b2measures the marginal effect of an increase in the interest rate oninvestment. Note that the slope of the LM curve becomes larger as moneydemand becomes more sensitive to income (i.e., as d1increases) and becomessmaller as money demand becomes more sensitive to the interest rate (i.e., as d2increases).3. a. The IS curve shifts left. Output and the interest rate fall. The effect oninvestment is ambiguous because the output and interest rate effects work inopposite directions: the fall in output tends to reduce investment, but thefall in the interest rate tends to increase it.b. From the answer to 2(c), Y=[1/(1-c1-b1+b2d1/d2)][c0-c1T+b0+(b2/d2)(M/P)+G].c From the LM relation, i=Y(d1/d2)–(M/P)/d2.To obtain the equilibrium interest rate, substitute for equilibrium Y from part (b).d. I= b0+b1Y-b2i=b0+(b1-b2d1/d2)Y+(b2/d2)(M/P)To obtain equilibrium investment, substitute for equilibrium Y from part (b).e. From part (b), holding M/P constant, equilibrium Y decreases by [1/(1-c1-b1+b2d1/d2)] when G decreases by one unit. From part (d), holding M/P constant,I decreases by(b1- b2d1/d2)/(1-c1-b1+b2d1/d2) when G decreases by one unit. So, if G decreasesby one unit, investment will increase when b1<b2d1/d2.f. A fall in G leads to a fall in output (which tends to reduce investment) and to afall in the interest rate (which tends to increase investment). Therefore, forinvestment to increase, the output effect (b1) must be smaller than the interest rateeffect (b2d1/d2).Note that the interest rate is the product of two factors: (i) d1/d2, the slope of theLM curve, which gives the effect of a one-unit change in equilibrium output onthe interest rate, and (ii) b2, which gives the effect of a one-unit change in theequilibrium interest rate on investment.4. a. Y=C+I+G=200+.25(Y-200)+150+.25Y-1000i+250Y=1100-2000ib. M/P=1600=2Y-8000ii=Y/4000-1/5c. Substituting from part (b) into part (a) gives Y=1000.d. Substituting from part (c) into part (b) gives i=5%.e. C=400; I=350; G=250; C+I+G=1000f. Y=1040; i=3%; C=410; I=380. A monetary expansion reduces the interest rateand increases output. Consumption increases because output increases.Investment increases because output increases and the interest rate decreases.g. Y=1200; i=10%; C=450; I=350. A fiscal expansion increases output and theinterest rate. Consumption increases because output increases. Investment isaffected in two ways: the increase in output tends to increase investment, and theincrease in the interest rate tends to reduce investment. In this example, these twoeffects exactly offset one another, and investment does not change.Dig Deeper5. Firms deciding how to use their own funds will compare the return on bonds to the returnon investment. When the interest rate on bonds increases, bonds become more attractive, and firms are more likely to use their funds to purchase bonds, rather than to finance investment projects.6. a. If the interest rate were negative, people would hold only money, and not bonds.Money would be a better store of value than bonds.b. See hint.c. See hint.d. The increase the money supply has little effect on the interest rate. If the interestrate is actually zero, than the increase in the money supply literally has no effect.e. No. If there is no effect on the interest rate, which affects investment, monetarypolicy cannot affect output.7. a. The reduction in T shifts the IS curve to the right. The increase in M shifts the LM curvedown. Output increases.b. The Clinton-Greenspan policy mix was (loosely) contractionary fiscal policy (ISleft) and expansionary monetary policy (LM down).c. In 2001, there was a recession, which was triggered by a fall in investmentspending following the decline in the stock market. The events of September 11,which came after the recession had begun, had only a limited effect. In fact, theeconomy had positive growth in the fourth quarter of 2001. The expansionarymonetary and fiscal policies tended to weaken the recession, but the policies cametoo late to avoid a recession.8. a. Increase G (or reduce T), which shifts the IS curve to the right, and increase M, whichshifts the LM curve down.b. Reduce G (or increase T), which shifts the IS curve to the left, and increase M,which shifts the LM curve down. The interest rate falls. Investment increases,since the interest rate falls while output remains constant.9. a. The IS curve shifts left. Output and the interest rate fall.b. Consumption falls. The change in investment is ambiguous: the fall in output tends toreduce investment, but the fall in the interest rate tends to increase investment.The change in private saving equals the change in investment. So, private savingcould rise or fall in response to a fall in consumer confidence.Explore Further10. a. The fall in G and the increase in T shift the IS curve to the left. The increase in M shiftsthe LM curve down. The interest rate falls, and investment increases.b. Receipts rose, outlays fell, and the budget deficit fell.c. On September 4, 1992, the FOMC reduced the federal funds rate by 25 basis points.Subsequent changes in federal funds rate over the period 1993-2000 are given below.Changes in the Federal Funds RateSeptember 4, 1992 3 March 25, 1997 5.5February 4, 1994 3.25 September 29, 1998 5.25March 22, 1994 3.5 October 15, 1998 5April 18, 1994 3.75 November 17, 1998 4.75May 17, 1994 4.25 June 30, 1999 5August 16, 1994 4.75 August 24, 1999 5.25November 15, 1994 5.5 November 16, 1999 5.5February 1, 1995 6 February 2, 2000 5.75July 6, 1995 5.75 March 21, 2000 6December 19, 1995 5.5 May 16, 2000 6.5January 31, 1996 5.25d. Investment was 12.1% of GDP in 1992 and increased every year over the period to reach17.7% of GDP in 2000.e. Over the period 1993-2000, the average annual growth rate of GDP per person was2.49%. Over the period first four years of the period, the average annual growthrate was 1.98%; over the second four years, the average annual growth rate was3%.11. a. Growth was negative in 2000:III, 2001:I, and 2001:III.b. Investment had a bigger percentage change, and unlike consumption, growth ininvestment was negative for every quarter in 2000 and 2001, except 2000:II.Overallinvestment was generally more variable than nonresidential fixed investment in2000 and 2001. Moreover, nonresidential fixed investment had positive growthduring 2000, but negative growth in 2001.c. Investment had a substantially larger decline in its contribution to growth in 2000 and2001. The proximate cause of the recession of 2001 was a fall in investment demand.d. Investment fell in the last two quarters of 2001, but began growing again in the firstquarter of 2001. Consumption growth was slow for the first three quarters of 2001, butgrew rapidly in the fourth quarter. As mentioned in the text, the Fed reduced the federalfunds rate several times during the fourth quarter of 2001. Moreover, automobilemanufacturers offered large discounts. These actions may have helped togenerate strong consumer spending. In any event, it is clear that the events ofSeptember 11 did not cause the recession of 2001. The recession had started wellbefore these events.CHAPTER 6Quick Check1. a. False. The participation rate has increased over time.b. False.c. False.d. True.e. False.f. Uncertain/False. The degree of bargaining power depends on the nature of the job andthe employee’s skills.g. True.h. False.2. a. (Monthly hires + monthly separations)/monthly employment =(4.4+4.6)/122=7%b. 1.4/6.2=23%c. (1.4+1.4)/6.2=45%. Duration is 1/.37 or 2.2 months.d. (3+2.8+1.4+1.4)/57.3=15%.e. new workers: 0.4/(3+1.4)=9%.3. a. W/P=1/(1+μ)=1/1.05=.952b. Wage setting: u=1-W/P=4.8%c. W/P=1/1.1=.91; u=1-.91=9%. The increase in the markup lowers the real wage.Algebraically, from the wage-setting equation, the unemployment rate must risefor the real wage to fall. So the natural rate increases. Intuitively, an increase inthe markup implies more market power for firms, and therefore less production,since firms will use their market power to increase the price of goods by reducingsupply. Less production implies less demand for labor, so the natural rate rises. Dig Deeper4. a. Answers will vary.b-c. Most likely, the difference between your actual wage and your reservation wage will be higher for the job you will have ten years later.d. The later job is more likely to require training, which means you will be costly toreplace, and will probably be a much harder job to monitor, which means youmay need an incentive to work hard. Efficiency wage theory suggests that youremployer will be willing to pay a lot more than your reservation wage for the laterjob, to make the job valuable to you, so you will stay at it and work hard.5. a. The computer network administrator has more bargaining power. She is muchharder to replace.b. The rate of unemployment is the most important indicator of labor marketconditions. When the rate of unemployment increases, it becomes easier for firmsto find replacements, and worker bargaining power falls.c. In our model, the real wage is always given by the price-setting relation:W/P=1/(1+μ).Since the price-setting relation depends on the actual price level and not theexpected one, this relation holds in the short run and the medium run of our model 6. a. When the unemployment rate is very low, it is very difficult for firms to find workers tohire and very easy for workers to find jobs. As a result, the bargaining power ofworkers is very high when the unemployment rate is very low. Therefore, thewage gets very high as the unemployment rate gets very low.b. Presumably, the real wage would grow without bound as the unemployment rateapproached zero. Since a worker could always find a job, there would be nothingto constrain aggressive wage bargaining. At any positive rate of unemployment,however, there is some constraint on worker bargaining power.。